Fill Out Your Ssa 1099 Form

The SSA 1099 form, officially known as the Social Security Benefit Statement, plays a crucial role in financial planning for recipients of Social Security benefits. Each year, this form details the benefits paid in the previous year, allowing individuals to accurately report their income on tax returns. In the form, several key components are highlighted, including the beneficiary’s name and Social Security number, the total benefits received, any amounts that were repaid to the Social Security Administration (SSA), and the net benefits calculated after such repayments. It’s important to note that a portion of the benefits listed in Box 5 may be considered taxable income, which could affect overall tax liability. Additionally, Box 6 outlines any voluntary federal income tax withheld from the benefits. For those needing to connect with the SSA for clarification or inquiries, the claim number provided in Box 8 is essential. Keeping this form secure is critical since it serves as proof of income and may be requested in various financial situations, underscoring its importance in both tax preparation and personal financial management.

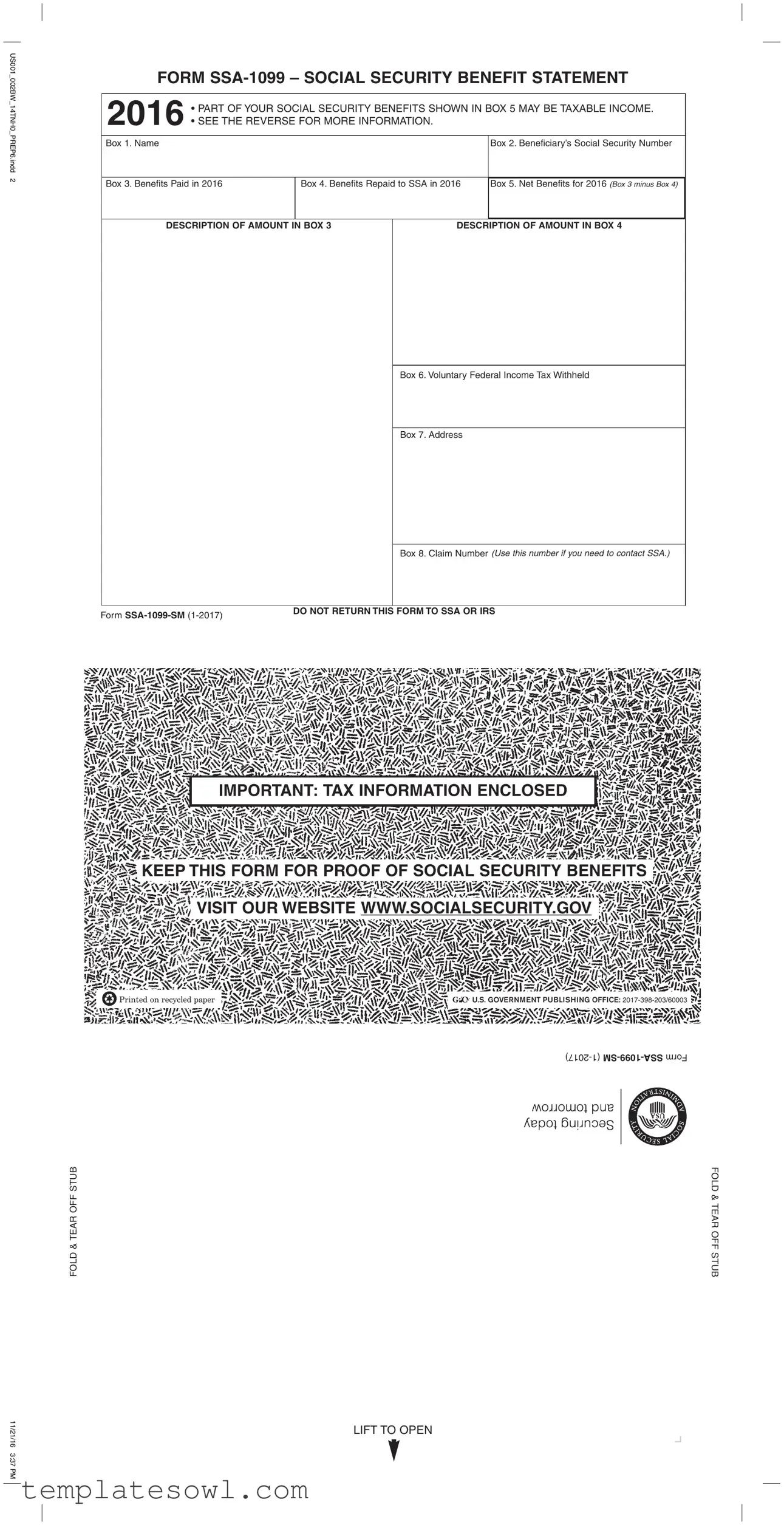

Ssa 1099 Example

US001_002BW_14TNH0_PREP6.indd 2

US001_002BW_14TNH0_PREP6.indd 2

FORM

2016 • PART OF YOUR SOCIAL SECURITY BENEFITS SHOWN IN BOX 5 MAY BE TAXABLE INCOME.

• SEE THE REVERSE FOR MORE INFORMATION.

Box 1. Name |

|

|

Box 2. Beneficiary’s Social Security Number |

|

|

|

|

Box 3. Benefits Paid in 2016 |

Box 4. Benefits Repaid to SSA in 2016 |

Box 5. Net Benefits for 2016 (Box 3 minus Box 4) |

|

|

|

|

|

DESCRIPTION OF AMOUNT IN BOX 3 |

DESCRIPTION OF AMOUNT IN BOX 4 |

||

Box 6. Voluntary Federal Income Tax Withheld

Box 7. Address

Box 8. Claim Number (Use this number if you need to contact SSA.)

Form |

DO NOT RETURN THIS FORM TO SSA OR IRS |

|

FOLD & TEAR OFF STUB

IMPORTANT: TAX INFORMATION ENCLOSED

KEEP THIS FORM FOR PROOF OF SOCIAL SECURITY BENEFITS

VISIT OUR WEBSITE WWW.SOCIALSECURITY.GOV

Printed on recycled paper |

U.S. GOVERNMENT PUBLISHING OFFICE: |

gov.SocialSecurity account yS Social my a nOpe

nOpe

$300 USE, PRIVATE FOR PENALTY BUSINESS OFFICIAL

FOLD & TEAR OFF STUB

11/21/16 3:37 PM

LIFT TO OPEN

Form Characteristics

| Fact Name | Details |

|---|---|

| Taxable Income | Some benefits shown in Box 5 of the SSA-1099 may be considered taxable income. |

| Information on the Reverse | The reverse side of the form provides further details related to the benefits and tax implications. |

