Fill Out Your Ssa 10 Form

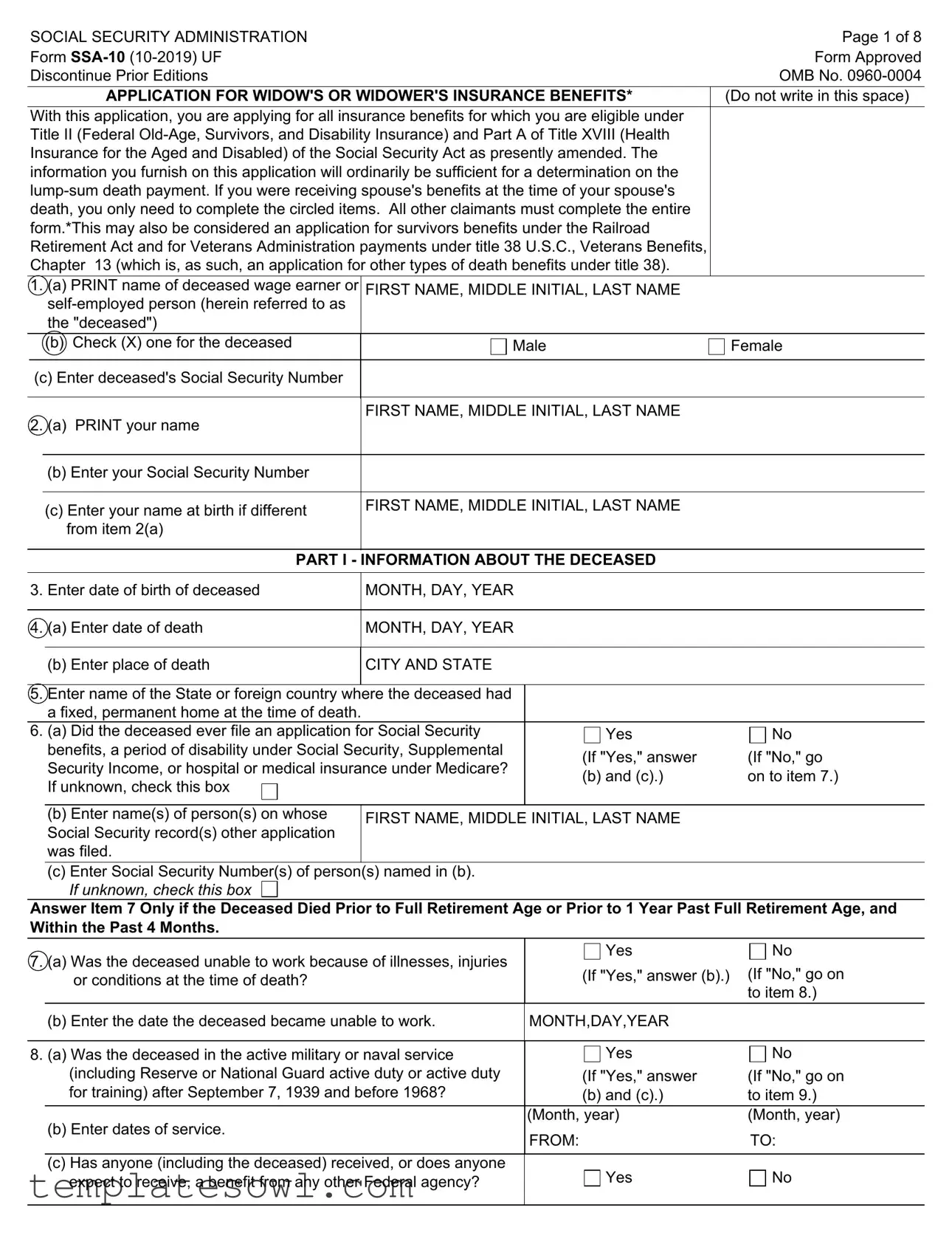

The Form SSA-10 is a vital document tailored for individuals seeking Widow's or Widower's Insurance Benefits. This application not only enables claimants to apply for benefits under Title II of the Social Security Act but also encompasses additional avenues, such as potential benefits through the Railroad Retirement Act and Veterans Administration. Primarily, the form collects essential information regarding both the deceased and the applicant, including names, Social Security numbers, dates of birth, and dates of death. These details help determine eligibility for various benefits, including a lump-sum death payment. The application also investigates specific circumstances surrounding the deceased's work history, marriages, and financial contributions, which are crucial for assessing the claim. A section on Medicare qualification outlines potential entitlements, aiding individuals in understanding their health insurance options as they age. The information provided is instrumental for the Social Security Administration to make timely decisions regarding benefits, ensuring that surviving spouses receive the support they need during a challenging time. Completing the SSA-10 accurately and comprehensively can significantly impact the outcome of the claim.

Ssa 10 Example

SOCIAL SECURITY ADMINISTRATION |

Page 1 of 8 |

Form |

Form Approved |

Discontinue Prior Editions |

OMB No. |

|

|

APPLICATION FOR WIDOW'S OR WIDOWER'S INSURANCE BENEFITS* |

(Do not write in this space) |

|

|

With this application, you are applying for all insurance benefits for which you are eligible under |

|

||

|

Title II (Federal |

|

||

|

Insurance for the Aged and Disabled) of the Social Security Act as presently amended. The |

|

||

|

information you furnish on this application will ordinarily be sufficient for a determination on the |

|

||

|

|

|||

|

death, you only need to complete the circled items. All other claimants must complete the entire |

|

||

|

form.*This may also be considered an application for survivors benefits under the Railroad |

|

||

|

Retirement Act and for Veterans Administration payments under title 38 U.S.C., Veterans Benefits, |

|

||

|

Chapter 13 (which is, as such, an application for other types of death benefits under title 38). |

|

||

|

1. (a) PRINT name of deceased wage earner or |

FIRST NAME, MIDDLE INITIAL, LAST NAME |

|

|

|

|

|

|

|

|

|

the "deceased") |

|

|

|

|

(b) Check (X) one for the deceased |

Male |

Female |

|

|

|

|

|

|

(c) Enter deceased's Social Security Number |

|

|

|

|

|

|

|

|

|

2. (a) PRINT your name |

FIRST NAME, MIDDLE INITIAL, LAST NAME |

|

|

|

|

|

||

|

|

|

|

|

|

|

(b) Enter your Social Security Number |

|

|

|

|

|

|

|

|

|

(c) Enter your name at birth if different |

FIRST NAME, MIDDLE INITIAL, LAST NAME |

|

|

|

from item 2(a) |

|

|

PART I - INFORMATION ABOUT THE DECEASED

3. |

Enter date of birth of deceased |

MONTH, DAY, YEAR |

|

|

|

|

|

|

|

|

|

4. |

(a) Enter date of death |

MONTH, DAY, YEAR |

|

|

|

|

|

|

|

|

|

|

(b) Enter place of death |

|

CITY AND STATE |

|

|

|

|

|

|

|

|

5. |

Enter name of the State or foreign country where the deceased had |

|

|

||

|

a fixed, permanent home at the time of death. |

|

|

|

|

6. |

(a) Did the deceased ever file an application for Social Security |

Yes |

No |

||

|

benefits, a period of disability under Social Security, Supplemental |

(If "Yes," answer |

(If "No," go |

||

|

Security Income, or hospital or medical insurance under Medicare? |

||||

|

(b) and (c).) |

on to item 7.) |

|||

|

If unknown, check this box |

|

|||

|

|

|

|

||

|

|

|

|

|

|

|

(b) Enter name(s) of person(s) on whose |

FIRST NAME, MIDDLE INITIAL, LAST NAME |

|

||

|

Social Security record(s) other application |

|

|

|

|

|

was filed. |

|

|

|

|

(c) Enter Social Security Number(s) of person(s) named in (b). If unknown, check this box

