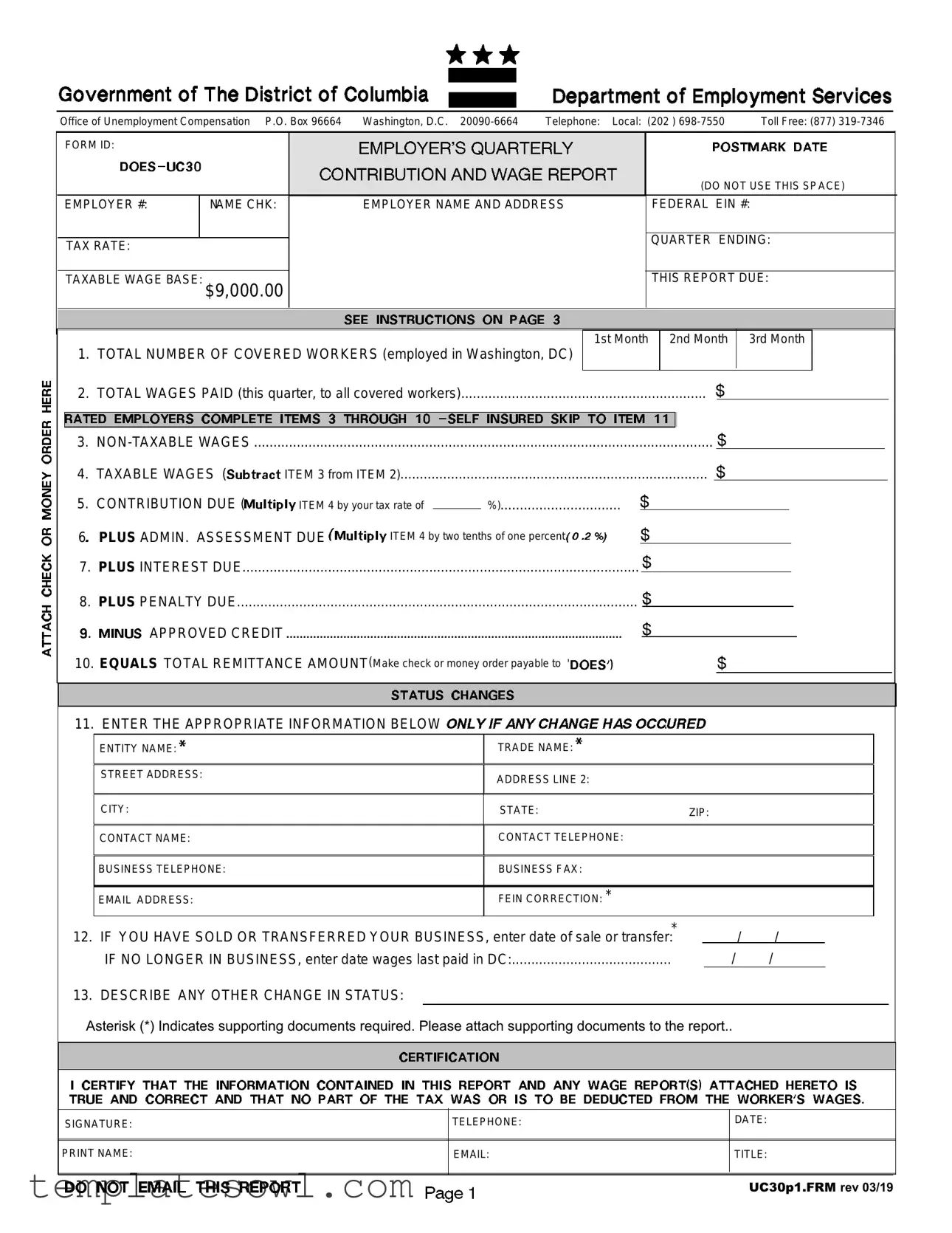

Fill Out Your Uc 30 Form

The UC 30 form is a crucial document for employers operating in Washington, D.C., as it serves to report quarterly contributions and wages paid to employees. Each employer must complete this form, especially if they have staff working in the District of Columbia, regardless of whether any wages are owed. The form collects essential information, including the employer's name, Federal Employer Identification Number (EIN), and the quarter ending date. It requires details about the number of covered workers, total wages paid, and a breakdown of taxable and non-taxable wages. The UC 30 also outlines the contributions due, administrative assessments, potential penalties for late submissions, and interest that may accrue if payments are not made promptly. Additionally, there are specific guidelines for entities such as those with over 250 employees, who are mandated to file electronically. Accurate completion of this form not only ensures compliance with local regulations but also benefits businesses by maintaining good standing with the Department of Employment Services. The requirement to attach supporting documents for any changes in business status reinforces the importance of precise record-keeping and timely filing for all employers. Understanding the components of the UC 30 form can significantly alleviate the complexities involved in the reporting process, fostering confidence among employers in fulfilling their obligations.

Uc 30 Example

Office of Unemployment Compensation |

P.O. Box 96664 |

Washington, D. . |

Toll Free: (877) |

||||||||||||||||||||||||

|

FORM ID: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(DO NOT USE THIS SPACE) |

|||||||||||

|

EMPLOY R #: |

|

NA E CHK: |

|

EMPLOYER NAME AND ADDRE |

|

FEDERAL EIN #: |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

QUARTER ENDING: |

|

||||||||||||

|

T X RATE: |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

