Fill Out Your Tr 152 Form

The TR-152 form, officially known as DTF-505, is an essential document used by taxpayers to request copies of their tax returns and related information from the New York State Department of Taxation and Finance. It is important for individuals to understand that this form requires not only their personal information, such as name, address, and Social Security Number, but also the identification of any authorized representatives who may be requesting this data on their behalf. The form consists of several parts, including sections for specifying the type and years of tax information requested, the reason for the request, and certification of the form by the taxpayer or their representative. One notable aspect of the TR-152 is that it facilitates the release of both paper and e-filed returns that are otherwise unavailable online. Additionally, there is a small fee charged per page of the requested documents, though payment is made after the request is processed. Thorough completion of the form is crucial, as any missing information or illegible identification may result in a returned request. Understanding how to properly utilize the TR-152 form is a valuable skill for ensuring timely access to vital tax information.

Tr 152 Example

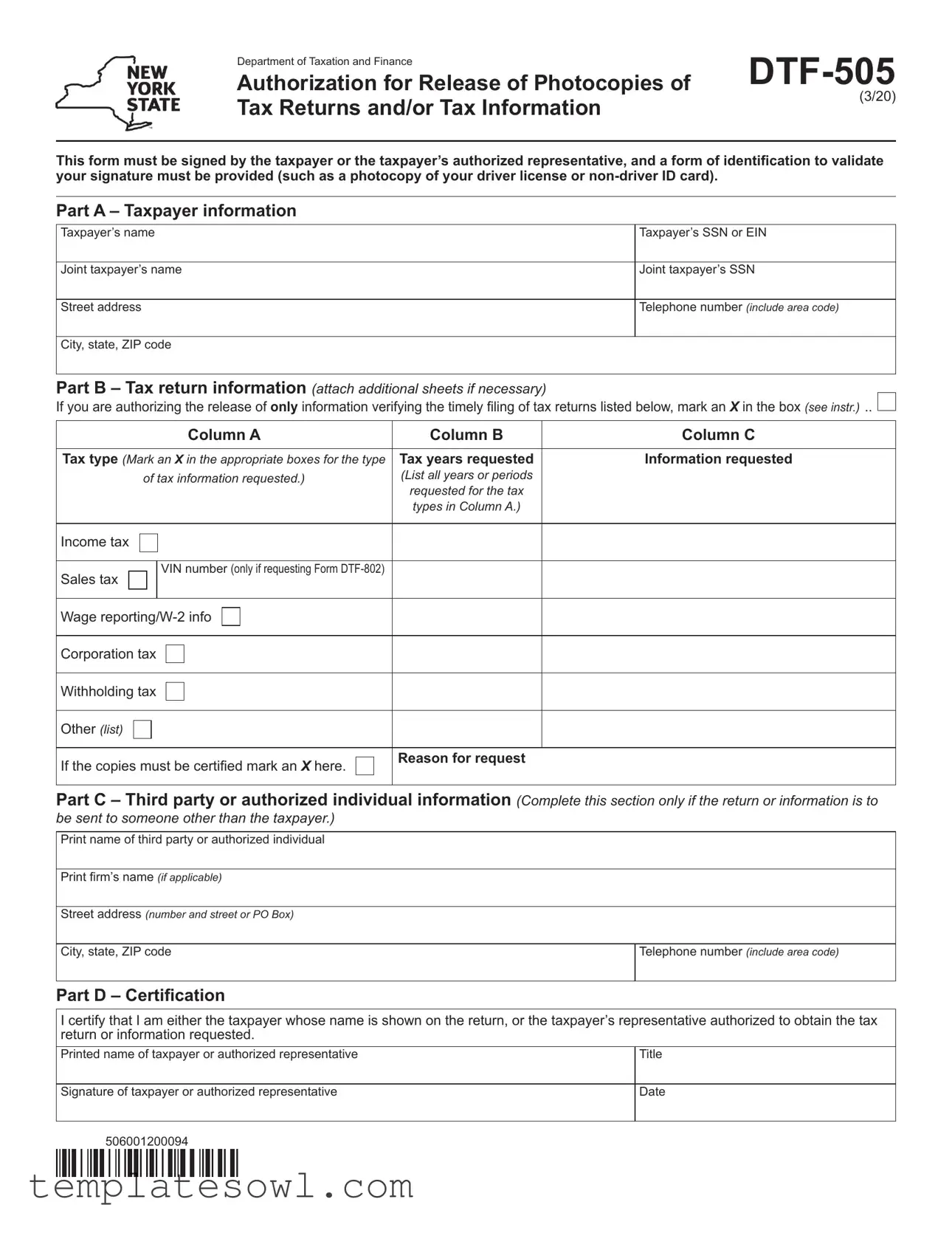

Department of Taxation and Finance |

|

Authorization for Release of Photocopies of |

|

Tax Returns and/or Tax Information |

(3/20) |

|

This form must be signed by the taxpayer or the taxpayer’s authorized representative, and a form of identification to validate your signature must be provided (such as a photocopy of your driver license or

Part A – Taxpayer information

Taxpayer’s name

Joint taxpayer’s name

Street address

City, state, ZIP code

Taxpayer’s SSN or EIN

Joint taxpayer’s SSN

Telephone number (include area code)

Part B – Tax return information (attach additional sheets if necessary)

If you are authorizing the release of only information verifying the timely filing of tax returns listed below, mark an X in the box (see instr.) ..

|

Column A |

Column B |

Column C |

|

|

|

|

Tax type (Mark an X in the appropriate boxes for the type |

Tax years requested |

Information requested |

|

of tax information requested.) |

(List all years or periods |

|

|

|

|

requested for the tax |

|

|

|

types in Column A.) |

|

|

|

|

|

Income tax |

|

|

|

|

|

|

|

Sales tax |

VIN number (only if requesting Form |

|

|

|

|

|

|

|

|

|

|

Wage |

|

|

|

|

|

|

|

Corporation tax |

|

|

|

|

|

|

|

Withholding tax |

|

|

|

|

|

|

|

Other (list) |

|

|

|

|

|

|

|

If the copies must be certified mark an X here. |

Reason for request |

|

|

|

|

||

|

|

|

|

Part C – Third party or authorized individual information (Complete this section only if the return or information is to be sent to someone other than the taxpayer.)