Answer Item 7 Only if the Deceased Died Prior to Full Retirement Age or Prior to 1 Year Past Full Retirement Age, and Within the Past 4 Months.

7. (a) Was the deceased unable to work because of illnesses, injuries |

Yes |

No |

||

(If "Yes," answer (b).) |

(If "No," go on |

|||

|

or conditions at the time of death? |

|||

|

|

|

to item 8.) |

|

|

(b) Enter the date the deceased became unable to work. |

MONTH,DAY,YEAR |

|

|

|

|

|

||

8. (a) Was the deceased in the active military or naval service |

Yes |

No |

||

|

(including Reserve or National Guard active duty or active duty |

(If "Yes," answer |

(If "No," go on |

|

|

for training) after September 7, 1939 and before 1968? |

(b) and (c).) |

to item 9.) |

|

|

(b) Enter dates of service. |

(Month, year) |

(Month, year) |

|

|

FROM: |

TO: |

||

|

|

|||

|

|

|

|

|

|

(c) Has anyone (including the deceased) received, or does anyone |

Yes |

No |

|

|

expect to receive, a benefit from any other Federal agency? |

|||

|

|

|

|

|

Form |

|

Page 2 of 8 |

|

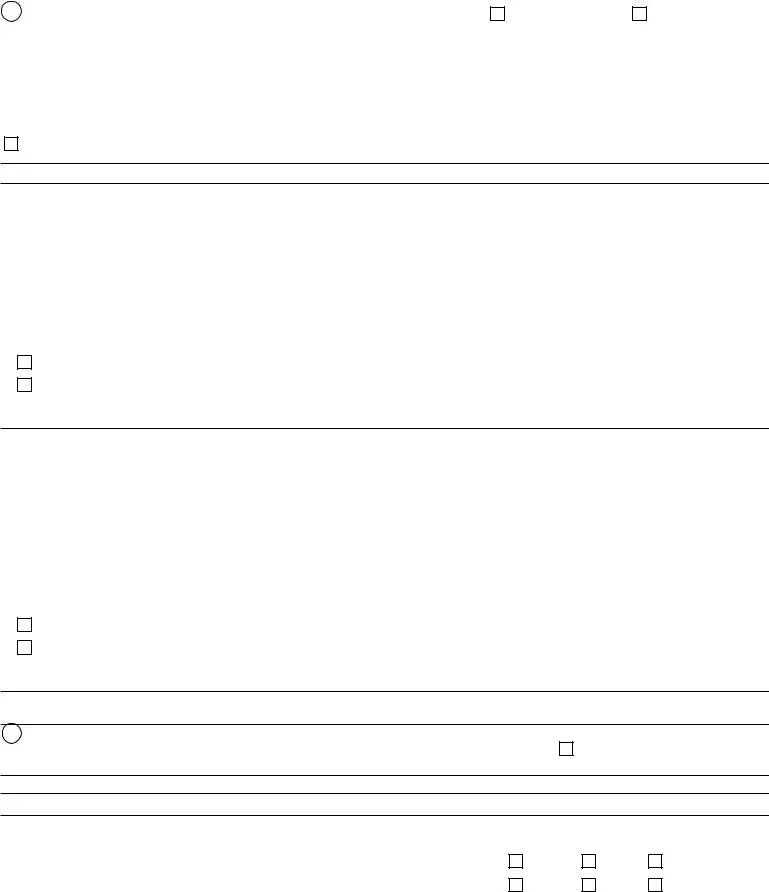

ANSWER ITEM 9 ONLY IF DEATH OCCURRED WITHIN THE LAST 2 YEARS. |

|

||

9. (a) About how much did the deceased earn from employment and |

Amount |

|

|

|

$ |

|

|

|

(b) About how much did the deceased earn the year before death? |

Amount |

|

|

$ |

|

|

|

|

|

|

10. (a) Did the deceased have wages or |

Yes |

No |

|

|

covered under Social Security in all years from 1978 through |

(If "Yes," skip to |

(If "No," |

|

last year? |

||

|

item 11.) |

answer (b).) |

|

|

|

||

|

(b) List the years from 1978 through last year in which the |

|

|

|

deceased did not have wages or |

|

|

|

covered under Social Security. |

|

|

11. CHECK IF APPLICABLE |

|

|

|

I am not submitting evidence of the deceased's earnings that are not yet on his/her earnings record. I understand that these earnings will be included automatically within 24 months, and any increase in my benefits will be paid with full retroactivity.

INFORMATION ABOUT THE DECEASED'S MARRIAGE(S)

12.Answer this item ONLY if the deceased had other marriages.

(a)If the deceased married after his or her marriage to you, enter the information on the last marriage.

(If none, write "NONE".)

Spouse's Name (including maiden name) |

When (Month, Day, and Year) |

Where (Name of City and State) |

|

|

|

How Marriage Ended |

When (Month, Day, and Year) |

Where (Name of City and State) |

|

|

|

Marriage performed by |

Spouse's date of birth (or age) |

If spouse deceased, give date |

Clergyman or public official |

|

of death |

|

|

|

Other (Explain in Remarks) |

|

|

|

|

|

Spouse's Social Security Number (If none or unknown, so indicate)

(b)If the deceased had any other marriages, and the marriage lasted at least 10 years or ended due to death of the spouse (whether before or after you married the deceased), enter the information below. If the deceased divorced then remarried the same individual within the year immediately following the year of the divorce, and the combined period of marriage totaled 10 years or more, include the marriage. (If none, write "NONE".)

Spouse's Name (including maiden name) |

When (Month, Day, and Year) |

Where (Name of City and State) |

|

|

|

How Marriage Ended |

When (Month, Day, and Year) |

Where (Name of City and State) |

|

|

|

Marriage performed by |

Spouse's date of birth (or age) |

If spouse deceased, give date |

Clergyman or public official |

|

of death |

|

|

|

Other (Explain in Remarks) |

|

|

|

|

|

Spouse's Social Security Number (If none or unknown, so indicate)

USE "REMARKS" SPACE ON BACK PAGE FOR INFORMATION ABOUT ANY OTHER MARRIAGE AS DESCRIBED IN 12b.

