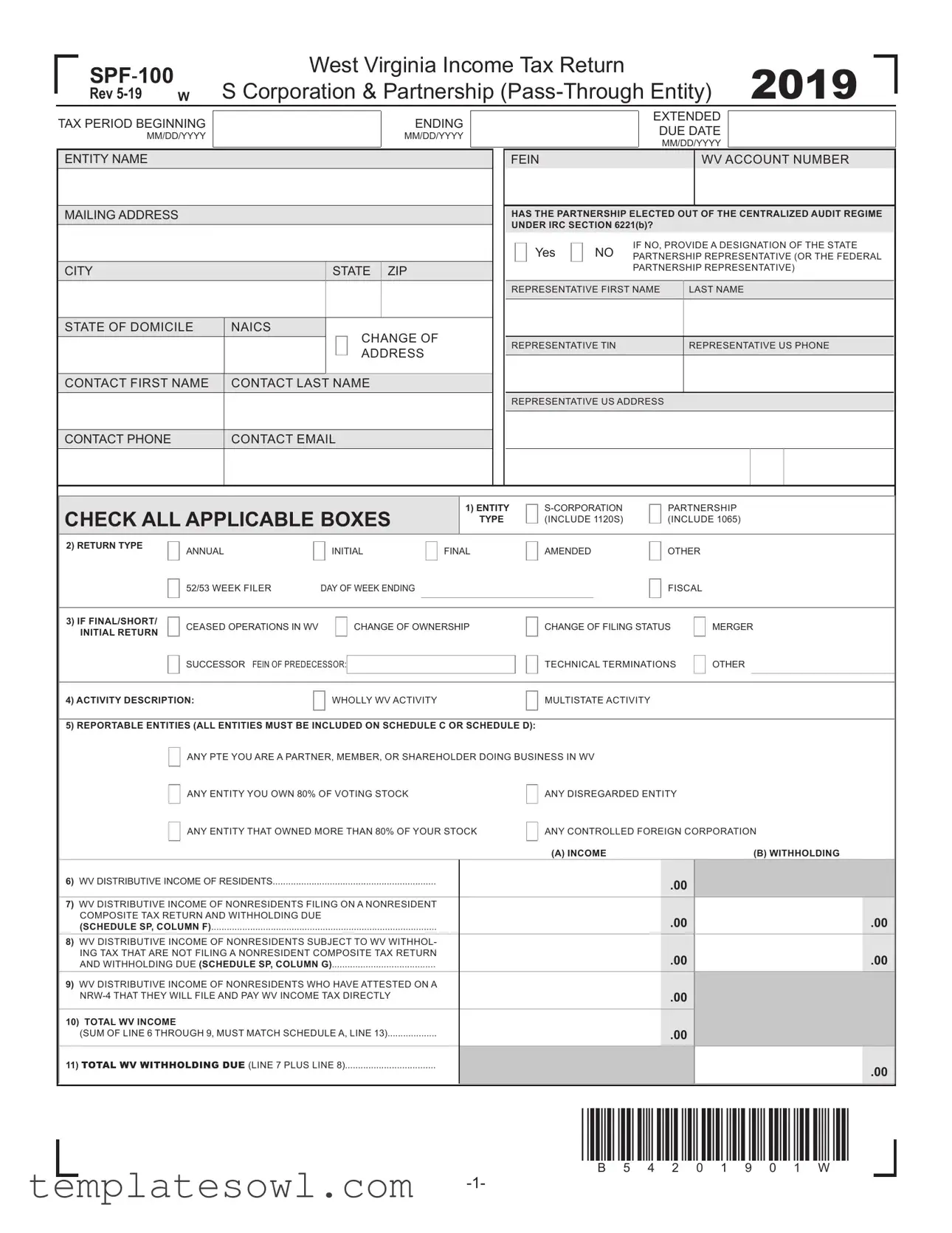

Fill Out Your Spf 100 Form

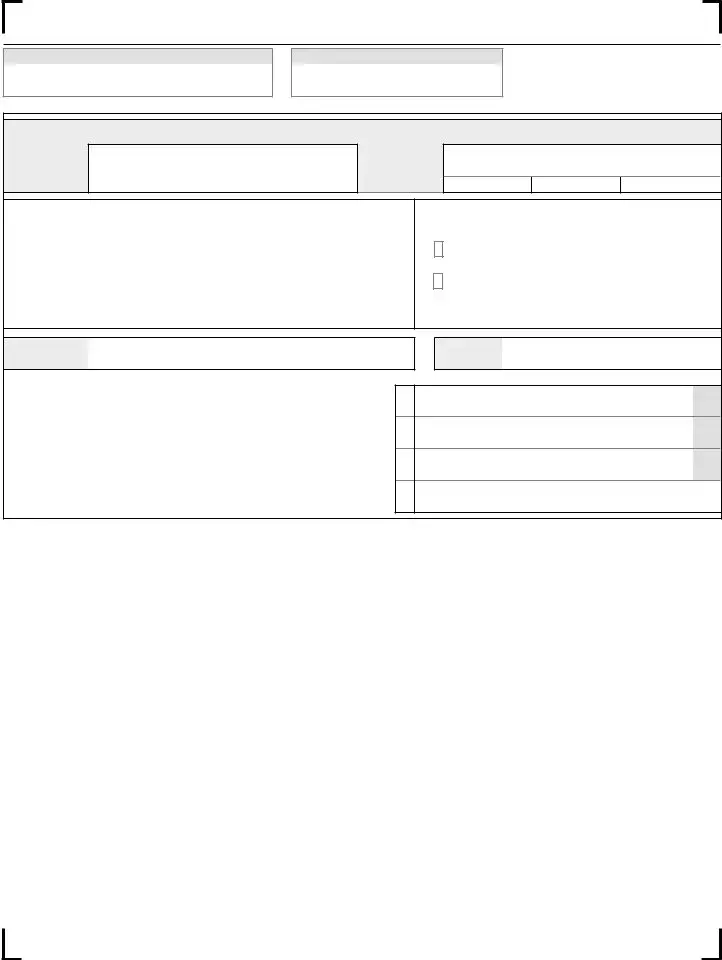

The SPF-100 form is essential for S corporations and partnerships operating in West Virginia, specifically for the 2019 tax year. This comprehensive document focuses on the income tax return requirements for pass-through entities, which play a significant role in the state's tax revenue. Users must begin by indicating the entity's name, address, and other identification details. The form requires the entity to specify the beginning and ending tax periods, along with any extended due dates, ensuring all timelines are accurately documented. Additionally, the form encompasses crucial questions related to the partnership’s election out of the centralized audit regime and the appointment of a state partnership representative. In terms of financial reporting, the SPF-100 outlines the need for precise calculations of West Virginia distributive income for both residents and nonresidents. Taxpayers must report withholding amounts, carryforward credits, and overpayments, in addition to specifying the total payments due. There are sections dedicated to detailing various modifications to federal income, making it clear what must be included or excluded when calculating state tax obligations. The comprehensive nature of the SPF-100 ensures that all pertinent information is gathered in one place, assisting users in meeting their tax responsibilities while promoting compliance with state regulations.

