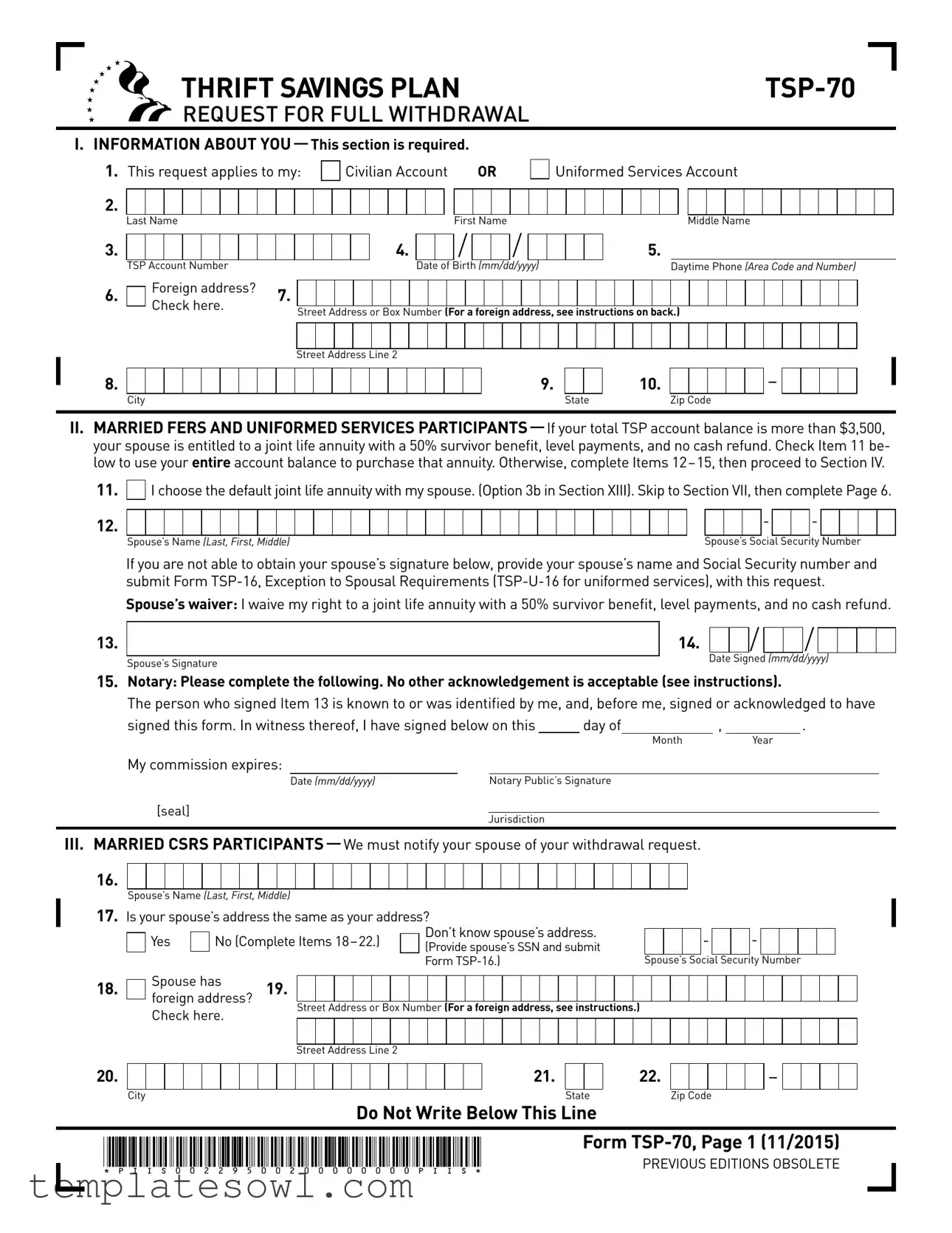

Fill Out Your Tsp 70 Form

The TSP-70 form is an essential document for participants in the Thrift Savings Plan (TSP) who wish to make a full withdrawal of their account balance. This form provides a structured way to request distributions from either a civilian or uniformed services account. Key sections of the TSP-70 cover vital personal information, including your name, TSP account number, and contact details. If you are married and have a TSP balance exceeding $3,500, both you and your spouse must complete specific parts of the form to acknowledge entitlements and options related to joint life annuities. The withdrawal choices are clearly outlined, allowing participants to specify their preferences for lump-sum payments, life annuities, or monthly payments based on life expectancy. Additionally, direct deposit options streamline the distribution process, ensuring participants can manage their finances efficiently. Importantly, the TSP-70 includes sections for tax withholding elections, ensuring individuals understand their tax obligations upon withdrawal. Signature and notarization requirements reinforce the form’s legal standing, making compliance with federal regulations a necessity. This introduction offers a glimpse into the comprehensive nature of the TSP-70 form, highlighting its critical role in the withdrawal process for TSP participants.

Tsp 70 Example

THRIFT SAVINGS PLAN |

REQUEST FOR FULL WITHDRAWAL

I.INFORMATION ABOUT

1. |

This request applies to my: |

Civilian Account |

OR |

|

Uniformed Services Account |

2. |

Last Name |

|

First Name |

|

Middle Name |

|

|

|

|||

3. |

|

4. |

/ |

/ |

5. |

|

TSP Account Number |

Date of Birth (mm/dd/yyyy) |

Daytime Phone (Area Code and Number) |

||

6.Foreign address? 7. Check here.

Street Address or Box Number (For a foreign address, see instructions on back.)

Street Address Line 2

8.

City

9.

State

10.

Zip Code

–

II.MARRIED FERS AND UNIFORMED SERVICES

11.

12.

I choose the default joint life annuity with my spouse. (Option 3b in Section XIII). Skip to Section VII, then complete Page 6.

|

- |

- |

Spouse’s Name (Last, First, Middle) |

