Fill Out Your St 1201 Form

The ST-120.1 form, known as the Contractor Exempt Purchase Certificate, serves as a crucial resource for contractors in New York State seeking to navigate the sales and use tax landscape. Specifically designed for contractors registered with the New York State Department of Taxation and Finance, this form allows eligible contractors to purchase certain tangible personal property and services without incurring sales tax. It’s essential for both contractors and vendors to understand that tax must be collected on all taxable sales unless this form is presented properly and within a specified timeframe. The ST-120.1 outlines the circumstances under which contractors can claim exemptions, covering various scenarios including projects involving government entities, production machinery, and solar energy systems. Additionally, it provides a series of criteria—marked by lettered options A through Q—that detail specific types of property and services eligible for tax exemption. It is important for contractors to ensure correct completion of this form, as misuse can lead to significant penalties. By following the guidelines in the accompanying instructions, contractors can effectively utilize the ST-120.1 to benefit from tax exemptions, making it an indispensable tool in project management and financial planning for construction and related services.

St 1201 Example

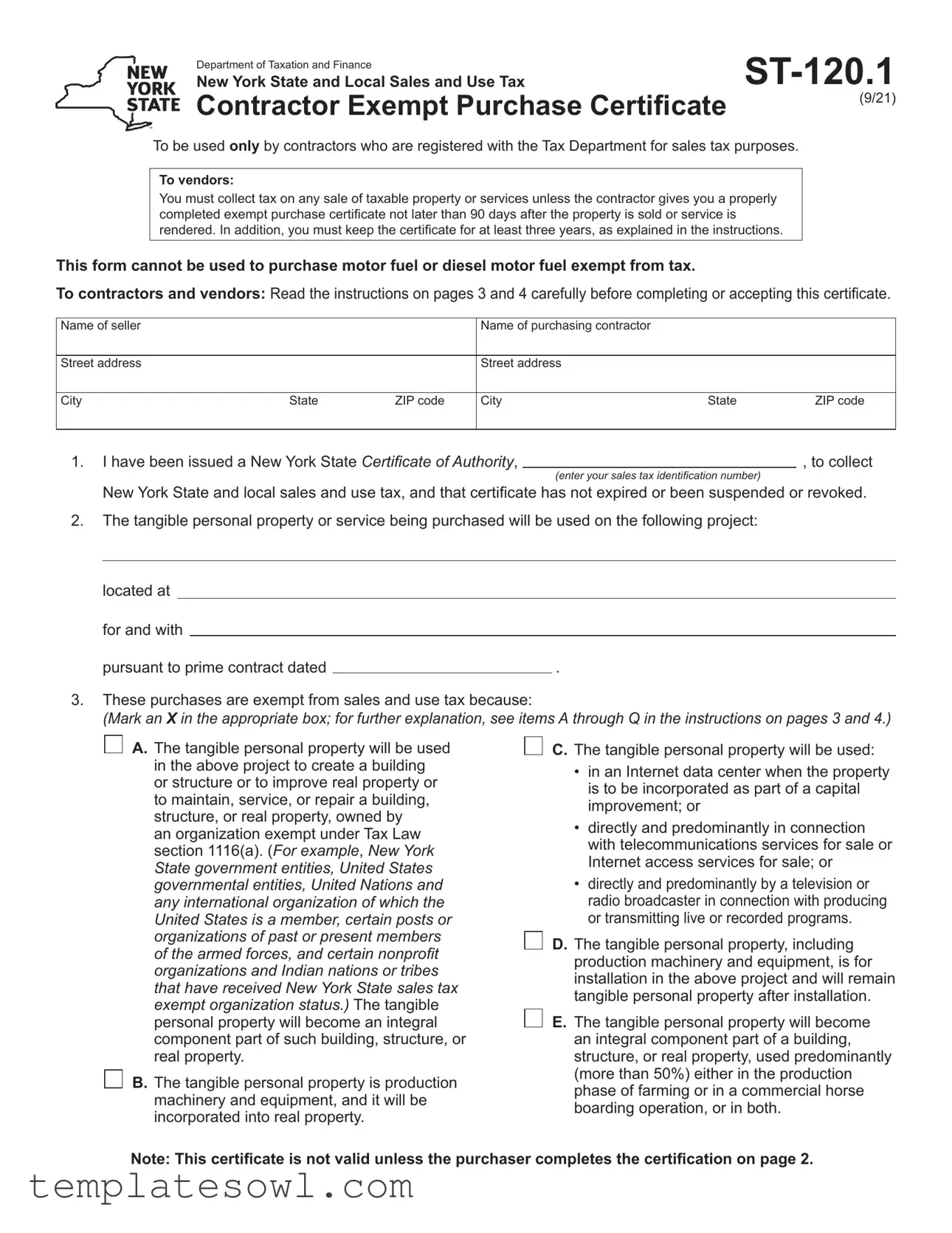

New York State and Local Sales and Use Tax |

Department of Taxation and Finance

Contractor Exempt Purchase Certificate |

(9/21) |

|

To be used only by contractors who are registered with the Tax Department for sales tax purposes.

To vendors:

You must collect tax on any sale of taxable property or services unless the contractor gives you a properly completed exempt purchase certificate not later than 90 days after the property is sold or service is rendered. In addition, you must keep the certificate for at least three years, as explained in the instructions.

This form cannot be used to purchase motor fuel or diesel motor fuel exempt from tax.

To contractors and vendors: Read the instructions on pages 3 and 4 carefully before completing or accepting this certificate.

Name of seller |

|

|

Name of purchasing contractor |

|

|

Street address |

|

|

Street address |

|

|

City |

State |

ZIP code |

City |

State |

ZIP code |

