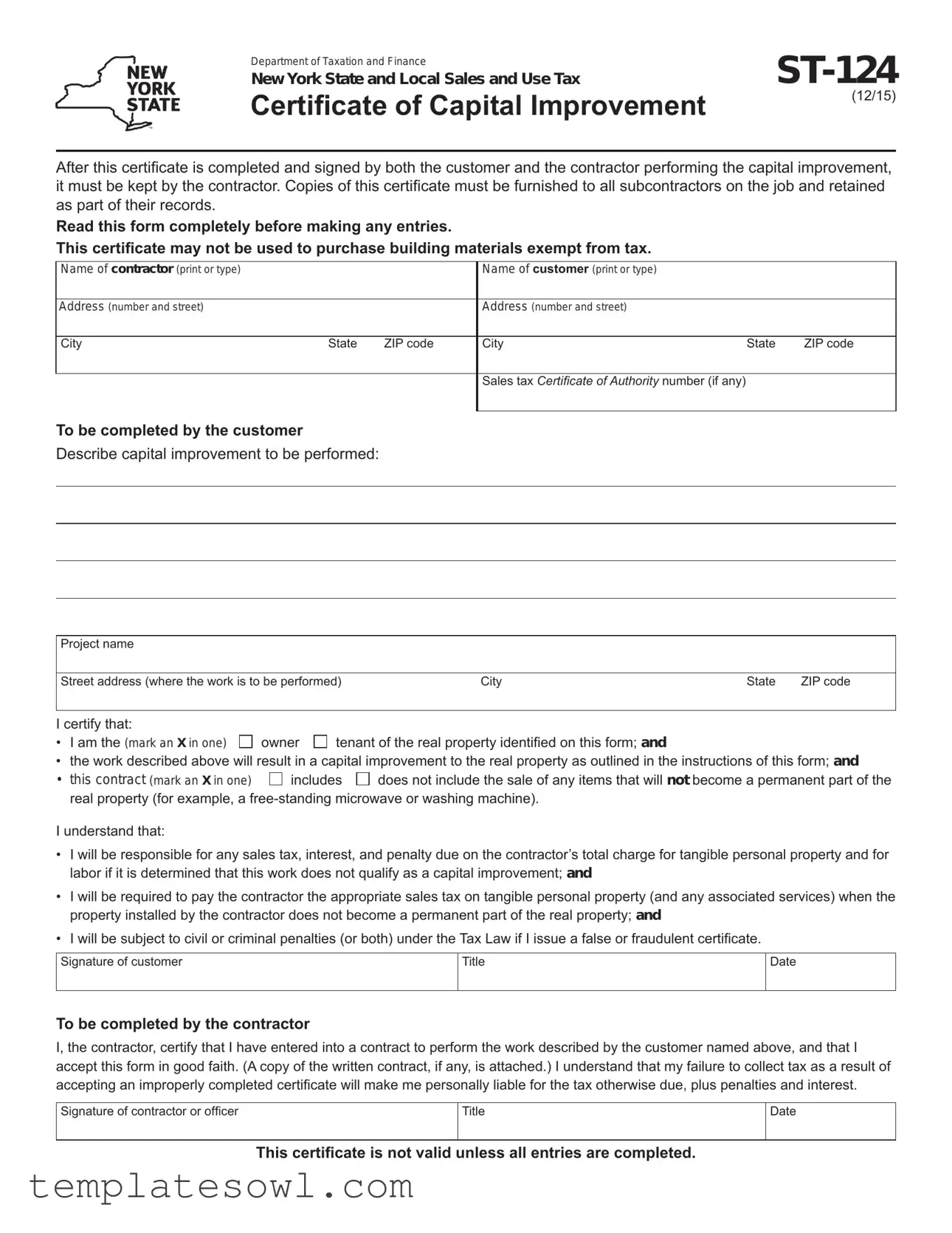

Fill Out Your St 124 Form

The ST-124 form, officially known as the New York State and Local Sales and Use Tax Certificate of Capital Improvement, is a crucial document in construction and improvement projects. It serves as evidence that a specific job will result in a capital improvement to real property, which can significantly affect tax obligations for both contractors and customers. To be valid, this certificate must be completed and signed by both parties involved: the customer and the contractor. It ensures that the contractor retains a legally recognized exemption from collecting sales tax on services related to capital improvements, provided the work meets defined criteria. These criteria require that the work notably enhances the property's value or extends its useful life, becomes a permanent fixture, and is intended as such. Importantly, the certificate cannot be used for purchasing building materials tax-free, and completion of the form necessitates detailed project information. Subcontractors also must receive copies to maintain accurate records. Potential penalties exist for both parties if the form is not properly utilized, emphasizing the need for compliance with all instructions and guidance provided by the New York State Department of Taxation and Finance.

