Fill Out Your St 105 Indiana Form

The St 105 Indiana form, officially known as the General Sales Tax Exemption Certificate, plays a crucial role for businesses registered in Indiana and those located outside the state. It enables eligible purchasers to claim exemptions from Indiana sales tax on qualifying purchases. To successfully use this form, the purchaser must complete all required sections, providing their identification number, detailed descriptions of the items being purchased, and the specific reasoning for the exemption. However, it is essential to note that this certificate cannot be issued for certain purchases, including utilities, vehicles, watercraft, or aircraft. The purchaser also needs to be properly registered with the Indiana Department of Revenue or the relevant taxing authority in their home state. If all required fields are not filled out completely, the seller is bound to charge sales tax. Besides the sales tax exemption, the St 105 form serves as an exemption certificate for other local taxes, including the county innkeeper’s tax and local food and beverage tax. Individuals and businesses must understand the implications of misuse of the certificate, as it could lead to significant tax liabilities and penalties for both the purchaser and their affiliated business entity.

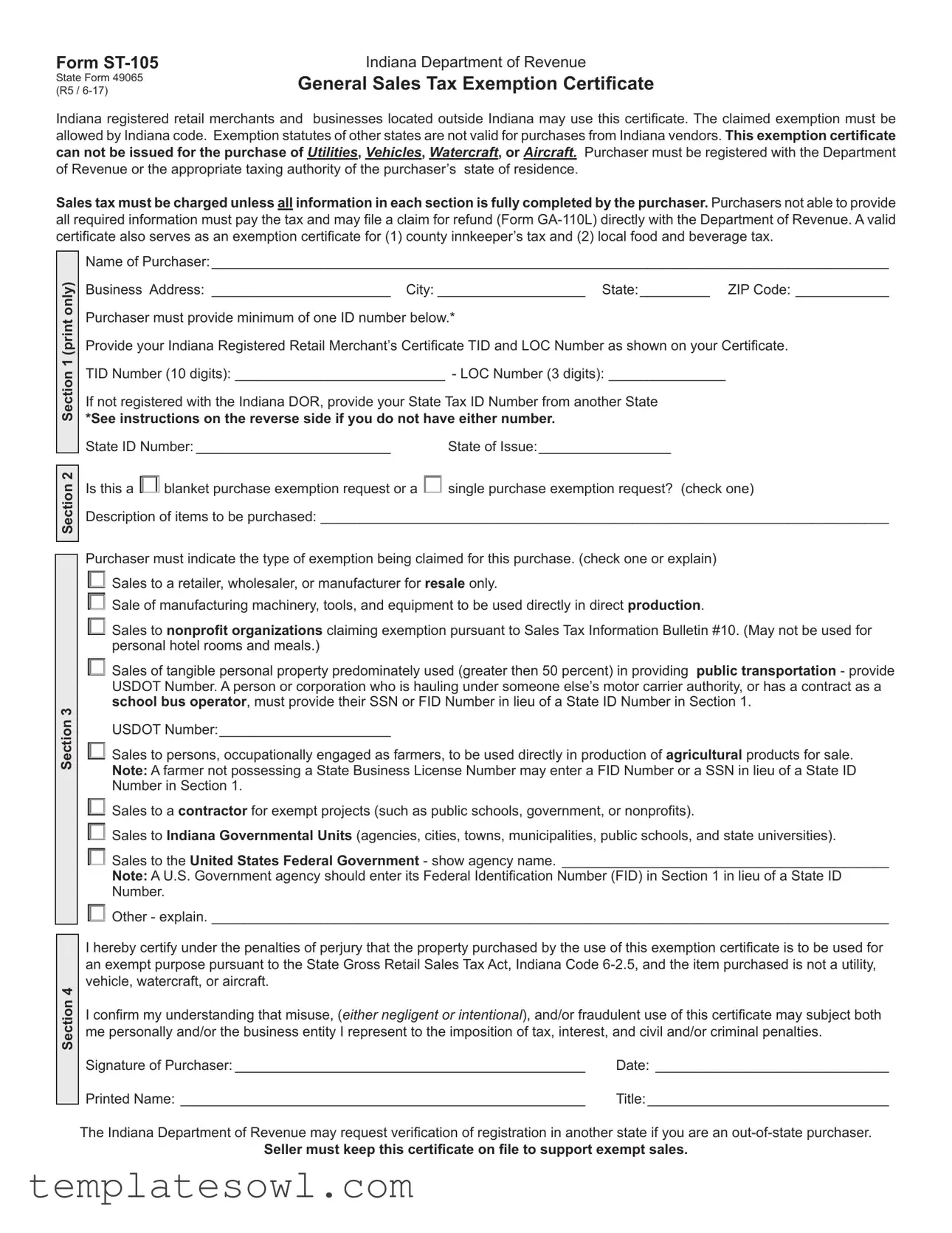

St 105 Indiana Example

Form |

Indiana Department of Revenue |

(R5 / |

General Sales Tax Exemption Certificate |

State Form 49065 |

|

Indiana registered retail merchants and businesses located outside Indiana may use this certificate. The claimed exemption must be allowed by Indiana code. Exemption statutes of other states are not valid for purchases from Indiana vendors. This exemption certificate can not be issued for the purchase of Utilities, Vehicles, Watercraft, or Aircraft. Purchaser must be registered with the Department of Revenue or the appropriate taxing authority of the purchaser’s state of residence.

Sales tax must be charged unless all information in each section is fully completed by the purchaser. Purchasers not able to provide all required information must pay the tax and may file a claim for refund (Form

Section 2 Section 1 (print only)

Section 2 Section 1 (print only)

Section 3

Section 4

Name of Purchaser:________________________________________________________________________________________

Business Address:_ _______________________ City:____________________ State:__________ ZIP Code:_____________

Purchaser must provide minimum of one ID number below.*

Provide your Indiana Registered Retail Merchant’s Certificate TID and LOC Number as shown on your Certificate.