Spf 100 Example

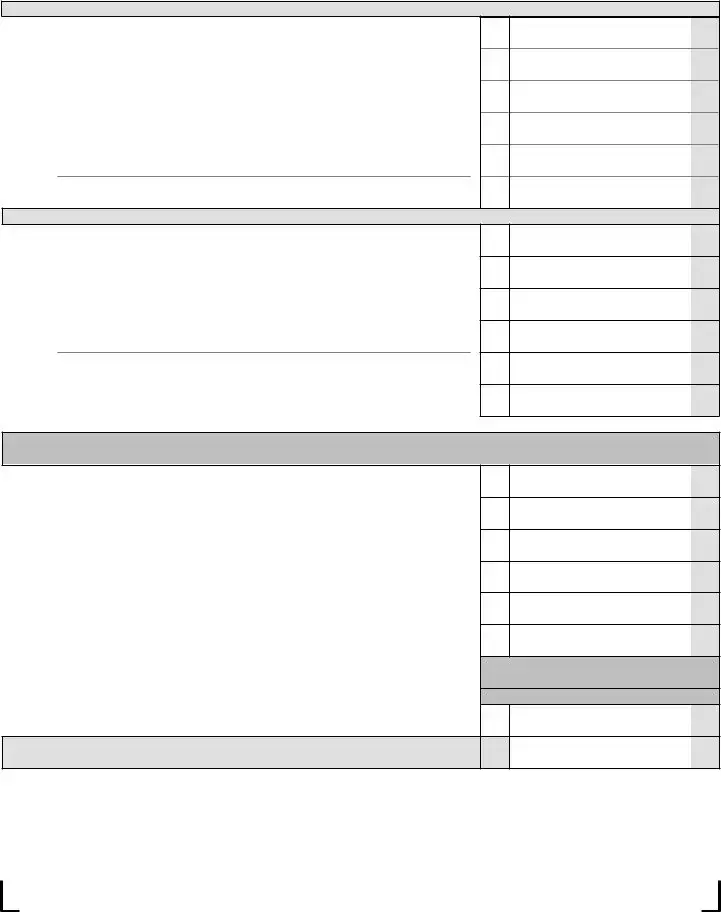

West Virginia Income Tax Return |

2019 |

||

S Corporation & Partnership |

|||

Rev |

TAX PERIOD BEGINNING

MM/DD/YYYY

ENDING

MM/DD/YYYY

EXTENDED DUE DATE

MM/DD/YYYY

ENTITY NAME

MAILING ADDRESS

CITY |

|

STATE |

ZIP |

|

|

|

|

|

|

STATE OF DOMICILE |

NAICS |

CHANGE OF |

|

|

|

|

|

||

|

|

ADDRESS |

|

|

|

|

|

|

|

CONTACT FIRST NAME |

CONTACT LAST NAME |

|

||

|

|

|

|

|

CONTACT PHONE |

CONTACT EMAIL |

|

||

FEIN |

WV ACCOUNT NUMBER |

|

|

HAS THE PARTNERSHIP ELECTED OUT OF THE CENTRALIZED AUDIT REGIME UNDER IRC SECTION 6221(b)?

|

|

Yes |

|

NO |

IF NO, PROVIDE A DESIGNATION OF THE STATE |

|

|

|

|

||||

|

|

|

PARTNERSHIP REPRESENTATIVE (OR THE FEDERAL |

|||

|

|

|

|

|

PARTNERSHIP REPRESENTATIVE) |

|

|

|

|||||

REPRESENTATIVE FIRST NAME |

LAST NAME |

|||||

|

|

|

||||

|

|

|

||||

REPRESENTATIVE TIN |

|

REPRESENTATIVE US PHONE |

||||

|

|

|||||

|

|

|

|

|

|

|

REPRESENTATIVE US ADDRESS |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHECK ALL APPLICABLE BOXES |

|

1) ENTITY |

PARTNERSHIP |

|||

|

TYPE |

(INCLUDE 1120S) |

(INCLUDE 1065) |

|||

|

|

|

|

|||

|

|

|

|

|

|

|

2) RETURN TYPE |

ANNUAL |

INITIAL |

FINAL |

AMENDED |

OTHER |

|

|

||||||

52/53 WEEK FILER |

DAY OF WEEK ENDING |

FISCAL

3)IF FINAL/SHORT/ INITIAL RETURN

CEASED OPERATIONS IN WV

CHANGE OF OWNERSHIP

CHANGE OF FILING STATUS

MERGER

SUCCESSOR FEIN OF PREDECESSOR:

TECHNICAL TERMINATIONS

OTHER

4) ACTIVITY DESCRIPTION:

WHOLLY WV ACTIVITY

MULTISTATE ACTIVITY

5) REPORTABLE ENTITIES (ALL ENTITIES MUST BE INCLUDED ON SCHEDULE C OR SCHEDULE D):

ANY PTE YOU ARE A PARTNER, MEMBER, OR SHAREHOLDER DOING BUSINESS IN WV

ANY ENTITY YOU OWN 80% OF VOTING STOCK

ANY DISREGARDED ENTITY

ANY ENTITY THAT OWNED MORE THAN 80% OF YOUR STOCK

ANY CONTROLLED FOREIGN CORPORATION

(A) INCOME |

(B) WITHHOLDING |

6)WV DISTRIBUTIVE INCOME OF RESIDENTS...............................................................

7)WV DISTRIBUTIVE INCOME OF NONRESIDENTS FILING ON A NONRESIDENT COMPOSITE TAX RETURN AND WITHHOLDING DUE

(SCHEDULE SP, COLUMN F).......................................................................................

8)WV DISTRIBUTIVE INCOME OF NONRESIDENTS SUBJECT TO WV WITHHOL- ING TAX THAT ARE NOT FILING A NONRESIDENT COMPOSITE TAX RETURN AND WITHHOLDING DUE (SCHEDULE SP, COLUMN G)........................................

9)WV DISTRIBUTIVE INCOME OF NONRESIDENTS WHO HAVE ATTESTED ON A

10)TOTAL WV INCOME

(SUM OF LINE 6 THROUGH 9, MUST MATCH SCHEDULE A, LINE 13)...................

11) TOTAL WV WITHHOLDING DUE (LINE 7 PLUS LINE 8)...................................

