Fill Out Your Ssa 8 Form

The SSA-8 form, also known as the Application for Lump-Sum Death Payment, is an essential document for individuals seeking benefits under the Social Security Administration following the death of a wage earner or a self-employed individual. This form can be submitted by the deceased's family members or beneficiaries, and it must be filed within two years of the date of death to be considered. The application addresses various fields, including essential personal details about the deceased, such as their name, Social Security number, date of birth, and date of death. It also requires information about the surviving family, including spouses and children who may be eligible for benefits. Key questions on the form explore the deceased's work history, prior applications for benefits, and military service, which may influence eligibility. Furthermore, the SSA-8 allows for detailed entries about other familial relationships, such as the existence of surviving parents or previous marriages, which can affect the distribution of benefits. Completing the SSA-8 accurately is crucial as it initiates the review process for any entitled lump-sum death payments, ensuring that families receive the financial support they may need during a difficult time.

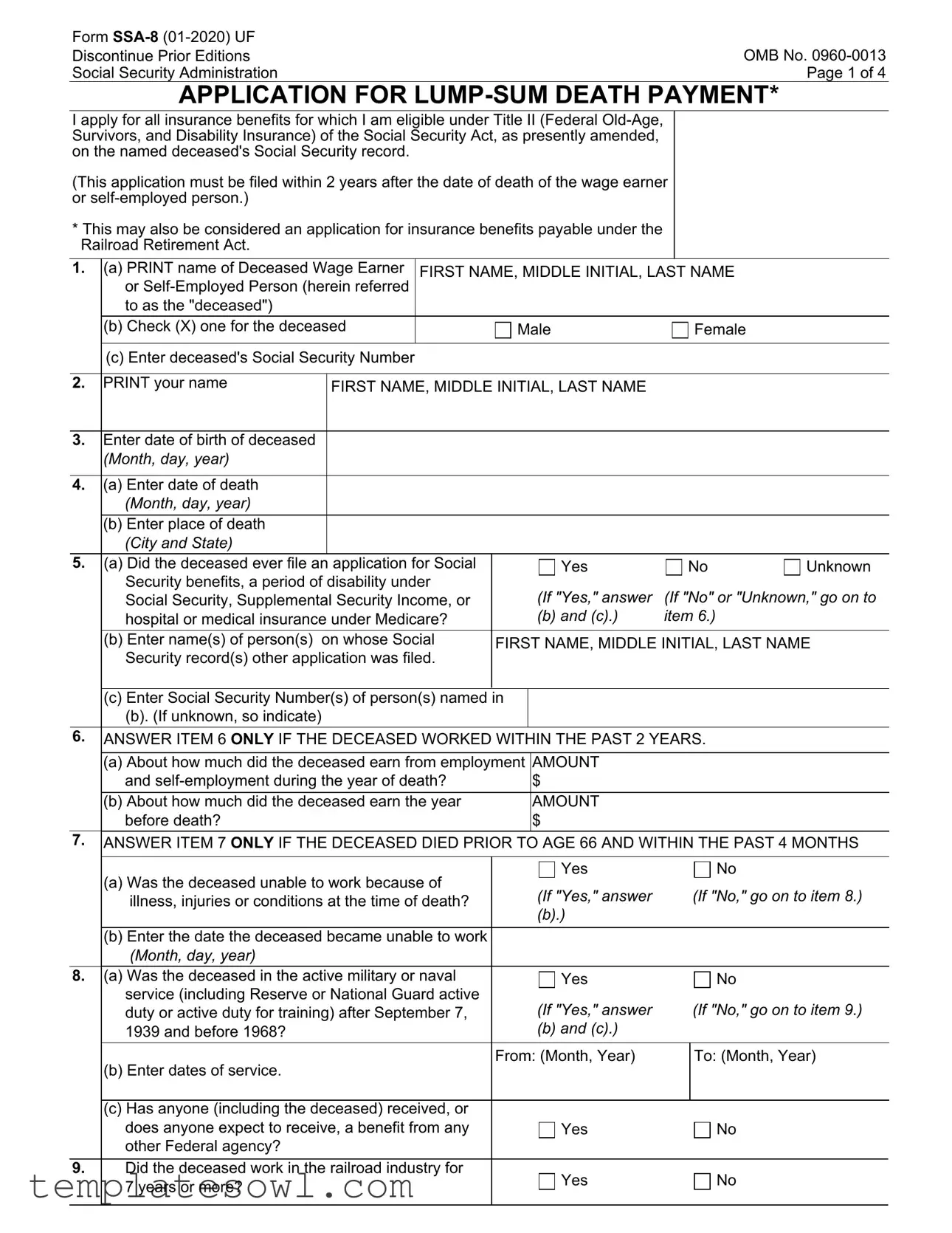

Ssa 8 Example

Form |

OMB No. |

Discontinue Prior Editions |

|

Social Security Administration |

Page 1 of 4 |

APPLICATION FOR

I apply for all insurance benefits for which I am eligible under Title II (Federal

(This application must be filed within 2 years after the date of death of the wage earner or

*This may also be considered an application for insurance benefits payable under the Railroad Retirement Act.

1. |

(a) PRINT name of Deceased Wage Earner |

