Fill Out Your Scc544 Form

The SCC544 form is a critical document for professionals looking to incorporate as a Virginia Professional Stock Corporation. It outlines essential information necessary for proper registration and compliance with state regulations. Included in the form are details such as the corporation's name, which must include specific designations like Corporation or Professional Corporation, ensuring it's distinct from existing entities. Furthermore, the form mandates a clear articulation of the professional services being offered, with guidelines on which professions can be combined under one corporation. Share issuance is another key aspect, requiring disclosure of the total number of shares and any distinct classes of stock. Additionally, the SCC544 necessitates the identification of a registered agent responsible for receiving legal documents on behalf of the corporation, along with a registered office that mirrors the agent's business location. Other requirements include declaring the number of directors on the initial board and providing the names of those directors if named within the articles. Also, incorporating parties must sign the document, confirming their authority to render the specified professional services. Finally, attention to detail is crucial, as the SCC544 includes specific fees and filing options, including online submissions, while also emphasizing the importance of not including personally identifiable information in the filed documents.

Scc544 Example

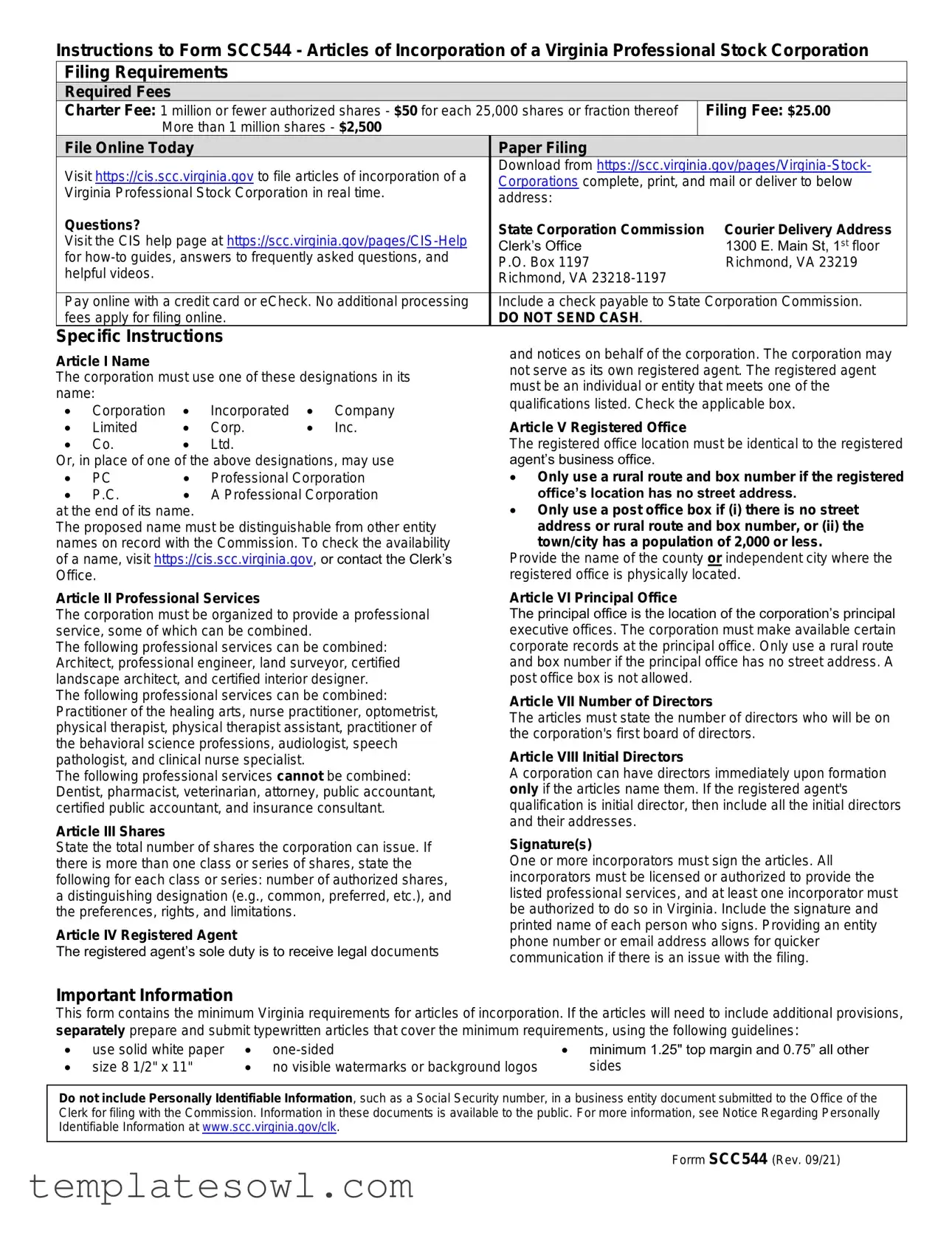

Instructions to Form SCC544 - Articles of Incorporation of a Virginia Professional Stock Corporation