Spouse’s Social Security Number |

|

If you are not able to obtain your spouse’s signature below, provide your spouse’s name and Social Security number and submit Form

Spouse’s waiver: I waive my right to a joint life annuity with a 50% survivor benefit, level payments, and no cash refund.

13.

15.

14. |

/ |

/ |

Spouse’s Signature |

Date Signed (mm/dd/yyyy) |

|

|

|

|

Notary: Please complete the following. No other acknowledgement is acceptable (see instructions).

The person who signed Item 13 is known to or was identified by me, and, before me, signed or acknowledged to have

signed this form. In witness thereof, I have signed below on this |

|

day of |

, |

. |

|||||

|

|

|

|

|

|

Month |

|

Year |

|

My commission expires: |

|

|

|

|

|

|

|

|

|

|

Date (mm/dd/yyyy) |

|

Notary Public’s Signature |

|

|

|

|||

[seal] |

Jurisdiction |

|

III.MARRIED CSRS

16.

17.Is your spouse’s address the same as your address?

Yes |

|

No (Complete Items |

|

Don’t know spouse’s address. |

|

|

|

- |

|

|

- |

|

|

|

|

|

|

(Provide spouse’s SSN and submit |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s Social Security Number |

|||||||||||

18. |

Spouse has |

19. |

foreign address? |

Check here.

Street Address or Box Number (For a foreign address, see instructions.)

Street Address Line 2

20.

City

21.

State

Do Not Write Below This Line

22.

Zip Code

–

Form

* P I I S 0 0 2 2 9 5 0 0 2 0 0 0 0 0 0 0 0 P I I S * |

PREVIOUS EDITIONS OBSOLETE |

|

Name: |

TSP Account Number: |

(Last, First, Middle)

IV. WITHDRAWAL

23. I would like to withdraw my entire account balance as follows:

a. |

|

|

|

.0% Single Payment |

|

|

|

|

|

|

|

|

|

|

b. |

|

|

|

.0% Life Annuity (Must equal $3,500 or more. Also complete Page 6.) |

||||||||||

|

|

|

||||||||||||

|

|

|

|

.0% TSP Monthly Payments → Tell us how to pay your monthly payments: |

||||||||||

c. |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 0 0 % (Total a, b, and c) |

$ |

|

|

, |

|

|

|

.00 |

per month ($25.00 or more) |

||||

|

|

|

OR |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

Compute my payments based on my life expectancy.

