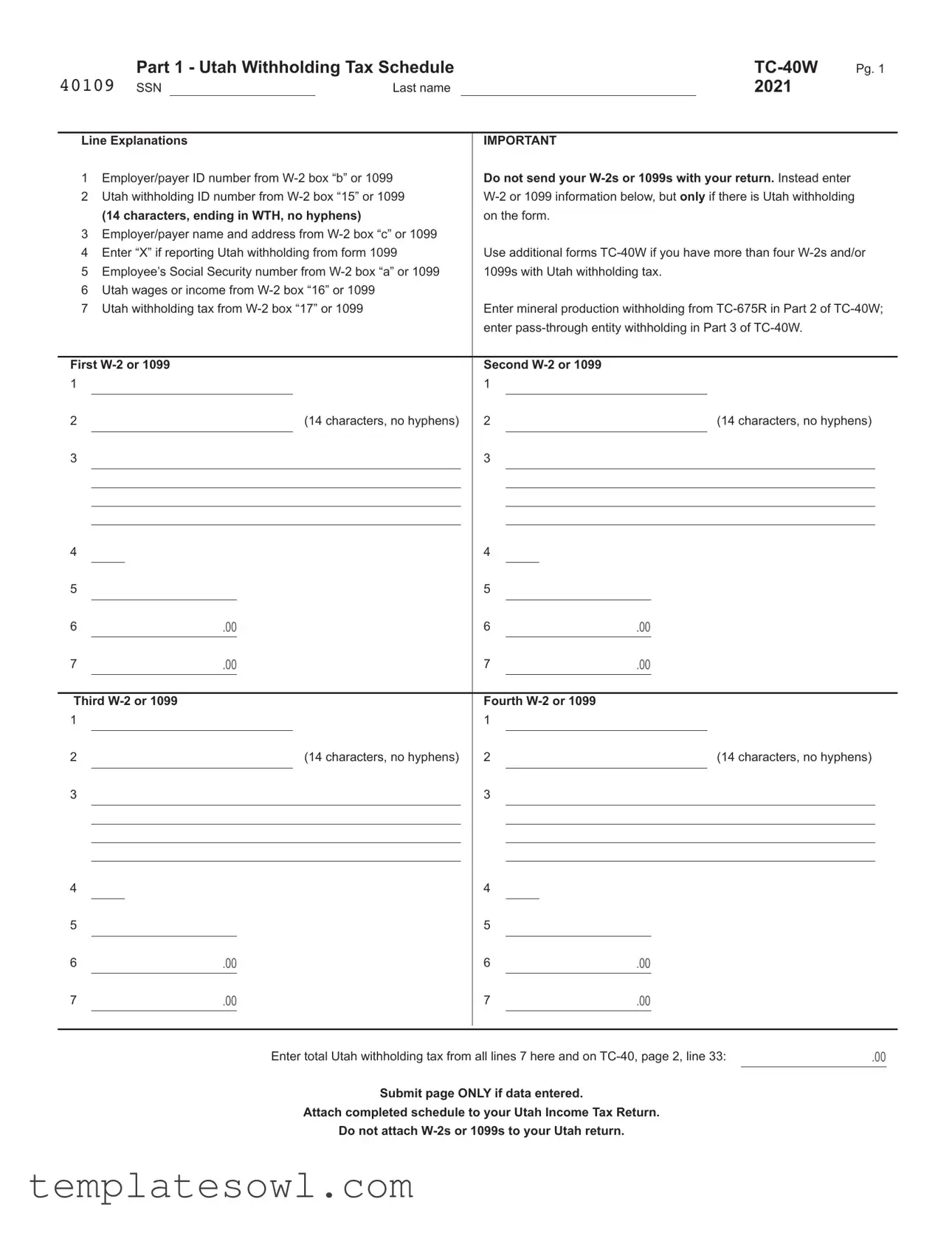

Fill Out Your Tc 40W Form

The TC-40W form serves as a crucial link between Utah taxpayers and their obligations regarding withholding tax. Designed specifically for individuals and businesses engaging in employment or who receive income in Utah, this form provides a structured way to report and reconcile various types of withholding, including wages and income reported on W-2s and 1099s. For each employment or income source listed, taxpayers must provide specific details like employer identification numbers and Utah withholding IDs. Importantly, the form requires no attachments of W-2s or 1099s; however, it does necessitate careful entry of Utah withholding amounts. In addition to providing information on standard withholding, TC-40W extends its functionality to accounts for mineral production and pass-through entity taxes, each requiring separate disclosures. Thus, whether you’re an independent contractor, employee, or part of a larger pass-through entity, understanding the intricacies of filling out this form ensures compliance and helps identify potential tax liabilities or credits. Navigating through its structured sections methodically assists in capturing an accurate financial picture, ultimately supporting smoother tax filing processes and obligations.

Tc 40W Example

|

Part 1 - Utah Withholding Tax Schedule |

|

Pg. 1 |

||||

40109 SSN |

|

|

Last name |

|

2021 |

|

|

USTC ORIGINAL FORM |

|

|

|

|

|||

|

|

|

|

|

|

|

|

Line Explanations |

|

IMPORTANT |

|

||||

1 |

Employer/payer ID number from |

Do not send your |

|

||||

2 |

Utah withholding ID number from |

|

|||||

|

(14 characters, ending in WTH, no hyphens) |

|

on the form. |

|

|||

3Employer/payer name and address from

4 |

Enter “X” if reporting Utah withholding from form 1099 |

Use additional forms |

5 |

Employee’s Social Security number from |

1099s with Utah withholding tax. |

6Utah wages or income from

|

7 Utah withholding tax from |

Enter mineral production withholding from |

|||||

|

|

|

|

enter |

|||

|

|

|

|

|

|

|

|

First |