Filing Requirements

Required Fees

|

Charter Fee: 1 million or fewer authorized shares - $50 for each 25,000 shares or fraction thereof |

|

Filing Fee: $25.00 |

||

|

More than 1 million shares - $2,500 |

|

|

|

|

|

File Online Today |

|

Paper Filing |

|

|

|

Visit https://cis.scc.virginia.gov to file articles of incorporation of a |

|

Download from |

||

|

|

Corporations complete, print, and mail or deliver to below |

|||

|

Virginia Professional Stock Corporation in real time. |

|

|||

|

|

address: |

|

||

|

|

|

|

||

|

Questions? |

|

State Corporation Commission |

Courier Delivery Address |

|

|

Visit the CIS help page at |

|

|||

|

|

Clerk’s Office |

1300 E. Main St, 1st floor |

||

|

for |

|

P.O. Box 1197 |

Richmond, VA 23219 |

|

|

helpful videos. |

|

|||

|

|

Richmond, VA |

|

||

|

|

|

|

||

|

|

|

|

||

|

Pay online with a credit card or eCheck. No additional processing |

|

Include a check payable to State Corporation Commission. |

||

|

fees apply for filing online. |

|

DO NOT SEND CASH. |

|

|

Specific Instructions

Article I Name

The corporation must use one of these designations in its name:

• |

Corporation |

• |

Incorporated |

• |

Company |

• |

Limited |

• |

Corp. |

• |

Inc. |

• |

Co. |

• |

Ltd. |

|

|

Or, in place of one of the above designations, may use

• |

PC |

• |

Professional Corporation |

• |

P.C. |

• |

A Professional Corporation |

at the end of its name.

The proposed name must be distinguishable from other entity names on record with the Commission. To check the availability of a name, visit https://cis.scc.virginia.gov, or contact the Clerk’s Office.

Article II Professional Services

The corporation must be organized to provide a professional service, some of which can be combined.

The following professional services can be combined: Architect, professional engineer, land surveyor, certified landscape architect, and certified interior designer.

The following professional services can be combined: Practitioner of the healing arts, nurse practitioner, optometrist, physical therapist, physical therapist assistant, practitioner of the behavioral science professions, audiologist, speech pathologist, and clinical nurse specialist.

The following professional services cannot be combined: Dentist, pharmacist, veterinarian, attorney, public accountant, certified public accountant, and insurance consultant.

Article III Shares

State the total number of shares the corporation can issue. If there is more than one class or series of shares, state the following for each class or series: number of authorized shares, a distinguishing designation (e.g., common, preferred, etc.), and the preferences, rights, and limitations.

Article IV Registered Agent

The registered agent’s sole duty is to receive legal documents

and notices on behalf of the corporation. The corporation may not serve as its own registered agent. The registered agent must be an individual or entity that meets one of the qualifications listed. Check the applicable box.

Article V Registered Office

The registered office location must be identical to the registered agent’s business office.

•Only use a rural route and box number if the registered office’s location has no street address.

•Only use a post office box if (i) there is no street address or rural route and box number, or (ii) the town/city has a population of 2,000 or less.

Provide the name of the county or independent city where the registered office is physically located.

Article VI Principal Office

The principal office is the location of the corporation’s principal executive offices. The corporation must make available certain corporate records at the principal office. Only use a rural route and box number if the principal office has no street address. A post office box is not allowed.

Article VII Number of Directors

The articles must state the number of directors who will be on the corporation's first board of directors.

Article VIII Initial Directors

A corporation can have directors immediately upon formation only if the articles name them. If the registered agent's qualification is initial director, then include all the initial directors and their addresses.

Signature(s)

One or more incorporators must sign the articles. All incorporators must be licensed or authorized to provide the listed professional services, and at least one incorporator must be authorized to do so in Virginia. Include the signature and printed name of each person who signs. Providing an entity phone number or email address allows for quicker communication if there is an issue with the filing.

