Fill Out Your St 5C Form

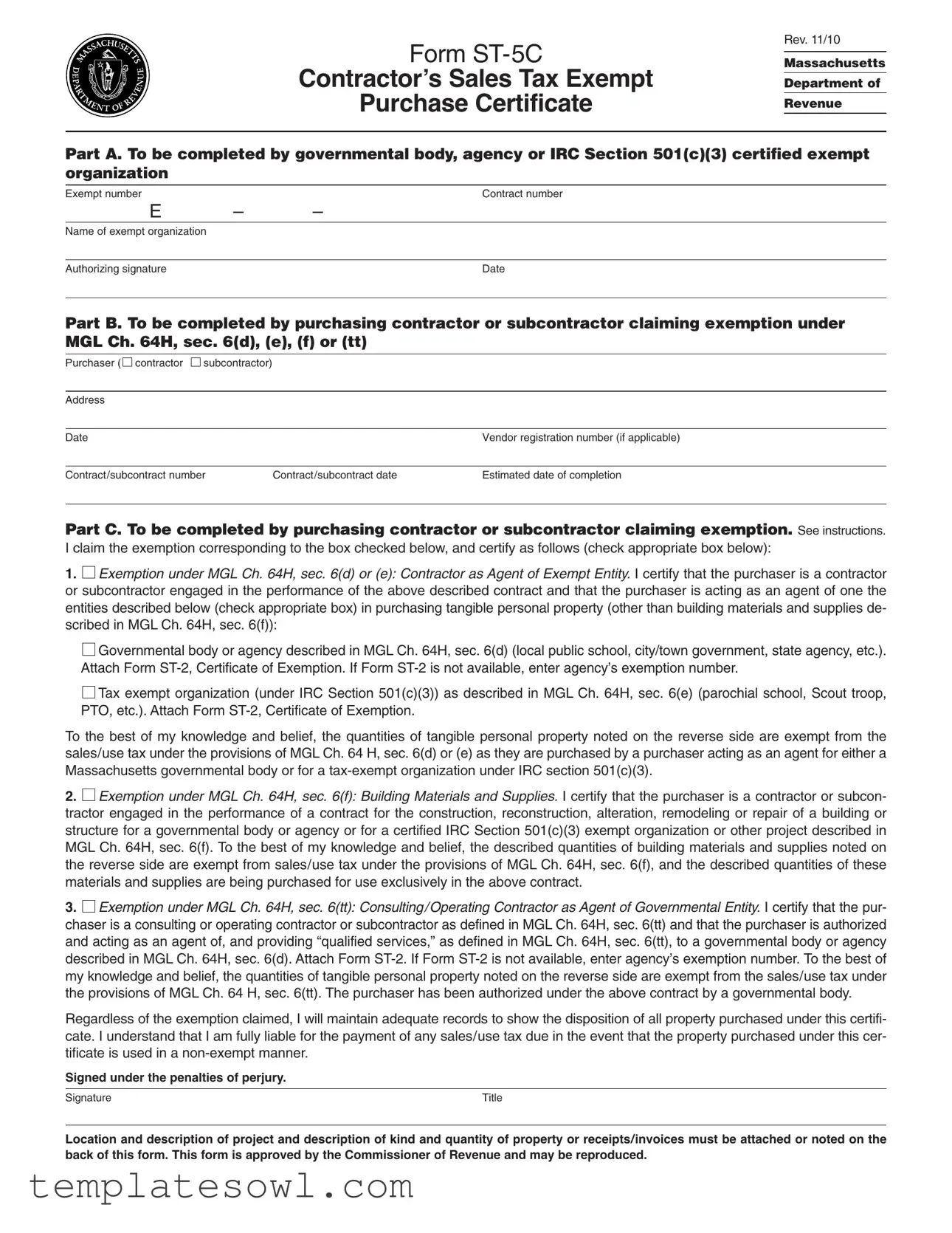

The ST-5C form, officially known as the Contractor’s Sales Tax Exempt Purchase Certificate, is an essential document for contractors and subcontractors in Massachusetts seeking exemptions from sales tax on specific purchases. Typically used for tax-exempt projects, this form allows qualifying entities to save money on necessary materials and supplies. The ST-5C comprises several sections that guide users through the exemption process. Part A requires information from government bodies or certified nonprofit organizations, ensuring they're properly identified. Part B focuses on the purchasing contractor’s details, such as the contract number and estimated completion date. Part C, the core of the form, highlights various exemptions related to property purchases as agents for governmental entities or nonprofit organizations, including building materials and supplies used in construction projects. It covers a range of exemption scenarios, from purchasing as agents for 501(c)(3) organizations to consulting contracts, making it a versatile tool for various projects. Each section requires certifications to affirm compliance with Massachusetts tax laws, ensuring all exempt purchases follow the appropriate guidelines.

St 5C Example

Form

Contractor’s Sales Tax Exempt

Purchase Certificate

Rev. 11/10

Massachusetts

Department of

Revenue

Part A. To be completed by governmental body, agency or IRC Section 501(c)(3) certified exempt organization

Exempt number |

|

Contract number |

E |

– |

– |

Name of exempt organization |

|

|

|

|

|

Authorizing signature |

|

Date |

Part B. To be completed by purchasing contractor or subcontractor claiming exemption under MGL Ch. 64H, sec. 6(d), (e), (f) or (tt)

Purchaser (

contractor

contractor  subcontractor)

subcontractor)

Address

Date |

|

Vendor registration number (if applicable) |

|

|

|

Contract/subcontract number |

Contract/subcontract date |

Estimated date of completion |

Part C. To be completed by purchasing contractor or subcontractor claiming exemption. See instructions.

I claim the exemption corresponding to the box checked below, and certify as follows (check appropriate box below):

