Fill Out Your Ssa 3105 Form

The SSA 3105 form plays a crucial role for individuals who find themselves in a situation involving potential overpayments related to their Social Security benefits. This form provides a mechanism for beneficiaries to request a reassessment of an overpayment decision, allowing them to seek either a reconsideration of the overpayment or a waiver of repayment. It's important to note that this form must be submitted within specific time frames to preserve your rights. If you believe that an error has been made, or if repaying the overpayment would cause undue hardship, the SSA 3105 allows you to formally express your concerns. The information collected is essential as it helps the Social Security Administration in making informed decisions about your benefits. While providing this information is voluntary, keep in mind that incomplete submissions could hinder the accuracy of the decisions regarding your benefits. The form also includes instructions on how to submit your request, ensuring you have the guidance needed to navigate this process effectively. By understanding the importance of the SSA 3105, you can take proactive steps in managing your Social Security payments.

Ssa 3105 Example

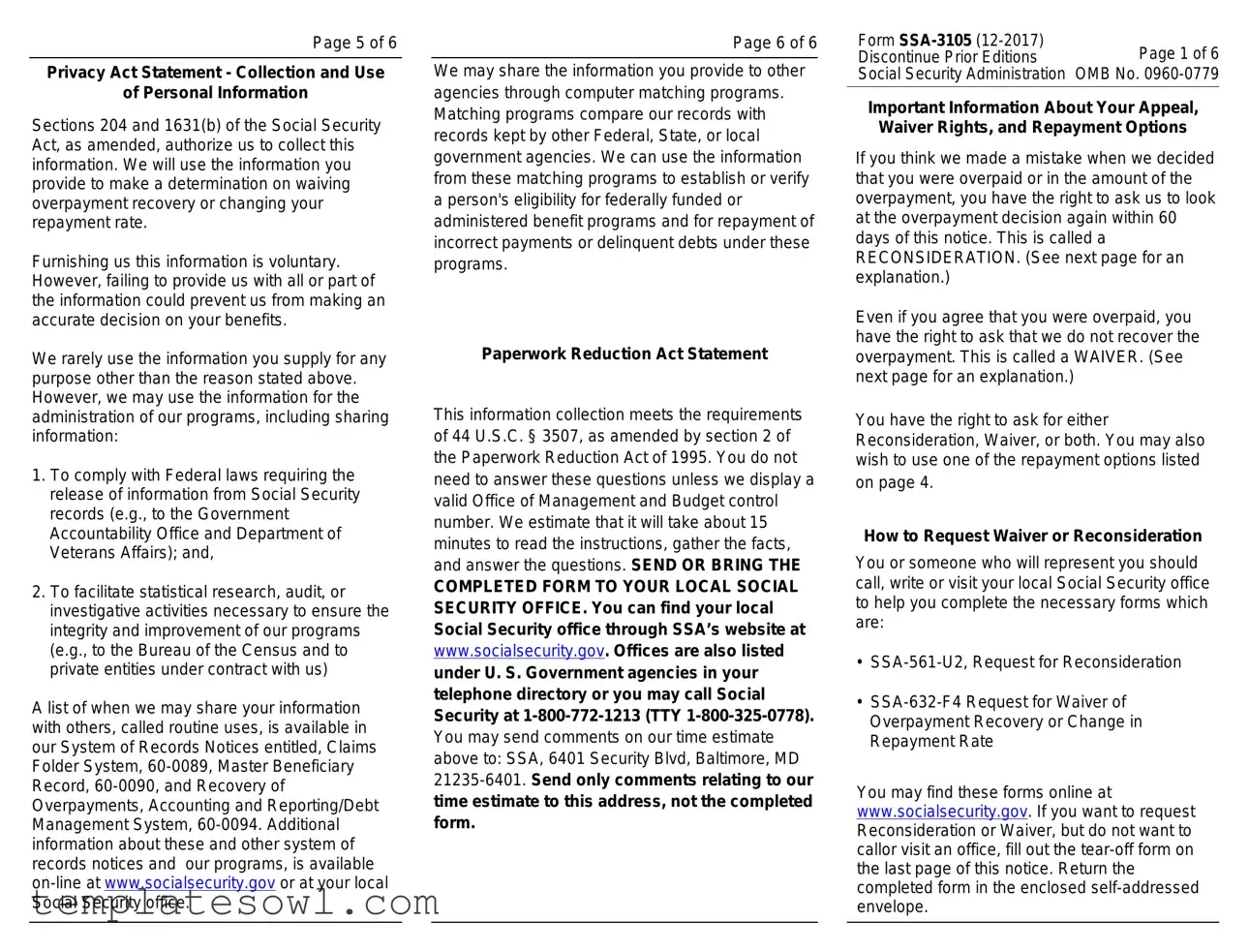

Page 5 of 6

Privacy Act Statement - Collection and Use

of Personal Information

Sections 204 and 1631(b) of the Social Security Act, as amended, authorize us to collect this information. We will use the information you provide to make a determination on waiving overpayment recovery or changing your repayment rate.

Furnishing us this information is voluntary. However, failing to provide us with all or part of the information could prevent us from making an accurate decision on your benefits.

We rarely use the information you supply for any purpose other than the reason stated above. However, we may use the information for the administration of our programs, including sharing information:

1.To comply with Federal laws requiring the release of information from Social Security records (e.g., to the Government Accountability Office and Department of Veterans Affairs); and,

2.To facilitate statistical research, audit, or investigative activities necessary to ensure the integrity and improvement of our programs (e.g., to the Bureau of the Census and to private entities under contract with us)

A list of when we may share your information with others, called routine uses, is available in our System of Records Notices entitled, Claims Folder System,

Page 6 of 6

We may share the information you provide to other agencies through computer matching programs. Matching programs compare our records with records kept by other Federal, State, or local government agencies. We can use the information from these matching programs to establish or verify a person's eligibility for federally funded or administered benefit programs and for repayment of incorrect payments or delinquent debts under these programs.

