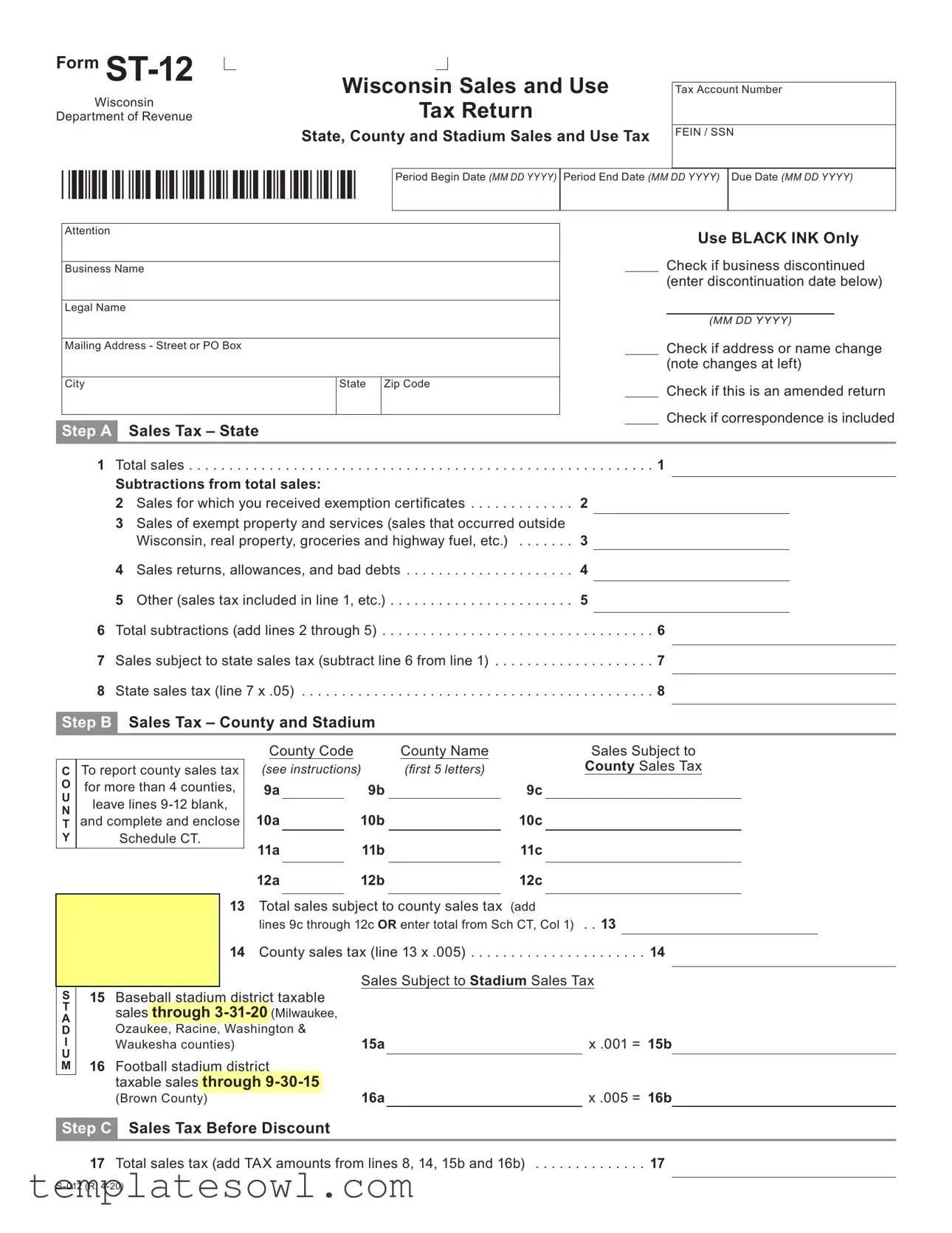

Fill Out Your St 12 Form

The ST-12 form is an essential document for businesses operating in Wisconsin, specifically for reporting sales and use taxes to the state Department of Revenue. This form encompasses various key elements that allow businesses to accurately account for their taxable sales during a specific reporting period. It includes sections for recording total sales, subtractions from those sales such as exemptions or returns, and the calculation of state and county sales taxes. Additionally, the form provides spaces for reporting any purchases subject to use tax, thus ensuring that both sales and use tax obligations are fulfilled. The ST-12 also captures crucial information such as the business's name, address, tax account number, and contact details. As you navigate the form, it’s important to note options like indicating name changes or discontinuing business operations. Completing this form accurately is vital to avoid penalties, and understanding its layout can significantly streamline the filing process for businesses involved in Wisconsin's commerce.