Second |

|

|

||||

1 |

|

|

|

1 |

|

|

|

2 |

|

|

(14 characters, no hyphens) |

2 |

|

(14 characters, no hyphens) |

|

3 |

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

4 |

|

|

|

|

|

|

5 |

|

|

|

|

|

5 |

|

|

|

|

|

|

6 |

|

|

.00 |

|

|

6 |

|

|

.00 |

|

|

|

7 |

|

|

.00 |

|

|

7 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third |

|

|

|

Fourth |

|

|

|

|

||||

1 |

|

|

|

|

|

1 |

|

|

|

|

|

|

2 |

|

|

|

|

(14 characters, no hyphens) |

2 |

|

|

|

|

(14 characters, no hyphens) |

|

3 |

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

4 |

|

|

|

|

|

5 |

|

|

5 |

|

|

|

|

|

6 |

.00 |

6 |

.00 |

|

|

|

||

7 |

.00 |

7 |

.00 |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Enter total Utah withholding tax from all lines 7 here and on |

.00 |

|

|||

Submit page ONLY if data entered.

Attach completed schedule to your Utah Income Tax Return.

Do not attach

Mineral Production and |

Pg. 2 |

||||

40110 SSN |

|

Last name |

|

2021 |

|

USTC ORIGINAL FORM

Part 2

Do not send

Line Explanations

1Producer’s EIN from box “2” of

2 Producer’s name from box “1” of

3 Producer’s Utah withholding number from box “3” of

4

5Utah mineral production withholding tax from box”6” of

First |

|

|

Second |

|

|

|

|

|||||

1 |

|

|

|

|

1 |

|

|

|

|

|

|

|

2 |

|

|

|

|

2 |

|

|

|

|

|

|

|

3 |

|

|

(14 characters, no hyphens) |

3 |

|

|

|

(14 characters, no hyphens) |

||||

4 |

|

|

|

|

4 |

|

|

|

|

|

|

|

5 |

.00 |

|

|

|

5 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third |

|

|

Fourth |

|

|

|

|

|||||

1 |

|

|

|

|

1 |

|

|

|

|

|

|

|

2 |

|

|

|

|

2 |

|

|

|

|

|

|

|

3 |

|

|

(14 characters, no hyphens) |

3 |

|

|

|

(14 characters, no hyphens) |

||||

4 |

|

|

|

|

4 |

|

|

|

|

|

|

|

5 |

.00 |

|

|

|

5 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter total mineral production withholding tax from all lines 5 here and on |

|

.00 |

|

||||||||

Part 3

Do not send Utah Schedule(s)