V.TRANSFER ELECTION

24.I would like to transfer all or a portion of my single payment and/or eligible monthly payments (indicated in Section IV) to an IRA or eligible employer plan. (See instructions for an explanation of eligible monthly payments. Note: You must include the completed applicable transfer page(s) from this form with your withdrawal request package.)

VI. DIRECT DEPOSIT

25. Pay by direct deposit (check all that apply): |

|

|

Single Payment |

|

|

|

|

|

|

TSP Monthly Payments |

|||||||||||||||||||||||||||

26. Type of Account: |

27. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Checking |

|

Name of Financial Institution |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OR |

28. |

|

|

|

|

|

|

|

|

|

|

|

29. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Savings |

|

ACH |

Routing Number (Must be 9 digits) |

Checking or Savings Account Number |

|||||||||||||||||||||||||||||||

VII. CERTIFICATION AND

30.

Participant’s Signature

31. |

|

/ |

|

/ |

|

|

Date Signed (mm/dd/yyyy)

32.Notary: Please complete the following. No other acknowledgement is acceptable (see instructions).

The person who signed Item 30 is known to or was identified by me, and, before me, signed or acknowledged to have

signed this form. In witness thereof, I have signed below on this |

day of |

, |

. |

|||||||

|

|

|

|

|

|

|

Month |

|

Year |

|

My commission expires: |

|

|

|

|

|

|

|

|

|

|

|

Date (mm/dd/yyyy) |

|

|

Notary Public’s Signature |

|

|

|

|||

|

|

|

|

|

|

|

|

|

||

[seal] |

Jurisdiction |

|

|

|

|

|

||||

|

|

Do not write in this section. |

Form |

|

|

|

|

PREVIOUS EDITIONS OBSOLETE |

|

|

|

|

|

|

Name: |

TSP Account Number: |

(Last, First, Middle)

VIII. FEDERAL TAX

Withholding on Single Payments

33.The TSP must withhold 20% of the taxable portion of your single payment for Federal income tax.

Indicate the dollar amount of withholding you want in addition to the mandatory 20% for Federal income tax:

$

,

.00

Withholding on Monthly Payments

The type and duration of monthly payments you elect will determine the required Federal tax withholding and which options below are available to you. You can use the monthly payment calculator on the TSP website (www.tsp.gov) to calculate the esti- mated duration of your payments.

34.For monthly payments that will last less than 10 years (less than 120 payments), indicate the dollar amount of with- holding you want on each monthly payment in addition to the mandatory 20% for Federal income tax:

$

,

.00

35.For monthly payments that will last 10 years or more (120 payments or more), or are computed based on life expectancy, I want:

a.

b.

No withholding

Withholding based on my marital status:

Single |

|

Married |

|

Married, but withhold at higher single rate |

Allowances (Enter the total number of allowances. If zero, enter 0.)

c. |

|

Withhold this additional dollar amount: |

$ |

|

|||

|

|

(Note: You must also complete Item 35b.) |

|

,

.00

|

|

Do not write in this section. |

Form |

|

|

|

|

PREVIOUS EDITIONS OBSOLETE |

|

|

|

|

|

|

Name: |

TSP Account Number: |

(Last, First, Middle)

This page is optional. You and the IRA trustee or plan administrator must complete this page if you want to transfer (i.e., direct rollover) all or a part of the traditional

IX. YOUR TRANSFER ELECTION FOR TRADITIONAL

36.Single Payment. Indicate the percentage of your traditional

37.Monthly Payments. Indicate the percentage of your traditional

.0%

.0%

X.TRANSFER INFORMATION FOR TRADITIONAL

38. |

Type of Account: |

|

|

|

|

|

Traditional IRA |

|

|

|

|

|

|

|

|

Eligible Employer Plan |

|

|

|

|

|

Roth IRA |

|||||||||||||||||||||||||||||||

39. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IRA/Plan Account Number or Other Customer ID |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