13.Is there a surviving parent (or parents) who was receiving support from the deceased at the time of death or at the time the deceased became disabled under

Social Security Law?

Yes (If "Yes," enter the name and address in"Remarks.")

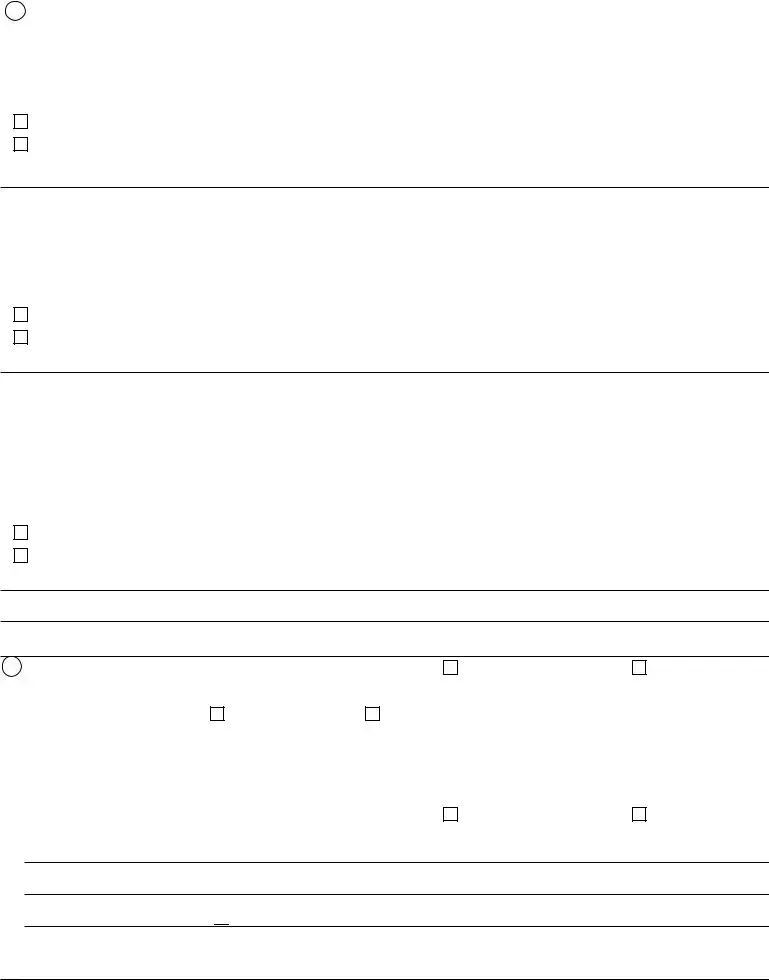

PART II - INFORMATION ABOUT YOURSELF

14. (a) Enter name of State or foreign country where you were born.

If you have already presented, or if you are now presenting, a public or religious record of your birth established before you were age 5, go on to item 15.

(b) Was a public record of your birth made before age 5? (If "yes", go to item 15.) |

Yes |

No |

Unknown |

(c) Was a religious record of your birth made before age 5? |

Yes |

No |

Unknown |

|

|

|

|

Form |

|

Page 3 of 8 |

INFORMATION ABOUT YOUR MARRIAGE(S) |

|

|

15. (a) Enter information about your marriage to the deceased. |

|

|

Spouse's Name (including maiden name) |

When (Month, Day, and Year) |

Where (Name of City and State) |

|

|

|

How Marriage Ended |

When (Month, Day, and Year) |

Where (Name of City and State) |

|

|

|

Marriage performed by |

Spouse's date of birth (or age) |

If spouse deceased, give date |

Clergyman or public official |

|

of death |

|

|

|

Other (Explain in Remarks) |

|

|

|

|

|

Spouse's Social Security Number (If none or unknown, so indicate)

(b) If you remarried after the marriage shown in 15.(a), enter information about the last marriage. (If none, write "NONE".)

Spouse's Name (including maiden name) |

When (Month, Day, and Year) |

Where (Name of City and State) |

|

|

|

How Marriage Ended |

When (Month, Day, and Year) |

Where (Name of City and State) |

|

|

|

Marriage performed by |

Spouse's date of birth (or age) |

If spouse deceased, give date |

Clergyman or public official |

|

of death |

|

|

|

Other (Explain in Remarks) |

|

|

|

|

|

Spouse's Social Security Number (If none or unknown, so indicate)

(c)Enter information about any other marriage you may have had that lasted at least 10 years (see item 12(b) for counting consecutive multiple marriages to the same individual) or ended due to death of the spouse (whether before or after you married the deceased). (If none, write "NONE".)

Spouse's Name (including maiden name) |

When (Month, Day, and Year) |

Where (Name of City and State) |

|

|

|

How Marriage Ended |

When (Month, Day, and Year) |

Where (Name of City and State) |

|

|

|

Marriage performed by |

Spouse's date of birth (or age) |

If spouse deceased, give date |

Clergyman or public official |

|

of death |

|

|

|

Other (Explain in Remarks) |

|

|

|

|

|

Spouse's Social Security Number (If none or unknown, so indicate)

*USE "REMARKS" SPACE ON BACK PAGE FOR INFORMATION ABOUT ANY OTHER MARRIAGE AS DESCRIBED IN 15c.

IF YOU ARE APPLYING FOR SURVIVING DIVORCED SPOUSE'S BENEFITS, OMIT 16 AND GO ON TO ITEM 17.

16.(a) Were you and the deceased living together at the same address when the deceased died?

Yes (If "Yes," go to

item 17.)

No No(If "No," answer (b).)

|

(b) If either you or the deceased were away from home (whether or not temporarily) when the deceased died, give the |

|||||||

|

following: Who was away? |

Deceased |

Surviving Spouse |

|

|

|

||

|

|

|

|

|

|

|||

Date last at home: |

Reason absence began: |

|

Reason you were apart at time of death: |

|

|

|||

|

|

|

|

|

|

|||

If separated because of illness, |

enter nature of illness or disabling condition. |

|

|

|

||||

|

|

|

|

|

|

|||

17. (a) Have you (or has someone on your behalf) ever filed |

|

Yes |

(If "Yes," answer |

No |

(If "No," go to |

|||

|

an application for Social Security benefits, a period of |

|

|

(b) and (c).) |

|

item 18).) |

||

|

disability under Social Security, Supplemental Security |

|

|

|

|

|

||

|

Income, or hospital or medical insurance under Medicare? |

|

|

|

|

|

||

(b) Enter name of person on whose Social Security record you filed other application.

