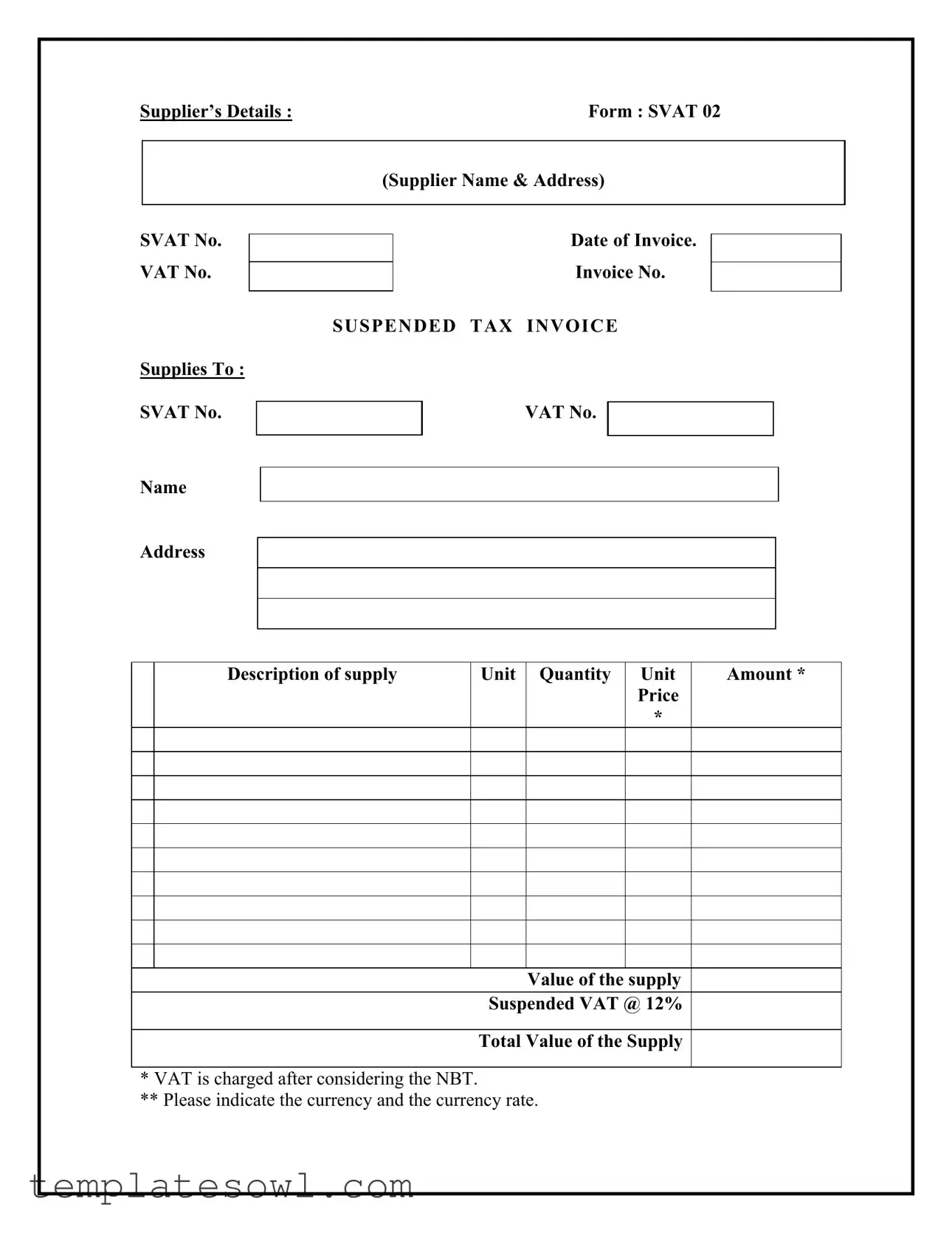

Fill Out Your Svat 02 Form

The Svat 02 form serves as an essential document for businesses engaged in supplying goods or services, specifically related to the computation of Value Added Tax (VAT). It captures critical information, including the supplier's details such as name, address, VAT number, and the date of the invoice. Each transaction is assigned a unique invoice number, making it easier to track for accounting purposes. Notably, the form includes details regarding the recipient of the supply, including their Svat number, name, address, and VAT number as well. The description of the supply is thoroughly documented, ensuring clarity about what is being provided. Additionally, the form requires specifying unit price, quantity, and the total amount for each item, hence providing a comprehensive view of the transaction. The amount due for VAT is also calculated at a standard rate, which is 12%, although it’s important to note that this is done after accounting for any applicable Nation Building Tax (NBT). For further clarity, the form prompts the user to indicate the currency and the corresponding currency rate, which is crucial in international transactions. Such structured information aids in maintaining compliance with taxation regulations while facilitating smoother financial processes between suppliers and their clients.

Svat 02 Example

Supplier’s Details : |

Form : SVAT 02 |

SVAT No.

VAT No.

(Supplier Name & Address)

Date of Invoice.

Invoice No.

SUSPENDED TAX INVOICE

Supplies To :

SVAT No.

Name

Address

VAT No.

Description of supply

Unit

Quantity

Unit

Price

*

Amount *

Value of the supply

Suspended VAT @ 12%

Total Value of the Supply

* VAT is charged after considering the NBT.

** Please indicate the currency and the currency rate.

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The SVAT 02 form is used for issuing Suspended Tax Invoices for value-added tax (VAT) purposes. |

| Governing Law | This form is governed by the VAT laws and regulations specific to the jurisdiction where the supplier operates. |

| Informational Requirements | It requires detailed supplier information such as the supplier's name, address, VAT number, and specifics of the supplies. |

| VAT Rate | A suspended VAT charge is applied at a rate of 12%, which affects the total value of the supply. |

| Currency Specification | The form requests the currency in which the transaction is conducted, as well as the applicable currency rate. |

Guidelines on Utilizing Svat 02

Completing the SVAT 02 form requires careful attention to detail. The form is meant to capture key information related to your supplies and the relevant VAT. Ensure that all information provided is accurate to avoid any issues later on.

