Fill Out Your Ssa 45 Form

The SSA 45 form, officially known as the Statement Concerning Your Employment in a Job Not Covered by Social Security, serves an essential role for employees who may find their work earnings not protected under the Social Security system. This situation often arises in certain state or local government jobs. The form highlights critical information regarding how receiving a pension from such employment can impact future Social Security benefits, specifically under two provisions: the Windfall Elimination Provision and the Government Pension Offset Provision. For instance, if individuals are entitled to both a pension from a job where they did not pay Social Security taxes and a Social Security benefit based on their personal earnings or those of a spouse, it is important to understand how that pension may reduce their Social Security benefits. The Windfall Elimination Provision utilizes a modified formula to calculate benefits, potentially leading to lower monthly payouts, while the Government Pension Offset Provision could reduce spousal or survivor benefits by a significant portion of the pension amount. Employers are obligated to provide this form to employees hired since January 1, 2005, ensuring that they are informed before starting their roles. With such implications for financial planning, understanding the SSA 45 form and its provisions is vital for employees, ensuring they can navigate their retirement planning with clarity.

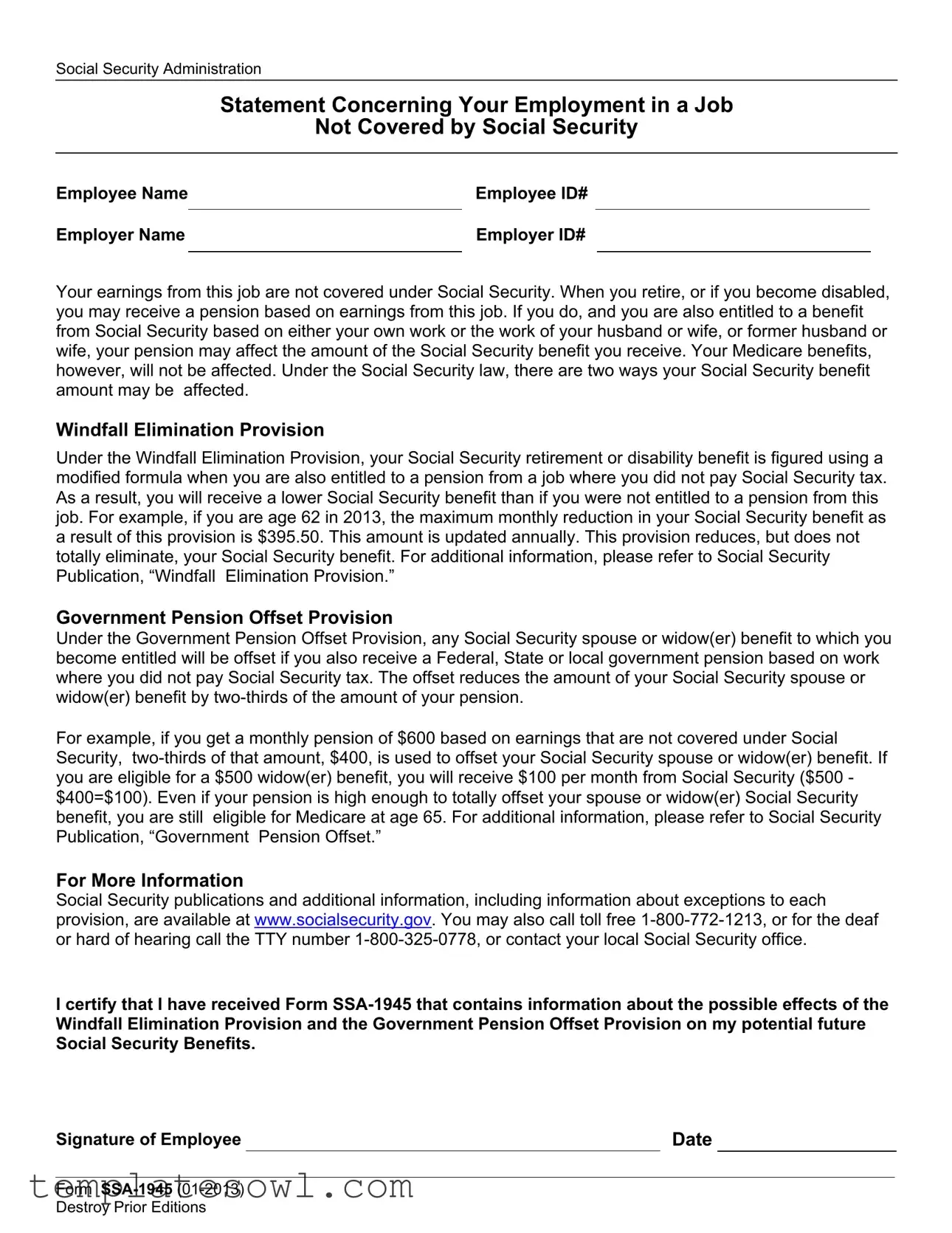

Ssa 45 Example

Social Security Administration

Statement Concerning Your Employment in a Job

Not Covered by Social Security

Employee Name |

Employee ID# |

|

|

|

|

Employer Name |

Employer ID# |

|

|

|

|

Your earnings from this job are not covered under Social Security. When you retire, or if you become disabled, you may receive a pension based on earnings from this job. If you do, and you are also entitled to a benefit from Social Security based on either your own work or the work of your husband or wife, or former husband or wife, your pension may affect the amount of the Social Security benefit you receive. Your Medicare benefits, however, will not be affected. Under the Social Security law, there are two ways your Social Security benefit amount may be affected.

Windfall Elimination Provision

Under the Windfall Elimination Provision, your Social Security retirement or disability benefit is figured using a modified formula when you are also entitled to a pension from a job where you did not pay Social Security tax. As a result, you will receive a lower Social Security benefit than if you were not entitled to a pension from this job. For example, if you are age 62 in 2013, the maximum monthly reduction in your Social Security benefit as a result of this provision is $395.50. This amount is updated annually. This provision reduces, but does not totally eliminate, your Social Security benefit. For additional information, please refer to Social Security Publication, “Windfall Elimination Provision.”

