Fill Out Your Rs 6370L 3 Form

The RS 6370L-3 form, officially titled the Electronic Funds Transfer Direct Deposit Enrollment Application, serves as a critical tool for pensioners of the New York State and Local Retirement System (NYSLRS). This form is specifically designed to facilitate the direct deposit of retirement benefits into the pensioner's financial institution, thereby streamlining the payment process. Section 1 requires the pensioner to review and correct their personal information, including crucial identifiers such as Social Security Number and Retirement Number. Once verified, Section 2 prompts the individual to authorize future benefit payments to their specified bank account, whether it be checking or savings. The form emphasizes the importance of providing accurate account details to avoid any disruption in payments. Moreover, it outlines the responsibilities and agreements pertaining to the pensioner and the financial institution, underscoring that NYSLRS is not liable for incorrect information provided. A significant aspect of the form is the joint account holder authorization, allowing for the recovery of funds deposited in error, which highlights the necessity of caution and verification in handling such transfers. Additionally, instructions for modifying or cancelling direct deposit arrangements provide further clarity, enabling pensioners to manage their finances proactively. By addressing these elements, the RS 6370L-3 form ensures pensioners have a reliable way to receive their benefits while fostering an understanding of their rights and responsibilities within the direct deposit framework.

Rs 6370L 3 Example

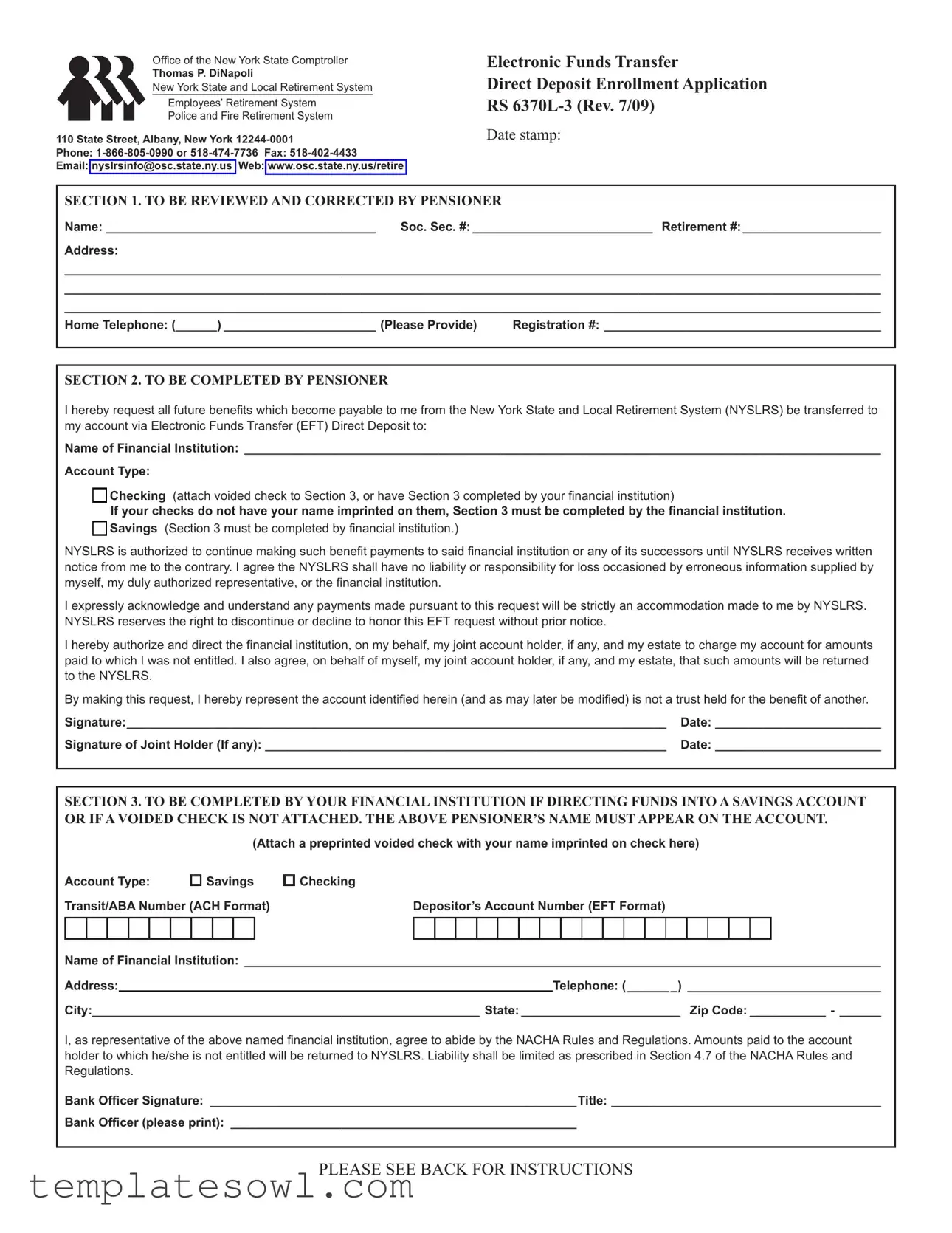

Office of the New York State Comptroller

Thomas P. DiNapoli

New York State and Local Retirement System

Employees’ Retirement System

Police and Fire Retirement System

110 State Street, Albany, New York

Phone:

Email: nyslrsinfo@osc.state.ny.us Web: www.osc.state.ny.us/retire

Electronic Funds Transfer

Direct Deposit Enrollment Application

RS

Date stamp:

SECTION 1. TO BE REVIEWED AND CORRECTED BY PENSIONER

Name: _______________________________________ Soc. Sec. #: __________________________ Retirement #:

Address:

______________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________

Home Telephone: (______) ______________________ (Please Provide) |

Registration #: ________________________________________ |

SECTION 2. TO BE COMPLETED BY PENSIONER

I hereby request all future benefits which become payable to me from the New York State and Local Retirement System (NYSLRS) be transferred to my account via Electronic Funds Transfer (EFT) Direct Deposit to:

Name of Financial Institution: ____________________________________________________________________________________________

Account Type:

o

Checking (attach voided check to Section 3, or have Section 3 completed by your financial institution)

Checking (attach voided check to Section 3, or have Section 3 completed by your financial institution)

If your checks do not have your name imprinted on them, Section 3 must be completed by the financial institution.

o

Savings (Section 3 must be completed by financial institution.)

Savings (Section 3 must be completed by financial institution.)

