Fill Out Your St 19 Form

When participating in events such as craft shows, flea markets, or conventions in Minnesota, sellers must be aware of the ST 19 form, which serves as an important tool for ensuring compliance with state tax regulations. This form is essential for individuals and businesses selling goods, as it helps operators confirm that sellers have the necessary tax identification or meet exemptions. The ST 19 form requires information from both the seller and the event organizer. Sellers need to provide details about their merchandise, including whether they will be selling taxable items. They must also declare if they meet specific exemption criteria, including instances where sales are not subject to tax or if they are part of a nonprofit organization. Importantly, the event operator must retain the completed ST 19 form for their records without submitting it to the Department of Revenue. Failing to complete and maintain such documentation could result in penalties for operators, adding to the urgency for compliance. By understanding the requirements outlined in the ST 19 form, sellers and event operators can navigate their obligations smoothly and avoid potential fines.

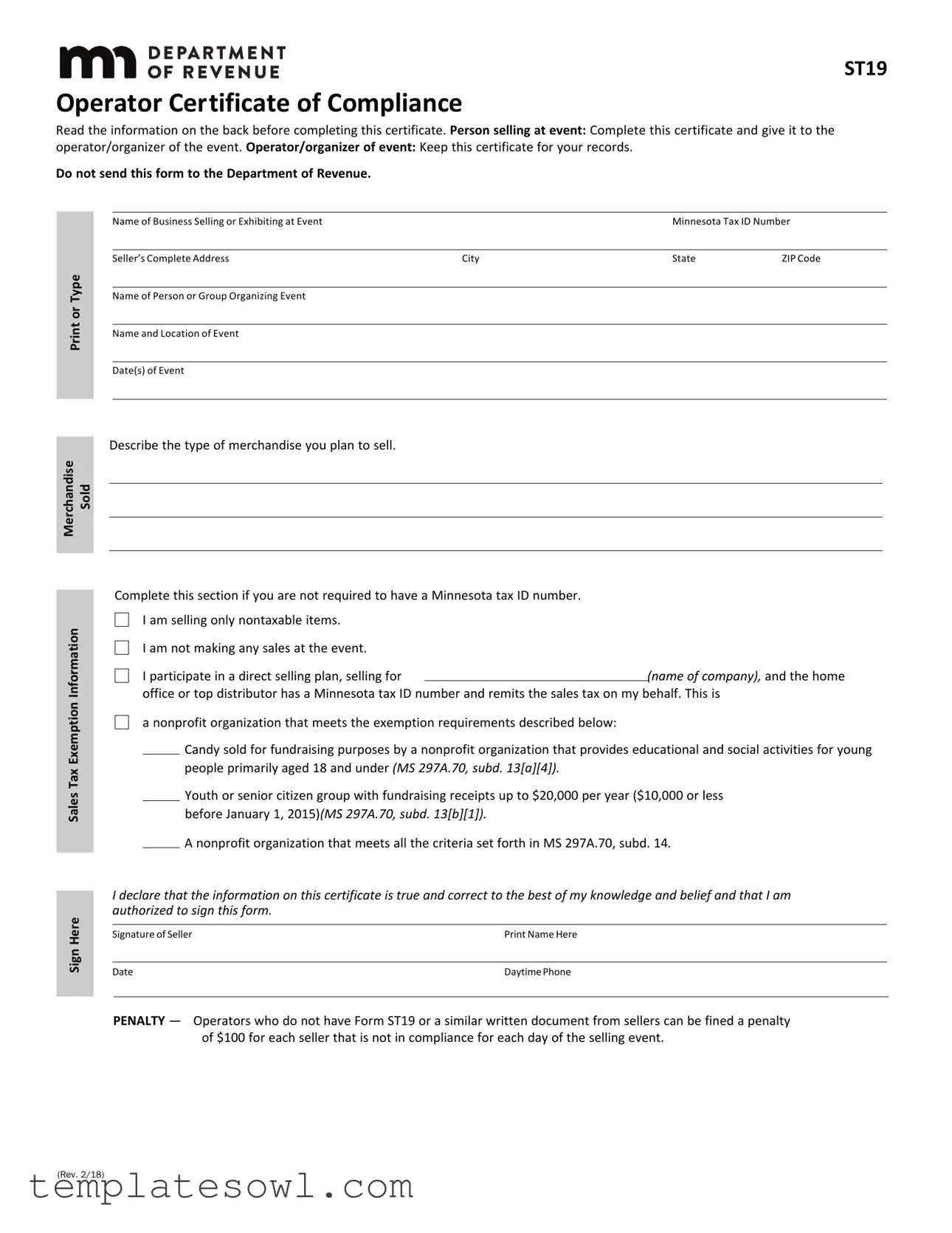

St 19 Example

ST19

Operator Certificate of Compliance

Read the information on the back before completing this certificate. Person selling at event: Complete this certificate and give it to the

operator/organizer of the event. Operator/organizer of event: Keep this certificate for your records.

Do not send this form to the Department of Revenue.

Print or Type

Merchandise Sold

Sales Tax Exemption Information

Sign Here

Name of Business Selling or Exhibiting at Event |

|

Minnesota Tax ID Number |

|

|

|

|

|

Seller’s Complete Address |

City |

State |

ZIP Code |

Name of Person or Group Organizing Event

Name and Location of Event

Date(s) of Event

Describe the type of merchandise you plan to sell.

Complete this section if you are not required to have a Minnesota tax ID number.

I am selling only nontaxable items.

I am not making any sales at the event.

I participate in a direct selling plan, selling for(name of company), and the home

office or top distributor has a Minnesota tax ID number and remits the sales tax on my behalf. This is

a nonprofit organization that meets the exemption requirements described below:

Candy sold for fundraising purposes by a nonprofit organization that provides educational and social activities for young people primarily aged 18 and under (MS 297A.70, subd. 13[a][4]).

