Fill Out Your S 103 Form

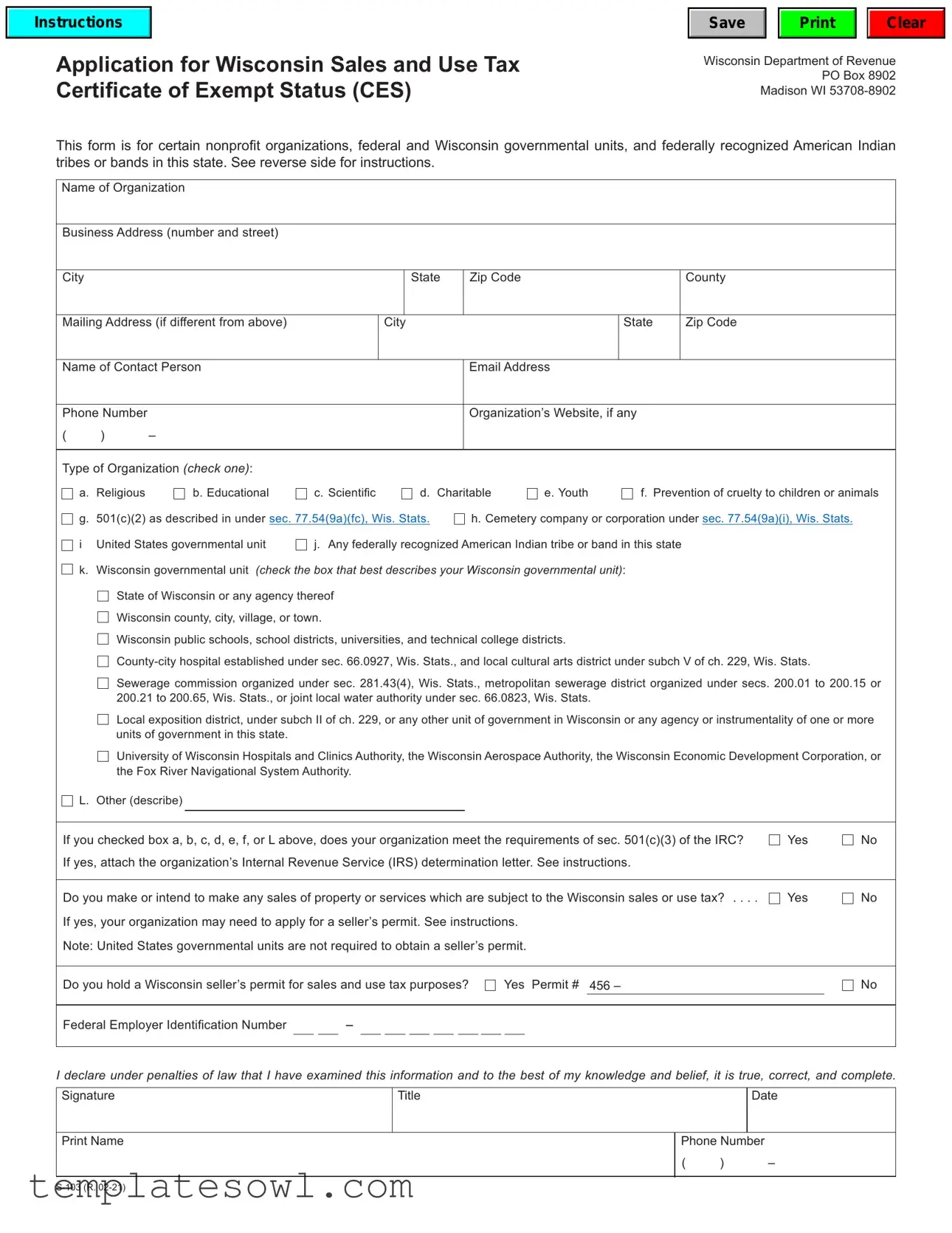

The S 103 form plays a crucial role for various organizations in Wisconsin seeking exemption from sales and use tax. Specifically designed for nonprofit organizations, government units, and federally recognized American Indian tribes or bands, this form allows eligible entities to apply for a Certificate of Exempt Status (CES). By obtaining a CES number, these organizations can help retailers identify their tax-exempt status easily. The application requires organizations to provide basic information, including their name, address, and type of organization, while also checking applicable boxes to confirm their eligibility under specific categories. Nonprofits must indicate if they meet the criteria of section 501(c)(3) of the Internal Revenue Code (IRC), attaching the necessary IRS determination letter when required. Moreover, governmental units need to provide their Federal Employer Identification Number (FEIN) to facilitate the issuance of the CES. Understanding these components is essential, as it streamlines the process of tax exemption for eligible entities and clarifies the expectations for compliance with Wisconsin tax laws.