St 124 Example

Department of Taxation and Finance |

|

New York State and Local Sales and Use Tax |

|

Certificate of Capital Improvement |

(12/15) |

|

After this certificate is completed and signed by both the customer and the contractor performing the capital improvement, it must be kept by the contractor. Copies of this certificate must be furnished to all subcontractors on the job and retained as part of their records.

Read this form completely before making any entries.

This certificate may not be used to purchase building materials exempt from tax.

Name of contractor (print or type) |

|

|

Name of customer (print or type) |

|

|

|

|

|

|

|

|

Address (number and street) |

|

|

Address (number and street) |

|

|

|

|

|

|

|

|

City |

State |

ZIP code |

City |

State |

ZIP code |

|

|

|

|

|

|

|

|

|

Sales tax Certificate of Authority number (if any) |

|

|

|

|

|

|

|

|

To be completed by the customer

Describe capital improvement to be performed:

Project name |

|

|

|

|

|

|

|

|

|

||

Street address (where the work is to be performed) |

City |

State |

ZIP code |

||

|

|

|

|

|

|

I certify that: |

|

|

|

|

|

• I am the (mark an X in one) |

owner |

tenant of the real property identified on this form; and |

|

|

|

• |

the work described above will result in a capital improvement to the real property as outlined in the instructions of this form; and |

||

• |

this contract (mark an X in one) |

includes |

does not include the sale of any items that will not become a permanent part of the |

|

real property (for example, a |

||

I understand that:

•I will be responsible for any sales tax, interest, and penalty due on the contractor’s total charge for tangible personal property and for labor if it is determined that this work does not qualify as a capital improvement; and

•I will be required to pay the contractor the appropriate sales tax on tangible personal property (and any associated services) when the property installed by the contractor does not become a permanent part of the real property; and

•I will be subject to civil or criminal penalties (or both) under the Tax Law if I issue a false or fraudulent certificate.

Signature of customer

Title

Date

To be completed by the contractor

I, the contractor, certify that I have entered into a contract to perform the work described by the customer named above, and that I accept this form in good faith. (A copy of the written contract, if any, is attached.) I understand that my failure to collect tax as a result of accepting an improperly completed certificate will make me personally liable for the tax otherwise due, plus penalties and interest.

Signature of contractor or officer

Title

Date

This certificate is not valid unless all entries are completed.

Page 2 of 2

Instructions

When the customer completes this certificate and gives it to the contractor, who accepts it in good faith, it is evidence that the work to be performed will result in a capital improvement to real property.

A capital improvement to real property is an addition or alteration to real property that:

(a)substantially adds to the value of the real property or appreciably prolongs the useful life of the real property, and

(b)becomes part of the real property or is permanently affixed to the real property so that removal would cause material damage to the property or article itself, and

(c)is intended to become a permanent installation.

The work performed by the contractor must meet all three of these requirements to be considered a capital improvement. This certificate may not be issued unless the work qualifies as a capital improvement. See Tax Bulletin Capital Improvements

If a contractor performs work that constitutes a capital improvement, the contractor must pay tax on the purchase of building materials or other tangible personal property, but is not required to collect tax from the customer for the capital improvement. No credit or refund is allowed for the tax paid on the cost of materials by the contractor. See Tax Bulletin Contractors – Sales Tax Credits

For guidance as to whether a job is a repair or a capital improvement, see Publication 862, Sales and Use Tax Classifications of Capital Improvements and Repairs to Real Property.

A contractor, subcontractor, property owner, or tenant, may not use this certificate to purchase building materials or other tangible personal property tax free. A contractor’s acceptance of this certificate does not relieve the contractor of the liability for sales tax on the purchase of building materials or other tangible personal property subsequently incorporated into the real property as a capital improvement unless the contractor can legally issue Form

The term materials is defined as items that become a physical component part of real or personal property, such as lumber, bricks, or steel. This term also includes items such as doors, windows, sinks, and furnaces used in construction.

