Fill Out Your St8 Form

In New Jersey, navigating the nuances of sales tax can feel overwhelming, especially for property owners and contractors alike. One crucial form in this landscape is the ST-8 form, designed to certify that certain construction or improvement work qualifies for a tax exemption. This form should be completed by both the property owner and the contractor, and it's essential to ensure it is accurately filled out as it determines whether the contractor can charge sales tax for their services. The ST-8 form essentially requires details about the nature of the project—specifying whether the work will result in an exempt capital improvement—as well as a declaration from the owner that they believe the work falls under this exemption. For example, significant enhancements, like new roofing or a central air conditioning installation, often qualify as exempt improvements, while general repairs might not. Additionally, the form must be retained by the contractor and should never be submitted to the Division of Taxation. By successfully navigating this process, both parties can avoid unnecessary taxes and ensure compliance with state regulations. Understanding the ST-8 form is empowering for property owners looking to enhance their spaces without the added burden of sales tax on qualifying improvements.

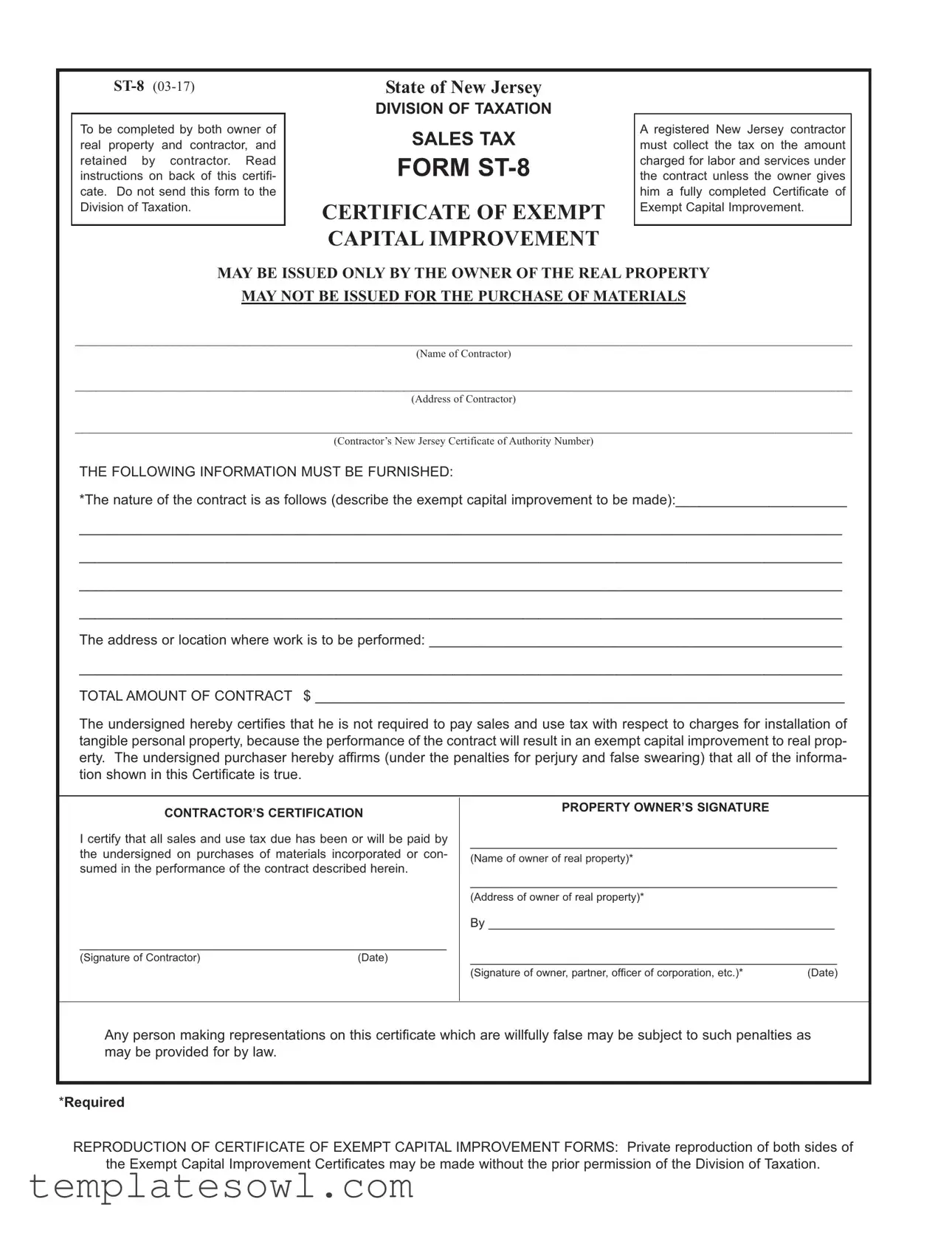

St8 Example

-

To be completed by both owner of real property and contractor, and retained by contractor. Read instructions on back of this certifi- cate. Do not send this form to the Division of Taxation.

w

DIVISION OF TAXATION

SALES TAX

FORM

A registered New Jersey contractor must collect the tax on the amount charged for labor and services under the contract unless the owner gives him a fully completed Certificate of Exempt Capital Improvement.

O

O

OOH

_______________________________________________________________________________________________________________

(Name of Contractor)

_______________________________________________________________________________________________________________

(Address of Contractor)

_______________________________________________________________________________________________________________

(Contractor’s New Jersey Certificate ofAuthority Number)

THE FOLLOWING INFORMATION MUST BE FURNISHED:

*The nature of the contract is as follows (describe the exempt capital improvement to be made):______________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

The address or location where work is to be performed: _____________________________________________________

__________________________________________________________________________________________________

TOTALAMOUNT OF CONTRACT $ ____________________________________________________________________

