Fill Out Your St 3 New Jersey Form

The ST-3 form, known as the New Jersey Resale Certificate, plays a crucial role in the tax collection process for sellers and buyers of taxable goods and services. This document enables the seller to avoid charging sales tax on certain transactions, specifically when a purchaser qualifies for an exemption. To utilize the ST-3 form, purchasers must provide key information, including their New Jersey Taxpayer Registration Number and details about their business and the merchandise being purchased. Additionally, they must certify that the items are being bought either for resale in their current form or as part of a service. The form serves to protect both the seller and the buyer; if the seller accepts a properly completed ST-3 certificate, they are relieved of any liability for collecting sales tax on the covered transactions. The importance of accurately filling out this form cannot be overstated, as incorrect or incomplete information could lead to penalties for the purchaser. It's essential that both parties retain these certificates for at least four years to ensure compliance with state regulations. Understanding the requirements and implications of the ST-3 form helps businesses navigate the complexities of New Jersey's sales tax law effectively.

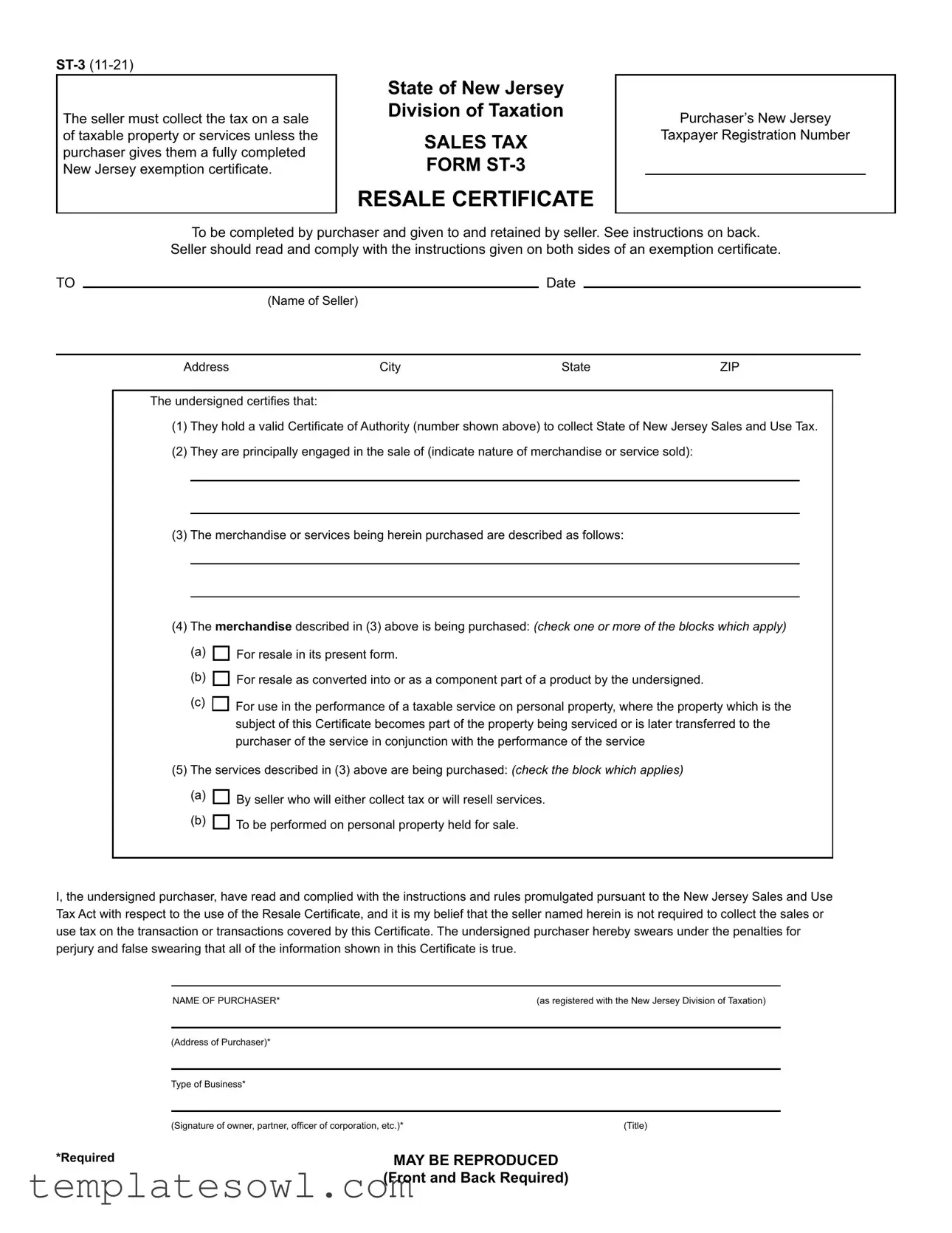

St 3 New Jersey Example

The seller must collect the tax on a sale of taxable property or services unless the purchaser gives them a fully completed New Jersey exemption certificate.

State of New Jersey

Division of Taxation

SALES TAX

FORM

RESALE CERTIFICATE

Purchaser’s New Jersey

Taxpayer Registration Number

To be completed by purchaser and given to and retained by seller. See instructions on back.

Seller should read and comply with the instructions given on both sides of an exemption certificate.

TO |

|

|

Date |

|

|

|

|

(Name of Seller) |

|

|

|

|

|

|

|

|

|

|

Address |

City |

State |

ZIP |

|

The undersigned certifies that:

(1)They hold a valid Certificate of Authority (number shown above) to collect State of New Jersey Sales and Use Tax.

(2)They are principally engaged in the sale of (indicate nature of merchandise or service sold):

(3)The merchandise or services being herein purchased are described as follows:

(4)The merchandise described in (3) above is being purchased: (check one or more of the blocks which apply)

(a)

(b)

(c)

For resale in its present form.

For resale as converted into or as a component part of a product by the undersigned.