Floor covering

Floor covering such as carpet, carpet padding, linoleum and vinyl roll flooring, carpet tile, linoleum tile, and vinyl tile installed as the initial finished floor covering in new construction, a new addition to an existing building or structure, or in a total reconstruction of an existing building or structure, constitutes a capital improvement regardless of the method of installation. As a capital improvement, the charge to the property owner for the installation of floor covering is not subject to New York State and local sales and use taxes. However, the retail purchase of floor covering (such as carpet or padding) itself is subject to tax.

Floor covering installed other than as described above does not qualify as a capital improvement. Therefore, the charges for materials and labor are subject to sales tax. The contractor may apply for a credit or refund of any sales tax already paid on the materials.

The term floor covering does not include flooring such as ceramic tile, hardwood, slate, terrazzo, and marble. The rules for determining when floor covering constitutes a capital improvement do not apply to such flooring. The criteria stated in (a), (b), and (c) above apply to such flooring.

Temporary facilities at construction sites

Subcontracts to provide temporary facilities at construction sites that are necessary for the construction of a capital improvement are considered to be part of the capital improvement project.

Examples of temporary facilities include temporary:

•heat, electric, or plumbing services;

•protective pedestrian walkways; and

•scaffolding services.

A primary contractor purchasing qualifying temporary facilities from a subcontractor must give the subcontractor a copy of Form

A certificate is accepted in good faith when a contractor has no knowledge that the certificate is false or is fraudulently given, and reasonable ordinary due care is exercised in the acceptance of the certificate.

If a contractor gets a properly completed Form

If you are a contractor who installs items such as washing machines, clothes dryers, dishwashers, refrigerators, furniture, etc., which when installed or placed in real property do not become part of the real property, you must collect tax on your charge for the installation. The individual charge for any of these items is also taxable as the sale of tangible personal property.

If a contractor does not get a properly completed Certificate of Capital Improvement within 90 days, the contractor bears the burden of proving the work or transaction was a capital improvement. The failure to get a properly completed certificate, however, does not change the taxable status of a transaction; a contractor may still show that the transaction was a capital improvement.

Contractors and subcontractors must keep any exemption certificate for at least three years after the due date of the last return to which it relates, or the date the return was filed, if later. The contractor must also maintain a method of associating an exempt sale made to a particular customer with the exemption certificate on file for that customer.

Need help?

Visit our website at www.tax.ny.gov

•get information and manage your taxes online

•check for new online services and features

Telephone assistance |

|

Sales Tax Information Center: |

(518) |

To order forms and publications: |

(518) |

Text Telephone (TTY) Hotline (for persons with

hearing and speech disabilities using a TTY): (518)

Persons with disabilities: In compliance with the Americans with Disabilities Act, we will ensure that our lobbies, offices, meeting rooms, and other facilities are

accessible to persons with disabilities. If you have questions about special accommodations for persons with disabilities, call the information center.

Privacy notification

See our website or Publication 54, Privacy Notification.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The ST-124 form certifies that work performed will result in a capital improvement to real property. |

| Governing Law | This certificate is governed by New York State tax law. |

| Completion Requirement | This form must be completed and signed by both the customer and the contractor. |

| Retention Requirement | Contractors must keep this certificate for their records, and it must be furnished to all subcontractors involved. |

| Tax Liability | Customers are liable for sales tax if the work does not qualify as a capital improvement. |

| Definition of Capital Improvement | A capital improvement significantly enhances property value or extends its useful life. |

| Exemption Limitations | This certificate cannot be used to purchase building materials exempt from tax. |

| Temporary Facilities | Temporary facilities necessary for construction may also be exempt under this certificate. |

| Evidence of Compliance | Using this form in good faith indicates work qualifies as a capital improvement under tax law. |

| Retention Period | Contractors must keep the exemption certificate for at least three years after the last tax return it relates to. |

Guidelines on Utilizing St 124

Once you have gathered all necessary information, you're ready to complete the ST-124 form. This step-by-step guide will help ensure that you fill it out correctly, allowing you to submit it with confidence.