Paperwork Reduction Act Statement

This information collection meets the requirements of 44 U.S.C. § 3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget control number. We estimate that it will take about 15 minutes to read the instructions, gather the facts, and answer the questions. SEND OR BRING THE

COMPLETED FORM TO YOUR LOCAL SOCIAL SECURITY OFFICE. You can find your local Social Security office through SSA’s website at www.socialsecurity.gov. Offices are also listed under U. S. Government agencies in your telephone directory or you may call Social Security at

You may send comments on our time estimate above to: SSA, 6401 Security Blvd, Baltimore, MD

Form

Discontinue Prior EditionsPage 1 of 6 Social Security Administration OMB No.

Important Information About Your Appeal, Waiver Rights, and Repayment Options

If you think we made a mistake when we decided that you were overpaid or in the amount of the overpayment, you have the right to ask us to look at the overpayment decision again within 60 days of this notice. This is called a RECONSIDERATION. (See next page for an explanation.)

Even if you agree that you were overpaid, you have the right to ask that we do not recover the overpayment. This is called a WAIVER. (See next page for an explanation.)

You have the right to ask for either Reconsideration, Waiver, or both. You may also wish to use one of the repayment options listed on page 4.

How to Request Waiver or Reconsideration

You or someone who will represent you should call, write or visit your local Social Security office to help you complete the necessary forms which are:

•

•

You may find these forms online at www.socialsecurity.gov. If you want to request Reconsideration or Waiver, but do not want to callor visit an office, fill out the

Form |

Page 2 of 6 |

Reconsideration

If you request Reconsideration, the overpayment decision will be reviewed by a Social Security employee who did not participate in the original overpayment decision.

If you request Reconsideration within 30 days from the date of this notice, we will not start to withhold any part of your benefits. However, after 30 days we will start to withhold part or all of your benefits.

If you request Reconsideration within 60 days from the date of this notice, we will suspend any withholding while the overpayment decision is being reviewed. Also, if we asked you to refund the overpayment, you will not have to make any refund while the overpayment decision is being reviewed.

If you do not appeal within the 60 day time limit, you may lose your right to this appeal. If you have a good reason (such as hospitalization) for not appealing within the time limits, we may give you more time. A request for more time must be made to us in writing, stating the reason for the delay.

Waiver

If you request Waiver of recovery of the overpayment and your request is approved, you will not have to repay the overpayment.

