Fill Out Your Uc 1208 Form

The UC 1208 form is an essential document for employers navigating the Pennsylvania Unemployment Compensation (UC) benefits process. This form serves two primary functions: it confirms the address where important correspondence regarding UC benefits will be sent, and it allows employers to appoint an attorney-in-fact to manage their UC-related affairs. Proper completion of the UC 1208 ensures that the Pennsylvania Department of Labor & Industry directs all notices and communications to the designated address, facilitating timely and efficient management of benefits. Employers can showcase their commitment to compliance and effective communication by meticulously filling out both parts of this form. Part A focuses on confirming the employer's address, which is crucial for receiving notifications, while Part B empowers an attorney-in-fact to act on behalf of the employer, allowing them to receive various documents related to UC benefits. This delegation of authority is vital for protecting the employer's interests and streamlining interactions with the UC Benefits Policy and Service Centers. Moreover, by utilizing this form, employers take steps to mitigate potential financial liabilities linked to incorrect benefit charges. Understanding the details of the UC 1208 form is instrumental for any employer wishing to manage UC benefits effectively and responsibly.

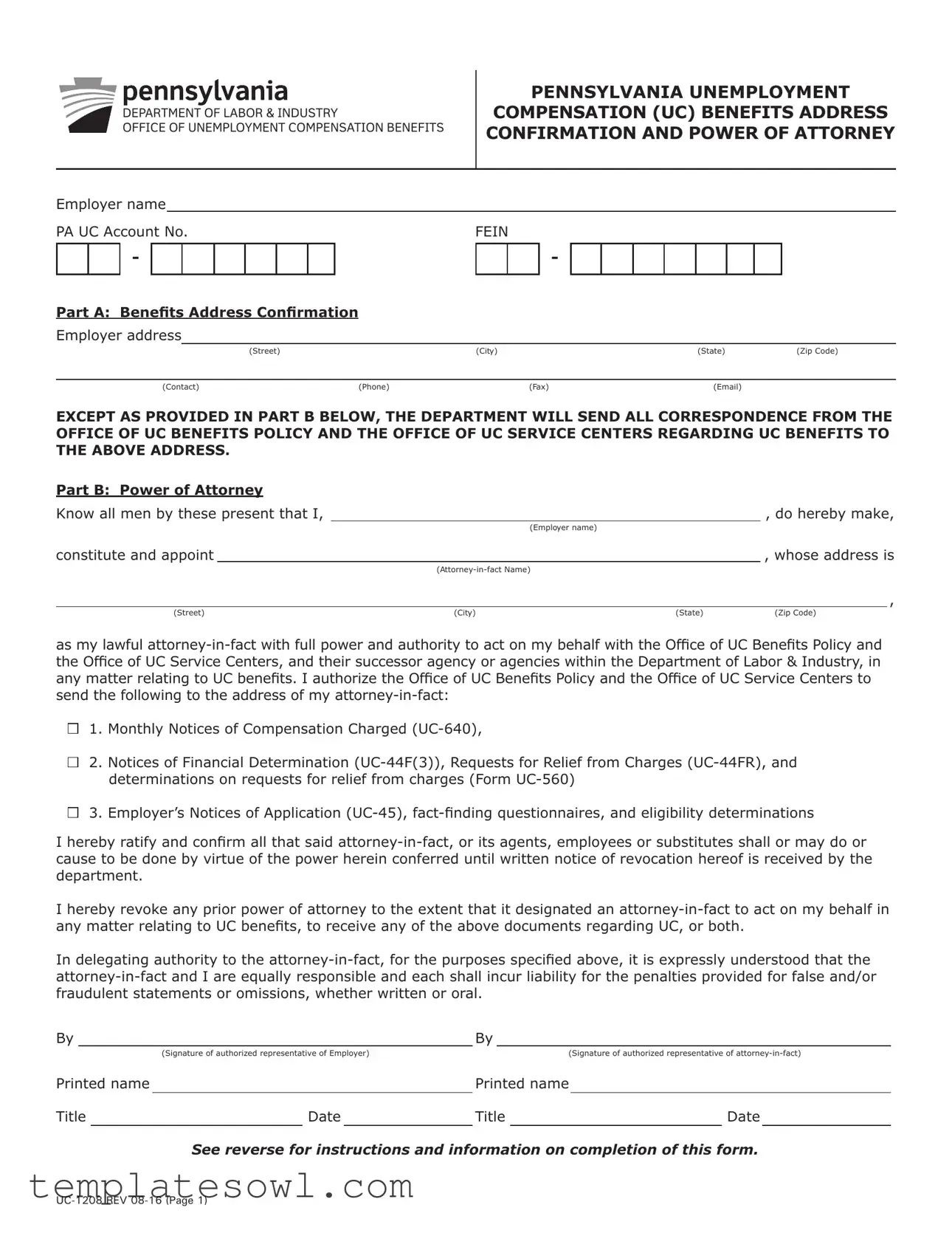

Uc 1208 Example

DEPARTMENT OF LABOR & INDUSTRY

OFFICE OF UNEMPLOYMENT COMPENSATION BENEFITS

PENNSYLVANIA UNEMPLOYMENT

COMPENSATION (UC) BENEFITS ADDRESS CONFIRMATION AND POWER OF ATTORNEY

Employer name

PA UC Account No. |

FEIN |

-

-

Part A: Benefits Address Confirmation

Employer address

(Street) |

|

(City) |

(State) |

(Zip Code) |

|

|

|

|

|

(Contact) |

(Phone) |

(Fax) |

(Email) |

|

EXCEPT AS PROVIDED IN PART B BELOW, THE DEPARTMENT WILL SEND ALL CORRESPONDENCE FROM THE OFFICE OF UC BENEFITS POLICY AND THE OFFICE OF UC SERVICE CENTERS REGARDING UC BENEFITS TO THE ABOVE ADDRESS.

Part B: Power of Attorney |

|

|

|

|

|

Know all men by these present that I, |

|

|

, do hereby make, |

||

|

|

(Employer name) |

|

|

|

constitute and appoint |

|

|

, whose address is |

||

|

|

|

|

|

|

|

|

|

|

|

, |

(Street) |

(City) |

(State) |

(Zip Code) |

||

as my lawful

1. Monthly Notices of Compensation Charged

2. Notices of Financial Determination

3. Employer’s Notices of Application

I hereby ratify and confirm all that said

I hereby revoke any prior power of attorney to the extent that it designated an

In delegating authority to the

By |

|

|

|

By |

|

|

|

||||

|

|

|

(Signature of authorized representative of Employer) |

|

|