.00

.00

.00

.00

.00

.00

.00

.00

*B54201901W*

B 5 4 2 0 1 9 0 1 W

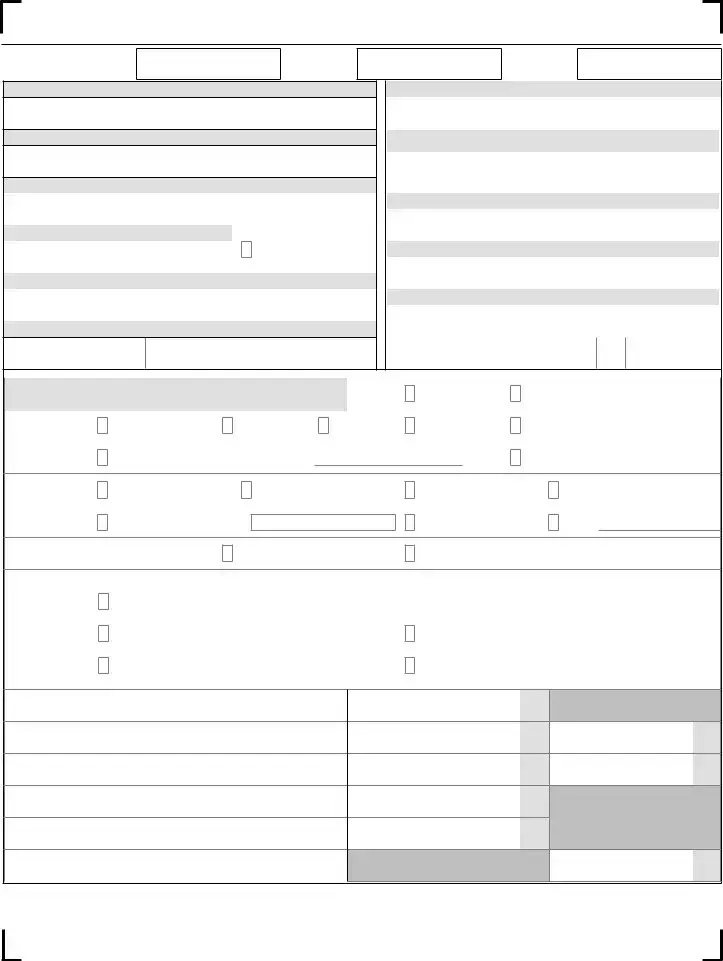

NAME

FEIN

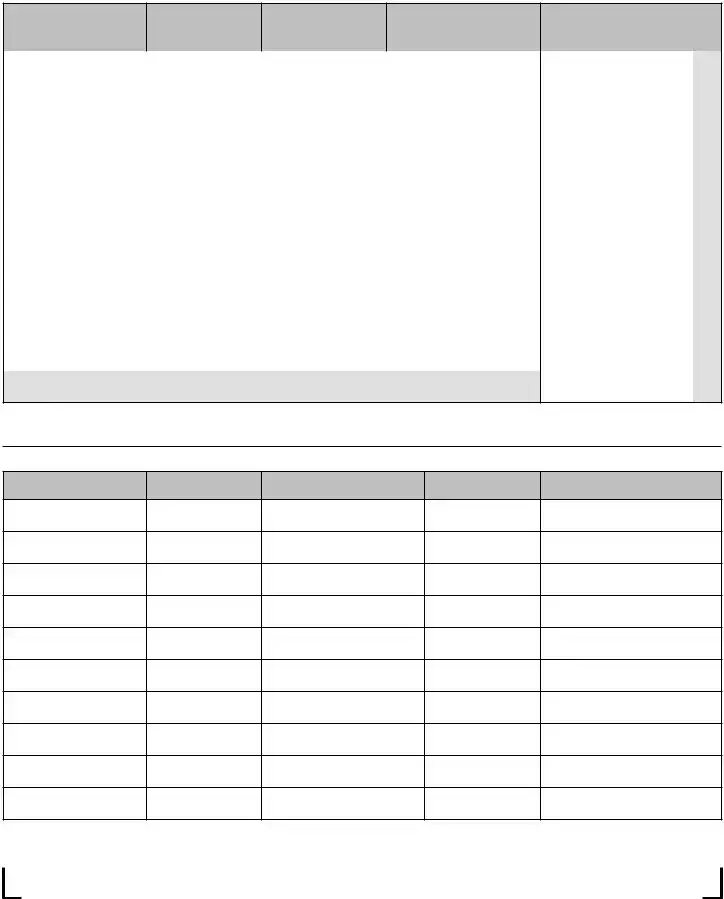

11. |

Total |

11 |

||

12. |

Prior year carryforward credit |

12 |

||

13. |

Estimated and extension payments |

13 |

||

14. |

Total Withholding credits (see instructions) |

|

||

|

CHECK HERE IF WITHHOLDING IS FROM NRSR (NONRESIDENT SALE OF REAL ESTATE) |

14 |

||

15. |

Payments (add lines 12 through 14; must match total on Schedule C) |

15 |

||

16. |

Overpayment previously refunded or credited (amended return only) |

16 |

||

17. |

TOTAL PAYMENTS (subtract line 16 from line 15) |

17 |

||

18. |

Tax Due – If line 17 is smaller than line 11, enter amount owed. If line 17 is larger |

|||

|

than line 11 skip to Line 22 |

18 |

||

19. |

Interest for late payment |

19 |

||

20. |

Additions to tax for late fi ling and/or late payment |

20 |

||

21. |

Total Due with this return (add lines 18 through 20) |

|

||

|

Make check payable to West Virginia State Tax Department |

21 |

||

22. |

Overpayment (Line 17 less line 11) |

22 |

||

23. |

Amount of line 22 to be credited to next year’s tax |

23 |

||

24. |

Amount to be refunded (line 22 minus line 23) |

24 |

||

Direct Deposit |

CHECKING |

SAVINGS |

|

|

of Refund |

|

|

|

|

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

ROUTING NUMBERACCOUNT NUMBER

PLEASE REVIEW YOUR ACCOUNT INFORMATION FOR ACCURACY. INCORRECT ACCOUNT INFORMATION MAY RESULT IN A $15.00 RETURNED PAYMENT CHARGE.

PLEASE SEE PAGE 3 OF INSTRUCTIONS FOR PAYMENT OPTIONS.

I authorize the State Tax Department to discuss my return with my preparer

YES

NO

Under penalty of perjury, I declare that I have examined this return, accompanying schedules, and statements, and to the best of my knowledge and belief, it is true, correct and complete.

|

Signature of Officer/Partner or Member |

Print name of Officer/Partner or Member |

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Title |

|

|

|

|

|

|

|

Business Telephone # |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of paid preparer |

Print name of Preparer |

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Firm’s name and address |

Preparer’s Email |

|

|

|

|

|

|

|

Preparer’s Telephone # |

|

||||

|

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAX ACCOUNT ADMINISTRATION DIVISION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PO BOX 11751 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHARLESTON WV |

