Fill Out Your Ssa 1699 Form

The SSA-1699 form serves as a crucial tool for individuals who wish to register as appointed representatives for the Social Security Administration (SSA) and to facilitate direct payment of fees associated with this representation. For aspiring representatives, this form is necessary under several circumstances, including the need to either register for direct payment of fees or update previously submitted information. It is essential for anyone who received a notice from the SSA instructing them to complete this form to do so promptly. However, if an individual aims to represent a relative or friend without being in the business of providing services to Social Security claimants, they are not required to complete the SSA-1699. The form must gather specific data to ensure compliance with Internal Revenue Code sections. A key detail is that representatives receiving $600 or more within a tax year will be documented on IRS Form 1099-MISC, which is generated based on the information provided in the SSA-1699. Completing the form accurately and promptly is vital, as incomplete or inaccurate submissions may be returned by the SSA. Upon successful submission, individuals will receive a Representative Identification (Rep ID) within two to three weeks, which simplifies future interactions with the SSA. Understanding the nuances of this form can significantly streamline the process of representation, ensuring that appointed representatives can assist claimants effectively while adhering to all regulatory requirements.

Ssa 1699 Example

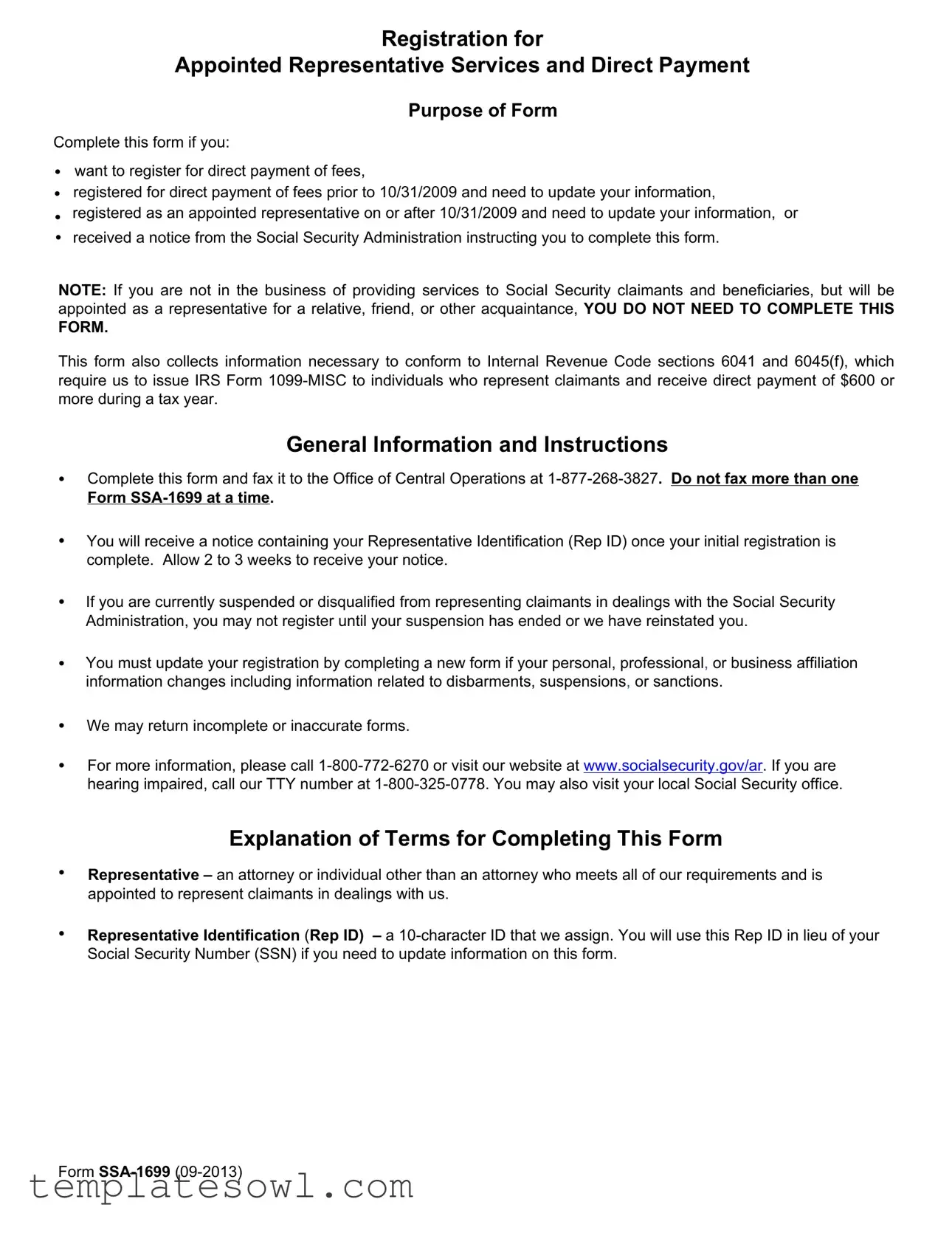

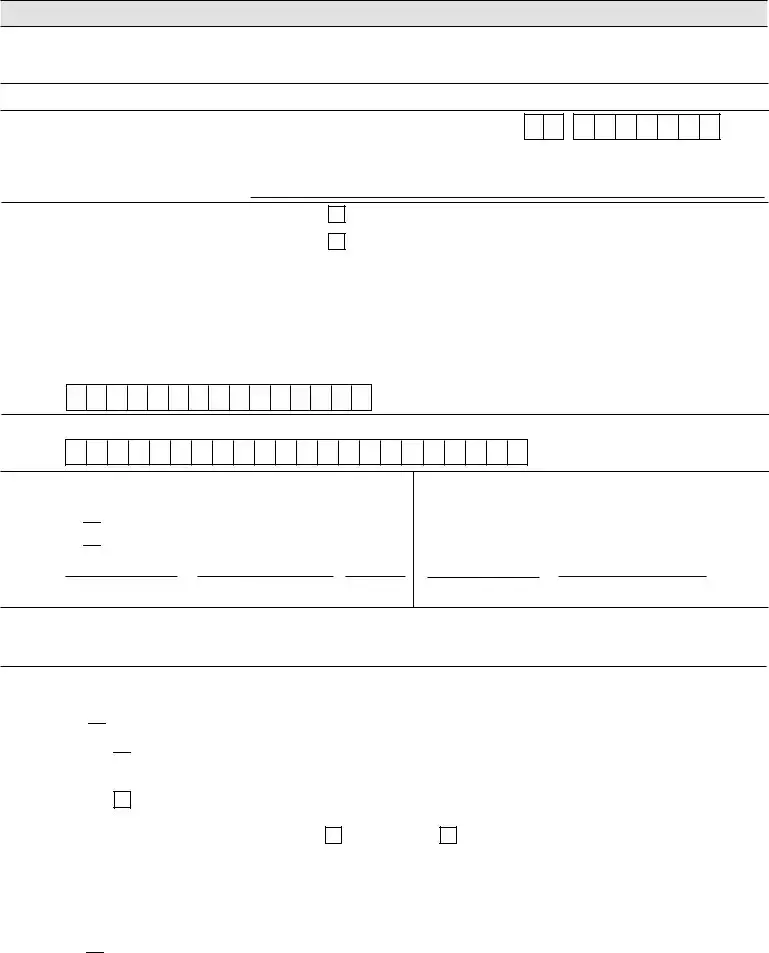

Registration for

Appointed Representative Services and Direct Payment

Purpose of Form

Complete this form if you:

•want to register for direct payment of fees,

•registered for direct payment of fees prior to 10/31/2009 and need to update your information,

•registered as an appointed representative on or after 10/31/2009 and need to update your information, or

•received a notice from the Social Security Administration instructing you to complete this form.

NOTE: If you are not in the business of providing services to Social Security claimants and beneficiaries, but will be appointed as a representative for a relative, friend, or other acquaintance, YOU DO NOT NEED TO COMPLETE THIS

FORM.

This form also collects information necessary to conform to Internal Revenue Code sections 6041 and 6045(f), which require us to issue IRS Form

General Information and Instructions

•Complete this form and fax it to the Office of Central Operations at

Form

•You will receive a notice containing your Representative Identification (Rep ID) once your initial registration is complete. Allow 2 to 3 weeks to receive your notice.

•If you are currently suspended or disqualified from representing claimants in dealings with the Social Security Administration, you may not register until your suspension has ended or we have reinstated you.