FIRST NAME, MIDDLE INITIAL, LAST NAME |

|||

|

|

or |

|

|

|

|

|

to as the "deceased") |

|

|

|

|

|

(b) Check (X) one for the deceased |

Male |

Female |

|

|

|

|

|

|

|

|

|

(c) Enter deceased's Social Security Number |

|

|

|

|

|

|

|

|

|

2. |

PRINT your name |

FIRST NAME, MIDDLE INITIAL, LAST NAME |

|

||

3. |

Enter date of birth of deceased |

|

|

|

|

(Month, day, year) |

|

|

|

|

|

|

|

|

4. |

(a) Enter date of death |

|

|

|

|

(Month, day, year) |

|

|

|

|

(b) Enter place of death |

|

|

|

|

(City and State) |

|

|

|

5. |

(a) Did the deceased ever file an application for Social |

Yes |

No |

Unknown |

|

Security benefits, a period of disability under |

(If "Yes," answer |

(If "No" or "Unknown," go on to |

|

|

Social Security, Supplemental Security Income, or |

|||

|

hospital or medical insurance under Medicare? |

(b) and (c).) |

item 6.) |

|

|

(b) Enter name(s) of person(s) on whose Social |

FIRST NAME, MIDDLE INITIAL, LAST NAME |

||

|

Security record(s) other application was filed. |

|

|

|

(c)Enter Social Security Number(s) of person(s) named in

(b). (If unknown, so indicate)

6.ANSWER ITEM 6 ONLY IF THE DECEASED WORKED WITHIN THE PAST 2 YEARS.

(a)About how much did the deceased earn from employment AMOUNT

and |

$ |

(b) About how much did the deceased earn the year |

AMOUNT |

before death? |

$ |

7.ANSWER ITEM 7 ONLY IF THE DECEASED DIED PRIOR TO AGE 66 AND WITHIN THE PAST 4 MONTHS

(a) Was the deceased unable to work because of |

Yes |

No |

|

(If "Yes," answer |

(If "No," go on to item 8.) |

||

illness, injuries or conditions at the time of death? |

|||

|

(b).) |

|

(b)Enter the date the deceased became unable to work (Month, day, year)