1. Exemption under MGL Ch. 64H, sec. 6(d) or (e): Contractor as Agent of Exempt Entity. I certify that the purchaser is a contractor or subcontractor engaged in the performance of the above described contract and that the purchaser is acting as an agent of one the entities described below (check appropriate box) in purchasing tangible personal property (other than building materials and supplies de- scribed in MGL Ch. 64H, sec. 6(f)):

Exemption under MGL Ch. 64H, sec. 6(d) or (e): Contractor as Agent of Exempt Entity. I certify that the purchaser is a contractor or subcontractor engaged in the performance of the above described contract and that the purchaser is acting as an agent of one the entities described below (check appropriate box) in purchasing tangible personal property (other than building materials and supplies de- scribed in MGL Ch. 64H, sec. 6(f)):

Governmental body or agency described in MGL Ch. 64H, sec. 6(d) (local public school, city/town government, state agency, etc.). Attach Form

Governmental body or agency described in MGL Ch. 64H, sec. 6(d) (local public school, city/town government, state agency, etc.). Attach Form

Tax exempt organization (under IRC Section 501(c)(3)) as described in MGL Ch. 64H, sec. 6(e) (parochial school, Scout troop, PTO, etc.). Attach Form

Tax exempt organization (under IRC Section 501(c)(3)) as described in MGL Ch. 64H, sec. 6(e) (parochial school, Scout troop, PTO, etc.). Attach Form

To the best of my knowledge and belief, the quantities of tangible personal property noted on the reverse side are exempt from the sales/use tax under the provisions of MGL Ch. 64 H, sec. 6(d) or (e) as they are purchased by a purchaser acting as an agent for either a Massachusetts governmental body or for a

2.

Exemption under MGL Ch. 64H, sec. 6(f): Building Materials and Supplies. I certify that the purchaser is a contractor or subcon- tractor engaged in the performance of a contract for the construction, reconstruction, alteration, remodeling or repair of a building or structure for a governmental body or agency or for a certified IRC Section 501(c)(3) exempt organization or other project described in MGL Ch. 64H, sec. 6(f). To the best of my knowledge and belief, the described quantities of building materials and supplies noted on the reverse side are exempt from sales/use tax under the provisions of MGL Ch. 64H, sec. 6(f), and the described quantities of these materials and supplies are being purchased for use exclusively in the above contract.