Youth or senior citizen group with fundraising receipts up to $20,000 per year ($10,000 or less before January 1, 2015)(MS 297A.70, subd. 13[b][1]).

A nonprofit organization that meets all the criteria set forth in MS 297A.70, subd. 14.

I declare that the information on this certificate is true and correct to the best of my knowledge and belief and that I am authorized to sign this form.

Signature of Seller |

Print Name Here |

|

|

Date |

Daytime Phone |

PENALTY — Operators who do not have Form ST19 or a similar written document from sellers can be fined a penalty of $100 for each seller that is not in compliance for each day of the selling event.

(REV. 2/18)

Information for Sellers and Event Operators

Operators/organizers of craft, antique, coin, stamp or comic book shows; flea markets; convention exhibit areas; or similar events are required by Minnesota law to get written evidence that persons who do business at the show or event have a valid Minnesota tax ID number.

If a seller is not required to have a Minnesota tax ID number, the seller must give the operator a written statement that items offered for sale are not subject to sales tax.

All operators (including operators of community sponsored events and nonprofit organizations) must obtain written evidence from sellers.

Certain individual sellers are not required to register to collect sales tax if they qualify for the isolated and occasional sales exemption. To qualify, all the following conditions must be met:

•The seller participates in only one event per calendar year that lasts no more than three days;

•The seller makes sales of $500 or less during the calendar year; and

•The seller provides a written statement to that effect, and includes the seller’s name, address and telephone number.

This isolated and occasional sales provision applies to individuals only. It does not apply to businesses.

Sales Tax Registration

To register for a Minnesota tax ID number, call

A registration application (Form ABR) is also available on our website at www.revenue.state.mn.us.

Information and Assistance

If you have questions or want fact sheets on specific sales tax topics, call

Most sales tax forms and fact sheets are also available on our website at www.revenue.state.mn.us.

For information related to sellers and event

operators, see Fact Sheet #148, Selling Event Exhibitors and Operators.

We’ll provide information in other formats upon request to persons with disabilities.