Important Information

This form contains the minimum Virginia requirements for articles of incorporation. If the articles will need to include additional provisions, separately prepare and submit typewritten articles that cover the minimum requirements, using the following guidelines:

• |

use solid white paper |

• |

• minimum 1.25" top margin and 0.75” all other |

|

• |

size 8 1/2" x 11" |

• |

no visible watermarks or background logos |

sides |

Do not include Personally Identifiable Information, such as a Social Security number, in a business entity document submitted to the Office of the Clerk for filing with the Commission. Information in these documents is available to the public. For more information, see Notice Regarding Personally Identifiable Information at www.scc.virginia.gov/clk.

Forrm SCC544 (Rev. 09/21)

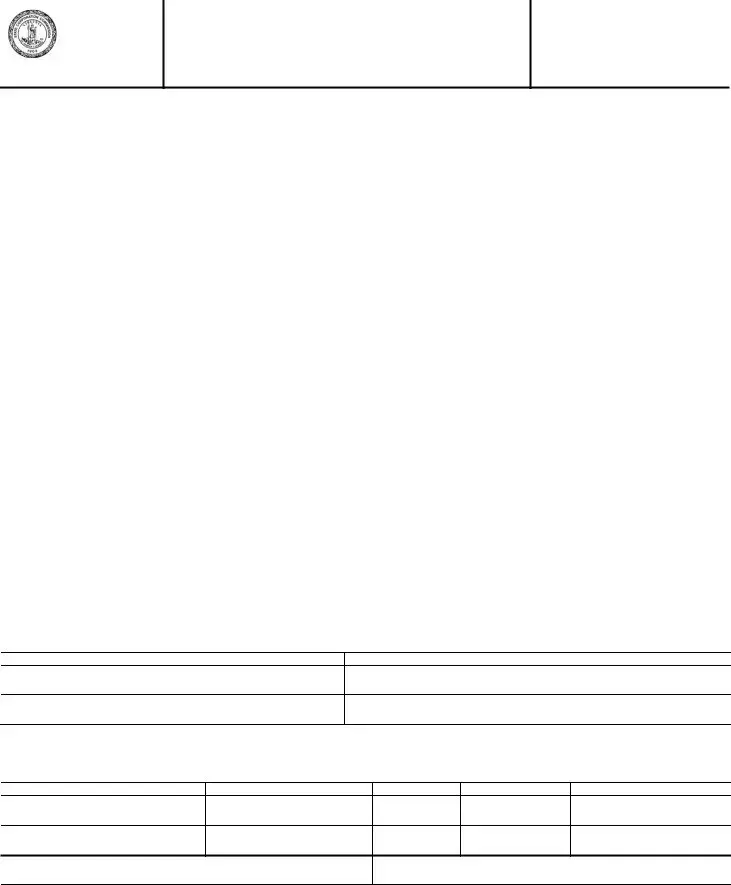

Form

SCC544

(Rev. 09/21)

State Corporation Commission

Articles of Incorporation of a Virginia

Professional Stock Corporation

Pursuant to Chapters 7 and 9 of Title 13.1 of the Code of Virginia, the undersigned state(s) as follows:

Article I The professional corporation’s name:

_______________________________________________________________________________________

_______________________________________________________________________________________

Article II The professional corporation is organized for the sole and specific purpose of rendering the professional services of:

_______________________________________________________________________________________

Article III The professional corporation is authorized to issue ________________ share(s) of stock.

(number)

Article IV A. The name of the professional corporation's initial registered agent:

_______________________________________________________________________________________

B. The initial registered agent is: (Mark appropriate box.)

(1)an individual who is a resident of Virginia and

an initial director of the professional corporation.

a member of the Virginia State Bar.

OR

(2) a domestic or foreign stock or nonstock corporation, limited liability company, or registered limited liability partnership authorized to transact business in Virginia.

Article V A. The professional corporation's initial registered office address, including the street and number, if any, which is identical to the business office of the initial registered agent, is

________________________________________________________________, VA ___________________

(number/street)(city or town)(zip)

B. The registered office is located in the county or city of ___________________________________

Article VI (Optional) The professional corporation’s principal office address, including the street and number (if any), is

_______________________________________________________________________________________

(number/street)(city or town)(zip)

Article VII The first board of directors shall have ______________ member(s).