The undersigned hereby certifies that he is not required to pay sales and use tax with respect to charges for installation of tangiblepersonalproperty,becausetheperformanceofthecontractwillresultinanexemptcapitalimprovementtorealprop- erty. The undersigned purchaser hereby affirms (under the penalties for perjury and false swearing) that all of the informa- tion shown in this Certificate is true.

CONTRACTOR’S CERTIFICATION |

PROPERTY OWNER’S SIGNATURE |

|

|

|

|

||

I certify that all sales and use tax due has been or will be paid by |

_____________________________________________________ |

||

the undersigned on purchases of materials incorporated or con- |

(Name of owner of real property)* |

|

|

sumed in the performance of the contract described herein. |

|

|

|

|

|

_____________________________________________________ |

|

|

|

(Address of owner of real property)* |

|

|

|

By __________________________________________________ |

|

_____________________________________________________ |

|

|

|

(Signature of Contractor) |

(Date) |

_____________________________________________________ |

|

|

|

(Signature of owner, partner, officer of corporation, etc.)* |

(Date) |

|

|

|

|

Any person making representations on this certificate which are willfully false may be subject to such penalties as may be provided for by law.

*Required

REPRODUCTION OF CERTIFICATE OF EXEMPT CAPITAL IMPROVEMENT FORMS: Private reproduction of both sides of the Exempt Capital Improvement Certificates may be made without the prior permission of the Division of Taxation.

O

OOIn cases where the contractor performs work which results in an exempt capital improvement to your house or land (real property), he may NOT charge you any sales tax if you issue to him a fully completed Certificate of Exempt Capital Improvement (Form

It is important to distinguish between an exempt capital improvement and a taxable capital improvement, repair or installation. If the fulfillment of a contract only maintains the existing value of the property, it is a repair and not a capital improvement. Where an improvement results in an increase in the capital value of the real property, it is generally considered that a capital improvement has been performed. (But see below list of taxable capital improvements.)

As an aid to determine whether a contract is for a repair to real property or a capital improvement to real property, the treatment of such transaction for income tax purposes under the Federal Internal Revenue Code may be used as a guide. If you have any doubt whether the work to be performed constitutes a repair or an exempt capital improvement, you should communicate with the Division of Taxation and describe in detail such work.