We will approve your waiver request if:

1.The overpayment was not your fault and repaying it would mean you could not pay your necessary living expenses, OR

2.The overpayment was not your fault and repaying it would be unfair to you.

Page 3 of 6

There is no time limit on your right to request waiver.

If you request Waiver within 30 days from the date of this notice, we will not start withholding any part of your benefits.

If you request Waiver after 30 days, we will suspend any withholding while we consider your Waiver request. If we asked you to refund the overpayment, you will not have to make any refund while your waiver request is being considered.

If we cannot approve your Waiver request, we will contact you to schedule a Personal Conference. At that conference, you or your representative may explain why you should not have to repay the overpayment.

Also, you or your representative may present witnesses on your behalf and, if you wish, question any witnesses that we used in making the determination being reviewed.

We will notify you in writing of the result of your Waiver request, and whether you must repay the overpayment. That notice will explain your right to appeal. If you do not want a Personal Conference, you still have the right to appeal. We will notify you of other appeal rights.

BE SURE TO CALL THE SOCIAL SECURITY ADMINISTRATION AT

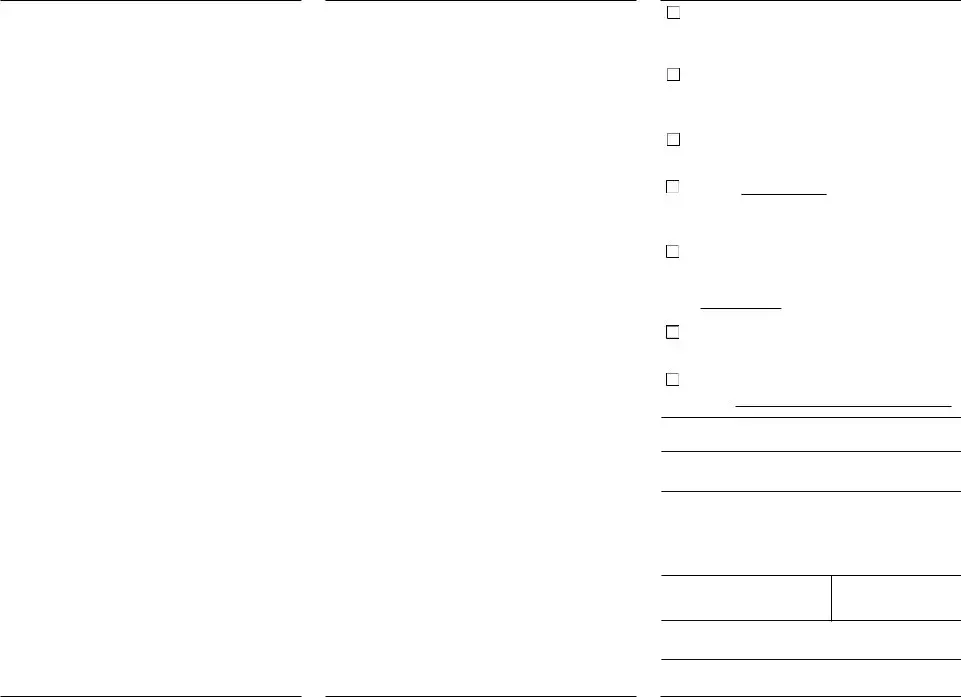

If you wish to mail your request for a Reconsideration of the overpayment, Waiver of recovery of the overpayment, or both; or if you wish to use one of the repayment options listed in the next column, please check the appropriate block, fill out the identifying information and return it in the enclosed

Page 4 of 6

I am requesting a Reconsideration (I disagree with the amount of the overpayment or the fact that I was overpaid).

I am requesting a Waiver (the overpayment was not my fault and I cannot afford to repay).

I am requesting both Reconsideration and Waiver.

I want $withheld from my monthly Social Security check to repay the overpayment.

I am no longer receiving benefits and want to repay the overpayment in monthly installments. Enclosed is my first refund of

$.

I am requesting an explanation of the overpayment.

Other (Please explain on a separate sheet of paper).

