Fill Out Your Sers 123 Form

The SERS 123 form is a key document for Pennsylvania State Employees’ Retirement System (SERS) members looking to manage the direct deposit of their pension payments. This form allows individuals to authorize the automatic deposit of their monthly pension into a specified checking or savings account. To initiate the process, the payee must complete Part I, which includes providing personal information such as their name, Social Security number, and address. Additionally, they must indicate the type of account for the deposit and attach a voided check or have their financial institution fill out Part II if using a savings account. Once submitted, SERS will confirm the effective date for this payment arrangement. The member's first payment after this date will be issued by check, ensuring accuracy before subsequent payments are deposited electronically. Regular pension payments are scheduled for the last working day of each month, making timely submission of the form essential for uninterrupted income. This straightforward process is designed to provide peace of mind to pension recipients, helping them access their funds conveniently and securely.

Sers 123 Example

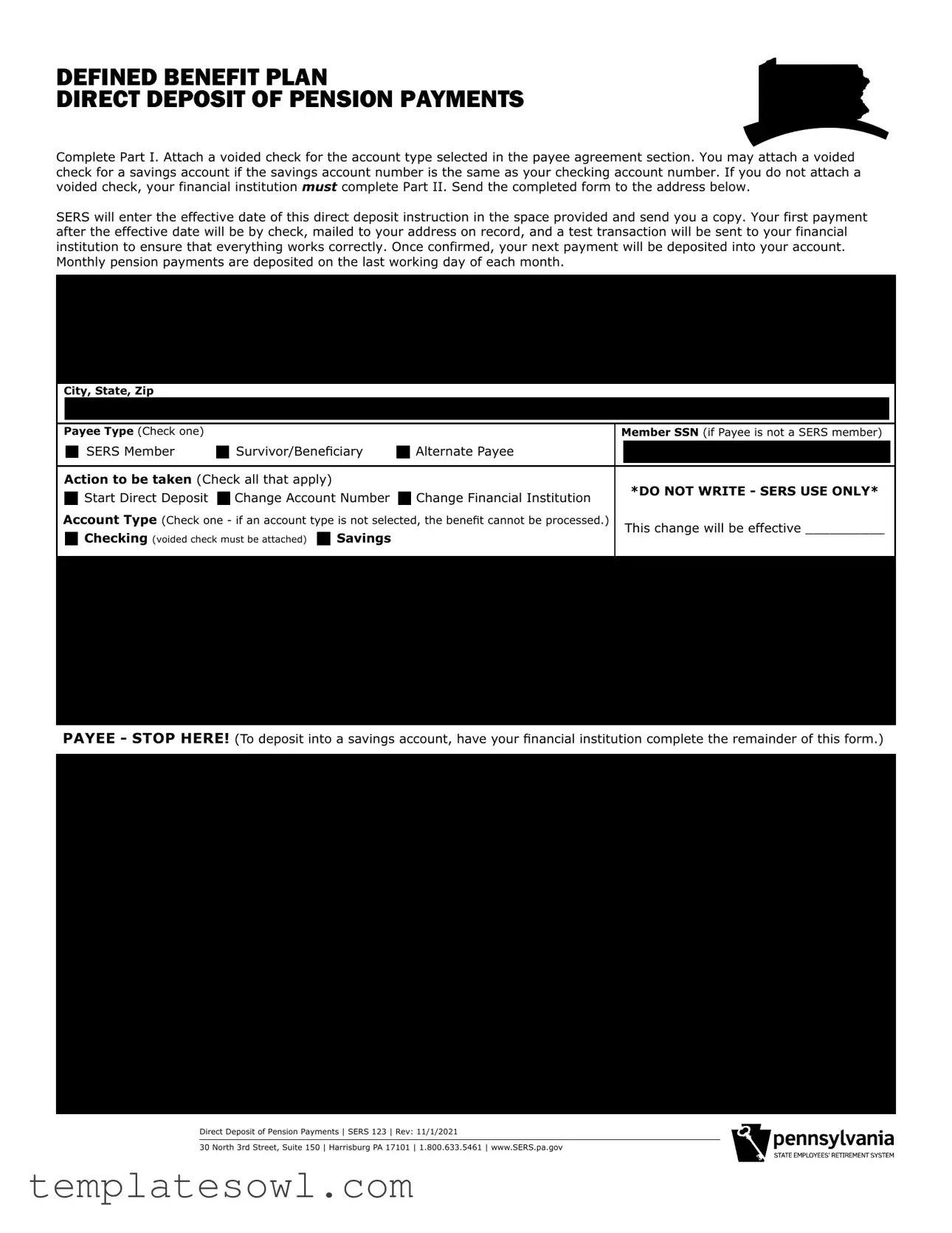

DEFINED BENEFIT PLAN

DIRECT DEPOSIT OF PENSION PAYMENTS

Complete Part I. Attach a voided check for the account type selected in the payee agreement section. You may attach a voided check for a savings account if the savings account number is the same as your checking account number. If you do not attach a voided check, your financial institution must complete Part II. Send the completed form to the address below.

SERS will enter the effective date of this direct deposit instruction in the space provided and send you a copy. Your first payment after the effective date will be by check, mailed to your address on record, and a test transaction will be sent to your financial institution to ensure that everything works correctly. Once confirmed, your next payment will be deposited into your account. Monthly pension payments are deposited on the last working day of each month.

PART I - PAYEE AGREEMENT

Payee Full Name (First, MI, Last)

Payee SSN

Street Address

Telephone

City, State, Zip

Payee Type (Check one) |

|

|

|

|

|

|

|

|

Member SSN (if Payee is not a SERS member) |

|||||

|

|

SERS Member |

|

|

Survivor/Beneficiary |

|

|