The following are examples of exemptcapital improvements: |

|

|

New construction (other than taxable |

Porch enclosure, construction of |

Paneling, installation of |

capital improvements listed below) |

New roof, installation of |

New heating system installation |

Tiled bath, installation of |

Rewiring |

|

New central air conditioner installation |

New bath fixtures, installation of |

New electrical outlets installed |

Painting a newly constructed house |

New kitchen cabinets, installation of |

New siding, installation of |

New hot water heater installation |

New kitchen fixtures, installation of |

Garage, construction of |

Patio, construction of |

Paving of driveway |

Storm doors and windows, original |

|

|

or initial installation of |

The following are examples of taxablecapital improvements. This form cannot be issued for these services, which are subject to sales tax on and after October 1, 2006:

Seeding, sodding, grass plugging of new lawns, planting trees, shrubs, hedges, plants, etc.

Clearing and filling land associated with seeding, sodding, grass plugging of new lawns, or planting trees, shrubs, hedges, plants, etc., including tree/stump removal

Installing carpeting and other flooring

Installing a

OOO : If you enter into a contract to add to or improve real property by an exempt capital improvement (see examples above) and the property owner issues to you a properly completed Certificate of Exempt Capital Improvement, which you must retain, you should not collect sales tax from the property owner. (You are required to pay sales tax to your supplier on the purchase of the tangible personal property you purchase for use in performing the contract irrespective of whether the work constitutes a repair or a capital improvement.)

However, if you enter into a contract to repair, maintain, or service real or tangible personal property, or to install a taxable capital improvement, you must collect tax on the charge for labor or services performed in accordance with the contract.

Registered sellers who accept fully completed exemption certificates within 90 days subsequent to the date of sale are relievedof liability for the collection and payment of sales tax on the transactions covered by the exemption certificate. The following information must be obtained from a purchaser in order for the exemption certificate to be fully completed:

•Purchaser’s name and address;

•Type of business;

•Reasons(s) for exemption;

•Purchaser’s New Jersey tax identification number or, for a purchaser that is not registered in New Jersey, the Federal employer identification number or

•If a paper exemption certificate is used (including fax), the signature of the purchaser.

The seller’s name and address are not required and are not considered when determining if an exemption certificate is fully completed. Aseller that enters data elements from paper into an electronic format is not required to retain the paper exemption certificate.

The seller may, therefore, accept this certificate as a basis for exempting sales to the signatory purchaser and is relieved of liability even if it is determined that the purchaser improperly claimed the exemption. If it is determined that the purchaser improperly claimed an exemption, the purchaser will be held liable for the nonpayment of the tax.

c- Certificates must be retained by the seller for a period of not less than four years from the date of the last sale covered by the certificate. Certificates must be in the physical possession of the seller and available for inspection.

cccxc– On and after October 1, 2011, if the seller either has not obtained an exemption certificate or the seller has obtained an incomplete exemption certificate, the seller has at least 120 days after the Division’s request for substantiation of the claimed exemption to either:

1.Obtain a fully completed exemption certificate from the purchaser, taken in good faith, which, in an audit situation, means that the seller obtain a certificate claiming an exemption that:

(a)was statutorily available on the date of the transaction, and

(b)could be applicable to the item being purchased, and

(c)is reasonable for the purchaser’s type of business; OR

2.Obtain other information establishing that the transaction was not subject to the tax.

If the seller obtains this information, the seller is relieved of any liability for the tax on the transaction unless it is discovered through the audit process that the seller had knowledge or had reason to know at the time such information was provided that the information relating to the exemption claimed was materially false or the seller otherwise knowingly participated in activity intended to purposefully evade the tax that is properly due on the transaction. The burden is on the Division to establish that the seller had knowledge or had reason to know at the time the information was provided that the information was materially false.

OOOORead publication

O OOOOO

This form is to be completed by purchaser and given to and retained by seller

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | The ST-8 form is used in New Jersey to exempt certain capital improvements from sales tax. |

| Who Completes It | The property owner and the contractor must fill out this form together. |

| Retention Requirement | The contractor must keep the completed form for record-keeping. |

| Tax Collection Responsibility | Contractors must collect sales tax unless provided with a completed ST-8 form. |

| Exempt Improvements | Examples of exempt improvements include new roofs, HVAC systems, and in-ground pools. |

| Taxable Improvements | Services like lawn planting and security system installations are typically taxable. |

| Validity Period | Contracts must adhere to the sales tax exemption rules valid as of the purchase date. |

| Documentation Requirement | Purchasers must provide their tax identification number and a valid reason for the exemption. |

| Retention Period | Contractors must keep exemption certificates for at least four years from the last sale date. |

Guidelines on Utilizing St8

Filling out the ST-8 form is essential for any property owner working with a registered New Jersey contractor. This completed form allows the contractor to not charge sales tax for specific capital improvements to real property, provided certain conditions are met. Follow the steps to ensure that all necessary information is accurately filled out.