Government Pension Offset Provision

Under the Government Pension Offset Provision, any Social Security spouse or widow(er) benefit to which you become entitled will be offset if you also receive a Federal, State or local government pension based on work where you did not pay Social Security tax. The offset reduces the amount of your Social Security spouse or widow(er) benefit by

For example, if you get a monthly pension of $600 based on earnings that are not covered under Social Security,

For More Information

Social Security publications and additional information, including information about exceptions to each provision, are available at www.socialsecurity.gov. You may also call toll free

I certify that I have received Form

Signature of Employee |

|

Date |

Form

Information about Social Security Form

Employment in a Job Not Covered by Social Security

New legislation [Section 419(c) of Public Law

Form

Employers must:

•Give the statement to the employee prior to the start of employment;

•Get the employee’s signature on the form; and

•Submit a copy of the signed form to the pension paying agency.

Social Security will not be setting any additional guidelines for the use of this form.

Copies of the

Form

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of SSA-45 | The SSA-45 form provides a statement to employees concerning their employment in jobs that are not covered by Social Security, detailing how a pension from that job may impact future Social Security benefits. |

| Applicable Provisions | This form explains the Windfall Elimination Provision and the Government Pension Offset Provision, which can affect the calculation of Social Security benefits for individuals also receiving a pension from a job not covered by Social Security. |

| Employer Requirements | Employers must provide this statement to employees hired on or after January 1, 2005, prior to the start of their employment, obtain their signatures, and submit a copy to the pension paying agency. |

| Availability | The SSA-45 form is accessible online through the Social Security Administration's website. Employers can also request paper copies in packages of 25 by providing specific contact information. |

Guidelines on Utilizing Ssa 45

Upon receiving the SSA-45 form, it's important to complete it accurately. The information provided will help clarify any potential impacts on future Social Security benefits resulting from employment not covered by Social Security. Follow the steps below to fill out the form properly.