Line Explanations

1

2Name of

3 Utah withholding tax paid by

First Utah Schedule |

|

|

|

|

Second Utah Schedule |

|||||

1 |

|

|

|

|

|

1 |

|

|

|

|

2 |

|

|

|

|

|

2 |

|

|

|

|

3 |

|

.00 |

|

|

|

3 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Utah Schedule |

|

|

|

|

Fourth Utah Schedule |

|||||

1 |

|

|

|

|

|

1 |

|

|

|

|

2 |

|

|

|

|

|

2 |

|

|

|

|

3 |

|

.00 |

|

|

|

3 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter total |

.00 |

Submit page ONLY if data entered.

Attach completed schedule to your Utah Income Tax Return.

Form Characteristics

| Fact | Description |

|---|---|

| Purpose | The TC-40W form is used for reporting Utah withholding tax, including information from W-2s and 1099s. |

| Lines for Reporting | The form includes multiple sections for reporting different types of withholding tax including mineral production and pass-through entity taxes. |

| Submission Requirements | Taxpayers must attach the completed TC-40W to their Utah Income Tax Return, but do not submit W-2s or 1099s. |

| Governing Law | The TC-40W form is governed by the Utah State Tax Commission laws regarding income tax withholding in the state of Utah. |

Guidelines on Utilizing Tc 40W

Completing the TC-40W form is essential for reporting Utah withholding tax accurately. Follow these steps to ensure all necessary information is provided. You will need your W-2s and 1099s for reference, but do not send them with your return.

- Begin by entering your Employer/Payer ID number from W-2 box “b” or 1099.

- Next, input your Utah withholding ID number from W-2 box “15” or 1099. This should be 14 characters long and end with WTH.

- Provide the Employer/Payer name and address from W-2 box “c” or 1099.

- Check the box to report Utah withholding from form 1099 if applicable.

- Enter the Employee’s Social Security number from W-2 box “a” or 1099.

- Fill in the Utah wages or income from W-2 box “16” or 1099.

- List the Utah withholding tax from W-2 box “17” or 1099.

If using multiple forms of W-2s or 1099s, repeat the previous steps as necessary in the designated spaces. After entering your total Utah withholding tax from all the lines of your W-2s and/or 1099s, move on to the subsequent sections for mineral production and pass-through entity withholding as needed. Finally, complete the additional information as specified in Part 2 and Part 3 of the form.

Ensure to review your entries for accuracy, as this will assist in the timely processing of your Utah Income Tax Return.

What You Should Know About This Form

What is the TC-40W form, and who needs to file it?

The TC-40W form is the Utah Withholding Tax Schedule used to report Utah income tax withheld from wages or payments, particularly for employees and independent contractors. If you have received income with Utah withholding tax from your employer or other payers, you are required to file this form. This includes individuals who have earned wages from jobs or received payments from which tax has been withheld.

How do I fill out the TC-40W form?

To fill out the TC-40W form, start by entering your Employer or Payer ID number as found on your W-2 or 1099 form. You will also need to provide your Social Security Number and the total Utah withholding tax from your earnings. Each W-2 or 1099 that you are reporting should be entered in the specific sections of the form. Make sure to only fill in the relevant sections, as necessary, and ensure that you do not send any W-2s or 1099s with your return.

Can I submit the TC-40W form if I have more than four W-2s or 1099s?

Yes, if you have more than four W-2s or 1099s reporting Utah withholding, you will need to use additional TC-40W forms. Each form can report up to four W-2s or 1099s at a time. Make sure to attach all completed forms to your Utah Income Tax Return.

What should I do if I need to report withholding from mineral production?

If you need to report mineral production withholding, you should complete Part 2 of the TC-40W form. This section requires details from your TC-675R form, including information about the producer and the amounts withheld. Remember to use additional TC-40Ws if necessary, and do not attach the TC-675R or other schedules to your return.

How is pass-through entity withholding reported on the TC-40W?

Pass-through entity withholding is reported in Part 3 of the TC-40W. You will need to enter the pass-through entity’s EIN, its name, and the Utah withholding tax that was paid by the entity. Like other sections, do not attach any Utah Schedules K-1 to your return, and ensure you summarize correctly on the TC-40W form if you have multiple pass-through entries.