T X BLE WAGE BASE: |

|

|

|

|

|

|

|

|

|

|

THIS REPORT DUE: |

|||||||||||||||

|

|

$9,000.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

TOTAL NUMBER |

F COV |

RED WORKE |

S (employed in Washington, DC) |

1st Month |

|

2nd Month |

3rd Month |

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

TOTA WAGES |

AID (this quarter, to all covered workers) |

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

4 |

TAXABLE WAGES ( |

ITEM 3 from ITEM 2) |

|

|

|

|

|

|

|

|

|

||||||||||||||||

5 |

CONTRIBUTION DUE ( |

|

ITEM 4 by your tax rate of |

|

|

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

6 |

PLUS ADMIN. ASSESSMENT DUE |

ITEM 4 by two tenths of one percent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

7 |

PLUS INTEREST DUE |

... .. .. ... .. .. ... .. .. ... .. .. .... |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

8 |

PLUS PENALTY DUE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

APPROVED CREDIT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

10.EQUALS TOTAL REMITTANCE AMOUNT(Make check or money order payable to '

11. ENTER THE APPROPRIATE INFORMATION BELOW |

|

: |

|

|

ENTITY NAME: |

TRADE NAME: |

|

|

|

|

|

|

STREET ADDRESS: |

ADDRESS LI |

2: |

|

|

||

|

|

|

|

|

CITY: |

STATE: |

ZIP: |

|

|

|

|

|

C NT CT N M : |

CONT CT TELEPHONE: |

|

|

|||

|

|

|

|

|

BUSI ESS TELEP ONE: |

BUSINESS FAX: |

|

|

|

|

|

|

EM IL ADDRESS: |

FEIN CORRECTION: * |

|

12. |

OU |

V SOLD |

TRA SFER ED YOUR BUS NESS, enter date of sale or transfer:* |

|

/ |

/ |

|

|

||

|

O L NGER IN BUSINESS, enter date wages last paid in DC: |

|

/ |

/ |

|

|

||||

13. |

DESCRIBE |

NY OTHER CHA GE IN ST TUS: |

|

|

|

|

|

|||

Asterisk (*) Indicates supporting documents required. Please attach supporting documents to the report. |

. |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE:

TELEPHONE:

DATE:

PRINT AME:

EMAIL:

TITLE:

UC30p1.FRM rev 03/19

GovernmentofTheDistrictofColumbia |

DepartmentofEmploymentServices |

|

||||||||||

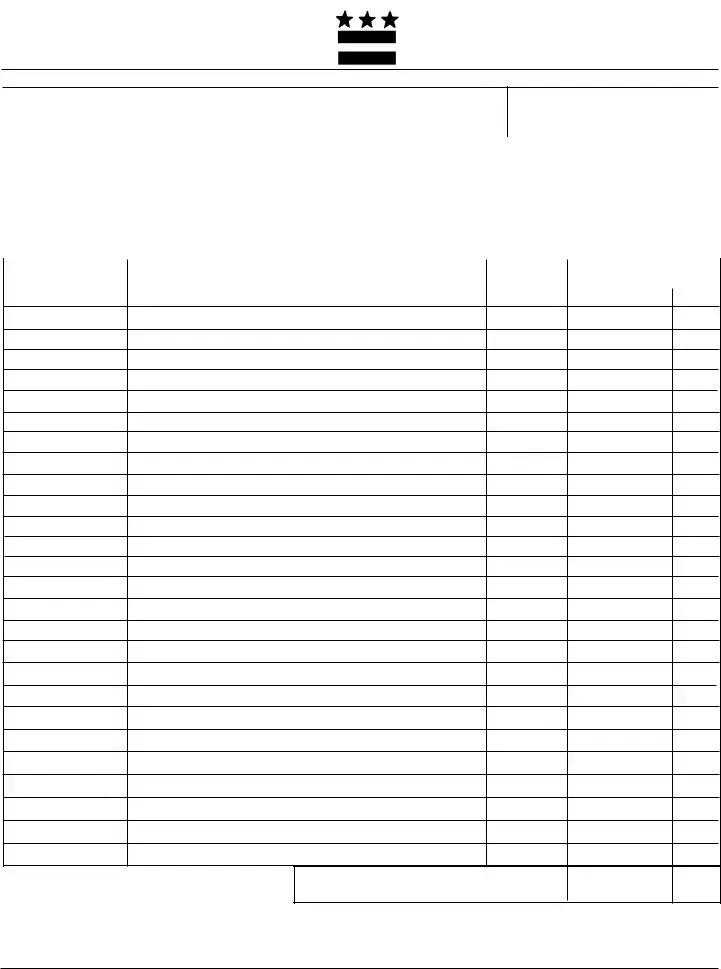

14. EMPLOYEEEE WAGE INFORMATIONEMPLOYEENAMEFOR(PLEASETHISTYPEQUARTERORPRINT) |

|

|

TAL |

|

|

TOTALGROSSPAIDTHISQUARTRWAGES |

|

|||||

|

Office of Unemployment Compensation . |

. Box 96664 Washington, D. . |

Telephone: Local: |

Toll Free - (877) |

|

|||||||

|

|

|

CONTRIBUTIONEMPLOYER'SANDQUARTERLYWAGEREPORT |

|

HTOURS |

|

POST MARK DATE: |

|

||||

|

|

FORM ID: |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

(DO NOT USE THIS SPACE) |

|

||

|

|

EMPLO ER #: |

NAME CHK: |

|

EMPLOYER'S NAME AND ADDRESS |

|

FEDERAL EIN #: |

|

||||

|

|

|

|

|

|

|

|

|

|

|||

|

|

TAX RATE: |

|

|

|

|

|

QU RTER ENDING: |

|

|||

|

|

|

|

|

|

|

|

|

|

|||

|

|

TAXABLE WAGE BASE: |

|

|

|

|

|

THIS REPORT DUE: |

|

|||

|

|

|

$9,000.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

SOC. SEC. NO. |

|

|

LAST NAME, FIRST NAME, MI |

|

WORKED |

|

DOLLARS CENTS |

|

||

NOTE: DC law requires that employers with 250 or more employeesTOTPageALMUSTW2AGESFILETHISwagePreportsAGEelectronically on Employer

