Fill Out Your St 13A Form

The ST-13A form, also known as the Sales and Use Tax Certificate of Exemption, plays a vital role for nonprofit churches in Virginia. Designed specifically for organizations that are exempt from income taxation under Internal Revenue Code Section 501(c)(3), this form enables eligible churches to purchase tangible personal property without incurring state sales and use tax. This includes a range of items such as prepared meals, cleaning supplies, and teaching materials necessary for the church's operations. The exemption applies not only to goods used during religious worship but also to items utilized in the administration of church-related programs, including kindergarten and elementary schools. In addition, the form outlines the required information for both the church and the supplier, ensuring a streamlined process for tax-exempt purchases. By certifying that the purchases made under this exemption will be funded through church resources, the ST-13A form serves as a crucial document to maintain compliance with Virginia's retail sales and use tax regulations. Without it, nonprofit churches may face unexpected tax liabilities on essential items needed to carry out their mission.

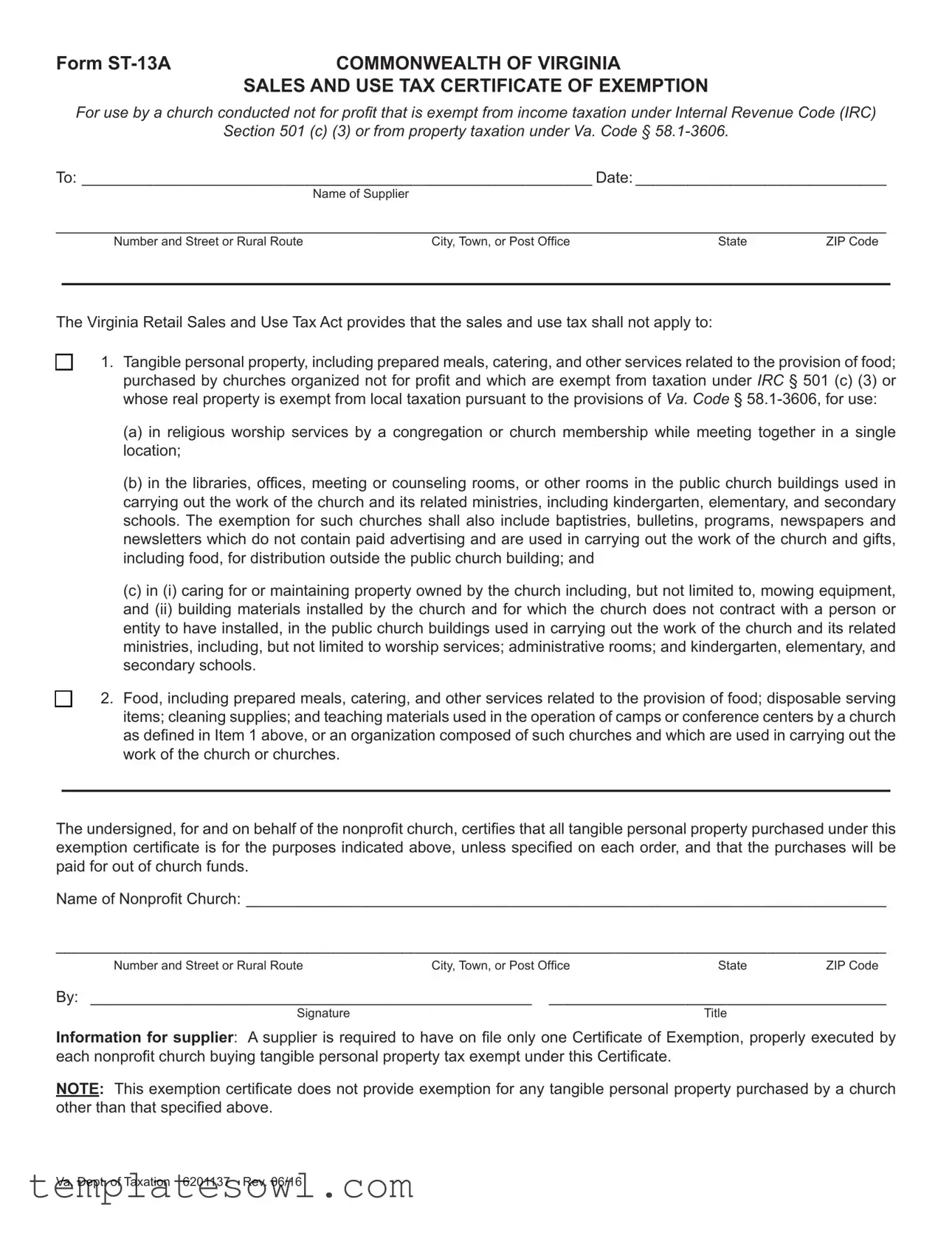

St 13A Example

Form |

COMMONWEALTH OF VIRGINIA |

|

SALES AND USE TAX CERTIFICATE OF EXEMPTION |

For use by a church conducted not for profit that is exempt from income taxation under Internal Revenue Code (IRC)

Section 501 (c) (3) or from property taxation under Va. Code §

To:____________________________________________________________ Date:______________________________

Name of Supplier

________________________________________________________________________________________________

Number and Street or Rural Route |

City, Town, or Post Office |

State |

ZIP Code |

The Virginia Retail Sales and Use Tax Act provides that the sales and use tax shall not apply to:

c1. Tangible personal property, including prepared meals, catering, and other services related to the provision of food; purchased by churches organized not for profit and which are exempt from taxation under IRC § 501 (c) (3) or whose real property is exempt from local taxation pursuant to the provisions of Va. Code §

(a)in religious worship services by a congregation or church membership while meeting together in a single location;

(b)in the libraries, offices, meeting or counseling rooms, or other rooms in the public church buildings used in carrying out the work of the church and its related ministries, including kindergarten, elementary, and secondary schools. The exemption for such churches shall also include baptistries, bulletins, programs, newspapers and newsletters which do not contain paid advertising and are used in carrying out the work of the church and gifts, including food, for distribution outside the public church building; and