- Obtain a copy of the SSA-45 form from the Social Security Administration website or your local office.

- Locate the section labeled "Employee Name" and enter your full name as it appears on your legal documents.

- In the "Employee ID#" section, provide your ID number if applicable, or leave blank if you do not have one.

- Find the "Employer Name" field and write the name of the company or organization that employs you.

- In the "Employer ID#" section, input the identification number assigned to your employer, if you have it.

- Review the information for accuracy and ensure all sections are completed.

- Sign and date the form to certify that you have read and understood the information regarding the Windfall Elimination Provision and the Government Pension Offset Provision.

- Provide the completed form to your employer as required.

Once you submit the SSA-45 form, it will become part of your employment record. The employer is responsible for including a copy of the signed form with your pension application. This process helps ensure that your pension information is aligned with any future Social Security benefits you may claim.

What You Should Know About This Form

What is Form SSA-45?

Form SSA-45, or Statement Concerning Your Employment in a Job Not Covered by Social Security, is a document issued by the Social Security Administration. It helps explain to employees how working in jobs that do not contribute to Social Security may influence their future benefits. This form is especially important for those who may receive a pension from such jobs.

Who needs to fill out Form SSA-45?

Employees who work in jobs not covered by Social Security should complete Form SSA-45. Employers must provide this form to new hires in such positions. This requirement applies to all state and local government workers who started on or after January 1, 2005.

How does my pension affect my Social Security benefits?

Your pension from a job not covered by Social Security can affect your benefits in two significant ways: through the Windfall Elimination Provision and the Government Pension Offset Provision. Each provision reduces the amount of your Social Security benefits to some extent, depending on your pension amount and eligibility for other benefits.

What is the Windfall Elimination Provision?

The Windfall Elimination Provision adjusts how your Social Security retirement or disability benefits are calculated if you also receive a pension from a job where you didn’t pay Social Security taxes. This means you may end up receiving a lower Social Security benefit. The reduction changes annually, so staying informed is crucial.

What is the Government Pension Offset Provision?

This provision affects any Social Security spousal or widow(er) benefit you may be entitled to if you also receive a government pension from work not covered by Social Security. Specifically, two-thirds of your pension amount will reduce your spouse or widow(er) benefit. Even if your pension offsets your benefit completely, you can still receive Medicare benefits at age 65.

Why do I need to sign the form?

Signing the form indicates that you understand how your employment and potential pension may affect your future Social Security benefits. It ensures that you are aware of the implications before making retirement decisions or planning for disability benefits.

Can I get a copy of the SSA-45 online?

Yes, you can access Form SSA-45 online at the Social Security Administration's website. Just look for the online version at www.socialsecurity.gov/online/ssa-1945.pdf. If you prefer paper copies, you can request them via email or fax from the Social Security Administration. Keep in mind they come in packages of 25.

What should my employer do with the completed form?

Once you complete and sign the SSA-45, your employer is responsible for keeping it on file. They must also submit a copy to the pension-paying agency as part of their compliance with Social Security regulations.

Where can I find more information?

For further details, you can check the Social Security website at www.socialsecurity.gov or reach out directly by calling 1-800-772-1213. If you're deaf or hard of hearing, you can use the TTY number 1-800-325-0778.

Common mistakes

When completing the SSA-45 form, individuals often make several common mistakes that can lead to delays or issues with their Social Security benefits. One of the frequent errors is incorrect employee information. It's essential to ensure that the name and employee ID are filled out accurately. Even simple typos can cause significant problems later on.

Another mistake involves the employer's information. Just as with your information, providing the correct name and ID number for the employer is crucial. This helps to eliminate any potential confusion about where your employment record is tracked.