TID Number (10 digits):____________________________ - LOC Number (3 digits):________________

If not registered with the Indiana DOR, provide your State Tax ID Number from another State

*See instructions on the reverse side if you do not have either number.

State ID Number:__________________________ |

State of Issue:_________________ |

Is this a □blanket purchase exemption request or a □single purchase exemption request? (check one)

Description of items to be purchased:__________________________________________________________________________

□must indicate the type of exemption being claimed for this purchase. (check one or explain)

□Sales to a retailer, wholesaler, or manufacturer for resale only.

□Sale of manufacturing machinery, tools, and equipment to be used directly in direct production.

Sales to nonprofit organizations claiming exemption pursuant to Sales Tax Information Bulletin #10. (May not be used for

□personal hotel rooms and meals.)

Sales of tangible personal property predominately used (greater then 50 percent) in providing public transportation - provide USDOT Number. A person or corporation who is hauling under someone else’s motor carrier authority, or has a contract as a school bus operator, must provide their SSN or FID Number in lieu of a State ID Number in Section 1.

□USDOT Number:______________________

Sales to persons, occupationally engaged as farmers, to be used directly in production of agricultural products for sale. Note: A farmer not possessing a State Business License Number may enter a FID Number or a SSN in lieu of a State ID

□Number in Section 1.

□Sales to a contractor for exempt projects (such as public schools, government, or nonprofits).

□Sales to Indiana Governmental Units (agencies, cities, towns, municipalities, public schools, and state universities).

Sales to the United States Federal Government - show agency name._ __________________________________________

Note: A U.S. Government agency should enter its Federal Identification Number (FID) in Section 1 in lieu of a State ID

□Number. Other - explain.________________________________________________________________________________________Purchaser

I hereby certify under the penalties of perjury that the property purchased by the use of this exemption certificate is to be used for an exempt purpose pursuant to the State Gross Retail Sales Tax Act, Indiana Code

I confirm my understanding that misuse, (either negligent or intentional), and/or fraudulent use of this certificate may subject both me personally and/or the business entity I represent to the imposition of tax, interest, and civil and/or criminal penalties.

