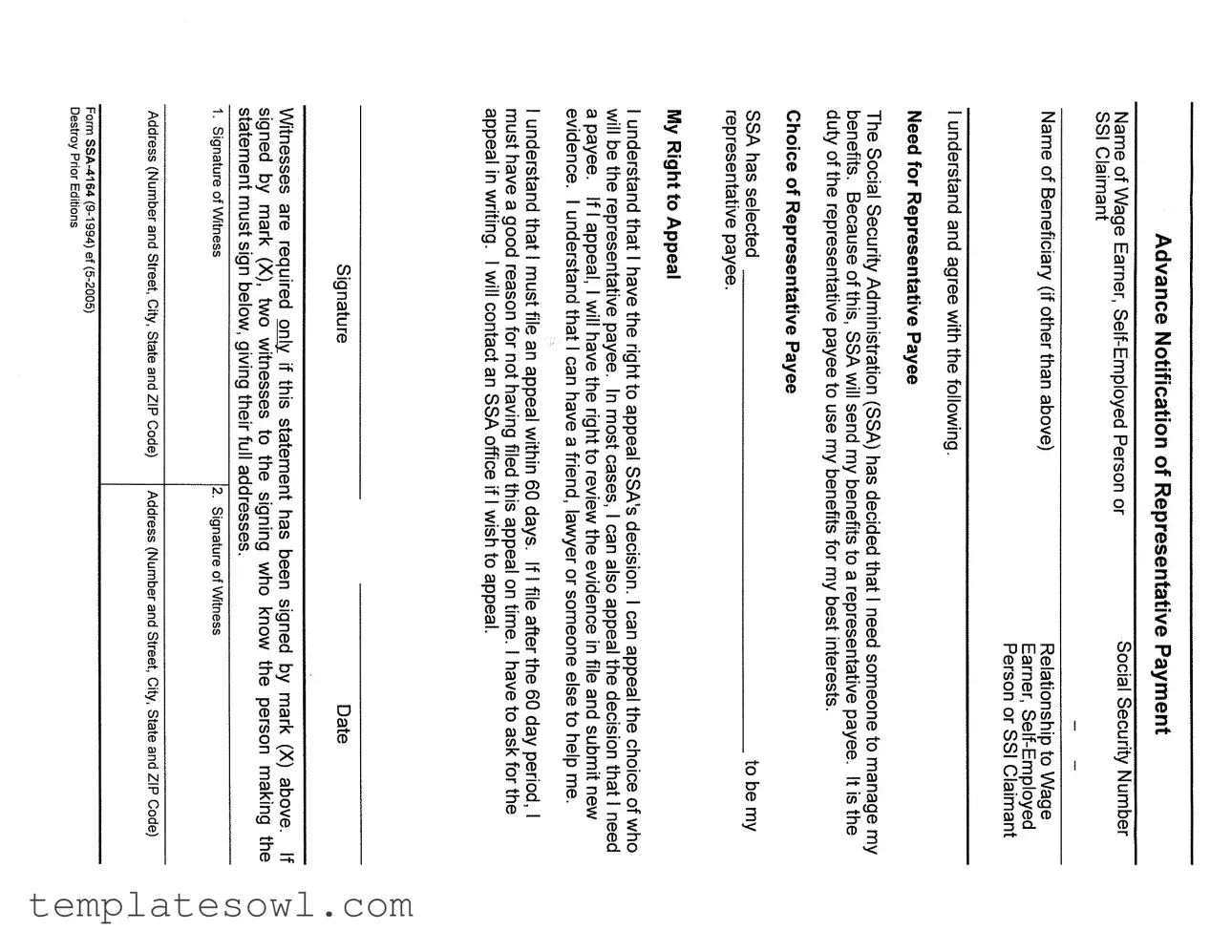

Fill Out Your Ssa 4164 Form

The SSA 4164 form serves a crucial role in the Social Security Administration's (SSA) process of managing benefit payments for individuals requiring assistance. This form, officially titled "Advance Notification of Representative Payment," is specifically designed to communicate the decision made by the SSA regarding the appointment of a representative payee. A payee is appointed when the SSA determines that a beneficiary, such as a Supplemental Security Income (SSI) claimant, needs someone to manage their benefits on their behalf. The form collects essential information, including the names of the wage earner or self-employed person, the SSI claimant, and the chosen representative payee. Importantly, the SSA acknowledges the claimant's right to appeal both the necessity of a payee and the selection of the payee. Beneficiaries must act within 60 days of the SSA's notification to file an appeal, which can involve submitting new evidence or having assistance from a trusted friend or attorney. Furthermore, if the individual signing the form does so by mark (X), the requirement for two witnesses ensures that the signature is verified. With these elements in mind, the SSA 4164 form is integral for protecting the interests of beneficiaries who may not be able to manage their benefits themselves.

Ssa 4164 Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Name of Form | The form is officially known as SSA-4164, titled "Advance Notification of Representative Payment." |

| Purpose | This form serves to notify individuals when the Social Security Administration (SSA) has deemed that they require a representative payee to manage their benefits. |

| Right to Appeal | Individuals have the right to appeal SSA's decision regarding the need for a representative payee or the selection of the payee. This appeal must be filed in writing within 60 days. |

| Witness Requirement | If the form is signed by mark (X), it requires two witnesses who must also provide their full addresses when signing the form. |

| Governing Law | This form is governed by federal law as established by the Social Security Administration, specifically under Title II of the Social Security Act. |

Guidelines on Utilizing Ssa 4164

Once you have determined that you need to fill out the SSA 4164 form, you can begin the process. Completing this form is necessary for notifying the Social Security Administration about the choice of a representative payee for managing your benefits. The following steps will guide you through filling out the form successfully.

- Obtain the Form: Make sure you have the SSA 4164 form. You can download it from the Social Security Administration's website or request a hard copy from your local SSA office.

- Begin with Basic Information: In the first section, fill in the name of the wage earner, self-employed person, or the SSI claimant's Social Security Number.

