Fill Out Your Tc 569A Form

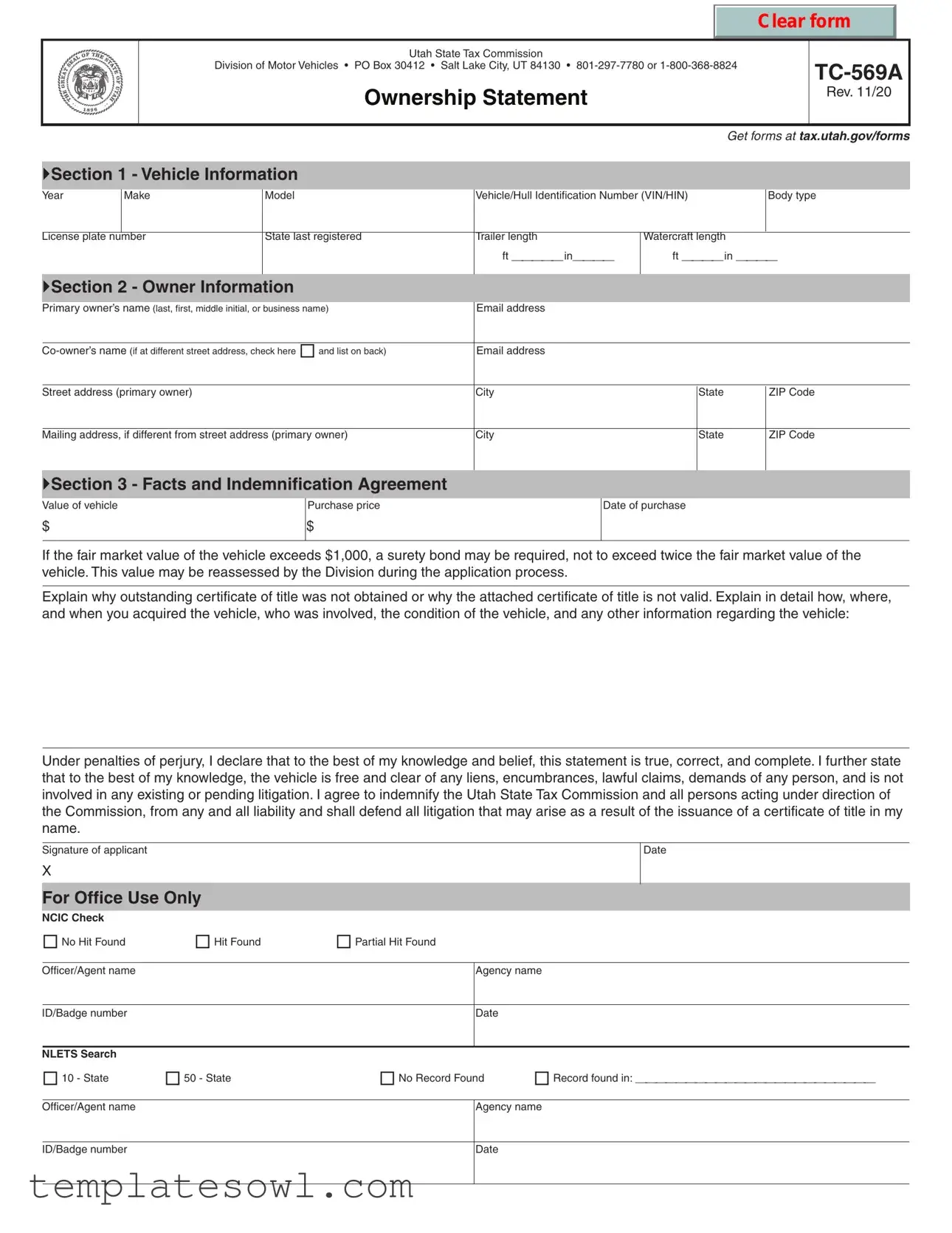

The TC-569A form is a vital document for vehicle ownership within the state of Utah, specifically aimed at individuals who are seeking to declare ownership of a vehicle when a traditional title is inaccessible. This form is utilized primarily by the Utah State Tax Commission’s Division of Motor Vehicles and serves as an official Ownership Statement. When filling out the TC-569A, applicants provide essential details about the vehicle, including its make, model, and Vehicle Identification Number (VIN). It also collects information about the primary owner and any co-owners, ensuring that all parties are duly noted. One critical aspect of this form is the declaration of the vehicle's value, including the purchase price, as it may require a surety bond if the fair market value exceeds a specific threshold. Additionally, applicants must explain why the original certificate of title has not been produced, detailing the circumstances surrounding the acquisition of the vehicle. This part of the form plays a significant role in attesting to the vehicle's status free from liens or claims. The form concludes with an agreement to indemnify the Utah State Tax Commission against any potential disputes arising after a title is issued. Overall, the TC-569A form not only facilitates the process of vehicle ownership transfer but also helps ensure that ownership is clear and undisputed, providing peace of mind for new owners.

Tc 569A Example

Clear form

Utah State Tax Commission

Division of Motor Vehicles • PO Box 30412 • Salt Lake City, UT 84130 •

Ownership Statement

Rev. 11/20

Get forms at tax.utah.gov/forms

Section 1 - Vehicle Information

|

Year |

Make |

Model |

Vehicle/Hull Identification Number (VIN/HIN) |

Body type |

||

|

|

|

|

|

|

|

|

|

License plate number |

State last registered |

Trailer length |

Watercraft length |

|

||

|

|

|

|

ft _____in____ |

ft ____in ____ |

||

|

|

|

|

|

|

|

|

|

Section 2 - Owner Information |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Primary owner’s name (last, first, middle initial, or business name) |

Email address |

|

|

|

||

|

|

|

|

|

|

|

|

|

Email address |

|

|

|

|||

|

|

|

|

|

|

|

|

|

Street address (primary owner) |

|

City |

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

Mailing address, if different from street address (primary owner) |

City |

|

State |

ZIP Code |

||

|

|

|

|

|

|

|

|