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of ST19 Form | The ST19 form serves as an Operator Certificate of Compliance. It is essential for documenting that the seller at an event has met the necessary conditions regarding sales tax exemption. |

| Record Keeping Requirement | Event organizers must retain this certificate for their records. The form should not be submitted to the Department of Revenue. Maintaining accurate records is crucial for compliance. |

| Sales Tax Identification | If a seller is not required to have a Minnesota tax ID number, they must provide a written statement to indicate that the items offered for sale are not subject to sales tax. |

| Governing Laws | This form is governed by Minnesota Statutes, specifically MS 297A.70. These statutes outline the sales tax requirements and exemptions applicable to nonprofit organizations and other sellers. |

Guidelines on Utilizing St 19

Carefully completing the ST 19 form is essential for ensuring compliance with Minnesota law when selling merchandise at an event. This form provides necessary information that event organizers need to verify sales tax compliance. Below are straightforward steps to fill out the ST 19 form accurately.

- Gather necessary information: Before beginning, collect all required details such as your business name, Minnesota Tax ID number, and event information.

- Fill in the seller's information: Write the name of your business, complete address, and Minnesota Tax ID number if applicable.

- Provide event details: Include the name and location of the event along with the dates of the event.

- Describe merchandise: Clearly indicate the type of merchandise you intend to sell at the event.

- Check appropriate boxes: If you don’t have a Minnesota tax ID number, check the appropriate box that applies to your situation regarding sales tax exemption.

- Signature: Sign the form to declare the information is true and correct. Then, print your name and include the date of signing.

- Provide a daytime phone number: Add your contact number for any necessary follow-up.

Once completed, hand the signed form to the event operator or organizer. They will keep this certificate for their records, ensuring compliance with Minnesota tax requirements. Remember not to send the form to the Department of Revenue.

What You Should Know About This Form

What is the ST 19 form?

The ST 19 form, also known as the Operator Certificate of Compliance, is a document used in Minnesota. It functions as proof that a seller participating in an event either has a valid Minnesota tax ID number or qualifies for certain exemptions from sales tax. This form ensures that both the sellers and the event organizers are compliant with state sales tax laws during events like craft fairs, flea markets, and conventions.

Who needs to fill out the ST 19 form?

Sellers at events must complete the ST 19 form before they begin sales. This applies to anyone selling merchandise, whether they are individuals or representatives of nonprofit organizations. Event organizers are also required to keep this form on file for their records. If the seller does not require a Minnesota tax ID number, they must provide a statement detailing their exemption status instead.

What information is required on the ST 19 form?

The ST 19 form requires several key pieces of information. Sellers must provide their name, business name, complete address, and tax ID number if applicable. They also need to describe the merchandise they plan to sell and mark the appropriate exemption option. Lastly, the seller must sign and date the form, confirming that all information provided is true and accurate.

What happens if a seller does not have an ST 19 form?

If an event operator cannot produce an ST 19 form or a similar written statement from a seller, the operator may face penalties. Specifically, they could incur a fine of $100 for each seller who is not compliant, for each day of the selling event. Therefore, it's important for operators to collect and keep this documentation from all participating sellers.

How do sellers qualify for the isolated and occasional sales exemption?

To qualify for the isolated and occasional sales exemption, individuals must meet specific criteria: they can only participate in one event per calendar year that lasts no longer than three days, sales must total $500 or less throughout the entire year, and they must provide a written statement to the event operator that includes their name, address, and phone number. It's important to note that this exemption only applies to individual sellers, not businesses.

Where can sellers and event organizers find more information?

Sellers and event organizers looking for additional information can visit the Minnesota Department of Revenue's website at www.revenue.state.mn.us. There, they can find downloadable forms, fact sheets, and resources pertaining to sales tax and other related topics. If you have specific questions, you can also call their office at 651-296-6181.

Is the ST 19 form submitted to the Department of Revenue?

No, the ST 19 form does not need to be submitted to the Department of Revenue. Instead, the seller should provide it to the organizer of the event, who will then keep it for their records. The documentation is meant for local compliance use and should not be sent to the state tax authority.

Common mistakes

When filling out the ST19 form, individuals often overlook a few key details that can lead to confusion and potential penalties. Paying attention to these common mistakes can save time and ensure compliance. One frequent error occurs when the business name is not clearly stated. It's important to print or type the name of the business accurately, as this is crucial for proper identification during the event.

