Fill Out Your St 8A Form

The ST-8A form is an essential document for businesses involved in the sale, lease, or rental of tangible personal property in South Carolina. This resale certificate serves as a formal declaration by a purchaser that the goods acquired are intended for resale, which effectively shifts the responsibility for sales tax from the seller to the purchaser. Importantly, it provides both parties with a layer of protection; the seller can maintain a copy to substantiate the tax exemption during audits, while the purchaser must ensure that all necessary information—including their South Carolina Retail License Number—is accurately recorded. The ST-8A form must be carefully completed, as any errors could invalidate its use, leaving the seller liable for the sales tax. Furthermore, the purchaser must acknowledge their duty to report any goods withdrawn for personal use, regardless of whether those items are ultimately resold. Adhering to the guidelines outlined in the ST-8A can help maintain compliance with state tax regulations and avoid potential penalties, enhancing the efficiency and legality of retail transactions.

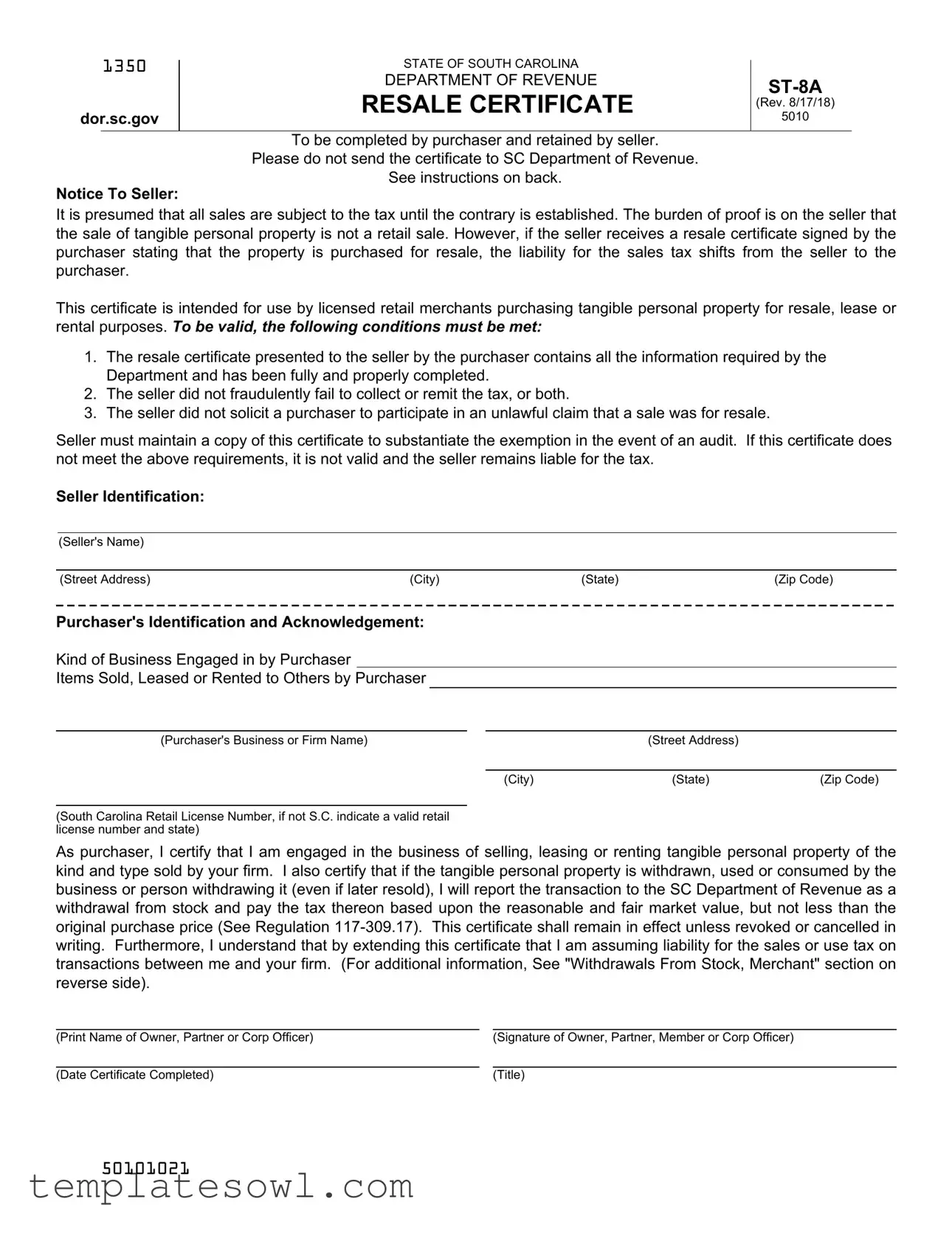

St 8A Example

1350 |

STATE OF SOUTH CAROLINA |

|

|

|

|

DEPARTMENT OF REVENUE |

|

|

|

RESALE CERTIFICATE |

|

|

|

(Rev. 8/17/18) |

|

|

|

|

|

dor.sc.gov |

|

5010 |

|

|

|

|

|

|

|

To be completed by purchaser and retained by seller. |

|

|

|

Please do not send the certificate to SC Department of Revenue. |

|

|

|

See instructions on back. |

|

Notice To Seller: |

|

|

|

It is presumed that all sales are subject to the tax until the contrary is established. The burden of proof is on the seller that the sale of tangible personal property is not a retail sale. However, if the seller receives a resale certificate signed by the purchaser stating that the property is purchased for resale, the liability for the sales tax shifts from the seller to the purchaser.

This certificate is intended for use by licensed retail merchants purchasing tangible personal property for resale, lease or rental purposes. To be valid, the following conditions must be met:

1.The resale certificate presented to the seller by the purchaser contains all the information required by the Department and has been fully and properly completed.

2.The seller did not fraudulently fail to collect or remit the tax, or both.

3.The seller did not solicit a purchaser to participate in an unlawful claim that a sale was for resale.

Seller must maintain a copy of this certificate to substantiate the exemption in the event of an audit. If this certificate does not meet the above requirements, it is not valid and the seller remains liable for the tax.

Seller Identification:

(Seller's Name)

(Street Address) |

(City) |

(State) |

(Zip Code) |

Purchaser's Identification and Acknowledgement:

Kind of Business Engaged in by Purchaser

Items Sold, Leased or Rented to Others by Purchaser

(Purchaser's Business or Firm Name) |

(Street Address) |

|

|

|

|

|

|

|

(City) |

(State) |

(Zip Code) |

(South Carolina Retail License Number, if not S.C. indicate a valid retail license number and state)

As purchaser, I certify that I am engaged in the business of selling, leasing or renting tangible personal property of the kind and type sold by your firm. I also certify that if the tangible personal property is withdrawn, used or consumed by the business or person withdrawing it (even if later resold), I will report the transaction to the SC Department of Revenue as a withdrawal from stock and pay the tax thereon based upon the reasonable and fair market value, but not less than the original purchase price (See Regulation

(Print Name of Owner, Partner or Corp Officer) |

|

(Signature of Owner, Partner, Member or Corp Officer) |

|

|

|

(Date Certificate Completed) |

|

(Title) |

50101021

Notice to Purchaser: If a purchaser uses a resale certificate to purchase tangible personal property tax free which the purchaser knows is not excluded or exempt from the tax, then the purchaser is liable for the tax plus a penalty of 5% of the amount of the tax for each month, or fraction of a month, during which the failure to pay the tax continues, not exceeding 50% in the aggregate. This penalty is in addition to all other applicable penalties authorized under the law.

SALES TAX - A sales tax is imposed upon every person engaged or continuing within this state in the business of selling tangible personal property at retail.

USE TAX - A use tax is imposed on the storage, use, or other consumption in this state of tangible personal property purchased at retail for storage, use, or other consumption in this state.

TANGIBLE PERSONAL PROPERTY - "Tangible personal property" means personal property which may be seen, weighed, measured, felt, touched, or which is in any other manner perceptible to the senses. It also includes services and intangibles, including communication, laundry and related services, furnishing of accommodations and sales of electricity, and does not include stocks, notes, bonds, mortgages, or other evidences of debt.

WITHDRAWAL FROM STOCK, MERCHANTS - (Regulation

The value to be placed upon such goods is the price at which these goods are offered for sale by the person withdrawing them. All cash or other customary discounts which he would allow to his customers may be deducted; however, in no event can the amount used as gross proceeds of sales be less than the amount paid for the goods by the person making the withdrawal.

ADDITIONAL INFORMATION

(1)A valid SC retail license number contains the words "Retail License" in bold printed at the top of the license and is comprised of 9 to 10 digits.