| Record Keeping | It's important to keep this form for proof of Social Security benefits received in the year reported. |

| Voluntary Tax Withholding | Box 6 may indicate if any federal income tax was voluntarily withheld from your benefits. |

| Contacting SSA | Use the Claim Number found in Box 8 if you need to reach out to the SSA for inquiries or issues. |

Guidelines on Utilizing Ssa 1099

Once you have received your SSA 1099 form, it is important to carefully fill it out with accurate information. This form provides essential details about your Social Security benefits for the tax year in question. To ensure you have the necessary information ready, follow these steps to complete the SSA 1099 form properly.

- Locate your SSA 1099 form, ensuring that you have a blank copy ready for filling out.

- In Box 1, enter your full name as it appears on your Social Security card.

- In Box 2, write your Social Security number. Double-check for accuracy.

- In Box 3, record the total benefits paid to you for the year. This amount can typically be found on the form itself.

- In Box 4, enter any benefits that you have repaid to the Social Security Administration (SSA) in the same year.

- Calculate your net benefits for the year by subtracting the amount in Box 4 from the amount in Box 3. Write the result in Box 5.

- If any federal income tax was withheld from your Social Security payments, indicate that amount in Box 6.

- In Box 7, provide your address. Ensure it is up-to-date and accurate.

- Finally, in Box 8, include your claim number. This is essential if you need to contact the SSA regarding your benefits.

After completing the form, keep it for your records. It is crucial for future reference, especially when preparing your taxes.

What You Should Know About This Form

What is the SSA 1099 form?

The SSA 1099 form, also known as the Social Security Benefit Statement, provides a summary of Social Security benefits awarded to an individual in a given tax year. It shows the total benefits paid, any repayments made to the Social Security Administration (SSA), and the net benefits received. It is an important document for tax reporting purposes, as some benefits may be taxable income.

How should I use the information on the SSA 1099 form?

You should use the SSA 1099 form when filing your taxes. Specifically, the form’s details help determine the amount of Social Security benefits that might be taxable. Pay close attention to Box 5. The net benefits in this box, which is the total benefits paid minus any repayments made to the SSA, are particularly relevant for your tax calculations.