Print name of third party or authorized individual

Print firm’s name (if applicable)

Street address (number and street or PO Box)

City, state, ZIP code |

Telephone number (include area code) |

|

|

Part D – Certification

I certify that I am either the taxpayer whose name is shown on the return, or the taxpayer’s representative authorized to obtain the tax return or information requested.

Printed name of taxpayer or authorized representative Signature of taxpayer or authorized representative

Title Date

506001200094

Page 2 of 2

Instructions

General instructions

Use this form to request copies of paper returns or

You may be able to access certain tax information online. Visit our website (see Need help?) to create an Online Services account to view and print a copy of your

•Sales and use

•Corporation

•Fuel use

Refer to the website for the most current information.

Payment and mailing information

There is a charge of

Mail your completed request, along with a copy of a form of identification from which your signature can be validated, to:

NYS TAX DEPARTMENT

DISCLOSURE UNIT

W A HARRIMAN CAMPUS

ALBANY NY

If not using U.S. Mail, see Publication 55, Designated Private Delivery Services.

Important information

We will return your request if the form is incomplete or you did not provide a legible copy of your valid identification. It takes approximately 30 days for your request to be processed once all the necessary information has been received. To avoid delays, be sure to:

•specify as best you can the type of information being requested,

•provide the reason for your request,

•include a daytime phone number,

•sign Part D of this form, and

•provide a form of identification from which your signature can be validated.

Part C – Third party or authorized individual information

Complete this section only if you are requesting that the information be sent to someone other than you.

Part D – Certification

This form must be signed by the taxpayer or the taxpayer’s authorized representative, and you must provide a form of identification from which your signature can be validated (such as a legible photocopy of your valid driver license or

If the taxpayer is unable to sign, you must submit a power of attorney, power of appointment, or other evidence to establish that you are authorized to act on behalf of the taxpayer or are authorized to receive the taxpayer’s tax information. A representative can sign Form

For a corporation, the signature of the president, secretary, or other principal officer is required.

For partnerships, any person who was a member of the requesting partnership during any part of the tax period can sign the form.

For entities other than individuals, you must attach the authorization document. For example, this could be the letter from the principal officer authorizing an employee of the corporation or the Letters Testamentary authorizing an individual to act for an estate.