S 103 Example

Instructions

Save

Clear

Application for Wisconsin Sales and Use Tax Certificate of Exempt Status (CES)

Wisconsin Department of Revenue

PO Box 8902

Madison WI

This form is for certain nonprofit organizations, federal and Wisconsin governmental units, and federally recognized American Indian tribes or bands in this state. See reverse side for instructions.

Name of Organization

Business Address (number and street)

City |

|

|

|

|

|

|

|

|

|

|

State |

|

Zip Code |

|

|

|

|

|

County |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Mailing Address (if different from above) |

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

State |

|

Zip Code |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Name of Contact Person |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email Address |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Phone Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Organization’s Website, if any |

|

|

|

|

|||||||||||

( |

) |

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Type of Organization (check one): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

a. Religious |

|

b. Educational |

|

c. Scientific |

|

|

|

d. Charitable |

e. Youth |

f. Prevention of cruelty to children or animals |

|||||||||||||||||||||

|

g. 501(c)(2) as described in under sec. 77.54(9a)(fc), Wis. Stats. |

h. Cemetery company or corporation under sec. 77.54(9a)(i), Wis. Stats. |

|

|||||||||||||||||||||||||||||

|

i United States governmental unit |

|

j. Any federally recognized American Indian tribe or band in this state |

|

|

|

|

|||||||||||||||||||||||||

|

k. Wisconsin governmental unit (check the box that best describes your Wisconsin governmental unit): |

|

|

|

|

|||||||||||||||||||||||||||

|

State of Wisconsin or any agency thereof |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Wisconsin county, city, village, or town. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Wisconsin public schools, school districts, universities, and technical college districts. |

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||

|

Sewerage commission organized under sec. 281.43(4), Wis. Stats., metropolitan sewerage district organized under secs. 200.01 to 200.15 or |

|||||||||||||||||||||||||||||||

|

200.21 to 200.65, Wis. Stats., or joint local water authority under sec. 66.0823, Wis. Stats. |

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Local exposition district, under subch II of ch. 229, or any other unit of government in Wisconsin or any agency or instrumentality of one or more |

|||||||||||||||||||||||||||||||

|

units of government in this state. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

University of Wisconsin Hospitals and Clinics Authority, the Wisconsin Aerospace Authority, the Wisconsin Economic Development Corporation, or |

|||||||||||||||||||||||||||||||

|

the Fox River Navigational System Authority. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

L. Other (describe) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you checked box a, b, c, d, e, f, or L above, does your organization meet the requirements of sec. 501(c)(3) of the IRC? |

Yes |

No |

||||||||||||||||||||||||||||||

If yes, attach the organization’s Internal Revenue Service (IRS) determination letter. See instructions. |

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Do you make or intend to make any sales of property or services which are subject to the Wisconsin sales or use tax? . . |

Yes |

No |

||||||||||||||||||||||||||||||

If yes, your organization may need to apply for a seller’s permit. See instructions. |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

Note: United States governmental units are not required to obtain a seller’s permit. |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

Do you hold a Wisconsin seller’s permit for sales and use tax purposes? |

|

|

|

Yes |

Permit # 456 – |

|

|

|

|

|

No |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Federal Employer Identification Number |

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

I declare under penalties of law that I have examined this information and to the best of my knowledge and belief, it is true, correct, and complete.

Signature |

Title |

|

|

Date |

|

|

|

|

|

Print Name |

|

Phone Number |

||

|

|

( |

) |

– |

|

|

|

|

|

PURPOSE OF THIS FORM

Purchases by certain nonprofit organizations, governmental units, and tribes described below are exempt from Wisconsin sales or use tax. The department issues Certificate of Exempt Status (CES) numbers to help retailers identify organizations that qualify for this exemption. The following organizations may apply for a CES number by completing this application.

1.Nonprofit organizations with a 501(c)(3) determination letter from the IRS and churches and religious organizations that meet the requirements of section 501(c)(3) of the Internal Revenue Code (IRC).

2.Federal and Wisconsin governmental units. Governmental units of other countries and states will not be issued a CES.

3.Federally recognized American Indian tribes or bands in this state.

4.Other organizations described in sec. 77.54(9a), Wis. Stats.