YOUR SOCIAL SECURITY CLAIM NUMBER

YOUR NAME (PRINT)

YOUR ADDRESS (PRINT)

CITY AND STATE |

ZIP CODE |

YOUR DAYTIME TELEPHONE NO. (include area code)

DATE

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The SSA-3105 form is used to request reconsideration or waiver of overpayment recovery from the Social Security Administration (SSA). |

| Governing Law | This form is governed by Sections 204 and 1631(b) of the Social Security Act, as amended. |

| Voluntary Submission | Providing information on the SSA-3105 form is voluntary; however, not submitting required information may affect benefit determination. |

| Information Sharing | The SSA may share provided information with other federal, state, or local agencies for program administration and compliance purposes. |

| Paperwork Reduction Act Compliance | This form complies with 44 U.S.C. § 3507, and a valid Office of Management and Budget control number must be displayed. |

| Time Estimate | The estimated time to complete the SSA-3105 form is approximately 15 minutes. |

| Request Procedures | A request for reconsideration or waiver can be initiated by calling, writing, or visiting a local Social Security office. |

| Waiver Eligibility | The SSA may approve a waiver if the overpayment was not the individual's fault and repayment would create undue hardship. |

Guidelines on Utilizing Ssa 3105

After filling out the SSA-3105 form, you will need to send or bring it to your local Social Security office. Completing the form accurately is essential for processing your request effectively. Follow these steps to fill out the form correctly.

- Start by locating the form SSA-3105. Ensure it's the most recent version.

- Enter your Social Security claim number in the designated space.

- Provide your full name. Print it clearly to avoid confusion.

- Fill in your address. Include the city, state, and ZIP code.

- Input your daytime phone number, including the area code, so they can contact you if needed.

- Indicate the current date in the format requested on the form.

- Review the section on important information about your appeal and repayment options. Make sure you understand your rights regarding reconsideration or waiver requests.

- Check the boxes for your request—whether it's for reconsideration, waiver, or both. Be specific about what you are requesting.

- If applicable, indicate how you would like to repay any overpayment, including amounts and payment plans.

- Provide an explanation for any additional requests in the available space or on a separate sheet, if necessary.

- Double-check all the information you’ve provided to ensure accuracy.

Once you have completed the form, take it to your local Social Security office or send it using the self-addressed envelope if provided. It is critical to act promptly to protect your rights and resolve your account status.

What You Should Know About This Form

What is the SSA 3105 form used for?

The SSA 3105 form is primarily used to request a waiver of an overpayment recovery or to change the repayment rate of overpaid Social Security benefits. If you believe an overpayment was made in error or if you’re facing financial hardship, you can file this form to seek relief from repayment obligations.

Who should complete the SSA 3105 form?

The form should be completed by individuals who have been notified of an overpayment of Social Security benefits. Whether you disagree with the amount of overpayment or feel you cannot repay due to financial circumstances, filing this form may help you address these concerns.

How do you submit the SSA 3105 form?

You can submit the completed SSA 3105 form by sending it to your local Social Security office. It is also possible to bring the form in person. You can locate your local office through the Social Security Administration’s website or by calling their customer service for assistance.

What happens after you submit the SSA 3105 form?

After you submit the SSA 3105 form, your request will be reviewed by a Social Security employee who was not involved in the original overpayment decision. You will receive notification regarding the outcome of your request, which will either grant relief from repayment or provide further instructions on how to proceed.

Are there time limits for submitting the SSA 3105 form?

Yes, there are specific time limits depending on your situation. If you wish to request reconsideration, you must do so within 60 days of the overpayment notice. For waivers, there is no time limit; however, submitting your request within 30 days of the notice will prevent any withholding of your benefits while your request is being processed.

Can you appeal if your waiver request is denied?

If your waiver request is denied, you have the right to appeal the decision. You will be notified about the next steps, including the option for a Personal Conference or other appeal rights. It’s important to follow the instructions given in the notice you receive.

What assistance is available if you have questions about the SSA 3105 form?

If you have questions or need assistance with the SSA 3105 form, you can call the Social Security Administration at 1-800-772-1213 (TTY 1-800-325-0778). They can provide guidance on how to properly complete the form and address any concerns you may have regarding your overpayment situation.