Privacy notification

New York State Law requires all government agencies that maintain a system of records to provide notification of the legal authority

for any request for personal information, the principal purpose(s) for which the information is to be collected, and where it will be maintained. To view this information, visit our website, or, if you do not have Internet access, call and request Publication 54, Privacy Notification. See Need help? for the Web address and telephone number.

Need help?

Specific instructions

Part A – Taxpayer information

Complete this section for all requests.

Part B – Tax return information

If you want us to provide only information regarding whether the returns and years requested were timely filed, mark an X in the box in Part B. If you mark this box, we will not provide copies or any other

Mark an X in the appropriate boxes in Column A and list the years or periods requested in Column B. List the specific information you would like to receive in Column C. If you need certified copies, mark an X in the box in Column A.

If you are requesting proof of sales tax paid on a purchase of a motor vehicle, or a copy of your Form

Visit our website at www.tax.ny.gov

•get information and manage your taxes online

•check for new online services and features

Telephone assistance |

|

Personal Income Tax Information Center: |

|

Corporation Tax Information Center: |

|

Sales Tax Information Center: |

|

Withholding Tax Information Center: |

|

Miscellaneous Tax Information Center: |

|

To order forms and publications: |

|

Text Telephone (TTY) or TDD |

Dial |

equipment users |

New York Relay Service |

506002200094

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The TR-152 form, known as DTF-505, is used by individuals to request photocopies of their tax returns or tax information from the New York State Department of Taxation and Finance. |

| Signature Requirement | This form must be signed by the taxpayer or their authorized representative, and it requires a form of identification for signature validation. |

| Processing Time | Once all necessary information is received, it typically takes about 30 days for the Department to process the request. |

| Fee Structure | A charge of twenty-five cents ($0.25) per page applies for the copies requested. Payment will be billed after the request is completed. |

| Legal Authority | The governing law for this form is based on New York State tax regulations, which include privacy notifications and requirements for the collection of personal information. |

Guidelines on Utilizing Tr 152

Successfully completing the TR-152 form is an essential step in requesting copies of your tax returns or other pertinent tax information. Once you've filled it out, you'll need to send it along with your identification to the appropriate address. The following steps provide a clear guide on what information to include and how to ensure your request is processed without delay.

- Gather Required Identification: Prepare a photocopy of a valid form of identification to validate your signature, such as a driver’s license or non-driver ID card.

- Complete Part A: Provide the taxpayer's name, joint taxpayer's name, street address, city, state, ZIP code, taxpayer's SSN or EIN, joint taxpayer's SSN (if applicable), and a daytime telephone number.

- Fill Out Part B: Indicate the type of tax information you are requesting by marking an X in the appropriate boxes. List the tax years or periods in Column B and specify the information you want in Column C. If you need certified copies, mark the relevant box.

- Complete Part C (if necessary): If the information is to be sent to a third party or authorized individual, print their name, firm’s name (if applicable), address, and telephone number.

- Sign Part D: Certify your request by signing and dating the form. If someone else is signing on your behalf, ensure you have the necessary power of attorney documentation attached.

- Mail Your Request: Send the completed form and a copy of your identification to the specified address: NYS TAX DEPARTMENT DISCLOSURE UNIT W A HARRIMAN CAMPUS ALBANY NY 12227-0870. If using a private delivery service, consult the relevant publication for guidelines.

- Await Processing: Allow approximately 30 days for processing once the request has been received. If additional information is necessary, be prepared to provide it promptly.

What You Should Know About This Form

What is the TR-152 form used for?

The TR-152 form is used to request copies of tax returns or tax information from the New York State Department of Taxation and Finance. It can be useful for accessing both paper and e-filed returns that you cannot find through online services.

Who needs to sign the TR-152 form?

The form must be signed by either the taxpayer or their authorized representative. If someone else is signing on your behalf, they should have proper authorization like a power of attorney.

What identification do I need to provide with the form?

You must include a copy of a valid identification that can confirm your signature. Acceptable forms include a photocopy of your driver’s license or non-driver ID card.

How much does it cost to request copies of tax information?

You will be charged twenty-five cents ($0.25) per page for copies of your tax information. However, you don’t need to send any payment initially. The total amount due will be communicated to you in a letter once your request is processed.