- Identify yourself: In the section for the contractor's information, enter the Name of the contractor, followed by their Address.

- Provide contractor's details: Next, input the contractor's New Jersey Certificate of Authority Number.

- Describe the contract: Clearly state the nature of the contract by describing the exempt capital improvement to be made.

- Location of work: Fill in the address or location where work is to be performed.

- Enter contract amount: Write the TOTAL AMOUNT OF CONTRACT in the specified area.

- Certify non-payment of sales tax: Both the contractor and property owner must sign and date the certification statements verifying that all provided information is accurate.

- Signatures: Ensure to include the living person's signature for the contractor as well as for the property owner, along with their respective dates.

Once completed, the contractor should retain the ST-8 form for their records. This clearly documented exemption certificate is vital for confirming eligibility for sales tax exclusion on the specified capital improvements.

What You Should Know About This Form

What is the purpose of the St8 form?

The St8 form, also known as the Certificate of Exempt Capital Improvement, is designed to help property owners confirm that certain types of improvements to real property are exempt from sales tax. If a property owner completes this form for a registered New Jersey contractor, the contractor will not charge sales tax for the work performed under a contract that qualifies as an exempt capital improvement.

Who must fill out the St8 form?

Both the owner of the real property and the contractor must complete relevant sections of the St8 form. The contractor retains the form as proof that they are not required to charge sales tax on the specified services. The form needs to be correctly filled out to be valid.

What qualifies as an exempt capital improvement?

An exempt capital improvement generally results in an increase in the property’s value. Examples include new construction, installation of a new roof, or adding a swimming pool. It is important to distinguish these from repairs or maintenance, which do not qualify for tax exemption.

What information is required on the St8 form?

The St8 form requires specific information from both the property owner and the contractor. This includes names, addresses, the contractor’s New Jersey Certificate of Authority Number, and details about the contract and the nature of the capital improvement. Completeness and accuracy are essential to ensure the exemption is recognized.

What happens if a contractor does not receive a completed St8 form?

If a contractor does not receive a properly completed St8 form from the property owner, they are required to charge sales tax on the labor and services provided under the contract. The contractor must also pay sales tax on materials used in the project, regardless of whether the work is considered a repair or a capital improvement.

How long should the St8 form be retained?

The contractor must retain the completed St8 form for at least four years from the date of the last sale covered by the certificate. This retention is essential for compliance with tax regulations and for potential inspections by the Division of Taxation.

What are the penalties for false information on the St8 form?

Providing false information on the St8 form can lead to penalties under laws related to perjury and false swearing. Both the contractor and the property owner should ensure that all information is accurate and truthful when completing the form.

Common mistakes

Filling out the ST-8 form is a crucial step for contractors and property owners who want to ensure that their improvements are exempt from sales tax in New Jersey. However, there are common mistakes often made during this process that can lead to complications. Recognizing these mistakes can help streamline your submission and save time and money.

One frequent error is neglecting to **provide complete information**. When filling out the form, each section requires specific details, such as the contractor’s name, address, and New Jersey Certificate of Authority Number. Omitting any of this information can invalidate the certificate and lead to the contractor having to collect sales tax from the property owner. It’s essential to double-check that every required field is filled out accurately before signing the form.

Another common pitfall is failing to correctly define the nature of the contract. You must clearly describe the exempt capital improvement being performed. Using vague terminology can cause confusion later on, especially if the nature of work is misinterpreted as a taxable improvement. For this reason, clarity is key. Use precise language to outline what work is being done and ensure that it aligns with what constitutes an exempt capital improvement.

Many people also make the mistake of not understanding the difference between exempt and taxable improvements. If you’re unsure whether the improvement qualifies as exempt, you might check the guidelines or consult with the Division of Taxation. Don't risk your potential tax exemption based on assumptions. Instead, do your homework or seek clarification to avoid unnecessary tax liabilities.