40. |

|

|

Check this box if |

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

41. |

Provide the name and mailing address information below exactly as it should appear on the front of the check. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Only the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

financial |

|

Make check payable to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

institution or |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

plan should |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

complete this |

|

|

If needed, use these boxes to supplement “check payable to” information above. |

|

|

|

|

|

|

|

|

|

|

|

|

|

information. |

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

It will be used |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to identify the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

account that |

|

Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

will receive the |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

– |

|

|

|

|

}transfer. |

||

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

Zip Code |

|

|

|

|

|

|

|

|

||||||

I confirm the accuracy of the information in this section and the identity of the individual named above. As a representative of the financial institution or plan to which the funds are being transferred, I certify that the financial institution or plan agrees to accept the funds directly from the Thrift Savings Plan and deposit them into the IRA or eligible employer plan identified above.

42.

Typed or Printed Name of Certifying Representative (Last, First, Middle)

43.

Signature of Certifying Representative

( )

Daytime Phone (Area Code and Number)

44. |

|

/ |

|

/ |

|

|

Date Signed (mm/dd/yyyy)

|

|

Do not write in this section. |

Form |

|

|

|

|

PREVIOUS EDITIONS OBSOLETE |

|

|

|

|

|

|

Name: |

TSP Account Number: |

(Last, First, Middle)

This page is optional. You and the IRA trustee or plan administrator must complete this page if you want to transfer (i.e., direct rollover) all or a part of the Roth portion of your single or eligible monthly payments to a Roth IRA or to a Roth account maintained by an eligible employer plan. Your Roth TSP balance consists of any employee contributions that you designated as Roth when you made your contribution election and the earnings associated with these contributions. Withdrawals of Roth contributions are paid

XI. YOUR TRANSFER ELECTION FOR ROTH

45.Single Payment. Indicate the percentage of your Roth single payment that you want to transfer:

46.Monthly Payments. Indicate the percentage of your Roth monthly payments that you want to transfer:

.0%

.0%

XII. TRANSFER INFORMATION FOR ROTH

47. Type of Account: |

|

Roth IRA |

|

Eligible Employer |

48.

IRA/Plan Account Number or Other Customer ID

49. Provide the name and mailing address information below exactly as it should appear on the front of the check.

|

|

|

|

Only the |

Make check payable to |

|

|

|

financial |

|

|

|

institution or |

|

|

|

|

|

plan should |

|

|

|

|

complete this |

If needed, use these boxes to supplement “check payable to” information above. |

|

|

|

information. |

|

|

|

|

It will be used |

|

|

|

|

to identify the |

Street Address |

|

|

|

account that |

|

|

|

will receive the |

|

|

|

|

|

|

City |

State |

Zip Code |

– |

}transfer. |

I confirm the accuracy of the information in this section and the identity of the individual named above. As a representative of the financial institution or plan to which the funds are being transferred, I certify that the financial institution or plan agrees to accept the funds directly from the Thrift Savings Plan and deposit them into the IRA or eligible employer plan identified above.

50.

51.

Typed or Printed Name of Certifying Representative (Last, First, Middle)

Signature of Certifying Representative

( )

Daytime Phone (Area Code and Number)

52. |

|

/ |

|

/ |

|

|

Date Signed (mm/dd/yyyy)

|

|

Do not write in this section. |

Form |

|

|

|

|

PREVIOUS EDITIONS OBSOLETE |

|

|

|

|

|

|

Name: |

TSP Account Number: |

(Last, First, Middle)

Complete this page if you chose a life annuity in Item 11 or 23b.

XIII. ANNUITY

53.Your Gender:

Male

Female

54.Indicate your annuity choice by checking one of the options below.