Alternate Payee |

|

|

|

|||

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Action to be taken (Check all that apply) |

|

|

|

|

|

*DO NOT WRITE - SERS USE ONLY* |

||||||||

|

|

Start Direct Deposit |

|

Change Account Number |

|

|

Change Financial Institution |

|

||||||

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|||||||

Account Type (Check one - if an account type is not selected, the benefit cannot be processed.) |

|

This change will be effective __________ |

||||||||||||

|

|

Checking (voided check must be attached) |

|

|

Savings |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I hereby authorize and request the Pennsylvania State Employees’ Retirement System (SERS) to direct my monthly pension payment to my account indicated in Part II below, and I further authorize the financial institution to credit the same account without responsibility for correctness of such amount. I hereby revoke all prior payment arrangements with SERS.

This authorization will remain in effect until I give written notice of its termination to SERS in such time and in such manner as to allow SERS a reasonable opportunity to act upon it. If I wish to change these instructions, I agree to notify SERS at least 60 days prior to the effective date of such change.

Payee’s Signature

Date

PAYEE - STOP HERE! (To deposit into a savings account, have your financial institution complete the remainder of this form.)

PART II - FINANCIAL INSTITUTION AGREEMENT

|

ACH Routing Number |

|

|

|

|

Account Number |

|||

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

||||||||

Financial Institution |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

Date |

|||

|

|

|

|

|

|

|

|

|

|

|

Street Address |

|

|

|

|

Telephone |

|||

|

|

|

|

|

|

|

|

|

|

|

City, State, Zip |

|

|

|

|

Title |

|||

In consideration of SERS making payments in accordance with this authorization without requiring other proof that the payee is alive on the date which such payment falls due, we hereby agree to repay, refund and/or reimburse to SERS, on demand, the amount of payments made to and received by us, the due date of which is after the date of death of the payee, to the extent that funds representing such payments remain on deposit with this financial institution at the time of certification of payee’s death by SERS, to this financial institution.