How long will it take to process my request?

Once the New York State Department of Taxation and Finance receives your completed request and identification, it generally takes about 30 days to process.

What should I do if I need information for only a specific tax return?

If you only want confirmation of whether returns were timely filed, check the appropriate box in Part B of the form. Make sure to clearly specify the tax type and years you are requesting to avoid any confusion.

Can I have my tax information sent to someone else?

Yes, if you want your tax information sent to someone other than yourself, fill out Part C with the third party's details. Make sure that the person is authorized to receive this information.

What if my request is incomplete?

If your request is incomplete or if the identification provided isn’t legible, the New York State Department of Taxation and Finance will return your application. To avoid this, ensure that all sections are filled out accurately, and your ID copy is clear.

Where do I send my completed TR-152 form?

Mail your completed form along with your identification to the NYS Tax Department, Disclosure Unit, W A Harriman Campus, Albany, NY 12227-0870. If you're using a delivery service other than U.S. Mail, check the guidelines in Publication 55.

Common mistakes

Completing the TR-152 form accurately is essential for a smooth processing of tax information requests. One common mistake made during this process involves omitting necessary taxpayer identifiers. This includes failing to include the taxpayer’s Social Security Number (SSN) or Employer Identification Number (EIN). Without these identifiers, the request may be delayed or rejected.

Another frequent error is neglecting to attach a proper identification document. The form requires a photocopy of a valid ID, such as a driver’s license or non-driver ID card. If this is not included, the request will be returned and the individual will need to start the process over. Ensuring that a clear and legible identification is provided can save significant time.

Completing Part B of the form incorrectly can also lead to complications. Individuals sometimes fail to mark the correct boxes for the types of tax information they are requesting. For instance, forgetting to indicate if certified copies are needed can result in receiving only standard copies, failing to meet the requestor's needs. Accurate completion of this section is vital for obtaining the desired information.

In addition, some form filers fail to provide a reason for their request. This can be a significant oversight, as the form explicitly states that a reason must be provided for the information being sought. Omitting this detail may lead to delays in processing or even a dismissal of the request.

Another mistake that can be made involves incomplete contact information. Including a reliable daytime phone number is crucial, as it allows tax authorities to reach out for any clarifications or additional information needed. Individuals sometimes assume their address alone is sufficient, which can lead to miscommunication.

Lastly, individuals often overlook the certification section of the form. The signature of the taxpayer or authorized representative is required in Part D. If this critical step is ignored, the entire request may be rendered invalid. It is imperative to review the completed form carefully to ensure that every necessary field is filled out and that all signatures are present.

Documents used along the form

When requesting tax information, you may come across several forms and documents that work hand-in-hand with the TR 152 form. Each document serves a specific purpose and understanding them can streamline your tax inquiry process.

- DTF-505: This is the primary form used to authorize the release of copies of tax returns. It requires valid identification and a signature from either the taxpayer or an authorized representative.

- Form POA-1: This form represents a Power of Attorney. It allows another party to act on behalf of the taxpayer regarding their tax matters. The authority must be explicitly outlined.

- Form DTF-802: This is the Statement of Transaction for motor vehicles. You may need this form when requesting proof of sales tax paid on a vehicle purchase.

- Tax Returns: Copies of past tax returns are often requested alongside the TR 152 to provide a comprehensive overview of the taxpayer’s history.

- Valid Identification: It is necessary to provide a form of identification, like a driver’s license, to validate your signature on the DTF-505 form.

- Written Authorization: In cases where someone else requests tax information on behalf of the taxpayer, a written authorization is required to confirm the request is legitimate.

- Partnership Documentation: For partnerships, documentation showing who can sign on behalf of the business must be submitted if a representative fills out the request.

- Privacy Notification: This document explains the legal authority and purpose for collecting personal information during the tax information request process.

- Publication 54: This publication provides details on the privacy notification concerning the handling of personal tax information by government agencies.

These documents and forms provide essential clarity and support when navigating tax matters. Having them organized and ready will make your process more efficient and less stressful.

Similar forms

- Form 4506: This form allows individuals to request a copy of their tax return from the IRS. Similar to the TR 152, it requires the taxpayer's information and a signature for verification.