•You must update your registration by completing a new form if your personal, professional, or business affiliation information changes including information related to disbarments, suspensions, or sanctions.

•We may return incomplete or inaccurate forms.

•For more information, please call

Explanation of Terms for Completing This Form

•Representative – an attorney or individual other than an attorney who meets all of our requirements and is appointed to represent claimants in dealings with us.

•Representative Identification (Rep ID) – a

Form

Privacy Act Statement

Collection and Use of Personal Information

Sections 206(a) and 1631(d) of the Social Security Act, as amended, authorize us to collect this information. The information. We will use the information you provide to facilitate direct payment of authorized fees and to meet the reporting requirements of the law.

The information you furnish on this form is voluntary. However, failure to provide the requested information will prevent you from serving as an appointed representative.

We generally use the information you supply for the purpose of facilitating payments. However, we may use it for the administration and integrity of Social Security programs. We may also disclose information to another person or to another agency in accordance with approved routine uses, which include but are not limited to the following:

1.To enable a third party or an agency to assist Social Security in establishing rights to Social Security benefits and/ or coverage;

2.To comply with Federal laws requiring the release of information from Social Security records (e.g., to the Government Accountability Office and Department of Veterans' Affairs);

3.To make determinations for eligibility in similar health and income maintenance programs at the Federal, State, and local level; and

4.To facilitate statistical research, audit or investigative activities necessary to ensure the integrity of Social Security programs.

We may also use the information you provide in computer matching programs. Matching programs compare our records with records kept by other Federal, State, or local government agencies. Information from these matching programs can be used to establish or verify a person's eligibility for

Additional information regarding this form, routine uses of information, and our programs and systems, is available

Paperwork Reduction Act Statement

This information collection meets the requirements of 44 U.S.C. § 3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget control number. We estimate that it will take 20 minutes to read the instructions, gather the facts, and answer the questions. You may send comments on our time estimate, not the completed form, to SSA, 6401 Security Boulevard, Baltimore, MD,

Form

Social Security Administration

Form Approved OMB No.

REGISTRATION FOR APPOINTED REPRESENTATIVE SERVICES AND DIRECT PAYMENT

Complete all sections that apply to you. We will return incomplete or inaccurate forms.

Section I: Your Personal Identification and Home Contact Information

●All fields in this section are required unless indicated as optional. For your protection, we collect your home contact information to check against our records.

●If you need to update information you provided on or after 10/31/09, include your name, Rep ID, and all information that has changed. You must attest, sign, and date the updated form.

●Enter your name in the boxes below exactly as it appears on your Social Security card. If you want to use a different name, contact your local Social Security office to change the name currently in our records. You must either receive a new card or receive confirmation that we processed your name change prior to completing this form.

If you registered as an Appointed Representative on or after 10/31/09 and need to update your information,

enter your Rep ID below:

|

Your First Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your Middle Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your Suffix (if any) |

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your Date of Birth (MM/DD/YYYY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your Home Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Street Line 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

Line 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ZIP/Postal Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Country (if outside the U.S.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your Daytime Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your Home Fax Number (Optional) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone Number |

|

|

|

|

|

|

|

Extension |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fax Number |

||||||||||||||||||||||||||||||||||||||||||

|

Country/Area Code |

|

|

|

|

|

|

|

|

|

|

|

|

Country/Area Code |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your Email Address (Optional - Used for registration purposes and Social Security online service messages.)

