Fill Out Your St 18 Form

The St 18 form, officially known as the Sales and Use Tax Certificate of Exemption, serves a crucial role for farmers and veterinarians in the Commonwealth of Virginia. This form provides a way for these individuals to make tax-exempt purchases of tangible personal property, specifically items that are directly related to agricultural production for market. The list of exempt items includes essential goods like commercial feeds, seeds, fertilizers, and various agricultural supplies. While farmers can purchase these items without paying sales tax, it's vital to remember that the exemption is specific to items used in agricultural production, not for personal use. For veterinarians, the form allows tax-free acquisitions of medicines used in the treatment of agricultural production animals. When filling out the St 18 form, the person certifies their status as a farmer or a veterinarian, ensuring that the purchases made are exclusively for business use as defined under the law. Importantly, this form simplifies record-keeping for dealers, as they only need to retain a single, properly executed certificate for tax exemption purposes. However, it cannot be used by contractors purchasing materials that will be affixed to real property. Overall, the St 18 form embody the intersection of agriculture and taxation, providing vital support for those dedicated to the farming industry in Virginia.

St 18 Example

Form

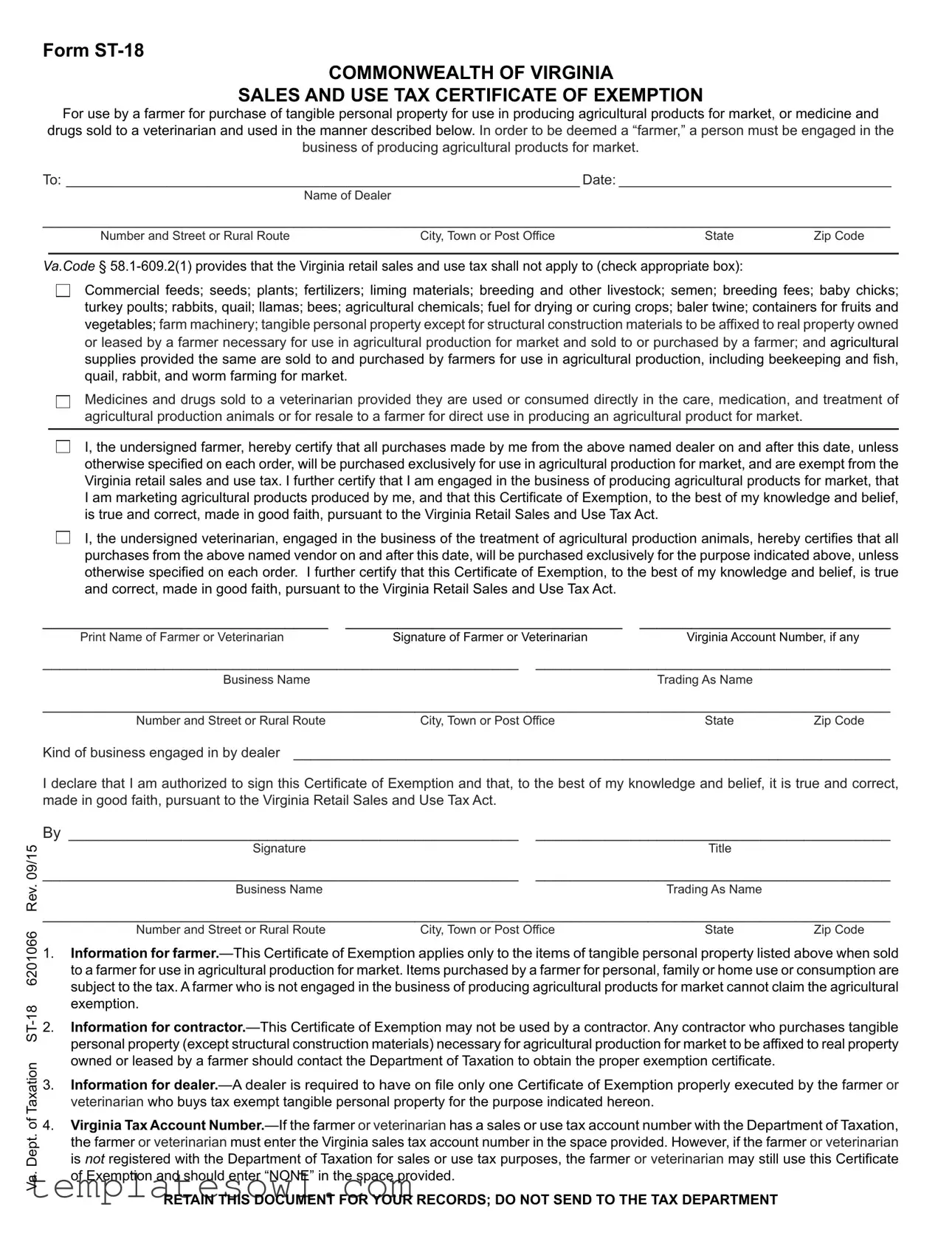

COMMONWEALTH OF VIRGINIA

SALES AND USE TAX CERTIFICATE OF EXEMPTION

For use by a farmer for purchase of tangible personal property for use in producing agricultural products for market, or medicine and

drugs sold to a veterinarian and used in the manner described below. In order to be deemed a “farmer,” a person must be engaged in the

business of producing agricultural products for market.

To:___________________________________________________________________ Date:____________________________________

Name of Dealer

__________________________________________________________________________________________________

Number and Street or Rural Route |

City, Town or Post Office |

State |

Zip Code |

Va.Code §

Commercial feeds; seeds; plants; fertilizers; liming materials; breeding and other livestock; semen; breeding fees; baby chicks; turkey poults; rabbits, quail; llamas; bees; agricultural chemicals; fuel for drying or curing crops; baler twine; containers for fruits and vegetables; farm machinery; tangible personal property except for structural construction materials to be affixed to real property owned or leased by a farmer necessary for use in agricultural production for market and sold to or purchased by a farmer; and agricultural supplies provided the same are sold to and purchased by farmers for use in agricultural production, including beekeeping and fish, quail, rabbit, and worm farming for market.