(2)The following are examples of numbers which are not acceptable for resale purposes: Social Security Numbers, Federal Employer Identification numbers and use tax registration numbers. A South Carolina certificate of registration (use tax registration number) is simply for reporting use tax and not a retail license number. The words "Certificate of Registration" is printed at the top of the certificate.

(3)Another state's resale certificate and number is acceptable in this State. Indicate the other state's number on the front when using this form.

(4)A wholesaler's exemption number may be applicable in lieu of a retail license number. A South Carolina wholesaler's certificate will have the section

Note: A copy of Form

50102029

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of the ST-8A Form | The ST-8A form serves as a resale certificate that allows licensed retail merchants in South Carolina to purchase tangible personal property without paying sales tax at the time of purchase, provided that the property is intended for resale. |

| Conditions for Validity | For the ST-8A form to be valid, it must contain all required information, be properly completed, and the seller should not have engaged in fraudulent activities related to tax collection. |

| Liability Transfer | The liability for sales tax shifts from the seller to the purchaser upon the seller's receipt of a properly completed resale certificate. If not valid, the seller may still be liable for tax on the sale. |

| Governing Law | The ST-8A form operates under South Carolina sales and use tax laws, primarily outlined in the South Carolina Code Annotated Section 12-36-120. |

Guidelines on Utilizing St 8A

After completing the St 8A form, the purchaser retains the original and the seller keeps a copy for their records. This ensures that both parties have a documented agreement regarding the resale of tangible personal property. Following this, you may proceed with your business transactions without incurring unnecessary sales tax.

- Begin by clearly writing the Seller's Name at the top of the form.

- Fill in the Seller's Street Address, followed by the City, State, and Zip Code.

- Next, provide the Purchaser's Business or Firm Name.

- Complete the Purchaser's Street Address, then include City, State, and Zip Code.

- Write in the South Carolina Retail License Number. If outside South Carolina, provide a valid retail license number along with the state.

- Specify the Kind of Business you are engaged in as the purchaser.

- List the Items Sold, Leased or Rented by your business.

- Print the name of the Owner, Partner or Corporate Officer at the designated area.

- Secure a signature of the Owner, Partner, Member or Corporate Officer. Ensure it is signed on the date that the certificate is completed.

- Include the Title of the individual signing the form.

What You Should Know About This Form

What is the purpose of the ST-8A form?

The ST-8A form is a resale certificate used in South Carolina. It allows licensed retail merchants to purchase tangible personal property tax-free when the items are intended for resale, lease, or rental. The form helps shift the liability for sales tax from the seller to the purchaser, provided it is properly completed and meets all necessary criteria.

Who is required to fill out the ST-8A form?

This form needs to be completed by the purchaser, especially those who are licensed retail merchants. The purchaser must provide relevant business information, including their retail license number, and certify that the items being purchased will be resold or leased. Sellers should retain a copy of the completed form for their records.

What information needs to be included on the ST-8A form?

To be valid, the ST-8A form must contain specific information. This includes the seller's name and address, the purchaser's business details, the South Carolina retail license number, and a statement confirming that the purchaser is engaged in selling tangible personal property. Additionally, the signature of an authorized individual is necessary to certify the information provided.

What happens if a seller does not collect sales tax when required?

If a seller fails to collect sales tax and does not have a valid resale certificate, they remain liable for the tax. The law assumes that all sales are taxable unless proven otherwise. Therefore, it is crucial for sellers to validate the resale certificates they receive to avoid any potential financial liability.

Can a purchaser use a resale certificate from another state?

Yes, a purchaser may use a resale certificate from another state when making tax-free purchases in South Carolina. However, they must provide the out-of-state resale license number on the ST-8A form. This allows the seller to validate that the purchaser is authorized to make tax-exempt purchases in their state as well.

Common mistakes

When filling out the ST-8A Resale Certificate, individuals often make several common mistakes that can lead to complications. One of the most frequent errors is **failing to provide complete information**. The form requires specific details about both the purchaser and seller, including names, addresses, and license numbers. Incomplete information can render the certificate invalid and create issues during audits.

Another common mistake involves **using the wrong type of identification number**. Purchasers must ensure that they provide a valid South Carolina retail license number. Acceptable numbers must clearly indicate "Retail License" at the top and consist of 9 to 10 digits. Submitting numbers like Social Security numbers or federal employer identification numbers will not suffice, potentially resulting in liability for sales tax.

It is essential to emphasize the **importance of signatures**. Some purchasers neglect to sign the form or may forget to include the printed name and title of the signatory. Without a proper signature, the validity of the certificate is questionable, as the purchaser must certify their engagement in business activities consistent with the resale claim.

