Fill Out Your Ub 106 A Ff Form

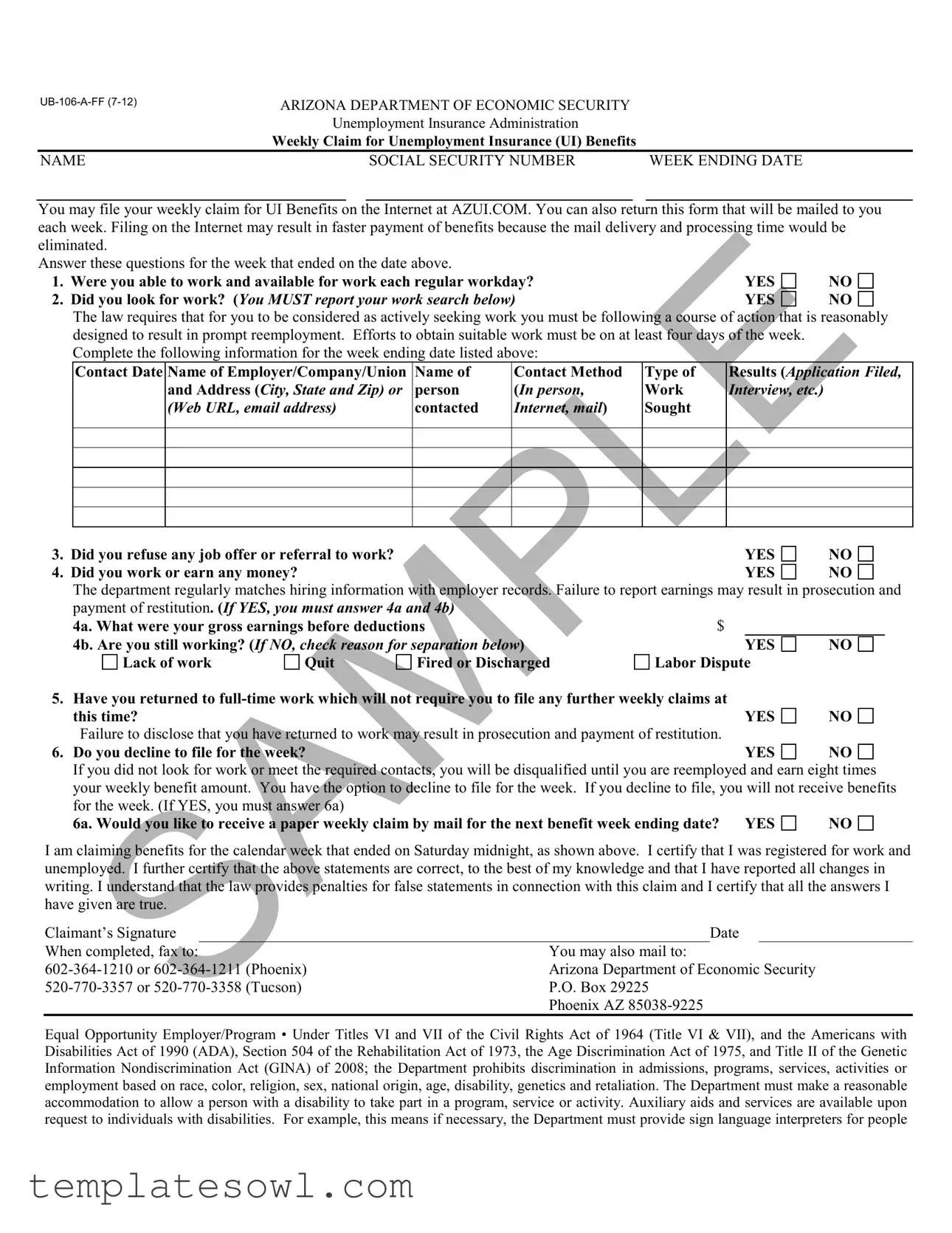

The UB-106-A-FF form, issued by the Arizona Department of Economic Security, plays a crucial role in the unemployment benefits process. This weekly claim form is designed for individuals seeking Unemployment Insurance (UI) benefits to report their work availability and job search efforts accurately. It requires claimants to provide their name, Social Security number, and the week-ending date for which they are applying. The form includes a series of questions that assess whether individuals were available for work, actively searching for jobs, and whether they earned any income during the week. Notably, it emphasizes the importance of actively seeking employment through detailed reporting of job contacts made throughout the week. Claimants must also declare any job offers they refused and provide information about their earnings, if applicable. In addition, the UB-106-A-FF form introduces an option for individuals to decline filing for the week and outlines the consequences of failing to meet job search requirements or disclosing relevant information. With clear instructions for submission via fax or mail, this form helps streamline the process of claiming UI benefits while ensuring compliance with the law. Understanding its components can assist individuals in successfully navigating their unemployment claims.

Ub 106 A Ff Example

ARIZONA DEPARTMENT OF ECONOMIC SECURITY

Unemployment Insurance Administration

Weekly Claim for Unemployment Insurance (UI) Benefits

NAME |

SOCIAL SECURITY NUMBER |

WEEK ENDING DATE |

You may file your weekly claim for UI Benefits on the Internet at AZUI.COM. You can also return this form that will be mailed to you each week. Filing on the Internet may result in faster payment of benefits because the mail delivery and processing time would be eliminated.

Answer these questions for the week that ended on the date above.

1. |

Were you able to work and available for work each regular workday? |

|

NO |

2. |

Did you look for work? (You MUST report your work search below) |

YES |

NO |

|

The law requires that for you to be considered as actively seeking work you must be following a course of action that is reasonably |

||

|