Single |

Single |

||

1a |

No additional features |

2a |

No additional features |

*1b |

Cash refund (Complete Section XV) |

*2b |

Cash refund (Complete Section XV) |

*1c |

*2c |

||

Joint Life With |

Joint Life With |

||||

3a |

100% |

to survivor, no additional features |

4a |

100% |

to survivor, no additional features |

3b |

50% |

to survivor, no additional features |

4b |

50% |

to survivor, no additional features |

*3c |

100% |

to survivor, cash refund (Complete Section XV) |

*4c |

100% |

to survivor, cash refund (Complete Section XV) |

*3d |

50% |

to survivor, cash refund (Complete Section XV) |

*4d |

50% |

to survivor, cash refund (Complete Section XV) |

Joint Life With Joint Annuitant Other Than

5a |

100% |

to survivor, no additional features |

*5c |

100% |

to survivor, cash refund (Complete Section XV) |

5b |

50% |

to survivor, no additional features |

*5d |

50% |

to survivor, cash refund (Complete Section XV) |

XIV. INFORMATION ABOUT SPOUSE OR OTHER JOINT ANNUITANT 55.

Name (Last, First, Middle)

56. |

/ |

/ |

57. |

- |

- |

58. Gender: |

Male |

Female |

|

Date of Birth (mm/dd/yyyy) |

|

Joint Annuitant’s Social Security Number |

|

|

|

||

59. |

Relationship to Participant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

XV. BENEFICIARY DESIGNATION FOR YOUR TSP

60.

Beneficiary’s Name (Last, First, Middle)

Share:

%

Social Security Number/EIN

Relationship to Participant

61.

Beneficiary’s Name (Last, First, Middle)

Share:

%

Social Security Number/EIN

Relationship to Participant

62.

Beneficiary’s Name (Last, First, Middle)

Social Security Number/EIN

Relationship to Participant

Share:

%

|

|

☞ |

|

Check here if you are submitting additional pages. How many additional pages are you attaching to this form? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do not write in this section. |

Form |

||||||

|

|

|

|

|

PREVIOUS EDITIONS OBSOLETE |

||||

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The TSP-70 is a request form to withdraw funds from the Thrift Savings Plan (TSP). It is used by participants to request a full withdrawal of their account balance. |

| Eligibility Requirements | Participants can submit the TSP-70 if they are separated from federal service and do not expect to be rehired by the Federal Government within 31 days. |

| Spousal Signature Requirement | If a participant has a TSP balance exceeding $3,500 and is married, spousal consent is necessary unless an exception is provided through Form TSP-16. |

| Withdrawal Options | Participants can choose from several withdrawal methods including a single payment, life annuity, or monthly payments, reflecting their individual financial needs. |

| Tax Withholding | The TSP-70 includes options for federal tax withholding on distributions, which varies based on chosen withdrawal methods and desired additional withholding. |

| Notary Requirement | Notarization is required for certain sections of the form, ensuring proper identification and legal compliance in the signing process. |

| Direct Deposit | Participants can choose to receive their funds via direct deposit into their checking or savings accounts, simplifying access to their funds. |

| Transfer Elections | The form allows participants to transfer portions of their accounts to IRAs or eligible employer plans, providing flexible options for managing retirement savings. |

| Governing Laws | The TSP-70 is governed by federal regulations outlined in the Federal Employees Retirement System Act and the Thrift Savings Plan provisions. |

Guidelines on Utilizing Tsp 70

Completing the TSP-70 form is an essential step for those looking to request a full withdrawal from their Thrift Savings Plan account. As you fill out this form, ensure all necessary information is accurate and complete, as any errors could delay processing. Once you have finished, you will need to sign and submit the form according to the outlined instructions to facilitate your withdrawal request.

- Identify Your Account: Select whether this request applies to your Civilian Account or Uniformed Services Account.

- Provide Personal Information: Fill in your last name, first name, middle name, TSP account number, date of birth, and daytime phone number.

- Complete Address Information: Enter your street address, city, state, and zip code. If you have a foreign address, indicate that accordingly.