8. |

(a) Was the deceased in the active military or naval |

Yes |

No |

|

service (including Reserve or National Guard active |

(If "Yes," answer |

(If "No," go on to item 9.) |

|

duty or active duty for training) after September 7, |

||

|

1939 and before 1968? |

(b) and (c).) |

|

|

(b) Enter dates of service. |

From: (Month, Year) |

To: (Month, Year) |

|

|

|

|

|

|

|

|

|

(c) Has anyone (including the deceased) received, or |

|

|

|

does anyone expect to receive, a benefit from any |

Yes |

No |

|

other Federal agency? |

|

|

9. |

Did the deceased work in the railroad industry for |

Yes |

No |

|

7 years or more? |

||

|

|

|

|

Form |

|

|

|

|

Page 2 of 4 |

|||

|

10. (a) Did the deceased ever engage in work that was covered under the social |

|

Yes |

(If "Yes," answer (b).) |

|||||

|

|

security system of a country other than the United States? |

|

No (If "No," go on to item 11.) |

|||||

|

|

|

|

|

|

||||

|

|

(b) If "Yes," list the country(ies). |

|

|

|

|

|

|

|

|

11. |

(a) Is the deceased survived by a |

spouse? |

|

|

|

|

Yes |

No |

|

|

If "Yes," enter information about the marriage at the time of death below. If "No," go on to |

|

||||||

|

|

item 11(b) if the deceased had prior marriages or item 12 if the deceased never married. |

|

|

|

||||

|

|

Spouse's Name (including Maiden Name) |

When (Month, day, year) |

Where (Name of City and State) |

|

||||

|

|

|

|

|

|

||||

|

|

How marriage ended |

When (Month, day, year) |

Where (Name of City and State) |

|

||||

|

|

|

|

|

|||||

|

|

Marriage performed by: |

Spouse's date of birth (or age) |

Spouse's Social Security Number (If |

|||||

|

|

Clergyman or public official |

none or unknown, so indicate) |

|

|||||

|

|

|

|

||||||

|

|

Other (Explain in "Remarks") |

|

|

|

|

|

|

|

(b)If the deceased had a prior marriage(s) that lasted at least 10 years, enter the information below. If the deceased married the same individual multiple times and the remarriage took place within the year immediately following the year of the divorce, and the combined period of marriage totaled 10 years or more, include the marriage. If no prior marriages or if information is unavailable, please indicate below.

Spouse's Name (including Maiden Name) |

When (Month, day, year) |

Where (Name of City and State) |

|

|

|

|

|

How marriage ended |

When (Month, day, year) |

Where (Name of City and State) |

|

|

|

|

|

Marriage performed by: |

Spouse's date of birth (or age) |

If spouse deceased, give date |

|

Clergyman or public official |

of death |

||

|

|||

Other (Explain in "Remarks") |

|

|

|

Spouse's Social Security Number (If none or unknown, so indicate) |

|

||

(c)If the deceased has a surviving child(ren) as defined in item 12 and the deceased was married to the child's mother or father but the marriage ended in divorce, enter information on the marriage if not already listed in 11(b). If no prior marriages or if information is unavailable, please indicate below.

|

Spouse's Name (including Maiden Name) |

When (Month, day, year) |

Where (Name of City and State) |

|

|

|

|

|

How marriage ended |

When (Month, day, year) |

Where (Name of City and State) |

|

|

|

|

|

Marriage performed by: |

Spouse's date of birth (or age) |

If spouse deceased, give date |

|

Clergyman or public official |

of death |

|

|

|

||

|

Other (Explain in "Remarks") |

|

|

|

Spouse's Social Security Number (If none or unknown, so indicate) |

|

|

|

|

|

|

12. |

The deceased's surviving children (including natural children, adopted children, and stepchildren) or dependent |

||

|

grandchildren (including stepgrandchildren) may be eligible for benefits based on the earnings record of the deceased. |

||

|

List below ALL such children who are now or were in the past 12 months UNMARRIED and: |