Another mistake people make is failing to provide a valid Minnesota Tax ID number when required. Individuals who are supposed to have a tax ID need to ensure they have registered beforehand. Conversely, those who are not required to have one still need to provide a written statement confirming the nature of their sales. Not including this crucial information can lead to compliance issues for event organizers.

Additionally, some sellers forget to specify the type of merchandise they plan to sell. This section is vital because it allows operators to understand the nature of the items being sold, especially regarding tax exemptions. Describing the merchandise accurately helps in determining if the seller qualifies for sales tax exemptions.

Signatures are another area where errors occur. Many fail to sign the form or do not date their signature correctly. Omitting a signature can invalidate the form, leading to unnecessary complications during the event. Double-checking to ensure all required signatures are present can prevent compliance challenges.

Some sellers neglect to indicate whether they are selling only nontaxable items. This information is essential, as it informs the operator of the seller's tax liability. Being clear about the nature of the sales can help avoid misunderstandings and simplify tax matters.

Another common error is not providing a daytime phone number. Including contact information allows event organizers to follow up with any questions or clarifications they may have regarding the seller’s compliance status. This simple step promotes smoother communication and more efficient resolution of potential issues.

Moreover, failing to understand the requirements for nonprofit organizations can lead to mistakes. Sellers from nonprofits should ensure they meet the specific criteria to qualify for tax exemptions. Misunderstandings about these regulations can hinder compliance and result in fines.

Lastly, many individuals do not read the instructions on the back of the form. These instructions contain valuable information related to compliance requirements and how to fill out the form correctly. Taking a moment to review this guidance can equip sellers and event organizers with the knowledge they need to avoid mistakes.

Documents used along the form

The ST 19 form serves as a Certificate of Compliance, important for ensuring that sellers at specific events comply with sales tax regulations in Minnesota. In addition to this form, there are several other documents and forms that are often utilized during such events. Each serves a unique purpose and helps both sellers and operators navigate the legal requirements related to sales tax. Below is a detailed list of these documents.

- Form ABR - Application for Sales Tax Registration: This form is necessary for individuals or businesses looking to obtain a Minnesota tax ID number. Registering for a tax ID is essential for collecting sales tax on taxable items sold during an event.

- Sellers’ Statement for Isolated and Occasional Sales: This written statement is required from individual sellers claiming an exemption under the isolated and occasional sales provision. It outlines that the seller participates in only one event per year and restricts total sales to $500 or less.

- Exemption Certificate: Used by sellers to declare that certain items they are selling are not subject to sales tax, this form provides necessary documentation when sellers do not have a tax ID number and are selling nontaxable items.

- Event Organizer Agreement: This contract outlines the responsibilities and expectations between the organizer of the event and the vendors. It may cover space rental, compliance with tax obligations, and other logistical elements.

- Vendor Registration Form: Vendors often fill out this form to register their business and specify the products they will be selling at the event. This allows organizers to keep track of the various participants and their compliance with necessary regulations.

- Sales Tax Guidelines Fact Sheet: This document typically contains relevant information about Minnesota sales tax laws and regulations. It serves as a resource for sellers and operators to better understand their obligations and rights when selling at events.

- Event Schedule or Agenda: This document details the timeline of the event, including setup and breakdown times, specific sales periods, and any performances or presentations planned throughout the day. This helps vendors plan their participation efficiently.

Understanding and completing these forms correctly can prevent potential penalties and ensure compliance with state regulations. It is advisable for both sellers and event organizers to review these documents thoroughly and seek guidance if uncertainties arise.

Similar forms

- Form ST3 - Certificate of Exemption: Similar to the ST19, the ST3 form allows sellers to certify that they are exempt from sales tax. Sellers use this document to prove they fall under specific exemptions, which can be crucial at events where sales tax compliance is required.

- Form ABR - Business Registration: This form is used to register for a Minnesota tax ID number. While the ST19 is a certificate to provide evidence of compliance at an event, the ABR is a foundational document that allows businesses to legally collect sales tax in Minnesota.