|

*B54201902W* |

|

||||||||||

|

|

|

|

|

|||||||||||

|

|

|

|

|

|||||||||||

|

|

|

B |

5 |

4 |

2 |

0 |

1 |

9 |

0 |

2 |

W |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

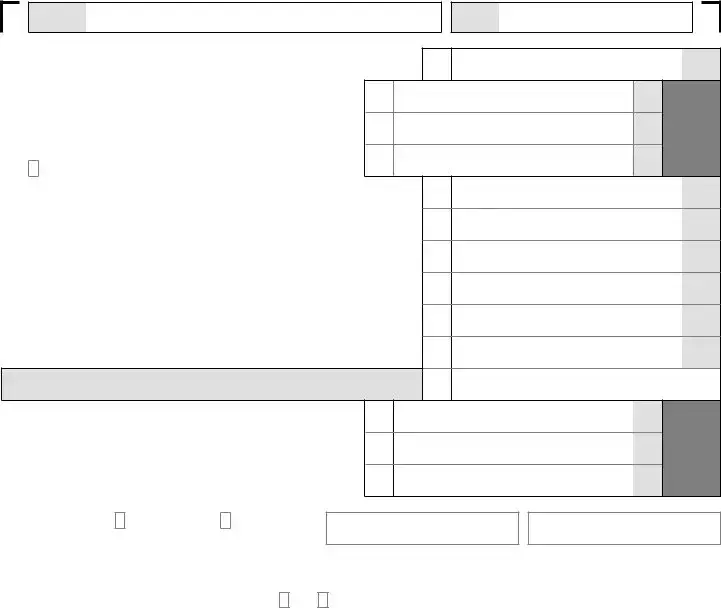

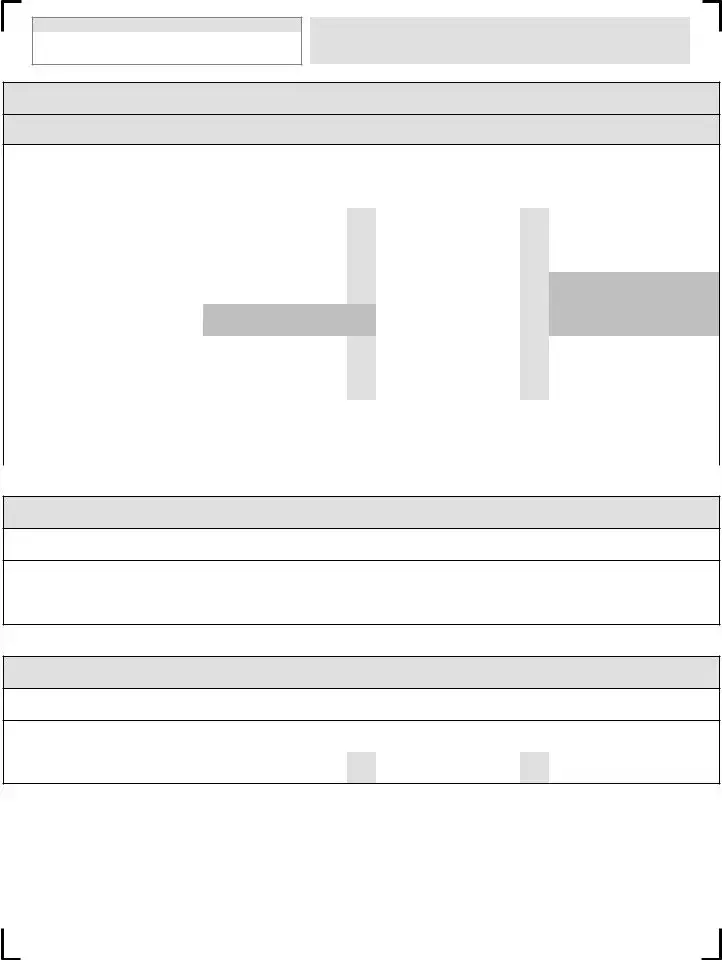

SCHEDULE

A

Income/Loss Modifi cations to |

2019 |

Federal |

1. |

.........Income/Loss: S Corporation use Federal Form 1120S; Partnership use Federal Form 1065 |

1 |

|||

2. |

Other income: S Corporation use Federal Form 1120S, Schedule K,; Partnership use Federal |

|

|||

2 |

|||||

|

Form 1065, Schedule K |

|

|

||

3. |

Other expenses/deductions: S Corporation use Federal Form 1120S, Schedule K; Partnership |

|

|||

3 |

|||||

|

use Federal Form 1065, Schedule K |

|

|

||

|

|

|

|

|

|

4. |

TOTAL FEDERAL INCOME: Add lines 1 and 2 minus line 3 – Attach federal return |

4 |

|||

|

|

|

|

|

|

5. |

Modifi cations Increasing Federal Income (Schedule B, Line 6) |

|

|

5 |

|

|

|

|

|

|

|

6. |

Modifi cations decreasing Federal Income (Schedule B, Line 12) |

|

|

6 |

|

7. |

Modifi ed Federal S Corporation/Partnership income (sum of lines 4 plus line 5 minus line 6) |

|

|||

7 |

|||||

|

Wholly WV Entity go to line 13. Multistate Entity continue to line 8. |

|

|

||

8. |

Total nonbusiness income allocated everywhere from Form |

8 |

|||

|

|

|

|

|

|

9. |

Income subject to apportionment (line 7 less line 8) |

|

|

9 |

|

10. |

West Virginia apportionment factor (Round to 6 decimal places) |

|

|

|

|

|

|

|

|||

|

from |

10 |

. |

|

|

|

if applicable, from |

|

|||

|

............................or |

|

|

11 |

|

11. |

Multistate S Corporation/Partnership’s apportioned income (line 9 multiplied by line 10) |

||||

|

|

|

|

|

|

12. |

Nonbusiness income allocated to West Virginia. From Form |

12 |

|||

13. |

West Virginia income (wholly WV entities enter amount from line 7; multistate entities add lines |

|

|||

13 |

|||||

|

11 and line 12). You must complete Schedule SP |

|

|

||

|

|

|

|

|

|

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

*B54201903W*

B 5 4 2 0 1 9 0 3 W

|

|

SCHEDULE |

|

MODIFICATIONS TO FEDERAL S CORPORATION |

|

|

|

|

|

|

|

||

|

|

B |

W |

AND PARTNERSHIP INCOME |

2019 |

|

|

|

|

|

Adjustments Increasing |

|

1. |

Interest or dividend income on federal obligations which is exempt from federal tax but subject |

|

|

to state tax |

1 |

2. |

Interest or dividend income on state and local bonds other than bonds from West Virginia sources |

2 |

3. |

Interest on money borrowed to purchase bonds earning income exempt from West Virginia tax |

3 |

4. |

Qualifying 402(e) |

|

|

to state tax |

4 |

5. |

Other: |

5 |

|

TOTAL INCREASING ADJUSTMENTS |

|

6. |

(Add lines 1 through 5; enter here and on Schedule A, line 5) |

6 |

|

Adjustments Decreasing |

|

7. |

Interest or dividends received on Unitied States or West Virginia obligations included in federal |

|

|

adjusted gross income but exempt from state tax |

7 |

8. |

Refunds of state and local income taxes received and reported as income to the IRS |

8 |

9. |

Qualifi ed Opportunity Zone business income |

9 |

10. |

Other: |

10 |

11. |

Allowance for governmental obligations/obligations secured by residential property |

|

|

(Complete Schedule |

11 |

12. |

TOTAL DECREASING ADJUSTMENTS |

|

|

(Add lines 7 through 11; enter here and on ScheduleA, line 6) |

12 |

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

Schedule

ALLOWANCE FOR GOVERNMENTAL OBLIGATIONS/OBLIGATIONS SECURED BY RESIDENTIAL PROPERTY

1.Federal obligations and securities...................................................................................................

2.Obligations of WV and political subdivisions of WV.......................................................................

3.Investments or loans primarily secured by mortgages or deeds of trust on residential property located in WV.................................................................................................................................

4.Loans primarily secured by a lien or security agreement on a mobile home or

5.TOTAL (add lines 1 through 4).......................................................................................................

6.Total assets as shown on Schedule L, Federal Form 1120S or Federal Form 1065......................

7. Line 5 divided by line 6 (round to 6 decimal places) |

7 |

• |

8.ADJUSTED INCOME.

(Add schedule A line 4 and Schedule B line 6. Subtract the sum of Schedule B lines 7 through 10 )

9.ALLOWANCE (line 7 x line 8, disregard sign) Enter here and on Schedule B line 11 ...................

