Fill Out Your St 129 Form

The ST-129 form is an important document for employees of the United States government, New York State, or its political subdivisions traveling for official business. This form serves as a New York State and Local Sales and Use Tax Exemption Certificate, allowing qualified government employees to stay at hotels or motels without incurring sales taxes on their occupancy charges. It is specifically designed for those whose lodging expenses are covered by a governmental entity during their official travel. The form requires details such as the name and address of the hotel or motel, the dates of occupancy, and certification from the employee about their official capacity and the payment source. Those using the form must also provide appropriate identification to the hotel operator and complete the necessary sections accurately. It is essential to understand that the exemption only applies when the government employee is on recognized governmental business and that any misuse or fraudulent use of the form may lead to severe legal consequences. Retaining this form is also crucial for hotel operators, as they must keep it for a designated period to validate the tax exemption during potential audits. In sum, the ST-129 form acknowledges the unique status of government employees concerning specific tax exemptions while ensuring compliance with state tax regulations.

St 129 Example

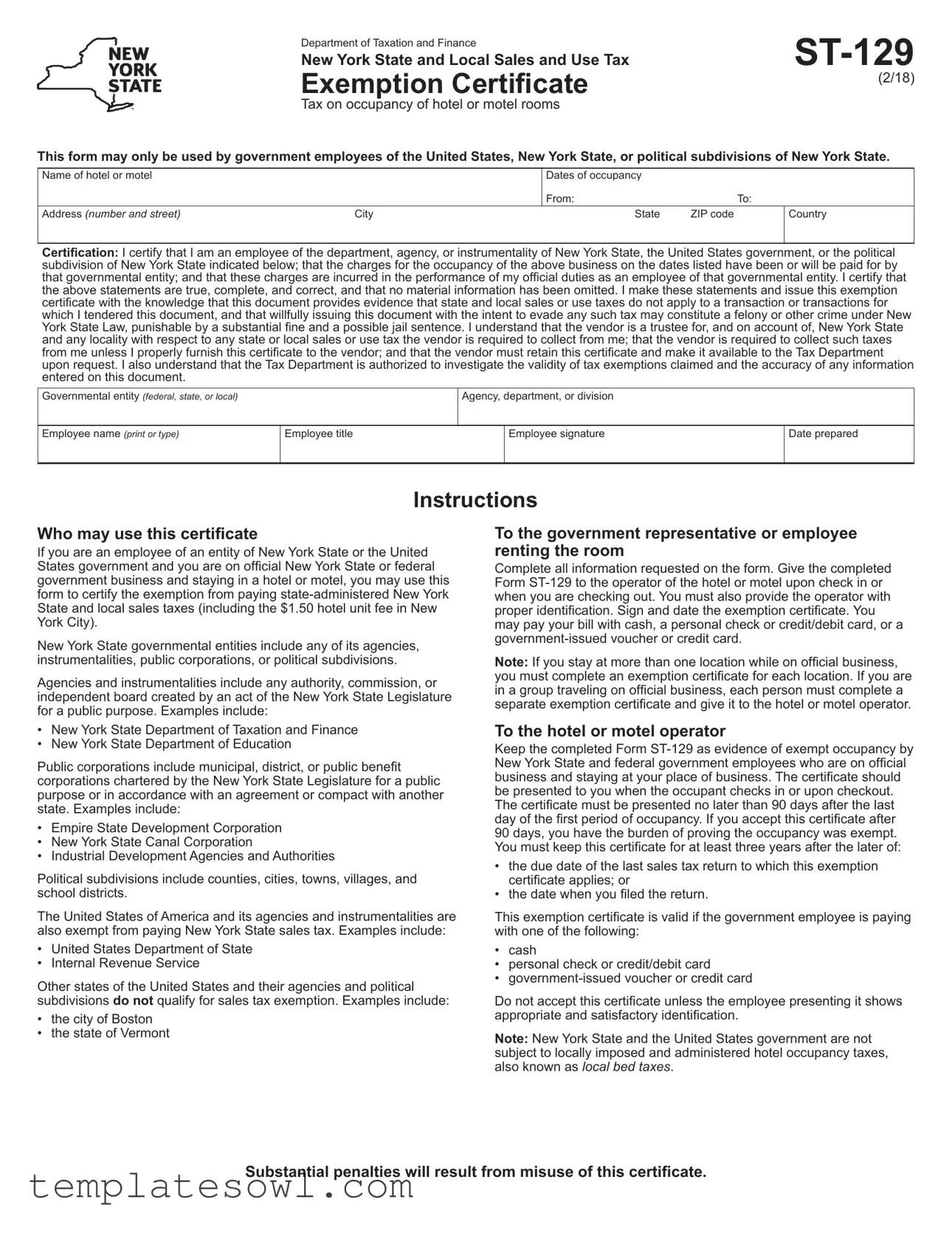

Department of Taxation and Finance |

|

New York State and Local Sales and Use Tax |

|

Exemption Certificate |

(2/18) |

|

Tax on occupancy of hotel or motel rooms

This form may only be used by government employees of the United States, New York State, or political subdivisions of New York State.

Name of hotel or motel |

|

Dates of occupancy |

|

|

|

|

|

|

|

|

From: |

|

|

|

To: |

|

|

Address (number and street) |

City |

|

State |

ZIP code |

|

|

Country |

|

|

|

|

|

|

|

|

|

|

Certification: I certify that I am an employee of the department, agency, or instrumentality of New York State, the United States government, or the political subdivision of New York State indicated below; that the charges for the occupancy of the above business on the dates listed have been or will be paid for by that governmental entity; and that these charges are incurred in the performance of my official duties as an employee of that governmental entity. I certify that the above statements are true, complete, and correct, and that no material information has been omitted. I make these statements and issue this exemption certificate with the knowledge that this document provides evidence that state and local sales or use taxes do not apply to a transaction or transactions for which I tendered this document, and that willfully issuing this document with the intent to evade any such tax may constitute a felony or other crime under New York State Law, punishable by a substantial fine and a possible jail sentence. I understand that the vendor is a trustee for, and on account of, New York State and any locality with respect to any state or local sales or use tax the vendor is required to collect from me; that the vendor is required to collect such taxes from me unless I properly furnish this certificate to the vendor; and that the vendor must retain this certificate and make it available to the Tax Department upon request. I also understand that the Tax Department is authorized to investigate the validity of tax exemptions claimed and the accuracy of any information entered on this document.