Often, individuals fail to understand the implications of the Windfall Elimination Provision and the Government Pension Offset Provision. Failing to acknowledge how these provisions may influence future Social Security benefits can result in unmet expectations. It’s important to review these sections closely.

Some people do not seek clarification or assistance when filling out the form. If there is any uncertainty about requirements or provisions, reaching out for help can mitigate errors. This advice can lead to a more seamless submission process.

Additionally, individuals sometimes neglect to sign and date the SSA-45 form. The certification section is not just a formality; without a signature, the form is incomplete. This oversight can lead to delays or denials of benefits.

Preparation is key, yet some people fill out the form without having accessible documentation on hand. Gathering necessary documents in advance can ensure you provide accurate information, thereby avoiding mistakes related to earnings or employment history.

Furthermore, individuals might overlook the requirement to submit a copy of the signed form to the pension paying agency. Keeping track of submissions contributes to a smoother process. Having proper records helps in dealing with any discrepancies that may arise in the future.

Finally, it’s crucial not to forget that the form may need updates or re-submissions in light of changing personal circumstances. Ignoring this could lead to discrepancies in benefit calculations. Staying proactive about your information means you can avoid complications down the road.

Documents used along the form

When dealing with the SSA-45 form, it's essential to understand that there are several other documents that might be necessary for comprehensive management of Social Security and pension-related matters. These forms collectively help clarify the implications of working in positions that are not covered by Social Security, ensuring that individuals are fully informed about their benefits.

- SSA-1945: The SSA-1945 form provides a detailed statement concerning employment in a job not covered by Social Security. It outlines how a pension from such employment could affect future Social Security benefits, including the Windfall Elimination Provision and the Government Pension Offset Provision.

- SSA-827: This is the Authorization to Disclose Information to the Social Security Administration form. It allows individuals to give permission for other parties, like employers or doctors, to share relevant information with the SSA that may affect their benefits and eligibility.

- SSA-1099: This tax form details the benefit amount that an individual received throughout the year from Social Security. Knowing this information is crucial for tax purposes and also for verifying income when applying for other assistance programs.

- SSA-16: The Application for Disability Insurance Benefits form is key for those applying for benefits based on their disability status. It collects necessary information that helps the SSA determine eligibility and calculate potential benefits.

- SSA-827 (Disability Report): This report is specifically designed to provide comprehensive details when applying for Social Security Disability benefits. It gathers important medical information, work history, and personal information relevant to disability claims.

- Form W-2: This form reports annual wages and taxes withheld from an individual’s paycheck. It is essential for understanding contributions to Social Security and calculating benefits, particularly for those who may have worked part-time or in non-covered employment.

Familiarity with these documents can be extremely beneficial. Understanding how each of them interacts with the SSA-45 form ensures that individuals are well-prepared for any eventualities regarding their Social Security benefits. Always consult with a qualified professional if there are any uncertainties or specific questions regarding your situation.

Similar forms

-

Form SSA-1945: Like the SSA-45, this form also provides information about employment not covered by Social Security and its potential impact on future benefits, emphasizing the need for awareness regarding pensions.

-

Form SSA-1090: This document is used to report estimated income and helps Social Security assess benefits accurately. It shares a similar purpose of ensuring that employees understand their financial situation concerning Social Security.

-

Form SSA-827: This release form allows Social Security to obtain medical records necessary for determining disability benefits, much like how SSA-45 sheds light on employment impacting benefit calculations.

-

Form SSA-3368: Used to apply for disability benefits, this form requires details about work history, a process that echoes the SSA-45 in documenting employment details that influence benefits.

-

Form SSA-559: This form appeals the denial of a Social Security claim; it addresses issues similar to those found on the SSA-45, focusing on the implications of non-covered work on benefits.

-

Form SSA-1788: This serves to request Social Security payments for special situations, sharing the goal of clarifying payment rights and responsibilities, akin to the SSA-45.