- Print or Type the Contractor's Name: Enter the full name of the contractor at the top of the form.

- Print or Type the Customer's Name: Enter the full name of the customer next to the contractor's name.

- Fill in the Addresses: Provide the contractor's address in the designated space, followed by the customer’s address.

- Enter the City, State, and ZIP Codes: Fill out the city, state, and ZIP code for both the contractor and customer sections.

- Sales Tax Certificate of Authority Number: If applicable, include the sales tax certificate number for the customer.

- Describe the Capital Improvement: Clearly outline the type of capital improvement work to be performed.

- Project Name and Street Address: Specify the name of the project and provide the street address where the work is to occur.

- Certify Customer Information: The customer must mark an X to indicate whether they are the owner or tenant of the property and if the contract includes or excludes non-permanent items.

- Customer's Signature: Have the customer sign the form, include their title, and add the date.

- Contractor’s Certification: The contractor must confirm they will perform the described work and sign the form, noting their title and the date.

Make sure all entries are complete before submission. Retain a copy of this form for your records, and provide copies to any subcontractors involved in the project. Following these steps carefully will facilitate a smooth process for both parties involved.

What You Should Know About This Form

What is the ST-124 form?

The ST-124 form is the New York State and Local Sales and Use Tax Certificate of Capital Improvement. This certificate is crucial for identifying work that results in a capital improvement to real property, allowing the contractor to perform the work without charging sales tax to the customer for that improvement. The completed form must be kept by the contractor and shared with any subcontractors involved in the project.

Who needs to fill out the ST-124 form?

Both the customer and the contractor need to complete the ST-124 form. The customer provides information about the property and certifies that the work qualifies as a capital improvement. The contractor, in turn, certifies their acceptance of this information, affirming that they will perform the described work. It's important for both parties to ensure all required sections are filled out to validate the form's use.

What constitutes a capital improvement according to the ST-124 form?

A capital improvement is defined as an addition or alteration to real property that enhances its value, prolongs its useful life, and becomes permanently attached to the property. These changes should be significant enough that removing them would cause material damage to the property or the installed item. Meeting all criteria is essential for the work to qualify under this form.

Can I use the ST-124 form to purchase building materials tax-free?

No, the ST-124 form cannot be used to purchase building materials or other tangible personal property exempt from sales tax. This certificate serves to confirm that the work performed will be a capital improvement, not for acquiring materials without tax. Contractors must pay tax on building material purchases, even when the work qualifies as a capital improvement.

What happens if I fail to collect tax while accepting the ST-124 certificate?

If a contractor accepts the ST-124 certificate without verifying its accuracy and the work does not actually qualify as a capital improvement, the contractor may become personally liable for the taxes that should have been collected, along with any potential penalties and interest. Therefore, exercising due diligence when accepting this form is crucial.

How long must contractors retain the ST-124 form and associated records?

Contractors must keep the ST-124 form and any related exemption certificates for at least three years after the due date of the last return linked to the transaction, or the date the return was filed, whichever is later. Proper record-keeping ensures compliance and can help defend against any future tax liability claims.

Can a contractor use the ST-124 certificate if they are providing temporary facilities at a construction site?

Yes, contracts for temporary facilities related to a capital improvement project can be considered part of the improvement. A contractor must provide a copy of the ST-124 certificate issued to them by the customer when purchasing these services to exempt them from tax. This practice helps streamline the tax handling for capital improvement projects.

What should a contractor do if they don’t receive a properly completed ST-124 form within 90 days?

If a contractor does not obtain a properly completed ST-124 certificate within 90 days of completing the work, the burden of proving that the services rendered were a capital improvement will fall on them. It’s essential for contractors to be vigilant and secure the necessary forms in a timely manner to protect their interests.

Where can I find more information or assistance regarding the ST-124 form?

For additional information about the ST-124 form or sales tax related queries, the New York State Department of Taxation and Finance provides various resources. You can visit their website or contact their Sales Tax Information Center at (518) 485-2889 for personalized assistance. They also offer help for individuals with disabilities regarding accessibility.

Common mistakes

When individuals tackle the ST-124 form, a few common mistakes can lead to misunderstandings or complications later on. One mistake is failing to read the form entirely before making entries. The instructions are set up to guide users through the process, and skipping this step can result in incomplete information or incorrect claims about the work's nature. Taking the time to familiarize oneself with the requirements ensures a smoother completion of the form.