For use in the performance of a taxable service on personal property, where the property which is the subject of this Certificate becomes part of the property being serviced or is later transferred to the purchaser of the service in conjunction with the performance of the service

(5) The services described in (3) above are being purchased: (check the block which applies)

(a)

(b)

By seller who will either collect tax or will resell services.

To be performed on personal property held for sale.

I, the undersigned purchaser, have read and complied with the instructions and rules promulgated pursuant to the New Jersey Sales and Use Tax Act with respect to the use of the Resale Certificate, and it is my belief that the seller named herein is not required to collect the sales or use tax on the transaction or transactions covered by this Certificate. The undersigned purchaser hereby swears under the penalties for perjury and false swearing that all of the information shown in this Certificate is true.

NAME OF PURCHASER* |

(as registered with the New Jersey Division of Taxation) |

(Address of Purchaser)*

Type of Business*

(Signature of owner, partner, officer of corporation, etc.)* |

(Title) |

*Required |

MAY BE REPRODUCED |

|

(Front and Back Required) |

INSTRUCTIONS FOR USE OF RESALE CERTIFICATES –

1.Registered sellers who accept fully completed exemption certificates within 90 days subsequent to the date of sale are relieved of liability for the collection and payment of sales tax on the transactions covered by the exemption certificate. The following information must be obtained from a purchaser in order for the exemption certificate to be fully completed:

•Purchaser’s name and address;

•Type of business;

•Reason(s) for exemption;

•Purchaser’s New Jersey tax identification number or, for a purchaser that is not registered in New Jersey, the

Federal employer identification number or

•If a paper exemption certificate is used (including fax), the signature of the purchaser.

The seller’s name and address are not required and are not considered when determining if an exemption certificate is fully completed. A seller that enters data elements from paper into an electronic format is not required to retain the paper exemption certificate.

The seller may, therefore, accept this certificate as a basis for exempting sales to the signatory purchaser and is relieved of liability even if it is determined that the purchaser improperly claimed the exemption. If it is determined that the purchaser improperly claimed an exemption, the purchaser will be held liable for the nonpayment of the tax.