Governmental entity (federal, state, or local)

Agency, department, or division

Employee name (print or type)

Employee title

Employee signature

Date prepared

Instructions

Who may use this certificate

If you are an employee of an entity of New York State or the United States government and you are on official New York State or federal government business and staying in a hotel or motel, you may use this form to certify the exemption from paying

New York State governmental entities include any of its agencies, instrumentalities, public corporations, or political subdivisions.

Agencies and instrumentalities include any authority, commission, or independent board created by an act of the New York State Legislature for a public purpose. Examples include:

•New York State Department of Taxation and Finance

•New York State Department of Education

Public corporations include municipal, district, or public benefit corporations chartered by the New York State Legislature for a public purpose or in accordance with an agreement or compact with another state. Examples include:

•Empire State Development Corporation

•New York State Canal Corporation

•Industrial Development Agencies and Authorities

Political subdivisions include counties, cities, towns, villages, and school districts.

The United States of America and its agencies and instrumentalities are also exempt from paying New York State sales tax. Examples include:

•United States Department of State

•Internal Revenue Service

Other states of the United States and their agencies and political subdivisions do not qualify for sales tax exemption. Examples include:

•the city of Boston

•the state of Vermont

To the government representative or employee renting the room

Complete all information requested on the form. Give the completed Form

Note: If you stay at more than one location while on official business, you must complete an exemption certificate for each location. If you are in a group traveling on official business, each person must complete a separate exemption certificate and give it to the hotel or motel operator.

To the hotel or motel operator

Keep the completed Form

90 days, you have the burden of proving the occupancy was exempt. You must keep this certificate for at least three years after the later of:

•the due date of the last sales tax return to which this exemption certificate applies; or

•the date when you filed the return.

This exemption certificate is valid if the government employee is paying with one of the following:

•cash

•personal check or credit/debit card

•

Do not accept this certificate unless the employee presenting it shows appropriate and satisfactory identification.