(c) Enter Social Security Number of person named in (b). (if unknown, check this box)

Form |

|

|

|

|

Page 4 of 8 |

||

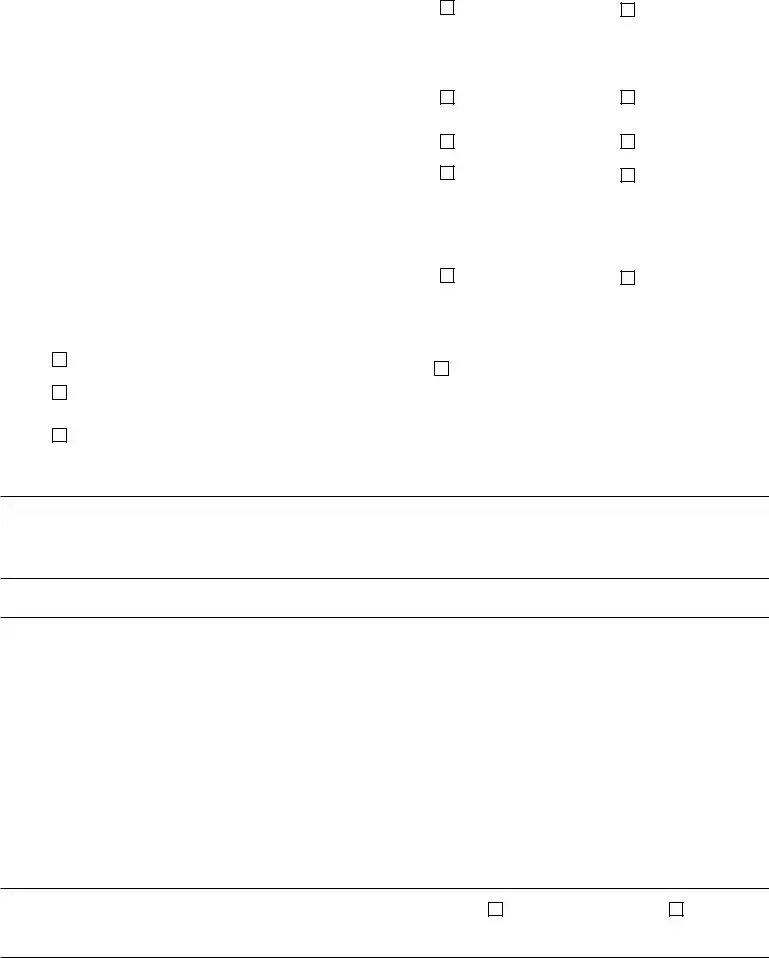

DO NOT ANSWER QUESTION 18 IF YOU ARE FULL RETIREMENT AGE OR OLDER. GO ON TO QUESTION 19. |

|||||||

18. (a) Are you, or during the past 14 months have you been, |

|

Yes |

(If "Yes," answer |

No |

(If "No," go on |

||

|

unable to work because of illnesses, injuries or conditions? |

|

(b) .) |

to item 19.) |

|||

|

(b) Enter the date you became unable to work. |

|

(Month, day, year) |

|

|

|

|

|

|

|

|

|

|

|

|

19. Were you in the active military or naval service (including |

|

Yes |

|

No |

|

|

|

|

Reserve or National Guard active duty or active duty for |

|

|

|

|

||

|

training) after September 7, 1939 and before 1968? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20. Did you or the deceased work in the railroad industry for 5 |

|

Yes |

|

No |

|

|

|

|

years or more? |

|

|

|

|

||

21. (a) Did you or the deceased have Social Security credits |

|

Yes |

(If "Yes," answer |

No |

(If "No," go on |

||

|

(for example, based on work or residence) under another |

|

|||||

|

|

(b).) |

to item 22.) |

||||

|

country's Social Security System? |

|

|

|

|

|

|

(b) If "Yes," list the country(ies) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22. (a) Have you qualified for, or do you expect to qualify |

|

|

|

|

|

|

|

|

for, a pension or annuity (or a lump sum in place of a pension |

|

|

(If "Yes," check |

|

|

|

|

or annuity) based on your own employment and earnings for the |

|

|

|

(If "No," go on |

||

|

|

Yes |

which of the items |

No |

|||

|

Federal Government of the United States, or one of its States |

|

|||||

|

|

in item (b) applies |

to item 23.) |

||||

|

or local subdivisions that was not covered under Social |

|

|

to you.) |

|

|

|

|

Security? (Social Security benefits are not |

|

|

|

|

|

|

|

government pensions.) |

|

|

|

|

|

|

|

(b) |

|

|

|

|

|

|

|

I receive a government pension or annuity. |

|

I have not applied for but I expect to begin |

||||

|

I received a lump sum in place of a |

|

receiving my pension or annuity: |

|

|

||

|

|

|

|

|

|

|

|

|

government pension or annuity. |

|

|

|

|

|

|

|

I applied for and am awaiting a decision on my |

|

|

|

|

|

|

|

|

|

(Month, day, year) |

|

|

||

|

pension or lump sum. |

|

(If the date is not known, enter "Unknown".) |

||||

|

|

|

|

|

|

|

|

MEDICARE INFORMATION

If this claim is approved and you are still entitled to benefits at age 65, or you are within 3 months of Age 65 or older you could automatically receive Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance) coverage at age 65. If you live in Puerto Rico or a foreign country, you are not eligible for automatic enrollment in Medicare Part B, and you will need to contact Social Security to request enrollment.

COMPLETE ITEM 23 ONLY IF YOU ARE WITHIN 3 MONTHS OF AGE 65 OR OLDER

Medicare Part B (Medical Insurance) helps cover doctor's services and outpatient care. It also covers some other services that Medicare Part A doesn't cover, such as some of the services of physical and occupational therapists and some home health care. If you enroll in Medicare Part B, you will have to pay a monthly premium. The amount of your premium will be determined when your coverage begins. In some cases, your premium may be higher based on information about your income we receive from the Internal Revenue Service. Your premiums will be deducted from any monthly Social Security, Railroad Retirement, or Office of Personnel Management benefits you receive. If you do not receive any of these benefits, you will get a letter explaining how to pay your premiums. You will also get a letter if there is any change in the amount of your premium.