(number)

Article VIII The initial directors are:

Name

Address

Signature(s)

The undersigned INCORPORATOR(s) is (are) duly licensed or legally authorized to render the professional services set forth in Article II, and at least one incorporator is so licensed or legally authorized in Virginia.

Signature

Printed Name

Date

Tel. # (optional)

Email Address (optional)

Business Tel. # (optional)

Business Email Address (optional)

Required Fees: See Instructions for Calculating

Form Characteristics

| Fact Name | Description |

|---|---|

| Name Requirement | The corporation's name must include designations such as "Corporation," "Inc.," "Professional Corporation," or similar terms. This ensures the name is appropriate for a professional stock corporation. |

| Governing Law | This form is governed by Chapters 7 and 9 of Title 13.1 of the Code of Virginia, which establishes the legal framework for incorporation. |

| Filing Fees | For corporations with one million or fewer authorized shares, the charter fee is $50 for every 25,000 shares or fraction thereof. If there are more than one million shares, the fee increases to $2,500. |

| Registered Agent | The corporation is required to appoint a registered agent, who cannot be the corporation itself. The agent receives legal documents on behalf of the corporation. |

| Professional Services | The corporation must be organized to provide specific professional services. Services include options like architecture, engineering, and various health professions. |

| Initial Directors | The articles must state the number of directors on the corporation's first board. This information helps establish governance early in the corporation's existence. |

| Office Address | The registered office must match the location of the registered agent's business office. This ensures that legal communications are sent to the correct place. |

| Signature Requirement | One or more incorporators must sign the articles. All should be licensed or authorized to provide the professions listed, with one ensuring compliance in Virginia. |

| Online Filing | The articles of incorporation can be filed online at https://cis.scc.virginia.gov, which streamlines the process and requires no additional processing fees. |

Guidelines on Utilizing Scc544

Filling out the SCC544 form is a crucial step in establishing a Virginia Professional Stock Corporation. Follow these steps carefully to complete the form accurately. Make sure to gather all necessary information before starting. This ensures a smooth submission process, whether you choose to file online or send a paper application.

- Gather Basic Information: Collect the proposed name for your corporation, the professional services it will offer, the number of shares you intend to issue, and the registered agent details.

- Check Name Availability: Verify that the proposed name is distinguishable from other entities by visiting cis.scc.virginia.gov.

- Complete Article I: Write the corporation’s name, ensuring it includes an appropriate designation (e.g., Corporation, Inc., P.C.).

- Complete Article II: Specify the professional services your corporation is organized to provide.

- Complete Article III: State the total number of shares the corporation can issue, including details for any classes of shares.

- Complete Article IV: Identify the registered agent. Indicate whether they are an individual or a qualifying entity and check the appropriate box.

- Complete Article V: Provide the address for the registered office, ensuring it matches the business office of the registered agent. Also, specify the county or independent city.

- Complete Article VI (Optional): If applicable, state the principal office address of the corporation.

- Complete Article VII: Indicate the number of directors on the initial board of directors.

- Complete Article VIII: List the names and addresses of the initial directors if they are named in the articles.

- Add Signatures: Have one or more incorporators sign the articles. Include their printed names, date, and optional contact information.

- Calculate Fees: Determine the fees based on the number of authorized shares. The charter fee and filing fee need to be included.

- Choose Submission Method: Decide between filing online or mailing a paper application to the State Corporation Commission.

After completing the form and ensuring all sections are filled out correctly, submit it to the appropriate office. If you choose to file online, visit this site for real-time processing. For paper submissions, use the provided address. Be mindful of the fees and do not send cash. Ensure timely submission to avoid potential delays in the incorporation process.

What You Should Know About This Form

What is the SCC544 form and why do I need it?

The SCC544 form is used to create a Virginia Professional Stock Corporation. This form outlines the corporation's founding details, including its name, the professional services it will provide, share structure, and names of directors. If you're planning to render a professional service in Virginia, like law, medicine, or engineering, you must file this form to operate legally as a professional corporation in the state.

What are the filing fees associated with the SCC544 form?

Filing fees for the SCC544 include a charter fee and a filing fee. If your corporation has up to 1 million authorized shares, the charter fee is $50 for every 25,000 shares or a fraction thereof. For corporations with more than 1 million shares, the charter fee is a flat rate of $2,500. Additionally, there's a $25 filing fee. It’s important to note that filing online incurs no extra processing fees, making it a convenient option.

What information do I need to provide regarding the corporation's name?