(c)in (i) caring for or maintaining property owned by the church including, but not limited to, mowing equipment, and (ii) building materials installed by the church and for which the church does not contract with a person or entity to have installed, in the public church buildings used in carrying out the work of the church and its related ministries, including, but not limited to worship services; administrative rooms; and kindergarten, elementary, and secondary schools.

c2. Food, including prepared meals, catering, and other services related to the provision of food; disposable serving items; cleaning supplies; and teaching materials used in the operation of camps or conference centers by a church as defined in Item 1 above, or an organization composed of such churches and which are used in carrying out the work of the church or churches.

The undersigned, for and on behalf of the nonprofit church, certifies that all tangible personal property purchased under this exemption certificate is for the purposes indicated above, unless specified on each order, and that the purchases will be paid for out of church funds.

Name of Nonprofit Church: __________________________________________________________________________

________________________________________________________________________________________________

Number and Street or Rural RouteCity, Town, or Post OfficeStateZIP Code

By: ____________________________________________________ |

_______________________________________ |

Signature |

Title |

Information for supplier: A supplier is required to have on file only one Certificate of Exemption, properly executed by each nonprofit church buying tangible personal property tax exempt under this Certificate.

NOTE: This exemption certificate does not provide exemption for any tangible personal property purchased by a church other than that specified above.

Va. Dept. of Taxation 6201137 Rev. 06/16

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The ST-13A form is a Sales and Use Tax Certificate of Exemption for churches in Virginia that are not-for-profit and meet certain tax-exempt criteria. |

| Governing Law | This form is governed by the Virginia Retail Sales and Use Tax Act and is pertinent to IRC Section 501(c)(3) and Va. Code § 58.1-3606. |

| Eligible Entities | Only nonprofit churches operating under IRC § 501(c)(3) can utilize this exemption certificate for applicable purchases. |

| Types of Exempt Purchases | The certificate covers the purchase of tangible personal property, food services, and necessary items for church operations and ministries. |

| Signature Requirement | The form must be signed by an authorized representative of the nonprofit church, affirming the accuracy of the information provided. |

| Limitations | This exemption certificate does not cover all types of purchases; only those specifically outlined in the form are exempt from sales and use tax. |

Guidelines on Utilizing St 13A

Filling out the ST-13A form is a simple process that involves providing specific information about your non-profit church and the purchases you intend to make tax-exempt. After you complete the form, it should be submitted to the supplier from whom the items will be purchased. The supplier will keep this certificate on file as proof of your church’s exemption status.