Purchasers sometimes **misunderstand the scope of the resale certificate**. This certificate is strictly intended for tangible personal property that is bought for resale. If goods are going to be used or consumed outside of this purpose, the purchaser is obliged to report that transaction to the South Carolina Department of Revenue and pay the appropriate tax.

Additionally, individuals might overlook the necessity of keeping a **copy of the completed certificate**. Sellers are recommended to retain a copy to substantiate any claimed exemptions in the case of an audit. Failing to do so may result in compliance issues, leaving sellers vulnerable to tax liabilities that could have been avoided.

There are also **errors related to the terms of validity and revocation**. Some purchasers do not understand that the resale certificate remains in effect unless explicitly cancelled or revoked in writing. Being unaware of this could lead to confusion in future transactions, undermining the intended structure of the sales tax framework.

Finally, individuals should be careful about **not relying on outdated versions of the form**. As of the last revision date, users must ensure they are utilizing the most current ST-8A form. Using obsolete versions can lead to misunderstandings regarding current regulations, compliance, and tax responsibilities.

Documents used along the form

The ST-8A form is a resale certificate used in South Carolina to allow licensed retail merchants to purchase tangible personal property without paying sales tax, under certain conditions. When using the ST-8A, several additional forms or documents may also be needed to ensure compliance with tax regulations. Here is a list of some commonly used forms alongside the ST-8A, along with a brief description of each:

- Form ST-3: This form is a Sales and Use Tax Certificate of Exemption. It allows a purchaser to claim an exemption from sales tax for specific types of purchases, such as materials used in manufacturing or items sold to exempt entities.

- Form ST-4: This is the Direct Pay Certificate. It allows businesses to make purchases without paying sales tax upfront, opting to report and pay the tax directly to the tax authority instead.

- Form ST-8: This is another version of a resale certificate, which may be used in different situations. Its purpose is similar; however, it may be tailored for specific types of transactions or property categories.

- Form ST-9: The ST-9 is the Exempt Use Certificate, which is used by individuals or businesses purchasing items that will be used in ways that exempt them from sales tax.

- Form ST-10: This is the Sales and Use Tax Return form. Businesses use it to report and pay sales tax collected from customers as well as remit any use tax obligations on purchases made.

- Form ST-11: Known as the Claim for Regular Refund form, it allows a taxpayer to request a refund for sales tax that was incorrectly paid on purchases.

- Form ST-12: This form is used to apply for a resale license. It must be obtained before making exempt purchases using a resale certificate.

- Form ST-13: The Industrial Exemption Certificate permits certain manufacturing businesses to purchase equipment or supplies without paying sales tax, as long as these items will be used directly in the manufacturing process.

- Form ST-15: The Temporary Exemption Certificate provides temporary tax-exempt status for certain purchases, often for special events or projects.

- Form ST-17: This is the Certificate of Exempt Sale, claiming that the transaction is exempt from sales tax due to the buyer's classification or purpose.

Using the ST-8A form correctly is crucial for businesses to avoid unexpected tax liabilities. It's essential to keep all related documentation organized and accessible. Understanding the various forms related to resale purchases can help ensure that transactions meet state requirements and protect businesses during audits.

Similar forms

-

Form ST-8A Resale Certificate: This document serves as a declaration made by purchasers to sellers, indicating that the items involved are intended for resale rather than direct consumption. Similar to the ST-8A, this form helps ensure that sales tax responsibilities are correctly assigned, shifting the tax liability from the seller to the purchaser based on the intention of resale.

-

Form ST-3 Sales Tax Exemption Certificate: This form allows certain organizations and individuals to claim exemption from sales tax for specific purchases. Like the ST-8A, it requires the purchaser to indicate the nature of their business or organization and the intended use of the purchased property.

-

Form ST-12 Exempt Use Certificate: Used by purchasers to declare items purchased will be used in a manner exempt from sales tax. This is akin to the ST-8A, as both forms shift tax responsibilities based on how the purchased goods will be utilized.

-

Form ST-4 Peddler’s Certificate: This document permits peddlers to purchase goods without paying sales tax for items they intend to sell directly in the market. The ST-4 works similarly to the ST-8A by affirming the intent of resale, protecting sellers from tax obligations.

-

Form ST-10 Manufacturer’s Exemption Certificate: This certificate allows manufacturers to purchase materials without paying sales tax, provided those materials will be used in the production of goods for resale. It aligns with the ST-8A in that it affirms the intention of resale and protects both parties in a sales transaction.