St 12 Example

Form |

|

|

|

|

|

Wisconsin Sales and Use |

|||

Wisconsin |

|

|||

|

Tax Return |

|||

Department of Revenue |

|

|||

|

|

State, County and Stadium Sales and Use Tax |

||

Tax Account Number

FEIN / SSN

Period Begin Date (MM DD YYYY)

Period End Date (MM DD YYYY)

Due Date (MM DD YYYY)

Attention

Business Name

Legal Name

Mailing Address - Street or PO Box

City |

State |

Zip Code |

|

|

|

Step A Sales Tax – State

Use BLACK INK Only

Check if business discontinued (enter discontinuation date below)

(MM DD YYYY)

Check if address or name change (note changes at left)

Check if this is an amended return Check if correspondence is included

1 Total sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Subtractions from total sales: |

|

2 Sales for which you received exemption certificates |

2 |

3Sales of exempt property and services (sales that occurred outside

|

Wisconsin, real property, groceries and highway fuel, etc.) |

3 |

4 |

Sales returns, allowances, and bad debts |

4 |

5 |

Other (sales tax included in line 1, etc.) |

5 |

6 |

Total subtractions (add lines 2 through 5) |

6 |

7 |

Sales subject to state sales tax (subtract line 6 from line 1) |

7 |

8 |

State sales tax (line 7 x .05) |

8 |

Step B Sales Tax – County and Stadium

C O U N T Y

To report county sales tax for more than 4 counties, leave lines

County Code |

|

County Name |

|

Sales Subject to |

||

(SEE INSTRUCTIONS) |

(first 5 letters) |

|

County Sales Tax |

|||

9a |

|

|

9b |

|

9c |

|

10a |

|

|

10b |

|

10c |

|

11a |

11b |

|

11c |

|||

|

|

|

|

|

|

|

12a |

12b |

|

12c |

|||

13Total sales subject to county sales tax (add

lines 9c through 12c OR enter total from Sch CT, Col 1) . . 13

14 County sales tax (line 13 x .005) . . . . . . . . . . . . . . . . . . . . . . 14 Sales Subject to Stadium Sales Tax

S

T

A D I U M

15Baseball stadium district taxable sales through

Waukesha counties) |

15a |

|

x .001 = 15b |

|

16 Football stadium district

taxable sales through

(Brown County) |

16a |

|

x .005 = 16b |

Step C Sales Tax Before Discount

17 Total sales tax (add TAX amounts from lines 8, 14, 15b and 16b) . . . . . . . . . . . . . . 17

