Fill Out Your St 10 Form

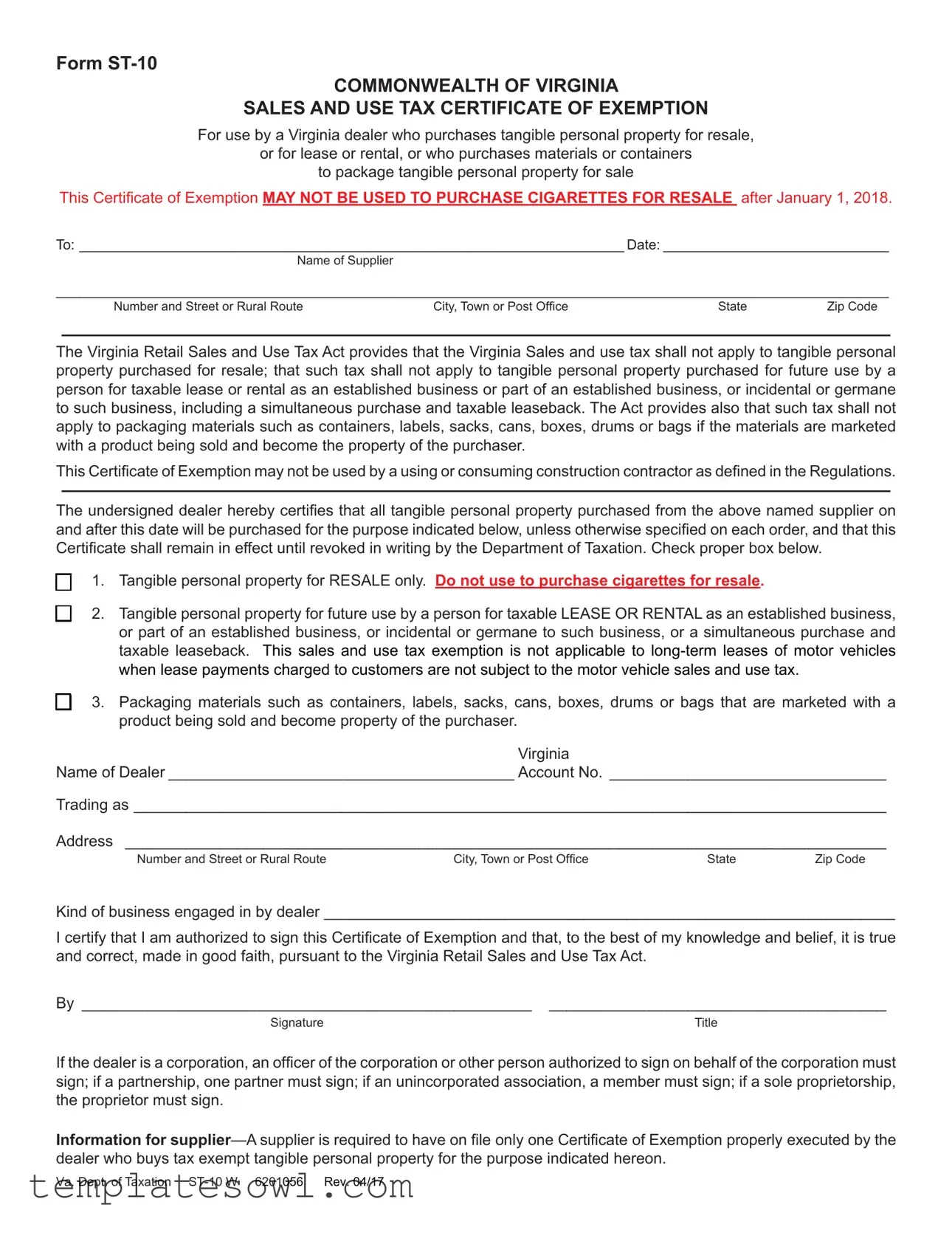

For businesses operating in Virginia, understanding tax exemptions can significantly impact their bottom line. The ST-10 form, known as the Sales and Use Tax Certificate of Exemption, serves as a vital tool for dealers who purchase tangible personal property intended for resale, lease, or rental. This form outlines specific scenarios in which sales and use tax does not apply, such as when items are acquired for resale or when materials are needed for packaging goods that are being sold—provided these containers will become the property of the purchaser. It also clarifies that the certificate cannot be used for purchasing cigarettes for resale, a restriction that has been in effect since January 1, 2018. Additionally, it’s important to note that construction contractors are not permitted to use the ST-10 form to claim exemptions for property they utilize in their ongoing projects. By accurately completing the form and providing the necessary details about the purchase and the business, dealers can enjoy the benefits of tax exemptions while ensuring compliance with Virginia's tax regulations.

St 10 Example

Form

COMMONWEALTH OF VIRGINIA

SALES AND USE TAX CERTIFICATE OF EXEMPTION

For use by a Virginia dealer who purchases tangible personal property for resale,

or for lease or rental, or who purchases materials or containers

to package tangible personal property for sale

This Certiicate of Exemption MAY NOT BE USED TO PURCHASE CIGARETTES FOR RESALE after January 1, 2018.

To: ______________________________________________________________________ Date: _____________________________

Name of Supplier

___________________________________________________________________________________________________________

Number and Street or Rural Route |

City, Town or Post Ofice |

State |

Zip Code |

The Virginia Retail Sales and Use Tax Act provides that the Virginia Sales and use tax shall not apply to tangible personal property purchased for resale; that such tax shall not apply to tangible personal property purchased for future use by a person for taxable lease or rental as an established business or part of an established business, or incidental or germane to such business, including a simultaneous purchase and taxable leaseback. The Act provides also that such tax shall not apply to packaging materials such as containers, labels, sacks, cans, boxes, drums or bags if the materials are marketed