1

2

3

4

5

6

8

9

.00

.00

.00

.00

.00

.00

.00

.00

*B54201904W*

B 5 4 2 0 1 9 0 4 W

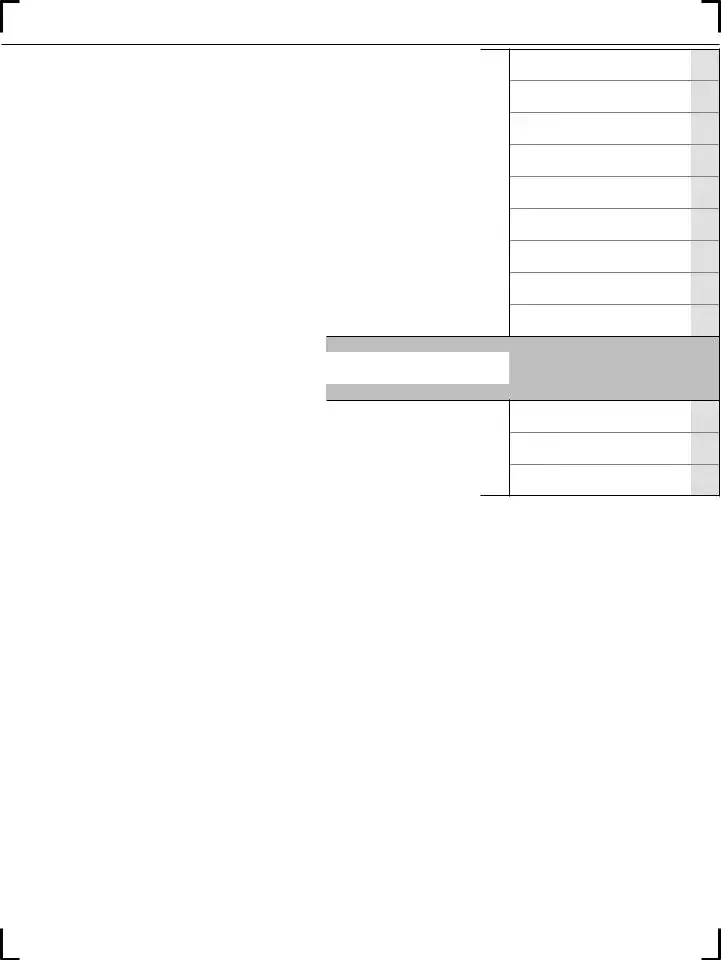

|

|

SCHEDULE |

|

REPORTABLE ENTITIES |

|

|

|

|

C |

W |

& SCHEDULE OF TAX PAYMENTS |

2019 |

|

|

|

|

If the number of entities to be reported on Schedule C exceeds 10, you must import the spreadsheet through www.MyTaxes.WVtax.

NAME OF

ENTITY

FEIN

DATE OF

PAYMENT

MM |

DD |

YYYY |

|

|

|

TYPE:

WITHHOLDING, ESTIMATED, EXTENSION, OTHER PMTS OR PRIOR YEAR CREDIT

AMOUNT OF PAYMENT

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

TOTAL (AMOUNT MUST AGREE WITH AMOUNT ON |

.00 |

|

|||||

SCHEDULE

D SCHEDULE OF REPORTABLE ENTITIES 2019

If the number of entities to be reported on Schedule D exceeds 10, you must import the spreadsheet through www.MyTaxes.WVtax.

Disregarded entities will be filing under the parents West Virginia account number.

NAME OF

ENTITY

FEIN

PARENT NAME

PARENT FEIN

EXPLANATION

*B54201905W*

B 5 4 2 0 1 9 0 5 W

REV |

W SUMMARY OF TAX CREDITS 2019 |

|

ENTITY NAME

FEIN

This form is to be used by S Corporations and Partnerships to summarize the tax credits that are allocable to their shareholders/partners. Both this summary form and the appropriate credit calculation schedule(s) or form(s) must be attached to your return in order to claim a tax credit. The S Corporation or Partnership must complete an allocation schedule for each tax credit claimed. These allocations will be reported on their

|

TAX CREDITS |

|

CREDIT CALCULATED ON APPROPRIATE |

AVAILABLE TAX CREDIT FOR CURRENT YEAR |

THE TOTAL AMOUNT OF CREDIT CANNOT EXCEED |

SCHEDULE |

|

||

|

THE TAX LIABILITY FOR THAT TAX |

|

|

|

|

|

|

|

|

1. |

Economic Opportunity Tax Credit |

1 |

|

|

|

.00 |

.00 |

||

2. |

Environmental Agricultural Equipment Tax Credit |

2 |

|

|

|

.00 |

.00 |

||

3. |

West Virginia Neighborhood Investment Program Credit |

3 |

|

|

|

.00 |

.00 |

||

4. |

Apprentice Training Tax Credit |

4 |

|

|

|

.00 |

.00 |

||

5. |

Film Industry Tax Credit |

5 |

|

|

|

.00 |

.00 |

||

6. |

Alternative Fuel Tax Credit |

|

|

|

6 |

|

|

||

|

.00 |

.00 |

||

7. |

Innovative Mine Safety Technology Tax Credit |

|

|

|

7 |

|

|

||

|

.00 |

.00 |

||

8. |

Historic Rehabilitated Buildings Investment Credit |

8 |

|

|

|

.00 |

.00 |

||

9. |

West Virginia Military Incentive Credit |

9 |

|

|

|

.00 |

.00 |

||

10. |

Farm to Food Bank Tax Credit |

10 |

|

|

|

.00 |

.00 |

||

11. |

TOTAL CREDITS |

11 |

|

|

|

add lines 1 through 10 |

.00 |

.00 |

|

*B54201906W*

B 5 4 2 0 1 9 0 6 W

|

|

ALLOCATION AND APPORTIONMENT |

2019 |

|

|

|

|

|

|

|

|||

|

|

REV |

W FOR MULTISTATE BUSINESSES |

|

|

|

|

|

|

This form is used by entities that are subject to tax in more than one state to allocate and ap-

FEINportion their income to the State of West Virginia. Complete and attach to Form

|

|

APT SCHEDULE A1 EVERYWHERE |

|

||

|

ALLOCATION OF NONBUSINESS INCOME FOR MULTISTATE BUSINESSES |

||||

TYPES OF ALLOCABLE INCOME |

Column 1 |

Column 2 |

Column 3 |

||

GROSS INCOME |

RELATED EXPENSES |

NET INCOME |

|||

|

|

||||

1. |

Rents |

.00 |

.00 |

.00 |

|

|

|

|

|

|

|

2. |

Royalties |

.00 |

.00 |

.00 |

|

|

|

|

|

|

|

3. |

Capital gains/losses |

.00 |

.00 |

.00 |

|

|

|

|

|

|

|

4. |

Interest |

.00 |

.00 |

.00 |

|

|

|

|

|

|

|

5. |

Dividends |

.00 |

.00 |

.00 |

|

|

|

|

|

|

|

6. |

Patent/copyright royalties |

.00 |

.00 |

.00 |

|

7. |

Gain – sale of natural resources |

|

|

|

|

.00 |

.00 |

.00 |

|||

|

(IRC Sec. 631 (a)(b)) |

||||

8. |

Income from nonunitary sources |

|

|

.00 |

|

|

reported on the schedule |

|

|

||

9. |

Nonbusiness income/loss |

|

|

.00 |

|

Sum of lines 1 through 8, of column 3. Enter total of Column on |

|||||

|

|

|

|

||

|

|

APT SCHEDULE A2 WEST VIRGINIA |

|

||

|

ALLOCATION OF NONBUSINESS INCOME FOR MULTISTATE BUSINESSES |

||||

TYPES OF ALLOCABLE INCOME |

Column 1 |

Column 2 |

Column 3 |

||

GROSS INCOME |

RELATED EXPENSES |

NET INCOME |

|||

|

|

||||

1. |

Rents |

.00 |

.00 |

.00 |

|

|

|

|

|

|

|

2. |

Royalties |

.00 |

.00 |

.00 |

|

|

|

|

|

|

|

3. |

Capital gains/losses |

.00 |

.00 |

.00 |

|

|

|

|

|

|

|

4. |

Interest |

.00 |

.00 |

.00 |

|

|

|

|

|

|

|

5. |

Dividends |

.00 |

.00 |

.00 |

|

|

|

|

|

|

|

6. |

Patent/copyright royalties |

.00 |

.00 |

.00 |

|

7. |

Gain – sale of natural resources |

|

|

|

|

.00 |

.00 |

.00 |

|||

|

(IRC Sec. 631 (a)(b)) |

||||

8. |

Income from nonunitary sources |

|

|

.00 |

|

|

reported on the schedule |

|

|

||

|

|

|

|

|

|

9. |

Net nonbusiness income/loss allocated to West Virginia |

|

.00 |

||

|

Sum of lines 1 through 8, column 3. Enter on |

..................................................... |

|||

*B54201907W*

B 5 4 2 0 1 9 0 7 W

FEIN

FAILURE TO COMPLETE

IN 100% APPORTIONMENT TO WV

APT SCHEDULE B

APPORTIONMENT FACTORS FOR MULTISTATE S CORPORATIONS/PARTNERSHIPS

PART 1 – REGULAR FACTOR

LINES 1 & 2: Divide Column 1 by Column 2 and enter six (6) digit decimal in column 3.