- Spouse Information: If applicable, provide your spouse's name and Social Security number. Indicate whether you choose a joint life annuity with your spouse or wish to waive that right.

- Withdrawal Election: Specify how you want to withdraw your account balance, including any monthly payment amounts if applicable. Ensure the total percentages add up to 100%.

- Transfer Election: If you plan to transfer a portion of your withdrawal to an IRA or eligible employer plan, complete that section as needed.

- Direct Deposit Information: For payments not transferred, provide your financial institution's information and account details if you wish to set up direct deposit.

- Certification and Notarization: Sign and date the form, and have a notary public validate your signature.

- Federal Tax Withholding (Optional): If you wish to specify additional withholding amounts for tax purposes, complete the relevant sections.

What You Should Know About This Form

What is the TSP-70 form used for?

The TSP-70 form is a request for a full withdrawal from your Thrift Savings Plan (TSP) account. It applies to either civilian or uniformed services accounts. Completing this form allows participants to specify how they would like to withdraw their account balance, whether through a single payment, life annuity, or TSP monthly payments.

Who needs to complete the TSP-70 form?

Participants who are eligible for withdrawal from their TSP accounts need to fill out this form. This includes both civilian employees and members of the uniformed services. If you have a balance of more than $3,500, and you are married, your spouse will also need to provide their information and signature.

What information do I need to provide on the TSP-70 form?

You will need to provide personal information, including your name, date of birth, TSP account number, and contact information. If you're married, you must include your spouse's name and Social Security number. Additionally, you should indicate your withdrawal election preferences and provide bank details if you wish for payments to be made via direct deposit.

Is my spouse required to sign the TSP-70 form?

Yes, if your TSP balance exceeds $3,500 and you want to withdraw the entire balance, your spouse must sign the form to waive their right to the joint life annuity. If you are unable to obtain your spouse's signature, you must submit a separate form (TSP-16) indicating the situation.

What are the different withdrawal options available on the TSP-70 form?

You can choose from several options. These include a single payment of your entire account balance, purchasing a life annuity, or setting up monthly payments. You can also transfer all or part of your balance to an IRA or an eligible employer plan. It's important to specify the percentage or amount you wish to withdraw in each category.

What happens if I don't complete the TSP-70 form correctly?

If the form is filled out incorrectly, your withdrawal request may be delayed. Additionally, any errors regarding tax withholding may result in the mandatory federal tax rules being applied instead of your preferences. To avoid complications, ensure all sections are completed accurately and all necessary signatures are obtained.

Can I change my withdrawal election after submitting the TSP-70 form?

Once your withdrawal election is processed, it is generally considered final. The elections you make on the TSP-70 form are irrevocable. If you have concerns about your options or timing, consider speaking with a financial advisor before submitting the form.

How long does it take to process the TSP-70 form?

The processing time can vary. Typically, you can expect a processed election within 30 days if all required information and documentation are in order. During peak times, it may take longer, so plan accordingly if you are relying on these funds for a specific purpose.

Where can I obtain more information about the TSP-70 form?

For additional information, you can visit the official TSP website at www.tsp.gov. The website contains helpful resources, including detailed explanations about withdrawal options, FAQs, and the latest forms. You can also contact TSP customer service for personalized assistance.

Common mistakes

Completing the TSP-70 form can be a straightforward process, but many individuals make common mistakes that can delay their request for a full withdrawal. One prevalent issue is neglecting to select the correct account type—either Civilian Account or Uniformed Services Account. This choice is critical, as it sets the foundation for the entire withdrawal request. Ensuring this selection is accurate helps avoid unnecessary complications later.

Another frequent error is failing to provide accurate personal information. Incomplete or incorrect entries for names, Social Security numbers, or even the TSP account number can lead to significant delays. It’s essential to double-check entries against official documents to ensure that all information is correct. Not confirming these details could result in processing setbacks and additional paperwork.

Some individuals forget to address the spousal requirements applicable to married participants. If the TSP account balance exceeds $3,500, obtaining the spouse's signature is necessary. Skipping this step can cause the entire withdrawal request to be declined. It’s advisable to gather all required documentation and signatures ahead of time to streamline the process.