||

|

• UNDER AGE 18 • AGE 18 TO 19 AND ATTENDING SECONDARY SCHOOL |

||

|

• AGE 18 OR OLDER WITH A DISABILITY THAT BEGAN BEFORE AGE 22 |

||

|

(If none, write ''None.'') |

|

|

|

|

|

|

|

Full Name of Child |

|

Full Name of Child |

13. |

Is there a surviving parent (or parents) of the deceased who |

Yes |

No |

|

was receiving support from the deceased either at the time |

(If "Yes," enter the name and |

|

|

the deceased became disabled under the Social Security law |

|

|

|

or at the time of death? |

address of the parent(s) in "Remarks".) |

|

14. |

Have you filed for any Social Security benefits on the |

Yes |

No |

|

deceased's earnings record before? |

||

|

|

|

|

NOTE: If there is a surviving spouse, continue with item 15. If not, skip items 15 through 18.

15.If you are not the surviving spouse, enter the surviving spouse's name and address here

Form |

|

Page 3 of 4 |

|

16. |

(a) Were the deceased and the surviving spouse living |

Yes |

No |

|

together at the same address when the deceased died? |

(If "Yes," go on to item 17.) |

(If "No," answer (b).) |

(b)If either the deceased or surviving spouse was away from home (whether or not temporarily) when the deceased died, give the following:

|

Who was away? |

|

Deceased |

|

Surviving spouse |

|

|

|

|

|

|

Date last home |

Reason absence began |

|

Reason they were apart at time of death |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

If separated because of illness, enter |

|

|

|

|

|

|

|

||

|

nature of illness or disabling condition. |

|

|

|

|

|

|

|

||

If you are the surviving spouse, and if you are under age 66, answer 17. |

|

|

|

|

||||||

17. |

(a) Are you so disabled that you cannot work or was there some period during the last 14 |

|

Yes |

No |

||||||

|

months when you were so disabled that you could not work? |

|

|

|||||||

|

|

|

|

|

||||||

|

(b) If ''Yes,'' enter the date you became disabled. |

|

|

|

(Month, day, year) |

|||||

|

|

|

|

|

|

|

|

|

||

Answer 18 ONLY if you are the surviving spouse. |

|

|

|

|

|

|

||||

18. Were you married before your marriage to the deceased? If yes, enter information about your |

|

Yes |

No |

|||||||

|

prior marriage(s) that lasted at least 10 years or ended due to death of the spouse. If you |

|

||||||||

|

divorced then remarried the same individual within the year immediately following the year of |

|

|

|

||||||

|

the divorce and the combined period of marriage totaled at least 10 years, include the marriage. |

|

|

|||||||

|

If you need more space, use "Remarks" section on back page or attach a separate sheet. |

|

|

|

||||||

|

Spouse's Name (including Maiden Name) |

When (Month, day, year) |

Where (Name of City and State) |

|

||||||

|

|

|

|

|

|

|||||

|

How marriage ended |

|

When (Month, day, year) |

Where (Name of City and State) |

|

|||||

|

|

|

|

|

|

|

|

|||

|

Marriage performed by: |

|

Spouse's date of birth (or age) |

If spouse deceased, give date |

|

|||||

|

Clergyman or public official |

of death |

|

|

|

|||||

|

|

|

|

|

|

|

||||

|

Other (Explain in "Remarks") |

|

|

|

|

|

|

|

||

Spouse's Social Security Number (If none or unknown, so indicate)

For additional information about survivor benefits see our publication at www.socialsecurity.gov.

Remarks: (You may use this space for any explanation. If you need more space, attach a separate sheet.)

I declare under penalty of perjury that I have examined all the information on this form, and on any accompanying statements or forms, and it is true and correct to the best of my knowledge.

