Fill Out Your Ssa 6232 Form

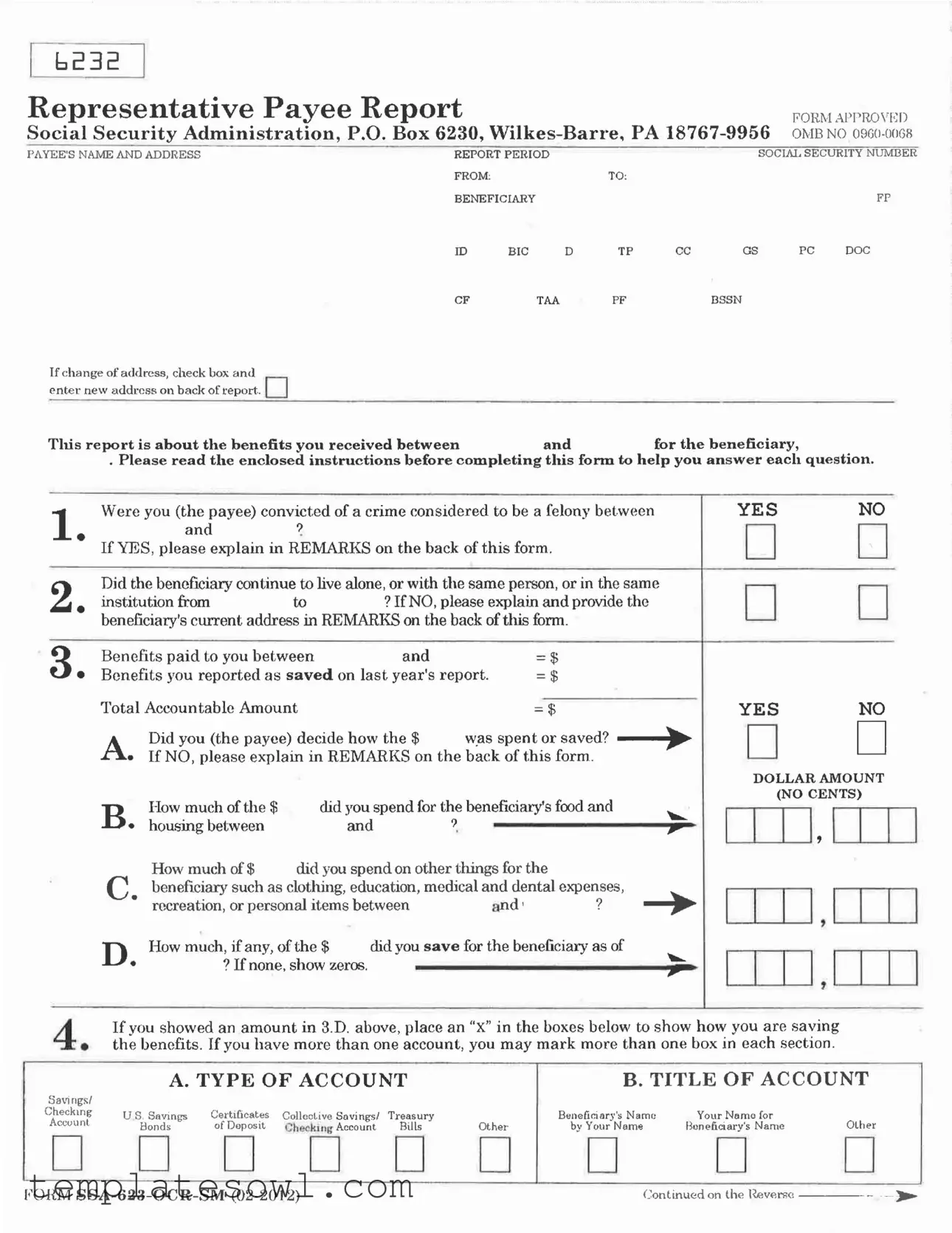

The SSA 6232 form, officially known as the Representative Payee Report, plays a critical role in the management of Social Security benefits for individuals who cannot manage their finances due to various reasons. This essential document is required for representative payees to report on how they used the benefits received on behalf of the beneficiary during a specified reporting period. The form requires detailed information, including the names and addresses of both the payee and the beneficiary, as well as the total amount of benefits paid. Key questions on the form focus on changes in circumstances, such as any felony convictions the payee may have had, changes in the beneficiary's living situation, and the allocation of funds for essential needs like food, housing, and medical expenses. Furthermore, representative payees must indicate how much of the benefits were saved, as well as provide details about the types of accounts those savings are held in. Completing this form accurately is imperative, as it is underpinned by declarations of truthfulness, with potential penalties for false information. Importantly, the SSA 6232 not only serves to keep a detailed account of financial management but also ensures that the interests of beneficiaries are safeguarded, fostering accountability among those entrusted with their support.

Ssa 6232 Example

Representative Payee Reportformapproved

Social Security Administration, P.O. Box 6230,

PAYEE'S NAME AND ADDRESS |

REPORT PERIOD |

|

|

|

SOCIAL SECURITY NUMBER |

|||

|

FROM: |

|

|

TO; |

|

|

|

|

|

BENEFICIARY |

|

|

|

|

|

FP |

|

|

ID |

BIC |

D |

TP |

CC |

GS |

PC |

DOC |

|

CF |

|