You can also enroll in a Medicare prescription drug plan (Part D). To learn more about the Medicare prescription drug plans and when you can enroll visit www.medicare.gov or call

If you have limited income and resources, we encourage you to apply for the Extra Help that is available to assist you with |

||

Medicare prescription drug costs. The Extra Help can pay the monthly premiums, annual deductibles and prescription co- |

||

payments. To learn more or apply, please visit www.socialsecurity.gov, call |

||

nearest Social Security office. |

|

|

23.Do you want to enroll in the Medicare Part B (Medical Insurance)? |

Yes |

No |

|

||

Form |

|

|

|

|

|

|

|

|

|

Page 5 of 8 |

ANSWER ITEM 24 ONLY IF THE DECEASED DIED BEFORE THIS YEAR. |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

24.(a) How much were your total earnings last year? |

|

$ |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(b) Place an "X" in each block for each month of last year in which you did |

|

NONE |

|

|

ALL |

|||||

not earn more than *$ |

in wages, and did not perform |

|

|

|

|

|||||

substantial services in |

|

|

|

|

|

|

|

|||

months. If no months were exempt months, place an "X" in "NONE." |

|

Jan. |

|

Feb. |

Mar. |

|

Apr. |

|||

If all months were exempt months, place an "X" in "ALL." |

|

|

|

|

|

|

|

|

||

|

|

May |

|

Jun. |

Jul. |

|

Aug. |

|||

*Enter the appropriate monthly limit after reading the information, |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|||

|

|

Sept. |

|

Oct. |

Nov. |

|

Dec. |

|||

"How Work Affects Your Benefits" (Publication No. |

|

|

|

|

||||||

25. (a) How much do you expect your total earnings to be this year? |

|

$ |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

(b) Place an "X" in each block for each month of this year in which you did |

|

|

|

|

|

|

|

|||

not or will not earn more than *$ |

|

in wages, and did not or will |

NONE |

|

|

ALL |

||||

not perform substantial services in |

|

|

|

|||||||

|

|

|

|

|

|

|

||||

exempt months. If no months are or will be exempt months, place an "X" |

|

|

|

|

|

|

||||

in "NONE." If all months are or will be exempt months, place an |

|

|

Jan. |

|

Feb. |

Mar. |

|

Apr. |

||

"X" in "ALL." |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

May |

|

Jun. |

Jul. |

|

Aug. |

|

*Enter the appropriate monthly limit after reading the information, "How Work |

|

|

||||||||

|

|

|

|

|

|

|||||

Sept. |

|

Oct. |

Nov. |

|

Dec. |

|||||

Affects Your Benefits" (Publication No. |

|

|

|

|

||||||

ANSWER ITEM 26 ONLY IF YOU ARE NOW IN THE LAST 4 MONTHS OF YOUR TAXABLE YEAR (SEPT., |

|

|

||||||||

OCT., NOV., AND DEC., IF YOUR TAXABLE YEAR IS A CALENDAR YEAR). |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

26. (a) How much do you expect to earn next year? |

|

$ |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

(b) Place an "X" in each block for each month of next year in which you do |

|

|

|

|

|

|

|

|||

not expect to earn more than *$ |

|

in wages, and do not expect |

NONE |

|

|

ALL |

||||

to perform substantial services in |

|

|

||||||||

|

|

|

|

|

|

|||||

exempt months. If no months are expected to be exempt months, place |

|

|

|

|

|

|

|

|||

an "X" in "NONE." If all months are expected to be exempt months, place |

Jan. |

|

Feb. |

Mar. |

|

Apr. |

||||

an "X" in "ALL." |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

May |

|

Jun. |

Jul. |

|

Aug. |

|

*Enter the appropriate monthly limit after reading the |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|||

|

|

Sept. |

|

Oct. |

Nov. |

|

Dec. |

|||

information, "How Work Affects Your Benefits." |

|

|

|

|

||||||

27. If you use a fiscal year, that is, a taxable year that does not end |

Month |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

December 31 (with income tax return due April 15), enter here the |

|

|

|

|

|

|

|

|

||

month your fiscal year ends. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IF YOU ARE FULL RETIREMENT AGE OR OLDER, GO ON TO ITEM 29. OTHERWISE, PLEASE READ CAREFULLY THE INFORMATION ON PAGE 8 AND ANSWER ONE OF THE FOLLOWING ITEMS.

28. After reading the information on page 8, check one of thefollowing:

(a) I want benefits beginning with the earliest possible month.

(b)I am full retirement age (or will be within 4 months) and I want benefits beginning with the earliest possible month, providing that there is no permanent reduction in my ongoing monthly benefits.

(c) I want benefits beginning with |

|

. I understand that either a higher initial payment or a higher continuing |

|

|

monthly benefit amount may be |

|

|

|

|

possible, but I choose not to take it. |

|

|

||

ANSWER QUESTION 29 ONLY IF YOU ARE NOW AT LEAST AGE 61 YEARS, 8 MONTHS. |

|

|||

|

|

|

||

29. Do you wish this application to be considered an application for |

|

|

||

retirement benefits on your own earnings record? |

Yes |

No |

||

Form |

Page 6 of 8 |

REMARKS (You may use this space for any explanations. If you need more space, attach a separate sheet.) |

|

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

Direct Deposit Payment Address (Financial Institution)

Routing Transit Number

Account Number

Checking

Checking

Savings

Savings

Enroll in Direct Express

Enroll in Direct Express

Direct Deposit Refused

Direct Deposit Refused

I declare under penalty of perjury that I have examined all the information on this form, and on any accompanying statements or forms, and it is true and correct to the best of my knowledge. I understand that anyone who knowingly gives a false or misleading statement about a material fact in this information, or causes someone else to do so, commits a crime and may be sent to prison, or may face other penalties, or both.

SIGNATURE OF APPLICANT |

Date (Month, day, year) |

|

|

|

|

Signature (First name, middle initial, last name) (Write in ink) |

Telephone number(s) at which you may |

|

be contacted during the day |

|

AREA CODE |

|

|

Applicant's Mailing Address (Number and street, Apt. No., P.O. Box, or Rural Route) |

|

(Enter Residence Address in "Remarks," if different.) |

|

City and State

ZIP Code

Country (if any) in which you now live

Witnesses are required ONLY if this application has been signed by mark (X) above. If signed by mark (X), two witnesses to the signing who know the applicant must sign below, giving their full addresses. Also, print the applicant's name in the

Signature block.

1. Signature of Witness |

2. Signature of Witness |

Address (Number and Street, City, State and ZIP Code)

Address (Number and Street, City, State and ZIP Code)

Form |

|

|

|

|

|

Page 7 of 8 |

RECEIPT FOR YOUR CLAIM FOR SOCIAL SECURITY WIDOW'S OR WIDOWER'S INSURANCE BENEFITS |

||||||

|

|

|

|

|

|

|

|

BEFORE YOU RECEIVE A |

|

SSA OFFICE |

DATE CLAIM RECEIVED |

||

|

NOTICE OF AWARD |

|

|

|

||

TELEPHONE NUMBER(S) |

|

|

|

|

|

|

TO CALL IF YOU HAVE A |

|

|

|

|

|

|

QUESTION OR |

AFTER YOU RECEIVE A |

|

|

|

||

SOMETHING TO REPORT |

|

|

|

|||

NOTICE OF AWARD |

|

|

|

|||

|

|

|

|

|||

|

|

|

|

|

|

|

Your application for Social Security benefits has been received |

In |

the meantime, if you change your address, or if there is some |

||||

and will be processed as quickly as possible. |

other change that may affect your claim, you - or someone for |

|||||

|

|

|

|

you - should report the change. The changes to be reported are |

||

You should hear from us within |

|

days after you have given |

listed on page 8. Always give us your claim number when |

|||

us all the information we requested. Some claims may take |

writing or telephoning about your claim. |

|||||

longer if additional information is needed. |

If you have any questions about your claim, we will be glad to |

|||||

|

|

|

|

|||

|

|

|

|

help you. |

|

|

CLAIMANT

DECEASED'S SURNAME IF DIFFERENT FROM CLAIMANT'S

SOCIAL SECURITY CLAIM NUMBER

PRIVACY ACT NOTICE

Collection and Use of Personal Information

Sections 202(e) and 202(f) of the Social Security Act, as amended, allow us to collect this information. Furnishing us this information is voluntary. However, failing to provide us with all or part of the information could prevent us from making an accurate and timely decision on your entitlement for widow or widower benefits.