Another frequent error is neglecting to fill out all necessary sections. Each field in the ST-124 form serves a purpose, and incomplete forms may not be accepted. If the name of the contractor or customer is missing or incorrectly entered, for example, it could invalidate the certificate. Individuals must pay attention to filling out every section carefully to avoid future issues.

A third mistake involves misunderstanding the nature of the work being performed. Some people might incorrectly classify a repair as a capital improvement. It's crucial to understand the definition of a capital improvement as one that adds substantial value or prolongs the useful life of a property. This misclassification can lead to unexpected tax liabilities for both the contractor and the customer.

In addition, many individuals fail to mark the appropriate options in the certification section, specifically regarding ownership status or whether the contract includes any non-permanent items. This oversight can undermine the authenticity of the document. Clarity and honesty about the nature of the work and ownership can help mitigate risks associated with tax audits.

People also commonly forget to include a signature and the date on the form. Omitting the customer’s or contractor’s signature can void the certificate, creating additional stress and potential tax consequences down the line. Always double-check for a completed signature and date before submission.

Another mistake occurs when individuals fail to provide accurate addresses for both the contractor and the job site. The form requires precise address information, and inaccuracies can lead to complications in verifying the work's location. Mistakes in the address can create unnecessary hurdles in future paperwork or audits.

Moreover, there is often a lack of clarity regarding the sales tax Certificate of Authority number. Some people assume it is optional, but providing it (if available) strengthens the form’s validity. Ensuring that this number is included helps streamline the verification process.

Lastly, individuals frequently overlook the retention requirement for the form. After signing, it is essential to keep the form on file. Both contractors and subcontractors are required to retain copies of the ST-124 for their records, and failing to do so could lead to complications if the state audits their tax compliance. Understanding and managing these retention requirements is an often-missed but crucial step in the process.

Documents used along the form

The ST-124 form plays a crucial role in documenting capital improvements in New York. When using this form, several other documents are often required to ensure compliance with sales tax regulations. Here’s a quick overview of these related forms and documents:

- Form ST-120.1: This is the Contractor Exempt Purchase Certificate. Contractors use this form when purchasing materials tax-free that will be incorporated into a capital improvement. It provides assurance that taxes have been accounted for appropriately.

- Form ST-130: Known as the Sales Tax Credits form, this document allows contractors to apply for a credit or refund for sales tax paid on materials needed for capital improvements. It ensures that contractors aren't taxed twice for the same materials.

- Tax Bulletin TB-ST-104: This bulletin explains the guidelines for capital improvements. It provides contractors and customers with detailed scenarios that qualify as capital improvements under New York State law, offering clarity about tax exemptions.

- Publication 862: This publication categorizes different types of work as either capital improvements or repairs. It helps to distinguish between projects to determine the appropriate tax implications for contractors.

- Written Contracts: Although not a formal tax document, a written contract serves as crucial evidence of the agreement between the contractor and the customer. It can be referred to if disputes about capital improvements arise in the future.

- Tax Bulletin TB-ST-1301: This bulletin covers the rules regarding the taxation of services provided by contractors, including what constitutes a taxable service versus a nontaxable capital improvement. It acts as a guideline for compliant billing practices.

Incorporating these forms and documents alongside the ST-124 ensures clarity and compliance in transactions relating to capital improvements. Understanding their purposes and maintaining accurate records can foster a smoother working relationship between contractors and customers while complying with New York State tax law.

Similar forms

The ST-124 form is a New York State certificate used for sales and use tax concerning capital improvements. Several other documents share similar purposes and functions. Each document serves as a certificate for tax exemptions in specific situations. Below are five documents comparable to the ST-124 in various contexts:

- ST-120: Exempt Purchase Certificate - This form allows an exempt organization to make purchases without paying sales tax. It must be completed and provided by the purchaser to the seller, ensuring that the seller is aware of the buyer's tax-exempt status.

- ST-121: Exempt Use Certificate - This document is filled out by a purchaser claiming that a specified item will be used solely for an exempt purpose. Much like the ST-124, it provides evidence necessary for sellers to validate the exemption from sales tax.