LINE 5: Column 1 – Enter line 3. Column 2 – line 3 less line 4. Divide column 1 by column 2 and enter six (6) digit decimal in column 3.

|

|

Column 1 |

|

Column 2 |

Column 3 |

|

|

|

West Virginia |

|

Everywhere |

Decimal Fraction (6 digits) |

|

1. |

Total Property |

|

.00 |

.00 |

. |

|

2. |

Total Payroll |

|

.00 |

.00 |

. |

|

3. |

Total sales |

|

.00 |

.00 |

|

|

4. |

Sales to purchasers in a state where |

|

|

|

|

|

|

|

.00 |

|

|

||

|

you are not taxable |

|

|

|

|

|

5. |

Adjusted sales |

|

.00 |

.00 |

. |

|

6. |

Adjusted sales (enter line 5 again) |

|

.00 |

.00 |

. |

|

|

|

|

|

|

|

|

7. |

TOTAL: add Column 3, Lines 1, 2, 5, and 6 |

|

. |

|

||

8. |

APPORTIONMENT FACTOR – Line 7 divided by the number 4, reduced by the number of factors showing |

|

|

|||

|

|

|||||

|

zero in column 2, lines 1, 2, 5, and 6. Enter six (6) digits after the decimal. Enter on |

. |

|

|||

|

|

|

|

|

|

|

PART 2 – MOTOR CARRIER FACTOR

Divide Column 1 by Column 2 and enter six (6) digit decimal in Column 3

Enter on

VEHICLE MILEAGE

Column 1 |

Column 2 |

Column 3 |

West Virginia |

Everywhere |

Decimal Fraction (6 digits) |

|

|

. |

|

|

|

PART 3 – FINANCIAL ORGANIZATION FACTOR

Divide Column 1 by Column 2 and enter six (6) digit decimal in column 3

Enter on

GROSS RECEIPTS

Column 1 |

Column 2 |

Column 3 |

West Virginia |

Everywhere |

Decimal Fraction (6 digits) |

.00 |

.00 |

. |

|

|

|

*B54201908W*

B 5 4 2 0 1 9 0 8 W

|

|

|

SCHEDULE |

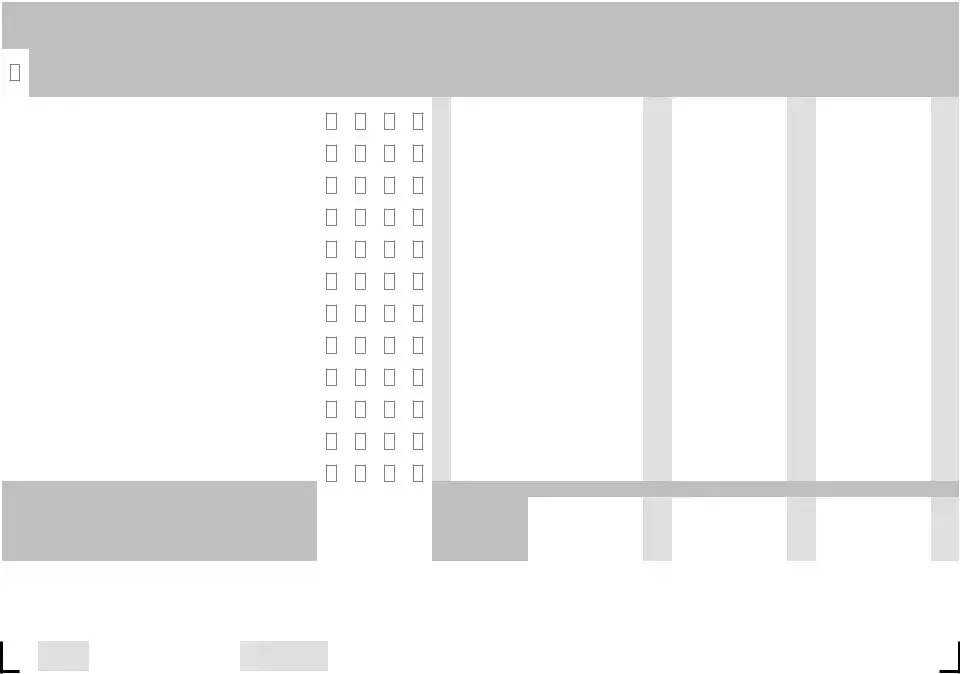

SUMMARY OF |

2019 |

|

||||||||||||

|

|

|

||||||||||||||||

|

|

|

|

AND COMPUTATION OF WITHHOLDING TAX |

|

|||||||||||||

|

|

|

SP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

(A) |

|

(B) |

(C) CHECK ONLY ONE |

(D) |

(E) |

|

(F) |

(G) |

|||||||

|

|

|

SHAREHOLDER/ |

|

SSN/FEIN |

1 |

|

2 |

|

3 |

|

4 |

PERCENTAGE |

WV DISTRIBUTIVE |

|

TAX WITHHELD FOR |

TAX WITHHELD FOR |

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

WVRESIDENT |

|

NONRESIDENT COMPOSITE |

|

NONRESIDENT |

|

|

||||||||

|

|

|

PARTNER NAME |

|

|

|

|

|

OF OWNERSHIP |

INCOME |

|

NONRESIDENT |

OTHER NONRESIDENT |

|||||

|

|

|

◄ Mark if a single shareholder/ |

|

|

|

|

|

|

|

|

to the sixth decimal place |

|

|

COMPOSITE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

partner has 100% ownership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

0. |

|

.00 |

.00 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

0. |

|

.00 |

.00 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

0. |

|

.00 |

.00 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

0. |

|

.00 |

.00 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

0. |

|

.00 |

.00 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

0. |

|

.00 |

.00 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

0. |

|

.00 |

.00 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

0. |

|

.00 |

.00 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

|

|

|

0. |

|

.00 |

.00 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

10 |

|

|

|

|

|

|

|

|

|

|

0. |

|

.00 |

.00 |

.00 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

11 |

|

|

|

|

|

|

|

|

|

|

0. |

|

.00 |

.00 |

.00 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

12 |

|

|

|

|

|

|

|

|

|

|

0. |

|

.00 |

.00 |

.00 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Page totals |

|

|

|

|

|

|

|

|

|

.00 |

.00 |

.00 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

SP Schedule Grand Total |

|

|

|

|

|

|

|

|

|

.00 |

.00 |

.00 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayers reporting more than twelve (12) shareholders/partners must upload the import spreadsheet electronically at www.mytaxes.wvtax.gov.