designed to result in prompt reemployment. Efforts to obtain suitable work must be on at least four days of the week. |

|

|

|

Complete the following information for the week ending date listed above: |

|

|

|

|

Contact Date |

Name of Employer/Company/Union |

Name of |

Contact Method |

Type of |

Results (Application Filed, |

|

|

|

|

and Address (City, State and Zip) or |

person |

(In person, |

Work |

Interview, etc.) |

|

|

|

|

(Web URL, email address) |

contacted |

Internet, mail) |

SoughtYES |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

SAMP |

|

YES |

NO |

||

Did you refuse any job offer or referral to work? |

|

|

|

|||||

4. |

Did you work or earn any money? |

|

|

|

YES |

NO |

||

The department regularly matches hiring information with employer records. Failure to report earnings may result in prosecution and payment of restitution. (If YES, you must answer 4a and 4b)

|

4a. What were your gross earnings before deductions |

$ |

|

|

||

|

4b. Are you still working? (If NO, check reason for separation below) |

|

YES |

NO |

||

|

Lack of work |

Quit |

Fired or Discharged |

Labor Dispute |

|

|

5. |

Have you returned to |

|

||||

|

this time? |

|

|

|

YES |

NO |

|

Failure to disclose that you have returned to work may result in prosecution and payment of restitution. |

|

||||

6. |

Do you decline to file for the week? |

|

|

YES |

NO |

|

If you did not look for work or meet the required contacts, you will be disqualified until you are reemployed and earn eight times your weekly benefit amount. You have the option to decline to file for the week. If you decline to file, you will not receive benefits for the week. (If YES, you must answer 6a)

6a. Would you like to receive a paper weekly claim by mail for the next benefit week ending date? YES |

NO |

I am claiming benefits for the calendar week that ended on Saturday midnight, as shown above. I certify that I was registered for work and unemployed. I further certify that the above statements are correct, to the best of my knowledge and that I have reported all changes in writing. I understand that the law provides penalties for false statements in connection with this claim and I certify that all the answers I have given are true.