with a product being sold and become the property of the purchaser.

This Certiicate of Exemption may not be used by a using or consuming construction contractor as deined in the Regulations.

The undersigned dealer hereby certiies that all tangible personal property purchased from the above named supplier on and after this date will be purchased for the purpose indicated below, unless otherwise speciied on each order, and that this Certiicate shall remain in effect until revoked in writing by the Department of Taxation. Check proper box below.

c

c

1.Tangible personal property for RESALE only. Do not use to purchase cigarettes for resale.

2.Tangible personal property for future use by a person for taxable LEASE OR RENTAL as an established business,

or part of an established business, or incidental or germane to such business, or a simultaneous purchase and taxable leaseback. This sales and use tax exemption is not applicable to

c3. Packaging materials such as containers, labels, sacks, cans, boxes, drums or bags that are marketed with a product being sold and become property of the purchaser.

Virginia

Name of Dealer ________________________________________ Account No. ________________________________

Trading as _______________________________________________________________________________________

Address ________________________________________________________________________________________

Number and Street or Rural RouteCity, Town or Post OficeStateZip Code

Kind of business engaged in by dealer __________________________________________________________________

I certify that I am authorized to sign this Certiicate of Exemption and that, to the best of my knowledge and belief, it is true and correct, made in good faith, pursuant to the Virginia Retail Sales and Use Tax Act.

By ____________________________________________________ |

_______________________________________ |

Signature |

Title |

If the dealer is a corporation, an oficer of the corporation or other person authorized to sign on behalf of the corporation must sign; if a partnership, one partner must sign; if an unincorporated association, a member must sign; if a sole proprietorship, the proprietor must sign.