Form |

1 |

Destroy Prior Editions

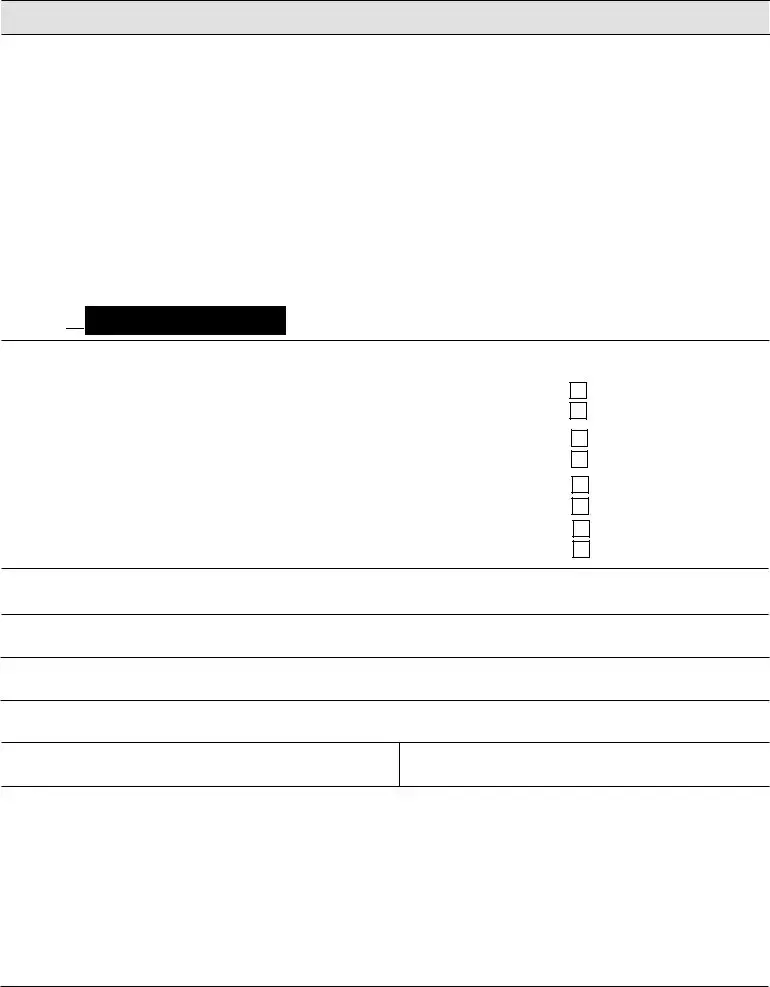

Section II: Your Representational Standing

Check one of the boxes below.

Are you currently in good standing and admitted to practice law before the U.S. Supreme Court; a U.S. Federal, state, territorial, insular possession, or District of Columbia court; or a member of a state bar if that membership carries with it the authority to practice law in that state?

Yes (Go to Section III) |

No (Go to Section IV) |

NOTE: If you are not in the business of providing services to Social Security claimants and beneficiaries, but will be appointed as a representative for a relative, friend, or other acquaintance, YOU DO NOT NEED TO COMPLETE THIS FORM.

Section III: Your Bar and Court Information

Provide information for one state, U.S. territory, or U.S. Federal Court in which you currently are in good standing and have the right to practice law.

Court or Bar |

Year |

Court or Bar License Number |

|

Admitted |

(If one issued) |

||

|

|||

|

(YYYY) |

|

|

|

|

|

|

|

|

|

Form |

2 |

Section IV: Your Information as a Representative

All representatives must complete this section.

1. |

Your Address for Receipt of Notices |

|

|

|

|

|

|

|

|

|

Same as Home Address in Section I |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Line 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

Line 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ZIP/Postal Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Country(if outside the U.S.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Business Telephone Number (if different from that |

|

|

|

|

|

Business Fax Number (Optional) |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

provided in Section I.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

Country/Area Code |

Phone Number |

Extension |

Country/Area Code |

Fax Number |

3.Business Email Address (Optional)

4. |

Did you check “Yes” in Section II OR have you been notified by us |

Yes |

|

that you are eligible for direct payment of your fees? |

No (Go to Section VI) |

|

|

|

|

|

|

5. |

What is your preferred payment method? |

|

Direct Deposit to U.S. Bank – I am the owner or

Type of Financial Account: |

Checking |

|

|

Savings |

|||||||||||||||||||||||

Routing Number |

|

Account Number |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OR

Check – Will be mailed to the Notice Address

Check – Will be mailed to the Notice Address

6.Your Tax Address (This is the address where we will send your FORM

Street |

Line 1 |

|

Line 2 |

Same as Home Address

Same as Home Address

Same as Notice Address in 1 in this section

Same as Notice Address in 1 in this section

City

ZIP/Postal Code

State

Country(if outside the U.S.)

Form |

3 |

SECTION V: Your Information When You Are Working for a Firm or Organization

Complete this section if your work as a representative will be affiliated with a firm or organization. If you work for more than one firm or organization complete and attach as many copies of this section as needed. You will need an EIN in order to complete this section.