SIGNATURE OF APPLICANTDate (Month, day, year)

Signature (First name, middle initial, last name) (Write in ink)

Telephone Number(s) at Which You

May Be Contacted During the Day

(Area Code)

Mailing Address (Number and street, Apt. No., P.O. Box, or Rural Route)

City and State |

|

ZIP Code |

Enter Name of County (if any) in which you now live |

||||

|

|

|

|

|

|

|

|

Direct Deposit Payment Information (Financial Institution) |

|

|

|

|

|||

Routing Transit Number |

Account Number |

|

Checking |

|

Enroll in Direct Express |

||

|

|

|

|

|

Savings |

|

Direct Deposit Refused |

|

|

|

|

|

|||

Witnesses are required ONLY if this application has been signed by mark (X) above. If signed by mark (X), two |

|||||||

witnesses to the signing who know the applicant must sign below, giving their full addresses. |

|

||||||

1. Signature of Witness |

|

|

|

2. Signature of Witness |

|

||

|

|

||||||

Address (Number and street, City, State, and ZIP Code) |

Address (Number and street, City, State, and ZIP Code) |

||||||

|

|

|

|

|

|

|

|

Form |

Page 4 of 4 |

RECEIPT FOR YOUR CLAIM FOR THE SOCIAL SECURITY |

|

TELEPHONE NUMBER TO CALL IF YOU HAVE A QUESTION OR SOMETHING TO REPORT

TELEPHONE NUMBER

SSA OFFICE

DATE CLAIM RECEIVED

RECEIPT FOR YOUR CLAIM

Your application for the

You should hear from us within days after you have given us all the information we requested. Some claims may take longer if additional information is needed.

In the meantime, if you change your mailing address, you should report the change.

Always give us your claim number when writing or telephoning about your claim.

If you have any questions about your claim, we will be glad to help you.

CLAIMANT

SOCIAL SECURITY CLAIM NUMBER

DECEASED'S NAME (If surname differs from claimant's name)

Privacy Act Statement - Application for

Collection and Use of Personal Information

Section 202 of the Social Security Act, as amended, allows us to collect this information. Furnishing us this information is voluntary. However, failing to provide all or part of the information may prevent us from making an accurate and timely determination on any claim filed and could result in a loss of a Social Security Administration (SSA) provided benefit.

We will use the information to authorize our

•Information may be disclosed to contractors and other Federal agencies, as necessary, for the purpose of assisting the SSA in the efficient administration of its programs. We contemplate disclosing information under this routine use only in situations in which SSA may enter a contractual or similar agreement with a third party to assist in accomplishing an agency function relating to this system of records; and

•To a congressional office in response to an inquiry from that office made at the request of the subject of a record.

In addition, we may share this information in accordance with the Privacy Act and other Federal laws. For example, where authorized, we may use and disclose this information in computer matching programs, in which our records are compared with other records to establish or verify a person’s eligibility for Federal benefit programs and for repayment of incorrect or delinquent debts under these programs.

A list of additional routine uses is available in our Privacy Act System of Records Notice (SORN)

Paperwork Reduction Act Statement - This information collection meets the requirements of 44 U.S.C. § 3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget (OMB) control number. We estimate that it will take about 10 minutes to read the instructions, gather the facts, and answer the questions. Send only comments relating to our time estimate above to: SSA, 6401 Security Blvd, Baltimore, MD

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of SSA-8 | The SSA-8 form is used to apply for a lump-sum death payment under Title II of the Social Security Act. |

| Filing Deadline | Applications must be submitted within two years of the deceased's death to be eligible for benefits. |

| Eligibility Criteria | Applicants can be the deceased's spouse, children, or parent(s) who were receiving support from the deceased. |

| Information Required | The form requires detailed information about the deceased, including their Social Security number, dates of birth, and death. |

| Military Service | The form asks whether the deceased served in the military after September 7, 1939, which may affect the application. |

| Dependent Eligibility | Eligible dependents include unmarried children under 18, those aged 18 to 19 attending school, or individuals 18 or older with disabilities beginning before age 22. |

| Governing Law | This form operates under the Social Security Act, specifically Title II, which deals with Federal Old-Age, Survivors, and Disability Insurance. |

Guidelines on Utilizing Ssa 8

Filling out the SSA-8 form is an important step in applying for a lump-sum death payment from Social Security. It requires precise information about the deceased and the applicant. Completing this form accurately helps ensure that the application is processed swiftly.