- Begin by entering the date at the top of the form.

- In the field labeled "To," write the name of the supplier you are purchasing from.

- Provide the supplier's full address, including street number, city, state, and ZIP code.

- Next, enter the name of your non-profit church in the designated space.

- Complete the address section for the non-profit church, including the street number, city, state, and ZIP code.

- Sign the form in the space provided to indicate your validation of the information. Be sure to print your name beneath the signature.

- In the "Title" section, include your position within the church to clarify your authority to sign the form.

Once the form is filled out, retain a copy for your records before providing the original to the supplier.

What You Should Know About This Form

What is the purpose of the St 13A form?

The St 13A form serves as a Sales and Use Tax Certificate of Exemption specifically designed for nonprofit churches. This form allows churches that are exempt under the Internal Revenue Code Section 501(c)(3) or Virginia Code § 58.1-3606 to purchase certain tangible personal property without having to pay sales tax. The items purchased must be used for stated religious purposes, such as for worship services, administrative functions, or related church activities. This exemption streamlines church operations and helps minimize expenses associated with tax on necessary goods and services.

Who is eligible to use the St 13A form?

Eligibility to utilize the St 13A form is restricted to churches that operate on a nonprofit basis and have received exemption status under Internal Revenue Code Section 501(c)(3) or are free from property taxation according to Virginia laws. Churches seeking this exemption must demonstrate their nonprofit status and the purpose of the items they plan to purchase. The form also requires the church’s name and confirmation that the purchases will be funded through church finances, ensuring that only qualifying purchases are made under the exemption.

What types of purchases are covered under the St 13A form?

Purchases made with the St 13A form typically include tangible personal property like prepared meals, catering services, cleaning supplies, and teaching materials. These items must be intended for religious worship, church operations, or church-related activities, such as camps or educational sessions. Notably, the exemption encompasses libraries, administrative rooms, and materials for ministry efforts, making it a broad tool for supporting the church's mission. However, it does not apply to every purchase made by the church—only those explicitly listed and used in accordance with the outlined purposes.

How should the St 13A form be presented to suppliers?

To ensure the supplier accepts the certificate, the church must properly complete the St 13A form, including all required details such as the church’s name and address, along with a signature from an authorized representative. Suppliers only need to keep one properly executed exemption certificate on file for each nonprofit church they do business with. It’s important to note that this form does not apply to all purchases. Therefore, careful attention should be paid to the items purchased under this exemption to avoid any legal complications regarding tax obligations.

Common mistakes

When filling out the ST-13A form for a Sales and Use Tax Certificate of Exemption in Virginia, common mistakes can lead to confusion or delays. Understanding these errors can help ensure that the form is completed correctly.

One common mistake is failing to include the correct name of the supplier. It is crucial for the buyer to detail both the supplier's full legal name and address accurately. Missing or incorrect information can lead to questions about validity and acceptance of the exemption.

Another frequent error is not specifying the name of the nonprofit church clearly. The church's name should match the name on its IRS exemption letter. Inconsistencies can raise doubts about the church's exempt status.

Individuals often overlook the requirement to include the date on the form. Omitting the date can render the form ineffective, as it indicates when the purchase took place. This is particularly important for record-keeping and tax compliance.

Providing a vague or incomplete description of the tangible personal property being purchased is another issue. Specificity is key. Clearly stating what items are being exempted under the certificate can help prevent disputes regarding eligibility for tax exemption.

Many also forget to include the signature of a representative of the nonprofit church. A valid signature is necessary to authenticate the document. Without it, the form lacks the essential validity required by the state.

