Fill Out Your Rp 524 Form

Understanding the intricacies of property assessments is crucial for homeowners and property owners alike, particularly when it comes to the RP-524 form, a key document in the assessment review process in New York State. This form provides an avenue for property owners to formally challenge their property tax assessments through the Board of Assessment Review. It encompasses vital information that includes the owner's details, property location, and the assessed value as recorded on the property tax roll. Moreover, the RP-524 form allows for an in-depth presentation of the grounds for complaint, which can encompass concerns about unequal, excessive, or unlawful assessments. Owners are encouraged to present supporting documentation such as recent appraisals, sale prices, and property descriptions, providing the Board with a comprehensive view of the property’s market value. Additionally, the form contains sections dedicated to those who may wish to appoint a representative to file the complaint on their behalf. By effectively utilizing the RP-524, property owners can voice their concerns and potentially adjust their property tax obligations, reinforcing the importance of this document in the realm of property rights and fair taxation.

Rp 524 Example

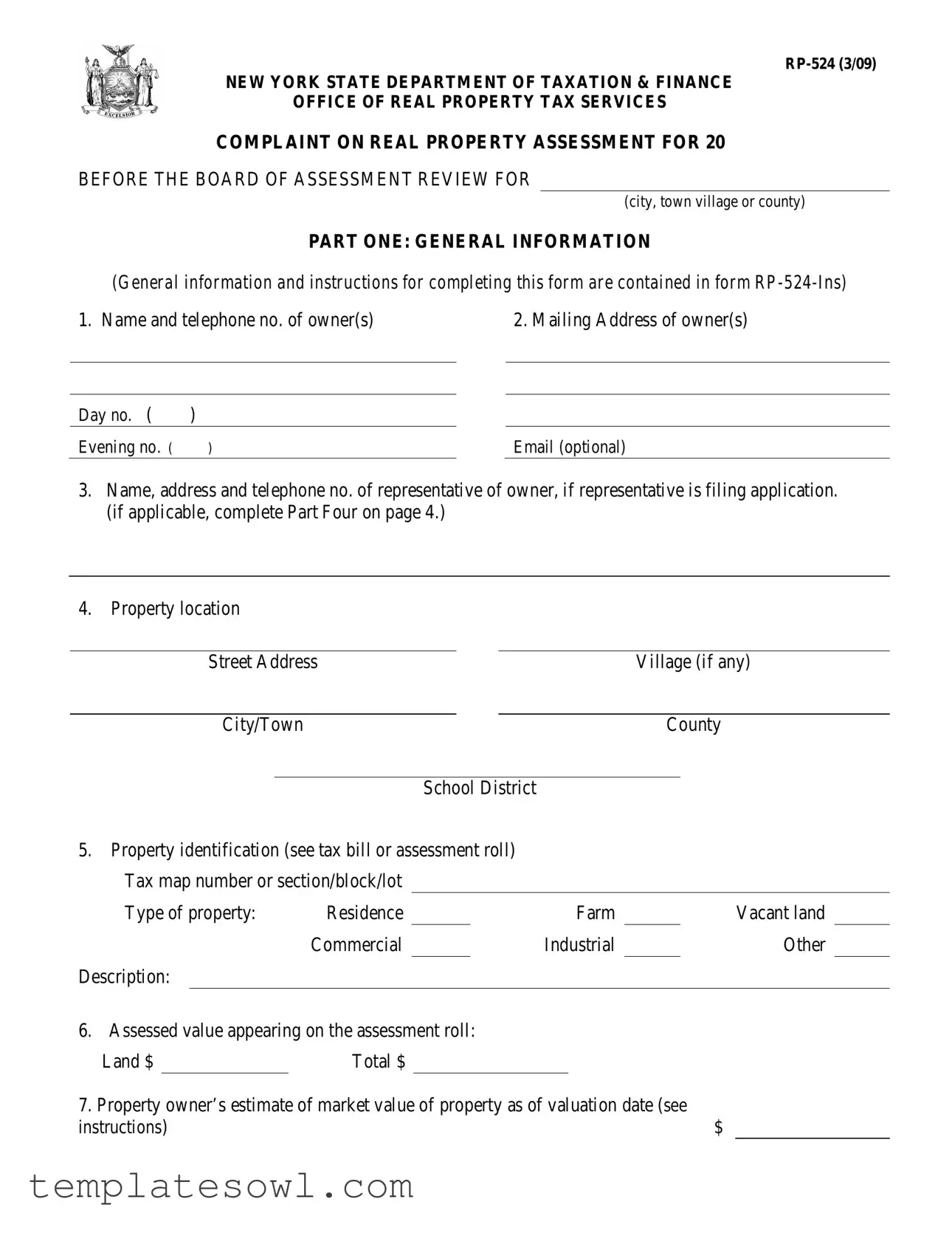

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

COMPLAINT ON REAL PROPERTY ASSESSMENT FOR 20

BEFORE THE BOARD OF ASSESSMENT REVIEW FOR

(city, town village or county)