- Print the name of the deceased wage earner clearly in the designated field.

- Select the gender of the deceased by checking either "Male" or "Female."

- Enter the deceased's Social Security number.

- Print your name in the specified area.

- Provide the date of birth of the deceased in the format of month, day, year.

- Enter the date of death in the same format, and specify the place of death (city and state).

- If applicable, indicate whether the deceased ever filed for Social Security benefits. If "Yes," provide names and Social Security numbers of those records; if "No" or "Unknown," proceed to item 6.

- If the deceased worked in the last two years, provide the amounts earned in the year of death and the year before.

- Answer whether the deceased was unable to work due to illness at the time of death and provide the date if applicable.

- Indicate if the deceased served in the military after September 7, 1939, and before 1968, along with service dates.

- State whether the deceased worked in the railroad industry for seven years or more.

- Determine if the deceased engaged in work covered under other countries' social security systems.

- If applicable, provide information about the deceased's surviving spouse or previous marriages.

- List all eligible surviving children meeting the criteria outlined in the form.

- Indicate if a surviving parent was receiving support from the deceased before their death.

- If applicable, indicate if you have filed for benefits on the deceased's earnings record before.

- Provide details about the surviving spouse and their living arrangements at the time of death.

- If you are the surviving spouse, answer about any prior marriages.

- Sign and date the application, providing your contact number and mailing address.

Once the form is completed, submit it to the Social Security Administration. You will receive a receipt confirming that your application has been processed. Expect a response within a few days regarding your claim. Should any further information be necessary, the SSA will reach out to you.

What You Should Know About This Form

What is the SSA-8 form used for?

The SSA-8 form is an application for a lump-sum death payment. This payment is available to eligible survivors or dependents of someone who has passed away and had worked under Social Security. The application must be submitted within two years following the date of death. Additionally, this form can also serve as a request for insurance benefits under the Railroad Retirement Act.

Who is eligible to apply for the SSA-8 form?

Individuals who are eligible to apply include the widow or widower of the deceased, children of the deceased, or in some cases, other dependents. If the deceased was eligible for Social Security benefits but passed away before receiving them, an application can be made on behalf of their survivors to claim these benefits.

What information is needed to complete the SSA-8 form?

To fill out the SSA-8 form, you will need specific information about both the deceased and the applicant. This includes the name, Social Security number, date of birth, and place of death of the deceased. You will also need details about the relationship to the deceased, any prior marriages, and information about children or other dependents. Ensure that you have all relevant information handy to avoid delays in processing.

What happens after I submit the SSA-8 form?

Once your application is submitted, it will be reviewed by the Social Security Administration. They aim to process claims as quickly as possible, often within a few days. However, if additional information is necessary, it might take longer. You will receive a notification about the status of your claim, so it’s important to provide a correct mailing address.

Can I fill out the SSA-8 form online?

Currently, the SSA-8 form cannot be filled out and submitted online. You will need to print the form, complete it, and then mail it to the appropriate Social Security office. It's essential to follow the instructions carefully to ensure that your application is processed without unnecessary delays.

What should I do if I have questions about the SSA-8 form?

If you have any questions about the SSA-8 form or the application process, you can contact your local Social Security office. They are available to help with any inquiries you may have about completing the form or about eligibility for benefits. You can also find information on the Social Security Administration's website.

Common mistakes

When filling out the SSA-8 form, applicants often make mistakes that can lead to delays or complications in receiving benefits. Understanding these common errors is essential to ensure a smoother application process.

One of the most frequent mistakes is not providing accurate information about the deceased. It is crucial to print the correct full name, Social Security number, and even the date and place of death. A small error in these details can cause significant issues in processing the application.