- Beneficiary Information: If applicable, provide the name of the beneficiary, especially if it differs from the above mentioned. Indicate your relationship to the wage earner or SSI claimant.

- Understand the Need for a Representative Payee: Read the section explaining the necessity of having a representative payee manage your benefits and make sure you agree with it.

- Choice of Representative Payee: Confirm that the SSA has selected a representative payee. Review that this choice aligns with your needs.

- Review Your Rights: Take time to read about your right to appeal. Understand the process of appealing the SSA's decision about needing a payee or the chosen payee.

- Prepare for Signature: If you are signing the form with a mark (X), ensure that two witnesses are present, as their signatures are also required below your mark.

- Sign and Date: Sign and date the form in the designated areas. Make sure all information is complete and accurate before submission.

- Witness Signatures: If you used a mark (X), the two witnesses must sign and provide their full addresses.

After completing the form, ensure that all sections are filled out and legible. Double-check for any errors to avoid any delays in processing. The completed form should be submitted to the appropriate SSA office as soon as possible to maintain compliance with required deadlines.

What You Should Know About This Form

What is the purpose of the SSA 4164 form?

The SSA 4164 form, also known as the Advance Notification of Representative Payment, is used by the Social Security Administration (SSA) to inform individuals that they require a representative payee to manage their benefits. This form ensures that the benefits are used in the best interests of the individual, whether they are a wage earner, self-employed person, or an SSI claimant.

Who can be my representative payee?

The SSA selects a representative payee based on various factors, including the individual's needs and circumstances. This person can be a family member, friend, or another trusted individual. It's important that the representative payee is someone who understands the responsibilities involved in managing the benefits and can act in the best interest of the beneficiary.

Can I appeal the decision of needing a representative payee?

Yes, you can appeal the SSA's decision regarding the need for a representative payee. If you disagree with the SSA's choice or decision, you have the right to file an appeal within 60 days of receiving the decision. You can also review the evidence against you and submit new evidence during the appeal process. It is possible to request help from a friend or lawyer if needed.

What happens if I miss the 60-day deadline to appeal?

If you miss the 60-day deadline to file your appeal, you can still submit it, but you must provide a good reason for the delay. The SSA will review your reason for filing late, and it may or may not accept your appeal depending on the circumstances.

Do I need witnesses if I sign the form by mark (X)?