We will use the information to make a determination for entitlement to widow or widower benefits. We may also share your information for the following purposes, called routine uses:

•To contractors and other Federal agencies, as necessary, for assisting Social Security Administration (SSA) in the efficient administration of its programs. We contemplate disclosing information under this routine use only in situations in which SSA may enter a contractual or similar agreement, with a third party to assist in accomplishing an agency function relating to this system of records; and

•To third party contacts, especially in situations where the party to be contacted has, or is expected to have, information relating to the individual’ capability to manage his/her affairs or his/her eligibility for or entitlement to benefits under the Social Security

program; when the data are needed to establish the validity of evidence; to verify the accuracy of information presented by the individual and, if it concerns his/her eligibility for benefits under the Social Security program.

In addition, we may share this information in accordance with the Privacy Act and other Federal laws. For example, where authorized, we may use and disclose this information in computer matching programs, in which our records are compared with other records to establish or verify a person’ eligibility for Federal benefit programs and for repayment of incorrect or delinquent debts under these programs.

A list of additional routine uses is available in our Privacy Act System of Records Notices (SORN)

Paperwork Reduction Act Statement - This information collection meets the requirements of 44 U.S.C.§ 3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget (OMB) control number. The OMB control number for this collection is

Form |

|

|

Page 8 of 8 |

|||||||

|

|

|

|

|

|

|

CHANGES TO BE REPORTED AND HOW TO REPORT |

|||

|

|

|

FAILURE TO REPORT MAY RESULT IN OVERPAYMENTS THAT MUST BE REPAID, AND IN POSSIBLE |

|||||||

|

|

|

|

|

|

|

|

MONETARY PENALTIES. |

||

• You change your mailing address for checks or residence. |

Disability Applicants |

|||||||||

(To avoid delay in receipt of checks, you should ALSO file a |

1. You return to work (as an employee or |

|||||||||

regular change of address notice with your post office.) |

||||||||||

regardless of amount of earnings. |

||||||||||

• Your citizenship or immigration status changes. |

||||||||||

2. Your condition improves. |

||||||||||

• You go outside the U.S.A. for 30 consecutive days or longer. |

||||||||||

WORK AND EARNINGS |

||||||||||

• Any beneficiary dies or becomes unable to handle benefits. |

For those under full retirement age, the law requires that a |

|||||||||

• Work Changes - On your application you told us you expect |

report of earnings be filed with SSA within 3 months and 15 |

|||||||||

days after the end of any taxable year in which you earn more |

||||||||||

total earnings for |

to be $ |

. |

than the annual exempt amount. You may contact SSA to file a |

|||||||

|

|

|

|

|

|

|

|

|

report. Otherwise, SSA will use the earnings reported by your |

|

You |

(are) |

(are not) earning wages of more than |

||||||||

employer(s) and your |

||||||||||

$ |

|

|

a month |

|

|

|

as the report of earnings test. It is your responsibility to ensure |

|||

You |

(are) |

(are not) |

that the information you give concerning your earnings is |

|||||||

correct. You must furnish additional information as needed |

||||||||||

services in your trade or business. |

|

|

when your benefit adjustment is not correct based on the |

|||||||

(Report AT ONCE if this work pattern changes.) |

earnings on your record. |

|||||||||

|

||||||||||

• Change of Marital Status - Marriage, divorce, annulment of |

HOW TO REPORT |

|||||||||

marriage. You must report a change in marital status even if |

You can make your reports by telephone, mail, in person, or |

|||||||||

you believe that an exception applies. |

||||||||||

online, whichever you prefer. If you are awarded benefits, and |

||||||||||

• You are confined for more than 30 continuous days to jail, |

one or more of the above change(s) occur, you should report |

|||||||||

prison, penal institution, or correctional facility for conviction |

by: |

|||||||||

of a crime or you are confined to a public institution by court |

• Visiting the section "Online Services" at our web |

|||||||||

order in connection with a crime. |

|

|

||||||||

• Custody Change - Report if a person for whom you are filing, |

site at www.socialsecurity.gov; |

|||||||||

• Calling us TOLL FREE at |

||||||||||

or who is in your care dies, leaves your care or custody, or |

||||||||||

changes address. |

|

|

|

• If you are deaf or hearing impaired, calling us TOLL FREE |

||||||

|

|

|

|

|

|

|

|

|

||

• You begin to receive a pension, annuity, or a lump sum |

at TTY |

|||||||||

payment based on your government employment not covered |

• Calling, visiting or writing your local Social Security office |

|||||||||

by Social Security or your pension or annuity amount |

||||||||||

changes or stops. |

|

|

|

shown at the phone number and address on your |

||||||

• You have an unsatisfied warrant for more than 30 continuous |

claim receipt. |

|||||||||

days for your arrest for a crime or attempted crime that is a |

For general information about Social Security, visit our web |

|||||||||

felony or flight to avoid prosecution or confinement, escape |

site at www.socialsecurity.gov. |

|||||||||

from custody, and |

|

|||||||||

not classify crimes as felonies, this applies to a crime that is |

|

|||||||||

punishable by death or imprisonment for a term exceeding 1 |

|

|||||||||

year (regardless of the actual sentence imposed). |

|

|||||||||

FIGURING YOUR YEARLY EARNINGS

To figure your total yearly earnings, count all gross wages (before deductions) and net earnings from

In figuring your total yearly earnings, however, DO NOT COUNT ANY AMOUNTS EARNED BEGINNING WITH THE MONTH YOU ATTAIN FULL RETIREMENT AGE. Count only amounts earned before the you attain full retirement age.

PLEASE READ THE FOLLOWING INFORMATION CAREFULLY BEFORE ANSWERING QUESTION 28.

Benefits may be payable for some months prior to the month in which you file this claim (but not for any month before you reach age 60 (unless you are disabled)) if:

• YOU WILL EARN OVER THE EXEMPT AMOUNT THIS YEAR.

(For the appropriate exempt amount, see "How Work Affects Your Benefits" (Publication No.

If your first month of entitlement is prior to full retirement age, your benefit rate will be reduced. However, if you do not actually receive your full benefit amount for one or more months before full retirement age because benefits are withheld due to your earnings, your benefit will be increased at full retirement age to give credit for this withholding. Thus, your benefit amount at full retirement age will be reduced only if you receive one or more full benefit payments prior to the month you attain full retirement age.