Section 3 - Facts and Indemnification Agreement

Value of vehicle |

Purchase price |

$ |

$ |

|

|

Date of purchase

If the fair market value of the vehicle exceeds $1,000, a surety bond may be required, not to exceed twice the fair market value of the vehicle. This value may be reassessed by the Division during the application process.

Explain why outstanding certificate of title was not obtained or why the attached certificate of title is not valid. Explain in detail how, where, and when you acquired the vehicle, who was involved, the condition of the vehicle, and any other information regarding the vehicle:

Under penalties of perjury, I declare that to the best of my knowledge and belief, this statement is true, correct, and complete. I further state that to the best of my knowledge, the vehicle is free and clear of any liens, encumbrances, lawful claims, demands of any person, and is not involved in any existing or pending litigation. I agree to indemnify the Utah State Tax Commission and all persons acting under direction of the Commission, from any and all liability and shall defend all litigation that may arise as a result of the issuance of a certificate of title in my name.

Signature of applicant

X

Date

For Office Use Only

NCIC Check |

|

|

No Hit Found |

Hit Found |

Partial Hit Found |

Officer/Agent name

Agency name

ID/Badge number

Date

NLETS Search |

|

|

|

10 - State |

50 - State |

No Record Found |

Record found in: ________________________ |

Officer/Agent name

Agency name

ID/Badge number

Date

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The TC-569A serves as an Ownership Statement for vehicles and watercraft in Utah. |

| Governing Law | This form is governed by the Utah Code Title 41, Motor Vehicles. |

| Filing Requirement | It must be filed when a title is not available or is being contested. |

| Owner Information | The form requires detailed owner information, including names and addresses. |

| Vehicle Details | Specific information about the vehicle, such as VIN and body type, is mandatory. |

| Indemnification Clause | The applicant agrees to indemnify the Utah State Tax Commission against any claims. |

| Potential Bond Requirement | If the vehicle's fair market value exceeds $1,000, a surety bond may be necessary. |

Guidelines on Utilizing Tc 569A

Filling out the TC-569A form is an essential process for vehicle ownership verification in Utah. The following steps outline how to accurately complete the form to ensure a smooth submission.