Additionally, a common oversight involves signatures. Both the property owner and the contractor must sign the ST-8 form. Some believe that a verbal agreement suffices, but without a signature, the form does not hold up. Missing signatures can jeopardize the tax exemption status, so make it a point to confirm this before submitting the form.

Lastly, many forget to keep a copy of the completed ST-8 form for their records. Retaining documentation is important, especially if the Division of Taxation requests further information or if there are discrepancies later on. Keeping a well-organized record of all documents related to your project can save you from potential headaches down the line.

By avoiding these pitfalls, you can ensure that the process of completing the ST-8 form goes smoothly. A little extra attention during the filling out of this certificate can help you avoid complications and better protect your interests.

Documents used along the form

When dealing with the ST-8 form, it is important to know about other related documents that may be necessary for tax exemption related to capital improvements. Each of these forms serves a specific purpose, and understanding them can help ensure compliance with tax regulations.

- Certificate of Exempt Capital Improvement: This certificate is issued to the contractor by the property owner, confirming that the work performed will result in an exempt capital improvement. It is essential for avoiding sales tax on qualifying labor and materials.

- Sales Tax Exemption Certificate (ST-4): This document allows businesses to make tax-exempt purchases of tangible personal property or services intended for resale, thus minimizing upfront costs.

- Contractor's Registration Certificate: Contractors must have this certificate to be legally recognized in New Jersey. It verifies that a contractor is registered and authorized to perform work within the state.

- New Jersey Tax Identification Number (NJ-TIN): This number is crucial for any business entity engaging in taxable or exempt sales. It serves as an official identifier for tax purposes.

- Federal Employer Identification Number (EIN): Similar to the NJ-TIN, the EIN identifies businesses for federal tax purposes. Out-of-state contractors may need to provide this number to comply with tax regulations.

- Affidavit of Exempt Use: This document may be required to declare that specific purchases were for exempt use only. It helps clarify the tax-exempt status of certain transactions.

- Receipt for Services Rendered: This is a proof of payment for any services or materials provided by the contractor. Keeping detailed receipts is important for both tax records and potential audits.

Understanding these accompanying forms can aid in navigating the complexities of sales tax exemptions related to property improvements. Ensuring that all paperwork is accurately completed and retained can help protect both the owner and the contractor in their transactions.

Similar forms

Sales Tax Exemption Certificate: Similar to the ST-8 form, a Sales Tax Exemption Certificate allows purchasers to claim exemption from sales tax for specific goods or services. This document requires the purchaser to provide information about their tax-exempt status and details about the purchase.

W-9 Form: The W-9 form is used to provide a taxpayer’s identification number and certification for purposes of reporting income. Like the ST-8, it requires the completion of specific information about the taxpayer and is also retained by the contractor or recipient of the services.

Form 1099: Used for reporting income other than wages, Form 1099 serves a similar purpose to the ST-8 in documenting transactions. Contractors and businesses must gather the proper information to complete this form and provide it to the IRS.

Certificate of Exempt Capital Improvement: This certificate is directly related to the ST-8 form, as it allows property owners to certify that improvements made to their property are exempt from sales tax, similar to the exemption provided by the ST-8.

Contractor License Application: A contractor license application captures necessary information about the contractor and their qualifications. Like the ST-8, it requires verification and retention of information by the governing authority, ensuring compliance with state regulations.

IRS Form 8508: This form is used to request a waiver from the electronic filing requirement for certain submissions to the IRS. Similar to the ST-8, it demands specific information from the requester to evaluate eligibility for exemption.

State Purchase Order: A state purchase order serves as an official document to procure goods or services from a vendor. It includes specific details, much like the ST-8, ensuring both parties understand the terms and obligations involved in the transaction.

Tax Registration Application: This document is used by businesses to register for tax purposes. Information is collected similarly to the ST-8, providing thorough details on the business and its tax-exempt certifications.

Property Tax Exemption Application: This application allows property owners to request exemptions from property taxes. Like the ST-8, it requires property owners to supply detailed information about their property and qualifications for an exemption.