How can I contact the SSA if I have questions about my SSA 1099 form?

If you need to reach out to the SSA regarding your SSA 1099 form, use the claim number listed in Box 8 on the form. This number helps SSA representatives locate your information quickly. Alternatively, you can visit the SSA’s website for additional contact options and resources.

What should I do if I notice an error on my SSA 1099 form?

If you find any inaccuracies on your SSA 1099 form, it is important to address them as soon as possible. Contact the SSA directly to report the error. They can provide guidance on how to correct the information and issue a revised form if necessary.

Do I need to submit the SSA 1099 form with my tax return?

No, you do not submit the SSA 1099 form with your tax return. However, it is crucial to keep it for your records. The IRS may ask for documents that support your income claims, and the SSA 1099 form serves as proof of the Social Security benefits you received.

Common mistakes

Filling out the SSA-1099 form can feel daunting. However, understanding the common mistakes people make can help you navigate the process more smoothly. Here are five mistakes to watch out for.

One major error occurs when individuals misreport their personal information. Accurate details are crucial for the Social Security Administration (SSA) to process your benefits correctly. This includes ensuring that your name matches the one on your Social Security card exactly. If there are any discrepancies, it could lead to delays in your benefits or complications during tax season.

Another common mistake is failing to consider the taxable portion of benefits. Some individuals overlook that part of their benefits, indicated in Box 5, may be taxable income. Not understanding how the taxes on Social Security benefits work can lead to underreporting your income. This may result in unexpected tax bills, which could have been avoided with proper planning.

People often forget to subtract any benefits they repaid to the SSA when calculating the net benefits for the year. Box 3 lists the total benefits paid, while Box 4 shows any repayments. The net benefits, shown in Box 5, should reflect the correct amount after accounting for any repayments. Ignoring this step could misrepresent your income when you file taxes.

Additionally, not including voluntary federal tax withholding information can cause issues as well. If you elected to have taxes withheld from your benefits, that amount will be in Box 6. Failing to report this can lead to underpayment of taxes, which could incur penalties later. Make sure this box is filled out if it applies to you.

Lastly, many neglect to keep a copy of their SSA-1099 for their records. This form serves as proof of your Social Security benefits, and having the information on hand can be beneficial, especially if questions arise in the future. It’s best to store this form safely along with your other important tax documents.

Avoiding these mistakes can simplify your experience with the SSA-1099 form. Being meticulous and ensuring all information is accurate can save you from problems down the line. With careful attention, you can make the process more straightforward and less stressful.

Documents used along the form

The SSA 1099 form serves as a critical document for individuals receiving Social Security benefits. It summarizes the benefits paid during the tax year and assists with income tax reporting. Additional forms and documents may accompany the SSA 1099 form for various purposes related to tax liability, benefit verification, or other necessary information. Below are some common documents often used alongside the SSA 1099 form.

- Form 1040: This is the standard individual income tax return form used by U.S. taxpayers. Recipients of SSA 1099 must report benefits received on this form, as some may be taxable income.

- Schedule SE: This schedule is used to calculate self-employment tax. If Social Security benefits are reported alongside self-employment income, this form is necessary for proper tax computation.

- Form SSA-1042S: This form is issued to non-resident aliens who receive U.S. Social Security benefits. It details the amount of benefits received and any tax withheld.

- Form 1099-R: Used to report distributions from pensions, annuities, retirement plans, and IRAs. If a recipient has benefits from such distributions, it may accompany the SSA 1099.

- Form 4506-T: Request for Transcript of Tax Return allows individuals to obtain a summary of their tax return information from the IRS. This may be useful for verifying income and benefits received.

- Proof of Income Documents: Paystubs, bank statements, or other documents may be used to provide additional context or verification of income when applying for loans or assistance programs.

These forms and documents collectively help individuals manage their tax responsibilities and verify their income status when necessary. Understanding their purpose can simplify the process of tax preparation and compliance.

Similar forms

The SSA 1099 form, also known as the Social Security Benefit Statement, serves an important purpose for beneficiaries. It outlines the income received from Social Security in a given tax year. Several other documents share similarities with the SSA 1099, particularly in terms of their function and content. Here are five such documents:

- Form 1099-MISC: This form reports miscellaneous income, which might include earnings from self-employment or contract work. Similar to the SSA 1099, it provides crucial information that can determine tax liability.