- Gather all necessary information: Before starting, collect your supplier's details, including their name, address, VAT number, invoice details, and supply specifics.

- Fill out the Supplier’s Details: Write the SVAT number, VAT number, supplier’s name, and address in the designated spaces. Don’t forget the date of the invoice and the invoice number.

- Indicate the type of invoice: Mark the invoice type as a “SUSPENDED TAX INVOICE”.

- Enter the "Supplies To" details: Provide the SVAT number and name of the recipient. Include their address and VAT number as well.

- Describe the supply: Clearly outline what is being supplied. Include details such as the description of supply, unit, quantity, and unit price in the appropriate fields.

- Calculate the amounts: Multiply the unit price by the quantity to get the amount. Record this in the “Amount” section.

- Determine the value of the supply: This step involves confirming the total value of the supply before VAT is added.

- Calculate the Suspended VAT: Apply the suspended VAT rate of 12% to the total value of the supply and enter this figure.

- Complete the Total Value of the Supply: Sum the total value of the supply and include any applicable VAT charges.

- Specify the currency: Clearly indicate which currency the amounts are in, along with the currency exchange rate if applicable.

Once you have filled out the form, double-check all entries for accuracy. Having a complete and correct form is crucial for your records and compliance with VAT regulations. After verifying, proceed with submitting the form according to your organization’s procedures.

What You Should Know About This Form

What is the purpose of the SVAT 02 form?

The SVAT 02 form serves as a tax invoice for suppliers registered under the Suspended Value Added Tax (VAT) scheme. It allows suppliers to document their transactions accurately, helping ensure that the correct amount of tax is accounted for and maintained in compliance with local tax regulations.

What information is required on the SVAT 02 form?

To complete the SVAT 02 form, suppliers must provide several key details. This includes the supplier's name and address, their VAT number, the date of the invoice, and the invoice number. Additionally, the form requires the recipient's details, including their SVAT number and VAT number. Information about the supply itself must also be included, like a description of the goods or services, unit quantity, unit price, and the total value of the supply along with the suspended VAT at 12%.

How do I calculate the suspended VAT on the SVAT 02 form?

To determine the amount of suspended VAT to be noted on the SVAT 02 form, take the total value of the supply and multiply it by 12%. This calculation reflects the VAT that is suspended, meaning it will not be collected upfront but will be accounted for during tax submissions. Remember to consider the Net Business Tax (NBT) when calculating this amount.