INSTRUCTIONS

1.Nonprofit Organizations: Check the box that best describes your organization. Include a copy of the organization’s 501(c)(3) determination letter from the IRS. Churches and religious organizations that meet the requirements of section 501(c)(3) of the IRC are not required to provide a determination letter.

2.Governmental Units: A CES number will be issued to the government unit level holding the Federal Employer Identification Number (FEIN) for the unit. In lieu of providing suppliers a CES number, a federal or Wisconsin gov- ernmental unit may provide a Wisconsin sales and use tax exemption certificate (Form

3.Tribes: A CES number will be issued to the federally recognized American Indian tribe or band in Wisconsin.

4.Other Organizations: Provide documentation or information showing the organization is the type described in sec. 77.54(9a), Wis. Stats.

5.Seller’s Permit: A nonprofit organization or Wisconsin governmental unit is required to charge Wisconsin sales tax on retail sales of tangible personal property or taxable services, unless the sales qualify as exempt occasional sales or are otherwise exempt. For more information, see Fact Sheet 2106, Occasional Sales Exemption for Nonprofit

Organizations.

6.Send completed application to the Wisconsin Department of Revenue.

Questions: Phone: |

(608) |

Fax: |

(608) |

Email: |

DORRegistration@wisconsin.gov |

Website: |

www.revenue.wi.gov |

Applicable Laws and Rules

This document provides statements or interpretations of the following laws and regulations in effect as of February 24, 2021: Section 77.54(9a), Wis. Stats., and secs. Tax 11.05, 11.14, 11.17, 11.19, 11.48, 11.68, 11.87, and 11.92, Wis. Adm. Code.

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of Form | The S 103 form applies to certain nonprofits, federal and Wisconsin governmental units, as well as federally recognized American Indian tribes in Wisconsin, allowing them to purchase tax-exempt. |

| Governing Laws | The application is governed by Section 77.54(9a) of the Wisconsin Statutes and specific sections of the Wisconsin Administrative Code. |

| Eligibility Requirements | To qualify, organizations must have a 501(c)(3) IRS determination letter or evidence of status as a governmental unit or federally recognized tribe. |

| Seller's Permit | Organizations may be required to obtain a seller's permit to collect sales tax unless exempt. U.S. government entities are not required to get one. |

| How to Submit | Completed applications should be sent to the Wisconsin Department of Revenue, using provided contact information for any inquiries. |

Guidelines on Utilizing S 103

Completing Form S-103 is an important step for nonprofit organizations and governmental units seeking exemption from Wisconsin sales and use tax. This form helps your organization receive a Certificate of Exempt Status (CES), facilitating tax-exempt purchases. Follow the steps below to fill out the form accurately and efficiently.

- Begin by entering the Name of Organization at the top of the form. This should be the full legal name of your organization.

- Provide the Business Address, including the street number, city, state, zip code, and county.

- If your mailing address differs from your business address, fill in the Mailing Address, along with the corresponding city, state, and zip code.

- List the Name of Contact Person. This should be someone who can answer questions related to the application.

- Next, include the Email Address and Phone Number of the contact person.

- If applicable, enter your organization’s Website URL.

- Select the Type of Organization by checking the box that best describes your organization. Make sure to read each option carefully.

- If you checked an option under sections a, b, c, d, e, f, or L, answer whether your organization meets the requirements of section 501(c)(3) of the IRS. If yes, attach the IRS determination letter.

- Indicate whether your organization makes or intends to make sales of property or services subject to Wisconsin sales or use tax by checking Yes or No.

- If you answered Yes, check whether you hold a Wisconsin seller’s permit for sales and use tax purposes. If applicable, provide the permit number.

- Fill in the Federal Employer Identification Number (FEIN) for your organization.

- Finally, sign the form, list your Title, and date the application. Make sure someone with authority to do so reviews the information.

- Print the name and phone number of the person signing the form.

After filling out the form, double-check all entries to ensure accuracy. Gather any necessary attachments, like the IRS determination letter if applicable. Send your completed application to the Wisconsin Department of Revenue at the provided address. Always retain a copy for your records.

What You Should Know About This Form

What is the purpose of the S 103 form?

The S 103 form is designed for certain nonprofit organizations, governmental units, and federally recognized American Indian tribes or bands in Wisconsin. It allows these entities to apply for a Certificate of Exempt Status (CES). This certificate exempts them from paying Wisconsin sales and use tax on qualifying purchases. By obtaining a CES number, retailers can easily identify organizations that qualify for tax-exempt status, making transactions smoother and more efficient.