NYSLRS is authorized to continue making such benefit payments to said financial institution or any of its successors until NYSLRS receives written notice from me to the contrary. I agree the NYSLRS shall have no liability or responsibility for loss occasioned by erroneous information supplied by myself, my duly authorized representative, or the financial institution.

I expressly acknowledge and understand any payments made pursuant to this request will be strictly an accommodation made to me by NYSLRS. NYSLRS reserves the right to discontinue or decline to honor this EFT request without prior notice.

I hereby authorize and direct the financial institution, on my behalf, my joint account holder, if any, and my estate to charge my account for amounts paid to which I was not entitled. I also agree, on behalf of myself, my joint account holder, if any, and my estate, that such amounts will be returned to the NYSLRS.

By making this request, I hereby represent the account identified herein (and as may later be modified) is not a trust held for the benefit of another.

Signature:______________________________________________________________________________ |

Date: ________________________ |

Signature of Joint Holder (If any): __________________________________________________________ |

Date: ________________________ |

SECTION 3. TO BE COMPLETED BY YOUR FINANCIAL INSTITUTION IF DIRECTING FUNDS INTO A SAVINGS ACCOUNT OR IF A VOIDED CHECK IS NOT ATTACHED. THE ABOVE PENSIONER’S NAME MUST APPEAR ON THE ACCOUNT.

(Attach a preprinted voided check with your name imprinted on check here)

Account Type: |

|

o Savings |

o Checking |

|

|

|

|

|

|||||||||||||||||||

Transit/ABA Number (ACH Format) |

Depositor’s Account Number (EFT Format) |

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Financial Institution: ____________________________________________________________________________________________

Address:Telephone: ( ______ _) ____________________________

City:________________________________________________________ State: _______________________ Zip Code: ___________ - ______

I, as representative of the above named financial institution, agree to abide by the NACHA Rules and Regulations. Amounts paid to the account holder to which he/she is not entitled will be returned to NYSLRS. Liability shall be limited as prescribed in Section 4.7 of the NACHA Rules and Regulations.

Bank Officer Signature: _____________________________________________________Title: _______________________________________

Bank Officer (please print): __________________________________________________

PLEASE SEE BACK FOR INSTRUCTIONS

PLEASE READ CAREFULLY

Enrollment Application

The Electronic Funds Transfer Direct Deposit Enrollment Application must be signed by you and the joint account holder if any. If you are requesting direct deposit to a “Checking Account,” review Section 1 and make any necessary corrections, complete Section 2, then attach a voided check to Section 3. If a voided check is not attached to Section 3, or if your checks do not have your name imprinted on them, then Section 3 must be completed by your financial institution. Return the application to the New York State and Local Retirement System (NYSLRS). If requesting direct deposit to a “Savings Account,” Section 3 must be completed by your financial institution before you return the application to the NYSLRS.