Is there a specific currency format to follow on the SVAT 02 form?

Yes, when completing the SVAT 02 form, it is essential to indicate the currency in which the transaction is conducted. Additionally, you should specify the currency rate, especially if the transaction involves foreign currency. This provides clarity regarding the valuation of the supply and ensures accurate tax reporting.

What happens if I make an error on the SVAT 02 form?

If an error is discovered on the SVAT 02 form after it has been issued, it is crucial to correct it as soon as possible. You may need to issue a revised invoice, which should reference the original invoice number and indicate the adjustments made. Keeping accurate and corrected records helps maintain compliance and prevents potential tax issues down the line.

Who should use the SVAT 02 form?

The SVAT 02 form is primarily utilized by suppliers who are part of the Suspended VAT scheme. This includes businesses that are registered for VAT purposes but are eligible for suspension of the VAT charge on specific supplies. It is beneficial for both providers and recipients to understand their obligations under this system to ensure compliance with tax laws.

Can the SVAT 02 form be submitted electronically?

Some jurisdictions may allow electronic submissions of the SVAT 02 form, while others may require a hard copy. It's important to check with local tax authorities for their specific submission procedures. Utilizing electronic formats where permitted can enhance efficiency and improve record keeping for both suppliers and buyers.

Common mistakes

Completing the SVAT 02 form requires careful attention to detail. One common mistake people make is failing to correctly provide the Supplier’s Details. This section requires accurate information, including the supplier's name, address, and VAT number. If any of these details are incorrect or incomplete, it can result in delays or refusals when submitting the form.

Another frequent error is in the Date of Invoice and Invoice Number sections. Neglecting to ensure accuracy in these areas can lead to confusion during the tax processing. Each invoice should have a unique number and a clearly stated date to trace the transaction effectively. A mismatch here could raise red flags and complicate matters further.

A third mistake occurs with the Total Value of the Supply and Suspended VAT @ 12% calculations. People often overlook the necessity of ensuring these figures are precisely calculated. Errors in addition or multiplication can skew the results and lead to incorrect submissions. It is essential to double-check these numbers to avoid financial implications.

The final frequent mistake involves the indication of currency and currency rate. Many individuals neglect to specify the currency used in their transactions, which can create misunderstandings. Additionally, forgetting to state the currency rate can lead to difficulties in valuation and tax assessments. Properly noting this information is crucial to ensure that everything aligns with regulatory requirements.

Documents used along the form

The SVAT 02 form is an important document for suppliers dealing with suspended VAT transactions. To facilitate this process, several other forms and documents may be used in conjunction with the SVAT 02 form. Each of these contains specific information that helps streamline accounting and compliance. Below is a list of forms you may encounter.

- Invoice Document: A formal request for payment sent to the buyer, detailing the goods or services provided, their cost, and payment terms.

- Purchase Order (PO): A document issued by a buyer indicating the types, quantities, and agreed prices for products or services to be delivered.

- Delivery Note: A document that accompanies goods during transit, confirming that the items have been delivered and received by the buyer.

- Credit Note: A document issued to a buyer, providing a reduction in the amount owed due to returns or overcharges.

- Statement of Accounts: A summary of all transactions between a buyer and seller, showing outstanding balances and payment history over a specific period.

- VAT Return: A periodic report submitted to tax authorities showing how much VAT is charged and paid, providing a complete overview of VAT obligations.

- Proforma Invoice: An estimated invoice sent to buyers in advance of a shipment or delivery of goods, outlining expected costs and payment terms.

- Escrow Agreement: A legal document that involves a third party holding funds until all parties fulfill their contractual obligations.

- Export Declaration: A document filed with the government when exporting goods, providing necessary information for customs clearance.

- Commercial Invoice: A detailed invoice used in international trade, specifying the transaction's details, including the sale price and terms.

These documents serve to back up the information provided in the SVAT 02 form and ensure clarity and compliance in business transactions. Each plays its unique role in managing financial and logistical aspects efficiently.