(Signature of authorized representative of |

|||||

Printed name |

|

|

|

Printed name |

|

|

|

||||

Title |

|

|

Date |

|

Title |

|

|

Date |

|

||

See reverse for instructions and information on completion of this form.

This power of attorney, when properly executed, will permit the

INSTRUCTIONS

Employer Name - Indicate the employer’s name as it appears on the Pennsylvania Enterprise Registration Form (Form

PA UC Account Number - Indicate the employer's Pennsylvania UC account number. This

FEIN (Federal Employer Identification Number) - Indicate the employer's FEIN. The FEIN will be two digits followed by a dash followed by seven digits, i.e.,

Part A: Benefits Address Confirmation: This is the address where

Part B: Power Of Attorney: You may name an

Insert a check mark in the appropriate box(es) - A check mark in:

Box 1 - will cause Monthly Notices of Compensation Charged (Form

Box 2 - will cause Notices of Financial Determination (Form

Box 3 - will cause Employer Notices of Application (Form

Signature Requirements - This form must be dated and signed by an authorized representative of the employer and the

Return by fax or mail - The completed power of attorney form can be emailed to: addresschangepoa@pa.gov, faxed to

Office of UC Service Centers Attn: Employer Information Center 651 Boas Street, Room 525 Harrisburg, PA

Please be advised that the department cannot guarantee the security of personally identifiable information submitted via unsecured means such as: fax or unencrypted email systems.

UC Taxes

This form may be used only to appoint an

Employers: Save Money by Providing Accurate Information to Employees Who May File for UC Benefits The Employer Information Form (Form

Auxiliary aids and services are available upon request to individuals with disabilities.

Equal Opportunity Employer/Program

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | This form is governed by the Pennsylvania Unemployment Compensation Law. |

| Purpose | The UC-1208 form is used to confirm the employer's benefits address and appoint an attorney-in-fact. |

| Signature Requirements | Both the employer's authorized representative and the appointed attorney-in-fact must sign the form. |

| Correspondence Submission | Any correspondence can be sent to the benefits address unless an attorney-in-fact is appointed. |

| Usage Limitations | This form is specifically for UC benefit matters, not for UC tax purposes. |

Guidelines on Utilizing Uc 1208

After gathering the necessary information and documents, you'll be ready to fill out the UC 1208 form. This form requires you to provide details about your company and designate an attorney-in-fact if desired. Follow the steps below to ensure that the information is accurately submitted.