PART ONE: GENERAL INFORMATION

(General information and instructions for completing this form are contained in form

1. Name and telephone no. of owner(s) |

|

2. Mailing Address of owner(s) |

|

|

|

|

|

|

Day no. ( |

) |

Evening no. ( |

) |

Email (optional)

3.Name, address and telephone no. of representative of owner, if representative is filing application. (if applicable, complete Part Four on page 4.)

4.Property location

Street Address |

|

|

Village (if any) |

||

|

|

|

|

|

|

City/Town |

|

|

County |

||

|

|

|

|

||

|

|

School District |

|||

5.Property identification (see tax bill or assessment roll) Tax map number or section/block/lot

Type of property: |

Residence |

|

|

|

Farm |

|

|

|

Vacant land |

|

|||

|

|

|

Commercial |

Industrial |

|

Other |

|||||||

Description: |

|

|

|

|

|

|

|

|

|

|

|

|

|

6. Assessed value appearing on the assessment roll: |

|

|

|

|

|

|

|

||||||

Land $ |

|

Total $ |

|

|

|

|

|

|

|

|

|||

7. Property owner’s estimate of market value of property as of valuation date (see |

|

|

|

||||||||||

instructions) |

|

|

|

|

|

|

|

|

$ |

|

|

||

2 |

PART TWO: INFORMATION NECESSARY TO DETERMINE VALUE OF PROPERTY

(If additional explanation or documentation is necessary, please attach)

Information to support the value of property claimed in Part One, item 7 (complete one or more):

1. |

|

|

Purchase price of property: …….……………………………………….. |

|

$ |

|||||

|

a. Date of purchase: |

|

|

|

|

|

|

|

||

|

b. Terms |

|

Cash |

|

Contract |

|

Other (explain) |

|||

c. Relationship between seller and purchaser

d. Personal property, if any, included in purchase price (furniture, livestock, etc.; attach list and sales tax receipt):

2.Property has been recently offered for sale (attach copy of listing agreement, if any):

|

|

When and for how long: |

|

|

|

|

|

|

|

|

||||

How offered: |

|

|

Asking price: $ |

|

|

|

|

|

||||||

3. |

|

|

Property has been recently appraised (attach copy): |

When: |

|

|

|

By Whom: |

|

|||||

|

Purpose of appraisal: |

|

Appraised value: |

$ |

|

|

|

|||||||

4.Description of any buildings or improvements located on the property, including year of construction and present condition:

5.Buildings have been recently remodeled, constructed or additional improvements made:

Cost $

Date Started:Date Completed:

Complainant should submit construction cost details where available.

6.Property is income producing (e.g., leased or rented), commercial or industrial property and the complainant is prepared to present detailed information about the property including rental income, operating expenses, sales volume and income statements.

7.Additional supporting documentation (check if attached).

3 |

PART THREE: GROUNDS FOR COMPLAINT

A.UNEQUAL ASSESSMENT (Complete items

1.The assessment is unequal for the following reason: (check a or b)

The assessed value is at a higher percentage of value than the assessed value of other real property on the

a.assessment roll.

The assessed value of real property improved by a one, two or three family residence is at a higher percentage of full (market) value than the assessed value of other residential property on the assessment roll or at a higher

b.percentage of full (market) value than the assessed value of all real property on the assessment roll.

|

|

|

|

|

|

|

|

The complainant believes this property should be assessed at |

% of full value based on one or more of the following |

||||

2. |

(check one or more): |

|

|

|

|

|

|

a. |

The latest State equalization rate for the city, town or village in which the property is located is |

%. |

|||

|

|

The latest residential assessment ratio established for the city, town or village in which the residential property is |

||||

|

|

located. Enter latest residential assessment ratio only if property is improved by a one, two or three family |

||||

|

b. |

residence |

%. |

|

|

|

|

c. |

Statement of the assessor or other local official that property has been assessed at |

%. |

|

||

d. Other (explain on attached sheet).