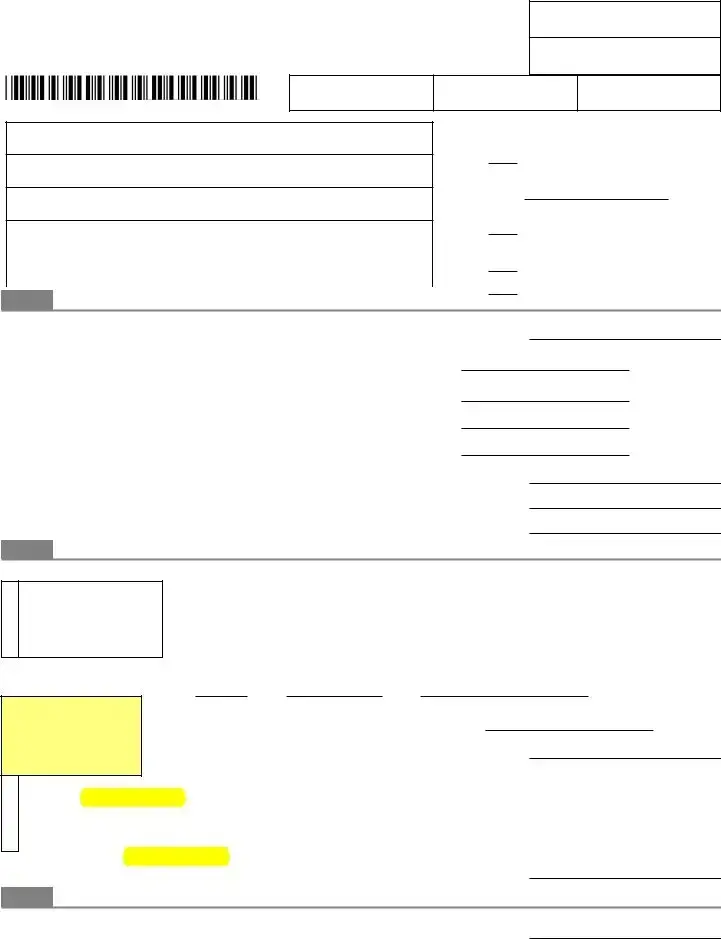

Step D Discount and Net Sales Tax |

|

|

|

|

|

18 |

Total sales tax (fill in amount from line 17) |

. . . . . |

. . |

18 |

|

19 |

Discount – Applies only if return is |

If line 18 is $0 to $10, enter the amount from line 18. |

|

|

|

|

|

If line 18 is $10 to $2,000, enter $10. If line 18 is greater |

|

|

|

|

filed and tax is paid by due date {than $2,000, multiply line 18 by .005 and enter the result. |

}19 |

|||

20 |

Net sales tax (subtract line 19 from line 18) |

. . . . . |

. . |

20 |

|

Step E Use Tax – State |

|

|

|

|

|

21 |

Purchases subject to state use tax |

21a |

.x .05 = |

21b |

|

Step F Use Tax – County and Stadium

C O U N T Y

To report county use tax for more than 4 counties, leave lines

County Code |

|

County Name |

|

Purchases Subject to |

||

(SEE INSTRUCTIONS) |

|

(first 5 letters) |

|

County Use Tax |

||

22a |

22b |

22c |

||||

|

|

|

|

|

|

|

23a |

23b |

23c |

||||

|

|

|

|

|

|

|

24a |

|

24b |

|

24c |

25a |

|

25b |

|

25c |

|

|

|||

|

|

|

|

|

S

T

A D I U M

26 |

Total purchases subject to county use tax (add |

|

|

lines 22c through 25c OR enter total from Sch CT, Col 2) |

. .26 |

27 |

County use tax (line 26 x .005) |

. . . . . . . 27 |

|

Purchases Subject to Stadium Use Tax |

|

28 Baseball stadium district taxable |

|

|

purchases through |

|

|

(Milwaukee, Ozaukee, Racine, Washington |

|

|

& Waukesha counties) |

28a |

x .001 = 28b |

29Football stadium district taxable purchases through

(Brown County) |

29a |

|

x .005 = 29b |

|

Step G Total Amount Due

30 Total sales and use taxes (add TAX amounts from lines 20, 21b, 27, 28b and 29b) . . . 30 31 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

32 Late filing fee ($20.00) and negligence penalty . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32 33 Total amount due (add lines 30 through 32) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

Step H Signature and Mailing Information

I hereby certify that this return, including any accompanying schedules and statements, has been examined by me and to the best of my knowledge and belief is a true, correct, and complete return.