Complete 1 through 5 below.

1.Employer Identification Number (EIN)

(See your

Name of Firm or Organization

2. Your Address for Receipt of Notices |

|

|

|

Same as home address in Section I |

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Same as notice address in Section IV |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Line 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

Line 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ZIP/Postal Code

Country (if outside the U.S.)

3.Business Telephone Number

Same as home number in Section I

Same as home number in Section I

Same as business number in Section IV

Same as business number in Section IV

Country/Area Code |

Phone Number |

Extension |

Business Fax Number (Optional)

Country/Area Code |

Fax Number |

4.Business Email Address (Optional)

5.What is your preferred payment method?

Direct Deposit to U.S. Bank

Direct Deposit to U.S. Bank

Same bank information as provided in Section IV

Same bank information as provided in Section IV

OR

Direct deposit to the account shown below. I am the owner or

Type of Financial Account: |

Checking |

|

|

Savings |

|||||||||||||||||||||||

Routing Number |

|

Account Number |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OR

Check – Will be mailed to the Notice Address

Check – Will be mailed to the Notice Address

Form |

4 |

Section VI: Attestations and Questions for Representation

You MUST ATTEST to these statements and complete the following questions.

1.I understand and will comply with SSA laws and rules relating to the representation of parties, including the Rules of Conduct and Standards of Responsibility for Representatives.

I will not charge, collect, or retain a fee for representational services that SSA has not approved or that is more than SSA approved, unless a regulatory exclusion applies.

I will not threaten, coerce, intimidate, deceive, or knowingly mislead a claimant or prospective claimant, or beneficiary, regarding benefits or other rights under the Social Security Act.

I will not knowingly make or present, or participate in making or presenting, false or misleading oral or written statements, assertions, or representations about a material fact or law concerning a matter within SSA's jurisdiction.

I am aware that if I fail to comply with any SSA laws and rules relating to representation, I may be suspended or disqualified from practicing as a representative before SSA.

I attest to all of the above.

I attest to all of the above.

2.Have you ever been:

a. |

Suspended or prohibited from practice before SSA or any |

Yes (Explain below.) |

|

other Federal program or agency? |

No |

|

|

|

|

|

|

b. |

Disbarred or suspended from a court or bar to which you were |

Yes (Explain below.) |

|

previously admitted to practice as an attorney? |

No |

|

|

|

|

|

|

c. |

Convicted of a violation under Section 206 or 1631(d) of the |

Yes (Explain below.) |

|

Social Security Act? |

No |

|

|

|

|

|

|

d. |

Disqualified from representing a claimant as a current or former |

Yes (Explain below.) |

|

officer or employee of the United States? |

No |

|

|

3.For each Yes answer in 2, provide the information below regarding that event (Attach copies of this page if you need more space.)

Federal Program or Agency; or Court or Bar Name:

Bar Number (provide the Bar Number if you have one AND you answered “Yes” to 2b):

Year Admitted (provide the year if you answered “Yes” to 2b):

Beginning Date of:

Ending Date: (if ended)

Brief Description of Circumstances:

Form |

5 |

Section VII: General Attestations

You MUST ATTEST to these statements.

I will not divulge any information that SSA has furnished or disclosed about a claim or prospective claim, unless I have the claimant's consent or there is a Federal law or regulation authorizing me to divulge this information.

I have in place reasonable administrative, technical, and physical security safeguards to protect the confidentiality of all personal information I receive from SSA, to avoid its loss, theft, or inadvertent disclosure.

I will not omit or otherwise withhold disclosure of information to SSA that is material to the benefit entitlement or eligibility of claimants or beneficiaries, nor will I cause someone else to do so, if I know or should know, that this would be false or misleading.

I will not use Social Security program words, letters, symbols, branding, or emblems in my advertising or other communications, in a way that conveys the false impression that SSA has approved, endorsed, or authorized me, my communications, or my organization, or that I have some connection with or authorization from SSA.

I will update this registration if my personal, professional or business affiliation information changes, including information related to disbarments, suspensions or sanctions.

I am aware that if I fail to comply with SSA laws and rules, I could be criminally punished by a fine or imprisonment or both, and I could be subject to civil monetary penalties.

I understand that SSA will validate the information I provide.