TAA |

PF |

|

BSSN |

|

|

If change of address, check box and enter new address on back of report.

This report is about the benefits you received between |

and |

for the beneficiary, |

. Please read the enclosed instructions before completing this form to help you answer each question.

Were you (the payee) convicted of a crime considered to be a felony between 1. and ?

If YES, please explain in REMARKS on the back of this form.

2. |

Did the beneficiary continue to live alone, or with the same person, or in the same |

||

institution from |

to |

? If NO, please explain and provide the |

|

beneficiary's current address in REMARKS on the back of this form.

3 |

Benefits paid to you between |

|

and |

|

|

= $ |

||

• Benefits you reported as saved on last year's report. |

= $ |

|||||||

|

Total Accountable Amount |

|

|

|

|

|

||

|

A. |

Did you (the payee) decide how the $ |

|

was spent or saved? |

||||

|

If NO, please explain in REMARKS on the back of this form. |

|||||||

|

B. |

How much of the $ |

|

did you spend for the beneficiary's food and |

||||

|

housing between |

|

|

and |

? |

■ |

||

|

|

How much of $ |

did you spend on other things for the |

|||||

|

|

beneficiary such as clothing, education, medical and dental expenses, |

||||||

|

|

recreation, or personal items between |

|

and1 |

? |

|||

|

D. |

How much, if any, of the $ |

did you save for the beneficiary as of |

|||||

|

? If none, show zeros. |

|

|

. |

||||

YES

YES

DOLLAR AMOUNT

(NO CENTS)

If you showed an amount in 3.D. above, place an “X” in the boxes below to show how you are saving 4• the benefits. If you have more than one account, you may mark more than one box in each section.