Exemption under MGL Ch. 64H, sec. 6(f): Building Materials and Supplies. I certify that the purchaser is a contractor or subcon- tractor engaged in the performance of a contract for the construction, reconstruction, alteration, remodeling or repair of a building or structure for a governmental body or agency or for a certified IRC Section 501(c)(3) exempt organization or other project described in MGL Ch. 64H, sec. 6(f). To the best of my knowledge and belief, the described quantities of building materials and supplies noted on the reverse side are exempt from sales/use tax under the provisions of MGL Ch. 64H, sec. 6(f), and the described quantities of these materials and supplies are being purchased for use exclusively in the above contract.

3. Exemption under MGL Ch. 64H, sec. 6(tt): Consulting/Operating Contractor as Agent of Governmental Entity. I certify that the pur- chaser is a consulting or operating contractor or subcontractor as defined in MGL Ch. 64H, sec. 6(tt) and that the purchaser is authorized and acting as an agent of, and providing “qualified services,” as defined in MGL Ch. 64H, sec. 6(tt), to a governmental body or agency described in MGL Ch. 64H, sec. 6(d). Attach Form

Exemption under MGL Ch. 64H, sec. 6(tt): Consulting/Operating Contractor as Agent of Governmental Entity. I certify that the pur- chaser is a consulting or operating contractor or subcontractor as defined in MGL Ch. 64H, sec. 6(tt) and that the purchaser is authorized and acting as an agent of, and providing “qualified services,” as defined in MGL Ch. 64H, sec. 6(tt), to a governmental body or agency described in MGL Ch. 64H, sec. 6(d). Attach Form

Regardless of the exemption claimed, I will maintain adequate records to show the disposition of all property purchased under this certifi- cate. I understand that I am fully liable for the payment of any sales/use tax due in the event that the property purchased under this cer- tificate is used in a

Signed under the penalties of perjury.

Signature |

Title |

Location and description of project and description of kind and quantity of property or receipts/invoices must be attached or noted on the back of this form. This form is approved by the Commissioner of Revenue and may be reproduced.

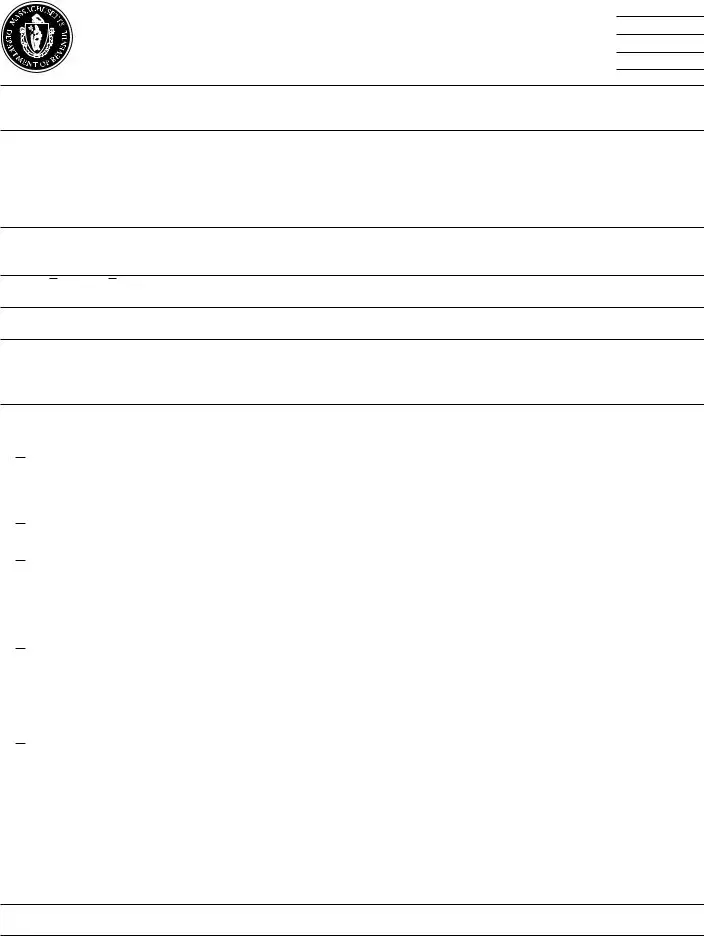

Part D. Location and description of project

Part E. Description of kind and quantity of property purchased

Date |

Description |

Quantity |

Cost |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

Total cost |

$ |

Additional information about the use of this form may be obtained by calling the Customer Service Bureau at (617)

printed on recycled paper

printed on recycled paper

Form

Instructions to Vendors

In general, this form is intended for use by contractors and sub- contractors purchasing building materials and supplies, as well as other types of tangible personal property for use in various