- Form 1099-INT: Issued by banks and financial institutions, this form reports interest income earned. Like the SSA 1099, it helps individuals understand their income for tax purposes and may affect their taxable income calculations.

- Form W-2: Employers use the W-2 to report wages, tips, and other compensation paid to employees. Both forms are essential in reporting income for tax filing but serve different sources of income.

- Form 1099-DIV: This document reports dividends and other distributions to shareholders. Just as the SSA 1099 details Social Security benefits, the 1099-DIV informs recipients about their investment income.

- Form 1098: This form reports mortgage interest paid by borrowers. Similar to the SSA 1099, it provides recipients with necessary information that may be relevant in determining tax deductions and liabilities.

Each of these forms plays a vital role in assisting individuals to accurately prepare their tax returns and understand their financial position for the year.

Dos and Don'ts

When filling out the SSA 1099 form, following best practices can help ensure accuracy and compliance. The following list outlines what you should and shouldn't do:

- Do double-check all entries for accuracy before submission.

- Do ensure your name and Social Security number are entered correctly.

- Do keep a copy of the form for your records.

- Do consult the instructions on the reverse side for additional guidance.

- Do verify the amounts in Boxes 3 and 4 to calculate Box 5 correctly.

- Don't submit the SSA 1099 form to the SSA or IRS.

- Don't ignore any missing information or errors.

- Don't fold or damage the form more than necessary.

- Don't forget to retain the form for proof of benefits received.

- Don't skip reviewing any changes to tax rules that could affect your filing.

Misconceptions

Misconceptions about the SSA 1099 form can lead to confusion regarding social security benefits and tax implications. Here are five common misunderstandings:

- All Social Security Benefits Are Tax-Free - While many believe that social security benefits are entirely tax-exempt, this is not always the case. Depending on your overall income, portions of your social security benefits might be taxable. It's essential to review your total income for the year to determine tax liability.

- The SSA 1099 Form Is Only for Seniors - Some might think that the SSA 1099 form applies only to retirees. However, anyone receiving social security benefits, regardless of age, will receive this form. This includes those who may be disabled or survivors of deceased workers.

- If You Don’t Receive the Form, You Don’t Need to Report Benefits - There's a common belief that if the SSA 1099 isn't received, benefits don’t need to be reported. In reality, beneficiaries should keep track of their payments and report them, even if they have not received the form. Always hold onto any payment statement for accuracy.

- Form SSA 1099 Can Be Ignored if You Don't File Taxes - Some assume that if their income falls below the filing threshold, they don’t need to bother with the SSA 1099. However, keeping a record of your benefits is essential for verification purposes, even if you're not filing a tax return.

- Claim Numbers Aren't Important - Many people overlook the claim number on the SSA 1099 and may think it isn’t essential. Yet, this number is crucial if you ever need to contact the Social Security Administration for questions about your benefits.

Understanding these misconceptions can help in effectively managing your social security benefits and tax obligations. Always consult with a tax professional if there are any doubts about your specific situation.

Key takeaways

When using the SSA-1099 form, it is essential to understand a few important aspects.

- Tax Implications: Part of the Social Security benefits reported in Box 5 may be subject to income tax. Review the guidelines to determine your tax situation.

- Personal Information: Ensure that your name and Social Security number are correct in Boxes 1 and 2, as this information must accurately reflect your records.

- Payment Details: Box 3 shows the total benefits paid to you during the year. If any amount is reported in Box 4 for benefits you repaid, Box 5 will reflect the net benefits resulting from these figures.

- Tax Withholding: If any voluntary federal income tax was withheld, this will be indicated in Box 6. This is crucial for calculating your overall tax obligations.

- Record Keeping: It's important to keep the SSA-1099 form for your records. It serves as proof of the Social Security benefits you received.

Understanding these key points will help in the proper handling of the SSA-1099 form during tax season.

Browse Other Templates

Support Payment Documentation,Child Support Payment Summary,Spousal Support Payment Report,Family Support Payment Declaration,Unreimbursed Medical Expense History,Support Payment Verification Form,Court-Ordered Support Payment Record,Monthly Support - The DCSS 0569 helps in verifying payment history with evidence.

How to Ask for Letter of Recommendation - The applicant's inquisitive nature leads to insightful questions and discussions.