- ST-125: Sales Tax Resale Certificate - This form is used by businesses to purchase goods without paying sales tax when they intend to resell those goods. It operates similarly to the ST-124 by providing a way to avoid tax on items not for final use.

- Form OP-200: Exemption Certificate for Utilities - This certificate is used by qualifying entities to avoid sales tax on utility services. Similar to the ST-124, it requires the acknowledgment of specific criteria to be eligible for exemption.

- Form ST-6: Sales Tax Exemption Certificate for Government Entities - This form allows government entities to purchase goods without paying sales tax. Similar to the ST-124, it provides assurance to vendors that the transaction will not incur tax, based on the buyer’s status.

Dos and Don'ts

When filling out the St 124 form, it’s important to follow certain guidelines to ensure the process runs smoothly and adheres to legal requirements. Here’s a list of actions to take and actions to avoid.

- Do read the form completely. Understanding every section before making entries is crucial.

- Do provide accurate information. Ensure that the names, addresses, and details of the capital improvement are correct.

- Do keep a copy of the completed form. This is essential for both the contractor and the customer for record-keeping.

- Do ensure both parties sign the form. Both the customer and contractor must provide their signatures to validate the document.

- Do check that your project meets the capital improvement criteria. Make sure it aligns with the definitions provided in the guidelines.

- Don't use the form to purchase building materials tax-free. This certificate cannot be used for that purpose.

- Don't leave any fields blank. All entries must be completed for the form to be valid.

- Don't issue the form without confirming capital improvement status. The project must qualify according to the terms outlined.

- Don't forget to furnish copies to subcontractors. Ensure all subcontractors involved receive a copy as part of their records.

- Don't ignore the responsibilities that come with the form. Understand the potential tax liabilities if the capital improvement is deemed otherwise.

Misconceptions

Understanding the ST-124 form, New York's Sales and Use Tax Certificate of Capital Improvement, is crucial for both contractors and customers. Here are some common misconceptions:

- The ST-124 form can be used for any type of work. This is not the case. The form is specifically for capital improvements that meet certain criteria set by the state.

- Customers do not have to retain a copy of the form. In fact, both the contractor and the customer must keep their copies of the completed form as part of their records.

- The ST-124 form allows contractors to purchase materials tax-free. This is misleading. Contractors must pay sales tax on materials used, even if the work qualifies as a capital improvement.

- All renovations qualify as capital improvements. Not true. A capital improvement must add substantial value or prolong the useful life of the property and become a permanent part of it.

- The contractor is not liable for sales tax if the customer provides an ST-124. This is incorrect. The contractor can still be liable for unpaid taxes if the certificate is improperly completed.

- It doesn’t matter how the ST-124 form is filled out, as long as it is signed. Completing the form incorrectly can lead to serious tax liabilities, making accuracy critical.

- The ST-124 can be used for purchasing appliances. This is a misconception. Items like washing machines and refrigerators do not qualify as capital improvements.

- Only the primary contractor needs to fill out the form. Misunderstanding here; subcontractors also require a copy to validate their tax-exempt services.

- The ST-124 form is valid indefinitely. This is false. The form must be completed and accepted within a specific timeframe related to the project.

By clearing up these misconceptions, both contractors and customers can better navigate the complexities of the ST-124 form and avoid potential tax issues.

Key takeaways

Filling out and using the ST-124 form effectively requires attention to detail and understanding of its purpose. Here are four key takeaways:

- Complete and Accurate Information: Ensure that all sections of the form are filled out completely. Missing or incorrect entries can invalidate the certificate.

- Record Keeping: Both the contractor and customer must retain a copy of the completed certificate. It is essential for audit purposes and to prove tax exempt status during capital improvement projects.

- Definition of Capital Improvement: Understand that not all construction work qualifies as a capital improvement. It must substantially add value to the property, become a permanent part of it, and be intended as such.

- Tax Responsibilities: The contractor must pay sales tax on the materials used, while the customer may be liable for taxes if the work does not qualify as a capital improvement. Potential penalties for issuing a false certificate exist.

Browse Other Templates

Essentials of Firefighting 6th Edition - Awareness of respiratory hazards and the use of appropriate protection is critical during firefighting operations.

Is Metroplus Medicaid - Be proactive in addressing any issues that may arise during the prior authorization process.