The name of your corporation must include specific designations like "Corporation," "Incorporated," or "Limited." Alternatively, designations like "PC," standing for Professional Corporation, are also acceptable. You must ensure that the proposed name is distinguishable from other entities on record with the State Corporation Commission. Before filing, check the name's availability online or by contacting the Clerk’s Office.

Who can serve as the registered agent for my corporation?

The registered agent is crucial as this person or entity will receive legal documents on behalf of your corporation. A registered agent can be either an individual resident of Virginia or a qualified business entity authorized to transact in Virginia. Importantly, your corporation cannot act as its own registered agent. Ensure you select someone who meets these qualifications to avoid any legal complications.

What happens if I need to include additional provisions in the articles?

If your incorporation documents need extra provisions beyond the minimum required by Virginia law, you must prepare separate typewritten articles. These must be formatted correctly: using solid white paper, one-sided, with specific margin sizes. Do not include any personally identifiable information, such as Social Security numbers. Keep in mind that all submitted documents are public records.

Common mistakes

When filling out the SCC544 form for the Articles of Incorporation of a Virginia Professional Stock Corporation, individuals often make several common mistakes. Identifying these pitfalls can streamline the process and prevent unnecessary delays.

One frequent error is neglecting to choose an appropriate corporate name. The name must include one of the accepted designations, such as "Corporation," "Inc.," or "Professional Corporation." Not ensuring that the desired name is distinguishable from existing entities can lead to rejection. Before submitting, checking name availability on the provided website is crucial.

Another mistake occurs in Article II, where the purpose of the corporation is specified. Some applicants fail to clearly outline the professional services being provided. It's important to be precise and include only those services that can legally be offered under Virginian law. Mixing incompatible professions can result in complications down the line.

In Article III, people often overlook the total number of shares the corporation is authorized to issue. Forgetting to provide a number or failing to clarify the classifications of shares can cause confusion and delay approval. If there are multiple classes of shares, detailing their preferences and rights is essential to avoid misunderstandings.

Registered agents play a crucial role, but mistakes can happen here too. In Article IV, applicants might incorrectly identify the registered agent, either by failing to mark the correct qualifications or by accidentally listing the corporation itself as the agent. Only individuals or specific entities can serve in this role, so double-checking this section is vital.

Next, consider the address requirements laid out in Article V. Some applicants mistakenly use a P.O. Box or a rural route without meeting the necessary conditions. If the office’s location has a street address, it must be used. Adhering to these specifications avoids potential rejections of the form.

Lastly, errors in signatures can derail the application process. Each incorporator must accurately sign and print their name in the appropriate section. If any incorporator lacks proper licensing or authorization, the form may be deemed invalid. Ensuring all signatures are correct and complete can make a significant difference.

By keeping these common errors in mind, applicants can approach the SCC544 form with confidence, leading to a smoother incorporation process.

Documents used along the form

The SCC544 form is crucial for establishing a Virginia Professional Stock Corporation. However, there are several other documents you might encounter during this process. Each document plays a vital role in ensuring compliance and proper organization. Here’s a helpful overview of related forms and documents that are often used alongside the SCC544.

- Articles of Incorporation - These are the foundational documents that officially create the corporation. They outline basic information such as the corporation's name, purpose, and registered agent.

- Bylaws - Bylaws serve as the internal rules that govern how the corporation will operate. They cover topics like how meetings are conducted, how directors are elected, and other operational procedures.

- Employer Identification Number (EIN) Application (Form SS-4) - This form is essential for tax purposes. It helps the IRS identify the corporation for tax filing and reporting purposes.

- Initial Report - Some states require a report to be filed shortly after incorporation, providing updated information about the corporation’s officers and registered agent.

- Registered Agent Consent Form - While not always required, this form confirms that the designated registered agent has agreed to fulfill this role on behalf of the corporation.

- Securities Registration (if applicable) - If the corporation plans to offer shares to the public, it may need to file additional paperwork to register the securities with state and federal agencies.

Being aware of these forms will help ensure a smooth incorporation process. It is always a good idea to consult with a professional to make certain all necessary documentation is completed accurately and submitted timely.

Similar forms

-

Form SCC631 - Articles of Organization for Domestic Limited Liability Company: This form is similar in purpose as it allows for the creation of a legal business entity in Virginia. Both forms require the submission of crucial details about the organization, including its name, registered agent, and registered office. The filing fees and online submission options are also comparable.