- Begin by gathering necessary information about the vehicle, including the Year, Make, Model, and Vehicle/Hull Identification Number (VIN/HIN).

- Fill in the Body type and License plate number, along with the State last registered.

- If applicable, indicate the Trailer length or Watercraft length in feet and inches.

- For the owner information, write the Primary owner’s name (last, first, middle initial, or business name) and the Email address.

- If there is a co-owner with a different address, check the box and provide their Name and Email address on the back of the form.

- Record the Street address, City, State, and ZIP Code for the primary owner.

- If the mailing address differs from the street address, specify it along with the City, State, and ZIP Code.

- In the section for vehicle facts, enter the Value of vehicle and Purchase price.

- State the Date of purchase of the vehicle.

- If applicable, provide a detailed explanation of why the outstanding certificate of title was not obtained or why the attached certificate is not valid, including how, where, and when the vehicle was acquired.

- Complete the declaration stating the truthfulness of the information provided, including the assurance that the vehicle is free from liens or encumbrances.

- Finally, sign and date the application where indicated as the applicant.

Once the form is filled out, make sure to review all entries to confirm accuracy. Double-check that all required fields are completed before submitting the form to the Utah State Tax Commission for processing.

What You Should Know About This Form

What is the TC-569A form and why do I need it?

The TC-569A form, also referred to as the Ownership Statement, is required by the Utah State Tax Commission for individuals seeking to establish ownership of a vehicle where the original title has not been obtained or is invalid. This form serves as a detailed declaration of ownership, allowing individuals to provide comprehensive information about the vehicle in question, including its identification number, make, model, and other relevant details. Completing this form is essential in order to apply for a title that legally recognizes you as the owner and enables you to register the vehicle for use on public roads.

What information do I need to provide on the TC-569A form?

When filling out the TC-569A form, you will need to provide several key pieces of information. Firstly, details regarding the vehicle, such as the year, make, model, and Vehicle Identification Number (VIN), must be included. Additionally, you will furnish personal information related to the owner(s), including names, addresses, and email addresses. If there is a co-owner, their information is also needed. Importantly, you should also be prepared to explain why the original title could not be acquired and provide a thorough narrative about how and when you obtained the vehicle, who was involved, and the vehicle's condition. This information forms the basis of the state's assessment of your ownership claim.

Do I need a surety bond when submitting the TC-569A form?

A surety bond may be required when the fair market value of the vehicle exceeds $1,000. This bond is intended to safeguard the state against any potential claims regarding the ownership of the vehicle. The bond amount cannot exceed twice the fair market value of the vehicle. It's important to be aware that the Utah State Tax Commission may reassess this value during the application process. Therefore, if your vehicle is valued above the specified threshold, you should arrange for a surety bond before submitting the TC-569A form to ensure compliance with state requirements.

What is the significance of the indemnification agreement in the TC-569A form?

The indemnification agreement included in the TC-569A form is a crucial component that ensures you, as the applicant, accept responsibility for any legal challenges that may arise from obtaining a title for the vehicle. By signing this agreement, you declare that to the best of your knowledge, your vehicle is free of liens and that there are no outstanding claims against it. This legal commitment also obligates you to defend against any litigation that may occur linked to the title’s issuance. Thus, this agreement serves as a protective measure for both you and the Utah State Tax Commission, establishing a clear understanding of liabilities and responsibilities concerning the vehicle's ownership.

Common mistakes

Completing the TC-569A form correctly is essential for a smooth processing of vehicle ownership in Utah. Unfortunately, many individuals make common mistakes that can result in delays or complications. One of the most prevalent errors occurs in the Vehicle Information section. Here, it's crucial to accurately enter the Vehicle Identification Number (VIN) or Hull Identification Number (HIN), as even a single incorrect digit can lead to significant issues.

Another frequent mistake involves the entry of the vehicle's value. Applicants sometimes state an incorrect purchase price or fail to include necessary details about the vehicle's condition. This omission can lead to complications, especially if the vehicle’s fair market value exceeds $1,000, which may trigger the need for a surety bond.