Do I need to send my W-2s or 1099s with the TC-40W form?

No, you should not send your W-2s or 1099s with the TC-40W form or your Utah Income Tax Return. Instead, enter the relevant data directly onto the TC-40W and keep the original forms for your records. The tax authorities will not review your W-2s or 1099s unless specifically requested.

How do I calculate the total Utah withholding tax to report?

To calculate the total Utah withholding tax, simply add up all the amounts reported in line 7 from each of your W-2s or 1099s. Once you have the total, enter this amount on the designated line of the TC-40W form. Ensure accuracy, as this information is critical in determining your tax obligations.

Common mistakes

Filling out the TC-40W form is an important task for tax reporting, but many people make common mistakes. One frequent error is failing to include the correct employer or payer ID number. This number can be found in box “b” of your W-2 or on your 1099 form. If this number is incorrect or missing, it can delay processing your return and lead to complications with your tax filings.

Another common mistake involves overlooking the Utah withholding ID number. You should look for this number in box “15” of your W-2 or on your 1099. An incorrect Utah withholding ID, especially one that does not follow the proper format, can render your submission invalid. Ensuring that this information is accurate is essential to avoid issues.

For those reporting Utah withholding from a 1099, it’s crucial to remember to enter an “X” in the appropriate box. Many people forget this step, creating unnecessary confusion. By marking this box, you clearly indicate that you are reporting withholding from a 1099 form, aligning everything correctly for the processing team.

Finally, don’t forget to double-check the numeric entries. Whether it's your Utah wages from box “16” or the withholding amounts from box “17,” any inaccuracies will lead to complications down the line. Taking your time to ensure these numbers are correct will save you potential headaches and guarantee smoother processing of your tax return.

Documents used along the form

The TC-40W form is utilized for reporting Utah withholding tax for income received during the tax year. Several additional forms and documents often accompany its submission to ensure accurate reporting and compliance with state tax regulations. This list provides an overview of these related forms and their specific functions.

- TC-675R - Utah Mineral Production Withholding Tax: This form is used to report mineral production withholding tax. Producers must enter their Employer Identification Number (EIN), name, and Utah withholding number, as well as the amount of mineral production withholding tax withheld. Like the TC-40W, the TC-675R should not be submitted with the tax return.

- Utah Schedule K-1: This document is relevant for pass-through entities, such as partnerships and S corporations. It details the income, deductions, and credits distributed to each shareholder or partner. Taxpayers report the withholding tax paid by the entity on the TC-40W, but the actual Schedule K-1 should not be submitted with the return.

- TC-40 - Utah Individual Income Tax Return: The primary document for filing individual income tax in Utah. Taxpayers consolidate information from the TC-40W, TC-675R, and Schedule K-1, among others, to report their overall tax liability on this form.

- W-2 Form: This is a wage and tax statement provided by employers to their employees. It details an employee's total earnings and the amount of federal, state, and local taxes withheld. While W-2s are not submitted with the tax return, the information must be accurately reflected on the TC-40W and TC-40 forms.

Accurate completion and submission of these forms alongside the TC-40W facilitates proper tax processing and ensures compliance with Utah tax law. Understanding the purpose of each document is crucial for taxpayers to effectively navigate their tax responsibilities.

Similar forms

The TC-40W form is a specific document used in Utah for reporting withholding taxes. Several other forms serve similar purposes in tax reporting. Below is a list of documents that share similarities with the TC-40W, outlining their relevant characteristics and functions.

- W-2 Form: This form is issued by employers to report wages paid to employees and the taxes withheld from their paychecks. Like the TC-40W, it includes information on total income and withholding amounts.

- 1099 Form: Similar to the W-2, the 1099 form is used to report various types of income other than wages, salaries, and tips. It also specifies the amount of taxes withheld, making it relatable to the TC-40W in terms of reporting income and withholding.

- TC-675R Form: This form is used specifically for reporting Utah mineral production withholding tax. It complements the TC-40W by detailing mineral production income, making the two forms interrelated in tax submissions.

- Utah Schedule K-1: Generally issued by partnerships and S corporations, this form reports each partner or shareholder's share of income, deductions, and credits. Similar to the TC-40W, it tracks withholding amounts owed to Utah based on income received from these entities.