Savings/ |

A. TYPE OF ACCOUNT |

|

B. TITLE OF ACCOUNT |

||||

|

|

|

|

|

|

|

|

Checking |

U S. Savings |

Certificates |

Collective Savings/ Treasury |

Other |

Beneficiary's Name |

Your Name for |

Other |

Account |

Bonds |

of Deposit |

Checking Account Bills |

bv Your Name |

Boneficiarv's Name |

||

FORM |

Continued on the |

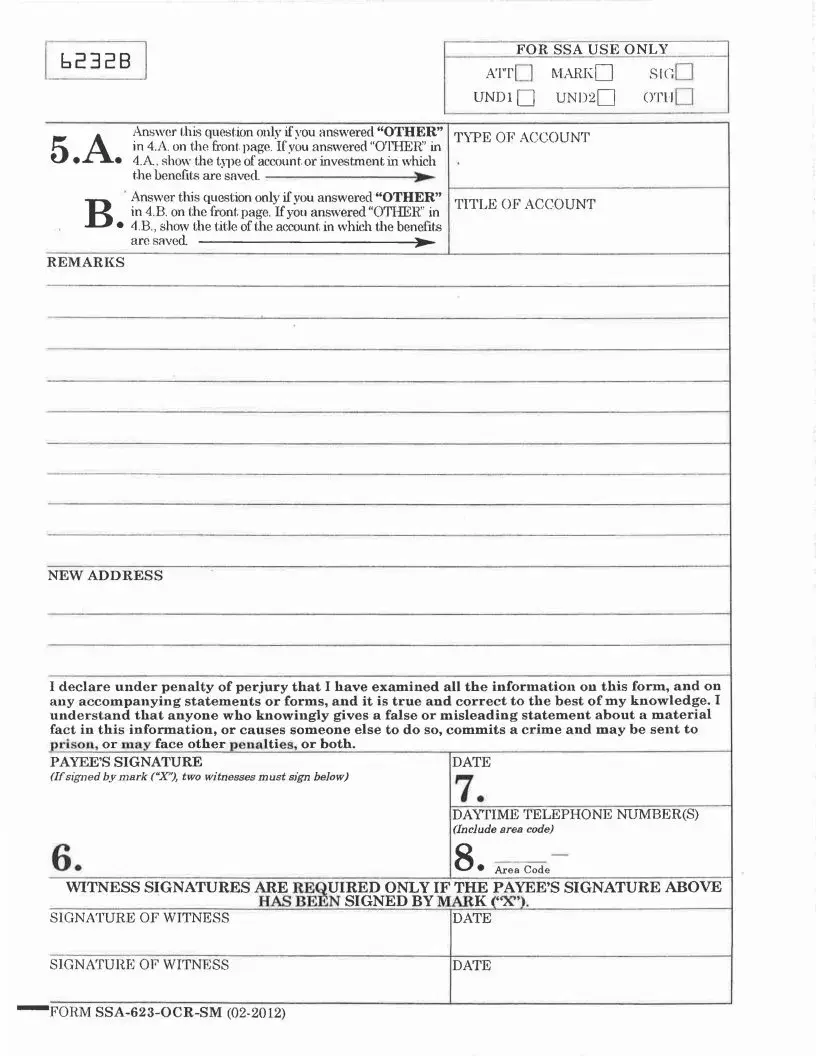

ьгзгв |

|

FOR SSA USE ONLY____ |

|

|

attO markQ |

sigD |

|

|

|

UNDlQ UND2Q |

ОТ1ІІ I |

5.A. |

Answer this question only if you answered “OTHER” |

TYPE OF ACCOUNT |

|

in 4.A. on the front page. Ifyou answered "OTHER” in |

|

|

|

4.A, show the type of account or investment in which |

|

|

|

the benefits are

ВAnswer this question only if you answered “OTHER” TITLE OF ACCOUNT in 4.B. on the front page. If you answered "OTHER” in

•4 .B., show the title of the account in which the benefits are saved

REMARKS

NEW ADDRESS

I declare under penalty of perjury that I have examined all the information on this form, and on any accompanying statements or forms, and it is true and correct to the best of my knowledge. I understand that anyone who knowingly gives a false or misleading statement about a material fact in this information, or causes someone else to do so, commits a crime and may be sent to prison, or may face other penalties, or both.

PAYEE’S SIGNATURE |

DATE |

(Ifsigned by mark (“X"), two witnesses must sign below) |

7. |

|

|

|

DAYTIME TELEPHONE NUMBER(S) |

6. |

(Include area code) |

g• Area Code |

WITNESS SIGNATURES ARE REQUIRED ONLY IF THE PAYEE’S SIGNATURE ABOVE

HAS BEEN SIGNED BY MARK (“X”).

SIGNATURE OF WITNESS |

DATE |

SIGNATURE OF WITNESS |

DATE |

'FORM

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The SSA 6232 form is used by representative payees to report how benefits received on behalf of a beneficiary were managed and spent during a specific period. |

| Submission Address | Completed forms must be sent to the Social Security Administration, P.O. Box 6230, Wilkes-Barre, PA 18767-9956. |

| Required Information | The form requires the payee's name and address, the beneficiary's Social Security number, and details about the account used to manage the funds received for the beneficiary. |

| Reporting Period | This form covers benefits reported for a specified period, which must be clearly indicated by the payee. |

| Felony Convictions | If the payee was convicted of a felony during the reporting period, it must be disclosed in the remarks section of the form. |

| Account Management | Payees must indicate how they have spent or saved the benefits, including any savings or checking accounts used for these funds. |

Guidelines on Utilizing Ssa 6232

Filling out the SSA-6232 form requires careful attention to detail. It is important to answer each question accurately and completely. The information collected helps ensure that the beneficiary's needs are properly met. Follow these steps to fill out the form correctly.