In the Owner Information section, many individuals neglect to verify that all names and addresses are complete and accurate. For those with co-owners, it’s important to note any differing addresses. Forgetting to check the box indicating a different street address for the co-owner can create confusion and delay.

The section explaining why a certificate of title was not obtained is often filled out insufficiently or without clarity. Applicants should provide a comprehensive explanation, detailing the circumstances surrounding the acquisition of the vehicle. Failing to provide thorough information might raise questions and complicate the overall review process.

Additionally, signatures and dates are sometimes missing or incorrectly filled in. The TC-569A form requires that the applicant signs and dates the form; neglecting to do so may result in automatic rejection of the application. A clear, legible signature is essential to validate the declarations made in the document.

Another oversight involves not attaching the necessary documents. Individuals often forget to include relevant paperwork, which can range from prior registration details to documentation proving the absence of liens. Assembling all required documents prior to submission can prevent unnecessary delays.

When filling out the application, some may rush through the indemnification agreement section. This careful agreement assures the state that the applicant holds no hidden claims against the vehicle. It’s important to understand that this part is not just a formality; it holds legal significance.

One of the less obvious mistakes involves failing to review the completed form for accuracy before submission. Reading through all the information to verify it matches accompanying documentation can make a critical difference. Even minor discrepancies can lead to hurdles in processing.

Lastly, individuals sometimes overlook the importance of providing contact information, such as email addresses, in the Owner Information section. Without up-to-date contact methods, reaching out for additional information or clarification can become difficult, hindering the entire process of title issuance.

A thorough review of these common mistakes can help applicants complete the TC-569A form accurately, ensuring a seamless title acquisition experience. Attention to detail in filling out the form may seem tedious, but it lays the foundation for a successful transaction.

Documents used along the form

The TC-569A form helps individuals claim ownership of a vehicle when the usual title documentation is not available. Several other forms and documents may accompany this form to facilitate ownership transfers or resolve issues related to vehicle registration. Here is a brief overview of those associated forms.

- TC-656: This form, also known as the “Application for Utah Title,” is used to formally apply for a new title for a vehicle. It is often completed when someone purchases a vehicle and needs to register it with the state.

- TC-673: If you are looking to transfer ownership of a vehicle without a title, the “Affidavit of Ownership” serves as a sworn statement to verify that you are the rightful owner.

- DMV Application for Vehicle Registration: This document is crucial when registering a vehicle. It provides all necessary information about the vehicle for state records, including ownership details and any fees due.

- Odometer Disclosure Statement: This form must be completed in transactions involving certain vehicles. It records the mileage at the time of transfer and is required by law to protect against odometer fraud.

- Surety Bond: If the vehicle's fair market value exceeds $1,000, a surety bond may be required. This document serves as a guarantee to the state for taxes or fees that may arise during ownership disputes.

- TC-721: The “Notice of Sale” form is used when a vehicle is sold. It officially records the sale with the Department of Motor Vehicles, transferring liability and ownership to the new buyer.

- Form 800: Known as the “Vehicle Lien Release,” this document is crucial when a vehicle has an existing lien. It provides proof that the lien has been paid off and is no longer applicable to the vehicle.

Understanding the use of these forms can streamline the process of vehicle registration and ownership verification in Utah. Being prepared with the necessary documents helps ensure a smoother transaction, saving time and reducing complications.

Similar forms

- Form MV-1: This document serves a similar purpose in many states as an application for vehicle title and registration. Like the TC 569A form, it collects information about the vehicle and its ownership.

- Form TT-003: This form, used in some jurisdictions, is for reporting the sale or transfer of a vehicle. It provides details about the sale similar to how the TC 569A requires information about the acquisition of the vehicle.

- Form TR-200: Often utilized for trailer registration and title, this document is comparable as it details ownership and requires similar vehicle specifications.

- Form ST-3: A vehicle tax exemption certificate that, like TC 569A, helps provide transparency regarding the ownership and status of a vehicle in tax considerations.