Who is eligible to use the S 103 form?

Eligibility for the S 103 form includes several categories of organizations. Nonprofit organizations with a 501(c)(3) determination letter from the IRS can apply, as can religious organizations that meet 501(c)(3) requirements. Additionally, federal and Wisconsin governmental units, as well as federally recognized American Indian tribes or bands, can utilize this form. Other organizations that fall under specific provisions in Wisconsin law may also be eligible.

What documents need to be submitted with the S 103 form?

When submitting the S 103 form, it's essential to include relevant documentation depending on the type of organization. Nonprofits claiming 501(c)(3) status must provide a copy of their IRS determination letter. Churches and religious organizations that also qualify under this section do not need to submit this letter. Other organizations must provide documentation that establishes their eligibility under Wisconsin law. This ensures a complete application and aids in the timely processing of requests.

Do I need a seller's permit if I apply for the S 103 form?

How can I submit the completed S 103 form?

Common mistakes

Filling out the S 103 form can be a daunting task for many. One common mistake is failing to provide accurate organizational information. Organizations must ensure that the name, address, and type are all entered correctly. Inaccurate information can lead to a denial of the application or delays in receiving the Certificate of Exempt Status.

Another frequent oversight is neglecting to check the appropriate type of organization box. It’s crucial for applicants to review the available options and select the one that truly reflects their status. Misclassification can result in complications, as it casts doubt on the organization’s entitlement to the sales and use tax exemption.

Many organizations forget to include the required documentation. For instance, if an organization claims to meet the requirements of section 501(c)(3) of the Internal Revenue Code, they must attach their determination letter from the IRS. Without this letter, the application may be deemed incomplete.

A further misstep involves ignoring the seller's permit question. If an organization intends to make taxable sales, they should apply for a seller's permit. Forgetting to address this aspect could lead to legal complications with tax compliance in the future.

Additionally, some applicants overlook the significance of providing the Federal Employer Identification Number (FEIN). This number is vital for governmental units, and its absence on the form can hinder the issuance of the Certificate of Exempt Status. Ensuring that this information is accurately and promptly included is essential.

Lastly, rushing through the declaration section at the bottom of the form can be problematic. Applicants must understand that by signing, they confirm the accuracy and completeness of the information provided. A hasty signature may imply a lack of thoroughness, leading to potential disputes or rejections. Taking the time to double-check all entries can prevent future complications.

Documents used along the form

The S-103 form is essential for certain organizations seeking exemption from Wisconsin sales and use tax. It serves as an application for the Certificate of Exempt Status (CES), crucial for nonprofits, governmental units, and federally recognized tribes. Alongside this form, there are several other related documents that may be necessary to ensure compliance and proper identification. Below is a list of these additional forms and documents.

- Form S-211: This is the Wisconsin sales and use tax exemption certificate that governmental units may provide in lieu of a CES number. It serves as proof that the governmental unit is exempt from paying sales and use tax.

- IRS Determination Letter: Nonprofit organizations that qualify under section 501(c)(3) must attach a copy of this letter from the IRS. This document confirms their tax-exempt status, which is necessary for the application.

- Purchase Order: A governmental unit may issue a purchase order identifying itself as the buyer, which also acts as proof of its tax-exempt status. This can be used instead of obtaining a CES number.

- Fact Sheet 2106: This document outlines the rules regarding occasional sales exemption for nonprofit organizations. It provides clarity on when these organizations may charge sales tax or qualify for exemptions.

- Federal Employer Identification Number (FEIN): This number is crucial for government units applying for the CES. It identifies the governmental unit for tax purposes and must be included in the S-103 application.

Together, these documents help organizations navigate the complexities of tax exemption in Wisconsin, ensuring that they can operate effectively while adhering to the applicable laws. Careful preparation and submission of these forms are essential for a smooth process.

Similar forms

The S 103 form is a key document for organizations seeking a Certificate of Exempt Status in Wisconsin. Several other forms serve similar purposes within the realm of tax-exempt transactions and requirements. Below is a list highlighting these documents and their similarities to the S 103 form:

- Form S-211: This is the Wisconsin sales and use tax exemption certificate used by governmental units. It allows entities exempt from sales tax to make purchases without incurring sales tax, similar to the exemptions granted through the S 103 form.

- Form 501(c)(3) Determination Letter: Issued by the IRS, this letter designates an organization as a tax-exempt charitable entity. Like the S 103 form, it conveys the organization’s status and eligibility for tax exemptions, although it specifically confirms 501(c)(3) status.