Signature of Purchaser:______________________________________________ |

Date:_ ______________________________ |

Printed Name:_____________________________________________________ |

Title:________________________________ |

The Indiana Department of Revenue may request verification of registration in another state if you are an

Seller must keep this certificate on file to support exempt sales.

Instructions for Completing Form

All four sections of the

Section 1

A)This section requires an identification number. In most cases this number will be an Indiana Department of Revenue issued Taxpayer Identification Number (TID - see note below) used for Indiana sales and/or withholding tax reporting. If the purchaser is from another state and does not possess an Indiana TID Number, a resident state’s business license, or State issued ID Number must be provided.

B)Exceptions - For a purchaser not possessing either an Indiana TID Number or another State ID Number, the following may be used in lieu of this requirement.

Federal Government – place your FID Number in the State ID Number space. Farmer – place your SSN or FID Number in the State ID Number space.

Public transportation haulers operating under another motor carrier authority, or with a contract as a school bus operator, must indicate their SSN or FID Number in the State ID Number space.

Nonprofit Organization – must show its FID Number in the State ID Number space.

Section 2

A)Check a box to indicate if this is a single purchase or blanket exemption.

B)Describe product being purchased.

Section 3

A)Purchaser must check the reason for exemption.

B)Purchaser must be able to provide additional information if requested.

Section 4

A)Purchaser must sign and date the form.

B)Printed name and title of signer must be shown.

Note: The Indiana Taxpayer Identification Number (TID) is a ten digit number followed by a three digit LOC Number. The TID is also known as the following:

a)Registered Retail Merchant Certificate

b)Tax Exempt Identification Number

c)Sales Tax Identification Number

d)Withholding Tax Identification Number

The Registered Retail Merchant Certificate issued by the Indiana Department of Revenue shows the TID (10 digits) and the LOC (3 digits) at the top right of the certificate.

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The ST-105 form serves as a General Sales Tax Exemption Certificate in Indiana. It allows registered retail merchants and qualifying businesses to claim exemptions from sales tax for eligible purchases. |

| Validity Conditions | For this exemption to be valid, all sections of the ST-105 must be fully completed. Failure to provide complete information may result in the seller being responsible for collecting sales tax. |

| Exempt Items | This exemption does not apply to purchases of utilities, vehicles, watercraft, or aircraft. These items remain taxable regardless of the purchaser's exempt status. |

| Applicable Laws | The use of the ST-105 form is governed by the Indiana Code 6-2.5, which outlines Sales and Use Tax provisions in the state. |

| Out-of-State Purchasers | Businesses located outside Indiana must also register with the Indiana Department of Revenue to use this exemption form. Verification may be required for out-of-state purchasers. |

| Penalties for Misuse | Misuse of the ST-105 exemption certificate, whether negligent or intentional, may lead to significant consequences. These can include tax liabilities, interest, and even civil or criminal penalties against the purchaser and the business entity. |

Guidelines on Utilizing St 105 Indiana

To fill out the St 105 form from Indiana, it's essential to provide accurate details about your business and the specific purchase(s) in question. Every section needs to be completed properly for the exemption to be valid. Failing to do so means that sales tax will be applied, and you would need to file a claim for a refund later. Gather all necessary information before starting the form to ensure a smooth process.

- Section 1: Purchaser Information

- Enter the Name of Purchaser.

- Fill in the Business Address, including city, state, and ZIP code.

- Provide an identification number. You have two options:

- If you have an Indiana Registered Retail Merchant's Certificate, enter your TID Number (10 digits) and LOC Number (3 digits).

- If you are from out of state and don’t have an Indiana TID, enter your State Tax ID Number along with the State of Issue.

- Indicate whether this is a blanket purchase exemption request or a single purchase exemption request by checking the appropriate box.

- Section 2: Description of Items

- Provide a detailed description of the items you will purchase.