A significant mistake involves failing to indicate if there are any exceptions to the purchases made under the certificate. If certain items do not qualify for exemption, those should be clearly specified on each order. Neglecting this can lead to audits or unexpected tax bills.

Another error is not ensuring that all purchases are made from church funds. If the purchases are made using personal funds or without proper documentation, this could invalidate the exemption. It is vital for the buyer to confirm that church funds are being used for all applicable purchases.

Lastly, many people do not keep a copy of the ST-13A form after submission. Retaining a copy is critical for reference in case of future inquiries or audits. Documentation is essential in proving compliance with the tax exemption requirements.

By avoiding these nine common mistakes, individuals can increase the likelihood that their ST-13A forms will be processed smoothly and without complications.

Documents used along the form

The ST-13A form is a vital document for churches organized as non-profit entities, enabling them to make purchases exempt from sales and use tax. Alongside the ST-13A form, several other forms and documents are commonly utilized to ensure compliance with various legal and operational standards. The following list outlines these documents, providing a brief description of each.

- Form ST-10: This form serves as the standard sales and use tax exemption certificate for various exempt organizations. It allows eligible entities to purchase tangible personal property without incurring sales tax.

- Form ST-11: This is the Virginia resale certificate. Retailers use this form to purchase goods intended for resale without paying sales tax upfront, allowing them to pass on tax obligations to the final consumer.

- Form W-9: Used by organizations to request the taxpayer identification number of a supplier or contractor, this form is essential for tax reporting purposes, particularly when payments exceed a certain threshold.

- Form 990: Nonprofit organizations must file this annual information return with the IRS. It provides the government and the public a comprehensive overview of the organization’s financial activities and compliance with tax regulations.

- Form 501(c)(3) Determination Letter: This document from the IRS certifies an organization’s status as a tax-exempt entity under Section 501(c)(3). It serves as proof of exemption for donors and other organizations.

- Charitable Registration Form: Required in many states, this form registers organizations fundraising for charitable purposes and ensures compliance with state regulations regarding solicitation and financial reporting.

- Bylaws: These governing documents outline the operational rules of a church or non-profit organization. Bylaws typically cover governance, membership, and the organization’s mission, playing a crucial role in internal compliance.

- Meeting Minutes: Documented records of the meetings held by a church's governing body are essential for transparency and accountability. They provide evidence of the decision-making process and compliance with the bylaws.

- Annual Budget: This financial plan serves as a tool for managing church funds and allocating resources. It aids in planning for operational needs and ensuring fiscal responsibility.

Each of these documents plays a significant role in the operational framework of non-profit organizations like churches. Ensuring that these forms are correctly executed and maintained can significantly enhance compliance and operational efficiency, ultimately supporting the mission of the church.

Similar forms

The ST-13A form is an important document for nonprofit churches in Virginia, allowing them to claim sales and use tax exemptions. There are other similar documents that serve specific purposes, and understanding these can help organizations navigate their tax responsibilities more effectively. Here’s a breakdown of four documents similar to the ST-13A form:

- IRS Form 1023: This is the application form for tax-exempt status under section 501(c)(3) of the Internal Revenue Code. Like the ST-13A, it certifies that an organization qualifies for tax exemption, ensuring it can operate without income tax liability. Nonprofits apply to the IRS for recognition of this status, just as they use the ST-13A for sales and use tax exemptions.

- Virginia Form ST-9: This form is a Certificate of Exemption for specific purchases made by nonprofit organizations, including charities and churches. Similar to the ST-13A, the ST-9 is used to make tax-exempt purchases, but it is applicable to a broader range of organizations. Both forms are designed to verify exemption for various purchases pivotal to the organizations' missions.

- Virginia Form ST-12: This is another Certificate of Exemption for entities engaged in specific business activities, allowing them to purchase tangible goods without paying sales tax. Like the ST-13A, the ST-12 provides documentation needed by suppliers to honor tax exemptions. Each document serves a role in legitimizing tax-exempt status for different types of entities.