-

Form ST-11 Direct Pay Permit: This document enables businesses to purchase goods and services without paying sales tax at the time of purchase. Instead, they report and pay either regular sales tax or exempt sales tax directly to the state. Like the ST-8A, it facilitates ease of transactions where tax liabilities are handled differently for the purchaser.

-

Form ST-7 Streamlined Sales Tax Exemption Certificate: This form is designed for multis-state usage, allowing businesses to purchase goods tax-free under streamlined sales tax agreements. Similar to the ST-8A, it declares that the goods purchased are intended for resale, following a consistent process across participating states.

Dos and Don'ts

When filling out the St 8A form, it's essential to follow specific guidelines to ensure its validity. Here are some recommendations:

- Do include all required information, such as the purchaser's and seller's details.

- Do ensure the form is fully completed before presenting it to the seller.

- Do maintain a copy of the completed form for your records.

- Do verify that the information provided is accurate and truthful.

- Do not submit the form to the SC Department of Revenue; keep it with your records.

- Do not claim a resale exemption if the property will be used or consumed in any capacity.

- Do not forge or alter signatures on the form; integrity is crucial.

- Do not fail to report any withdrawals from stock as required.

- Do not use another type of identification number, such as a Social Security number, in place of the retail license number.

Misconceptions

- Misconception 1: The ST-8A form must be submitted to the South Carolina Department of Revenue.

- Misconception 2: The resale certificate is only for large businesses.

- Misconception 3: All sales are exempt from tax when a resale certificate is used.

- Misconception 4: The seller cannot be held responsible if they accept a resale certificate.

- Misconception 5: Only South Carolina retail license numbers are valid for the form.

- Misconception 6: The ST-8A form is required to be valid as a resale certificate.

- Misconception 7: There are no record-keeping requirements associated with the resale certificate.

- Misconception 8: Using a resale certificate guarantees no sales tax will be ever incurred.

- Misconception 9: Only tangible goods are covered by the resale certificate.

The ST-8A form is not sent to the Department of Revenue. It is completed by the purchaser and kept by the seller for their records.

Any licensed retail merchant, regardless of size, can use the ST-8A form for purchasing items for resale, lease, or rental.

The certificate is only valid if the purchase is truly for resale. If the purchaser plans to use the items personally, they remain liable for sales tax.

If the seller fails to verify that the resale certificate is valid and properly completed, they could be held liable for the tax.

A resale certificate from another state is acceptable as long as the other state's number is noted on the form.

While Form ST-8A can be used, any resale certificate that meets the required information is acceptable.

Sellers must keep a copy of the ST-8A form to support the tax exemption in case of an audit.

If the goods are withdrawn for personal use or consumption, sales tax must be reported and paid based on the market value.

The definition of tangible personal property includes services and certain intangibles but not things like stocks or bonds.

Key takeaways

Understanding the St 8A form, also known as the Resale Certificate in South Carolina, is crucial for any business involved in the sale of tangible goods. Here are some key takeaways to keep in mind:

- Purpose: The St 8A form allows businesses to purchase items tax-free if those items are intended for resale, lease, or rental.

- Completion: Make sure the form is fully completed with all required information, including seller and purchaser details, along with the valid retail license number.

- Seller's Responsibility: The seller must retain a copy of the certificate to establish the tax exemption in case of an audit.

- Liability Shift: When this certificate is validly presented, the liability for sales tax shifts from the seller to the purchaser.

- Fraud Prevention: Sellers must not engage in fraudulent practices, such as failing to collect tax, or they risk losing the tax exemption.

- Penalties for Misuse: If a purchaser uses the resale certificate for goods that are not tax-exempt, they can face a tax liability and additional penalties.

- Validity: The certificate remains valid unless it is revoked or canceled in writing by the purchaser.

- Other Certificates: A resale certificate from another state can be acceptable, as long as the corresponding state number is included.

- Documentation Reference: More information and templates can be found on the South Carolina Department of Revenue website if you need to reference the form or related regulations.

Filling out the St 8A form accurately not only protects businesses but also ensures compliance with state tax laws. Misunderstandings related to tax responsibilities can lead to significant liabilities, so it’s essential to approach this task with care.

Browse Other Templates

Community Service Hours Template - Ensure your service hours are recognized and appreciated.

Choices Opwdd - Users are responsible for their actions taken while using their OPWDD User ID.