- Section 3: Reason for Exemption

- Check the box that corresponds to the reason for your tax exemption. Options include:

- Sales to retailers, wholesalers, or manufacturers for resale only.

- Sale of manufacturing machinery, tools, and equipment for direct production.

- Sales to nonprofit organizations with the proper exemption status.

- Sales to contractors for exempt projects.

- Sales to governmental units or the United States Federal Government (provide agency name).

- Explain any other exemptions if applicable.

- Section 4: Certification

- Sign and date the form. This confirms your certification under penalties of perjury.

- Print your name and title clearly following your signature.

Ensure that you check all sections for completeness. Each section carries critical details that are necessary for validating the exemption. After filling out the form, keep a copy for your records and submit it to the seller, who must keep it on file to support any exempt sales they conduct.

What You Should Know About This Form

What is the ST-105 Indiana form used for?

The ST-105 Indiana form is a General Sales Tax Exemption Certificate. It allows Indiana registered retail merchants and businesses located outside Indiana to make purchases without paying sales tax, as long as the items qualify under Indiana law. Notably, the exemption cannot be applied to certain purchases such as utilities, vehicles, watercraft, or aircraft. The form serves a vital function, enabling eligible businesses to save on taxes for qualifying sales.

Who is eligible to use the ST-105 form?

Eligibility for using the ST-105 form is primarily directed towards Indiana registered retail merchants and businesses that are registered with the appropriate taxing authority in their own state. To qualify, the purchaser must ensure that the exemption being claimed is supported by Indiana code. Businesses not registered in Indiana but operating legally in their home state may also use this form, provided they can supply their State Tax ID number.

What information must be completed on the ST-105 form?

All four sections of the ST-105 form must be fully completed to ensure the exemption is valid. Section 1 requires an identification number, typically your Indiana Taxpayer Identification Number (TID). If you are from another state, your State Tax ID number will suffice. Additionally, you must indicate whether you are requesting a blanket exemption or a single purchase exemption. In Section 2, you describe the items to be purchased. Section 3 focuses on confirming the reason for claiming the exemption. Finally, Section 4 mandates your signature and printed name, along with your title, to validate the form.

What happens if the ST-105 form is incomplete or incorrect?

If the ST-105 form is not completely filled out, the sales tax is to be charged. It is crucial to provide all necessary information to avoid any tax implications. If a purchaser cannot submit all required details at the time of the purchase, they must pay the sales tax and may subsequently file for a refund using Form GA-110L with the Department of Revenue. Ensuring accuracy on this form can save both time and financial resources.

Can the ST-105 form be used for other taxes?

Yes, a valid ST-105 certificate serves as an exemption for both county innkeeper’s tax and local food and beverage tax as well, provided it is completed correctly. This additional benefit further emphasizes the importance of this form to businesses that engage in activities that may incur these specific taxes.

Common mistakes

Completing the ST-105 Indiana form is crucial for businesses and individuals seeking sales tax exemptions. Many make mistakes that can lead to delays or invalid exemptions. One common error occurs when purchasers fail to provide complete identification numbers. Section 1 requires both an Indiana Taxpayer Identification Number (TID) and a Local Operating Certificate (LOC) number. If these are not filled out correctly, the exemption cannot be granted.

Another mistake involves not checking the appropriate exemption type. In Section 2, purchasers must identify whether the request is for a blanket exemption or a single purchase exemption. Omitting this information can cause confusion, as sellers rely on this detail to process the transaction appropriately.

Sometimes, individuals do not accurately describe the items they intend to purchase. Section 2 includes a space for a brief description of the items. Failing to provide this detail or being vague about the product can hinder the exemption process. It's essential to be clear about what is being purchased to ensure validity.

Many purchasers also overlook the necessity of indicating the reason for exemption in Section 3. This section requires selecting the appropriate checkbox that matches the intended use of the purchase. If this is not completed, the seller may reject the exemption, resulting in unnecessary tax charges.

Another frequent oversight is related to the signature and date in Section 4. Purchasers must sign and date the form to certify the information provided. Neglecting to do so can invalidate the certificate, leaving the purchaser responsible for sales tax.