Yes, if you sign the form by mark (X), you need to have two witnesses sign the form as well. These witnesses must know you personally and provide their signatures along with their full addresses. This is to ensure the validity of the signature and the consent provided in the form.

Common mistakes

Filling out the SSA 4164 form can be a straightforward process if the necessary steps are followed. However, there are common mistakes that people often make. Understanding these pitfalls can help ensure that your application is completed correctly and efficiently.

One of the most frequent errors is failing to provide accurate information about the wage earner or SSI claimant. It's essential to verify that the name and Social Security Number match the records held by the Social Security Administration (SSA). Incorrect details can lead to delays or even denials of benefits.

Another common mistake involves misunderstanding the role of the representative payee. Many individuals assume that the SSA will automatically select someone they trust, but this is not always the case. It's crucial to be clear about your wishes regarding who should manage your benefits. Providing the relevant information about your chosen representative payee can prevent confusion later.

Many applicants neglect to consider their right to appeal. If you disagree with SSA's decision, the form allows you to appeal the choice of representative payee or even the decision that necessitated a payee in the first place. Failing to acknowledge this right can limit your options significantly.

Missing deadlines is another serious oversight. The appeal process requires you to submit your request within 60 days. If you miss this window, it is vital to have a good reason, substantiated with evidence. Keeping track of timelines can help avoid complications.

Individuals often forget to sign and date the form. This signature confirms that you understand the contents and agree with the information provided. If the form is signed by mark (X), two witnesses are required. Overlooking this detail can render the form invalid.

Providing incomplete witness information can be problematic as well. If you have signed by mark (X), both witnesses must include their full addresses. Ensuring that this information is complete can simplify authentication processes.

Some applicants overlook the requirement to include all relevant details about their representative payee. This includes the relationship to the wage earner or SSI claimant. Miscommunication about the connection can raise questions about the appropriateness of the representative.

Lastly, applicants often do not seek assistance. It’s perfectly acceptable to ask a friend, lawyer, or another advocate for help in filling out the form. Engaging others can provide clarity and reduce potential errors.

By being aware of these common mistakes, individuals can approach the SSA 4164 form with greater confidence. Careful preparation and attention to detail can contribute significantly to a smoother application process.

Documents used along the form

The SSA-4164 form, also known as the Advance Notification of Representative Payment, is critical for individuals designated to receive Social Security benefits through a representative payee. Alongside this form, several other documents may be needed to ensure everything is processed smoothly. Below are five important forms and documents often used in conjunction with the SSA-4164:

- SSA-11: This form is an application for a person to become a representative payee. It collects essential information about the beneficiary and the payee's eligibility to manage benefits responsibly.

- SSA- 827: This is the Authorization for the Social Security Administration to collect information from third parties. It allows SSA to gather necessary documents to evaluate the claim involving the applicant’s benefits.

- Form SSA-833: This form is used to determine if an individual is entitled to disability benefits. The assessment provided can influence the necessity for appointing a representative payee.

- SSA-454: This form is a report of continuing disability, which needs to be filed periodically by individuals receiving disability benefits. The status reported might affect the ongoing need for a payee.

- Form SSA-21: This is the "Supplemental Security Income (SSI) Claim." It provides critical financial information and personal circumstances necessary for determining benefit eligibility.

Having a clear understanding of these related documents can make the process more manageable. Each form plays a unique role in ensuring that Social Security benefits are handled appropriately and in the best interest of the beneficiary. Be sure to consult with the appropriate authorities or resources if any clarifications are needed.

Similar forms

The SSA 4164 form, which is used for notifying about representative payments, shares similarities with several other documents that address similar needs or processes in managing benefits or rights. Below is a list of five such documents, each including a brief explanation of their similarities:

- SSA-827: Authorization to Disclose Information to the Social Security Administration - This form allows individuals to authorize the release of their personal information to the SSA. Like the SSA 4164, it focuses on ensuring that the SSA has the necessary information to make decisions that affect an individual's benefits.

- SSA-3926: Request for the Appointment of a Representative Payee - This document is used to request the appointment of a representative payee. Similar to the SSA 4164, it deals with the management of benefits and the need for someone to handle those benefits on behalf of the claimant.