I attest to all of the above.

I attest to all of the above.

Perjury Statement

I agree that a copy of this signed Form

I declare under penalty of perjury that I have examined all of the information on this application and it is true and correct to the best of my knowledge.

Signature of Person Identified in Section I (You must sign your OWN name.)

Date

Form |

6 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Form | The SSA 1699 form is used to register for direct payment of fees for appointed representatives and to update previous registrations. |

| Eligibility | This form is necessary if you intend to receive a direct payment of $600 or more during a tax year on behalf of a Social Security claimant. |

| Fax Submission | Applicants must fax the completed SSA 1699 to the Office of Central Operations, ensuring that only one form is submitted at a time. |

| Identification Number | Once registered, individuals receive a Representative Identification (Rep ID) for future updates instead of using their Social Security Number. |

| Required Updates | Changes in personal, professional, or business information must be reported by completing a new SSA 1699 form. |

| Privacy Considerations | The form collects personal information under the authority of specific sections of the Social Security Act, ensuring compliance with privacy requirements. |

Guidelines on Utilizing Ssa 1699

Completing the SSA-1699 form is essential for individuals looking to register for appointed representative services and direct payment of fees. Following the steps carefully will ensure your application is processed smoothly. After submission, you should anticipate receiving a notice with your Representative Identification (Rep ID) within 2 to 3 weeks.

- Obtain the SSA-1699 form from the Social Security Administration website or your local office.

- Fill out Section I with your personal identification and home contact information:

- Include your full name as it appears on your Social Security card.

- Provide your date of birth, Social Security Number, and mailing address.

- List your daytime telephone number, optional fax number, and optional email address.

- In Section II, indicate your representational standing:

- Check the appropriate box to confirm your standing in the legal practice.

- Complete Section III by providing information about your bar or court details:

- Include the name of the court or bar, the year you were admitted, and your license number.

- Move to Section IV to provide information as a representative:

- Input the address for notices, if different from the home address.

- Fill in your business telephone and optional fax number.

- Provide an optional business email address.

- Answer whether you are eligible for direct payment.

- Choose your preferred payment method: direct deposit or check.

- Specify your tax address for FORM 1099-MISC if it differs from your home or notice address.

- Review all sections for accuracy and completeness.

- Fax the completed SSA-1699 form to the Office of Central Operations at 1-877-268-3827.

- Wait for your notice containing your Representative Identification (Rep ID), expected in 2 to 3 weeks.

What You Should Know About This Form

What is the purpose of Form SSA-1699?

Form SSA-1699 is used for registering for appointed representative services and for direct payment of fees. Individuals should complete this form if they want to register for direct payment, need to update previously submitted registration information, or have received a notice from the Social Security Administration (SSA) instructing them to complete the form. It is important to note that if someone is only acting as a representative for a friend or family member and is not in the business of providing services to Social Security claimants, they do not need to submit this form.

How should I submit Form SSA-1699?

Individuals should complete the form and then fax it to the Office of Central Operations at the designated number, 1-877-268-3827. It is crucial to only send one Form SSA-1699 at a time to ensure processing efficiency. Upon successful registration, you will receive a notice that contains your Representative Identification (Rep ID), which may take approximately 2 to 3 weeks to arrive.

What happens if my registration information changes?

In the event that a representative's personal, professional, or business information changes, they must fill out and submit a new Form SSA-1699. This includes any changes related to disbarments, suspensions, or sanctions. Keeping information up to date is vital to maintain the integrity of your registration and ensure that all communications from SSA are accurate and directed appropriately.

Can I register if I am currently suspended or disqualified?

No, individuals who are currently suspended or disqualified from representing claimants in dealings with the SSA are not permitted to register using Form SSA-1699 until their suspension has ended, or their eligibility has been reinstated. It is important for representatives to ensure they meet all eligibility requirements before attempting to register.

Why is personal information collected on this form?

The SSA collects personal information on Form SSA-1699 to facilitate direct payments of authorized fees and comply with IRS reporting requirements. Your information is used to ensure accurate payments and to maintain the integrity of Social Security programs. Although providing this information is voluntary, failure to do so will prevent you from serving as an appointed representative.

What is the Representative Identification (Rep ID) and how is it used?