Lastly, there is a misunderstanding regarding the information provided by out-of-state purchasers. Those not registered with the Indiana Department of Revenue should still check the requirements in Section 1. Providing a state tax ID number from their state is essential, as many erroneously assume their home state's documentation suffices. Without this adherence, the exemption might not hold up under scrutiny.

Documents used along the form

Purchasing in Indiana often requires several important forms for proper documentation and tax exemption. Along with the ST-105 Indiana form, there are other crucial documents that businesses may need to complete transactions smoothly. Understanding these forms and their purposes is key for both buyers and sellers to ensure compliance with tax regulations.

- Form GA-110L: This is the claim for refund form, allowing purchasers who have paid sales tax to seek reimbursement from the Indiana Department of Revenue if they meet the requirements for an exemption.

- Registered Retail Merchant Certificate: This certificate is essential for businesses, showing that they are authorized to collect sales tax. It includes the Taxpayer Identification Number, which is often needed on the ST-105 form.

- Form ST-105-M: This is a multi-state exemption certificate tailored for Indiana. Businesses operating in multiple states can use this form to claim tax exemptions on purchases made across state lines.

- Form ST-117: This form can be used for sales to exempt organizations, such as nonprofits. It requires detailed information about the organization claiming the exemption.

- Form ST-136: This form allows for the exemption of purchases used directly in manufacturing or production. It is often used by manufacturers to document tax-exempt purchases.

- Form ST-103: This is the exemption certificate used for certain sales of tangible personal property. It is designed for specific situations where sales tax does not apply.

- Form ST-108: This form is utilized for claiming a refund or credit for Indiana sales or use taxes paid in error. Businesses must provide adequate proof with this submission.

- Indiana Department of Revenue Business Registration: This registration shows that a business is compliant and recognized by the state, enabling them to engage in taxable sales without issues.

- Sales Tax Exemption Letter: Some organizations may require a letter from the Department of Revenue that specifically states their exempt status. This can aid in clarifying tax obligations when making purchases.

- Form ST-105-C: This form addresses providing exemptions for specific categories of sales, such as resales by wholesalers or sales for direct public transportation needs.

Staying informed about these documents is essential for anyone involved in sales and purchases in Indiana. Missing any required form can lead to complications, including potentially incurring liabilities. Therefore, ensure that all necessary documentation is completed correctly and retained for future reference.

Similar forms

-

Form ST-101: Indiana Sales Tax Exemption Certificate - Similar to Form ST-105, this certificate allows certain entities to purchase goods without paying sales tax. It is primarily used for purchases related to resale and has similar requirements regarding identification numbers.

-

Form ST-108: Indiana Exempt Use Certificate - This form certifies that the buyer is exempt from sales tax for specific purchases related to manufacturing. Like ST-105, it requires the purchaser to provide a valid tax identification number to qualify for the exemption.

-

Form ST-103: Indiana Sales Tax Exemption Certificate for Governmental Units - This form is similar because it allows governmental units to purchase goods free of sales tax. Identification requirements align with those found in the ST-105 form.

-

Form GA-110L: Indiana Claim for Refund - This form is related to ST-105 in that it can be issued if a purchaser did not complete the exemption certificate fully and paid sales tax. Claiming a refund requires similar information about the transaction.

-

Form ST-116: Indiana Sales Tax Exemption for Nonprofit Organizations - Nonprofits can use this form to purchase items without paying sales tax, mirroring the provisions of Form ST-105 in terms of required documentation and identification numbers.

-

Form ST-104: Indiana Sales Tax Exemption for Farmers - This form serves farmers specifically, allowing them to be exempt from sales tax on certain agricultural purchases, much like how ST-105 provides exemptions for specific buyer categories.

-

Form ST-109: Indiana Manufacturer's Exemption Certificate - Used by manufacturers to purchase materials without sales tax, this form similarly necessitates detailed identification, emphasizing proper use and potential penalties for misuse.