Inaccurate or incomplete selections in the Withdrawal Election section are also common pitfalls. When specifying withdrawal methods, individuals sometimes fail to indicate percentages correctly. If one chooses multiple methods of withdrawal, the sum of the indicated percentages must equal 100%. Oversights in this area can lead to misunderstanding or rejection of the request.

Some participants overlook the importance of seeking notarized signatures. Notaries play a crucial role in validating signatures within the TSP-70. Omitting this step or relying on an incorrect form of acknowledgment can make the submission invalid. Engaging a licensed notary at the correct stages of the process protects the integrity of one’s application.

Individuals often miss filling out the Federal Tax Withholding section despite it being optional. By neglecting to indicate their preferences, they risk having default withholding apply, which may not align with their financial needs or situation. Taking a moment to decide and fill out this part can have a lasting impact on tax obligations.

Some people rush through the submission process and forget to review the entire form. Rushing increases the chances of missing critical details, leading to processing delays or denials. Taking the time for a thorough review before submission helps ensures all details are correct, reducing the likelihood of complications.

Lastly, a misunderstanding of the transfer options available can hinder an effective withdrawal strategy. When participants elect to transfer funds to IRAs or employer plans, clarity on the amounts and percentages desired is key. Inaccuracies here can result in funds being incorrectly allocated, impacting future financial planning. Knowledge of these options and a careful selection process can significantly strengthen one's withdrawal strategy.

Documents used along the form

The TSP-70 form, used for requesting full withdrawal from the Thrift Savings Plan, often accompanies several related forms and documents. These forms help facilitate withdrawal, ensure compliance with regulations, and manage tax implications. Below is a list of commonly associated forms that may be necessary for completing the withdrawal process.

- TSP-16 - Exception to Spousal Requirements: This form is required if a participant cannot obtain their spouse's signature. It provides an exception to the requirement for spousal consent in certain situations.

- TSP-U-16 - Exception to Spousal Requirements for Uniformed Services: Similar to TSP-16, this form offers a spouse waiver option specifically for members of the uniformed services.

- IRS Form W-4P - Withholding Certificate for Pension or Annuity Payments: Optional for participants to indicate their withholding preferences for federal income tax on payments received.

- TSP Transfer Page (Traditional) - This page should be completed if a participant wishes to transfer part or all of their traditional (non-Roth) balance to another eligible plan or IRA.

- TSP Transfer Page (Roth) - This page manages the transfer of Roth contributions to a Roth IRA or eligible employer plan, ensuring all tax requirements are met.

- Direct Deposit Form - This document allows participants to authorize direct deposit for their withdrawals into a designated checking or savings account.

- Notary Acknowledgement Form - A form that must be completed if notarization is needed for the participant’s or spouse’s signature to validate the application process.

- TSP Tax Notice - This notice provides fundamental information about the tax implications of withdrawing funds, guiding participants in understanding potential tax repercussions.

In summary, these forms and documents play vital roles in ensuring that the withdrawal process is executed smoothly and in compliance with legal and tax obligations. Participants should review all required and optional materials carefully to ensure thorough and accurate submissions.

Similar forms

The TSP-70 form, which is a request for full withdrawal from the Thrift Savings Plan, shares similarities with several other financial documents. Each of these documents serves a unique purpose but often involves the management of retirement or investment accounts. Below is a comparison of the TSP-70 with five similar documents:

- Form 5305-SA, Simple IRA Plan Document: This form creates a Simple IRA plan for small employers. Like the TSP-70, it requires the identification of participants and their decision-making regarding account management. Both documents focus on facilitating withdrawal and account transfer processes.

- Form 8606, Nondeductible IRA Contribution: This IRS form is used by individuals who make nondeductible contributions to IRAs. Similar to the TSP-70, it involves reporting on account contributions and distributions while ensuring tax implications are addressed.