- Begin by entering the payee's name and address at the top of the form.

- Fill in the report period dates—make sure to indicate the start and end dates.

- Enter the beneficiary's Social Security number.

- If you have moved, check the appropriate box and provide your new address on the back of the report.

- Indicate whether you were convicted of a felony during the specified time. If yes, explain in the remarks section on the back.

- Answer whether the beneficiary continued to live at the same address during the report period. If no, explain the situation and provide their current address.

- Report the total benefits received during the period and clearly indicate the amounts as requested.

- State whether you determined how the received benefits were spent. If no, provide an explanation in the remarks section.

- Detail the amount spent on food and housing as well as the amount used for other expenses related to the beneficiary.

- If any money was saved for the beneficiary, fill that amount in. If none, indicate zeros.

- In the account section, mark the boxes to show how and where the benefits are saved, including type and titles of accounts if necessary.

- Complete the remarks section if applicable, and ensure to include any additional information needed.

- Sign and date the form at the bottom. If a mark ("X") was made, two witnesses must also sign.

- Provide contact information, including daytime telephone numbers.

After completing these steps, double-check the form to ensure all information is accurate. Then, submit it to the address listed at the top of the form for processing. Remember that submitting a complete and accurate form will facilitate the proper management of the beneficiary's needs.

What You Should Know About This Form

What is the SSA-6232 form?

The SSA-6232 form, also known as the Representative Payee Report, is used by individuals who manage Social Security benefits on behalf of another person. It provides important information about how the benefits were used during a specific reporting period.

Who needs to fill out the SSA-6232 form?

This form must be completed by a payee—someone who receives and manages Social Security benefits for another individual, known as the beneficiary. If you are the designated payee, it is your responsibility to report how the funds were managed and spent.

When should the SSA-6232 form be submitted?

The SSA-6232 form is typically submitted annually. The specific time frame for submission can depend on the Social Security Administration's request or schedule. Be sure to comply with deadlines to ensure continued benefits.

What information is required on the SSA-6232 form?

You will need to provide details such as your name and address, the beneficiary's name and Social Security number, the reporting period for the benefits, and how the funds were spent. You may also need to provide information if there were any significant changes in the beneficiary's living situation or if any criminal convictions occurred.

What happens if the beneficiary's living situation changes?

If the beneficiary has changed their living situation, you must explain this on the form. Provide the new address and any relevant details to ensure the Social Security Administration has accurate information.

How do I report the amount spent for the beneficiary's needs?

The form requires you to break down expenditures. You will report how much was spent on food, housing, clothing, medical expenses, and other necessities. It's important that you keep records of these expenses for accuracy.

What if I didn’t use all the funds for the beneficiary?

If there were funds remaining, you must indicate how much was saved for the beneficiary. If none was saved, you should clearly show zeros in that section. Honesty is crucial as misleading information can lead to penalties.

What are the consequences of providing false information?

Providing false or misleading information can have serious consequences. It may result in criminal charges, including potential imprisonment. Integrity in reporting is essential to maintain trust with the Social Security Administration.

Who should I contact if I have questions while filling out the SSA-6232 form?

If you have questions, you should reach out directly to the Social Security Administration. You can contact them by phone or visit your local office for assistance. They can provide clarification on completing the form correctly.

Where do I send the completed SSA-6232 form?

You must send the completed SSA-6232 form to the address provided on the form itself: Social Security Administration, P.O. Box 6230, Wilkes-Barre, PA 18767-9956. Ensure it is mailed by the required deadline to avoid any issues with benefit management.

Common mistakes

Completing the SSA-6232 form, also known as the Representative Payee Report, requires careful attention to detail. Failing to do so can lead to complications in managing benefits for the person you represent. Common mistakes, notably, can undermine the integrity of the submission. Let’s explore some of these pitfalls.

One frequent mistake involves neglecting to read the accompanying instructions. The SSA provides specific guidelines on how to fill out the form accurately. These instructions are there for a reason. Overlooking them can result in significant errors that might delay the processing of the report.