-

Form SSA-1120: Designed for self-employed individuals to report their earnings, this document can relate to SSA-45 as both involve understanding how specific income affects Social Security entitlements.

-

Form SSA-1000: This form is used for certain types of benefit applications and focuses on issues surrounding collecting Social Security, similar to how the SSA-45 clarifies employment-related impacts.

Dos and Don'ts

When completing the SSA-45 form, it’s crucial to ensure accuracy and compliance. Here’s a helpful list of things you should and shouldn't do:

- Do read all the instructions carefully before starting the form.

- Do provide accurate and up-to-date information about your employment.

- Do ensure your signature and the date are present at the end of the form.

- Do keep a copy of the completed form for your records.

- Don't skip sections on the form; complete every part that applies to you.

- Don't use incorrect or inconsistent employee or employer identification numbers.

- Don't forget to check for errors or typos before submission.

- Don't submit the form without ensuring it has been signed by the employer.

Misconceptions

- Misconception 1: The SSA-45 form does not affect any Social Security benefits.

- Misconception 2: The Windfall Elimination Provision (WEP) completely eliminates Social Security benefits.

- Misconception 3: Medicare benefits are affected by the SSA-45 form.

- Misconception 4: Only current employees need to be aware of the SSA-45 form.

- Misconception 5: The SSA-45 form is optional and can be ignored.

- Misconception 6: The SSA-45 form is the only document needed to understand Social Security benefits.

This is incorrect. The SSA-45 form explains how pensions from jobs that do not pay into Social Security can impact your future benefits, including possible reductions.

In reality, the WEP reduces benefits but does not eliminate them entirely. You will still receive some benefits based on your earnings from jobs covered by Social Security.

This is a common misunderstanding. Medicare benefits remain unaffected, regardless of any pension you might receive.

Actually, anyone who has worked in a job not covered by Social Security, including retirees, could be impacted by these provisions. Being informed is important.

This is not true. Employers are required by law to provide this statement to employees in certain circumstances, particularly those hired on or after January 1, 2005.

While the SSA-45 is important, it is just one part of a broader set of rules and publications that explain Social Security benefits. Additional resources are available for complete understanding.

Key takeaways

Understanding Form SSA-45 is essential for both employees and employers, especially concerning pensions from jobs not covered by Social Security. Here are some key takeaways to keep in mind:

- Purpose of the Form: The SSA-45 is designed to inform employees about how their employment in a job not covered by Social Security may affect future Social Security benefits.

- Windfall Elimination Provision: This provision may result in a reduced amount of Social Security benefits for individuals receiving a pension from a job without Social Security coverage.

- Government Pension Offset Provision: If an employee receives a pension from government work where Social Security taxes weren't paid, their Social Security spouse or widow(er) benefits may be reduced by two-thirds of their pension amount.

- The Impact on Medicare: It's important to note that while pensions can affect Social Security benefits, they do not impact Medicare eligibility, which remains unaffected regardless of pension amounts.

- Employee Notification: Employers must provide employees with the SSA-45 before they start their employment, explaining the implications of their pension on potential Social Security benefits.

- Signature Requirement: Employees must sign the SSA-45 to acknowledge receipt and understanding of the information regarding the effects on their future benefits.

- Accessing the Form: Employers can obtain SSA-45 forms from the Social Security Administration’s website or request paper copies directly via email or fax, ensuring that they meet the legal requirements.

These points underline the importance of awareness regarding how employment and pensions interact with Social Security benefits. Taking the time to understand Form SSA-45 can help prevent future financial surprises.

Browse Other Templates

An Attending Physician Statement Would Be Appropriate for Which Life Insurance Purpose - Physicians are reminded to use blue or black ink, ensuring legibility and professional presentation.

Registrar Gmu - Applicants must acknowledge their understanding of the admission requirements to finalize their application.

How to Write a Contract for Rental Property - Late charges apply if rent is not paid within the set grace period.