2.Retention of Certificates - Certificates must be retained by the seller for a period of not less than four years from the date of the last sale covered by the certificate. Certificates must be in the physical possession of the seller and available for inspection.

3.Acceptance of an exemption certificate in an audit situation - On and after October 31, 2011, if the seller either has not obtained an exemption certificate or the seller has obtained an incomplete exemption certificate, the seller has at least 120 days after the Division’s request for substantiation of the claimed exemption to either:

1.Obtain a fully completed exemption certificate from the purchaser, taken in good faith, which, in an audit situation, means that the seller obtain a certificate claiming an exemption that:

(a)was statutorily available on the date of the transactions, and

(b)could be applicable to the item being purchased, and

(c)is reasonable for the purchaser’s type of business; OR

2.Obtain other information establishing that the transaction was not subject to the tax.

If the seller obtains this information, the seller is relieved of any liability for the tax on the transaction unless it is discovered through the audit process that the seller had knowledge or had reason to know at the time such information was provided that the information relating to the exemption claimed was materially false or the seller otherwise knowingly participated in activity intended to purposefully evade the tax that is properly due on the transaction. The burden is on the Division to establish that the seller had knowledge or had reason to know at the time the information was provided that the information was materially false.

4.Additional Purchases by Same Purchaser - This certificate will serve to cover additional purchases by the same purchaser of the same general type of property. However, each subsequent sales slip or purchase invoice based on this Certificate must show the purchaser’s name, address and New Jersey, Federal, or out of state registration number for your purpose of verification.

5.Retention of Certificates - Certificates must be retained by the seller for a period of not less than four years from the date of the last sale covered by the certificate. Certificates must be in the physical possession of the seller and available for inspection on or before the 90th day following the date of the transaction to which the certificate relates.

EXAMPLES OF PROPER USE OF RESALE CERTIFICATE

a. A retail household appliance store owner issues a Resale Certificate when purchasing household appliances from a supplier for resale. b. A furniture manufacturer issues a Resale Certificate to cover the purchase of lumber to be used in manufacturing furniture for sale.

c. An automobile service station operator issues a Resale Certificate to cover the purchase of auto parts to be used in repairing customers cars.

EXAMPLES OF IMPROPER USE OF RESALE CERTIFICATE

In the examples below, the seller should not accept Resale Certificates, but should insist upon payment of the sales tax. a. A lumber dealer can not accept a Resale Certificate from a tire dealer who is purchasing lumber for use in altering their premises.

b. A distributor may not issue a Resale Certificate on purchases of cleaning supplies and other materials for their own office maintenance, even though they are in the business of distributing such supplies.

c. A retailer may not issue a Resale certificate on purchases of office equipment for their own use, even though they are in the business of selling office equipment.

d. A supplier can not accept a Resale Certificate from a service station owner who purchases tools and testing equipment for use in their business.

REPRODUCTION OF RESALE CERTIFICATE FORMS: Private reproduction of both sides of Resale Certificates may be made without the prior permission of the Division of Taxation.

FOR MORE INFORMATION: Read publication

https://www.state.nj.us/treasury/pdf/pubs/sales/su6.pdf

DO NOT MAIL THIS FORM TO THE DIVISION OF TAXATION

This form is to be completed by purchaser and given to and retained by seller.

Form Characteristics

| Fact Name | Description |

|---|---|

| Usage Requirement | The ST-3 form acts as a resale certificate. Sellers must collect tax on sales unless the buyer provides this completed form. |

| Retention Period | Sellers must keep the ST-3 forms for at least four years. They should be readily available for inspection during this time. |

| Governing Law | The ST-3 form is governed by the New Jersey Sales and Use Tax Act. |

| Exemption Conditions | The form allows for tax exemptions if completed properly. Incomplete forms may result in tax liability for the seller. |

Guidelines on Utilizing St 3 New Jersey

Filling out the New Jersey ST-3 Resale Certificate is essential for businesses looking to claim exemption from sales tax on qualifying purchases. This process requires accurate information to ensure compliance with state regulations. Following the steps outlined below can help simplify your experience.