1. I have been issued a New York State Certificate of Authority, |

|

, to collect |

|

(enter your sales tax identification number) |

|

New York State and local sales and use tax, and that certificate has not expired or been suspended or revoked.

2.The tangible personal property or service being purchased will be used on the following project:

located at

for and with

pursuant to prime contract dated |

|

. |

3.These purchases are exempt from sales and use tax because:

(Mark an X in the appropriate box; for further explanation, see items A through Q in the instructions on pages 3 and 4.)

A.The tangible personal property will be used in the above project to create a building or structure or to improve real property or to maintain, service, or repair a building, structure, or real property, owned by

an organization exempt under Tax Law section 1116(a). (For example, New York State government entities, United States governmental entities, United Nations and any international organization of which the United States is a member, certain posts or organizations of past or present members of the armed forces, and certain nonprofit organizations and Indian nations or tribes that have received New York State sales tax exempt organization status.) The tangible personal property will become an integral component part of such building, structure, or real property.

B.The tangible personal property is production machinery and equipment, and it will be incorporated into real property.

C.The tangible personal property will be used:

•in an Internet data center when the property is to be incorporated as part of a capital improvement; or

•directly and predominantly in connection with telecommunications services for sale or Internet access services for sale; or

•directly and predominantly by a television or radio broadcaster in connection with producing or transmitting live or recorded programs.

D.The tangible personal property, including production machinery and equipment, is for installation in the above project and will remain tangible personal property after installation.

E.The tangible personal property will become an integral component part of a building, structure, or real property, used predominantly

(more than 50%) either in the production phase of farming or in a commercial horse boarding operation, or in both.

Note: This certificate is not valid unless the purchaser completes the certification on page 2.