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Purpose | The SSA-10 form is used to apply for widow's or widower's insurance benefits under the Social Security Administration. |

| Eligibility Criteria | Applicants must be eligible for benefits under Title II of the Social Security Act, which includes survivors of deceased wage earners. |

| Application Completeness | All claimants, except those already receiving spouse's benefits, must complete the entire form. |

| OMB Approval | The form is approved by the Office of Management and Budget (OMB) and has an OMB number of 0960-0004. |

| Version Date | The current version of the SSA-10 form was revised in October 2019. |

| Governing Law | This form is governed by the Social Security Act and may also involve the Railroad Retirement Act and Veterans Benefits under Title 38 U.S.C. |

| Information Requirements | Applicants must provide personal identifying information, including Social Security numbers and details about the deceased. |

| Medicare Information | The form includes details regarding Medicare enrollment and potential premium costs for applicants age 65 or older. |

| Additional Benefits Consideration | The SSA-10 form may be regarded as an application for various other benefits, such as those from the Veterans Administration. |

Guidelines on Utilizing Ssa 10

Completing Form SSA-10 is an important step for individuals seeking benefits as a widow or widower. This process requires careful attention to detail to ensure that all necessary information is accurately provided. Following the outlined steps will help you fill out the form correctly and efficiently.

- Begin with information about the deceased: Print the name of the deceased wage earner or self-employed person. Check the appropriate box for their gender and enter their Social Security Number.

- Provide your personal details: Print your name, Social Security Number, and any different name used at birth.

- Enter the deceased's date of birth: Input the month, day, and year.

- Provide the date and place of the deceased's death: Specify the month, day, and year, along with the city and state of death.

- Indicate the deceased's permanent home: Name the state or foreign country where the deceased resided at the time of death.

- Social Security application history: Answer whether the deceased ever filed an application for Social Security benefits and provide additional details as necessary.

- Earned income details: Enter the deceased's earnings for the year of death and the year prior.

- Marriage history: Provide details about the deceased's marriages, including names, dates, and how the marriages ended.

- Share your personal marriage information: Include details of your marriage to the deceased, along with any subsequent marriages.

- Living situation: Indicate if you lived together at the time of the deceased's death, or provide details about any absence.

- Past benefits applications: Confirm if you or someone on your behalf has filed for any benefits previously.

- Military service questions: Answer questions regarding military service for both you and the deceased.

- Government pensions: Specify if you or the deceased had any pensions or annuities outside of Social Security.

- Medicare enrollment: Decide whether you want to enroll in Medicare Part B.

- Expected earnings: Provide your expected income for the current and next year, marking any months that qualify as exempt months.

- Application for benefits: Indicate the date you would like your benefits to begin.

After filling out the SSA-10 form, it is crucial to review all information for accuracy. Ensuring completeness at this stage will help facilitate a smoother application process. Once the form is correctly filled, it can be submitted to the Social Security Administration for processing.

What You Should Know About This Form

What is the SSA-10 form used for?

The SSA-10 form is an application for widow's or widower's insurance benefits under the Social Security Administration. By filling out this form, you are applying for all insurance benefits for which you may qualify due to the death of your spouse. It also serves as an application for certain benefits under the Railroad Retirement Act and for Veterans Administration payments. The form collects information about both you and the deceased to determine eligibility for benefits.

Who should fill out the SSA-10 form?

The SSA-10 form should be completed by individuals who are widows or widowers applying for survivor benefits. If you were receiving spouse’s benefits at the time of your spouse’s death, you only need to complete the specific sections indicated on the form. Other claimants will need to provide detailed information as required by the entire application.

What information is required on the SSA-10 form?

You will need to provide personal information about both yourself and the deceased. This includes names, Social Security numbers, dates of birth, and dates of death. You will also need to provide information about the deceased's work history, including any Social Security benefits they may have received. If there are additional marriages, this information is also required. Complete details about any military service and earnings are necessary to assess the eligibility for benefits.

How does the SSA-10 form affect my Medicare coverage?

If your application for benefits is approved and you are eligible for Medicare at age 65, you might receive automatic enrollment in Medicare Part A and Part B. This applies if you continue to qualify for benefits at that age. Completing the SSA-10 also helps ensure that your benefits are calculated correctly, potentially affecting your Medicare coverage and premiums.

What should I do if I have questions or need help with the SSA-10 form?

If you have questions about the SSA-10 form or need assistance completing it, you can contact your local Social Security office for help. You can also call the Social Security Administration directly at 1-800-772-1213. They can provide support and guidance related to the application process and eligibility.

Common mistakes

Filling out the SSA-10 form for widow's or widower's insurance benefits is a significant step for many. However, common mistakes can lead to unnecessary delays or complications in processing the benefits. Understanding these typical errors can help ensure a smoother application process.

One frequent mistake is providing incorrect or incomplete information about the deceased. When naming the deceased, ensure that the full name appears correctly, including any middle initials. Forgetting to input the Social Security Number can also hinder the process. If this number is missing or inaccurately recorded, it may delay the assessment.

In particular, not checking relevant boxes can create issues. For instance, in item 3, one must clearly mark the deceased's gender. Failing to do so can raise questions during the review process, possibly requiring additional follow-up. Furthermore, entering the wrong date of birth or date of death, which are critical for verifying eligibility, is a mistake that can lead to severe consequences.

Misunderstanding what information is needed regarding any previous marriages is another common error. Respondents should provide details for any marriage lasting ten years or more. If there were multiple marriages, listing them all is essential. Omitting this information can result in delays as the Social Security Administration may need to request further details.

The section regarding other benefits can often pose challenges. Applicants sometimes answer incorrectly regarding whether the deceased ever filed for Social Security benefits. If unsure, marking the box for not knowing is crucial instead of leaving it blank. In such cases, providing accurate information about income from the year of death is also important to avoid errors.

The applicant's own information can be just as critical. Missing the details like the Social Security Number or date of birth can slow down the process. Residents sometimes fail to understand the importance of all the items, which can lead to administrative questions. Moreover, it’s advisable not to skip questions simply because they seem irrelevant; every piece of information is essential for processing the claim accurately.

Lastly, when applying for Medicare coverage, individuals often neglect to indicate their enrollment preference clearly. Selecting "Yes" or "No" inaccurately can lead to issues down the road. Incomplete or unclear indications about preferences can complicate benefits, causing confusion when the time comes for implementation.

By carefully reviewing each section and ensuring all required fields are completed accurately, applicants can substantially reduce the risk of errors. Ensuring the form is filled out in clarity and attention to detail will help facilitate a quicker processing time for the benefits and reduce potential stress during what can already be a challenging time.

Documents used along the form

When applying for Widow's or Widower's Insurance Benefits using the SSA-10 form, there are several other documents that may be required to accompany the application. These forms can help streamline the application process and provide essential information relevant to your claim. Below is a list of commonly used forms and documents along with brief descriptions of each.