Contact Person (please print clearly)

Phone Number

Signature

Date

Mail to: |

|

Wisconsin Department of Revenue |

For tax questions, call |

PO Box 8921 |

(608) |

Madison WI |

|

- 2 - |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Designation | The ST-12 form is the Wisconsin Sales and Use Tax Return, used for reporting state, county, and stadium sales and use taxes. |

| Governing Law | This form is governed by Wisconsin state tax laws, which outline the requirements and procedures for sales and use tax reporting. |

| Filing Deadline | Taxpayers must submit the ST-12 form by the due date specified within the form to avoid penalties and interest. |

| Discount Eligibility | A discount on the total sales tax is applicable if the return is filed and payment is made by the due date, based on the amount due. |

Guidelines on Utilizing St 12

Completing the ST 12 form is necessary for reporting state and local sales and use tax in Wisconsin. Care must be taken to answer all questions accurately and use black ink only. After filling out the form, it should be submitted to the Wisconsin Department of Revenue by the specified due date to ensure compliance.

- Locate the "Tax Account Number," "FEIN / SSN," and the period dates (begin and end dates) at the top of the form. Fill these sections with the relevant information.

- In the "Attention" section, provide the business name, legal name, mailing address, city, state, and zip code.

- If applicable, check the boxes for: "business discontinued," "address or name change," "amended return," or "correspondence included."

- For Step A, enter the "Total sales" amount on line 1.

- Complete lines 2 through 5 for subtractions from total sales, listing amounts for exemption certificates, exempt property, sales returns, allowances, and bad debts, and any other relevant amounts.

- Add lines 2 through 5 to find the "Total subtractions" and record the total on line 6.

- Subtract line 6 from line 1 to determine the "Sales subject to state sales tax" and place that amount on line 7.

- Calculate the "State sales tax" by multiplying line 7 by 0.05 and enter that amount on line 8.

- For Step B, report county sales tax for up to four counties. Fill in the county code, name, and sales subject to county sales tax for each county listed (lines 9a, 9b, 9c through 12a, 12b, 12c). If reporting for more than four counties, leave lines 9-12 blank and complete Schedule CT instead.

- Add lines 9c through 12c or use the total from Schedule CT, and enter the total sales subject to county sales tax on line 13.

- Calculate county sales tax by multiplying line 13 by 0.005 and enter the result on line 14.

- Report any baseball and football stadium district taxable sales on lines 15-16, calculating the tax amounts for each as indicated.

- Add the tax amounts from lines 8, 14, 15b, and 16b to find the "Total sales tax" and record this on line 17.

- Fill in line 18 with the total sales tax amount from line 17.

- Calculate the discount on line 19 based on the total sales tax (line 18) according to the provided instructions and enter it on line 19.

- Subtract line 19 from line 18 to find the "Net sales tax" and place that amount on line 20.

- In Step E, report the purchases subject to state use tax on line 21. Calculate the tax for this amount and record on line 21b.

- Repeat similar steps for county use tax (lines 22-25) and stadium use tax (lines 28-29), calculating totals and entering them in the appropriate spaces.

- Add lines 20, 21b, 27, 28b, and 29b to determine "Total sales and use taxes" on line 30.

- Include any interest from line 31 and the late filing fee and negligence penalty from line 32 to find the "Total amount due" on line 33.

- Sign and date the form in Step H and provide contact information for any follow-ups.

- Mail the completed form to the Wisconsin Department of Revenue at the address listed.

What You Should Know About This Form

What is the ST-12 form?

The ST-12 form is a tax return used in Wisconsin for reporting state and county sales and use taxes. Businesses must complete this form to provide the Wisconsin Department of Revenue with information about their sales and any applicable taxes during a specific reporting period.

Who needs to file the ST-12 form?

How often must the ST-12 form be filed?

What information is needed to complete the ST-12 form?

What are the 'subtractions from total sales' on the form?

How is the sales tax calculated on the ST-12 form?

What should I do if I need to make changes after filing the ST-12 form?

How do I submit my ST-12 form?

What happens if I miss the due date for filing the ST-12 form?

Common mistakes

Filling out the ST-12 form can be straightforward, but many people encounter common pitfalls that can lead to issues down the line. One mistake often made is neglecting to use black ink as specified. The instructions on the form clearly indicate the need for black ink to ensure clarity and proper scanning. Submitting a form completed in pencil or another color could result in it being rejected or delayed, causing needless stress and potential penalties.