Medicines and drugs sold to a veterinarian provided they are used or consumed directly in the care, medication, and treatment of agricultural production animals or for resale to a farmer for direct use in producing an agricultural product for market.

I, the undersigned farmer, hereby certify that all purchases made by me from the above named dealer on and after this date, unless otherwise specified on each order, will be purchased exclusively for use in agricultural production for market, and are exempt from the Virginia retail sales and use tax. I further certify that I am engaged in the business of producing agricultural products for market, that I am marketing agricultural products produced by me, and that this Certificate of Exemption, to the best of my knowledge and belief, is true and correct, made in good faith, pursuant to the Virginia Retail Sales and Use Tax Act.

I, the undersigned veterinarian, engaged in the business of the treatment of agricultural production animals, hereby certifies that all purchases from the above named vendor on and after this date, will be purchased exclusively for the purpose indicated above, unless otherwise specified on each order. I further certify that this Certificate of Exemption, to the best of my knowledge and belief, is true and correct, made in good faith, pursuant to the Virginia Retail Sales and Use Tax Act.

_________________________________ |

_________________________________ |

_ _____________________________ |

Print Name of Farmer or Veterinarian |

Signature of Farmer or Veterinarian |

Virginia Account Number, if any |

_______________________________________________________ _________________________________________

Business NameTrading As Name

__________________________________________________________________________________________________

Number and Street or Rural RouteCity, Town or Post OfficeStateZip Code

Kind of business engaged in by dealer _ _____________________________________________________________________

I declare that I am authorized to sign this Certificate of Exemption and that, to the best of my knowledge and belief, it is true and correct, made in good faith, pursuant to the Virginia Retail Sales and Use Tax Act.