Part C

1.Contractors and subcontractors purchasing certain prop- erty (excluding building materials and supplies) as agents acting on behalf of governmental bodies and agencies or 501(c)(3) organizations. In general, contractors or subcontrac- tors purchasing tangible personal property (other than building materials and supplies for use in projects described in MGL Ch. 64H, sec. 6(f), which are discussed in section 2, below) as duly authorized agents acting on behalf of governmental bodies or agencies or Internal Revenue Service certified tax exempt 501(c)(3) organizations must check Box 1 under Part C of Form

Use of Form

personal property on behalf of exempt entities for fundraising pur- poses, should follow the instructions for Form

2.Contractors purchasing building materials and supplies for use in projects described in MGLCh. 64H, sec. 6(f). Con- tractors or subcontractors purchasing building materials or sup- plies for use in an exempt project described in MGL Ch. 64H, sec. 6(f), for example, contracts for the construction, reconstruc- tion, alteration, remodeling or repair of a building or structure owned by or held in trust for the benefit of for a governmental body or agency mentioned in MGL Ch. 64H, sec. 6(d) and used exclusively for public purposes, or for an IRS certified section 501(c)(3) exempt organization mentioned in MGL Ch. 64H, sec. 6(e), must check Box 2 under Part C of Form

Items that do not constitute “building materials and supplies” within the meaning of MGL Ch. 64H, sec. 6(f) include office sup- plies, furniture and equipment and other overhead items pur- chased for use by the contractor or its employees in performing its contracts. Contractors and subcontractors, as the consumers of such items, must pay sales/use tax on these purchases.

Exempt purchases of building materials and supplies are limited to those materials and supplies used, consumed, employed or ex- pended in the construction, reconstruction, alteration, remodeling or repair of any building, structure, public highway, bridge or other such public work as well as such materials and supplies physically incorporated therein. Exemptions also include rental charges for construction vehicles, equipment and machinery rented specifi- cally for use on the site of any

3.Consulting or operating contractors purchasing certain property as agents of, and providing “qualified services” to governmental entities under MGLCh. 64H, sec. 6(tt). “Consult- ing or operating contractors or subcontractors,” as defined in MGL Ch. 64H, sec. 6(tt) purchasing tangible personal property on behalf of, and acting as agents of, and providing “qualified serv- ices” (as defined in MGL c. 64H, sec. 6(tt)) to a governmental body or agency described in MGL Ch. 64H, sec. 6(d) must check Box 3 under Part C of Form

empt governmental entity’s Form

Any abuse or misuse of this certificate by any

If necessary, additional information may be obtained by calling the Customer Service Bureau at (617)

printed on recycled paper

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The ST-5C form is used to claim a sales tax exemption on purchases made by contractors or subcontractors for tax-exempt projects in Massachusetts. |

| Governing Laws | This form is governed by Massachusetts General Laws Chapter 64H, specifically sections 6(d), (e), (f), and (tt). |

| Parts Structure | The form is divided into multiple parts: Part A for the exempt organization, Part B for the purchasing contractor, and Part C for claiming the exemption. |

| Exemption Types | Exemptions can be claimed for various purposes, including being an agent of a governmental body or purchasing building materials for exempt organizations. |

| Record Keeping | Purchasers must maintain adequate records of transactions made under this certificate to avoid tax liability. |

| Penalties for Misuse | Misuse of the ST-5C can lead to severe penalties, including fines up to $50,000 and potential prison time for willful violations. |

Guidelines on Utilizing St 5C

After gathering all necessary information, you're ready to fill out the ST-5C form. This form requires detail about your purchase and the exemption you’re claiming. Make sure to have relevant documentation, such as the exempt organization’s Form ST-2, if applicable. Follow the steps carefully to ensure a smooth process.