Claimant’s ignature |

|

|

Date |

||

When completed, fax to: |

|

|

You may also mail to: |

|

|

(Phoenix) |

Arizona Department of Economic Security |

||||

(Tucson) |

.O. Box 29225 |

||||

|

|

|

Phoenix AZ |

||

Equal Opportunity Employer/Program • Under Titles VI and VII of the Civil Rights Act of 1964 (Title VI & VII), and the Americans with Disabilities Act of 1990 (ADA), Section 504 of the Rehabilitation Act of 1973, the Age Discrimination Act of 1975, and Title II of the Genetic Information Nondiscrimination Act (GINA) of 2008; the Department prohibits discrimination in admissions, programs, services, activities or employment based on race, color, religion, sex, national origin, age, disability, genetics and retaliation. The Department must make a reasonable accommodation to allow a person with a disability to take part in a program, service or activity. Auxiliary aids and services are available upon request to individuals with disabilities. For example, this means if necessary, the Department must provide sign language interpreters for people

who are deaf, a wheelchair accessible location, or enlarged print materials. It also means that the Department will take any other reasonable action that allows you to take part in and understand a program or activity, including making reasonable changes to an activity. If you believe that you will not be able to understand or take part in a program or activity because of your disability, please let us know of your disability needs in advance if at all possible. To request this document in alternative format or for further information about this policy, contact your local office manager; TTY/TDD Services:

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Title | UB-106-A-FF Weekly Claim for Unemployment Insurance Benefits |

| Governing Department | Arizona Department of Economic Security (DES) |

| Filing Options | Claimants can file online at AZUI.COM or submit the mailed form. |

| Work Availability Requirement | Claimants must verify their ability and availability to work each regular workday. |

| Job Search Criteria | Claimants must engage in job search activities on at least four days of the week. |

| Reporting Earnings | Failure to report earnings can lead to prosecution and repayment of benefits. |

| Job Refusal | Claimants must report any job offers or referrals that were refused. |

| Disqualification for Non-compliance | Not looking for work can lead to disqualification until reemployment. |

| Anti-discrimination Policy | DES prohibits discrimination based on race, color, religion, sex, national origin, age, disability, and genetics. |

Guidelines on Utilizing Ub 106 A Ff

Once you have gathered the necessary information, you're ready to fill out the UB 106 A FF form. Completing this form properly is essential to ensure you receive your unemployment benefits promptly. Follow these steps carefully to provide the required information for your weekly claim.

- At the top of the form, write your name and your Social Security number.

- Fill in the week ending date for which you are claiming benefits.

- Answer question 1: Indicate if you were able to work and available for work each regular workday. Mark YES or NO.

- For question 2, indicate if you looked for work. Again, select YES or NO.

- If you answered YES to question 2, provide your job search details. Fill out the Contact Date, Name of Employer/Company/Union, Name of Contact, Method, and Type of Results for each contact made that week.

- Answer question 3 about refusing any job offers. Select YES or NO.

- For question 4, indicate whether you worked or earned any money that week. Choose YES or NO.

- If you answered YES to question 4, fill out the gross earnings in 4a and specify if you are still working in 4b by selecting YES or NO.

- Answer question 5 regarding whether you returned to full-time work. Select YES or NO.

- For question 6, indicate whether you decline to file for the week. Choose YES or NO.

- If you declined to file, answer 6a regarding receiving a paper weekly claim by mail for the next week.

- At the bottom of the form, certify that your statements are correct by signing and dating the form.

After completing the form, submit it by faxing to the provided numbers or mailing it to the Arizona Department of Economic Security address. Ensure that you keep a copy for your records.

What You Should Know About This Form

What is the UB-106-A-FF form used for?

The UB-106-A-FF form is used to claim weekly unemployment insurance benefits in Arizona. This form helps track your eligibility for benefits by documenting your work availability, job search activities, any earnings, and your status related to other work opportunities.

How can I file my weekly claim using the UB-106-A-FF form?

You can file your claim by mailing in the form or by using the Internet at AZUI.COM. Filing online may lead to faster processing and quicker benefit payments because it eliminates delays associated with mail delivery.

What information do I need to provide when filling out this form?

You'll need to provide details like your name, social security number, and the week ending date. Additionally, you must answer questions about your work availability, job search efforts, any job offers you rejected, and your earnings during the week.

What happens if I did not look for work during the week?

If you did not look for work, you must answer "Yes" to declining to file for the week. This means you will not receive any benefits for that week. Consistent failure to meet the job search requirements may result in disqualification from future benefits until you become reemployed.