Note: New York State and the United States government are not subject to locally imposed and administered hotel occupancy taxes, also known as local bed taxes.

Substantial penalties will result from misuse of this certificate.

Form Characteristics

| Fact Name | Detail |

|---|---|

| Document Title | ST-129 New York State and Local Sales and Use Tax Exemption Certificate |

| Governing Law | New York State Tax Law |

| Eligibility | Only U.S. government employees and New York State employees may use this form. |

| Purpose | This form certifies exemption from state and local sales taxes for hotel/motel occupancy. |

| Date of Issue | Last revised on 2/18. |

| Submission | Completed form must be presented to the hotel or motel operator upon check-in or check-out. |

| Retention Period | Hotels/motels must keep the certificate for three years. |

| Exemption Conditions | Exemption applies only if charges are paid by the governmental entity while on official duty. |

| Penalties | Issuing false statements can lead to felony charges or substantial fines. |

| Accepted Payment Methods | Payment may be made with cash, personal checks, credit/debit cards, or government-issued vouchers. |

Guidelines on Utilizing St 129

Completing the St-129 form is crucial for government employees who need to certify their exemption from state and local sales taxes while staying in hotels or motels for official business. Properly filling out and submitting this form will protect you from unnecessary charges. Follow the steps outlined below to ensure your form is completed correctly.

- Obtain the Form: Secure a copy of the St-129 form, either online from the New York State Department of Taxation and Finance or from your agency's administrative office.

- Fill in Hotel or Motel Information: Write the name, address, city, state, ZIP code, and country of the hotel or motel where you will be staying.

- Document Dates of Occupancy: Specify the dates you will be occupying the hotel—from the start date to the end date.

- Provide Governmental Entity Information: Indicate the federal, state, or local governmental entity you represent, along with the specific agency, department, or division you work for.

- Employee Details: Print or type your name, position title, and sign the form to certify that the information provided is accurate.

- Complete the Date Prepared: Fill in the date when you completed the form.

- Review the Completed Form: Before submission, double-check all entries for accuracy and completeness to avoid delays or issues.

- Submit the Form: Provide the completed St-129 form along with appropriate identification to the hotel or motel operator at check-in or checkout.

What You Should Know About This Form

What is the ST-129 form used for?

The ST-129 form is a New York State and Local Sales and Use Tax Exemption Certificate. This form allows government employees from the United States, New York State, or its political subdivisions to certify their exemption from certain sales and use taxes when renting hotel or motel rooms for official business. By completing this form, the employee provides evidence that they are staying for official duties, which means the charges incurred can be exempt from these taxes, including the local hotel unit fee in New York City.

Who is eligible to use the ST-129 form?

Eligibility to use the ST-129 form is limited to government employees of New York State, federal government employees, and employees of political subdivisions of New York State. This includes a range of entities such as state agencies, public corporations, and local governments. It is important to note that employees from other states or their subdivisions are not eligible for this exemption. For example, a municipal employee from Vermont would not qualify to use this form.

How should the ST-129 form be completed and used?

To use the ST-129 form, the government employee must complete all fields on the form, including details about the hotel or motel, dates of occupancy, and their identification details. This completed form must be presented to the hotel or motel operator either upon check-in or checkout. Additionally, employees should provide proper identification. If an individual is traveling in a group, each member must fill out their own ST-129 form, as one form cannot cover multiple employees.

What should hotel or motel operators do with the ST-129 form?

Hotel or motel operators must retain the completed ST-129 form to validate tax-exempt occupancy for government employees. The certificate must be kept for a minimum of three years, as it serves as proof against the sales tax obligation. It is crucial for operators to collect this form no later than 90 days after the last day of occupancy to ensure compliance. Accepting the form after this period means the operator must demonstrate proof of the exempt occupancy, which can be challenging. Operators should also verify that the employee provides satisfactory identification to maintain the integrity of the transaction.

Common mistakes

Many individuals mistakenly overlook critical details when filling out the ST-129 form, which is designed for government employees seeking tax exemptions for hotel stays. One common error is failing to include all necessary identifying information. This includes the name of the hotel or motel, and the exact dates of occupancy. When these details are omitted, it becomes difficult for tax authorities to validate the exemption.