The Representative Identification (Rep ID) is a unique 10-character identification number assigned to registered representatives by the SSA. It serves as a substitute for your Social Security Number when updating information on this form. This measure helps protect your privacy while allowing SSA to efficiently process your requests.

Common mistakes

Completing the SSA 1699 form can be daunting, and mistakes are common. One frequent error is not including all required sections. Every section has specific fields that need to be filled out; neglecting any of them can lead to delays. Make sure to double-check that everything applies to your situation.

Another common mistake is entering incorrect personal information. Errors in your name, Social Security number, or other identification fields can result in the form being returned. Always ensure that the information matches what is documented on your Social Security card. If you have had a name change, you need to have this rectified with the Social Security Administration before submitting the form.

Many individuals do not take the time to review the instructions thoroughly. Without a clear understanding of the requirements, it's easy to overlook important details. Carefully read through every instruction to avoid unnecessary complications and ensure accurate completion of the form.

Another mistake is failing to sign and date the form. Many assume that by filling out the information, they are finished. However, your signature indicates that the information provided is true and should be included before submission.

Some applicants incorrectly believe that the form is optional. If you wish to be compensated for your services as an appointed representative, filing the SSA 1699 is mandatory. Be diligent in understanding when this form is necessary to avoid negative impacts on your fee collection.

Inaccurate updates are also a notable mistake. If any of your personal or professional information changes after your initial registration, it is essential to submit an updated form. Neglecting to do so can create discrepancies and affect your standing with the Social Security Administration.

Failing to provide a valid payment method is another misstep. You must clearly indicate your preferred payment method on the form. If this information is missing or incorrect, it can delay payment or result in complications later on.

Some individuals think they can submit more than one SSA 1699 form at a time. This is false. The Social Security Administration requires that only one form is submitted at a time to avoid processing confusion. Make sure to wait for notice of your registration before submitting another form.

Moreover, many people forget to provide a secondary contact method, like an email. While this is optional, including it can ease communication and expedite the processing of your request. Providing multiple ways to reach you can only be beneficial.

Lastly, some representatives overlook the importance of following up. After submitting the SSA 1699 form, keep track of when you should expect your Representative Identification (Rep ID). If you do not receive it within the expected timeframe, don't hesitate to reach out for clarification. Being proactive can save you time and frustration.

Documents used along the form

The SSA 1699 form is critical for appointed representatives seeking direct payment of their fees from the Social Security Administration (SSA). Along with this form, certain other documents are often necessary to ensure compliance and facilitate the registration process. Below is a list of these commonly used forms and their descriptions.

- IRS Form 1099-MISC: This form reports payments made to individuals who receive $600 or more from the SSA in a tax year. It helps ensure proper tax reporting and compliance.

- SSA-827 Authorization to Disclose Information: This document grants the SSA permission to disclose information regarding the claimant’s records. It is essential for securing necessary information for representation.

- SSA-54 Representative Payee Report: This form is used by representative payees to report on their management of benefits they received on behalf of another individual. Transparency is important here.

- SSA-3368 Disability Report: This form gathers crucial information about a claimant’s disability claim. It aids representatives in understanding the basis of the claims they are supporting.

- Form SSA-16 Application for Disability Insurance Benefits: This is the initial application form for individuals seeking disability benefits from the SSA. Representatives often assist clients in completing this application.

- Form SSA-827-SUPP: This supplemental form is often required along with the SSA-827 to provide further clarification on the disclosure permissions granted.

- SSA-789 Application for Adult Disability Report: This document is specifically designed for adults seeking disability benefits. It collects information about their condition to assess eligibility.

Understanding these forms and their purposes will streamline the process of registering as an appointed representative and improve compliance with the requirements of the SSA. Promptly gathering and submitting these documents can mitigate potential delays in your registration and payment processes.

Similar forms

- IRS Form W-9: Similar to the SSA-1699 form, the W-9 collects identification information from individuals and businesses for tax purposes. Both require details like name, address, and taxpayer identification numbers to ensure proper documentation of payments and services.

- IRS Form 1099-MISC: This form is used to report payments made to others, much like the SSA-1699, which is linked to direct payments. If fees exceed $600, the information on the SSA-1699 is used to issue this tax form.