- Obtain the Form: Make sure you have a copy of the ST-3 Resale Certificate form.

- Fill in Seller Information: Write the date, seller's name, address, city, state, and ZIP code.

- Provide Purchaser Information: Enter your New Jersey Taxpayer Registration Number, name, and address. Include details about your type of business.

- Declare Merchandise or Services: Specify the nature of the merchandise or services you are purchasing.

- Indicate Purchase Intent: Check the appropriate boxes to indicate whether the merchandise is for resale in its current form, as a component of another product, or for use in a taxable service.

- Service Purchase Information: If applicable, check the box that describes how the services are being purchased.

- Read Compliance Statement: Ensure you understand the compliance statement regarding the completion of this certificate.

- Sign and Date the Certificate: Sign and include your title. The signature confirms that the information is accurate and truthful.

After filling out the ST-3 form, present it to the seller. The seller must retain it for their records, typically for a minimum of four years. This retention is crucial for future audits or inspections by the New Jersey Division of Taxation. Your diligence in completing and submitting this form correctly will help ensure a smooth transaction.

What You Should Know About This Form

What is the purpose of the ST-3 Resale Certificate in New Jersey?

The ST-3 Resale Certificate allows the seller to avoid charging sales tax on items sold to a purchaser who intends to resell those items. By submitting this certificate, the purchaser certifies that they hold a valid Certificate of Authority from the State of New Jersey to collect sales tax. The seller retains this certificate to provide documentation in case of an audit. It ensures that both parties comply with state tax regulations while facilitating the resale process.

Who is required to fill out the ST-3 Resale Certificate?

The purchaser is responsible for completing the ST-3 Resale Certificate. The form must include important information such as the purchaser's New Jersey Taxpayer Registration Number, type of business, and the specific items or services being purchased for resale. This information is crucial to validate the exemption claim. Without a fully completed certificate, sellers may be legally obligated to collect sales tax on transactions.

How long must a seller retain the ST-3 Resale Certificate?

Sellers are required to keep the ST-3 Resale Certificate for at least four years from the last transaction date covered by the certificate. The certificate must be physically available for inspection at any time during this retention period. This ensures that sellers can substantiate their tax-exempt sales during audits or inspections by tax authorities.

What happens if a purchaser improperly claims an exemption using the ST-3 Resale Certificate?

If a purchaser claims an exemption incorrectly, they may be held liable for nonpayment of the sales tax due on the transaction. The seller, however, is relieved of responsibility if they have accepted a fully completed certificate in good faith. This means that if the seller followed the proper procedures for accepting the certificate, they may not face penalties even if the purchaser did not qualify for the exemption. Therefore, due diligence in accepting and retaining the correct documentation is essential for sellers.

Common mistakes

Completing the ST-3 New Jersey form can seem straightforward, but many people overlook important details that can lead to mistakes. One common error occurs with the Purchaser's New Jersey Taxpayer Registration Number. Failing to provide this number, or entering it incorrectly, can invalidate the certificate. It's essential that this number is accurate, as it verifies the purchaser’s status with the state and allows the seller to accept the exemption certificate properly.

Another frequent mistake is not fully completing all required fields. The form asks for the purchaser's name, address, and type of business, among other things. Skipping any of these sections can raise red flags for sellers. They must ensure that all necessary information is filled out clearly and accurately to avoid complications later on.

Many purchasers also neglect to check the correct boxes regarding the nature of the purchase. The ST-3 form includes specific options for how the purchased goods or services will be used. If a purchaser fails to check any relevant boxes, it can cause confusion and put the seller at risk of liability for unpaid taxes.

It is also crucial for purchasers to understand their obligation to retain the certificate. Some might assume that once submitted, they no longer need to keep a copy. However, sellers are required to keep a physical copy of the ST-3 form for at least four years. Not having this on hand for inspection can lead to issues during audits.