Common mistakes

Filling out the SSA 3105 form can be a straightforward process, but many individuals make mistakes that can lead to delays or complications. One common error is neglecting to provide all required personal information. The form asks for specific details such as your Social Security claim number, address, and contact number. Omitting any of this vital information can result in a processing delay. Ensure that every field is completed accurately.

Another frequent mistake is failing to sign the form. Many people assume that simply filling out the form is enough, but without a signature, the application may not be considered valid. It is crucial to sign and date the form to confirm that you affirmatively request reconsideration or waiver of the overpayment. This step is often overlooked and can lead to frustration.

Many individuals also misinterpret the requirements for requesting a waiver. A waiver can be complex. You need to demonstrate that the overpayment was not your fault and that repaying it would cause you hardship. Failing to provide adequate supporting documentation can undermine your request. Be prepared to submit evidence to support your claim to avoid rejection.

Lastly, submitting the form to the wrong address can cause significant delays in processing. Make sure to send or deliver your completed SSA 3105 form to your local Social Security office. A simple mistake in the mailing address or not following the provided instructions can create unnecessary complications. Take time to verify that you are sending your paperwork to the correct location.

Documents used along the form

The SSA-3105 form is an essential document when dealing with overpayment issues related to Social Security benefits. Several other forms are frequently used in conjunction with the SSA-3105 to address various aspects of overpayment reconsideration, waivers, or repayment options. Below is a list of these forms and a brief description of each.

- SSA-561-U2, Request for Reconsideration: This form is used to formally request a review of the Social Security Administration's decision regarding an overpayment. It allows individuals to present their case to a different official who was not involved in the original determination.

- SSA-632-F4, Request for Waiver of Overpayment Recovery: This form is submitted to request a waiver, allowing individuals to avoid repaying an overpayment if certain conditions are met, such as additional financial burden or error not caused by the individual.

- Form SSA-827, Authorization to Disclose Information to the Social Security Administration: This form authorizes the SSA to obtain information from third parties. It’s often used when additional documentation is needed to support a waiver or reconsideration request.

- Form SSA-545, Report of Continued Disability: This document may be required if an individual is claiming that their financial situation has not improved since the last overpayment review. It provides updated information on their condition.

- Form SSA-3441, Adult Disability Report: This form could be necessary for individuals seeking to provide current information about their financial state and needs, particularly if requesting a waiver based on financial hardship.

- Form SSA-11, Application for a Social Security Card: While not directly related to overpayment, having an updated Social Security card may be necessary if personal information changes during the waiver or reconsideration process.

These forms support individuals in navigating the complexities of Social Security overpayments. Proper completion and submission of these documents are crucial for a successful appeal or waiver request. Seeking assistance from knowledgeable representatives can also be beneficial for understanding specific requirements and processes.

Similar forms

- SSA-561-U2, Request for Reconsideration: This form allows individuals to ask for a review of an overpayment decision. Similar to SSA-3105, it is used when a person believes an error was made regarding their benefit amount.

- SSA-632-F4, Request for Waiver of Overpayment Recovery: Just like the SSA-3105, this form enables individuals to request that the Social Security Administration not recover an overpayment, especially when the overpayment was not their fault.

- SSA-10203, Application for Adult Disability Insurance Benefits: Similar in function, this form collects income and personal information to determine eligibility for benefits and decisions regarding overpayments.

- SSA-827, Authorization to Disclose Information to the Social Security Administration: This document shares relevant information with SSA, much like the SSA-3105 which includes personal details needed for processing overpayment issues.

- SSA-2458, Request for Information: This is another form used to request information from SSA. It is closely related to the SSA-3105 in that both involve requests for transparency regarding benefit decisions.

- SSA-341, Request for Reinstatement: This form allows individuals to request reinstatement of benefits that may have been stopped. It parallels SSA-3105 in terms of initiating a review of benefit status.

- Form 1040, U.S. Individual Income Tax Return: While primarily a tax document, it captures personal financial information that may also be relevant in contexts involving SSA payments and overpayments.

- SSA-1199A, Direct Deposit Sign-Up Form: This form allows beneficiaries to manage how benefits are received, connecting closely with SSA-3105 through its emphasis on financial arrangements regarding payments.