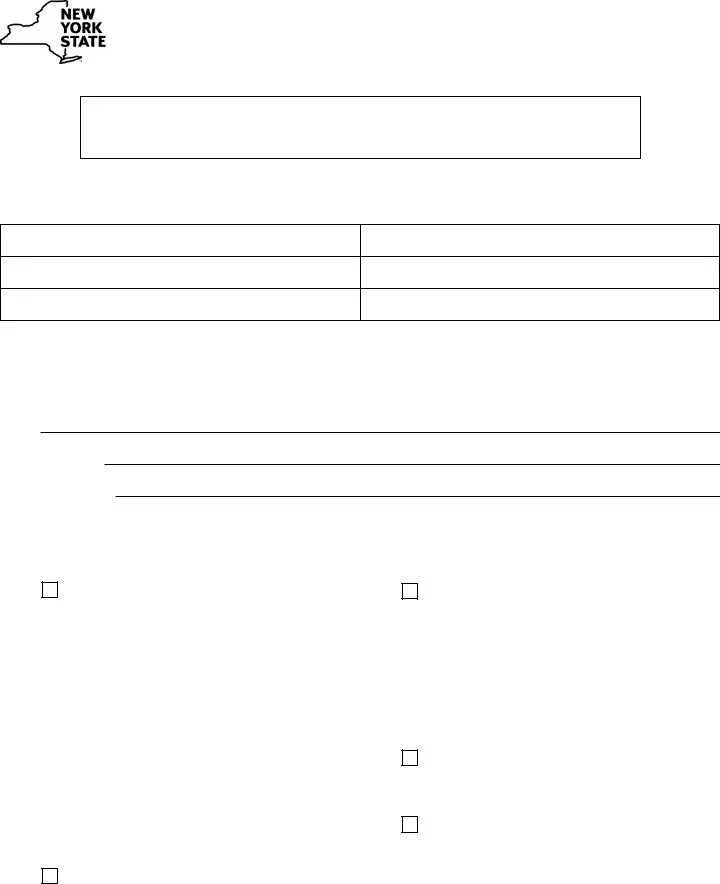

Page 2 of 4

F.The machinery or equipment will be used directly and predominantly to control, prevent, or abate pollution or contaminants from manufacturing or industrial facilities.

G.The tangible personal property is residential or commercial solar energy systems equipment. (Note: Item G purchases are exempt from the

4% New York State tax rate and from the ⅜%

MCTD rate. Item G purchases may be exempt from local taxes. See instructions.)

H.The tangible personal property will be used directly and exclusively in adding to, altering, or improving a qualifying tenant’s leased premises for use as commercial office space in Eligible Area A or B as described in TSB‑M‑05(12)S, Sales and Use Tax Exemptions on Certain Purchases of Tangible Personal Property and Services for Leased Commercial Office Space in Lower Manhattan, provided that the tangible personal property becomes an integral component part of the building in which the leased premises are located, and where such property is purchased during the first year of the qualifying tenant’s lease and delivered to the leased premises no later than 90 days after the end of that first year.

I.The tangible personal property is machinery or equipment used directly and predominantly in loading, unloading, and handling cargo at a qualified marine terminal facility in New York

City. This exemption does not apply to the local tax in New York City.

J.The tangible personal property is commercial fuel cell systems equipment. (Note: Item J purchases are exempt from the 4% New York State tax rate and from the ⅜% MCTD rate.

Item J purchases may be exempt from local taxes. See instructions.)

K.The tangible personal property will be used in a project for an exempt Housing Development

Fund Corporation (HDFC).

L.The services are for the project described in line 2 on page 1 and will be resold. (This includes trash removal services in connection with repair services to real property.)

M.The services are to install, maintain, service, or repair tangible personal property used in an Internet data center, for telecommunication or Internet access services, or for radio

or television broadcast production or transmission.

N.The services are to install, maintain, service, or repair tangible personal property that will be used predominantly either in farm production or in a commercial horse boarding operation, or in both provided such tangible personal property will become an integral component part of such structure, building, or real property.

O.The services are to install residential or commercial solar energy systems equipment.

P.The services are to install tangible personal property purchased during the first year of the qualifying tenant’s lease and delivered to the leased premises no later than 90 days after the end of that first year, that will be used directly and exclusively in adding to, altering, or improving a qualifying tenant’s leased premises for use as commercial office space in Eligible Area A or B as described in

TSB‑M‑05(12)S.

Q.The services are to install or maintain commercial fuel cell systems equipment.

Caution: Contractors may not use this certificate to purchase services tax exempt unless the services are resold to customers in connection with a project. Construction equipment, tools, and supplies purchased or rented for use in completing a project but that do not become part of the finished project may not be purchased exempt from tax through the use of this certificate.

Certification: I certify that the above statements are true, complete, and correct, and that no material information has been omitted. I make these statements and issue this exemption certificate with the knowledge that this document provides evidence that state and local sales or use taxes do not apply to a transaction or transactions for which I tendered this document and that willfully issuing this document with the intent to evade any such tax may constitute a felony or other crime under New York State Law, punishable by a substantial fine and a possible jail sentence. I understand that this document is required to be filed with, and delivered to, the vendor as agent for the Tax Department for the purposes of Tax Law section 1838 and is deemed a document required to be filed with the Tax Department for the purpose of prosecution of offenses. I also understand that the Tax Department is authorized to investigate the validity of tax exclusions or exemptions claimed and the accuracy of any information entered on this document.

Type or print name and title of owner, partner, or authorized person of purchasing contractor

Signature of owner, partner, or authorized person of purchasing contractor

Date prepared

Substantial penalties will result from misuse of this certificate.