Other individuals make the mistake of submitting the form without a signature. The ST-3 certificate requires the purchaser's signature, which serves as a declaration that the information provided is accurate. Omitting this step may invalidate the form, leading to unwanted tax implications for both the purchaser and seller.

Additionally, misunderstandings about the function of the resale certificate contribute to errors. Some purchasers believe that the ST-3 allows them to purchase anything tax-free, which isn’t correct. The exemption only applies to items intended for resale or for specific uses outlined in the instructions. Misusing the certificate can mean financial penalties later.

Moreover, another common mistake is assuming that the ST-3 is only a one-time use document. In reality, while the form can cover multiple transactions for similar types of sales, each transaction requires specific information. Each purchase should reference the purchaser's details to ensure compliance.

Many individuals also fail to account for the implications of an incomplete exemption certificate during audits. If a seller does not have a complete ST-3 form at the time of an audit, they risk facing penalties. It's important for both buyers and sellers to understand that the burden lies in ensuring that the form is filled out correctly.

Lastly, individuals might overlook the importance of the specific language used in the ST-3 form. Phrasing matters; misinterpreting or misrepresenting the declaration can lead to severe consequences. Always approach the form with attention to detail and clarity to maintain compliance and avoid liabilities.

Documents used along the form

When dealing with the ST-3 New Jersey form, it is helpful to understand other related documents that may also be used. These documents offer additional clarification and guidance regarding tax exemption and resale in New Jersey. Here are a few commonly encountered forms alongside the ST-3.

- ST-4 Exempt Use Certificate: This form is provided to certify that a purchaser intends to use the purchased item in a way that is exempt from sales tax. It is specifically for items used in processes exempt from tax according to New Jersey law.

- ST-5 Sales Tax Exempt Certificate: Nonprofit organizations often use this certificate to buy items exempt from sales tax. It helps organizations making legitimate tax-exempt purchases to verify their status as exempt entities.

- ST-8 Direct Payment Permit: Businesses may use this permit to pay sales tax directly to the state instead of paying the seller. It serves as a way for certain qualified purchasers to streamline tax payments for their purchases.

- ST-18 Resale Certificate for Nonprofit Organizations: This form allows nonprofit organizations to make tax-free purchases of goods for resale. Organizations must complete and provide this form to the seller to validate their tax-exempt status.

These documents work together with the ST-3 form to ensure proper compliance with New Jersey sales tax regulations. Understanding their purpose helps make the sales process smoother for both buyers and sellers.

Similar forms

The St 3 New Jersey form, also known as the Resale Certificate, has similarities with several other documents commonly used in transactions involving sales tax exemptions. Here are four documents that share characteristics with the St 3 form:

- Form ST-4 (Exempt Use Certificate): This form is used when a purchaser intends to use property in a manner that is exempt from sales tax. Like the St 3, it requires detailed information about the purchaser, including tax identification numbers, and must be completed by the purchaser and retained by the seller for verification purposes.

- Form ST-5 (Sales Tax Exempt Certificate): This document is for nonprofit organizations or governmental entities that qualify for sales tax exemptions. Both the ST-3 and ST-5 require the seller to collect specific information from the purchaser to validate the exemption and protect the seller from liability for under-collecting sales tax.

- IRS Form W-9 (Request for Taxpayer Identification Number): While primarily used for reporting income to the IRS, the W-9 serves a similar validation purpose to that of the St 3. It collects identifying information from the purchaser and helps ensure proper documentation is retained to avoid penalties or issues related to taxation.

- Form ST-8 (Direct Payment Certificate): This form is for businesses that wish to pay sales tax directly to the state instead of the seller at the time of purchase. Similar to St 3, it involves the completion of certain fields regarding the purchaser's tax status, focusing on ensuring the tax is correctly accounted for in the sales process.

Dos and Don'ts

When filling out the ST-3 New Jersey form, it’s essential to be precise and attentive. Here are important do's and don'ts to keep in mind:

- Do ensure that the purchaser’s New Jersey Taxpayer Registration Number is accurately provided.

- Do clearly indicate the nature of the merchandise or services being purchased.