Information for

Va. Dept. of Taxation

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The ST-10 form is a Sales and Use Tax Certificate of Exemption used by Virginia dealers. It allows them to purchase tangible personal property for resale, lease, or rental without incurring sales tax. |

| Restrictions on Use | This certificate cannot be used to purchase cigarettes for resale as of January 1, 2018. It is essential to comply with this regulation to avoid penalties. |

| Tax Exemption Principles | The Virginia Retail Sales and Use Tax Act acknowledges that certain purchases of tangible personal property are exempt from sales tax. This includes property purchased for resale and packaging materials that become the buyer's property. |

| Validity | The Certificate of Exemption remains valid until it is revoked in writing by the Virginia Department of Taxation. Dealers should ensure their certificates are current to avoid issues. |

| Required Signatures | For the form to be valid, an authorized person must sign it, indicating that they have the authority to certify its accuracy. This may be a corporate officer, partner, or proprietor depending on the business structure. |

Guidelines on Utilizing St 10

Follow these steps to properly fill out the St 10 form. It is important to ensure that all the information you provide is accurate and complete to avoid any issues with your exemption request.

- Begin by entering the name of your supplier in the designated space.

- Add the address of your supplier, including the number and street, city or town, state, and zip code.

- Fill in the date on which you complete the form.

- Indicate your purpose for the exemption by checking the appropriate box:

- 1. For tangible personal property intended for resale.

- 2. For tangible personal property for lease or rental for your established business.

- 3. For packaging materials that will be included with the product being sold.

- Complete the dealer's information section:

- Provide the name of the dealer.

- Enter your account number.

- List any trade name under which you operate.

- Fill in your business address, including the number and street, city or town, state, and zip code.

- Describe the kind of business you are engaged in.

- Sign the form where indicated. Include your title beneath your signature.

After completion, ensure you keep a copy for your records. Submit the form to your supplier. This process completes your certification of exemption under the Virginia Retail Sales and Use Tax Act.

What You Should Know About This Form

What is the purpose of the ST-10 form in Virginia?

The ST-10 form, officially known as the Sales and Use Tax Certificate of Exemption, allows Virginia dealers to purchase tangible personal property without paying sales tax. This form is specifically for items meant for resale, leasing, or rental, as well as packaging materials that become the property of the purchaser when sold with a product. It's important to note that this certificate cannot be used for purchasing cigarettes for resale, effective January 1, 2018.

Who is eligible to use the ST-10 form?

Only Virginia dealers engaged in business are eligible to use the ST-10 form. This includes businesses that plan to sell, lease, or rent tangible goods. It can also apply to those purchasing materials or containers for packaging products. However, construction contractors who consume or use tangible personal property in their operations cannot use this certificate. It’s essential that the dealer accurately certifies their eligibility before utilizing this form.

How long is the ST-10 form valid?

The ST-10 form remains in effect until it is revoked in writing by the Virginia Department of Taxation. Dealers are responsible for notifying their suppliers if the certificate is no longer valid. As long as it’s active, dealers can use it for qualifying purchases without incurring sales tax. If any changes occur regarding the purpose of the purchases, those must be documented on each order.

What happens if a dealer misuses the ST-10 form?

Misuse of the ST-10 form can lead to serious consequences. If a dealer uses the certificate for items that don’t qualify for the exemption, they may be liable for unpaid sales tax, along with potential penalties and interest. Additionally, repeated misuse may result in a revocation of the ability to use the ST-10 form for future purchases. Dealers should ensure compliance with all regulations and use the form correctly to avoid complications.

Common mistakes

Completing the ST-10 form properly is essential for dealers in Virginia to benefit from sales and use tax exemptions. Yet, many individuals make common mistakes when filling it out that can lead to confusion or even denial of their exemptions. Understanding these pitfalls can make the process smoother and more efficient.

One frequent mistake occurs when individuals do not accurately describe the type of business they are engaged in. The form requires a clear and concise explanation of the business operations, and vague descriptions can raise red flags. Providing enough detail not only demonstrates transparency but also aligns the exemption purpose with the actual business activity, which is crucial for approval.

Another common error involves failing to specify the purpose of the purchase by not checking the appropriate box. The ST-10 form includes precise categories for resale, future use in leasing, and packaging materials. Skipping this step or marking the wrong category can render the exemption invalid. It’s important to take a moment and thoroughly assess the nature of each purchase to ensure the correct checkbox is marked.