- SSA-12 - Request for Change of Address: This form is used to update your address with the Social Security Administration. Keeping your contact information current is vital, as it ensures you receive important correspondence regarding your benefits.

- Form SSA-827 - Authorization for Release of Information: This form grants permission to the Social Security Administration to collect medical records and other information from healthcare providers. This can be necessary for assessing your eligibility for benefits based on medical conditions.

- Form SSA-21 - Employer's Statement About Work Activity: If you or the deceased were self-employed or had specific work activities, this form provides details about employment history and income, which are critical for calculating benefits.

- Death Certificate: A copy of the deceased’s death certificate is often required to verify the death and is a key document in establishing eligibility for survivor benefits.

- Marriage Certificate: This document proves the marriage between you and the deceased. It may be necessary to establish eligibility for spousal benefits, particularly if prior marriages were involved.

- Form SSA-49 - Application for Widow's or Widower's Insurance Benefits: In situations where you are also seeking disability benefits, this form can be submitted concurrently with the SSA-10 to streamline the process.

- Proof of Social Security Numbers: Documentation showing the Social Security numbers of both the applicant and the deceased is essential. This can often include cards, tax returns, or other official documentation.

By gathering these forms and documents in advance, applicants can help ensure a smoother process when applying for benefits through the SSA-10 form. Proper preparation is key to a successful claim, and obtaining the right documents will greatly assist in navigating the bureaucracy of benefits applications.

Similar forms

The SSA-10 form, which is an application for widow's or widower's insurance benefits, shares similarities with several other forms commonly used in similar scenarios. Below is a list of those forms and their related functions:

- SSA-1 (Application for Benefits): This form is used to apply for retirement, disability, and survivor benefits under Social Security. Like the SSA-10, it requires personal details and information about the deceased.

- SSA-8 (Request for Waiver of Overpayment Recovery): This form allows individuals to request a waiver for overpayments made under Social Security. Both forms necessitate financial details and personal information to assess eligibility.

- SSA-2 (Application for Child's Insurance Benefits): This application is for children of deceased workers seeking benefits. Similar to the SSA-10, it collects relevant information regarding the deceased and the claimant's relationship to them.

- SSA-4 (Application for a Social Security Card): Used for applying for a Social Security card, it gathers personal data and may require information on deceased relatives, akin to the SSA-10's approach to personal and familial information.

- SSA-5 (Application for Parent's Insurance Benefits): This form is intended for parents of deceased workers. Similar structures exist between the SSA-5 and SSA-10, focusing on the relationship with the deceased and required documentation.

- SSA-11 (Application for Widow's/Widower's Insurance Benefits): This application is specifically for surviving spouses wishing to claim benefits based on their deceased spouse's work record. It parallels the SSA-10 closely, often using overlapping fields and content.

Each of these forms plays a vital role in the benefits application process, ensuring that individuals receive the assistance they need during challenging times.

Dos and Don'ts

When filling out the SSA-10 form, it is important to follow specific guidelines to ensure the application is processed smoothly. Below is a list of things you should and shouldn’t do.

- Do read the instructions carefully before starting the application.

- Do provide accurate information to avoid delays.

- Do check your spelling, especially on names and places.

- Do use black or blue ink for legibility.

- Do keep copies of the completed form for your records.

- Don’t leave any required fields blank; fill them in to the best of your knowledge.

- Don’t submit the form without reviewing it for accuracy.

- Don’t include unnecessary information that isn't requested in the form.

- Don’t hesitate to ask for help if you have questions about the form or the process.

Misconceptions

- Misconception: The SSA-10 is only for married individuals.

Many believe that only individuals who were married to the deceased can use the SSA-10 form. However, the form is also applicable to widowed spouses of individuals who were receiving benefits prior to their spouse's death, as well as individuals who may qualify under other specific criteria.

- Misconception: Completing the SSA-10 is a lengthy process.

While the SSA-10 requires information about both the deceased and the applicant, most find that gathering documentation beforehand simplifies the process. The form is designed to be straightforward, and many claimants complete it in under an hour.

- Misconception: The SSA-10 is irrelevant if the deceased had no employment history.

Regardless of the deceased's work history, this form can still be crucial. Individuals who had no qualifying work may still receive certain benefits due to other eligibility criteria such as a spouse’s record or due to military service.

- Misconception: Filing the SSA-10 guarantees automatic approval for benefits.

Submitting the SSA-10 does not ensure benefits will be granted. While the form starts the application process, the SSA will review all submitted information and documentation to make a final determination regarding benefit eligibility.

- Misconception: There's no deadline for submitting the SSA-10 after the death of a spouse.

It's essential to understand that there are time limits for submitting the SSA-10 form. For many applicants, especially those applying for survivor benefits, timely submission can impact the amount of benefits received.

- Misconception: You don't need to provide any documentation with the SSA-10.

While the SSA-10 requests various information, applicants are often required to submit supporting documents. This may include the deceased's Social Security number, proof of marriage, or death certificate, based on the applicant's specific circumstances.

- Misconception: The SSA-10 is the only form needed for survivor benefits.

In some cases, additional forms may be required, particularly if there are complexities such as multiple marriages or other benefits involved. It's vital to verify if supplementary documentation is necessary to support your application.

- Misconception: The SSA-10 process is automatically handled after submission.

After submitting the SSA-10, applicants remain responsible for any follow-up. SSA might request additional information or clarification, and active engagement with the process is often necessary to ensure timely and complete consideration of the claim.

Key takeaways

Completing the SSA-10 form can feel overwhelming, but understanding the key points can streamline the process for applicants seeking widow's or widower's insurance benefits. Here are some essential takeaways to keep in mind:

- Eligibility: This form is for individuals applying for benefits following the death of a spouse. It's important to ensure that all relevant sections are filled out correctly, particularly if the deceased had previously filed any Social Security claims.

- Information Requirement: Make sure to provide complete and accurate information regarding the deceased, such as their name, Social Security number, and dates of birth and death. Each detail supports the determination of benefits.

- Attention to Marital History: Applicants must disclose details of prior marriages, if any. This information is essential, especially if those marriages were long-term or ended due to the spouse's death.

- Income Details: It's crucial to provide accurate income details. The form requires information about the deceased's earnings for the year of death and the prior year, as well as the applicant's earnings. This can impact benefit calculations.

- Check for Other Benefits: The form includes questions about any other federal benefits that the deceased may have been receiving. Be thorough in answering these questions to avoid delays.

- Medicare Information: If applicable, consider the implications of Medicare Part B enrollment upon approval of the SSA-10 claim. Understand the costs associated and your eligibility, particularly as you approach age 65.

As the process unfolds, remember to follow the form's instructions closely and provide additional information as necessary. A well-completed SSA-10 form can help ensure timely access to the benefits you may be entitled to.

Browse Other Templates

Bank of America Transfer - Indicate whether you want to transfer all assets or only a specific amount of cash.

What Is a Nda Used for - Describes the introduction process and the benefits from a chain of referrals.