- Begin with **Part A**. Fill in the exempt number, contract number, name of the exempt organization, the authorizing signature, and the date.

- Proceed to **Part B**. Indicate whether you are a contractor or subcontractor by checking the appropriate box. Provide your address, the date, and your vendor registration number if applicable. Also, fill in the contract or subcontract number and the date associated with it, along with the estimated date of project completion.

- Move to **Part C**, where you will claim the exemption. Check the box that corresponds to the exemption type you are claiming. Make sure to certify and complete the required information based on the selected option.

- In **Part D**, provide details about the location and description of the project.

- Next, fill in **Part E** with a description of the property purchased. List each item with the corresponding quantity and cost. Ensure that the total cost is calculated accurately at the bottom.

- Lastly, sign the form, including your title, to confirm that the information provided is correct. Remember to attach any required supporting documentation, like receipts or invoices, as instructed.

Once completed, keep a copy of the form for your records. This will help if you need to refer to it in the future. Now, your ST-5C form is ready for submission or for use in your purchasing process.

What You Should Know About This Form

What is the St 5C form?

The St 5C form is a Contractor’s Sales Tax Exempt Purchase Certificate used in Massachusetts. It enables contractors and subcontractors to purchase building materials and other tangible personal property without paying sales tax, when these purchases are made for tax-exempt projects.

Who should complete Part A of the St 5C form?

Part A should be completed by a governmental body, agency, or an organization that is certified exempt under IRC Section 501(c)(3). This section captures the necessary details to verify the exempt status of the purchasing entity, including their exempt number and contract number.

When should a contractor or subcontractor use the St 5C form?

A contractor or subcontractor should use the St 5C form when making purchases of tangible personal property intended for tax-exempt projects. This includes items like building materials for projects managed by governmental or 501(c)(3) exempt organizations. Ensure the appropriate exemption box is checked in Part C.

What are the different exemptions available on the St 5C form?

There are three primary exemptions available:

- Exemption for purchases as an agent of a governmental entity or tax-exempt organization (MGL Ch. 64H, sec. 6(d) or (e)).

- Exemption for building materials and supplies for construction projects (MGL Ch. 64H, sec. 6(f)).

- Exemption for consulting or operating contractors providing services to governmental entities (MGL Ch. 64H, sec. 6(tt)).

What documents need to be attached to the St 5C form?

You must attach a valid Form ST-2, Certificate of Exemption, when claiming exemptions for items purchased as agents of governmental bodies or 501(c)(3) organizations. Additionally, you should provide detailed records of the project, including descriptions and quantities of the property purchased.

Is there a limit on the types of items I can purchase using the St 5C form?

Yes, certain items are not eligible for tax exemption, including office supplies, furniture, and equipment. Only items that fall under the specified categories for construction or qualified services can be exempt. Always verify the eligibility of the items you intend to purchase.

What happens if I misuse the St 5C form?

Misuse of the St 5C form can result in serious consequences. This includes potential criminal charges, fines, and revocation of tax-exempt status. Always ensure that you are using the form correctly and only for eligible purchases.

Can I get assistance with the St 5C form?

Yes, if you have questions or need more information, you can contact the Massachusetts Customer Service Bureau at (617) 887-MDOR or toll-free at 1-800-392-6089. They can provide guidance on how to properly fill out the form and use it for your tax-exempt purchases.

Is it necessary to keep records of purchases made using the St 5C form?

Absolutely. You are responsible for maintaining adequate records showing the disposition of all property purchased under the St 5C certificate. This will help demonstrate compliance with tax regulations and assist if you are audited.

Can the St 5C form be reproduced?

Yes, the form is approved by the Commissioner of Revenue and can be reproduced for legitimate use. Just ensure that any copies made are clear and complete to avoid confusion when submitted to vendors.

Common mistakes

Filling out the ST-5C form can be straightforward, but mistakes can lead to complications. One common error is leaving out the exempt number in Part A. The exempt number is essential for proving that the organization is indeed tax-exempt. Without it, the entire certificate may be rejected.