DONOTEMAILTHISREPORT

GovernmentofTheDistrictofColumbia |

|

DepartmentofEmploymentServices |

|||

INSTRUCTIONSFORFILINGTHEEMPLOYER'SQUARTERLYCONTRIBUTIONANDWAGEREPORT |

|

||||

|

|

|

|||

|

stateofresidence. regardless |

oftheir |

|||

|

You must file this port for the quarter indicated if you had employees who worked in the District of Columbia |

||||

|

|

any |

|||

Office of Unempl yment Compensation P.O. Box 96664 Washington, D.C. |

|||||

|

oYouhavemustclosedyouralso file thisaccountreportorhaveeven if youbeendidplacedinnot pay |

wagesinactivestatusto employees.for work done in the District of Columbia unlessyou |

|||

RECORDKEPYou mustNG:file this report even if you paid wages and had no tax liability.

|

Please make a copy of the report for your records. |

EXTENSPOLICY:ONThis Office has NOauthority to offer extensions of time to file quarterly reports or to pay amount due. |

|

PAYMENT |

In addition to the PENALTYdiscussed in ITEM8,if a payment to DOES is DISHONORED,a $65.00 penalty |

1: |

will be imposed. |

TOTAL NUMBER OF COVERED WORKERS: For each month, count all workers (including corporate officials, executives, etc.) who performed services in or received pay for any part of the payroll period that includes the 12th of the month.

2TOTAL WAGES PAID THIS QUARTER. Enter the total gross wages paid (before deductions) including the cash value of all remuneration paid in any medium other than cash. Gross wages must agree with the total of all wages reported under ITEM 14

3:of your quarterly wage report. If you paid no wages, enter '0'.

4computing the first $9,000 paid.

|

|

|

|

TAXABLE WAGES. Subtract ITEM 3 from ITEM 2. Taxable wages are limited to the first $9,000 of gross remuneration paid to |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

DOES, |

|

96664, |

|

|

|

|

|

|

|

20090 |

|

|||||

|

|

5each employee in any Calendar Year, regardless of the state to which the wages were reported. |

|

|

|

|

|

|

|||||||||||||||||||||

|

|

6 |

|

CONTRIBUTION DUE. Amount of UI taxes owed to |

|

. Multiply ITEM |

|

by your tax rate. Report this amount on IRS form 940. |

|||||||||||||||||||||

|

|

|

|

ADMINISTRATIVE SSESSMENT DUE. Amount of Administrative Assessment owed to DOES. Multiply ITEM 4 by two tenths of |

|||||||||||||||||||||||||

|

|

7one percent (0.2 %). Do not report this amount on IRS form 940 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

10:8: |

INTEREST DUE. Interest of 1.5 % p r month or fraction of month of the amount due will be assessed if the amount due |

||||||||||||||||||||||||||

I |

|

on the report is not paid by the end of the month f |

llowing the close of the quarter to which it pertains. |

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

Port |

or |

|

loyees |

|

|

|

|

re |

|

electroni |

ouraged |

|

|

||||||||||

TEM |

|

|

|

|

|

|

ttps://essp |

|

|

|

|

|

|

loyers |

|

|

, will be assessed if |

||||||||||||

|

|

PENALTY DUE. In addition to inter st, a penalty |

f 10 % of the amount due, BUT NOT LESS THAN $100. |

||||||||||||||||||||||||||

|

|

|

|

this report is n |

filed, |

|

if the amount |

ue is not paid by the end of the month following |

he close of the quarter to which it |

||||||||||||||||||||

|

|

|

reports |

|

|

|

|

|

|

informati |

|

electronic filing, please |

|

|

|

|

|

|

|

||||||||||

|

|

9: |

pertains. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

APPROV |

D C |

EDIT. The amo nt of your approved credit that will be appl ed towards your am unt |

wed. (Please contact |

||||||||||||||||||||||

|

|

|

|

DOES to confirm he amount any cred t balance |

n the acc unt). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

TOTAL |

MITTANCE AMOUNT. Add I |

EMS 5, 6, 7 and 8, then subtract ITEM 9. Make ch ck |

|

mon y rder payable to |

|||||||||||||||||||||

|

|

|

|

'DEPARTMENT OF EMPLOYMENT SERVICES' |

|

'DOES'. Y u must include your |

|

m oy r UI Tax acc unt number nd the |

|||||||||||||||||||||

|

S: |

|

MAILREPORTANquart /y ar on your checkDONOTsendcashorEMAILTHISREPORTPAYMENTTO:DCmoney o er. Attach y ur paymentPOBOXon the first page.WASHINGTONin the space providedDC,. |

|

|

||||||||||||||||||||||||

|

STATUS CHANGES. If any information isted has chaPageged 3since the ast |

|

ting period, please enter he chang d inf rmation |

||||||||||||||||||||||||||

TEM14:and |

ovide supporting documentation as indicated by asterisk (*). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