Pensioner and Joint Account Holder Authorization For Recovery of Funds Deposited in Error

By signing this Electronic Funds Transfer Direct Deposit Enrollment Application, you, both for yourself and your estate, and each joint account holder, if any, consent to allow NYSLRS, through the designated financial institution, to debit your account in order to recover any NYSLRS benefits to which you were not entitled. This means of recovery shall not prevent the NYSLRS from utilizing any other lawful means to retrieve NYSLRS benefit payments to which you were not entitled.

Changing Financial Institutions and/or Accounts

You may change financial institutions and/or accounts by completing a new enrollment application. The new enrollment application, when processed, will cancel the enrollment at the previous financial institution or your prior account. You should, however, be aware that changing financial institutions and/or accounts could take up to

30 days to complete. We recommend that the old account not be closed until the first deposit is made to your new account or financial institution.

Cancellation of Electronic Funds Transfer Direct Deposit

To cancel this request, written notification from you must be received by the NYSLRS at least 30 days prior to the next payment date.

The financial institution may terminate the electronic funds transfer direct deposit agreement with a written notice 30 days in advance of the cancellation date. The financial institution cannot cancel the authorization without notification to both you and NYSLRS.

The New York State and Local Retirement System reserves the right to discontinue or cancel this electronic funds transfer direct deposit agreement at any time. Written notice will be provided to you.

The completed applications should be returned to the following address:

EFT/Pensioner Services

New York State and Local Retirement System

110 State Street

Albany, New York

Questions or problems should be directed to the address above or you may call us at (518)

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The RS 6370L-3 form is governed by the New York State and Local Retirement System regulations. |

| Purpose of the Form | This form is used for enrolling in Electronic Funds Transfer (EFT) direct deposit for pension payments. |

| Required Signatures | The form must be signed by both the pensioner and any joint account holder to authorize the payment transfer. |

| Contact Information | Queries regarding the form can be addressed to the New York State and Local Retirement System at 1-866-805-0990 or via email at nyslrsinfo@osc.state.ny.us. |

Guidelines on Utilizing Rs 6370L 3

After gathering the necessary information, you will be ready to fill out the RS 6370L-3 form. This document allows pensioners to authorize direct deposit for their benefits, ensuring they are transferred to their chosen financial institution. Completing this form correctly is important for a smooth banking experience.

- Obtain the form - Make sure you have the RS 6370L-3 form, either printed or downloaded.

- Enter your personal details - In Section 1, provide your name, Social Security number, and retirement number. Fill in your address and home telephone number as well.

- Complete Section 2 - Indicate that you request future benefits to be paid via Electronic Funds Transfer (EFT). Write the name of your financial institution and select the account type (checking or savings).

- Attach a voided check if applicable - If you are selecting a checking account, attach a voided check in Section 3. If your checks do not have your name printed, leave Section 3 for your bank to complete.

- Sign and date the form - Ensure you sign and date Section 2. If there is a joint account holder, they must also sign and date as well.

- Have your financial institution complete Section 3 if needed - For a savings account or if a voided check is not attached, your bank needs to fill out Section 3. Ensure the bank officer signs and provides the necessary details.

- Mail the completed form - Send the completed RS 6370L-3 form to the address provided: EFT/Pensioner Services, New York State and Local Retirement System, 110 State Street, Albany, New York 12244-0001.

What You Should Know About This Form

What is the RS 6370L-3 form used for?

The RS 6370L-3 form is an application for Electronic Funds Transfer (EFT) Direct Deposit for benefits from the New York State and Local Retirement System (NYSLRS). By completing this form, pensioners can request that all future pension payments be deposited directly into their bank accounts, either checking or savings, thereby ensuring timely access to their funds.

Who needs to sign the RS 6370L-3 form?

The form must be signed by the pensioner and any joint account holder, if applicable. This requirement ensures that all involved parties agree to the terms of the direct deposit arrangement. If the application involves a checking account, a voided check must also be attached to corroborate the account details.

How can I change my financial institution or account information after submitting the form?

If you wish to change your financial institution or account, you will need to complete a new RS 6370L-3 form. This new application will cancel your previous enrollment. It's important to note that processing your change may take up to 30 days. To avoid any interruption in payments, do not close your old account until the first deposit has been confirmed in the new account.