3.Value of property from Part one #7 …………………………............................................................... $

4.Complainant believes the assessment should be reduced to ….............................................................. $

B. EXCESSIVE ASSESSMENT (Check one or more)

The assessment is excessive for the following reason(s):

1.The assessed value exceeds the full value of the property.

a.Assessed value of property ………………………………………………………………………. $

b. |

Complainant believes that assessment should be reduced to full value of (Part one #7) |

$ |

c.Attach list of parcels upon which complainant relies for objection, if applicable.

2.The taxable assessed value is excessive because of the denial of all or portion of a partial exemption.

a.Specify exemption (e.g., senior citizens, veterans, school tax relief [STAR])

b. Amount of exemption claimed …………………………………………………………………… $

c.Amount granted, if any …………………………………………………………………………... $

d.If application for exemption was filed, attach copy of application to this complaint.

Improper calculation of transition assessment. (Applicable only in approved assessing unit which has adopted

3.transition assessments.)

a.Transition assessment ……………………………………………………………………………. $

b. Transition assessment claimed …………………………………………………………………… $

C. UNLAWFUL ASSESSMENT (Check one or more)

The assessment is unlawful for the following reason(s):

1.

2.

3.

4.

5.

Property is wholly exempt. (Specify exemption (e.g., nonprofit organization))

Property is entirely outside the boundaries of the city, town, village, school district or special district in which it is designated as being located.

Property has been assessed and entered on the assessment roll by a person or body without the authority to make the entry.

Property cannot be identified from description or tax map number on the assessment roll.

Property is special franchise property, the assessment of which exceeds the final assessment thereof as determined by the Office of Real Property Tax Services. (Attach copy of certificate.)

D. MISCLASSIFICATION (Check one)

The property is misclassified for the following reason (relevant only in approved assessing unit which establish homestead and

Class designation on the assessment roll: …………............

1.Complainant believes class designation should be ………..

2.The assessed value is improperly allocated between homestead and

|

|

|

|

|

Allocation of assessed value on assessment roll |

|

Claimed allocation |

||

Homestead |

$ |

|

$ |

|

Non |

$ |

|

$ |

|

|

|

|

|

4 |

|||||

|

PART FOUR: DESIGNATION OF REPRESENTATIVE TO MAKE COMPLAINT |

||||||||

I, |

|

, as complainant (or officer thereof) hereby |

|||||||

designate |

|

|

|

to act as my representative in any and all |

|||||

proceedings before the board of assessment review of the city/town/village/county of |

|

for |

|||||||

purposes of reviewing the assessment of my real property as it appears on the |

(year) tentative assessment |

||||||||

roll of such assessing unit. |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

|

|

Date |

|

|

Signature of owner (or officer thereof) |

||||

PART FIVE: CERTIFICATION

I certify that all statements made on this application are true and correct to be best of my knowledge and belief, and I understand that the making of any willful false statement of material fact herein will subject me to the provisions of the Penal Law relevant to the making and filing of false instruments.

|

Date |

|

Signature of owner (or representative) |

|

|

|

|

|

|

PART SIX: STIPULATION

The complainant (or complainant’s representative) and assessor (or assessor designated by a majority of the board of assessors) whose signatures appear below stipulate that the following assessed value is to be applied to the above

described property on the(year) assessment roll: Land $Total $ (Check box if stipulation approves exemption indicated in Part Three, section B.2. or C.1.)

|

Complainant or representative |

|

Assessor |

|

Date |

|

|

|

|

|

|

|

|

SPACE BELOW FOR USE OF BOARD OF ASSESSMENT REVIEW

Disposition |

|

Unequal assessment |

Excessive assessment |

Unlawful assessment |

Misclassification |

Ratification of stipulated assessment |

No change in assessment |

Clear Form

Reason:_____________________________________________________________________________________

____________________________________________________________________________________________

|

Vote on Complaint |

|

|

||

All concur |

|

|

|

|

|

All concur except: _______________________ |

against |

abstain |

absent |

||

|

Name |

|

|

|

|

|

_______________________ |

against |

abstain |

absent |

|

|

Name |

|

|

|

|

|

|

|

|

|

Decision by |

|

Tentative assessment |

Claimed assessment |

Board of Assessment Review |

||

Total assessment |

$________________ |

$_________________ |

$_________________________ |

||

Transition assessment (if any) |

... $________________ |

$_________________ |

$_________________________ |

||

Exempt amount |

$________________ |

$_________________ |

$_________________________ |

||

Taxable assessment |

$_________________ |

$_________________ |

$_________________________ |

||

Class designation and allocation of assessed value (if any): |

|

|

|

||

Homestead |

$________________ |

$_________________ |

$_________________________ |

||

$________________ |

$_________________ |

$__________________________ |

|||

Date notification mailed to complainant ________________________________

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The RP-524 form is designed for property owners in New York to formally contest their property's assessment before the Board of Assessment Review. |