- Form W-9: This form is often used by individuals and entities to provide their taxpayer identification number to others. Nonprofits may need to submit a W-9 to vendors for tax reporting purposes, aligning with the informational and identification aspects present in the S 103 form.

- Form 990: Nonprofit organizations must file this IRS form annually, providing financial information about their operations. Like the S 103 form, it demonstrates the nature of the organization and its commitment to the nonprofit mission.

- Form ST-3: This is the resale certificate in Wisconsin. Retailers utilize it to purchase goods intended for resale without paying sales tax, akin to the S 103 form, which enables qualifying organizations to purchase tax-free.

- Form 1023: Organizations apply for tax-exempt status using this IRS form. It requires the applicant to demonstrate eligibility under section 501(c)(3). This is similar in purpose to the S 103 form, which serves to request a specific sales and use tax exemption.

Each of these documents plays a critical role in facilitating tax-exempt status for various organizations, helping ensure compliance while supporting vital missions within communities.

Dos and Don'ts

When completing the S 103 form for the Wisconsin Sales and Use Tax Certificate of Exempt Status, it is important to follow specific guidelines to ensure accuracy and compliance. Below are four dos and don'ts to consider:

- Do check the correct box for your organization's type. This ensures proper classification and processing.

- Do include a copy of your 501(c)(3) determination letter if applicable. This documentation supports your organization’s exempt status.

- Do provide accurate contact information. Ensure that the name, email, and phone number of the contact person are clear and correct.

- Do send the completed form to the Wisconsin Department of Revenue. Make sure to keep a copy for your records.

- Don't leave any sections blank. Incomplete forms may delay processing or lead to denial of the certificate.

- Don't forget to indicate whether your organization makes taxable sales. This information is crucial for determining your tax obligations.

- Don't provide false information or misrepresent your organization’s activities. This can have legal repercussions.

- Don't forget to check for updates or changes to the form before submission. Regulations and requirements may change.

Misconceptions

Many individuals may have misconceptions about the S 103 form, which is used to apply for a Certificate of Exempt Status in Wisconsin. Here are some common misunderstandings:

- Only non-profit organizations can apply. While most applicants are indeed non-profit organizations, governmental units and federally recognized American Indian tribes can also file for a Certificate of Exempt Status.

- A 501(c)(3) status is mandatory for all applicants. Not all organizations need a 501(c)(3) status. Religious organizations qualifying under this section do not need to provide a determination letter.

- This form applies to all sales taxes. The S 103 form specifically pertains to Wisconsin sales and use tax exemptions, not all sales tax situations across the country.

- Once obtained, the certificate lasts forever. The Certificate of Exempt Status does not have a permanent status; organizations must ensure they still qualify and inform the Department of Revenue of any changes.

- All governmental units require a seller's permit. United States governmental units are exempt from obtaining a seller’s permit.

- Organizations cannot reapply once denied. Organizations can reapply for the Certificate of Exempt Status if they make necessary adjustments and meet the qualifying criteria.

- A CES number guarantees complete tax exemption. While a CES number allows for exemptions from sales and use tax, it does not eliminate all tax obligations. Organizations must still comply with other tax laws.

- Applying for a CES is a lengthy and complicated process. The application process is straightforward. Most organizations can easily gather the required information and submit the form without significant delays.

- All exemptions apply alike to every type of organization. Different categories of organizations may have distinct requirements and types of exemptions. Each organization must review guidelines specific to its category.

Understanding these points can help clarify the purpose and applicability of the S 103 form. If you have further questions or need additional assistance, reaching out to the Wisconsin Department of Revenue can provide added support.

Key takeaways

Filling out and using the S-103 form can be straightforward when key considerations are followed.

- The S-103 form applies to specific entities, including certain nonprofit organizations, government units, and federally recognized tribes in Wisconsin.

- Nonprofit organizations must check the appropriate box that describes their type and may need to provide their 501(c)(3) determination letter.

- It is important to determine if the organization will make any sales that are subject to sales tax; if so, a seller’s permit may be needed.

- Once completed, the application should be sent to the Wisconsin Department of Revenue for processing.

- Organizations should keep a copy of the Certificate of Exempt Status for their records, as it may be required to prove tax-exempt status to retailers.

Browse Other Templates

Dea Application - A section for revoking the power of attorney allows registrants to retract authority as needed.

Navpers 1070/6 - Pending legal matters that could delay mobilization require disclosure.

3849 - The form confirms that items requiring a signature must be signed for at delivery.