Va. Dept. of Taxation

By _____________________________________________________ |

_________________________________________ |

Signature |

Title |

_______________________________________________________ |

_________________________________________ |

Business Name |

Trading As Name |

__________________________________________________________________________________________________

Number and Street or Rural Route |

City, Town or Post Office |

State |

Zip Code |

1.Information for

2.Information for

3.Information for

4.Virginia Tax Account

RETAIN THIS DOCUMENT FOR YOUR RECORDS; DO NOT SEND TO THE TAX DEPARTMENT

Form Characteristics

| Fact Name | Detail |

|---|---|

| Governing Law | This certificate is governed by the Virginia Code § 58.1-609.2(1). |

| Purpose | The ST-18 form is used by farmers to purchase tangible personal property exempt from sales tax. |

| Qualifications | A person must be engaged in producing agricultural products for market to be considered a farmer. |

| Exempt Items | Exempt purchases include commercial feeds, seeds, fertilizers, and farm machinery among others. |

| Veterinarian Use | The form also applies to veterinarians for medicinal purchases related to agricultural animals. |

| Restrictions | Items purchased for personal use or by non-farming individuals are subject to sales tax. |

| Dealer Obligations | Dealers must retain only one properly executed Certificate of Exemption for each farmer or veterinarian. |

| Tax Account Number | If applicable, farmers or veterinarians must provide their Virginia sales tax account number on the form. |

Guidelines on Utilizing St 18

Completing the ST-18 form is an important step for farmers and veterinarians in Virginia looking to exempt certain purchases from sales tax. This form certifies that the items will be used exclusively for agricultural production or veterinary care, which qualifies them for exemption under Virginia law. Follow the steps below carefully to fill out the form.

- Start by entering the date at the top of the form.

- Fill in the name of the dealer where you are making your purchase.

- Provide the dealer's address, including the number and street, city, state, and zip code.

- In the section below the dealer's address, check the box next to the items you are purchasing that qualify for exemption. Options include commercial feeds, seeds, fertilizers, and more.

- Sign the form, entering your printed name, signature, and Virginia account number (if applicable) in the designated fields.

- Indicate your business name and the trading as name in the provided spaces.

- Complete the dealer’s kind of business section to specify the type of business the dealer engages in.

- Finally, if you are also filling out details for a veterinarian, ensure they sign and provide their information in the relevant fields.

After completing the ST-18 form, keep it on file as a record of your exemption. Make sure not to send it to the tax department. Store it safely to reference it if needed in the future.

What You Should Know About This Form

What is the St 18 form used for?

The St 18 form, or the Sales and Use Tax Certificate of Exemption, is primarily used by farmers in Virginia. This certificate allows farmers to purchase certain tangible personal property without paying the Virginia retail sales and use tax. Eligible items include agricultural inputs like seeds, fertilizers, and farm machinery, as well as specific veterinary medicines used for production animals.

Who can use the St 18 form?

Only individuals engaged in the business of producing agricultural products for market can use the St 18 form as farmers. Additionally, veterinarians treating agricultural production animals may also utilize this certificate for specific medicinal purchases. Both must certify their engagements in agricultural production to claim this exemption.

What items are exempt under the St 18 form?

The St 18 form exempts a variety of items. These include commercial feeds, seeds, fertilizers, breeding livestock, agricultural chemicals, and farm machinery. It also covers medicines and drugs sold to veterinarians for treating production animals. However, purchases for personal or non-agricultural use are not exempt.

Are contractors able to use the St 18 form?

No, the St 18 form cannot be used by contractors. If contractors need to purchase items for agricultural use that will be affixed to real property owned or leased by a farmer, they must contact the Virginia Department of Taxation for the appropriate exemption certificate. This helps to avoid confusion regarding eligibility.

What information must be included on the St 18 form?

When filling out the St 18 form, the farmer or veterinarian must provide their name, business name, address, and Virginia account number, if applicable. They must also indicate the name of the dealer from whom they are purchasing. Accurate information ensures that the exemption is valid and correctly processed.

What should I do with the St 18 form once it's completed?

After completing the St 18 form, it should be retained for your records. Do not send it to the Virginia Department of Taxation. The dealer must keep this certificate on file to substantiate the exemption from sales and use tax for future purchases.

Common mistakes

Filling out the Form ST-18 can be straightforward, but there are common mistakes that individuals often make. One of the most significant errors is failing to accurately specify the purpose of the purchases. The form is intended for items used exclusively in agricultural production. If a farmer mistakenly checks items for personal use, the exemption will not apply.

Another frequent oversight is not providing complete contact information for the dealer. The form requires the full name, address, and account information for the vendor. Incomplete details can lead to challenges in verifying the transaction and may render the exemption invalid.