Another frequent mistake is improper certification. Applicants must certify that they are working on official governmental business. If a person does not accurately represent their employment status or the purpose of their stay, it could lead to significant consequences. Misrepresentation undermines the integrity of the exemption process.

Some individuals forget to sign or date the form. An unsigned certificate lacks validity and cannot be accepted by hotel operators. Additionally, the absence of a date may cause confusion regarding the timing of the exemption.

A closely related issue is not providing proper identification. Government employees must show appropriate identification when submitting the ST-129 form. Without valid ID, the hotel may deny the tax exemption, leaving the employee responsible for the tax payment.

Moreover, individuals may not realize that each hotel stay requires a separate ST-129 form. For those traveling on official business and staying in multiple locations, it's essential to complete a form for each hotel or motel. Assuming one form suffices can create unnecessary financial burdens.

Another mistake arises from not submitting the certificate within the required timeframe. The ST-129 form must be presented no later than 90 days after the last day of occupancy. If missed, the hotel operator may have trouble proving the validity of the tax exemption.

Lastly, failure to read the instructions can lead to errors. Each section of the ST-129 form has specific requirements, which if ignored, could result in delays or denials of the exemption. Paying attention to the instructions ensures a smoother process and adherence to tax compliance.

Documents used along the form

When utilizing the ST-129 form, there are several other documents and forms that often accompany it. These documents help ensure compliance with tax regulations and provide additional information necessary for tax exemption verification. Below is a list of commonly used forms that may be required alongside the ST-129.

- Form ST-120: This is the New York State Resale Certificate, used by buyers to purchase goods or services without paying sales tax, indicating they intend to resell the items.

- Form ST-121: Known as the Exempt Use Certificate, this form allows certain organizations, such as non-profits, to purchase items tax-exempt for specific uses directly related to their mission.

- Form ST-4: This form serves as an exemption certificate for certain organizations, like educational institutions or charities, detailing the specifics for tax-exempt purchases.

- Form AC-4: This is the New York State Tax Exemption Application for Agriculture, enabling farms and agricultural businesses to purchase eligible products free from sales tax.

- Vendor Agreement: This document outlines the responsibilities and agreements between the governmental entity and the vendor, including payment terms related to the tax-exempt status.

- Payment Authorization: This is often a government-issued document that authorizes the hotel or motel to charge the appropriate fees to a government account, confirming official business status.

- ID Verification: A form of identification must be presented to confirm the employee’s governmental status and eligibility for tax exemption, such as a government-issued employee ID.

- Travel Authorization Form: This document indicates that the employee is on official government business, detailing trip information; useful for tax provision compliance.

- W-9 Form: The Request for Taxpayer Identification Number and Certification may be collected for proper tax reporting by vendors receiving payments under these exemptions.

- Form ST-151: Known as the Direct Payment Permit, this form allows certain entities to purchase items without paying sales tax upfront, requiring them to report and remit tax later.

These documents work together to establish and verify tax exemptions for government employees, ensuring compliance with New York State regulations. Always ensure that all necessary paperwork is completed accurately and submitted promptly to maintain tax-exempt status during transactions.

Similar forms

-

ST-120 Exempt Use Certificate - This form is used by organizations that are exempt from sales tax to claim exemption on purchases made for exempt uses. Like the ST-129, it certifies that the buyer is not liable for sales tax, but it applies to a broader range of purchases beyond hotel stays.

-

ST-121 Exempt Certificate - This document serves a similar purpose in declaring exempt sales for businesses purchasing items for resale. It is used by those buying goods to sell as part of their business operations, ensuring they are not taxed at the point of sale, just as ST-129 waives tax for government-related hotel stays.

-

ST-142 Resale Certificate - The ST-142 is aimed more at wholesalers and retailers who buy products for resale. Much like the ST-129, it indicates that the purchaser is exempt from paying sales tax at the moment of purchase.

-

ST-5 Exempt Organization Certificate - This certificate is intended for tax-exempt organizations. Similar to the ST-129, it provides evidence of exemption from sales tax when making purchases in connection with the organization’s exempt activities.