EMPLOYEE WAGE INFORMATION. Enter |

ach employee's c mplete s |

|

|

al security number, c mplete na |

e, total h urs |

||||||||||||||||||||

|

|

|

|

w rk |

d n the quarter, and total wag |

|

paid |

this quarter. Wages for an |

mploy |

are |

include all |

|

emuneration paid, such as |

||||||||||||||||

|

|

|

|

tips receiv |

d fr |

m cust |

mers, bonus s, commi sions, everance p |

y, vacati pay, si k |

y (unl |

ss paid under a third party |

|||||||||||||||||||

ulting fromMUSTFILEwageorts.desornaboutinstatement.dc.gov.Allemof mploymentp |

as areenwell thecallyonEmployrsrefertoPART2onvalue of meatosfileandwagelod ing. |

||||||||||||||||||||||||||||

UC30p3.FRM rev 03/19

UC30p4.FRM rev 03/19

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Body | The UC-30 form is managed by the Government of the District of Columbia's Department of Employment Services. |

| Required Filing Frequency | Employers must file the UC-30 form on a quarterly basis, as specified by the applicable employment laws. |

| Employer Eligibility | All businesses operating in the District of Columbia with employees must submit this form if any services were rendered during the quarter. |

| Wage Reporting | Employers are required to report both taxable and non-taxable wages paid to employees during the quarter. Taxable wages are limited to the first $9,000 paid to each employee per calendar year. |

| Electronic Filing | Employers with 250 or more employees are mandated to file the UC-30 electronically. All employers are encouraged to utilize the Employer Self-Service Portal (ESSP) for electronic submissions. |

| Penalties for Non-Compliance | If the UC-30 form is not filed by the due date, a penalty of 10% of the amount due may be assessed, with a minimum fine of $100. |

| Contact Information | To inquire about the UC-30 form or for assistance, employers can contact the Department of Employment Services at (202) 698-7550 or toll-free at (877) 319-7346. |

Guidelines on Utilizing Uc 30

After gathering all necessary information, proceed to fill out the UC 30 form accurately. Ensure you have all required details for compliance and avoid any penalties.

- Write the name and address of your business at the top of the form.

- Fill in your Federal Employer Identification Number (FEIN).

- Indicate the quarter ending date.

- Enter your tax rate and taxable wage base.

- State the total number of covered workers employed in Washington, D.C., for each of the three months of the quarter.

- Document total wages paid to all covered workers during the quarter.

- List any non-taxable wages paid during this period.

- Calculate taxable wages by subtracting non-taxable wages from total wages.

- Determine the contribution due based on taxable wages and your tax rate.

- Calculate the administrative assessment as a percentage of taxable wages.

- Add any interest and penalties due, if applicable.

- Calculate the total remittance amount and make the check or money order payable to the "Department of Employment Services".

- Complete the contact information fields, including the entity name, address, and contact numbers.

- If applicable, indicate any changes in business status and provide supporting documents.

- Sign and date the form before submission.

Once completed, mail the form to the indicated address, ensuring it is postmarked by the due date. Keep a copy for your records.

What You Should Know About This Form

What is the UC-30 form used for?

The UC-30 form is used by employers in the District of Columbia to report contributions for unemployment insurance and to provide a summary of wages paid to covered workers during a specific quarter. This form is essential for ensuring compliance with local unemployment compensation laws.

Who needs to file the UC-30 form?