Instructions

Only a contractor who has a valid Certificate of Authority issued by the Tax Department may use this exempt purchase certificate. The contractor must present a properly completed certificate to the vendor to purchase tangible personal property, or to a subcontractor to purchase services tax exempt. This certificate is not valid unless all entries have been completed.

The contractor may use this certificate to claim an exemption from sales or use tax on tangible personal property or services that will be used in the manner specified in items A through Q below. The contractor may not use this certificate to purchase tangible personal property or services tax exempt on the basis that

The contractor must use a separate Form ST‑120.1, Contractor Exempt Purchase Certificate, for each project.

Purchase orders showing an exemption from the sales or use tax based on this certificate must contain the address of the project where the property will be used, as well as the name and address of the project owners (see page 1 of this form). Invoices and sales or delivery slips must also contain this information (name and address of the project for which the exempt purchases will be used or where the exempt services will be rendered, as shown on page 1 of this form).

Use of the certificate

Note: Unless otherwise stated, the customer must furnish the contractor a properly completed Form

This certificate may be used by a contractor to claim exemption from tax only on purchases of tangible personal property that is:

A.Incorporated into real property under the terms of a contract entered into with an exempt organization that has furnished the contractor with a copy of

B.Production machinery or equipment that will be incorporated into real property.

C.Used in one of the following situations:

•Machinery, equipment, and other tangible personal property related to providing website services for sale to be installed in an Internet data center when the property is to be incorporated as part of a capital improvement. The customer must furnish the contractor a completed

•Used directly and predominantly in the receiving, initiating, amplifying, processing, transmitting,

•Machinery, equipment, and other tangible personal property (including parts, tools, and supplies) used by a television or radio broadcaster directly and predominantly in the production and post‑production of live or recorded programs used by a broadcaster predominantly for broadcasting by the broadcaster either over‑the‑air or for transmission through a cable television or direct broadcast satellite system. (Examples of exempt machinery and equipment include cameras, lights, sets, costumes, and sound equipment.) This exemption also includes machinery, equipment, and other tangible personal property used by a broadcaster directly and

predominantly to transmit live or recorded programs. (Examples of exempt machinery and equipment include amplifiers, transmitters, and antennas.)

D.Installed or placed in the project in such a way that it remains tangible personal property after installation. The contractor must collect tax from its customer when selling such tangible personal property or related services to the customer, unless the customer gives the contractor an appropriate and properly completed exemption certificate.

E.Going to become an integral component part of a structure, building, or real property used predominantly (more than

50%) either in the production phase of farming or in a commercial horse boarding operation, or in both, for which the customer has provided the contractor a completed Form ST‑125, Farmer’s and Commercial Horse Boarding Operator’s Exemption Certificate.

F.Machinery or equipment used directly and predominantly to control, prevent, or abate pollution or contaminants from manufacturing or industrial facilities.

G.Residential or commercial solar energy systems equipment.

Residential solar energy systems equipment means an arrangement or combination of components installed in a residence that utilizes solar radiation to produce energy designed to provide heating, cooling, hot water, and/or electricity. Commercial solar energy systems equipment means an arrangement or combination of components installed upon nonresidential premises that utilize solar radiation to produce energy designed to provide heating, cooling, hot water, or electricity. The exemption is allowed on the 4% New York State tax rate and where applicable, the ⅜% MCTD rate. The exemption does not apply to local taxes unless the locality specifically enacts the exemption.

The customer must furnish the contractor a completed Form ST‑121 by completing the box marked Other (U.). For the definition of residence and for an exception relating to recreational equipment used for storage, as well as for other pertinent information, see TSB‑M‑05(11)S, Sales and Use Tax Exemption for Residential Solar Energy Systems Equipment. For the definition of nonresidential premises, as well as other pertinent information, see

H.Delivered and used directly and exclusively in adding to, altering, or improving a qualifying tenant’s leased premises for use as commercial office space in Eligible Area A or

B as described in TSB‑M‑05(12)S, Sales and Use Tax Exemptions on Certain Purchases of Tangible Personal Property and Services for Leased Commercial Office Space in Lower Manhattan, provided that the tangible personal property becomes an integral component part of the building in which the leased premises are located, and where such property is purchased within the first year of the qualifying tenant’s lease.