- Social Security Form SSA-24: This form is for applying for Social Security disability benefits. It, too, requires personal identification and information from the applicant, similar to how the SSA-1699 gathers representative data.

- Form SSA-827: This form authorizes the release of medical information for Social Security disability claims. Like the SSA-1699, it serves to facilitate a process involving Social Security, focusing on enabling access to essential information.

- Form SSA-3368: Used to apply for a disability benefit, this form collects comprehensive information from the claimant about their condition and work history, paralleling how the SSA-1699 collects data for representatives.

- Form SSA-11: This form is used to apply for Social Security benefits. It shares a similar purpose with the SSA-1699 in that both forms are foundational for initiating services within the Social Security system.

- Form SSA-1335: This is a request for reconsideration of a Social Security decision. Like the SSA-1699, it includes personal information to identify the individual and their case, ensuring proper handling by the Social Security Administration.

- Form SSA-16: This form is for applying for Social Security Disability Insurance. Similar to the SSA-1699, it requires detailed personal information to process claims and facilitate representation in the Social Security system.

Dos and Don'ts

- Do ensure all sections that apply to you are completed.

- Do double-check your name as it appears on your Social Security card.

- Do provide accurate information to avoid delays.

- Do fax only one Form SSA-1699 at a time to the Office of Central Operations.

- Don't submit the form if you are not in the business of providing services to Social Security claimants.

- Don't ignore updates in your personal or professional information; submit a new form if changes occur.

- Don't forget to include your Rep ID when updating information.

- Don't leave any required fields blank, as incomplete forms may be returned.

Misconceptions

1. Misconception: Only attorneys can use the SSA 1699 form.

While many people think that only lawyers can complete this form, that is not true. Individuals other than attorneys can also register as representatives if they meet the necessary requirements.

2. Misconception: The SSA 1699 form is only for new representatives.

This form is not just for new representatives. If you were registered before October 31, 2009, you need to update your information using this form if it has changed.

3. Misconception: Completing the SSA 1699 form guarantees payment.

Filing the SSA 1699 form does not automatically result in receiving payment. It is a step in the process. You must follow additional procedures to ensure payment for your services.

4. Misconception: If you're representing a family member, you have to complete the SSA 1699 form.

If you are not in the business of representing Social Security claimants and are only assisting relatives or friends, you do not need to fill out this form.

5. Misconception: The SSA does not check the information provided.

The Social Security Administration does review the information submitted. If your form is incomplete or inaccurate, it will be returned to you.

6. Misconception: You can fax multiple SSA 1699 forms at once.

It is important to note that you should only fax one form at a time. Sending multiple forms in one fax can lead to processing delays.

7. Misconception: You can wait indefinitely to update your information.

This is not the case. You are required to update your registration if your personal or professional information changes, such as disbarments or suspensions.

8. Misconception: The form is not time-sensitive.

While it may seem like a straightforward form, timely submission is crucial, especially if there are changes in your status as a representative.

Key takeaways

- Form Purpose: The SSA-1699 form is used to register for direct payment of fees as an appointed representative. Individuals must fill it out if they want to either register for this service for the first time or update previous information.

- Eligibility: Only individuals formally engaged in representing Social Security claimants should complete this form. Those helping friends or relatives do not need to register.

- Submission Process: Completed forms must be faxed to the Office of Central Operations. It is important to send only one SSA-1699 at a time to avoid confusion in processing.

- Identification Number: Upon successful registration, individuals will receive a Representative Identification (Rep ID). This ID replaces the need to use a Social Security Number when updating information.

- Timeliness: After registration, individuals should allow 2 to 3 weeks to receive their Rep ID. Delays may occur if the form is incomplete or contains errors.

- Updates Required: If any personal or professional details change—such as your address or legal standing—you need to complete a new form to maintain accurate records.

- Contact Information: For assistance or more information regarding the SSA-1699 form, individuals can call the Social Security Administration directly or visit a local office in their area.

Browse Other Templates

Florida Electronic Title - Accurate declarations bolster the credibility of each party's position.

Maryland Child Care Credential Form,Early Childhood Development Credential Application,Child Care Provider Credentialing Application,Maryland Early Childhood Credential Application,Application for Maryland Child Care Certification,Child Care Central - The essay can address important questions regarding their motivations in the child care field, encouraging a thoughtful examination of their practice.