•Transfer Total of Column F to line 7 (Withholding column) of

•Transfer Total of Column G to line 8 (Withholding column) of

TOTALS FOR ALL PAGES OF SCHEDULE SP MUST BE REPORTED ON THE FIRST PAGE “SP SCHEDULE GRAND TOTAL” LINE.

FEIN |

Total WV Income |

|

|

*B54201909W*

B 5 4 2 0 1 9 0 9 W

W Extension of Time to File Information Returns 2019 |

|

REV |

FEIN

EXTENDED DUE DATE

BEGINNING

TAX YEAR

ENDING

MM |

DD |

YYYY |

|

|

|

MM

DD

YYYY

BUSINESS NAME AND ADDRESS

TYPE OF BUSINESS

(CHECK ONLY ONE)

Partnership Filing Form

S Corporation Filing Form

Contact Person

Contact Phone #

1.Nonresident Withholding Tax....................................................

2.Nonresident Composite Withholding Tax..................................

3.Less Prior Year Credit and Estimated Payment .......................

4.Balance Due..............................................................................

1

2

3

4

.00

.00

.00

.00

NOTE: This form is to be used for requesting an extension of time to fi le the S Corporation or Partnership Income Tax Return and for making an extension payment for the

WHO MAY FILE: Any S Corporation or Partnership needing an extension of time to fi le the West Virginia Income Tax Return (Form

PAYMENT OF NONRESIDENT WITHHOLDING TAX: West Virginia tax law (Code

The nonresident withholding tax is due and payable with this request. You must remit by the unextended due date 90% of the nonresident withholding tax due for the taxable year or 100% of the tax paid for the prior taxable year, if the prior tax year was a full 12 months and tax was paid. If the balance due on your annual return is paid by the last day of your extension and the amount due is 10% or less of the tax due for the taxable year, no additions to tax will be imposed on the balance remitted. Overpayments may be refunded or credited to next year’s withholding.

WHEN TO FILE: An S Corporation’s annual West Virginia Income Tax return is due on or before the fi fteenth day of the third month following the close of the taxable year. A Partnership’s annual West Virginia Income Tax return is due on or before the fi fteenth day of the third month following the close of the taxable year.

CLAIMING OF EXTENSION PAYMENT: A tentative payment made by fi ling Form

Make check payable and remit to:

West Virginia State Tax Department

Tax Account Administration Division

PO Box 11751

Charleston, WV

*B54201910W*

B 5 4 2 0 1 9 1 0 W

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Name | SPF-100 West Virginia Income Tax Return 2019 |

| Governing Law | West Virginia tax law governing income taxation for pass-through entities |

| Filing Purpose | This form is for S Corporations and Partnerships to report income. |

| Due Date | The extended due date is specified in the form under "EXTENDED DUE DATE." |

| Entity Types | Includes S Corporations and Partnerships. |

| Reporting Requirements | Entities must include all reportable entities on Schedule C or Schedule D. |

| Tax Period | The tax period is indicated by the fields "BEGINNING" and "ENDING." |

| Residency Status | Form addresses both resident and nonresident income taxation. |

| Electronic Filing | Entities may be required to submit certain filings electronically via MyTaxes.WVtax. |

| Signatory Requirements | The form must be signed by an Officer, Partner, or Member of the entity. |

Guidelines on Utilizing Spf 100

These instructions will help ensure the completion of the SPF-100 form accurately. This form must be filled out with precise details regarding your S Corporation or Partnership tax return for West Virginia.

- Fill in the Tax Period: Enter the beginning and ending dates in MM/DD/YYYY format.

- Entity Information: Write the entity name and mailing address, including city, state, and ZIP code.

- State of Domicile: Indicate the state where your business is based.

- NAICS Code: Provide your NAICS code, if applicable.

- Contact Information: Fill in the contact's first name, last name, phone, and email.

- FEIN and Account Number: Enter the Federal Employer Identification Number (FEIN) and West Virginia account number.

- Centralized Audit Regime: Indicate if the partnership has elected out of the centralized audit regime. Provide the details of the designated representative if applicable.

- Select Applicable Boxes: Check all the boxes that apply to your entity (S-Corporation, Partnership type, return type, etc.).

- Activity Description: Specify whether your activities are wholly in West Virginia or multistate.

- Reportable Entities: List all applicable entities you are involved with as outlined in Section 5 of the form.

- Income Details: Enter the distributive income for both residents and nonresidents, totaling amounts required.

- Withholding Information: Complete the withholding due section based on the amounts calculated.

- Credits and Payments: Fill in any carryforward credits, estimated payments, and other credit amounts.

- Tax Calculation: Calculate the tax due or overpayment based on the provided lines.

- Signature Section: Sign the form, providing the printed name, date, and title of the officer or partner.

- Paid Preparer’s Section: If applicable, the paid preparer must fill out their details.

- Mailing Information: Send the completed form to the specified address within West Virginia State Tax Department.

What You Should Know About This Form

What is the SPF-100 form?

The SPF-100 form is the West Virginia Income Tax Return for S Corporations and Partnerships for the year 2019. It is used by pass-through entities to report income, deductions, and credits that are passed on to their partners or shareholders. This form ensures that the state taxes are correctly calculated and reported based on the entity's income activities within West Virginia.

Who needs to file the SPF-100 form?

What is the purpose of the SP-100 form?

The SPF-100 form serves multiple purposes. It calculates the taxable income for the entity, allows for the reporting of any withholding due, and facilitates compliance with state tax laws. Additionally, it provides the tax department with essential information regarding the entity’s structure and financial activities in West Virginia.

What information is required to complete the SPF-100?

To complete the SPF-100, the entity must provide its name, address, and Federal Employer Identification Number (FEIN). Dates for the tax period, ownership information, and income details are also needed. Furthermore, you'll need to report any applicable withholding, credits, and payments made to the state during the tax year.

What are reportable entities?

Reportable entities include any entities where the partnership or S Corporation has a stake. This means that any partners, members, or shareholders actively engaged in business in West Virginia must be reported. Additionally, if the partnership owns more than 80% of another entity, that entity must also be included.

Is there a due date for the SPF-100 form?

The due date for filing the SPF-100 form generally aligns with the federal tax deadline, which is typically April 15th of the following year. However, if an extension is filed, the extended due date must be noted on the form and will vary based on other factors.

Can I amend the SPF-100 form?

Yes, if you discover errors or need to make adjustments after the original filing, you can file an amended SPF-100. Make sure to indicate that this is an amended return and provide details of the changes on the form.

What should I do if I have an overpayment?

If you find that you have overpaid your taxes, you can either request a refund or choose to apply the overpayment to the next year’s tax liability. The SPF-100 form provides sections for indicating how you would like to handle an overpayment.

How can I contact the West Virginia State Tax Department for assistance?

For assistance, you can contact the West Virginia State Tax Department directly. Their mailing address is the Tax Account Administration Division, PO Box 11751, Charleston, WV 25324-1751. You can also find their contact information on the West Virginia state website for any specific inquiries related to the SPF-100 form.

Common mistakes

Completing the SPF 100 form can be a straightforward process when approached with care. However, several common pitfalls can lead to complications or delays in processing. Recognizing these mistakes can significantly improve the accuracy of your submission and streamline interactions with tax authorities.

One major mistake is failing to provide accurate entity information. Specifically, every field needs to be fully filled out, including the entity name, mailing address, and state of domicile. Any inaccuracies or omissions here can cause confusion and prompt unnecessary follow-up inquiries from the tax department.