Dos and Don'ts

When filling out the ST-105 Indiana form, it’s essential to get it right. Here are important dos and don’ts to consider:

- Do complete all four sections of the form.

- Do provide your Indiana Registered Retail Merchant’s Certificate TID and LOC Number if you are registered in Indiana.

- Do check the box indicating whether you are applying for a blanket or single purchase exemption.

- Do describe the items you intend to purchase accurately and clearly.

- Do sign and date the form, and print your name and title below your signature.

- Don’t leave any section incomplete; missing details may invalidate your exemption.

- Don’t use this form for the purchase of utilities, vehicles, watercraft, or aircraft.

- Don’t rely on exemption statutes from other states when making purchases in Indiana.

- Don’t submit the form without the necessary identification numbers, as this could lead to automatic sales tax charges.

Misconceptions

Understanding the ST-105 Indiana form is essential for any business looking to take advantage of sales tax exemptions. However, several misconceptions can lead to confusion and potentially costly mistakes. Here’s a list of six common misconceptions about this form:

- Misconception 1: It can be used for any purchase.

- Misconception 2: You can submit the form without all required information.

- Misconception 3: This certificate works for exemptions from other states.

- Misconception 4: It’s valid for perpetual purchases.

- Misconception 5: Anyone can fill out the form.

- Misconception 6: A valid certificate removes all liability.

This is not true. The ST-105 form is specifically for certain exempt purchases only. It can’t be used for utilities, vehicles, watercraft, or aircraft.

Incomplete forms are invalid. Sales tax must be charged unless every section of the ST-105 is fully completed.

That is incorrect. Only exemptions recognized by Indiana law apply here. Out-of-state exemption statutes do not hold up for purchases made with Indiana vendors.

This form allows for either a blanket exemption or a single purchase exemption, but it must clearly state the type being requested.

The purchaser must be registered with the Indiana Department of Revenue, or possess the appropriate identification number of their home state.

Misuse of the ST-105, whether willful or negligent, can lead to both the individual and the business facing potential tax liabilities and penalties.

Being aware of these misconceptions can help ensure that the ST-105 is used accurately and effectively, protecting your business from unnecessary issues.

Key takeaways

When it comes to using the ST-105 form in Indiana, there are several important points to remember. This form serves as a General Sales Tax Exemption Certificate, which allows certain purchases to be exempt from sales tax. Here are six key takeaways:

- Eligibility is Key: Only Indiana registered retail merchants and businesses from other states can use this certificate. If you're purchasing from Indiana vendors, make sure your exemption meets Indiana code requirements.

- Restrictions on Purchases: The ST-105 cannot be used for specific items such as utilities, vehicles, watercraft, or aircraft. Always check if your intended purchase falls into one of these restricted categories.

- Complete Information: Ensure you fill out all sections of the form completely. Incomplete information may lead to the seller charging sales tax, meaning you could end up paying more than you intended.

- Types of Exemptions: Be clear about the type of exemption you are claiming. Whether it’s for resale, manufacturing, or agricultural purposes, select the appropriate option and provide a description of the items being purchased.

- Sign and Certify: The form must be signed and dated by the purchaser. This is not just a formality; signing certifies that the purchase is for an exempt purpose and acknowledges the potential penalties for misuse.

- Keep Records: Sellers should maintain a copy of the ST-105 on file to support exempt sales. This is crucial for compliance and may help avoid complications in the event of an audit.

By being mindful of these key points, you can navigate the ST-105 form effectively and ensure your purchases in Indiana are handled correctly.

Browse Other Templates

Florida Divorce Financial Affidavit - Consult with a legal expert if unsure about how to accurately report your financial data.

MN Crash Inquiry Form,Minnesota Incident Documentation Form,Minnesota Vehicle Collision Report,MN Traffic Accident Worksheet,Minnesota Road Safety Report,Minnesota Auto Incident Form,Driver Accident Submission Form,MN Accident Details Form,Minnesota - Filling out the accident report forms accurately is essential for legal purposes.