- Form HIN-1: This is used for watercraft identification and is similar in structure, focusing on identifying vital ownership and vehicle details.

- Form VTR-271: This form is designed for lost title applications. It shares similarities with TC 569A by demonstrating proof of ownership under specific circumstances.

- Form ROV-10: Used for registering off-road vehicles, this document mirrors the TC 569A in its approach to establishing ownership and vehicle specifics necessary for registration.

- Form NYS DMV-2: This is a transfer of title document in New York State. It functions similar to the TC 569A by facilitating the transfer of ownership and gathering pertinent vehicle information.

- Form UT-921: This form is used for vehicle and trailer claims. Like TC 569A, it serves to ensure that ownership claims are documented and executed correctly.

- Form MCO (Manufacturer’s Certificate of Origin): Similar to the TC 569A, this document is essential for transferring ownership from the manufacturer to the first purchaser, establishing a clear chain of title.

Dos and Don'ts

When filling out the TC-569A form, several important dos and don’ts can help ensure the process goes smoothly. Here’s a list of key points to consider:

- Do provide accurate and complete vehicle information, including the year, make, model, and VIN/HIN.

- Don't leave any sections blank; all required fields must be completed to avoid delays.

- Do explain clearly why you are applying for the certificate of title if the original is not available.

- Don't guess about the vehicle's fair market value; it's crucial to provide an accurate assessment.

- Do ensure your signature is present and that you date the form to certify the information is true.

- Don't forget to include the mailing address if it is different from your street address.

- Do reach out to the Utah State Tax Commission or their website if you have questions about the form or process.

Misconceptions

Misconceptions about the TC 569A form can lead to confusion and delay in processing vehicle ownership claims. Here are five common misconceptions:

- It is only necessary for new vehicle purchases. The TC 569A form is not just for newly purchased vehicles. It is required in various situations, including cases where ownership is transferred without a valid title.

- A surety bond is always required. Many believe that if the vehicle's fair market value exceeds $1,000, a surety bond is mandatory. In reality, this is only necessary if the Utah State Tax Commission determines it is needed during the application process.

- The form can be submitted without detailed explanations. Some people think they can simply fill out the form without providing any context or detailed information. However, clear explanations about why a title was not obtained or the circumstances of the vehicle's acquisition are essential for processing.

- Only the primary owner needs to sign the form. While the primary owner’s signature is crucial, if there is a co-owner, that individual may also need to provide information or sign. Checking all details carefully is important.

- The TC 569A form is not legally binding. There is a misconception that the information on this form is not taken seriously. In fact, providing false information can lead to penalties, including charges of perjury. Honesty is paramount in this process.

Key takeaways

When filling out and utilizing the TC-569A form for vehicle ownership in Utah, consider the following key takeaways:

- Accurate Information: Ensure that all vehicle and owner information is accurately entered. Mistakes can lead to processing delays.

- Vehicle Details: Include critical details such as the VIN, make, model, and last registered state. Pay special attention to the vehicle's body type and length if applicable.

- Owner Information: Clearly list the primary owner's name and contact information. If there’s a co-owner with a different address, provide that information too.

- Purchase Details: Document the purchase price and the date of acquisition. The fair market value influences the need for a surety bond.

- Indemnification Agreement: Understand that by signing the form, you are agreeing to indemnify the Utah State Tax Commission, protecting them from potential legal issues related to your application.

- Complete Explanations: If any issues arose in obtaining a certificate of title, provide a detailed account of how and when you acquired the vehicle, including any individuals involved.

- Signature and Date: Don't forget to sign and date the application. This single step asserts the truthfulness of the provided information.

By keeping these points in mind, the process of filling out and submitting the TC-569A form can be much smoother. Always remember, providing complete and accurate information helps ensure a quicker resolution to your title application.

Browse Other Templates

Colorado Sales Tax Refund 2024 - Returns are generally due on a monthly basis, and frequency details can be found in the Sales Tax Guide.

Cg2010 Form - Understanding the stipulations of this endorsement is crucial for contract negotiations.

Ri State Police - Clear and concise reporting helps expedite the investigation process by the DMV.