Additionally, many people overlook the requirement for appropriate signatures on the form. The ST-10 cannot be accepted if it is not signed by an authorized person. This means that if the dealer is a corporation, an officer must sign; if it's a partnership, one partner must take responsibility. Failing to provide a valid signature is an easy yet crucial oversight that can impact the legitimacy of the exemption.

Furthermore, individuals often neglect to provide an accurate date on the form. The date is necessary as it establishes a timeline for when the exemption is valid. An incorrect or missing date can create complications if the Department of Taxation needs to reference the timing of the exemption. It only takes a moment to ensure the date is filled in correctly, but it can save a lot of hassle down the road.

Lastly, a common error is not retaining a copy of the completed form for their own records. Keeping a copy ensures there is a reference point in case of questions or audits from the tax authorities. This simple step can provide peace of mind and assist in future transactions, reinforcing the importance of organization in tax matters.

In conclusion, avoiding these mistakes when completing the ST-10 form can significantly streamline the process of applying for sales and use tax exemptions. By being mindful of the details -- from the business description and checkbox selection to signatures, dates, and record retention -- dealers can take proactive steps towards compliance and efficiency.

Documents used along the form

When dealing with sales and use tax exemptions, the ST-10 form plays a crucial role for Virginia dealers. However, there are several other forms and documents that may accompany it, ensuring compliance with tax regulations and supporting the dealer's transactions. Below is a summary of commonly used documents relevant to the ST-10 form.

- Form ST-9: This is the Virginia Sales and Use Tax Exemption Certificate for direct purchases of tangible personal property. It allows buyers to claim exemptions on various tax-exempt purchases, simplifying the process of managing tax liability.

- Form ST-13: This form is a Certificate of Exemption for Nonprofit Organizations. Qualified nonprofit organizations use it to purchase items tax-exempt, so long as their purchases fall under qualifying uses.

- Form ST-12: Specifically designed for governmental entities, this form provides a means for these organizations to purchase goods and services without paying sales tax, reflecting their tax-exempt status.

- Form ST-14: This is used by manufacturers to obtain a sales tax exemption on materials used in production. It helps streamline the procurement of production materials without incurring sales tax.

- Form ST-15: This document applies to purchases of certain types of machinery and equipment used directly in manufacturing. It allows manufacturers to purchase these essential items without paying sales tax, supporting their operations.

- Form ST-18: A declaration for items sold in interstate commerce, this form allows businesses to claim exemptions for tangible personal property that is shipped directly out of Virginia.

- Form ST-4: This form serves as a basis for non-taxable transactions involving certain services or tangible personal property, allowing businesses to document exemptions clearly.

- Form ST-16: Focused on the resale of tangible property, this form helps verify that property purchased will be resold, thus exempting it from sales tax, promoting economic activity.

- Form ST-2: This serves as a resale certificate allowing dealers to purchase goods intended for resale without incurring sales tax, ensuring that taxes are only paid by the end consumer.

These forms each have their unique purposes, but collectively, they facilitate smoother transactions for businesses while ensuring compliance with Virginia’s sales and use tax laws. Proper documentation helps maintain transparency and supports the legitimacy of tax-exempt purchases.

Similar forms

The Form ST-10 is a critical tool for Virginia dealers, allowing them to make tax-exempt purchases of tangible personal property under specific circumstances. Several other documents provide similar functions, offering exemptions based on different contexts. Here’s a list of eight documents similar to the ST-10 form:

- Form ST-11: This form is used by non-profits in Virginia to claim exemption from sales tax. Like the ST-10, it allows for tax-free purchases, but specifically for items sold or used in charitable activities.

- Form ST-12: This document serves as an exemption certificate for manufacturers in Virginia, allowing them to purchase materials tax-free. Similar to the ST-10, it requires the buyer to certify that the materials will be used in tax-exempt production.