Another common error involves skipping or improperly answering sections of the form. Each question is designed to gather specific information. Failing to answer or marking “Yes” or “No” inconsistently can raise red flags and necessitate additional follow-up, slowing down the process considerably.

A third mistake relates to the income details of the deceased. Item 6 requires accurate figures regarding earnings before death. Misreporting or estimating these amounts can lead to under or over qualification for benefits.

Moreover, not providing information about prior marriages can complicate the claim. Many applicants overlook the necessity of detailing marriages that lasted ten years or more, even if they ended in divorce. This information is important for benefit calculations.

Failing to sign and date the form is another oversight that can derail a claim. Every application must include a signature to verify that the information provided is true. An unsigned form cannot be processed.

Using vague or unclear responses can also be problematic. For instance, in the 'Remarks' section, being specific about any unusual circumstances can aid in the review process. General statements may lead to confusion and delays.

Additionally, applicants often forget to include contact information. Providing a reliable phone number ensures that the Social Security Administration can quickly reach out if further information is needed, expediting the process.

Moreover, not keeping a copy of the completed form for personal records can lead to challenges later. Having a copy allows applicants to refer back to their submissions if questions arise during processing.

Lastly, many individuals fail to check for updates on their claim status. Applicants should be proactive about following up if they don't receive a confirmation in a reasonable timeframe. This vigilance can help prevent unnecessary delays and ensure a timely resolution to their claims.

Documents used along the form

The SSA-8 form, officially known as the Application for Lump-Sum Death Payment, is essential for claimants seeking benefits after the death of a wage earner. To effectively complete the process of applying for benefits, claimants often need additional documentation to support their claims. Below is a list of documents that may accompany the SSA-8, each serving a unique purpose in the application process.

- Death Certificate: This official document verifies the date and cause of death. It is a crucial part of the SSA-8 application as it provides evidence that the deceased has indeed passed away.

- Social Security Card: A copy of the deceased's Social Security card demonstrates their Social Security Number, which is essential for the processing of claims.

- Proof of Relationship: Documents such as marriage certificates or birth certificates are necessary to establish the claimant's relationship to the deceased, especially for surviving spouses or children applying for benefits.

- Tax Returns: Recent tax returns for the deceased may be required to assess income details relevant to the claim, particularly if the deceased worked or earned substantial income before their death.

- Military Service Records: If the deceased served in the military, these records may need to be submitted to determine eligibility for additional benefits associated with military service.

- Prior Benefit Applications: Any previous applications for Social Security benefits made by the deceased can help clarify their benefit history and expedite the current claim.

- Legal Documents: Wills or estate papers can provide necessary information regarding the deceased's financial standing and beneficiaries, which may influence the claims process.

- Direct Deposit Information: To facilitate the deposit of any benefits, claimants may need to include financial institution details, such as a bank statement or account information.

- Identification Proof: The claimant must typically provide identification, such as a driver's license or state ID, to confirm their identity and facilitate the application process.

- Witness Signatures (if applicable): If the SSA-8 form is signed by mark, the signatures and addresses of two witnesses who can confirm the claimant's identity are required.

Preparing these documents in advance can streamline the application process for the lump-sum death payment. Claimants should ensure all information is accurate and complete to avoid delays in processing. Consulting with legal or financial advisors may also be beneficial to navigate this system effectively.

Similar forms

- Form SSA-10: Similar to the SSA-8, this form is used to apply for children's benefits based on a parent's Social Security earnings record. Both forms require information about the deceased and the applicant's relationship to them.

- Form SSA-7: This form is for applying for retirement benefits. It shares the need for personal information about the applicant and the individual whose work record is being used, similar to the SSA-8.

- Form SSA-2: Used to apply for disability benefits, it shares a common goal of determining eligibility based on the deceased’s work record, akin to what the SSA-8 aims to achieve.

- Form SSA-24: This form is for applying for a lump-sum death benefit under certain retirement plans. It involves similar eligibility concerns and documentation requirements as the SSA-8.