Affidavit of Exemption: An affidavit of exemption allows individuals or businesses to formally declare their tax-exempt status. It parallels the ST-8 by requiring sworn statements and relevant details to affirm eligibility for the exemption.

Dos and Don'ts

Do's:

- Ensure both the property owner and contractor complete the St8 form.

- Provide accurate information about the nature of the exempt capital improvement.

- List the correct address or location where work will be performed.

- Sign and date the form in the appropriate sections.

- Retain a copy of the completed form for your records.

Don'ts:

- Do not send the form to the Division of Taxation.

- Avoid incomplete forms; all required fields must be filled out.

- Do not enter inaccurate information, as it may lead to penalties.

- Do not forget to pay any sales tax owed on taxable services.

- Do not rely on assumptions; verify if the work constitutes a capital improvement or repair.

Misconceptions

- Misconception 1: The ST-8 form must be submitted to the Division of Taxation.

- Misconception 2: Any contractor can charge no sales tax for any type of work.

- Misconception 3: All improvements to real property are considered capital improvements.

- Misconception 4: No information needs to be provided on the ST-8 form.

- Misconception 5: The contractor can ignore sales tax if a property owner provides an ST-8 form.

- Misconception 6: An ST-8 form can be used for services classified as taxable improvements.

- Misconception 7: There are no consequences for improperly completing the ST-8 form.

- Misconception 8: Once the ST-8 form is issued, it does not need to be retained.

In reality, the ST-8 form should not be sent to the Division of Taxation. It is to be completed and retained by the contractor.

This is incorrect. Only New Jersey contractors performing work that results in an exempt capital improvement may not charge sales tax, provided they receive a completed ST-8 form from the property owner.

This is a misunderstanding. An improvement must enhance the capital value of the property to be categorized as a capital improvement. Maintenance that merely preserves existing value is considered a repair and is taxable.

Contrary to this belief, specific information—such as the nature of the contract, location of work, and signatures from both the contractor and property owner—must be included for the form to be valid.

This is misleading. Contractors must still pay sales tax on materials sold to them for use in the project, regardless of the status of the ST-8 form.

This is inaccurate. The ST-8 form cannot be issued for services that are known to be taxable, such as maintaining landscapes or installing certain flooring types.

In truth, submitting false or incomplete information on the ST-8 form can lead to penalties for the property owner.

This is incorrect. The ST-8 form must be retained by the contractor for a minimum of four years for inspection purposes.

Key takeaways

Filling out and using the St8 form is an important process for property owners and contractors in New Jersey when seeking to secure exemptions from sales tax on certain improvements. Here are key takeaways to keep in mind:

- Both Parties Involved: The St8 form must be completed by both the owner of the real property and the contractor. A clear, mutual understanding is essential.

- No Submission Necessary: Do not send the form to the Division of Taxation. Simply complete and retain the form for your records.

- Understanding Exempt Improvements: Familiarize yourself with what qualifies as an exempt capital improvement, such as a new roof or installation of a new heating system. Not all home improvements qualify.

- Detail is Crucial: Provide detailed descriptions of the work to be performed. Vague descriptions risk complications later.

- Address Required: The location of the work being performed must be included on the form. This is vital for accurate record-keeping.

- Exemption Validity: If a properly completed St8 form is provided to the contractor, they are not obligated to charge sales tax for the work performed, assuming the improvement qualifies as exempt.

- Retain Your Forms: Contractors should keep the completed St8 forms on file for at least four years. This is important in case of audits or questions from tax authorities.

- Consequences for Misrepresentation: Providing false information on the certificate may lead to penalties. Honesty is not just a policy, it’s a necessity.

- Timeliness Matters: If there’s any doubt about the status of an exemption, reach out to the Division of Taxation for clarification before the work begins.

- Information Clarity: Ensure that the required information about the purchaser is completed accurately, including their New Jersey tax identification number or appropriate federal equivalent.

By following these guidelines, both property owners and contractors can navigate the process smoothly and take advantage of potential tax savings while avoiding pitfalls.

Browse Other Templates

Direct Deposit Wells Fargo - Access granted through this form can assist in managing your mortgage obligations.

Rate of Respiration Virtual Lab Answer Key - Reinforce the significance of data collection as a fundamental aspect of scientific experiments.