An incomplete contract or subcontract number is another frequent mistake. Every contractor must ensure that the contract number is clearly stated. If this number is not documented correctly, it can create confusion between parties and result in a potential loss of tax exempt status.

Many people forget to attach the required Form ST-2. This form must accompany claims for exemption made on behalf of certain organizations. If this attachment is missing, the exemption claim may not be valid. Remember, documentation is key!

Failing to specify the description of the property purchased is another issue. The form asks for detailed information about the kind and quantity of property. Leaving this blank can lead to misunderstandings later on as to what exactly is being purchased under the exemption.

Another common oversight is not checking the appropriate box in Part C that corresponds to the type of exemption being claimed. There are several exemptions listed, and misclassifying the transaction can complicate matters. Select the correct exemption to avoid issues with the tax authorities.

Using outdated versions of the form can also be problematic. The ST-5C is periodically revised, and using an old version can lead to errors. Always make sure you download the most current version to ensure compliance with regulations.

In addition to checking for proper forms and numbers, be sure to include signatures where necessary. A missing signature can invalidate the entire certificate. Additionally, the person signing should have the authority to do so, as poorly signed documents can result in questions of legitimacy.

The date is also crucial. Failing to provide the date can raise concerns about when the authority granted the exemption. Any ambiguity in dates could lead to confusion and possible audits down the road.

Lastly, neglecting to maintain proper record keeping is a significant mistake. Keeping copies of this form and all related documents is essential for tracking purposes and ensuring compliance. Not maintaining these records can make providing proof of exemption difficult if ever challenged by tax authorities.

Documents used along the form

The ST-5C form is primarily used by contractors and subcontractors in Massachusetts to certify exemption from sales tax for certain purchases. However, other forms and documents also play vital roles in the exemption process. Understanding these documents can streamline the purchasing and compliance process for contractors involved in tax-exempt projects.

- Form ST-2, Certificate of Exemption: This form is issued by governmental bodies or certified tax-exempt organizations, such as 501(c)(3) entities, to validate their tax-exempt status. Contractors must attach a copy of this certificate when claiming exemptions on purchases. It serves as proof that the entity qualifies for the exemption being claimed.

- Form ST-5, Exempt Purchaser Certificate: This form is intended for use by purchasers who are not contractors or subcontractors but are acting on behalf of exempt organizations. It allows them to purchase tangible personal property on behalf of the exempt entity while ensuring that sales tax is not applied to these purchases.

- Consulting Agreements: These documents outline the terms and conditions under which consultants or operating contractors will provide services to governmental entities. They often specify the nature of the services provided, budgetary constraints, and any materials that may be purchased tax-exempt, ensuring compliance with applicable laws.

- Vendor Agreements: These contracts solidify the relationship between contractors and vendors supplying materials and equipment. They typically include clauses related to compliance with tax exemption rules, specifying that the contractor will provide the necessary exemption certificates to claim tax-free purchases.

Considering these documents alongside the ST-5C form can provide clarity and support for contractors navigating the complexities of tax exemptions. Having all necessary paperwork readily available can lead to smoother transactions and compliance with tax laws in Massachusetts, ultimately benefiting both the contractors and the organizations they serve.

Similar forms

The Massachusetts Form ST-5C is utilized for specific tax-exempt purchases by contractors or subcontractors acting on behalf of governmental bodies or certified 501(c)(3) organizations. Several other documents serve similar functions, ensuring compliance with sales tax exemptions. Here’s a breakdown of eight documents that share similarities with Form ST-5C:

- Form ST-2: This is a Certificate of Exemption, which tax-exempt organizations or governmental bodies provide to validate their status. It must accompany the ST-5C when purchases are made.

- Form ST-5: This Exempt Purchaser Certificate is utilized by exempt entities (such as nonprofits) for purchases that do not fall under contractor-specific transactions, primarily for fundraising.

- Form ST-4: This document is used to claim sales tax exemption for machinery and equipment purchases by manufacturing and research and development businesses, showcasing corporate initiatives similar to those outlined in ST-5C.