| Governing Law | This form operates under New York Real Property Tax Law, specifically focusing on processes related to property assessments and disputes. |

| Main Sections | The form includes several essential sections: General Information, Grounds for Complaint, and Designation of Representative, among others. |

| Filing Timeline | Property owners must file the RP-524 form within a specific timeframe that is typically set by local assessing officials each year. |

| Supporting Documents | Along with this form, complainants are required to submit evidence such as purchase prices or appraisals to substantiate their claims regarding property value. |

| Certification Requirement | A certification statement is included in the form, requiring the owner to affirm that all provided information is accurate and truthful to the best of their knowledge. |

Guidelines on Utilizing Rp 524

Filling out the RP-524 form is an important step for property owners looking to contest their real property assessment. Ensuring that all sections of the form are completed accurately will help facilitate the review process. Here are the steps to fill out the RP-524 form correctly:

- Owner Information: Provide the name and telephone number of the property owner(s). Include the mailing address, day and evening phone numbers, and email (optional).

- Representative Information: If someone else is filing on behalf of the owner, fill in the name, address, and phone number of that representative.

- Property Location: State the property’s street address, including village (if applicable), city/town, county, and school district.

- Property Identification: Enter the tax map number or section/block/lot. Specify the type of property (e.g., residence, commercial, etc.) and provide a brief description.

- Assessed Value: Record the assessed value of land and total property as shown on the assessment roll.

- Market Value Estimate: State the property owner’s estimated market value of the property as of the valuation date.

In Part Two, you will provide information needed to determine the property’s value. This includes the purchase price, appraisal details, descriptions of buildings, and any income-related information if applicable. In Part Three, explain the grounds for your complaint, checking the relevant boxes and providing necessary details for unequal, excessive, or unlawful assessments.

Next, you will designate a representative (if applicable) in Part Four. Sign the certification in Part Five to affirm the accuracy of your statements. If there’s an agreement with the assessor, Part Six will detail the stipulated assessment value. Review all information carefully before submission.

What You Should Know About This Form

What is the RP-524 form used for?

The RP-524 form is a formal complaint you can file regarding your property assessment in New York State. It allows property owners to contest the assessed value of their property, which may affect your property taxes. If you believe your assessment is too high or incorrect in any way, submitting this form is a way to request a reassessment from the Board of Assessment Review.

Who should file the RP-524 form?

Property owners whose property has been assessed can file the RP-524 form. If you’re not the owner but are acting on behalf of the owner (like a family member or a real estate agent), you’ll need to provide information about the owner and may need their consent to file the complaint.

What information do I need to complete the RP-524 form?

You’ll need several pieces of information, including your contact details, the property’s location, and its assessed value. The form also asks for the owner’s estimate of the property’s market value. Gather any documentation that supports your case—such as a recent sale price, appraisal, or details about improvements made to the property—before you begin filling it out.

Where do I submit the RP-524 form?

Submit the completed RP-524 form to the local Board of Assessment Review in the city, town, or village where the property is located. Be sure to check if there’s a specific deadline, as these submissions often have timelines to meet, especially around assessment periods.

What happens after I submit the RP-524 form?

Once your form is submitted, the Board of Assessment Review will review your complaint. You may be asked to provide additional information or attend a hearing. After reviewing all of the evidence, they will make a decision regarding your property’s assessed value, which you will be notified about.

Can I appeal the decision made by the Board of Assessment Review?

If you disagree with the decision made by the Board, you can further appeal the outcome. Procedures for appeals will differ based on your local regulations, so it’s important to follow their guidance closely. Be aware that there may be additional timelines and forms required if you choose to appeal.

Is there a fee associated with filing the RP-524 form?

Typically, there is no fee to file the RP-524 form itself. However, if you have to appeal a decision or involve legal representation, there may be costs associated with those processes. Always check with your local Board of Assessment for the latest information regarding fees.

Common mistakes

Filling out the RP-524 form can be a straightforward process, but individuals often encounter certain pitfalls that may lead to delays or complications. One common mistake is neglecting to provide complete contact information for the property owner. The form requires both daytime and evening phone numbers, as well as an optional email address. Omitting any of this essential information could hinder effective communication with the Board of Assessment Review.