Many individuals also neglect to include their Virginia Tax Account Number when applicable. If a farmer or veterinarian has registered with the Department of Taxation, leaving this section blank can raise questions. Conversely, it's important to write "NONE" if they do not have an account number. Not doing so may lead to misunderstandings.

Additionally, some people misunderstand the eligibility requirements. A farmer must actively be engaged in producing agricultural products for market to qualify for this exemption. Those who aren't consistently involved may put their eligibility in jeopardy by incorrectly certifying their status.

A common error is related to electronic signatures. Some may overlook the necessity of a physical signature on the form. The requirement for an official signature is crucial; without it, the document lacks validity, even if all other information is accurate.

Finally, individuals often forget to retain a copy of the completed Certificate of Exemption for their records. This oversight can create confusion if questioned about past purchases or in case of an audit. Keeping a copy ensures that all parties can verify the claim if needed.

Documents used along the form

The ST-18 form is essential for farmers and veterinarians in Virginia to claim exemptions from sales and use tax on certain purchases. However, several other documents may also be necessary to ensure compliance with tax regulations or to facilitate transactions. Below is a list of forms and documents often used in conjunction with the ST-18 form, along with brief descriptions of each.

- Form ST-12 - This is a Sales and Use Tax Certificate of Exemption that allows entities other than farmers and veterinarians, such as non-profits, to purchase tangible goods without paying sales tax for specific purposes.

- Form ST-13 - This form is used by government agencies to certify that purchases are exempt from sales tax due to the entities' governmental status.

- Form ST-14 - This is a Certificate of Exemption for manufacturers. Manufacturers use this form to claim an exemption for purchases related to their manufacturing processes.

- Form ST-15 - This document serves as a Certificate of Exemption for certain types of purchases made by direct marketers. It allows these businesses to claim sales tax exemptions on qualified items.

- Form ST-16 - This form is specifically for the purchase of items related to pollution control or environmental protection and allows buyers to claim tax exemptions for those purchases.

- Form ST-19 - This document is used by farmers to claim exemptions on sales tax for machinery and equipment purchases specifically needed for agricultural use.

- Form ST-20 - This Certificate allows educational institutions to make purchases of qualified items without tax, provided they meet specific criteria for exemption.

- W-9 Form - This is the Request for Taxpayer Identification Number and Certification. It is often required by businesses to obtain the correct tax information from vendors or independent contractors.

- Vendor Invoices - Invoices from vendors that detail the items purchased, prices, and tax exemptions claimed. These should match with exemption documentation for audit purposes.

- Sales Tax Exemption Letters - Additional letters or supporting documentation may be required to clarify and support exemption claims on specific products or purchases.

Careful attention to detail is necessary when handling these forms and documents. Each plays a crucial role in ensuring compliance with tax laws and safeguarding tax exemptions. Always keep these documents organized and readily available for audits or reviews.

Similar forms

The ST-18 form serves as a Certificate of Exemption for sales and use tax in Virginia, particularly for farmers and veterinarians. It has similarities with several other documents applied primarily in business transactions, tax exemptions, and agricultural purchases. Below are nine similar documents, each with its specific focus:

- Form ST-9: This is the Virginia Sales and Use Tax Exemption Certificate. It is used by exempt entities to claim exemption for purchases related to their tax-exempt activities, similar to how the ST-18 applies to agricultural purchases.

- Form ST-14: This document is a Virginia Sales and Use Tax Exemption Certificate for nonprofit organizations. Like the ST-18, it allows organizations to purchase necessary items without paying sales tax.

- Form ST-15: The Virginia Sales and Use Tax Exemption Certificate for “Common Carriers.” This form is used by airlines and other transportation services, aligning with ST-18’s purpose of facilitating tax-exempt purchases in specific sectors.

- Form ST-4: The Virginia Sales and Use Tax Exemption Certificate for manufacturers. Similar to the ST-18, it provides exemption for certain purchases made in the course of producing tangible products.

- Form ST-12: This is an Exemption Certificate for agricultural production. Farmers can utilize this document to purchase agricultural-related goods without incurring tax, much like the ST-18.

- Form ST-45: The Virginia “Direct Pay” Permit. This allows businesses to make tax-exempt purchases for certain transactions, indicating a method of managing sales tax liability similar to that of the ST-18.