- Form 990: Although different in purpose, this form is used by tax-exempt organizations to report their financial information to the IRS. It ensures transparency and accountability, much like the ST-13A ensures compliance when claiming sales and use tax exemptions. Both forms are essential for maintaining benefits granted under nonprofit status.

Understanding these related documents can help organizations ensure they’re fully compliant with tax regulations while maximizing their exemptions. Each form plays a unique yet interrelated role in the nonprofit and religious sector.

Dos and Don'ts

Filling out the ST-13A form can seem daunting, but taking the right steps can simplify the process significantly. Here are ten important dos and don'ts to keep in mind as you complete this certificate of exemption for your church.

- Do ensure your church is recognized as a nonprofit under IRC § 501 (c) (3).

- Don't forget to include all relevant contact information for your church.

- Do clearly specify the purposes for which the tax-exempt items will be used.

- Don't list any items that are not covered under the exemption guidelines.

- Do provide your signature and title at the bottom of the form.

- Don't neglect to inform your supplier that they need only one Certificate of Exemption on file.

- Do check for accuracy in all the details you provide before submitting.

- Don't overlook the importance of using church funds for these purchases.

- Do keep a copy of the completed form for your records.

- Don't submit the form if there are any incomplete sections; completeness is crucial.

By following these dos and don'ts, you can navigate the ST-13A form with confidence and ensure compliance with tax exemption regulations. Remember, careful attention to detail will make the process smoother for your church.

Misconceptions

Understanding the nuances of the St 13A form is essential for churches looking to navigate tax exemptions correctly. Here are some common misconceptions about this form:

- The St 13A form is only for large churches. Many believe this exemption is exclusive to larger congregations, but any nonprofit church qualifying under the IRS 501(c)(3) can utilize the St 13A form.

- All purchases made by a church are tax-exempt. This is not the case. The St 13A form applies only to specific types of purchases directly related to the church's activities.

- The form is only necessary for food and supplies. While it covers prepared meals and cleaning supplies, it also includes building materials and items related to educational ministries.

- Once the form is submitted, it’s permanent. The St 13A form must be used for each specific purchase. It doesn’t provide a blanket exemption for future transactions.

- Churches can use the form for personal purchases. The form is designed for items bought for church use only. Personal items, even if purchased during church events, do not qualify.

- Any church can file the St 13A form. Only churches that meet the criteria of being recognized as 501(c)(3) nonprofit organizations are eligible to use this exemption certificate.

- The St 13A form is only necessary for in-person purchases. This form can also be used for online transactions as long as the purchases meet the criteria for exemption.

- Once a church qualifies for an exemption, it can’t lose it. If a church changes its operational structure or no longer meets the qualifications, it may lose its tax-exempt status.

- The form doesn't require any signatures. To be valid, the St 13A form must be signed by an authorized representative of the church, confirming the legitimacy of the purchases.

- Suppliers can apply the exemption without the certificate. Suppliers need a properly executed St 13A form on file for each nonprofit church to validate tax-exempt purchases.

Key takeaways

Filling out and using the ST 13A form correctly is important for nonprofit churches in Virginia. Here are some key takeaways:

- The form is intended for churches that are not for profit and are exempt from income taxation.

- To qualify, the church must be recognized under IRC Section 501(c)(3) or exempt from property taxation.

- Details about the supplier must be provided, including their name and address.

- The church’s name and address need to be clearly stated on the form.

- The form lists specific items exempt from sales tax, such as tangible personal property and food.

- Exempt items can be used for worship services, church operations, and related ministries.

- A supplier should only keep one properly filled ST 13A form from each church, not multiple forms.

- The undersigned church representative must sign and state their title on the form.

- Make sure to indicate on each order if there are exceptions to the exemptions.

- The form does not exempt all types of purchases by a church; it is limited to those specified.

Browse Other Templates

How to Get Pa License Plate - Ensure all certifications are signed before mailing the form to avoid delays.

Can I Buy Sperm From a Sperm Bank - A history of substance use will be evaluated for risk factors in the donation process.

Pennsylvania License - Must be signed in the presence of an official or notary.