What should I do if I want to cancel my direct deposit request?

To cancel your direct deposit request, you must provide written notification to the NYSLRS at least 30 days before the next scheduled payment date. If your financial institution also wishes to terminate the direct deposit agreement, they must provide a similar notice. Keep in mind that the NYSLRS reserves the right to cancel the agreement at any time, with written notification provided to you.

What happens if a payment is deposited into my account by mistake?

By signing the RS 6370L-3 form, you authorize NYSLRS and the financial institution to debit your account for any payments made to you which you were not entitled to receive. This provision allows for the recovery of funds mistakenly deposited. It is critical to ensure that the information provided on the form is accurate to prevent such situations.

Common mistakes

Completing the RS 6370L-3 form can be a straightforward process, but several common mistakes can delay or complicate your enrollment in the Electronic Funds Transfer (EFT) program. Understanding these pitfalls is essential to ensure a smooth application process.

One frequent error is failing to provide a voided check when requesting direct deposit to a checking account. Attaching a voided check is crucial as it verifies the account details, including your name, bank information, and the account number. If a voided check isn’t included, the form will likely be returned or delayed until further information is provided.

Another common mistake involves inaccuracies in the personal information section. This includes not fully completing your name, Social Security number, or retirement number. Each piece of information must be legible and accurate to prevent any administrative issues. Even a small typo could result in confusion and a potential delay in processing.

Additionally, many applicants overlook the requirement for signatures. Both the pensioner and any joint account holder must sign the form. Failing to obtain all necessary signatures will result in the rejection of the application. It is important to ensure all signatures are present before submission.

Some individuals mistakenly believe they can change their bank account information without notifying NYSLRS. Changing financial institutions requires a new enrollment application. If you fail to properly submit this, deposits may continue to go into your old account, complicating your finances. Always allow time for processing when changing accounts.

Lastly, applicants often forget to read the back of the form, which contains important instructions. Missing crucial information can lead to errors, such as misunderstanding the requirements for submitting the application. By reviewing the entire document carefully, you minimize the risk of mistakes.

By being aware of these common errors, you can fill out the RS 6370L-3 form with greater accuracy and confidence, ensuring a smoother enrollment process for your electronic funds transfer.

Documents used along the form

The Rs 6370L 3 form is essential for pensioners wishing to initiate Electronic Funds Transfer (EFT) for Direct Deposit of their retirement benefits. Along with this form, several other documents might be required to ensure a smooth process regarding pension benefits and account management. The descriptions below provide a brief overview of commonly associated documents.

- Verification of Identity: This document often includes a government-issued ID or Social Security card to validate the pensioner's identity.

- Voided Check: A voided check must accompany the application for direct deposit into a checking account. This verifies the account number and routing information.

- Account Confirmation Letter: A statement from the financial institution confirming account details may be requested, especially for savings accounts.

- Change of Address Form: If the pensioner has moved, this form updates the retirement system with new address information, crucial for maintaining accurate records.

- Financial Institution Agreement: This document outlines the agreement between the pensioner and their bank regarding direct deposit and may include terms of service.

- Withdrawal Authorization Form: If there is a need to withdraw funds that were deposited erroneously, this authorization form allows the financial institution to reverse the transaction.

- Pension Benefit Statement: This statement outlines the current pension benefits and may be needed when updating or verifying information with the retirement system.

Each of these documents serves a distinct purpose in facilitating the efficient administration of pension benefits and ensuring that the pensioner’s requests are processed accurately. Proper completion and submission of the Rs 6370L 3 form alongside these ancillary documents will help maintain seamless financial transactions between pensioners and the New York State Local Retirement System.

Similar forms

Form W-4 (Employee’s Withholding Certificate): Similar to the RS 6370L-3 in that both require personal information from the individual filling it out, including their name and social security number. Both forms aim to ensure accurate and timely processing for financial transactions.

Check Authorization Form: This form allows individuals to authorize automatic withdrawals from their bank accounts. Like the RS 6370L-3, it requires bank account details and personal identification, ensuring that funds are transferred correctly.

Direct Deposit Authorization Form: Both forms facilitate the direct deposit of funds. They involve similar sections for listing bank information and confirming the individual's request for electronic transfers, thereby streamlining benefits or payroll payments.

IRS Form 4506-T (Request for Transcript of Tax Return): This form requests personal information and may involve the same social security number requirement as RS 6370L-3. Both forms are designed to manage financial records accurately and securely.