- Employer Name: Write the name of the employer exactly as it appears on the Pennsylvania Enterprise Registration Form (Form PA-100).

- PA UC Account Number: Enter the seven-digit Pennsylvania UC account number, which can be found on documents such as the New Employer Confirmation Letter (Form UC-1408) or the Contribution Rate Notice (Form UC-657).

- FEIN: Fill in the Federal Employer Identification Number in the format of two digits, a dash, and seven digits (e.g., 23-0000000). If you don’t have an FEIN yet, you can apply for one at IRS.gov.

- Part A - Benefits Address Confirmation: Provide the employer’s address: street, city, state, and zip code. Fill in the contact person's name, phone number, fax number, and email address for correspondence.

- Part B - Power of Attorney: Here, you can appoint an attorney-in-fact who can represent you in matters related to UC benefits. Enter the name and address of the attorney-in-fact including street, city, state, and zip code.

- Authorize Correspondence: Indicate which documents you want the attorney-in-fact to receive by checking the appropriate boxes provided for Monthly Notices of Compensation Charged, Notices of Financial Determination, and Employer Notices of Application.

- Signatures: Ensure that both the employer's authorized representative and the attorney-in-fact sign and date the form. For corporations, the president, vice president, secretary, or treasurer must sign. Partnerships require a general partner’s signature, while sole proprietorships need the owner's signature.

- Submit the Form: Once the form is filled out and signed, you can return it by email to addresschangepoa@pa.gov, fax it to 717-783-3734, or mail it to the designated office in Harrisburg, PA.

Completing this form accurately will help streamline communication between your organization and the Office of UC Benefits Policy. Make sure to keep a copy for your records.

What You Should Know About This Form

What is the purpose of the UC 1208 form?

The UC 1208 form serves two main purposes. First, it allows employers to confirm the address where all correspondence regarding Unemployment Compensation (UC) benefits will be sent. This ensures that important information reaches the employer promptly. Second, it allows employers to appoint an attorney-in-fact. This attorney can represent the employer in matters related to UC benefits and receive relevant correspondence on their behalf.

Who should fill out the UC 1208 form?

The UC 1208 form should be filled out by employers who wish to confirm their benefits address or appoint an attorney to handle UC-related matters. This includes corporations, partnerships, and sole proprietorships. For a corporation, an authorized representative, such as a president or vice president, must sign the form. In a partnership, a general partner must complete it. Sole proprietors simply sign on their own behalf.

How does one appoint an attorney-in-fact using the UC 1208 form?

To appoint an attorney-in-fact, the employer must complete Part B of the form. This includes entering the name and address of the attorney-in-fact and providing authorization for them to receive certain documents pertaining to UC benefits. There are boxes to check off which types of correspondence the attorney-in-fact will receive. Lastly, both the employer and the appointed attorney must sign and date the form for it to be valid.

What types of correspondence can the attorney-in-fact receive?

The attorney-in-fact can receive several types of correspondence if authorized. This includes Monthly Notices of Compensation Charged, Notices of Financial Determination, Requests for Relief from Charges, Employer’s Notices of Application, and other eligibility determinations. By allowing an attorney-in-fact to receive this correspondence, the employer can ensure that relevant information is managed effectively.

How should the completed UC 1208 form be submitted?

Once the UC 1208 form is completed and signed, it can be submitted in a few ways. The employer can mail it to the Office of UC Service Centers in Harrisburg, Pennsylvania, or fax it to the provided number. Additionally, for convenience, the form can be emailed. However, it is important to note that sending sensitive information via unsecured methods may pose risks to personal data, so caution is advised.

Common mistakes

Filling out the UC 1208 form can be straightforward, but many make critical errors that can complicate the process. One common mistake is inaccurate employer information. The employer name must match exactly what appears on the Pennsylvania Enterprise Registration Form, or discrepancies can lead to delays. Double-check the spelling to ensure smooth processing.