Another frequent error occurs when people fail to accurately estimate the market value of their property. The RP-524 specifically requests the property owner's opinion on what the market value is as of the valuation date. A miscalculation here can affect the entire basis of the complaint. It is crucial to ensure that the figure reflects reality and is supported by comparable sales or recent appraisals.

Inaccurate property identification is yet another common issue. The form asks for specific property details, including the tax map number or section/block/lot information. Providing incorrect or incomplete property identification can lead to confusion and a potential rejection of the complaint. It is advisable to verify the property details on the latest tax bill or assessment roll.

The supporting documentation section often becomes a missed opportunity for many. Applicants sometimes forget to attach necessary documents or do not provide adequate explanation for their valuation claims. Whether it is a recent appraisal, a list of comparable properties, or a sales contract, the absence of supporting evidence can undermine the credibility of the complaint.

Understanding grounds for complaint is critical. Many filers mistakenly check multiple boxes under the grounds for complaint when only one is appropriate. The RP-524 allows for the selection of specific options such as unequal assessment, excessive assessment, and unlawful assessment. Selecting too many can complicate the review process. Precision is key in articulating the specific reasons for contesting the assessment.

Another oversight can occur in the designation of a representative. If a representative is designated to file the application, relevant information must be included, including their contact details. Failing to do this can result in important communications being missed or misdirected.

Signatures are also a common area where mistakes happen. Many forget to sign or fail to date the form. No matter how well the form is completed, a missing signature can render the complaint invalid. Ensuring all required parties have signed is essential for the submission’s acceptance.

In the certification section, individuals occasionally misinterpret the requirement. The form mandates a statement certifying that all information provided is true and correct. Some feel this is optional or overlook the importance of this declaration. Failing to certify can not only endanger the application but may also have legal ramifications.

Finally, inattentiveness to deadlines is an area where many applicants falter. The RP-524 must be submitted within designated timeframes to be considered. Late submissions frequently lead to dismissals, regardless of merit. Filers should note important dates and plan accordingly to avoid these situations.

Documents used along the form

The RP-524 form is essential for property owners in New York who wish to challenge their property tax assessments. It lays the groundwork for filing a complaint with the Board of Assessment Review and necessitates supporting documentation. Along with the RP-524 form, several other documents can be useful in the assessment appeal process. Here is a list of forms and documents you might consider using alongside the RP-524.

- RP-524-Ins: This is the instruction form that accompanies the RP-524. It provides detailed guidance on how to complete the RP-524, ensuring that all necessary information and documentation are included.

- Property Tax Bill: A current property tax bill shows the assessed value and taxation details. It serves as a basis for the challenge and is often required for reference in the appeal process.

- Sales Contract: A copy of your property’s sales contract can substantiate claims regarding market value. This document outlines the agreed sale price, which can compare with the assessed value.

- Appraisal Report: An independent appraisal can strengthen your case. It provides an expert opinion on your property’s market value and can help establish grounds for your complaint.

- Listing Agreement: If your property was recently offered for sale, a listing agreement can indicate the asking price and marketing efforts. Such details are relevant in establishing market value.

- Income Statements: For income-producing properties, recent income statements prove the revenue generated. This document helps assess whether the property’s valuation reflects its earning potential.

- Exemption Applications: If you applied for any property tax exemptions and were denied, including a copy of the application can reveal potential reasons for the excessive assessment.

- Construction Costs Documentation: If improvements have been made to the property, detailed cost documentation can clarify the value of enhancements and may influence the assessed value.

- Formal Written Statement: A narrative explaining grounds for the complaint may help clarify your position. This supporting document can outline your rationale and the evidence backing your claims.

- Photographic Evidence: Taking photographs of the property can illustrate its current condition and support claims about necessary improvements or discrepancies in the assessment.

Compiling these forms and documents will assist in making your case when filing a complaint against your property assessment. Properly documenting your appeal not only strengthens your position but also helps to ensure a smoother review process.

Similar forms

- Form RP-5217: Similar to the RP-524, the RP-5217 is a property tax exemption application form used for claiming exemptions for property taxes. Both forms require property identification and owner information, and both can be submitted to local assessing authorities.

- Form RP-425: This is the application for the School Tax Relief (STAR) benefit. Like the RP-524, it provides a way for property owners to argue about the valuation concerning exemptions, ensuring fair tax treatment based on property value assessments.