- Form SSA-11: It is an application for a representative payee. Both forms require detailed information about the deceased and the applicant's relationship with them to ensure proper eligibility.

- Form 1040: The federal tax return, while not specific to Social Security, requires information regarding the deceased’s financial situation, similar to income reports needed in the SSA-8.

- Form SSA-1724: This is used to apply for a lump-sum death payment when there is more than one potential Payee. Both forms include detailed information regarding dependency and relationships to determine entitlement.

Dos and Don'ts

Filling out the SSA-8 form for a lump-sum death payment can seem daunting, but knowing what to do and what to avoid can make the process smoother. Here are five essential tips.

- DO gather all necessary documents beforehand. Having the deceased’s Social Security number and relevant dates handy will save you time and prevent errors.

- DO read each question carefully. Understanding what is being asked will help you provide accurate information, which is crucial for your application.

- DO use black or blue ink to fill out the form. Clear, legible writing ensures that your application is processed without unnecessary delays.

- DO double-check your information before submission. Verify that names, dates, and numbers are correct to avoid complications later.

- DO submit your application promptly. Remember, the application must be filed within two years of the deceased’s passing.

- DON'T leave any sections blank. If a question doesn’t apply, provide a clear explanation rather than skipping it altogether.

- DON'T rush through the form. Completing it carefully can prevent errors that might result in processing delays.

- DON'T use correction fluid. If you make an error, neatly cross it out and write the correct information above to maintain clarity.

- DON'T ignore the "Remarks" section. Use it to clarify any unique situations or additional information that may be relevant to your application.

- DON'T forget to include your contact information. Ensure you can be reached if the Social Security Administration needs further details.

By following these guidelines, you can more easily navigate the SSA-8 form process while ensuring that the necessary details are accurately presented for consideration.

Misconceptions

Understanding the SSA-8 form is important for those applying for a lump-sum death payment from the Social Security Administration. Unfortunately, there are several misconceptions that can create confusion.

- Misconception 1: The SSA-8 form can be submitted at any time after the death. In reality, this form must be filed within two years of the wage earner's or self-employed person's death. Failing to do so may result in the loss of benefits.

- Misconception 2: Only spouses can apply for benefits using the SSA-8 form. This form can also be used by qualified children or other eligible individuals. It's essential to understand who qualifies to ensure the correct party is applying for the benefits.

- Misconception 3: Completing the SSA-8 guarantees immediate benefits. While this form initiates the process, the payment depends on various factors. The Social Security Administration will review the information and may request additional details before issuing any payments.

- Misconception 4: All information on the form is optional. Many items on the SSA-8 are required. Missing information can delay processing or affect eligibility. It's crucial to fill out the form completely and accurately.

Key takeaways

- Form SSA-8 is used to apply for a one-time lump-sum death payment from the Social Security Administration. The application must be submitted within two years following the wage earner's death.

- Gather all required information about the deceased, including their Social Security number, date of birth, date of death, and place of death, to complete the application accurately.

- It's important to check if the deceased had previously applied for any Social Security benefits or worked in the railroad industry, as this may affect eligibility.

- Provide details about the deceased's earnings, especially if they worked within the two years prior to their death. Be prepared to enter their income from both employment and self-employment.

- If applicable, include information on the deceased's surviving family members, such as a spouse and children, as they may be eligible for benefits based on the deceased's earnings.

- Direct deposit options are available for receiving the lump-sum payment. If preferred, the applicant should provide bank account details to facilitate this.

- After submitting the form, keep a copy of the application and any other relevant documents. This is crucial for tracking the application status or addressing any questions in the future.

Browse Other Templates

Band Set Up Chart - Row 1 will set the stage for your principal musicians.

Is Carpal Tunnel Workers Comp - This form requests specific documentation and project descriptions to minimize misunderstandings.