Similar forms

The SVAT 02 form, used for documentation of suspended VAT transactions, shares similarities with various other documents related to tax and invoicing. Here are six documents that resemble the SVAT 02 form:

- Invoice - Like the SVAT 02, this document records the sale of goods or services and includes details such as supplier information, date, and amounts due.

- Purchase Order - This document outlines the buyer's request for goods or services, encompassing supplier details and item descriptions, making it similar in function to the SVAT 02.

- Sales Receipt - A sales receipt serves as proof of transaction, detailing the items purchased and total amounts, similar to the summarized supply values in the SVAT 02.

- Tax Invoice - This official document includes all necessary details for tax reporting and complies with tax regulations, paralleling the SVAT 02’s focus on VAT.

- Credit Note - A credit note, issued after a return or adjustment, specifies changes to previously recorded sales, just as the SVAT 02 aligns with adjusting VAT liabilities.

- Proforma Invoice - Although not a final bill, this document estimates costs and outlines expected supplies, retaining similarities with the SVAT 02's purpose of detailing intended supplies.

Dos and Don'ts

When filling out the SVAT 02 form, proper attention to detail is crucial. Below is a list of essential actions to take and avoid when completing this form.

- Do ensure all supplier details are accurate. Verify that the supplier’s name, address, and VAT number are correct to avoid processing delays.

- Do fill in the invoice details completely. This includes the date of invoice and the invoice number; incomplete information can lead to confusion.

- Do calculate the suspended VAT accurately. Ensure to apply the correct VAT percentage based on the total value of the supply.

- Do indicate the currency clearly. Specify the currency and provide the applicable currency rate as required.

- Do keep a copy of the filled form for your records. Retaining a copy helps in future reference and can be useful for audits.

- Don't leave any sections blank. Incomplete sections can result in delays or rejections of the form.

- Don't use outdated information. Ensure that all data is current to meet compliance requirements.

- Don't forget to double-check your calculations. Mistakes in calculations could lead to significant problems at later stages.

- Don't overlook the requirements for suspended VAT. Be clear on which supplies qualify for suspended VAT treatment.

- Don't ignore submission deadlines. Timely submission of the form is critical to maintaining compliance.

Misconceptions

Understanding the Svat 02 form is crucial for accurate invoicing and tax reporting. However, several misconceptions can lead to confusion. Here are four common misunderstandings:

- The Svat 02 form is only for large businesses. This form is applicable to all businesses that conduct supplies subject to VAT, regardless of their size. Small, medium, and large enterprises can all benefit from using this form.

- The Svat 02 form is the same as a regular tax invoice. While it may look similar, the Svat 02 form has specific features, such as sections for suspended VAT, that differentiate it from a standard invoice. It is designed to handle special cases where VAT is deferred.

- You do not need to include currency information. This is incorrect. It is essential to indicate the currency and its rate on the form. This helps ensure that all parties understand the values and can verify the amounts accurately.

- The VAT rate on the Svat 02 form is fixed. Many believe that the VAT rate is unchangeable. However, it is subject to change based on current regulations. Always check for the most recent rates before completing the form.

Clarifying these misconceptions can enhance your understanding and proper use of the Svat 02 form. Ensuring accuracy on this document is key to compliant and efficient business operations.

Key takeaways

When filling out and using the SVAT 02 form, it is essential to keep a few key points in mind. Here are four important takeaways:

- Accuracy is Crucial: Ensure that all fields, including the supplier’s details, VAT numbers, and invoice information, are completed accurately to avoid issues with tax returns.

- Detail the Supply: Clearly describe the supplies being invoiced. Include unit quantity and unit price, as this information is critical for calculating the total value of the supply.

- Suspended VAT Rate: Remember that suspended VAT is typically charged at 12%. It's essential to calculate this carefully, as it impacts the total value on the invoice.

- Currency Considerations: If applicable, specify the currency and the currency rate in use, as this will help in determining the exact amounts during financial reporting.

Being thorough and precise when completing the SVAT 02 form can greatly streamline tax compliance and establish clarity in financial transactions.

Browse Other Templates

Specimen Signature Meaning - Clearstream Banking S.A. requires this form to maintain accurate client records.

Nfpa 25 Testing Frequencies - Control valves require close scrutiny, as their proper functioning is essential for fire control measures.