-

ST-121 Exempt Use Certificate for Utilities - This form is specific to utility services and claims exemption from sales tax for certain utility usage. Like the ST-129, it is used by qualifying entities, thus highlighting the common aim of certifying tax-exempt purchases.

-

ST-140 Non-Profit Exempt Certificate - Non-profit organizations use this document to exempt themselves from sales tax on purchases made in relation to their charitable activities. This parallels the ST-129, as both forms verify that no tax is owed based on the purchaser's status.

-

ST-8606 Certificate of Exemption for Sales Tax - This form is specifically for state and local government employees, indicating exempt purchases. Similar to the ST-129, it serves as a confirmation that sales tax does not apply to transactions for official duties.

-

ST-129.1 Travel Voucher Exemption Certificate - This form can be used in lieu of the ST-129 under certain conditions when an employee is combining business and personal travel. Like the ST-129, this document is related to lodging expenses for government employees and emphasizes the official nature of the trip.

Dos and Don'ts

When filling out the ST-129 form, consider these important dos and don’ts:

- Do: Clearly print or type all required information, including the name of the hotel, dates of occupancy, and employee details.

- Do: Sign and date the exemption certificate to validate your claim for tax exemption.

- Do: Provide proper identification to the hotel or motel operator when you present the form.

- Do: Submit a separate exemption certificate for each location if you stay at multiple hotels during your trip.

- Do: Ensure the certificate is presented at check-in or checkout, and within the specified timeframe of 90 days after the last day of occupancy.

- Don’t: Neglect to complete all sections of the form, as incomplete information can invalidate the exemption.

- Don’t: Use the exemption certificate for any transaction not directly related to your official government duties.

- Don’t: Fail to retain a copy of the certificate for your records after it has been submitted to the hotel or motel.

- Don’t: Accept the exemption if proper identification is not provided along with the form.

- Don’t: Attempt to misuse the exemption certificate, as it may lead to legal penalties or criminal charges.

Misconceptions

Misconception 1: Anyone can use the ST-129 form.

Many believe that the ST-129 form can be used by any individual for tax exemption at hotels or motels. However, this form is specifically designated for employees of the United States government, New York State, or its political subdivisions. Personal use or use outside these specific employment categories is not permitted.

Misconception 2: This form can be submitted anytime.

Some may think that they can present the ST-129 form at any time during their stay to avoid taxes. In reality, the form must be presented either at check-in or check-out and cannot be accepted after 90 days from the last date of the first occupancy period.

Misconception 3: The hotel or motel must accept the certificate regardless of conditions.

It is a common misunderstanding that hotels are obligated to accept the ST-129 form without verification. In fact, hotel operators must confirm that the certificate is accompanied by proper identification and must retain it for record-keeping. Accepting the form imposes a burden of evidence on the vendor if it is accepted after the specified time frame.

Misconception 4: It’s permissible to use one form for multiple hotel stays.

Some believe that they can use a single ST-129 form for several hotel stays. However, if you are staying at multiple locations for official business, you must complete a new exemption certificate for each location. Each individual traveling in a group must also submit their own certificate to qualify for the tax exemption.

Key takeaways

Here are some key takeaways about utilizing the ST-129 form for tax exemption purposes:

- Eligibility: Only employees of the United States government, New York State, or its political subdivisions can use this form.

- Proper Completion: Fill out all required sections of the form, including your name, agency, and the hotel details.

- Submission: Present the completed ST-129 form to the hotel operator during check-in or checkout, along with valid identification.

- Multiple Stays: If you stay in more than one hotel, a separate ST-129 form is necessary for each location.

- Group Travel: Each member in a group traveling on official business must complete an individual exemption certificate.

- Retention of Certificate: Hotels must keep the ST-129 for at least three years for verification purposes, and it should be presented no later than 90 days after the last day of stay.

- Punishments for Noncompliance: Misuse of this certificate can lead to significant penalties, including fines or other legal consequences.

Browse Other Templates

Pennsylvania Llc Filing Requirements - It creates a formal record of the establishment of the new entity.

Ao78 Form - Ensure all contact information is up-to-date for follow-up correspondence.

When You Start a New Job, How Would You Sign Up for Direct Deposit? - Utilize TCF Bank to manage deposits for federal benefits effectively.