- Form 4506-T: Used for requesting a transcript of tax returns, this document also demands the taxpayer’s identification and specific details about the returns needed, mimicking the information required in the TR 152.

- Form W-9: This form is utilized to provide taxpayer identification information to businesses or entities. Like the TR 152, it must be signed by the taxpayer and includes identification information.

- Form 8821: This allows a taxpayer to authorize the IRS to release tax information to a designated third party. Similar to the TR 152, it must be completed and signed by the taxpayer.

- Form 1040-X: A request for amendment of a previously submitted tax return. It requires taxpayer validation, much like the certification process in the TR 152.

- Form 12150: This document authorizes a representative to access tax information. The requirement for a signature and identification is akin to the TR 152's verification process.

- Form POA-1: A Power of Attorney form allowing designated individuals to act on behalf of the taxpayer. It includes requirements for signatures and identification similarly to the TR 152.

- Form 4868: This is an application for an extension to file federal taxes. It requires taxpayer information and a signature, paralleling the TR 152’s sections on taxpayer details and certification.

- Form DTF-800: This form, used for sales tax refund requests, demands taxpayer identification and must be verified by a signature, just like the TR 152.

- Form 1098-E: This form reports student loan interest, requiring taxpayer information and a signature. The need for proper identification reflects the verification process involved in the TR 152.

Dos and Don'ts

When filling out the TR-152 form, keep these important guidelines in mind:

- Ensure that you provide a legible copy of a valid form of identification, such as a driver’s license or non-driver ID.

- Clearly specify the type of tax information you are requesting in Part B and indicate the years or periods for each tax type.

- Complete Part D by signing the form. Remember that either the taxpayer or an authorized representative may sign.

- Include a daytime phone number where you can be reached in case of questions.

Avoid these common mistakes:

- Do not submit the form without providing a valid identification copy; it will be returned.

- Avoid leaving any sections of the form incomplete, as this will cause delays in processing.

- Do not forget to mark an X in the appropriate boxes for the information requested in Part B.

- Refrain from sending payment with your request; you will be billed later.

Misconceptions

Understanding the Tr 152 form can be confusing. Here are some common misconceptions about this important document:

- It is only for individuals - Many believe this form is exclusively for personal tax matters. In reality, businesses, corporations, and partnerships can also use it to request tax information.

- It can be filed online - Some assume that the Tr 152 form can be submitted electronically. However, this form must be printed and mailed in with the required identification.

- Identification isn't necessary - A common misunderstanding is that no identification is needed when submitting the form. In fact, a legible photocopy of a valid ID is essential to validate the signature.

- Only the main taxpayer needs to sign - People often think that only one spouse must sign if they file jointly. However, only one signature is sufficient, but both should be aware of the request.

- The form is free to file - Many think that there are no costs associated. There is a charge of $0.25 per page for copies, which will be billed after the request is processed.

- Processing time is quick - Some may assume their request will be handled immediately. The usual processing time is approximately 30 days, provided all necessary information is complete.

- Any identification works - It is a misconception that any form of ID is acceptable. The form specifically requires a legible photocopy of a driver’s license or non-driver ID.

- It can be requested verbally - Many individuals believe they can request the information over the phone. However, a completed and signed form must be submitted to initiate the request.

Clearing up these misconceptions can help ensure a smoother process when dealing with tax information requests using the Tr 152 form.

Key takeaways

When filling out the TR-152 form, carefully consider the following key takeaways to ensure a smooth experience:

- Complete all required sections: Make sure to fill out every part of the form. This includes taxpayer information, tax return details, and any third-party authorization if necessary. Incomplete forms may be returned.

- Sign your request: The taxpayer or their authorized representative must sign the certification section. Without a valid signature, the request cannot be processed.

- Provide valid identification: Include a copy of a form of identification, such as a driver’s license or non-driver ID. This validates the signature and is essential for processing your request.

- Specify your information needs: Clearly indicate the type of tax information you are requesting. If you only want verification of timely filing, mark the designated box to expedite processing.

- Anticipate processing time: After submitting your completed form, expect it to take around 30 days for processing. To avoid delays, ensure that all requested information is accurate and complete.

Browse Other Templates

Maryland Workers Compensation Commission - This document supports sole proprietors in navigating regulatory requirements.

Krispy Kreme Jobs - The role you apply for plays a significant part in our operational success.