Any employer who has employees working in Washington, D.C., must file the UC-30 form, regardless of the number of employees or the amount of wages paid. This includes businesses that are currently operational as well as those that may have had no tax liability but have employees working in the district.

When is the UC-30 form due?

The UC-30 form must be submitted by the end of the month following the end of each quarter. For instance, if the quarter ends on March 31, the report is due by April 30. Failing to meet this deadline may result in penalties.

What information is required on the UC-30 form?

The form requires several key pieces of information, including the employer's name and address, the Federal Employer Identification Number (EIN), the quarter ending date, total wages paid, non-taxable wages, taxable wages, and contributions due. Additionally, it requests a breakdown of employee wage information and any status changes since the last filing.

What are the penalties for not filing the UC-30 form on time?

Penalties for late filing of the UC-30 form may include a 10% penalty on the amount due, with a minimum penalty of $100. Furthermore, interest may accrue at a rate of 1.5% per month if the amount owed remains unpaid beyond the due date. This increases the financial burden on the employer.

Can I file the UC-30 form electronically?

Yes, employers with 250 or more employees are required to file the UC-30 electronically using the Employer Self-Service Portal (ESSP) provided by the Department of Employment Services. However, all employers are encouraged to take advantage of electronic filing to streamline the process.

What if I have changes in my business status?

If there are any changes to your business status, such as a sale, transfer, or closure, you must report this on the UC-30 form. It is essential to provide accurate and updated information as it affects your tax liabilities and unemployment contributions.

Common mistakes

Filling out the UC 30 form accurately is crucial for employers in Washington, D.C., yet many make common mistakes that can lead to complications. One frequent error is failing to include the correct Federal Employer Identification Number (EIN). This number is vital for identifying the business and ensuring proper reporting of wages and contributions. Omitting or misprinting this number can delay processing and lead to penalties.

Another common mistake involves inaccurately reporting the total number of covered workers. Employers sometimes miscount or misunderstand who qualifies as a covered worker. A miscalculation can impact tax rates and assessments, and it is important to include all employees, including executives and corporate officials who received wages during the quarter.

In addition, many people neglect to update their information about status changes. When businesses undergo changes, such as selling or transferring ownership, it is necessary to report these alterations on the form. Failure to disclose this information can lead to problems with compliance and potential penalties.

Another frequent error arises with the reporting of taxable and non-taxable wages. Employers may inadvertently misclassify wages, leading to significant discrepancies in what is owed. Understanding the difference and accurately calculating amounts ensures that the form reflects the true financial position of the business.

Additionally, many users underestimate the importance of double-checking supporting documentation. Some forget to attach the required documents mentioned in the form. This oversight can cause delays in processing, as the Office of Unemployment Compensation may need to reach out for the missing paperwork.

Lastly, postponing the submission of the form can lead to unnecessary penalties. Employers often rely on the misconception that late filings will not incur consequences. However, financial penalties can accumulate quickly if the report is not submitted on time. Being proactive in filing and payment can save businesses money and avoid complications.

Documents used along the form

The UC 30 form is crucial for employers in Washington, D.C., to report quarterly contributions and wages. It is typically accompanied by several other forms and documents to ensure compliance with local regulations. Here’s a brief list of those documents, which may be required based on specific circumstances.

- W-2 Form: This form reports an employee’s annual wages and the taxes withheld from their paychecks. Employers issue it at the end of the tax year for each employee.

- Form 940: This federal tax form reports annual Federal Unemployment Tax Act (FUTA) tax liability. Employers use it to detail unemployment tax payments made throughout the year.

- Form 941: This form is filed quarterly to report income taxes, social security tax, and Medicare tax withheld from employee paychecks. It summarizes tax liabilities paid by the employer.

- Employer Self-Service Portal (ESSP) Documentation: Employers with 250 or more employees must use this online portal to file wage reports electronically. Supporting documents may be required for this submission.

- Payroll Records: Employers need to maintain detailed payroll records, including wages, hours worked, and other compensation details. These records support the information reported on forms like the UC 30.