Are there penalties for providing false information on the form?

Yes, submitting false statements can lead to prosecution and require you to repay any benefits you inaccurately received. It’s important to answer all questions truthfully to avoid any legal issues.

What should I do if I earn money while receiving benefits?

If you earned money during the week, you must report your gross earnings and whether you are still working. Not reporting your earnings could lead to serious consequences, including prosecution and the need to repay benefits.

Can I request assistance if I have a disability?

Yes, the Arizona Department of Economic Security is committed to providing reasonable accommodations for individuals with disabilities. If you need assistance or would like this document in an alternative format, contact your local office manager or request help in advance. Auxiliary aids and services are available upon request.

Common mistakes

When filling out the UB-106-A-FF form, one common mistake individuals often make is failing to accurately report their work search efforts. Respondents are required to document their job search activities for at least four days of the week. Neglecting to provide this information or listing insufficient contacts can lead to complications in the claim process. It’s essential to be meticulous when detailing contacts, including the date, employer’s name, and method of contact, to ensure compliance with the law.

Another frequent error lies in the misrepresentation of earnings. Some individuals may not report income earned during the week, perhaps believing it to be negligible. This approach can have severe consequences, including prosecution or repayment of benefits received. Understanding that the Department of Economic Security regularly checks hiring information against employer records further underscores the importance of transparency in reporting any earnings.

A third mistake that may occur involves misunderstanding the requirements related to work availability. Claimants should ensure they can affirmatively answer that they were available for work each regular workday. If someone mistakenly indicates they were available when they weren’t, it can jeopardize their eligibility for benefits. Therefore, thorough self-assessment is critical when addressing this question on the form.

Lastly, individuals may fail to recognize the implications of declining to file for a week. Choosing to skip a week’s claim without understanding the consequences might lead to a disqualification of benefits until certain conditions are met. It is imperative to evaluate the situation carefully before deciding to decline claiming unemployment benefits for that week. Each of these errors can complicate the claim process and delay much-needed financial assistance.

Documents used along the form

When filing the UB-106-A-FF form for unemployment insurance benefits, several other documents may commonly accompany it. These documents serve to provide additional information or support your claims, enhancing communication with the state’s unemployment office. Here are some frequently used forms and what they entail:

- UB-106: The initial application for unemployment insurance. This form collects basic information about your employment history and eligibility for benefits.

- W-2 Form: This document shows your earnings from the previous year and the taxes withheld by your employer. It helps substantiate your income during the claim process.

- Payroll Records: These records detail your wages and hours worked. They are crucial for proving employment status and earnings if required.

- Job Search Log: A personal record that lists your job applications and interviews. Keeping track of your job search efforts demonstrates your active pursuit of employment.

- Separation Notice: This form explains the reason for your unemployment, usually provided by your former employer. Understanding why you are no longer employed can affect your eligibility for benefits.

- Appeal Form (if necessary): If your claim is denied, this form allows you to contest the decision. It outlines the grounds for your appeal and any supporting documentation.

- Identity Verification Document: A copy of a government-issued identification, such as a driver’s license or passport. This helps confirm your identity as part of the application process.

Providing these supporting documents along with your UB-106-A-FF form can facilitate a smoother processing of your unemployment benefits claim. Each document plays a role in verifying your eligibility and ensuring that you receive accurate and timely payments during your period of unemployment.

Similar forms

The UB-106-A-FF form, used for filing weekly claims for unemployment insurance benefits in Arizona, shares similarities with several other documents related to unemployment claims. Each of these documents plays a vital role in the process of claiming benefits and reporting work activities. Below are six documents that are similar to the UB-106-A-FF form, along with brief descriptions of how they relate to it.

- Weekly Certification Form: Much like the UB-106-A-FF, a Weekly Certification Form is used to confirm eligibility for unemployment benefits on a weekly basis. Claimants report their work search efforts and any earnings during the week, ensuring compliance with state requirements.