- Form ST-11 - Seller's Permit: The ST-11 serves as a permit that authorizes businesses to collect sales tax on taxable sales. In essence, while the ST19 certifies compliance during an event, the ST-11 permits ongoing sales tax obligations for businesses.

- Form ST19A - Seller’s Certificate of Tax Exemption: Similar to the ST19, this form is specifically for sellers who are exempt from collecting tax on certain transactions. It serves as a way for sellers to document their tax-exempt status at sales events.

Dos and Don'ts

When filling out the ST19 form, there are important guidelines to follow. Here are six do's and don'ts to keep in mind:

- Do read the instructions on the back of the form carefully before starting.

- Do ensure you provide accurate information about your business and merchandise.

- Do fill in all required sections to avoid delays or penalties.

- Do sign and date the form to validate it.

- Don't submit the form to the Department of Revenue; it is meant for the event organizer.

- Don't omit your Minnesota tax ID number if you have one, as it is necessary for compliance.

Following these tips can help ensure that your completion of the ST19 form is correct and compliant with regulations.

Misconceptions

Misconceptions about the ST19 form can lead to confusion for sellers and event operators alike. Here are eight common misconceptions along with explanations to clarify the correct information:

- The ST19 form must be sent to the Department of Revenue. This is not true. The form is meant for internal use. Sellers complete it and give it to the event organizer, who retains it for their records.

- Only large businesses need a Minnesota tax ID number. Not necessarily. Individual sellers may not need a tax ID if they qualify for certain exemptions, such as isolated and occasional sales.

- The ST19 form is only for sales tax collection. This is a misconception. It serves to confirm that sellers either have a valid tax ID or are exempt from needing one based on the type of goods they sell.

- If a seller has no Minnesota tax ID number, they cannot sell anything. This is incorrect. Sellers who do not have a tax ID can still sell nontaxable items or may qualify for specific exemptions laid out in the ST19 details.

- All events require sellers to pay sales tax. This is misleading. Some sellers may be involved in fundraising activities or sell only nontaxable items, which may exempt them from sales tax obligations.

- Organizations do not need the ST19 form if they are nonprofit. This is a common misbelief. Nonprofits must still obtain the ST19 form from their sellers to demonstrate compliance with tax regulations.

- The penalties for not using the ST19 form are minor. On the contrary, operators can face fines of $100 for each non-compliant seller for every day of the event, which can add up significantly.

- All sellers are obligated to sign the ST19 form. Not true for everyone. Sellers who qualify for exemptions, like the isolated and occasional sales exemption, may provide a different written statement and are not required to complete the ST19 form.

Key takeaways

Here are nine key takeaways about filling out and using the ST19 form:

- Read Instructions Carefully: Always check the information provided on the back of the ST19 form before completing it.

- Who Completes the Form: The seller at the event must fill out the form and submit it to the event operator or organizer.

- Retention of Records: Operators or organizers should keep a copy of the completed ST19 form for their records. Do not send it to the Department of Revenue.

- Details Needed: Provide clear details regarding the merchandise being sold and the relevant sales tax exemption information.

- No Minnesota Tax ID? If a seller does not need a Minnesota tax ID number, they must declare that the items they are selling are not taxable.

- Penalties for Noncompliance: Operators who fail to secure the ST19 or similar documentation can incur a penalty of $100 per seller for each day of the event.

- Understand Exemptions: Familiarize yourself with various exemptions, such as those for nonprofit organizations or specific fundraising activities.

- Isolated Sales Exemption: Individual sellers may be exempt from tax registration if they meet specific criteria, including a limit on sales and frequency of events.

- Registration Assistance: Sellers can register for a Minnesota tax ID number by calling 651-282-5225 or visiting the Minnesota Department of Revenue’s website.

Browse Other Templates

Invisalign Case Transfer Form - The patient’s new doctor must agree to assume all future costs related to treatment.

Disability Payments Taxable - Email contact preferences can also be selected on the form for future correspondence.