- Form ST-13: Used by governmental entities, this form provides an exemption for sales tax when acquiring goods and services. Like the ST-10, it requires the buyer to declare that the purchases are for official use.

- Form ST-14: This is an exemption certificate for direct mail. It allows companies that provide direct mail services to make tax-exempt purchases under the condition that the goods are used exclusively to produce direct mail.

- Form ST-15: Similar to the ST-10, this form is issued for purchases by qualified agricultural growers. It permits tax-free acquisition of tangible personal property used directly in farming operations.

- Form ST-16: This exemption certificate is intended for utilities in Virginia. It allows suppliers of water and certain utility services to purchase equipment necessary for their operations without incurring sales tax.

- Form ST-17: This form is designed for certain organizations that operate in Virginia, allowing them to buy goods and services without sales tax if the purchases are related to their exempt activities.

- Form ST-18: Retailers use this document to purchase inventory tax-free for resale. Just as with the ST-10, the ST-18 requires a certification to substantiate the exempt purpose of the purchases.

Each of these exemption forms shares the basic principle of allowing specific groups to purchase goods without the burden of sales tax, while also requiring a certification process to ensure compliance with Virginia's tax laws.

Dos and Don'ts

When filling out the ST-10 form, attention to detail is crucial. Here’s a list of what you should and shouldn’t do:

- Do provide accurate information in all sections of the form.

- Don’t leave any required fields blank.

- Do clearly indicate the type of property for which the exemption is being claimed.

- Don’t use the form to purchase items that are not eligible for tax exemption.

- Do sign the form on behalf of your company or business type.

- Don’t forget to include your account number to ensure proper identification.

- Do ensure that the form is dated properly.

- Don’t use the ST-10 form for purchasing cigarettes for resale.

- Do keep a copy of the completed form for your records.

- Don’t submit the form without verifying all provided information is correct.

Misconceptions

- Misconception 1: The ST-10 form can be used for any purchase.

- Misconception 2: Cigarettes can be purchased using the ST-10 form.

- Misconception 3: Any entity can use the ST-10 form without restrictions.

- Misconception 4: The ST-10 form is valid indefinitely once submitted.

- Misconception 5: You can purchase any type of containers or packaging materials with the ST-10 form.

- Misconception 6: There are no penalties for incorrectly using the ST-10 form.

In reality, the ST-10 form is specifically for buying tangible personal property for resale or lease. It cannot be used for purchases outside these categories.

This is incorrect. The form explicitly states that it may not be used to purchase cigarettes for resale after January 1, 2018.

Only Virginia dealers who purchase tangible personal property for the specified purposes can use this form. Construction contractors cannot use it for materials they will consume in their activities.

This is misleading. The certificate remains in effect until it is revoked in writing by the Department of Taxation.

This form only applies to packaging materials that are marketed with a product being sold. It must become the property of the purchaser as part of the transaction.

Incorrect use can lead to penalties and taxes owed. It’s essential to understand the limitations and conditions of the certificate to avoid issues with the tax authorities.

Key takeaways

The ST-10 form is essential for Virginia dealers, allowing them to purchase tangible personal property without incurring sales tax, provided the items are intended for resale or specific business uses.

Dealers must clearly indicate the purpose of each purchase by checking off the appropriate box on the form. It is crucial to provide accurate information, as this helps ensure compliance with the Virginia Retail Sales and Use Tax Act.

This certificate remains in effect until the Virginia Department of Taxation explicitly revokes it in writing. Dealers should keep track of their exemptions to avoid complications in future transactions.

It is important to note that the ST-10 form cannot be used for purchasing cigarettes for resale, a restriction that has been in place since January 1, 2018.

Browse Other Templates

3613-a - Designed specifically for various care facilities, this form supports reporting incidents.

Florida Accident Report - Captures insurance company name and policy number for claims.

Cadet Command Regulations - The ROTC program relies on this form for student academic support.