- Initial Claim Form: The Initial Claim Form is the first step in the unemployment benefits process. It captures essential information about the claimant, similar to the UB-106-A-FF's need for personal details, but focuses on the initial eligibility rather than weeklyactivities.

- Job Search Log: This log is maintained to document efforts made to find employment. The UB-106-A-FF form requires reporting of job search activities, making both documents essential in demonstrating that a claimant is actively seeking work.

- Reemployment Plan: In some states, claimants may be required to complete a Reemployment Plan that outlines steps for returning to work. This parallels the UB-106-A-FF’s focus on work availability and job search, as both emphasize the importance of being proactive in finding employment.

- Employment Verification Form: This form is often required by agencies to confirm employment status, similar to the UB-106-A-FF’s need to report any earnings. Both documents ensure that claimants accurately represent their employment situation to the unemployment office.

- Benefit Payment Request: A Benefit Payment Request is submitted to indicate that a claimant is seeking payment for benefits. This bears similarities to the UB-106-A-FF, as claimants must affirm their eligibility each week before benefits are released.

Each of these documents plays a key role in the process of claiming unemployment benefits, ensuring that claimants are meeting their obligations while also protecting the integrity of the system. Understanding the relationship among these documents can help claimants navigate the complexities of unemployment insurance effectively.

Dos and Don'ts

Do:

- Fill out your name, social security number, and week ending date accurately.

- Report any work you did and earnings you made during the week.

- Provide detailed information about your job search activities, including dates and employer contacts.

- Submit the form on time to avoid delays in receiving benefits.

Don't:

- Do not falsify any information on the form; this can lead to severe penalties.

- Do not leave any required fields blank, as incomplete information can delay processing.

- Do not ignore the requirement to actively seek work; failure to do so can disqualify you from benefits.

- Do not wait until the last minute to submit the form; early submission is advisable.

Misconceptions

Misconception 1: The UB 106 A Ff form is only necessary for those who are unemployed due to being fired.

In reality, this form must be filled out by anyone claiming unemployment benefits, regardless of the reason for their unemployment. Whether you were laid off, quit, or were terminated, the form is essential to file for benefits.

Misconception 2: Filing online is not any faster than sending the form by mail.

Contrary to this belief, filing your weekly claim on the Internet can lead to quicker payments. Internet filing eliminates delays associated with mail delivery and processing times.

Misconception 3: It is acceptable to skip answering questions on the form.

Every question on the UB 106 A Ff form must be answered accurately. Omitting information could result in your claim being delayed or denied.

Misconception 4: Reporting earnings while receiving benefits is optional.

This is a serious misconception. The law requires you to report any earnings each week you claim benefits. Failure to do so can lead to prosecution and the requirement to pay restitution.

Misconception 5: It’s okay to decline filing for a week without consequences.

While you can choose not to file for a week, this decision means you will not receive benefits for that period. If you choose to decline filing but did not meet work-search requirements, you will also face disqualification from receiving benefits until you earn eight times your weekly benefit amount.

Misconception 6: Once I submit the form, I do not need to do anything else.

Submitting the UB 106 A Ff form is just one part of the process. You must continue to seek work and maintain records of your job search to ensure compliance with regulations. Regular updates may also be required if your situation changes.

Misconception 7: Employers do not share information with the unemployment administration.

This is incorrect. The Arizona Department of Economic Security actively matches hiring information with employer records to verify claims. Transparency is crucial throughout this process.

Key takeaways

When filling out the UB-106-A-FF form, remember these key points:

- Filing Options: You can file your weekly claim online at AZUI.COM for quicker processing, or you can mail the paper form you receive each week.

- Work Search Requirement: You must report a minimum of four job contacts for the week. This is essential to demonstrate that you are actively seeking employment.

- Accurate Reporting: Ensure you accurately report any earnings and job offers. Failing to do so may result in legal consequences, including prosecution.

- Certification and Signature: After completing the form, certify that your statements are true and complete. Sign and date the form before submission.

Browse Other Templates

Bigfoot Java Application - Ensure all sections of the application are filled out for quicker processing.

Sanofi Patient Connection - Insulin injections such as Admelog® and Lantus® are available through this assistance program.