- Federal Form 1040: This is a standard individual income tax return form for reporting annual income to the IRS. It includes information similar to that found on the TC-40W, such as total income and tax withheld, albeit at the federal level instead of state.

- Utah TC-40 Form: While TC-40W addresses withholding specifically, the TC-40 is the main income tax form for residents in Utah. It requires total income and withholding amounts, including those reported on the TC-40W, thereby closely relating the two forms.

Dos and Don'ts

When filling out the TC-40W form, keep these tips in mind for a smooth process.

- Do double-check your Social Security Number (SSN) to ensure it is correct.

- Do enter the correct Employer ID numbers from your W-2 or 1099 forms.

- Do clearly write your name and address as it appears on your tax documents.

- Do report Utah withholding tax accurately based on your W-2 or 1099 information.

- Do use additional TC-40W forms if you have more than four W-2s or 1099s.

- Don't forget to submit only the completed TC-40W form. Do not send W-2s or 1099s with your return.

- Don't skip any required information. Ensure you fill in all relevant sections of the form.

- Don't leave the total Utah withholding tax fields blank; enter the total amount from all lines.

- Don't attempt to submit incomplete forms. Make sure all necessary data is entered before submitting.

- Don't mix up lines or information from different tax documents; keep everything organized.

Following this guidance can help ensure that your TC-40W form is filled out correctly, streamlining the tax filing process for you.

Misconceptions

Misconceptions about the TC-40W form can lead to confusion during tax season. Here are some common misunderstandings clarified:

- You need to submit your W-2s or 1099s with the TC-40W. This is incorrect. You should not attach W-2s or 1099s to your Utah Income Tax Return. Only enter the relevant information from these documents.

- The TC-40W can only handle one W-2 or 1099. Actually, the TC-40W allows you to report multiple W-2s and/or 1099s. If you have more than four, simply use additional TC-40W forms.

- Entering incorrect ID numbers is not a big deal. On the contrary, accuracy is crucial. Make sure to input your employer ID numbers from the correct boxes on your W-2 or 1099 forms.

- All income types are reported on the TC-40W. This form specifically focuses on Utah withholding tax. Other income types might need different forms.

- If I miss a line, I can fill it in later. Once submitted, any missing or incorrect information may complicate your tax filing process. It’s best to check everything carefully before submitting.

- Mineral production tax is covered in the same section as regular income tax. There are separate sections for mineral production and pass-through entity taxes on the TC-40W. Ensure you report these in the correct parts of the form.

- Pass-through entity tax information is optional. If applicable, you must include this information. It is essential to properly report Utah withholding done by pass-through entities.

Understanding these misconceptions can help simplify the process of completing the TC-40W and minimize errors during tax filing.

Key takeaways

When filling out the TC-40W form, keep these important points in mind:

- Do not send W-2s or 1099s with your TC-40W submission. Just report the necessary information from those documents.

- Enter the employer/payer ID number from W-2 box “b” or 1099 in the designated field.

- Ensure the Utah withholding ID number begins and ends correctly, using 14 characters and ending with WTH.

- If reporting from a 1099, indicate this by marking an “X” in the appropriate box.

- For more than four W-2s or 1099s that involve Utah withholding, additional TC-40W forms are required.

- For all relevant lines, ensure to total your Utah withholding taxes and carry this total to the specified line on TC-40.

- Attach the completed TC-40W to your Utah Income Tax Return but again, do not attach any W-2s or 1099s.

By following these steps, you can ensure proper completion of the TC-40W form and avoid complications with your tax return.

Browse Other Templates

What Is a 1004d Appraisal - Details must include surface well location and coordinates.

Bargain Sale Agreement,Statutory Transfer Deed,Oregon Real Estate Conveyance,Deed of Sale Form,Real Property Transfer Document,Bargain and Sale Instrument,Property Conveyance Declaration,Statutory Property Deed,Oregon Transfer of Title Form,Real Esta - It requires signatures from authorized individuals if the grantor is a corporation.

Rl Tracking Number - Hazardous materials must be clearly marked and accompanied by the shipper’s Haz-Mat emergency contact number.