Dos and Don'ts

When filling out the SSA-3105 form, consider the following guidelines to ensure the process goes smoothly:

- Do provide complete information. Make sure every section is filled out accurately to avoid delays.

- Do double-check your personal information. Ensure your name, address, and Social Security number are correct.

- Do submit the form in a timely manner. Early submission can prevent unnecessary withholding of benefits.

- Do keep a copy of the completed form. This will help you track your submission and any communications.

- Don't leave any sections blank. If a question does not apply, indicate that instead of skipping it.

- Don't use whiteout or erasers. If you make a mistake, cross it out neatly and write your correction beside it.

- Don't forget to sign the document. An unsigned form will not be processed.

- Don't send the form without verifying the mailing address. Make sure it goes to your local Social Security office.

Misconceptions

When it comes to the SSA 3105 form, several misconceptions can lead to confusion about its purpose and the process involved. Here is a helpful breakdown of some of the most common misunderstandings:

- 1. The SSA 3105 form is mandatory. Many believe they must complete this form to receive Social Security benefits. However, providing information on this form is voluntary.

- 2. Submitting the form means you automatically waive your overpayment. It’s a common misconception that filling out the SSA 3105 guarantees a waiver of the overpayment. In reality, a review process determines if a waiver is granted.

- 3. There is a strict deadline for submitting the form. While it’s important to act quickly, particularly for the Reconsideration, there is actually no time limit for requesting a Waiver, which can cause some misunderstandings about deadlines.

- 4. You can only request a Waiver or Reconsideration, not both. Some individuals think they must choose between requesting a Waiver or a Reconsideration. In truth, you can request both at the same time.

- 5. Only mistakes made by Social Security can lead to a Waiver. People often believe that only errors on the part of Social Security can justify a Waiver request. However, if repaying the overpayment would result in financial hardship, a Waiver may still be granted.

- 6. The SSA 3105 form is used solely for overpayment issues. While the form is linked to addressing overpayment concerns, it also serves to adjust repayment rates, creating further misunderstanding about its full purpose.

- 7. You can ignore the form if you disagree with the overpayment amount. Some individuals mistakenly think they can simply decline to respond if they disagree with the overpayment. In reality, taking action is crucial to preserve appeal rights.

- 8. Sharing of personal information is prohibited. Many believe that the SSA will not share their information at all. However, the SSA may share information for purposes like compliance with federal laws and necessary audits under strict conditions.

Understanding these misconceptions can help in successfully navigating the measures related to the SSA 3105 form. Taking the time to learn about the process will empower you in handling overpayment situations effectively.

Key takeaways

Filling out and using the SSA-3105 form can feel daunting, but with some key points in mind, the process can be much smoother. Here are some important takeaways to guide you:

- Purpose of the Form: The SSA-3105 is used to request a waiver of overpayment recovery or a change in repayment rate concerning Social Security benefits.

- Voluntary Provision of Information: While you are encouraged to provide all requested information, it is ultimately voluntary. Not providing complete information could lead to an inaccurate decision.

- Time Limits are Crucial: If you believe there's been an overpayment, you have 60 days to request a reconsideration. Missing this deadline could forfeit your right to appeal.

- Notification of Results: After your request is reviewed, you will receive written notification regarding the decision and your rights to further appeal.

- Personal Conference Option: If your waiver request is denied, you may have the opportunity to explain your case in a Personal Conference. Be prepared to present any evidence or witnesses that support your situation.

- Paperwork Reduction Act Compliance: The SSA-3105 form complies with the Paperwork Reduction Act. Completing it is estimated to take about 15 minutes.

- Mailing Options: You can send your completed form to your local Social Security office. To find the nearest office, visit the Social Security Administration's website.

- Stay Informed: For any issues or questions, you can contact the Social Security Administration directly at their toll-free number: 1-800-772-1213 (TTY 1-800-325-0778).

By keeping these key takeaways in mind, you will be better equipped to navigate the SSA-3105 form successfully.

Browse Other Templates

Mastercom - Indicate how long your business has operated for assessment purposes.

Domestic Violence Hotline - If you are unsure about any section, seek help or clarification before filing.