- Do check all applicable boxes regarding the purpose of the purchase, such as whether it is for resale or for use in a taxable service.

- Do retain the completed exemption certificate for at least four years after the last sale covered by it.

- Don't forget to include the purchaser's full name and address as they are registered with the New Jersey Division of Taxation.

- Don't submit the form to the Division of Taxation; it is meant to be provided to the seller only.

- Don't use the resale certificate for personal use or for items that do not qualify for resale exemptions.

By following these guidelines, you can ensure that the ST-3 form is filled out correctly, helping to avoid any potential complications with sales tax compliance. If there are any uncertainties, seek clarification from reliable sources or professionals who can provide assistance.

Misconceptions

Understanding the ST-3 New Jersey form is essential for both buyers and sellers involved in taxable transactions. However, several misconceptions persist about its use and requirements. Here’s a breakdown of ten common misunderstandings:

- A resale certificate eliminates all sales tax obligations. This is incorrect. A resale certificate only provides an exemption for items purchased for resale. If it's used improperly, the purchaser is liable for the tax.

- Any vendor can accept a resale certificate. Not true. Only registered sellers can accept this certificate. The seller must hold a valid Certificate of Authority issued by the State of New Jersey.

- The seller does not need to retain the certificate after the sale. This is a misconception. Sellers must keep signed resale certificates for at least four years for records and potential audits.

- All information must be collected from the seller. Actually, it’s the purchaser's responsibility to provide complete information on the certificate, including their New Jersey taxpayer registration number.

- Resale certificates can be used for any purchase. This is misleading. They should only be utilized for items that are being purchased specifically for resale or in the manufacturing of a product intended for resale.

- If the form is incomplete, it can still be accepted. That’s not correct. An incomplete certificate cannot be accepted, and sellers risk liability for uncollected taxes if they do.

- Using a resale certificate absolves responsibility for tax discrepancies. Incorrect. If a buyer misapplies the certificate, the buyer is responsible for any unpaid taxes discovered during an audit.

- There’s no time limit on correcting incomplete certificates. False. If a seller receives an incomplete resale certificate, they must obtain a fully completed one within 120 days after receiving a notice from the Division of Taxation.

- Resale certificates can be used indefinitely without renewal. This isn’t true. Each certificate covers a specific transaction type and while some may cover additional purchases, they still require verification for each sale.

- You must mail the ST-3 form to the Division of Taxation. This is a misunderstanding. The form should be completed by the purchaser and delivered to the seller, not mailed to the Division.

Clarifying these misconceptions can greatly streamline the process for everyone involved. Ensuring both parties understand their responsibilities helps maintain compliance and protects against future tax liabilities.

Key takeaways

Understanding the ST-3 New Jersey Form is essential for both buyers and sellers engaged in taxable transactions. Here are some important points to keep in mind.

- The seller is responsible for collecting sales tax unless they receive a fully completed exemption certificate from the purchaser.

- Purchasers must provide their New Jersey Taxpayer Registration Number along with necessary details about their business.

- The form must be accurate and include specific information, such as the type of merchandise or services being purchased.

- Sellers must keep the exemption certificates for at least four years for potential audits, ensuring they are accessible for inspection.

- Incorrect use of the ST-3 form can result in the seller being liable for unpaid sales taxes, so it's crucial to understand when a resale certificate is appropriate.

- This certificate can be used for multiple purchases of the same type, but each transaction should be documented correctly to validate the use of the form.

Being informed and thorough when using the ST-3 form can protect both parties in a transaction. Always ensure proper completion and retention of records to avoid future issues.

Browse Other Templates

De9 - Employers select the appropriate deposit schedule: next-day, semiweekly, monthly, or quarterly.

Microloan Assistance Application,FSA Microloan Request Form,USDA Microloan Support Form,Farm Service Agency Loan Request,Microloan Funding Application,FSA Microloan Inquiry Form,Farm Loan Assistance Document,Microloan Eligibility Application,Request - Each member of an entity must provide their information separately to ensure clarity about ownership and responsibilities.