Another frequent error involves the Pennsylvania UC account number. This seven-digit number is vital, and forgetting or miswriting it can cause issues. New employers should remember to register with the department if they don’t have an account number yet. This step is crucial and must not be overlooked.

The FEIN, or Federal Employer Identification Number, presents yet another opportunity for mistakes. The correct format is essential: two digits, a dash, and seven digits following the dash (for example, 23-0000000). Errors in this section can lead to significant hold-ups, so it’s wise to review it carefully. If one hasn’t been assigned an FEIN, applying promptly through the IRS is advised.

Completing Part A of the form often gets overlooked. Employers must ensure that the Benefits Address Confirmation is accurate. This is where all correspondence related to unemployment compensation will be sent unless an attorney-in-fact is appointed. The address must be current and checked for accuracy before submission.

The appointment of an attorney-in-fact in Part B can also lead to errors. It’s essential to fully understand the implications of appointing someone to act on behalf of the employer. Failing to mark the appropriate boxes for which categories of correspondence the attorney will receive can result in missed notices and critical information.

Another aspect that can create confusion is the signature requirements. It's mandatory for both the authorized representative of the employer and the attorney-in-fact to sign the form. Neglecting to secure all necessary signatures will result in the form being returned and delays in processing.

Submission methods present their challenges. Many individuals mistakenly assume that submitting the form via unsecured means, like unencrypted email or fax, is safe. The department issues warnings about the risks associated with sending personally identifiable information in this manner. Always consider the security of the submission method.

Lastly, using the UC 1208 for the wrong purposes is a critical error. This form specifically caters to UC benefit matters and should not be used for tax-related issues. To handle matters regarding UC taxes, a different procedure must be followed. Misusing the form can lead to extended processing times and confusion about the status of both benefit claims and tax responsibilities.

Documents used along the form

The UC 1208 form is an important document used by employers in Pennsylvania to confirm their benefits address and appoint an attorney-in-fact for handling unemployment compensation matters. Along with the UC 1208 form, several other forms may also be necessary. Here’s a list of related documents you might encounter.

- UC-640 - Monthly Notices of Compensation Charged: This form provides employers with monthly updates on the compensation charges associated with unemployment claims against them.

- UC-44F(3) - Notices of Financial Determination: This document informs employers of the financial determinations made regarding unemployment compensation claims filed by their former employees.

- UC-44FR - Requests for Relief from Charges: Employers can use this form to request relief from charges that may result from unemployment benefits paid out to an individual after separation.

- UC-560 - Determinations on Requests for Relief from Charges: This is a formal decision regarding an employer's request for relief from specific charges outlined in the UC-44FR form.

- UC-45 - Employer’s Notices of Application: This document notifies employers when an unemployment compensation application has been filed by a former employee.

- UC-1609(P) - Employer Information Form: This form allows employers to provide accurate information about separating employees, which can help avoid unnecessary charges to their unemployment account.

- PA-100 - Pennsylvania Enterprise Registration Form: This registration form is necessary for employers to set up their Pennsylvania Unemployment Compensation account.

Being familiar with these documents can help streamline the process of managing unemployment compensation in Pennsylvania. Ensure you have the proper forms and understanding to facilitate effective communication with the Office of UC Benefits Policy and the Office of UC Service Centers.

Similar forms

- Form UC-640 (Monthly Notices of Compensation Charged) - This document serves as a report that details the compensation charged to an employer's account. Similar to the UC-1208, it involves communication about unemployment compensation costs and allows for the receipt of important financial information.

- Form UC-44F(3) (Notices of Financial Determination) - This form provides a determination of an employee’s eligibility for unemployment benefits. Like the UC-1208, it requires official confirmation of correspondence, ensuring the employer is informed about benefit claims.

- Form UC-44FR (Requests for Relief from Charges) - This document is used when an employer wishes to contest charges against their account. It parallels the UC-1208 in that both establish a formal relationship between the employer and the office handling unemployment claims.

- Form UC-560 (Determinations on Requests for Relief from Charges) - Similar to the UC-44FR, it provides the outcome of an employer's request to dispute charges. Both forms facilitate communication regarding financial implications for the employer.

- Form UC-45 (Employer’s Notices of Application) - This form alerts employers when a claim for benefits has been made. In the same way as the UC-1208, it keeps employers informed about applications affecting their records.

- Form UC-851 (Notice of Pennsylvania Unemployment Compensation Responsibilities) - This notification outlines an employer's responsibilities and obligations under unemployment compensation law. Like the UC-1208, it serves to guide employers through compliance matters.