Another frequent error involves misclassification of the entity type. Many people overlook selecting the correct box that indicates whether the entity is an S-Corporation or Partnership. This classification can impact tax treatment and obligations, so careful attention to detail is essential.

Ignoring the election status for the centralized audit regime under IRC Section 6221(b) is another critical oversight. Failing to answer this question can lead to misinterpretation of the partnership’s responsibilities and may result in compliance issues later on. Be sure to check “Yes” or “No,” as required.

Completing the reportable entities section can be tricky, yet it is vital to include all entities accurately. Not including all relevant entities on Schedule C or D can result in incomplete filings. Make sure to capture every partner, member, or shareholder that affects reporting requirements in West Virginia.

Additionally, neglecting to provide proper income figures on the form can be detrimental. Lines regarding the distributive income of residents and nonresidents should reflect accurate financial data. Discrepancies may provoke audits or penalties, emphasizing the importance of thorough record-keeping.

Many filers also mistakenly overlook the line for total withholding due. This critical section should be filled out precisely, as it reflects what is owed to the state. Incorrect amounts can seriously impact cash flow and lead to complications with state compliance.

Finally, submitting without a signature or date can halt the processing of the return. The declaration of accuracy and completeness is vital. Without a proper signature from the officer or partner, the form is not valid, leading to delays and potential penalties

.By being vigilant about these common mistakes, individuals and businesses can ensure a smoother tax filing experience in West Virginia. A little attention to detail can help avoid unnecessary hurdles and promote compliance with state regulations.

Documents used along the form

The SPF-100 form serves as an essential document for S Corporations and partnerships in West Virginia to report income, deductions, and various tax liabilities. When navigating through the tax reporting process, there are several other forms and documents that work alongside the SPF-100 to ensure compliance with state tax regulations. Below is an overview of these related documents.

- Federal Form 1120S: This is the tax return form specifically for S Corporations, detailing the income, deductions, and credits of the corporation. It is important for reporting income to the IRS, especially since state income tax calculations for West Virginia rely on the information found in this federal form.

- Federal Form 1065: This form is for partnerships to report income, gains, losses, deductions, and credits from the partnership. Like the 1120S, it provides vital information to both state and federal authorities regarding the partnership's income.

- Schedule A: Known as Income/Loss Modifications, this schedule adjusts federal pass-through income for state reporting. It identifies changes made to federal income to determine the correct state taxable income.

- Schedule B: This document outlines adjustments to federal S Corporation and partnership income. It specifies any additions or subtractions needed to calculate the state taxable income accurately.

- Schedule C: This schedule lists reportable entities associated with the partnership or S Corporation, ensuring that all entities conducting business in West Virginia are accounted for properly.

- Schedule D: This schedule documents the schedule of reportable entities as well, specifically providing details about disregarded entities that will report under the parent’s West Virginia account number.

- NRW-4 Form: This is a declaration form for nonresident employees or individuals, affirming their intention to file and pay West Virginia income tax directly on their income earned within the state.

Understanding these forms is crucial for those involved with S Corporations and partnerships in West Virginia. Each form plays a specific role in ensuring accurate reporting, compliance, and safeguarding against potential tax-related issues. By familiarizing oneself with these documents, tax professionals and business owners can navigate the complexities of state tax requirements with greater confidence.

Similar forms

- 1040 Individual Income Tax Return: Like the SPF-100, the 1040 is used for income reporting. It requires details on income, deductions, and credits, catering to individual taxpayers, whereas the SPF-100 focuses on pass-through entities like S Corporations and partnerships.

- 1120S S Corporation Income Tax Return: This document serves a similar purpose as the SPF-100 for S Corporations. It captures income, losses, and deductions specific to corporations, highlighting information about shareholder distributions.

- 1065 Partnership Return: Like the SPF-100, the 1065 is designed for partnership reporting. It encompasses income, deductions, and credits of the partnership, detailing each partner's share of income and losses.

- K-1 Schedule: The K-1 works similarly to the SPF-100 by allocating income and deductions to shareholders or partners. Each entity or partnership prepares a K-1 for distribution, reflecting their share which appears on individual tax returns.

- W-2 Wage and Tax Statement: Though primarily for employees, the W-2 is related to income reporting. Like the SPF-100, it summarizes wages paid and taxes withheld, relevant for individuals receiving income from an entity.

- State Income Tax Forms: Various state-specific income tax forms provide similar functions to the SPF-100 by ensuring entities meet state tax obligations. Each form is tailored to align with the reporting requirements of their respective states.

- Form 990 Return of Organization Exempt From Income Tax: Nonprofit organizations use this form to report their income, much like the SPF-100 for S Corporations and partnerships. It provides transparency on operational income and expenditures.

Dos and Don'ts

Filling out the SPF-100 form can seem daunting, but a few simple guidelines can make the process much easier. Here’s a list of things to remember when you’re ready to complete the form:

- Do: Double-check all entries for accuracy before you submit. Mistakes can lead to delays or issues with your tax return.

- Do: Use the correct tax period dates. Ensure you enter the beginning and ending dates clearly.

- Do: Provide complete and clear contact information. This ensures that the tax department can reach you if they have questions.

- Do: Review the applicable schedules carefully. Every detail matters and must align with your reported income.

- Don't: Leave any required fields blank. All sections marked with an asterisk (*) need your attention.

- Don't: Ignore the filing deadlines. Submitting your form on time avoids penalties and interest charges.

By following these tips, you can fill out your SPF-100 form with confidence and ease. Good luck!

Misconceptions

-

Misconception 1: SPF 100 only applies to S Corporations.

This form is used by both S Corporations and Partnerships in West Virginia. It facilitates the income tax return process for pass-through entities, capturing essential information for both types of entities.

-

Misconception 2: Submitting an SPF 100 is optional for partnerships.

Filing the SPF 100 form is mandatory for partnerships operating in West Virginia. This form ensures that state tax obligations are met and avoids potential penalties for non-compliance.

-

Misconception 3: All income reported on the SPF 100 is taxable in West Virginia.

Not all income is subject to taxation. For example, certain income may be exempt based on its nature or location, such as interest from federal obligations. Understanding these distinctions is crucial for accurate reporting.

-

Misconception 4: Submitting a completed SPF 100 guarantees tax refund approval.

The submission of this form does not automatically ensure a refund. The West Virginia State Tax Department must review and verify the information provided before issuing any refunds.

-

Misconception 5: Partnerships do not need to report distributive income of non-resident members.

Partnerships must report the distributive income of non-resident members. This income should be accurately reflected on the form to comply with state tax regulations and ensure proper withholding where applicable.

Key takeaways

When filling out and using the SPF-100 form, keep these key points in mind:

- Accurate Information is Crucial: Ensure all entity details, including name, address, and identification numbers, are correct. Mistakes can lead to processing delays.

- Understand Your Filing Requirements: Determine if your entity is an S-Corporation or Partnership and whether your return is annual, initial, final, or amended.

- Compliance with Withholding Tax: Report all applicable withholding amounts accurately. Any discrepancies can result in penalties or interest charges.

- Review for Completeness: Before submitting, double-check that all necessary schedules and supporting documents are included to avoid unnecessary complications.

Browse Other Templates

Ds-261 Form Pdf - The form is updated as of July 2020, ensuring current compliance.

Food Depot Job Application Pdf - State whether you prefer to work on Mac or PC systems.

Sinai Hospital Medical Records Phone Number - Review the form thoroughly to ensure it meets your needs before submission.