Another common error is failing to answer all the questions completely. Each section of the form seeks critical information about the beneficiary’s living situation and how their funds have been managed. Incomplete answers can raise red flags for the Social Security Administration, leading to unnecessary scrutiny.

Forgetting to update address details is also a prevalent issue. If the beneficiary has moved, the payee must check the appropriate box and provide the new address on the back of the report. Not doing this could signal to the SSA that the payee is not properly overseeing the beneficiary’s needs.

A misunderstanding regarding the account amounts is yet another mistake. Payees need to clearly indicate the amounts spent and saved for the beneficiary. If errors slip into the financial data, it can create confusion and potential discrepancies that could complicate future benefit disbursements.

Additionally, many payees forget to explain “Yes” responses in the remarks section. For instance, if the payee was convicted of a felony, the form requires an explanation in the designated area. Failing to provide this context can lead to unnecessary follow-up requests from the SSA, prolonging the review process.

Another notable blunder is the improper signing of the form. If the payee signs by mark, it is crucial to ensure that two witnesses also sign. Not including the required signatures can render the submission invalid, causing delays in benefit management.

Lastly, payees should not overlook the significance of their declarations. The statement at the end of the form emphasizes the seriousness of providing accurate information. Ignoring this could lead to criminal charges for making false statements, which can have long-lasting consequences.

In summary, filling out the SSA-6232 form with attention and care can prevent a myriad of issues. Being thorough and precise not only helps in ensuring the beneficiary receives their benefits smoothly but also safeguards the payee against potential legal repercussions.

Documents used along the form

The SSA 6232 form is used to report the activities of a Representative Payee who manages social security benefits for a beneficiary. Along with this form, there are several other documents commonly utilized in conjunction with it. These documents help in providing a comprehensive understanding of the beneficiary's situation and the handling of funds.

- SSA-11 Form: This form is used to apply for benefits, providing information about the applicant's work history and reasons for requesting benefits.

- SSA-827 Form: This release form authorizes the Social Security Administration to collect necessary medical or other records, ensuring proper evaluation of the beneficiary's needs.

- SSA-588 Form: Used for requesting a change in payment method or for direct deposit of benefits, enhancing convenience for the payee.

- SSA-21 Form: This is a supplemental form that provides additional information about living arrangements and other factors affecting the beneficiary's eligibility for benefits.

- Notice of Award: This document notifies the beneficiary and payee of the approval and details of the benefits, including payment amount and frequency.

- Payee Identification Document: This may be a government-issued ID showing the payee's identity and authority to manage the funds for the beneficiary.

- Bank Statements: These help document the transactions made with the benefits, providing transparency on how the funds were used or saved.

- Any Relevant Court Documents: If the payee has been appointed by a court, those documents verify the authority and responsibility of the payee toward the beneficiary.

- Beneficiary's Medical Records: These records may be needed to assess the beneficiary's ongoing needs and the adequacy of the benefits received.

Each of these documents plays an important role in supporting the SSA 6232 form. Together, they help ensure that the beneficiary's needs are met and that funds are managed properly under the guidelines set by the Social Security Administration.

Similar forms

The SSA-6232 form is a Representative Payee Report used to report on benefits received on behalf of a beneficiary. Below are eight documents that are similar to the SSA-6232 form along with a brief explanation of their similarities:

- SSA-24: This form is used to apply for Social Security Disability Insurance (SSDI) benefits. Like the SSA-6232, it helps ensure proper use and management of benefits for beneficiaries.

- SSA-16: This is the Application for Disability Insurance Benefits. It shares the purpose of assessing an individual's eligibility for receiving benefits.

- SSA-827: This form allows the Social Security Administration to release information to a third party. Similar to the SSA-6232, it involves the management of a beneficiary’s information.

- SSA-789: The Request for Waiver of Overpayment is used when a beneficiary believes an overpayment should not be returned. It focuses on financial management, much like the SSA-6232.

- SSA-501: This form is utilized for a request for reconsideration of a Social Security decision. Similar to the SSA-6232, it is part of the process for beneficiaries to manage their eligibility and benefits.