- Form W-4P, Withholding Certificate for Pension or Annuity Payments: This form allows individuals to determine their tax withholding preferences on pensions and annuities. The TSP-70 also requires similar tax information, particularly regarding how taxes will be withheld from withdrawals.

- Form TSP-16, Exception to Spousal Requirements: This form is used when a participant cannot obtain their spouse's consent for certain transactions, echoing the consent requirements found in the TSP-70 for spousal waivers and certifications.

- Form 8889, Health Savings Account (HSA) Tax Form: This document is used to report HSA contributions and distributions, akin to the TSP-70 in the sense that both deal with funds designated for retirement and medical expenses. Both require accurate reporting for tax purposes.

Dos and Don'ts

- Do read all instructions carefully before filling out the form. Understanding the requirements will help ensure that your application is processed smoothly.

- Do double-check your personal information. Ensure that your name, TSP account number, and contact details are accurate.

- Don't leave any required sections blank. Failing to complete mandatory fields can delay your request.

- Don't forget to include your spouse's information if applicable. If you're married and have a TSP account balance greater than $3,500, remember to address spousal requirements.

- Do sign and date the form. Your signature indicates that you understand the terms and conditions of your withdrawal request.

Misconceptions

- Misconception 1: The TSP-70 form is only for federal employees.

- Misconception 2: Spousal consent is not necessary for all withdrawals.

- Misconception 3: The TSP-70 can be submitted without documentation.

- Misconception 4: All payments are subject to the same tax withholding.

- Misconception 5: The form can only be submitted by the account holder.

- Misconception 6: Choosing a life annuity is the only way to ensure survivor benefits for a spouse.

- Misconception 7: Completing the form incorrectly will lead to an automatic denial.

- Misconception 8: The withdrawal election is reversible.

- Misconception 9: The TSP-70 form is the only required step for transferring funds out.

In reality, this form is applicable to both civilian federal employees and members of the uniformed services, allowing access to funds from their Thrift Savings Plans.

If your total TSP account balance exceeds $3,500, spousal consent is required as per federal regulations. This ensures both spouses acknowledge and agree on the withdrawal.

This form necessitates specific documentation, including the spouse's Social Security number and consent in certain cases. Without the required documentation, the processing of the withdrawal may be delayed.

Tax withholding varies based on the type of withdrawal chosen. Single payments have a mandatory 20% federal tax withholding, while monthly payments may allow options based on individual circumstances.

A representative may submit the form, but they need to include proper authorization. The individual must also sign and certify the submission.

A participant can opt for a joint life annuity to provide a survivor benefit, but there are alternative withdrawal options available that may also include survivor benefits.

While incorrect or incomplete submissions may slow down processing, providing any needed corrections promptly can allow the request to proceed as intended.

Once a withdrawal election has been made and processed, it is generally considered final and cannot be undone. Understanding this is crucial to making informed decisions about fund management.

In some cases, additional forms and documentation are needed, particularly if funds are directed to an IRA or another employer plan. It is important to refer to the instructions for any supplemental requirements.

Key takeaways

When filling out and utilizing the TSP-70 form, several key aspects should be understood to ensure a smooth process:

- The form is required for requesting a full withdrawal from your Thrift Savings Plan (TSP) account.

- It is crucial to specify whether you are requesting a withdrawal from a Civilian Account or a Uniformed Services Account.

- Married participants need to consider spousal consent if the total TSP balance exceeds $3,500.

- Accurate personal information, including your name, TSP account number, and contact information, must be provided.

- Understanding the different withdrawal methods, such as single payments, life annuities, or monthly payments, is essential before making selections.

- Providing your financial institution details is necessary for direct deposit options.

- All signatures, including those of a notary, need to be included where indicated to validate the request.

- Tax implications, particularly federal withholding for withdrawals, should be carefully evaluated.

- Reviewing the completed form for accuracy before submission helps prevent delays in processing your request.

Browse Other Templates

Nm Board of Nursing - It is necessary to provide the number of days or shifts worked while the license was expired.

Statements of Information - It is important to verify that all information is accurate before submission.