Another frequent error involves incorrect reporting of sales figures. Individuals sometimes miscalculate their total sales or make mistakes in their subtractions. For instance, failing to accurately account for exempt sales or refunds can lead to overpaying or underpaying taxes. It is important to double-check these figures and ensure all relevant sales and deductions are reported correctly. This diligence can help avoid adjustments and potential audits.

People also often overlook the importance of keeping their contact information up to date. If there has been a name or address change, it is essential to indicate this on the form. Failing to do so can result in missed communications regarding the tax return. Providing accurate and current details helps facilitate smoother correspondence and prevents future complications.

Finally, many individuals forget to sign the form before mailing it. The signature serves as a certification that the information provided is true and correct. Without it, the form is considered incomplete and may not be processed. Taking a moment to review the entire form, including ensuring that all required sections are completed, can spare you from delays and ensure compliance.

Documents used along the form

The ST-12 form is a vital document used for sales and use tax reporting in Wisconsin. Businesses utilize this form to accurately declare their sales, calculate tax owed, and submit payments to the state. Alongside the ST-12, several other forms and documents are often required for a complete tax submission or to address specific circumstances. Below are seven common forms that may accompany the ST-12 form, along with their brief descriptions.

- Form ST-11: This form is used for claiming sales and use tax exemption, which allows certain qualified transactions to be exempt from sales tax. Businesses must demonstrate their eligibility for such exemptions.

- Schedule CT: This schedule is utilized to report county sales tax for businesses operating in multiple counties. It provides a comprehensive breakdown of sales taxable in each county.

- Form ST-12E: When a business incorrectly pays sales tax on a sale that should have been exempt, this form allows for the claim of a refund. Businesses can file ST-12E to recover the tax paid on exempt sales.

- Form W-2: Employers must file this form for their employees, detailing the annual wages and amount of taxes withheld. It is pivotal for tax filing and has implications on individual tax returns.

- Form 1099: This form is important for reporting income received by freelancers or contractors. If a business pays a non-employee more than a set amount during the year, it must provide a 1099 form.

- Form S-100: For businesses with a nexus in Wisconsin, this form is necessary to register for a seller's permit. It enables businesses to collect sales tax on taxable sales.

- Form ST-3: This form acts as a resale certificate. It allows businesses to purchase goods intended for resale without paying sales tax upfront, provided they are registered to collect such taxes.

Understanding these various forms and their purposes is crucial for businesses to maintain compliance with Wisconsin's tax regulations. When filing the ST-12, ensure that all necessary supporting documentation is collected and submitted as required, as this will facilitate a smoother tax process.

Similar forms

- IRS Form 1040: This is the individual income tax return form used by U.S. citizens and residents. Like Form ST-12, it allows taxpayers to report income but focuses on personal income rather than sales and use tax.

- IRS Form 1065: Used by partnerships to report income, deductions, and other tax items. It shares a similar structure with Form ST-12, as both require detailed reporting of financial information to determine tax liability.

- W-2 Form: Issued by employers to employees, it summarizes wages and tax withholdings for a year. Similar to Form ST-12, the W-2 must be filed annually, reflecting financial transactions and the resulting tax implications.

- Sales Tax Return (varies by state): Many states have their own versions of sales tax return forms. These forms work similarly to Form ST-12, collecting information about total sales and the corresponding taxes owed.

- Form 941: This is the Employer's Quarterly Federal Tax Return, where employers report income taxes, social security tax, and Medicare tax withheld from employee wages. Like Form ST-12, it tracks tax obligations over a specified period.

- Business License Application: While not a return, this document requires similar information regarding business operations and financial data. It helps authorities assess compliance before issuing licenses.

- Form 990: Nonprofit organizations use this form to report their income, expenses, and activities to the IRS. It parallels Form ST-12 in that both require detailed financial information to maintain compliance with tax regulations.

- Form 1060: This is a tax form used by corporations to calculate their income tax liability. Both forms necessitate the reporting of financial data to determine tax sums owed to government entities.

- State Use Tax Return: This specific form collects taxes on goods purchased outside the state that are used within the state. Its purpose is akin to Form ST-12, as it governs tax obligations for both sales and use.