I.Machinery and equipment used at qualified marine terminal facilities located in New York City. The machinery and equipment must be used directly and predominantly in loading, unloading, and handling cargo at marine terminal facilities located in New York City that handled more than

350,000 twenty foot equivalent units (TEUs) in 2003. For purposes of this exemption, the term TEU means a unit of volume equivalent to the volume of a twenty‑foot container. This exemption does not apply to the local tax in New York City.

Page 4 of 4

J.Commercial fuel cell systems equipment. Commercial fuel cell systems equipment means an electric generating arrangement or combination of components that is installed upon nonresidential premises and utilizes solid oxide, molten carbonate, a proton exchange membrane, phosphoric acid, or a linear generator to provide heating, cooling, hot water, or electricity. The exemption is allowed on the 4% New York State tax rate and the ⅜% MCTD rate, if applicable. The exemption does not apply to local taxes unless the locality specifically enacts the exemption.

The customer must furnish the contractor a completed Form

to Commercial Fuel Cell Systems Equipment, for more information.

K.For use in a project for an exempt HDFC that has furnished the contractor with a copy of the exemption letter issued to them by the Tax Department.

This certificate may also be used by a contractor to claim exemption from tax on the following services:

L.Installing tangible personal property, including production machinery and equipment, that does not become a part of the real property upon installation.

Repairing real property, when the services are for the project named on page 1 of this form and will be resold.

Trash removal services rendered in connection with repair services to real property, if the trash removal services will be resold.

Note: Purchases of services for resale can occur between prime contractors and subcontractors or between two subcontractors. The retail seller of the services, generally the prime contractor, must charge and collect tax on the contract price, unless the project owner gives the retail seller of the service a properly completed exemption certificate.

M.Installing, maintaining, servicing, or repairing tangible personal property used for Web hosting, telecommunication or Internet access services, or by a broadcaster (described in item C on page 3).

N.Installing, maintaining, servicing, or repairing tangible personal property that will be used predominantly either in farm production or in a commercial horse boarding operation, or in both (described in item E on page 3).

O.Installing qualifying residential or commercial solar energy systems equipment (described in item G on page 3).

P.Installing tangible personal property delivered to and used directly and exclusively in adding to, altering, or improving a qualifying tenant’s leased premises for use as commercial office space in Eligible Area A or B as described in TSB‑M‑05(12)S, provided that the tangible personal property becomes an integral component part of the building in which the leased premises are located.

Q.Installing or maintaining commercial fuel cell systems equipment (described in item J above).

Misuse of this certificate

Misuse of this exemption certificate may subject you to serious civil and criminal sanctions in addition to the payment of any tax and interest due. These include:

•a penalty equal to 100% of the tax due;

•a $50 penalty for each fraudulent exemption certificate issued;

•criminal felony prosecution, punishable by a substantial fine and a possible jail sentence; and

•revocation of your Certificate of Authority, if you are required to be registered as a vendor. See

To the seller

When making purchases that qualify for exemption from sales and use tax, the contractor must provide you with this exemption certificate with all entries completed to establish the right to the exemption.

As a New York State registered vendor, you may accept an exemption certificate in lieu of collecting tax and be protected from liability for the tax if the certificate is valid. The certificate will be considered valid if it is:

•accepted in good faith;

•in your possession within 90 days of the transaction; and

•properly completed (all required entries were made).

An exemption certificate is accepted in good faith when you have no knowledge that the exemption certificate is false or is fraudulently given, and you exercise reasonable ordinary due care. If you do not receive a properly completed certificate within 90 days after the delivery of the property or service, you will share with the purchaser the burden of proving the sale was exempt.

Failure to collect sales or use tax, as a result of accepting an improperly completed exemption certificate or receiving the certificate more than 90 days after the sale, will make you personally liable for the tax plus any penalty and interest charges due.

You must maintain a method of associating an invoice (or other source document) for an exempt sale with the exemption certificate you have on file from the purchaser. You must also keep this certificate at least three years after the due date of your sales tax return to which it relates, or the date the return was filed, if later.

Need help?