- Form SSA-11: Application for Widow's or Widower's Benefits - This form is used to apply for specific benefits. While it serves a different purpose, it operates within the same framework of requesting assistance from the SSA, and can also lead to situations where a representative payee may be needed.

- Form SSA-561: Request for Reconsideration - When an individual disagrees with an SSA decision, they can use this form to request a fresh review. Both this and the SSA 4164 allow individuals to express their rights regarding benefit management and decision-making.

- Form SSA-787: Third Party Authorization - This form allows benefit claimants to designate a third party to receive information. Similar to the SSA 4164, it involves the management of a beneficiary's rights and choices related to their benefits.

Dos and Don'ts

When filling out the SSA 4164 form, there are important actions to consider that can help ensure your application is processed smoothly. Below are some recommended practices, as well as pitfalls to avoid.

- Do accurately provide all requested information. Ensure that you include the full name of the wage earner or SSI claimant and their Social Security number, if applicable.

- Do read the instructions carefully. Understanding each section of the form can minimize errors and omissions.

- Do keep copies of all documents submitted. Having a personal record can be helpful for future reference.

- Do seek assistance if needed. Having a friend, lawyer, or advocate can provide clarity and support during the process.

- Do appeal in writing if you disagree with the decision. Remember to submit your appeal within 60 days.

- Don't leave any fields blank without reason. Unanswered questions may delay processing.

- Don't submit the form without reviewing it. Errors or unclear information can lead to complications.

- Don't miss the appeal deadline. If you wait too long, your request for review may be denied.

- Don't forget to sign the form. Missing signatures can result in processing delays.

- Don't assume the SSA will contact you for missing information. It's better to ensure everything is complete when submitted.

Misconceptions

- Misconception 1: The SSA 4164 form is only for elderly beneficiaries.

- Misconception 2: Once a representative payee is assigned, they cannot be changed.

- Misconception 3: Filing an appeal on the SSA 4164 form is a complicated process.

- Misconception 4: The representative payee must be a family member.

- Misconception 5: The representative payee can use benefits for their own expenses.

- Misconception 6: You cannot receive your benefits if you have an assigned payee.

- Misconception 7: Witnesses are always required when signing the form.

This form can be used by any individual who receives Social Security benefits, including younger individuals and those with disabilities, not just the elderly.

In fact, beneficiaries have the right to appeal the choice of their representative payee. If you are not satisfied, you can request a different payee.

Appealing is a straightforward process. You only need to submit a written request within 60 days, and you can include evidence or seek help from others.

A representative payee can be anyone deemed suitable by the Social Security Administration, including friends and professional organizations.

The representative payee has a fiduciary duty to use the beneficiaries’ funds solely in their best interest. Misuse of funds can lead to serious legal consequences.

Beneficiaries still receive their full benefits, but they are managed by the payee. The benefits remain available for the beneficiary’s needs.

Witnesses are only needed if the beneficiary signs by marking an "X." If the person can sign their name, no witnesses are necessary.

Key takeaways

When filling out and using the SSA 4164 form, consider the following key takeaways:

- Purpose: The SSA 4164 form is used for notifying the Social Security Administration (SSA) about the need for a representative payee.

- Identification: Clearly provide the names of the wage earner, self-employed person, or SSI claimant, along with their Social Security Number.

- Relationship: State the relationship of the beneficiary to the wage earner or SSI claimant. This information helps in understanding the context of the payment.

- Understanding Responsibilities: A representative payee is responsible for managing benefits and ensuring they are used in the best interest of the individual.

- Right to Appeal: You have the right to appeal SSA's decision regarding the need for a representative payee or the choice of payee.

- Time Limit: Appeals must be filed within 60 days. If filed late, a valid reason must be provided.

- Assistance: You can seek help from a friend, attorney, or advocate when making an appeal.

- Signatures: If the form is signed by mark (X), two witnesses must also sign and provide their addresses.

These points can guide individuals in understanding and correctly filling out the SSA 4164 form, ensuring that their interests are well represented.

Browse Other Templates

Contigent Beneficiary - Employees must sign and date the form to validate their information.

Bank of America Transfer - When dealing with Brokerage IRAs, be aware that assets need to be liquidated before submitting this form.