- Form RP-504: The RP-504 is a grievance application form used to challenge property assessments. It shares similar data requirements as the RP-524, focusing on property details and owner representation.

- Form RP-521: This form is used to apply for a veteran’s exemption from property taxes. The RP-521, like the RP-524, mandates specific ownership details and property type, allowing for fair reassessment.

- Form RP-576: This application relates to a partial exemption for disabled persons. Much like the RP-524, it addresses owner particulars and required evidence to establish claims for benefits affecting assessment values.

- Form RP-485-b: This is used for the application of a non-profit organization property exemption. Similar to the RP-524, it asks for comprehensive owner and property information to validate claims against property tax assessments.

- Form RP-522: This is another complaint form used in the context of real property assessments. It functions similarly to the RP-524 by focusing on providing clear reasonings and evidence regarding property value discrepancies.

- Form RP-551: This form applies to properties that were only partially improved. It employs similar methods as the RP-524, guiding property owners through the process of challenging and documenting their assessments.

Each of these forms serves a unique purpose related to property assessments and tax exemptions but shares core similarities with the RP-524, focusing on accurate property representation and fair assessments.

Dos and Don'ts

When filling out the RP 524 form, it is important to follow specific guidelines to ensure the process runs smoothly. Here is a list of what to do and what to avoid:

- Do: Clearly fill in all required information such as your name, address, and contact details. Incomplete forms may delay processing.

- Do: Attach supporting documentation related to your claim, such as appraisals or sale listings. This strengthens your case and provides necessary evidence.

- Do: Review your information for accuracy before submission. Errors can cause complications and prolong the review process.

- Do: Keep a copy of the completed form and all attachments for your records. This helps track the submission and serves as a reference if needed later.

- Don't: Leave any sections blank unless specified. Missing information can lead to rejection of the form.

- Don't: Use vague statements when explaining your grounds for the complaint. Provide specific reasons and evidence as necessary.

- Don't: Submit outdated or irrelevant documentation. Ensure all attached records relate to your current assessment.

- Don't: Wait until the last minute to submit your complaint. Allow sufficient time for potential follow-up or additional information requests.

Misconceptions

Misconceptions about the RP-524 form can lead to confusion and mistakes in the assessment complaint process. Here are nine common misconceptions along with clarifications:

-

Only property owners can file a complaint.

This is not true. A representative can file on behalf of the property owner, but the owner must designate the representative on the form.

-

A complaint is only for large properties.

Any property owner, regardless of property size or type, can file a complaint about their property assessment. Residential, commercial, and industrial properties all qualify.

-

The form must be completed in a specific way.

While there are guidelines, the RP-524 form allows for flexibility in how information is presented. Clear, thorough information is the priority.

-

You must have legal representation to file.

This is a misconception. Property owners can file the form themselves without needing an attorney or legal representative.

-

All complaints result in assessment reductions.

This is inaccurate. A complaint may or may not lead to a change in assessment. Each case is considered on its own merits.

-

The deadline to file for a complaint is flexible.

Deadlines for filing are strictly enforced. Missing the deadline can bar property owners from contesting their assessment.

-

Once the complaint is filed, no further action is needed.

This is misleading. Property owners may need to provide additional documentation or attend a hearing to support their complaint.

-

A lower assessed value means lower property taxes.

While a lower value can lead to lower taxes, it’s not guaranteed. Tax rates and other factors play a significant role in determining tax amounts.

-

The RP-524 form alone determines the outcome of a complaint.

The form is crucial, but assessments are also influenced by evidence, market conditions, and decisions made by the Board of Assessment Review.

Key takeaways

Understanding how to fill out and utilize the RP-524 form is vital for property owners seeking to challenge their property assessment. Here are some key takeaways to keep in mind:

- The RP-524 form is used to file a complaint regarding property assessment with the Board of Assessment Review.

- Provide complete and accurate contact information for yourself and any representative involved. This includes phone numbers, an email address (optional), and addresses.

- Clearly state your property details, such as the location and the assessed value, comparing it against your own estimate of the market value.

- Attach any supporting documentation that substantiates your claim. This may include information about the purchase price, recent appraisals, or evidence of recent renovations.

- Select the appropriate grounds for your complaint, such as unequal, excessive, or unlawful assessment, and fill out the corresponding sections carefully.

- Sign and date the certification section to confirm that all information provided is true and accurate, as false statements can lead to legal consequences.

Browse Other Templates

Hours of Operation Template Word - Wednesday is a great day to visit.

Informed Refusal Form - Feel free to ask for help in filling out the form if needed.