Visit our website at www.tax.ny.gov

•get information and manage your taxes online

•check for new online services and features

Telephone assistance: |

|

To order forms and publications: |

|

Text Telephone (TTY) or TDD |

Dial |

equipment users |

New York Relay Service |

|

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The ST-120.1 form is the New York State Contractor Exempt Purchase Certificate used by contractors registered for sales tax. |

| Usage Limitation | This certificate cannot be used for purchasing motor fuel or diesel fuel exempt from tax. |

| Tax Collection Responsibility | Vendors must collect tax unless presented with a completed certificate within 90 days of sale or service. |

| Retention Requirement | Vendors must keep the exemption certificate for a minimum of three years. |

| Certificate Validity | The certificate is valid only when all entries are completed by the contractor. |

| Exemptions Detail | Exemptions cover various purchases, including machinery for production or services related to certain construction projects. |

| Accountability | Contractors can face severe penalties for willfully issuing false exemption certificates, including criminal charges. |

| Authorized Users | Only contractors with a valid New York State Certificate of Authority can utilize this form. |

| Form Completion | Contractors must ensure that the form is completed accurately, or it will not be recognized as valid. |

| Contact Information | The New York State Tax Department offers telephone assistance at 518-485-9863 for questions regarding the form. |

Guidelines on Utilizing St 1201

Completing the ST-120.1 form is a crucial step for contractors in New York seeking tax exemptions on purchases related to specific projects. After ensuring you have a valid Certificate of Authority, follow the procedure below to fill out the form accurately to avoid fines or issues.

- Begin by entering the name of the seller and the name of the purchasing contractor at the top of the form.

- Fill in the street address, city, state, and ZIP code for both the seller and the contractor.

- In the first statement, input your sales tax identification number issued by the New York State Tax Department. Ensure this number is valid and has not expired.

- For the project details, describe the tangible personal property or service being purchased, specifying its use in the project.

- Provide the project location where the property will be used, along with details such as the contract date.

- Mark an X in the box next to the reason why these purchases are exempt from sales and use tax. Choose from options A through Q based on the purpose of the purchase.

- Complete the certification section by affirming that all statements made are true and correct. Sign and date this part of the form.

- Finally, type or print the name and title of the owner, partner, or authorized person for the purchasing contractor below the signature line.

After filling out the form, review all entries to confirm accuracy. This document must be presented to the vendor from whom the purchases are made.

What You Should Know About This Form

What is the ST-120.1 form and who can use it?

The ST-120.1 form is the New York State Contractor Exempt Purchase Certificate. It is specifically designed for contractors who are registered with the Tax Department for sales tax purposes. Contractors may use this form to purchase certain tangible personal property or services without paying sales tax. However, they must comply with specific rules, including presenting a completed certificate to the vendor within 90 days of the transaction.

What are the consequences for misuse of the ST-120.1 form?

Misusing the ST-120.1 form can lead to serious consequences, including hefty civil and criminal penalties. If the form is misused, individuals might face a penalty equal to 100% of the tax due, a $50 penalty for each fraudulent certificate issued, or even criminal felony prosecution, which could involve substantial fines and possible jail time. Additionally, the Tax Department may revoke a contractor's Certificate of Authority if deemed necessary.

How long must vendors keep the ST-120.1 form?

Vendors must retain the ST-120.1 form for a minimum of three years from the due date of their sales tax return to which the form relates, or from the date the return was filed, whichever is later. This documentation is essential, as it protects vendors from liability in the event of an audit or tax inquiry regarding exempt purchases.

Can the ST-120.1 form be used to purchase services?

Yes, the ST-120.1 form can be used to purchase certain services exempt from sales tax. However, the services must be related to a specific project and must meet specific criteria outlined in the form. Contractors cannot use this exemption for general construction equipment, tools, or supplies that do not become an integral part of a finished project. It is crucial for contractors to ensure they have a valid reason for claiming the exemption when it comes to service purchases.

What do contractors need to do to validate the ST-120.1 form?

To validate the ST-120.1 form, contractors must ensure that it is properly filled out and signed, containing all required information. In addition, they must maintain a good faith acceptance of the form, meaning they should not have any knowledge that the information provided is false. For the certificate to be deemed valid, the contractor needs to present it to the vendor within 90 days of the transaction and keep accurate records linking the certificate to the corresponding sale.

Common mistakes

When filling out the New York State Contractor Exempt Purchase Certificate, Form ST-120.1, the process can seem straightforward. However, several common mistakes often lead to complications. One major error is failing to provide an accurate sales tax identification number. Contractors must ensure that their New York State Certificate of Authority number is current and accurately entered. Missing or invalid identification numbers can invalidate the certificate, resulting in tax liabilities.