- Form 1099: This document provides recipients with information about their annual benefit payments. It reports financial transactions, paralleling the accountability aspect of the SSA-6232.

- Form SSA-11: This form is an Application for a Statement of Benefits. It requires information about the beneficiary’s situation, similar to updates required in the SSA-6232.

- SSA-3368: The Adult Function Report is used to give more details about a person’s limitations. Like the SSA-6232, it is concerned with the beneficiary's well-being and management of their benefits.

Dos and Don'ts

When filling out the SSA 6232 form, attention to detail is crucial. Here are important dos and don'ts to consider.

- Do read the instructions carefully before starting to fill out the form.

- Do provide accurate information regarding the beneficiary's living situation.

- Do clearly indicate any changes in addresses or circumstances.

- Do double-check all dollar amounts reported to ensure accuracy.

- Don't leave any sections blank; if a question does not apply, mark it appropriately.

- Don't skip the "REMARKS" section if additional explanations are needed.

- Don't forget to sign and date the form; failure to do so can lead to delays.

- Don't provide misleading information, as this can have legal consequences.

Misconceptions

Understanding the SSA 6232 form is crucial for those involved in managing Social Security benefits for others. However, several misconceptions persist about this form. Here are eight common misunderstandings:

- This form is only for people with felony convictions. Many believe that the SSA 6232 is only relevant for payees who have been convicted of a felony. In reality, while it questions felony convictions, the form is primarily a financial report for all representative payees.

- Only the beneficiary can fill out this form. Some assume that only the beneficiary must complete this form. However, it is the responsibility of the representative payee to fill it out, providing information about how the benefits were managed.

- Submitting this form is optional. There is a misconception that completing the SSA 6232 is voluntary. In truth, the form is a necessary requirement for monitoring how benefits are spent on behalf of the beneficiary and must be submitted on time.

- All representative payees must submit a report annually. People often think every representative payee needs to submit the form every year. The requirement for annual reporting depends on individual circumstances and the request from the Social Security Administration.

- The form is only about spending. It is commonly believed that the SSA 6232 focuses solely on how the money is spent. While spending is a significant aspect, it also asks for information about savings, addresses, and living arrangements.

- Providing inaccurate information has no consequences. Some individuals may think they can submit inaccurate information without repercussions. However, providing false or misleading information is a serious offense that could lead to criminal charges and penalties.

- Changes in circumstance do not need to be reported. A common assumption is that changes regarding the beneficiary's living situation or expenses don’t need to be reported. In fact, these changes must be documented to ensure accurate oversight of benefits.

- The SSA 6232 form is the same as other forms for benefits. Many may confuse the SSA 6232 with other forms related to Social Security benefits. Each form serves a distinct purpose, and it is important to use the correct form for the specific reporting or application needed.

By clearing up these misconceptions, individuals can better navigate the responsibilities associated with the SSA 6232 form, ensuring compliance and proper support for beneficiaries.

Key takeaways

Understanding the SSA 6232 Form is essential for ensuring the proper reporting and handling of benefits for a beneficiary. Here are 7 key takeaways to keep in mind:

- Accurate completion of the form is crucial. This form accounts for all benefits received on behalf of the beneficiary during a specified reporting period.

- Before filling out the form, carefully read the enclosed instructions. They provide necessary guidance for answering each question correctly.

- When reporting income, make sure to clarify any changes in the beneficiary’s living situation, such as moving or living with someone else.

- Declare how the benefits were spent. It is important to detail expenditures for food, housing, and other necessities for the beneficiary.

- Save records. The form allows you to report any savings—be prepared to provide specifics about how the saved benefits were kept.

- If the payee has had any felony convictions during the reporting period, they must disclose this in the remarks section.

- Remember to sign and date the form. If signed by mark, ensure that two witnesses also sign to validate the submission.

Browse Other Templates

Olympia Sports Employment Application,Job Seeker Form for Olympia Sports,Olympia Sports Career Application,Employment Request Form at Olympia Sports,Olympia Sports Position Application,Job Application for Olympia Sports,Olympia Sports Candidate Appli - All applicants must confirm their legal eligibility to work in the U.S.

2022 Tax Checklist - Transportation expenses for medical purposes can potentially qualify for deductions.