- Form ST-11: The Virginia Exemption Certificate for certain retail purchases. It allows qualified buyers to avoid paying sales tax at the point of sale, just as the ST-18 does for farmers and veterinarians.

- Form ST-19: This is the Virginia Sales and Use Tax Exemption Certificate for the federal government and its agencies. Government entities use it to eliminate sales tax obligations similar to the relief provided by ST-18.

- Form ST-20: This document is designated for religious organizations claiming tax exemption. It operates on the same principle as the ST-18, facilitating transactions without tax in specific sectors.

Understanding and utilizing the correct forms ensures compliance and can significantly benefit businesses in their operational costs. For farmers and veterinarians, using the ST-18 appropriately is crucial in leveraging tax exemptions for qualified purchases.

Dos and Don'ts

When filling out the ST-18 form, here are five important things to keep in mind:

- Do make sure to provide accurate information about yourself as the farmer or veterinarian.

- Don't mix personal purchases with business-related purchases on this form.

- Do check the items listed carefully to ensure they are eligible for exemption.

- Don't sign the form unless you fully understand the certifications you’re making.

- Do keep a copy of the completed form for your records after submission.

Misconceptions

Understanding the Form ST-18 can be crucial for farmers and veterinarians seeking tax exemption. However, several misconceptions often arise regarding its use and applicability. Here are nine common misconceptions about the Form ST-18:

- Only farmers can use the Form ST-18. While the form is primarily for farmers, veterinarians treating agricultural production animals can also utilize it for certain purchases.

- The Form ST-18 is for all types of purchases. This form is specifically for tangible personal property used exclusively for agricultural production. Purchases made for personal or home use do not qualify for this exemption.

- All agricultural supplies are exempt. Not all agricultural supplies qualify for exemption. Only those listed within the form's parameters are considered tax-exempt.

- Farmers do not need to prove their status. Farmers must certify that they are actively engaged in producing agricultural products for market to justify their use of the form.

- Contractors can use this form for any purchase. Contractors cannot utilize the form for materials. They must seek out a different exemption certificate for structural construction materials.

- If there’s no Virginia tax account number, I cannot use the form. Farmers or veterinarians without a tax account number can still use the Form ST-18 by entering “NONE” in the designated space.

- The dealer must submit the form to the Tax Department. Both the farmer and dealer should retain the completed form for their records. It is not necessary to send it to the Tax Department.

- All purchase details must be submitted with the form. The form does not require detailed purchase information upfront. The farmer certifies that future purchases will be for agricultural use unless otherwise noted on each order.

- There are no consequences for misusing the form. Incorrect use of the Form ST-18 can result in penalties. It is important to ensure that all claims made on the form are truthful and made in good faith.

Clarifying these misconceptions can help individuals better understand their rights and responsibilities regarding tax exemptions in Virginia. Proper use of the Form ST-18 is vital to ensure compliance with tax regulations.

Key takeaways

Understanding the ST-18 form is crucial for farmers and veterinarians looking to purchase certain items tax-free in Virginia. Here are several key takeaways to consider when filling out and utilizing this certificate of exemption:

- Eligibility is Important: Only individuals engaged in the business of producing agricultural products for market may use the ST-18 form. Personal or household purchases do not qualify for tax exemption.

- Correct Completion: Ensure that the form is filled out accurately. This includes the name of the dealer, the date, and the specifics about the items being purchased. Errors can lead to complications later.

- Single Certificate Requirement: Dealers need to keep only one properly executed ST-18 certificate on file for each farmer or veterinarian. This streamlines record-keeping and simplifies the process of tax exemption.

- Virginia Tax Account Number: If a farmer or veterinarian has a sales tax account number, it must be included on the form. If they do not have an account, they should write "NONE" in that section.

Always retain the completed ST-18 form for your records. Do not submit it to the tax department, as it serves primarily as proof for your transactions.

Browse Other Templates

Indiana Handicap Placard - The address for application submission is provided on the form for convenience.

Dmv Reg 256 - Ensuring all required documents are attached can facilitate a smoother processing experience.

United Health Care Eap - Specify the amount charged by the provider for the services rendered.