Another frequent mistake is not completing all sections of the form. The ST-120.1 requires detailed descriptions, including the project location and type of property or service being exempted. Omitting information in these fields can lead to questions about the validity of the exemption, placing the burden on the contractor to justify their tax-exempt status.

Additionally, many contractors neglect to mark the appropriate exemption boxes accurately. Each exemption has specific criteria outlined in the instructions. If the contractor does not select the box that correctly corresponds to their situation, they risk non-compliance. This oversight can trigger scrutiny from tax authorities and potential penalties.

Another common mistake involves the project's details. Incomplete submissions that fail to indicate the project name or address can lead to significant problems. It is vital for a contractor to provide clear, complete details about the actual project so that the transaction can be validated effectively.

Some contractors also erroneously use this exemption certificate for the purchase of services that are not explicitly allowed. The misuse of the certificate for non-qualifying services can result in additional tax assessments. Understanding what services qualify is crucial, as certain contexts may restrict service exemptions.

Moreover, contractors often assume that a previous form submission suffices for new projects. Each project requires a separate, properly completed ST-120.1. Failure to submit individual certificates for each project can create compliance issues and lead to fines.

Signatures are another point of contention. Neglecting to sign and date the certificate is a critical error. The certification statement at the end of the form confirms the accuracy and truthfulness of the submitted information. An unsigned form cannot stand as evidence of compliance.

In addition, a frequent oversight is failing to maintain proper records. Vendors must keep the exemption certificates on file for a minimum of three years. This documentation must be accessible for review by tax authorities, and inability to produce these records can expose contractors to fines and liabilities.

Lastly, contractors should be cautious about timing. If the exemption certificate is not presented to vendors within 90 days of the transaction, the exemption is voided. Missing this critical timeline can lead to the necessity of paying taxes that the contractor believed to be exempt.

In summary, careful attention to detail is essential when completing the ST-120.1 form. Avoiding the common pitfalls outlined can save contractors from unnecessary complications and financial repercussions.

Documents used along the form

The ST-120.1 form, known as the New York State Contractor Exempt Purchase Certificate, plays a crucial role in allowing contractors to make tax-exempt purchases for specific projects. However, several other forms and documents often accompany this certificate. Understanding these documents can help contractors ensure compliance with tax regulations while taking advantage of available exemptions.

- Form ST-121: This is an Exempt Use Certificate, which contractors may provide to vendors to claim exemptions on tangible personal property used according to specific criteria. It outlines the conditions under which a contractor can purchase goods without incurring sales tax.

- Form ST-124: Known as the Certificate of Capital Improvement, this form is used when a contractor purchases property that will become a permanent part of real estate. It is essential for purchases related to improvements on exempt properties.

- Form ST-119.1: This Exempt Organization Exempt Purchase Certificate is provided by exempt organizations to contractors to demonstrate that they are authorized to make tax-exempt purchases under New York State law. It verifies the tax-exempt status of the purchasing organization.

- Form ST-125: The Farmer’s and Commercial Horse Boarding Operator’s Exemption Certificate allows farmers or boarding operators to purchase certain items tax-free. This form is relevant when contractors work on projects related to agricultural or equine operations.

- Invoices and Sales Slips: These documents must include specific project details, such as the name and address of the project where the purchased goods or services will be utilized. They are essential for maintaining a clear record of exempt transactions.

- Vendor’s Certificate of Authority: Contractors must present their Certificate of Authority to vendors to establish their eligibility to make tax-exempt purchases. This form is crucial in proving compliance to both vendors and tax authorities.

- Purchase Orders: For claiming tax exemptions, these orders must clearly state the project address and the name of the project owners. Properly documented purchase orders safeguard against misinterpretation of tax obligations.

These forms and documents collectively aid contractors in navigating the complexities of sales tax exemptions. By understanding their purposes, contractors can ensure legal compliance and minimize tax obligations effectively. Each document has its specific role in facilitating tax-exempt purchases while maintaining transparent records for state verification.

Similar forms

- Form ST-121: Exempt Use Certificate - This document allows a buyer to claim that certain purchases of tangible personal property, which will be incorporated into real estate, are exempt from sales tax. Both forms require proper documentation for the exemption to be valid, ensuring accountability in tax transactions.