Authorized Signature

Direct Deposit of Pension Payments | SERS 123 | Rev: 11/1/2021

30 North 3rd Street, Suite 150 | Harrisburg PA 17101 | 1.800.633.5461 | www.SERS.pa.gov

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The SERS 123 form is designed for members of the Pennsylvania State Employees’ Retirement System to set up or change direct deposit for their monthly pension payments. |

| Requirements | To complete the form, payees must attach a voided check for the selected account type. If a voided check is not included, the financial institution must fill out the second part of the form. |

| Effective Date | The effective date of the direct deposit instructions, once processed by SERS, will be noted on the form and is crucial for ensuring timely payments. |

| Monthly Payments | Pension payments are deposited on the last working day of each month, offering a consistent and reliable payment schedule for retirees. |

Guidelines on Utilizing Sers 123

The SERS 123 form is an important document for setting up direct deposit of your pension payments. Completing this form correctly ensures a smooth transition to receiving your funds directly in your bank account. Follow these detailed steps to make sure everything is filled out properly.

- Begin with Part I - Payee Agreement. Fill in your full name, including your first, middle initial, and last name.

- Enter your Social Security Number.

- Provide your current street address, including city, state, and zip code.

- List your phone number for any follow-up communication.

- Indicate your payee type by checking the appropriate box: Member, Survivor/Beneficiary, or Alternate Payee.

- If you are not a SERS member, provide your Member SSN.

- Check all the actions you want SERS to take: Start Direct Deposit, Change Account Number, or Change Financial Institution.

- Select an Account Type: Checking or Savings. Ensure to attach a voided check if you select Checking.

- Sign and date the form to authorize the direct deposit.

If you are depositing into a savings account, your financial institution needs to complete Part II. This part includes fields for the bank’s information and refers to agreements regarding the handling of your funds.

- In Part II - Financial Institution Agreement, write the ACH Routing Number.

- Fill in your Account Number.

- Provide the name of your Financial Institution.

- Enter the bank's street address, including city, state, and zip code.

- Include the bank's phone number.

- Designate a title for the bank representative signing the agreement.

- Obtain the authorized signature from your financial institution.

Once both parts of the form are filled out, send it to the specified address. Make sure to keep a copy for your records. After processing, you will receive confirmation and details about your first payment.

What You Should Know About This Form

What is the purpose of the SERS 123 form?

The SERS 123 form is used to set up or change direct deposit for pension payments from the Pennsylvania State Employees’ Retirement System (SERS). By completing this form, you authorize SERS to deposit your monthly pension directly into your bank account. This process provides a secure and convenient way to receive your funds without the need for physical checks.

What information do I need to provide in Part I of the form?

In Part I, you need to provide your full name, Social Security number, address, and contact information. You will also indicate your payee type, such as whether you are a SERS member or a beneficiary. Additionally, you will select the action you wish to take, such as starting direct deposit or changing your account number. It is crucial to specify the account type (checking or savings) and attach a voided check if you're using a checking account.

What happens after I submit the SERS 123 form?

Once you submit the completed form, SERS will process your request and enter the effective date for the direct deposit in the appropriate space. You will receive a copy of the form for your records. Your first pension payment made after this effective date will be mailed as a check to your address. SERS will also send a test transaction to your financial institution to ensure that your direct deposit setup works smoothly. After this test is confirmed, your subsequent payments will be deposited directly into your account.

Can I cancel or change my direct deposit instructions?

Yes, you can cancel or change your direct deposit instructions. To do so, you must notify SERS in writing at least 60 days before the desired effective date of your change. This allows SERS sufficient time to update your account and ensures there are no interruptions to your pension payments. Remember to confirm any changes with your bank as well.

Common mistakes

When filling out the SERS 123 form for direct deposit of pension payments, individuals often stumble upon several common mistakes. Attention to detail is crucial, as even minor errors can delay the deposit process or cause additional complications.

One frequent mistake is failing to attach a voided check. The instructions explicitly state that a voided check must accompany the application for the selected account type. If this requirement is overlooked, the financial institution must complete Part II of the form instead. This additional step can lead to delays in processing the direct deposit.