-

Form SCC840 - Articles of Incorporation for a Virginia Corporation: Like the SCC544 form, the SCC840 is used for establishing a corporation in Virginia. Both require specific articles detailing shares, registered agents, principal offices, and the number of directors, ensuring that essential information about the corporation is documented during the formation process.

-

Form SCC633 - Articles of Incorporation for a Nonstock Corporation: This form is used when forming a nonstock corporation in Virginia. It shares similarities with the SCC544 in that both need applicant details, such as the name of the corporation, registered agent, and the address of the registered office. The structure of required information essentially parallels each other.

-

Form SCC101 - Statement of Change of Registered Office/Registered Agent: This document allows corporations to update their registered agent or office details. Similar to the SCC544, it involves official filings that keep key information current with the State Corporation Commission, ensuring that legal documents reach the correct entity and location.

Dos and Don'ts

- Do use the proper designation in the corporation's name, such as "Corporation," "Incorporated," or "Professional Corporation." Make sure it meets state requirements.

- Do confirm the availability of your chosen name before submitting. You can check this through the State Corporation Commission's website.

- Do clearly specify the professional services your corporation will provide in Article II. Be concise and accurate.

- Do list all directors in Article VIII if the inclusion of directors is needed at formation. Make sure their names and addresses are complete.

- Don't attempt to serve as your own registered agent. Choose someone qualified to ensure proper handling of legal documents.

- Don't forget to include all required signatures. All incorporators should legally qualify to provide the services mentioned in Article II.

Misconceptions

Here are some common misconceptions about the SCC544 form, which is used for the Articles of Incorporation of a Virginia Professional Stock Corporation:

- The SCC544 form can be submitted by any corporation. Only professional corporations offering specific services as outlined by the state can utilize this form.

- You can serve as your own registered agent. In fact, the corporation cannot serve as its own registered agent. An individual or qualified entity must be designated.

- The professional services can be mixed freely. Certain professional services, like those of dentists and pharmacists, cannot be combined within the same corporation.

- Filing the SCC544 form is always the same experience. The filing process can vary based on whether you file online or by paper. Online filings can incur fewer additional fees and provide quicker processing.

- Any address can be used for the registered office. The registered office must match the registered agent's business office and follow specific address requirements.

- There are no fees associated with filing the SCC544. A charter fee applies based on the number of authorized shares, alongside a set filing fee.

- Personal information is secure in these filings. Business entity documents filed with the Commission are public, meaning certain personal information can be accessed by anyone.

- A professional corporation does not need to specify its services. The form requires a clear declaration of the specific professional services the corporation will offer.

- All incorporators must be Virginia residents. While at least one incorporator must be authorized to render professional services in Virginia, not all need to be Virginia residents.

Understanding these misconceptions can help ensure a smoother filing process when establishing a professional corporation in Virginia.

Key takeaways

Filling out and utilizing the SCC544 form for forming a Virginia Professional Stock Corporation requires thorough attention to detail. Here are some key takeaways to assist with the process:

- The form is available for online filing, which can expedite the process significantly.

- Begin by checking the availability of your proposed corporation name on the Virginia Corporation Commission website.

- Ensure that your corporation name includes a designation such as "Corporation," "Incorporated," or variations thereof.

- Clearly state the professional services your corporation will offer, as certain services cannot be combined.

- Specify the total number of shares your corporation can issue, along with any classes or series of shares.

- Select a registered agent; this individual or entity must not be the corporation itself.

- Provide a registered office address that matches the registered agent's business address.

- Include the number of directors on your corporation's first board; this must be specified in the articles.

- At least one incorporator must be licensed to provide the listed professional services in Virginia.

- It is vital to avoid including personally identifiable information in the submitted documents, as they become public.

Understanding these points can help ensure the successful filing and operation of a Virginia Professional Stock Corporation. For additional support, accessing the resources on the SCC website can provide valuable guidance throughout the process.

Browse Other Templates

What Is Nhis - Applicants should indicate the category of application by selecting from options like new or renewal.

Board of Vocational Nursing - Fill out your name clearly in the specified format using printed letters, avoiding pencil.

Private Investigator Agency Application,P.I. Principal Endorsement Addendum,Business License Addendum for Investigative Agencies,BLS Private Investigative Agency Supplemental Form,Principal Investigator Licensing Form,Agency and Principal Endorsement - The form serves as an official declaration of the applicant's qualifications and intentions within the industry.