- Form ST-6: This is a Sales Tax Exempt Use Certificate for organizations that intend to claim exemption for items used exclusively in tax-exempt operations, akin to the ST-5C's provisions.

- Form ST-7: This form serves as a Certificate of Exemption for certain purchases by educational institutions, functioning similarly to the exemptions specified in Form ST-5C.

- Form ST-9: An Exemption Certificate used by vendors to document exempt sales made to purchasers who claim a valid reason under applicable state statutes, correlating with the ST-5C’s purpose.

- Form ST-10: Similar to the ST-5C, this form is aimed at financial institutions seeking exemptions for purchases essential for their everyday operations under particular conditions.

- Form ST-11: This document provides a Sales Tax Exempt Certificate for integrated projects, particularly in the construction industry, capturing similar concepts as the ST-5C in project execution.

Each of these forms serves an essential role in delineating financial responsibilities concerning sales tax, particularly for contractors and tax-exempt entities. Understanding their use can streamline compliance and ensure that purchases are handled correctly under Massachusetts law.

Dos and Don'ts

- Do carefully read the instructions before filling out the form.

- Do provide accurate details in all sections to avoid processing delays.

- Do attach the necessary supporting documents, such as Form ST-2, when required.

- Do ensure your agency or organization has a valid exemption number before submitting.

- Don’t leave any sections blank unless instructed; incomplete forms can lead to rejection.

- Don’t claim exemptions for personal purchases; only use the form for authorized contract expenses.

- Don’t forget to keep copies of the completed form and any attachments for your records.

Misconceptions

Misconceptions about the Form ST-5C can lead to misapplication of tax exemptions and potential liabilities. Here are five common misconceptions:

- The ST-5C is only for governmental agencies. Many believe that only governmental bodies can use the ST-5C form. In reality, it is also available to IRC Section 501(c)(3) certified organizations. Contractors acting on behalf of these entities can also utilize this form to claim tax exemptions.

- All purchases made using the ST-5C are tax-exempt. This form does not grant blanket tax exemption for all purchases. For example, overhead items like office furniture and consumables purchased for the contractor's own use are still subject to sales tax. Understanding the specific exemptions stipulated in the Massachusetts General Laws is crucial.

- You can complete the form retrospectively. Some individuals mistakenly think they can fill out the ST-5C after a purchase has been made. This form must be presented at the time of sale to claim the exemption. Failing to do so means that sales tax will be required for that transaction.

- Any contractor can use the ST-5C regardless of the type of work. It is a misconception that all contractors can make tax-exempt purchases using this form. The ST-5C is specifically designated for certain types of contracts, such as construction projects for governmental or IRC certified organizations. Not adhering to this can lead to tax liabilities.

- Only one copy of the Form ST-2 is needed. Many assume that providing one copy of the Form ST-2 is sufficient. In truth, when using the ST-5C, contractors must present a copy of Form ST-2 for each exempt purchase. This ensures that the vendor has the correct documentation to validate the exemption.

Addressing these misconceptions can enhance compliance and reduce the risk of penalties associated with misuse of tax exemption forms.

Key takeaways

Key Takeaways About Form ST-5C

- Form ST-5C is specifically for contractors and subcontractors who claim exemption from sales tax on purchases related to tax-exempt projects.

- It consists of several parts that different parties must complete. Governmental bodies and exempt organizations fill out Part A, while contractors and subcontractors complete Parts B and C.

- Three types of exemptions can be claimed on this form: for purchases as agents of exempt entities, for building materials and supplies, and for consulting or operating contractors.

- When claiming an exemption, it is crucial to maintain records showing how the purchased items are used. Misuse of this certificate can have serious consequences.

- Vendors typically require a copy of Form ST-2, Certificate of Exemption, to accompany ST-5C when claiming tax exemptions; this ensures all documentation is in order.

- For any questions or clarifications regarding the use of this form, individuals can contact the Customer Service Bureau at the provided phone numbers.

Browse Other Templates

Publx - Each section of this form serves a purpose in making a strong impression.

Public Partnerships Forms - Clear guidelines for document submission ensure compliance with employment policies.