Another pitfall occurs when individuals forget to indicate their account type. The form clearly states that an account type must be checked, whether it is checking or savings. If this is left blank, SERS cannot process the benefit request. This crucial oversight can result in unnecessary delays and complications.

Providing incorrect or incomplete personal information is yet another error. The payee’s full name, social security number, address, and telephone number should be recorded accurately. Any discrepancies can lead to confusion and may disrupt timely deposits.

Moreover, individuals sometimes neglect to check the appropriate action to be taken, whether starting direct deposit or changing existing account details. All relevant boxes should be checked to ensure clarity and to help SERS understand the intended instructions. Failure to do so might lead to assumptions or misinterpretations of the request.

Lastly, not reviewing the completed form before submission can be detrimental. Errors in the signature, date, or any other section should be rectified prior to sending the form. A thorough review can prevent costly mistakes and help ensure that the direct deposit of pension payments proceeds smoothly.

Documents used along the form

The SERS 123 form is an essential document used for setting up the direct deposit of pension payments. Alongside this form, there are several other important documents frequently required to ensure the seamless process of pension management. Below is a list of these complementary forms and documents.

- Voided Check: This document is essential as it provides the necessary banking information for the account where the pension payments will be deposited. It must be attached to the SERS 123 form to authorize the direct deposit.

- Change of Address Form: When a retiree moves, they must notify the Pennsylvania State Employees’ Retirement System by completing this form. It ensures that pension payments and important communications are sent to the correct address.

- Tax Withholding Form: This document allows pension recipients to designate how much federal and state tax they would like withheld from their pension payments. Completing this form can help prevent under-withholding and unexpected tax bills.

- Beneficiary Designation Form: In the event of a member's passing, this form indicates who will receive any remaining benefits. Updating it ensures that pension assets are distributed according to the retiree’s wishes.

- Pension Application Form: This initial document is submitted when applying for pension benefits. It gathers the necessary personal information and details on the member's employment history and eligibility.

These documents work together to support the effective administration of pension benefits. Properly completing and submitting them ensures that monthly payments are timely and that recipients’ preferences and circumstances are accurately recorded.

Similar forms

The SERS 123 form serves a specific purpose: to facilitate the direct deposit of pension payments. However, there are other documents that share similar functions in various contexts, especially concerning direct deposits and authorizations. Here’s a look at 10 documents that are comparable to the SERS 123 form:

- Direct Deposit Authorization Form: This form is used by employees to authorize their employers to deposit their paychecks directly into their bank accounts. Like the SERS form, it involves providing bank account information and requires a signature to initiate the process.

- Financial Aid Direct Deposit Form: Students can submit this form to have their financial aid funds directly deposited into their bank accounts. Similar to the SERS 123, it also requires account details and a verification process before funds are deposited.

- Social Security Direct Deposit Form: Beneficiaries use this document to authorize the Social Security Administration to deposit their benefits directly into a bank account. It parallels the SERS form in its aim to ensure timely and secure payment transfers.

- Pension Account Change Form: Individuals may need this form when they wish to change how their pension payments are processed, mirroring the SERS form’s function of updating account details for pension distributions.

- Vendor Direct Deposit Agreement: Businesses utilize this form to ensure that payments from clients or partners are deposited directly into their bank accounts. Similar to the SERS document, it requires bank account verification to avoid payment disruptions.

- Automatic Teller Machine (ATM) Direct Deposit Request: This form is utilized by individuals wishing to have their ATM deposits automatically credited to a specific account. Its objective aligns with the SERS form in making the deposit process seamless.

- Retirement Account Distribution Request: This form allows beneficiaries to request the direct deposit of funds from retirement accounts, mimicking the SERS process to initiate regular payments into a designated bank account.

- State Benefit Payment Direct Deposit Form: Similar to the SERS 123, this document is used by state benefit recipients to authorize direct deposit of benefits, ensuring that payments are deposited properly and efficiently.