- Form ST-125: Farmer’s and Commercial Horse Boarding Operator’s Exemption Certificate - This certificate serves a similar purpose for farmers or commercial horse boarding operations, enabling them to purchase machinery or equipment without incurring sales tax. Much like the ST-120.1 form, it specifies the connection between the tax-exempt purchases and the project or operation.

- Form ST-119.1: Exempt Organization Exempt Purchase Certificate - Nonprofit and exempt organizations use this form to indicate that their purchases of tangible property or services are tax-exempt. The ST-120.1 also serves as a means to validate tax-exempt transactions in specified projects, focusing on document accuracy for tax compliance.

- Form ST-130: Resale Certificate - Vendors and retailers use this document to claim exemption from sales tax when purchasing items for resale. In essence, both ST-120.1 and ST-130 highlight the necessity of substantiating the reasons for tax exemptions, although they target different types of transactions.

Dos and Don'ts

- Do read the instructions carefully before filling out the form to ensure all requirements are understood.

- Do ensure you have a valid New York State Certificate of Authority before attempting to use the ST-120.1 form.

- Do fill in all required fields completely and accurately to avoid delays in processing.

- Do provide your sales tax identification number on the form to confirm your registration.

- Don't forget to identify the specific project for which the purchases are being made—it should be clearly noted on the form.

- Don't use this certificate for purchasing motor fuel or diesel fuel as these items are not exempt from tax.

- Don't issue the form if your Certificate of Authority has expired or has been suspended.

- Don't neglect to maintain the certificate for a minimum of three years, as required for audit purposes.

Misconceptions

Misunderstanding the ST-120.1 form can lead to confusion and errors. Here are ten common misconceptions:

- Only contractors with a specific type of license can use the ST-120.1 form. All contractors must have a valid Certificate of Authority issued by the Tax Department, not just a particular type of license.

- The ST-120.1 form can be used for any purchase. This form is specifically for contractors and can only be used for purchases related to certain projects outlined in the instructions.

- This form can be used to purchase motor fuel or diesel fuel tax-exempt. In reality, the ST-120.1 form cannot be used for purchasing motor fuel or diesel motor fuel without tax.

- As long as I fill out the form, I won't owe any taxes. Correctly completing the form does not guarantee an exemption. The purchases still need to meet specified criteria to qualify.

- Contractors can use this form to buy any tools or equipment needed for a project. The form is intended for items that become a part of the real property, not general tools or equipment.

- Once submitted, the vendor does not need to keep the form. Vendors are required to keep the certificate on file for at least three years.

- I can use the ST-120.1 form multiple times for the same project. A separate form must be used for each project; it is not valid for multiple projects.

- It does not matter when I provide the completed form. Vendors must receive the properly completed form within 90 days of the transaction date.

- The ST-120.1 form applies to all sales tax exemptions in New York. This form only covers specific exemptions outlined within its instructions; broader exemptions may require different forms.

- This form protects me from penalties if I misuse it. No, misuse of the ST-120.1 form can lead to significant penalties, including fines or criminal charges.

Understanding these points is essential to ensure proper use of the ST-120.1 form and to avoid unnecessary tax liabilities.

Key takeaways

1. Eligibility for Use: Only contractors registered with New York State for sales tax purposes can utilize the ST-120.1 form. This exemption certificate must be presented to vendors for purchases of tangible personal property or services.

2. Timeliness Matters: Contractors must provide the completed ST-120.1 to vendors within 90 days after the sale of property or provision of services to remain valid. Vendors are required to keep this certificate for at least three years.

3. Specific Projects: Each completed ST-120.1 form must reference a specific project, indicating where the property or services will be used. Properly filled invoices and purchase orders must also include project details.

4. Valid Purchases: This certificate can be applied to tangible personal property and services that will become integral parts of a real property project or be used in specific activities outlined in the form.

5. Misuse Consequences: Misuse of the ST-120.1 form can result in severe penalties, including substantial fines or even felony charges, in addition to tax liabilities.

6. Proper Completion Required: To ensure validity, contractors must complete all required entries on the form. An incomplete ST-120.1 will not qualify for tax exemption.

Browse Other Templates

Dmas 99 Form - DMAS 99 allows for a comprehensive approach to understanding individual needs.

Virginia State Application - Details of jobs must begin with the most recent position held.

Master Job Application - Your reflections on what you liked or disliked about previous jobs can indicate your work preferences.