Dos and Don'ts

Filling out the ST-12 form requires careful attention to detail to ensure accuracy and compliance. Here are some essential do's and don'ts to guide you through the process.

- Do use black ink only when completing the form. This helps ensure legibility.

- Do review the form for any name or address changes before submitting it.

- Do calculate all totals carefully, double-checking addition and subtraction.

- Do ensure that you include your tax account number and FEIN/SSN.

- Don't forget to sign and date the form to validate your submission.

- Don't rush through the process; taking your time will help prevent errors that could delay processing.

By adhering to these guidelines, you can navigate the completion of the ST-12 form with greater ease and accuracy. Prioritizing accuracy is vital, as it can lead to seamless processing and fewer headaches down the line. Take a moment to ensure everything is in order before you send it off!

Misconceptions

When it comes to the ST-12 form for Wisconsin sales and use tax, several misconceptions can lead to confusion. Here are six prevalent myths that you should be aware of:

- Only large businesses need to file the ST-12 form. This is untrue. Any business that sells goods or services in Wisconsin and meets the sales tax threshold is required to file this form, regardless of its size.

- The ST-12 form only includes sales tax calculations. Many believe that the form is solely for sales tax. In reality, it also covers use tax, which is applicable to the purchase of goods used in the state.

- Filing is only necessary if sales were made. Some think that if their business did not make any sales during the period, they do not need to file. However, Wisconsin law requires even zero sales returns to be filed.

- The form is the same for every county. Not exactly. Each county might have its own specific requirements or additional forms to consider, especially if local taxes vary. It's essential to check for county-specific instructions.

- Deadline extensions are automatically granted. Many assume that they can file late without any penalties. Unfortunately, extensions need to be requested and are not given automatically for the ST-12 filing.

- Filling out the form is easy and takes no time. While the form might look straightforward, collecting the necessary data can be time-consuming. It's important to allow ample time for thorough and accurate completion.

Understanding these misconceptions can help ensure compliance and avoid potential pitfalls in the filing process. Staying informed is always beneficial for managing your tax responsibilities effectively.

Key takeaways

Filling out the ST-12 form can seem daunting, but understanding its components is key to ensuring compliance with Wisconsin's tax regulations. Here are ten essential takeaways to help you navigate the process.

- Know Your Dates: The period begin and end dates, along with the due date, must be accurate. This ensures timely submission to avoid penalties.

- Complete Identification Sections: Clearly fill in your business name, address, and Tax Account Number. Correctly identifying your entity is crucial for processing.

- Understand Sales Tax Calculations: The form allows you to report your total sales and any applicable sales tax. Make sure to calculate sales tax by multiplying your taxable sales by the appropriate rate.

- Identify Subtractions: You can subtract exempt sales and returns from your total sales. Lines 2 through 5 require careful attention to ensure accurate deductions.

- County and Stadium Taxes: If your sales are subject to county or stadium sales taxes, fill in those sections rigorously. Misreporting can affect your overall tax liability.

- Discount Options: If you file your return and pay taxes on time, you may qualify for a discount. Understand how to calculate this and apply it correctly on the form.

- Use Tax Reporting: Don’t overlook reporting purchases subject to state and county use tax. This helps in accounting for taxes owed on taxable purchases not covered in sales tax.

- Line-by-Line Accuracy: Review every line. Small errors could lead to increased tax due or miscommunication with the Department of Revenue.

- Signature Requirement: Ensure to sign and date the form. Your signature affirms the accuracy of the information reported.

- Submit on Time: Timely submission of the ST-12 form is vital. Late filing can result in additional fees and penalties.

Taking the time to carefully complete each section of the ST-12 form can save you from potential complications down the road. Remember, thoroughness is your best ally in tax compliance!

Browse Other Templates

Exxonmobil Foundation - Grant requests can be made individually or as part of a team initiative.

Trauma Patient - Understanding the mechanism of injury helps inform the patient assessment process.

Idaho Tax Id - Specify if your business will have employees working in Idaho.