- Insurance Claim Direct Deposit Form: This form authorizes insurance companies to deposit claims directly into an insured individual's bank account, akin to how the SERS form addresses pension payment transactions.

- Payroll Deduction and Direct Deposit Form: Employees fill out this document to manage both payroll deductions and direct deposits, sharing a common goal of handling payments directly and securely through banking institutions.

Understanding the similarities between these documents can help simplify financial transactions and ensure timely payments. Each form serves as a gateway to a streamlined financial process, making life just a little easier for those who rely on them.

Dos and Don'ts

When filling out the SERS 123 form, it is essential to pay careful attention to detail. Here are five helpful tips to ensure that the process goes smoothly.

- Do: Complete Part I fully, providing all required personal information, including your full name, Social Security number, and contact details.

- Do: Attach a voided check for the selected account type to avoid any delays in processing your direct deposit.

- Do: Double-check that you have selected the appropriate account type, either checking or savings, before submitting the form.

- Do: Notify SERS at least 60 days in advance if you wish to make any changes to your direct deposit instructions.

- Do: Keep a copy of your completed form for your records after submission.

- Don’t: Forget to provide an authorized signature; without it, your instructions may not be processed.

- Don’t: Leave any sections blank, as incomplete information can lead to delays.

- Don’t: Submit the form without a voided check, especially if you are requesting a direct deposit into a checking account.

- Don’t: Ignore the instructions related to your financial institution; ensure they complete Part II if necessary.

- Don’t: Assume that your first payment will be deposited directly; the first payment after your effective date will still be by check.

By following these do's and don'ts, you can help ensure the successful processing of your pension direct deposit. Always remember to verify the information for accuracy before sending the form to SERS.

Misconceptions

There are several misconceptions about the SERS 123 form that can lead to confusion. Here are seven common misunderstandings.

- You must only use a checking account. While a checking account is the most common option, individuals can also set up direct deposit to a savings account as long as the numbers match.

- A voided check is not necessary if you switch accounts. If changing to a different account, a voided check for the new checking account is essential for processing.

- The first payment will go directly into the new account. After submitting the form, the first payment will be mailed as a check, while a test transaction will confirm the account details.

- Direct deposits start immediately upon form submission. There is a processing period, and the changes will take effect on a specific date noted in the form.

- Only SERS members can use this form. Surviving beneficiaries and alternate payees can also utilize the SERS 123 form to receive payments.

- Once the form is submitted, you can never change your mind. Payees can revoke the authorization at any time with proper written notice.

- There are no deadlines for submitting changes. Changes must be communicated to SERS at least 60 days prior to the desired effective date.

Understanding these points can help ensure that the direct deposit process runs smoothly and that pension payments are received on time.

Key takeaways

Here are some key takeaways about filling out and using the SERS 123 form:

- Complete Part I: This section requires your full name, Social Security number, and address. Make sure all details are accurate.

- Attach a Voided Check: You must include a voided check to verify your account. This applies to checking accounts and savings accounts if their numbers match.

- First Payment Process: After submitting the form, your first payment will arrive by check. Expect this check in the mail, while a test transaction verifies your account.

- Monthly Payment Schedule: Pension payments will be directly deposited on the last working day of each month once everything is confirmed.

- Be Mindful of Changes: If you need to change your deposit instructions, you must notify SERS at least 60 days in advance.

Browse Other Templates

Ga Lottery Retailer - Compliance with all applicable laws and regulations is mandatory as part of the retailer agreement.

Couples' Registry Form,Wedding Essentials Registry,Nuptial Wish List,Bridal Registry Sheet,Happily Ever After Registry,Love's Gift List,Ceremony Registry Form,Evermore Registry,Union Registry Document,Wedding Gift Selection Form - Digital communication offers a modern twist to gift-giving.

Venn Diagram Instructions - Can be used in educational settings to enhance learning.