- State-Specific Supplemental Reports: Certain states may require additional reporting or documentation. Employers should check for any unique local requirements that apply to their business.

Employers should ensure that all necessary documents are completed and submitted accurately. Maintaining these records not only helps in compliance but also shields businesses from potential penalties or disputes.

Similar forms

When considering the UC 30 form, which serves to report contributions and wages, one can draw parallels with several other documents that fulfill similar purposes in the realm of employment and taxation. Here are four such documents:

- Form W-2: This is the year-end wage and tax statement that employers provide to their employees. Like the UC 30 form, it details wages paid and taxes withheld, though it covers the entire year rather than a quarterly period.

- Form 940: This annual Federal Unemployment Tax Return reports an employer's annual contributions to federal unemployment insurance. Similar to the UC 30, it requires accurate reporting of wages, but it focuses on the overall year rather than quarterly results.

- Form 941: This is the Employer’s Quarterly Federal Tax Return, which reports income taxes, Social Security tax, and Medicare tax withheld from employee's paychecks. Just as the UC 30 form, this document is filed quarterly and contains detailed information about employee wages and tax liabilities.

- Form 1099-MISC: This form is used to report payments to independent contractors. While the UC 30 focuses on employees, both forms require comprehensive reporting of remuneration and tax obligations, reinforcing the obligation to report income accurately.

Understanding the similarities and differences between these documents helps employers navigate their reporting responsibilities efficiently.

Dos and Don'ts

When filling out the UC 30 form, follow these guidelines to ensure proper completion.

- Do provide accurate information. Double-check your employer information, including the name, address, and Federal EIN. Errors can lead to delays.

- Don't leave fields blank. Ensure every required field is filled out. If a question does not apply, indicate it clearly instead of leaving it empty.

- Do attach supporting documents where necessary. If a section requires additional documentation, include it to avoid complications.

- Don't forget the payment. Ensure you include the correct payment along with the report. Failure to do so can result in penalties.

- Do keep a copy for your records. After submission, retain a copy of the completed form and any supporting documents for future reference.

Misconceptions

-

Misconception 1: Employers can skip the UC 30 form if they did not pay any wages during the quarter.

This is not true. Even if no wages were paid, employers must still file the UC 30 form. The requirement to file exists regardless of tax liability.

-

Misconception 2: The UC 30 form only applies to businesses with a high number of employees.

In fact, the UC 30 form is required for any employer with employees working in Washington, D.C., regardless of how many employees they have.

-

Misconception 3: Employers have an automatic extension to file the UC 30 form.

-

Misconception 4: Employers can submit the UC 30 form via email.

This is incorrect; the UC 30 form must not be emailed. Instead, it should be mailed to the designated address to ensure it is processed correctly.

Key takeaways

Filling out the UC 30 form correctly is essential for employers in Washington, D.C. Here are some key takeaways to keep in mind:

- Timeliness is crucial. The UC 30 form must be submitted by the due date, which is the end of the month following the close of the quarter. Late submissions can lead to penalties.

- Complete all required sections. Ensure that every section of the form is filled out, including your business name, Federal EIN, and the total wages paid. Incomplete forms can result in processing delays.

- Understanding taxable and non-taxable wages is key. Report total wages accurately: taxable wages should not exceed $9,000 per employee for the calendar year, while non-taxable wages must be carefully calculated to avoid discrepancies.

- Electronic filing is encouraged. For companies with 250 or more employees, filing electronically through the Employer Self-Service Portal is mandatory. However, all employers are encouraged to file electronically for convenience.

- Keep copies of your filings. Always retain a copy of the submitted form for your own records. This practice can be beneficial for future reference, especially in case of audits or discrepancies.

Browse Other Templates

Ppvt-5 Score Interpretation - Results are critical for understanding language development in children and adults.

Responsibility Roster,Task Tracker,Chore Log,Duty Dashboard,Family Contribution Chart,Household Task Board,Chore Schedule,Activity Allocation Sheet,Weekly Task Planner,Kid's Chore Organizer - Address issues of non-completion with encouragement, not punishment.