- Form UC-657 (Contribution Rate Notice) - This document informs employers of their contribution rates for unemployment compensation. It aligns with the UC-1208 in relaying significant financial obligations that an employer needs to monitor closely.

- Form UC-1408 (New Employer Confirmation Letter) - This letter confirms that an employer has been registered in the Pennsylvania unemployment system. It shares the UC-1208’s role of affirming essential information and official processes related to UC.

- Form UC-1609(P) (Employer Information Form) - This form is used to provide accurate information for separating employees applying for benefits. Its purpose is aligned with the UC-1208 in managing the flow of accurate and relevant information between employers and the UC system.

Dos and Don'ts

When filling out the UC 1208 form, there are specific actions to take and avoid. Here’s a clear guide:

- Do provide accurate information regarding the employer's name as it appears on official documents.

- Do include the correct PA UC Account Number to ensure proper processing.

- Do check the right boxes to authorize the attorney-in-fact for the necessary correspondence.

- Do ensure signatures are provided by both the employer's authorized representative and the attorney-in-fact.

- Do submit the form through the recommended channels: email, fax, or mail.

- Don't leave any fields blank, especially critical identifiers like FEIN and account numbers.

- Don't use this form for UC tax matters; it is strictly for benefits-related appointments.

- Don't submit the form via unsecured means if you can help it to protect sensitive information.

- Don't forget to revoke any prior powers of attorney that might conflict with the new designation.

Following these guidelines will help ensure that the form is completed correctly and that the processing of your request goes smoothly.

Misconceptions

- Misconception 1: The UC 1208 form is only necessary for large employers.

- Misconception 2: Filing the UC 1208 form grants unlimited power to the attorney-in-fact.

- Misconception 3: You can use the UC 1208 form for any legal representation.

- Misconception 4: The attorney-in-fact is not responsible for any errors.

Many believe that only large companies or organizations need to complete the UC 1208 form. In reality, any employer in Pennsylvania who wishes to appoint someone to handle unemployment compensation matters should utilize this form, regardless of size.

Some employers think that signing the UC 1208 form gives the attorney-in-fact complete authority to act without limits. However, the scope of authority is specifically defined in the form, and it is limited to matters concerning unemployment compensation benefits.

It's a common misunderstanding that this form can serve for all types of legal representation. The UC 1208 is specifically designed for unemployment compensation matters, including the receipt of various notices. For other legal needs, different forms are required.

Some employers think that appointing an attorney-in-fact absolves them of all responsibility. This is not correct. Both the employer and the attorney-in-fact bear responsibility for any mistakes made in the handling of unemployment compensation matters, particularly regarding false statements or omissions.

Key takeaways

Completing and utilizing the UC 1208 form is an important process for employers in Pennsylvania dealing with unemployment compensation (UC) benefits. Below are key takeaways that can guide employers in effectively filling out and managing this form.

- Accurate Information is Crucial: Ensure that the employer's name, Pennsylvania UC account number, and Federal Employer Identification Number (FEIN) are filled out correctly. These details appear on various employer documents and must match exactly.

- Designate an Attorney-in-Fact: Employers have the option to appoint an attorney-in-fact to handle benefits-related matters. This attorney can receive specified correspondence, which streamlines communication and management of UC benefits.

- Understand Correspondence Categories: The UC 1208 allows selection of specific correspondence types to be sent to the attorney-in-fact. Review the categories thoroughly to ensure relevant documents are directed to the right person.

- Signature Requirements: This form must be signed and dated by both the authorized representative of the employer and the attorney-in-fact. Ensure that the appropriate individuals sign the form as required under business entity laws.

- Submission Options: Completed forms can be returned electronically or by mail. Options include emailing, faxing, or mailing the form directly to the Office of UC Service Centers, so choose the most convenient method for your situation.

- Do Not Confuse Purposes: The UC 1208 form is specifically for matters concerning UC benefits and should not be used for UC tax issues. Ensure you are using the correct form to avoid complications.

By adhering to these guidelines, employers can facilitate a smoother process in managing unemployment compensation benefits in Pennsylvania.

Browse Other Templates

Drhomeair - The form requires both your name and the address where the test will occur.

Warranty Deed Louisiana - The form aims to minimize potential legal issues in a property sale.