Payment Authorization Form: This document serves a similar purpose as it allows individuals to authorize payments. Like the RS 6370L-3, it requires confirmation of banking details and agreement to terms for handling funds.

ACH Withdrawal Authorization Form: Both forms provide an authorization mechanism for electronic transactions. They require banking information and a signature, affirming agreement with the terms of the electronic funds transfer.

Beneficiary Designation Form: This form outlines how benefits will be distributed after death. While its primary focus differs, it also seeks crucial personal information similar to the RS 6370L-3, ensuring the correct distribution of funds.

Loan Application Form: Much like the RS 6370L-3, loan applications require detailed personal and financial information. Both forms aim to ensure that the organization maintains accurate records for transactions involving money.

Dos and Don'ts

When filling out the RS 6370L-3 form, there are some recommended practices to follow, as well as some common mistakes to avoid. The goal is to ensure your application is processed smoothly.

- Do read all instructions carefully before starting the form.

- Do double-check all the information you provide, especially your Social Security number and retirement number.

- Do attach a voided check if you are requesting direct deposit into a checking account.

- Do ensure your name appears on the checks if you are not providing a voided check.

- Don't forget to sign the form. Both you and any joint account holder must sign it.

- Don't use corrections fluid or tape to change any information on the form. If you make a mistake, it's best to start over with a new form.

- Don't assume your previous enrollment is still valid if you have recently changed financial institutions.

- Don't close your old account until after the first deposit is successfully made into your new account.

Taking these steps can greatly increase the likelihood of your request being processed without issues. If you have questions, don't hesitate to reach out to the contact numbers provided in the instructions.

Misconceptions

There are several misconceptions surrounding the RS 6370L-3 form related to electronic funds transfer and direct deposit for retirement benefits. Addressing these misconceptions is essential for ensuring a smooth and efficient process for pensioners. Below are some of the most common misunderstandings.

- Misconception 1: The form is only for individuals with checking accounts.

- Misconception 2: Submitting the form guarantees immediate direct deposit.

- Misconception 3: Cancelling direct deposit is a simple process.

- Misconception 4: Errors in the form do not matter if corrections are made later.

- Misconception 5: Financial institutions do not need to confirm account details.

- Misconception 6: The New York State Comptroller has no responsibility for errors related to direct deposits.

This is not accurate. The RS 6370L-3 form can be used for both checking and savings accounts. Pensioners can choose either option by indicating their preference on the form.

While submitting the RS 6370L-3 form initiates the process, it may take up to 30 days for the changes to be fully processed and for deposits to begin in the new account. It's advisable to monitor your old account until the first deposit in the new one is confirmed.

Cancellation requires formal written notification to the New York State and Local Retirement System at least 30 days before the next scheduled payment. This timeline ensures the request is processed without disrupting benefit payments.

It is crucial that pensioners review and correct any information before submission. Providing incorrect details can lead to delays in processing and potentially affect benefit payments.

The financial institution must complete Section 3 if no voided check is attached. This ensures that all account information is accurate and verified, which is critical for proper fund transfers.

While the NYSLRS does reserve the right to decline EFT requests without prior notice, they emphasize that pensioners must provide accurate information. If errors occur due to incorrect information given by the pensioner or their representative, the NYSLRS is not liable for any resulting losses.

Understanding these misconceptions can significantly enhance the experience of managing retirement benefits. It is imperative for pensioners to approach the RS 6370L-3 form with clarity and diligence.

Key takeaways

1. Fill Out Carefully: Ensure all sections are completed accurately. Pay special attention to your name and retirement number.

2. Attach Required Documents: If requesting direct deposit for a checking account, attach a voided check. For savings accounts, your financial institution must complete specific sections.

3. Understand Your Rights: Once you authorize electronic funds transfer, NYSLRS can debit your account for any overpayments. Familiarize yourself with this agreement to avoid surprises.

4. Changes Take Time: Changing financial institutions or accounts requires a new enrollment application. Be prepared for this process to take up to 30 days.

5. Notification is Key: If you wish to cancel the direct deposit, notify NYSLRS in writing at least 30 days before your next payment date.

Browse Other Templates

How to Fill Out E-500 Form Nc - Each line of the form must be filled clearly and concisely.

Partial Disclaimer of Inheritance - This form is an essential tool for heirs managing the estate of a deceased shareholder.

What Is a Verified Complaint in California - Filing the PLD-050 with the court’s clerk is a critical step in the legal denial process.