Fill Out Your Uc 5A Form

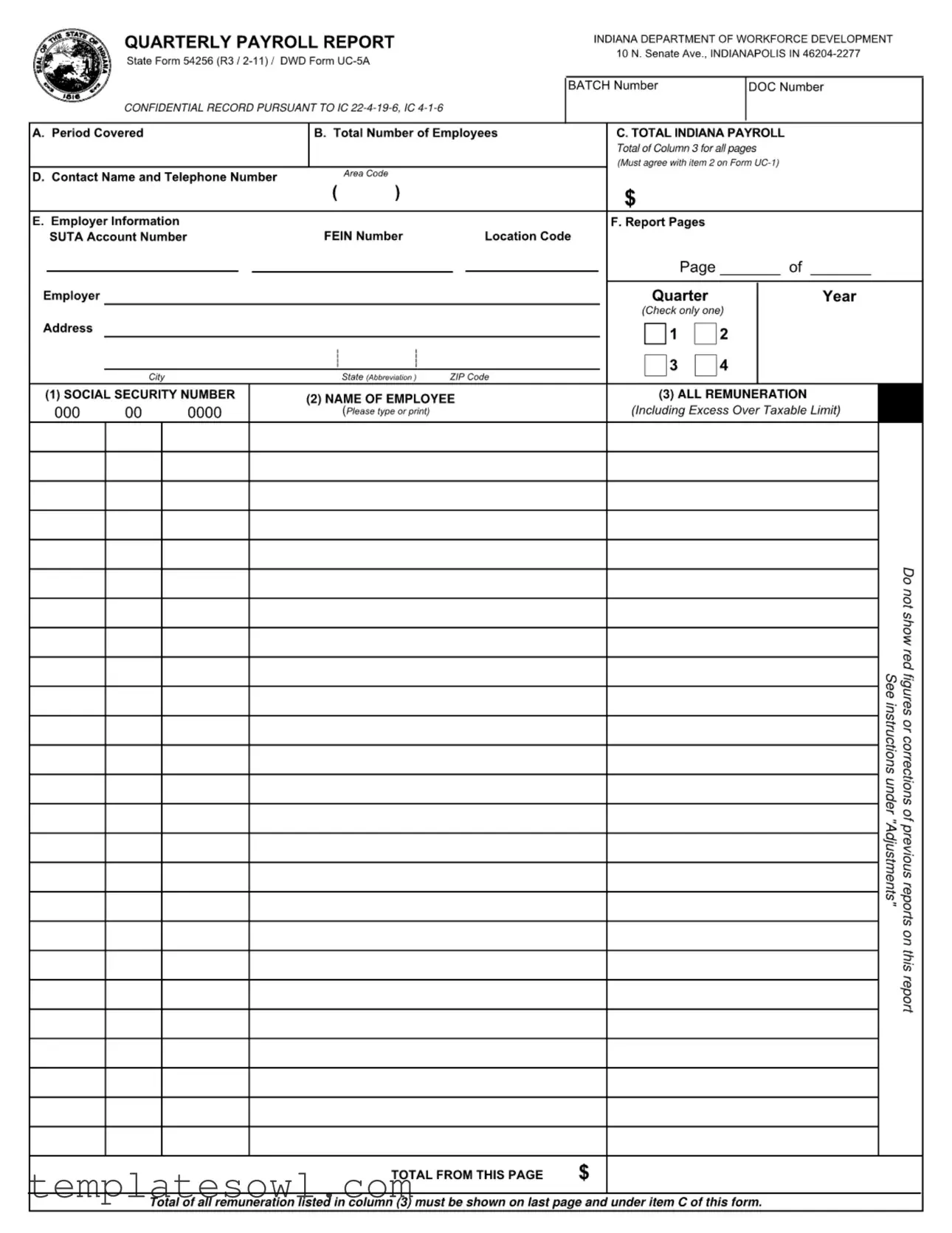

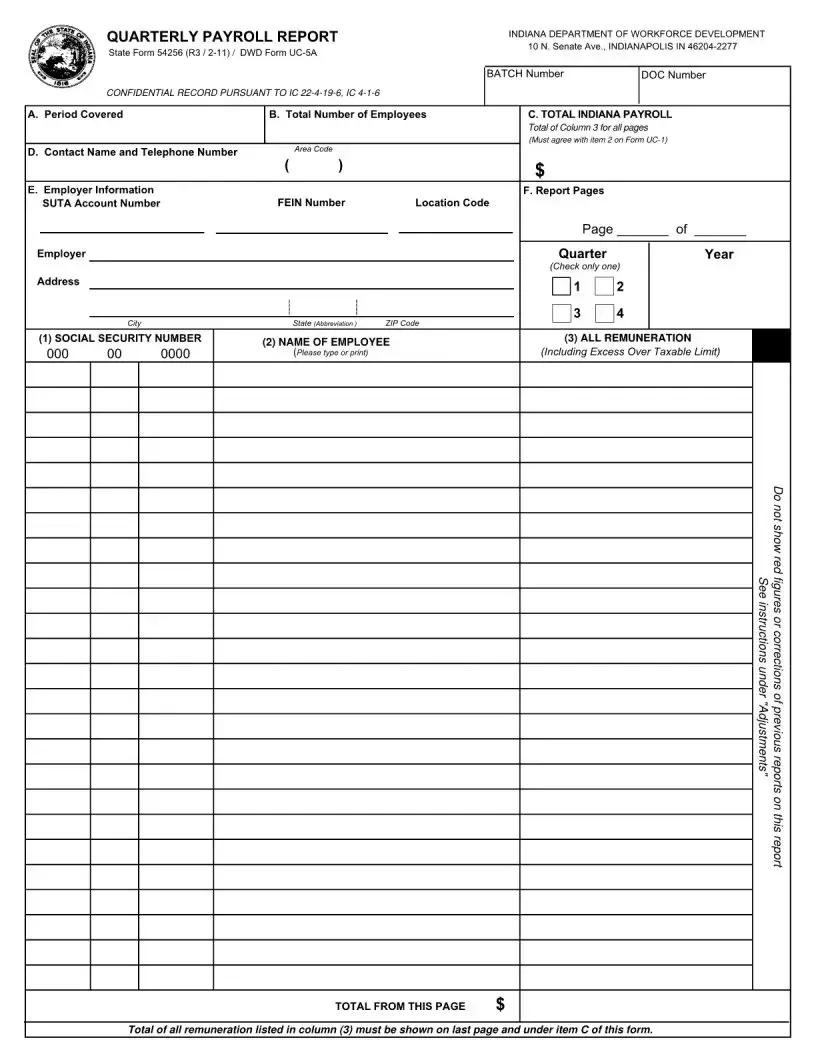

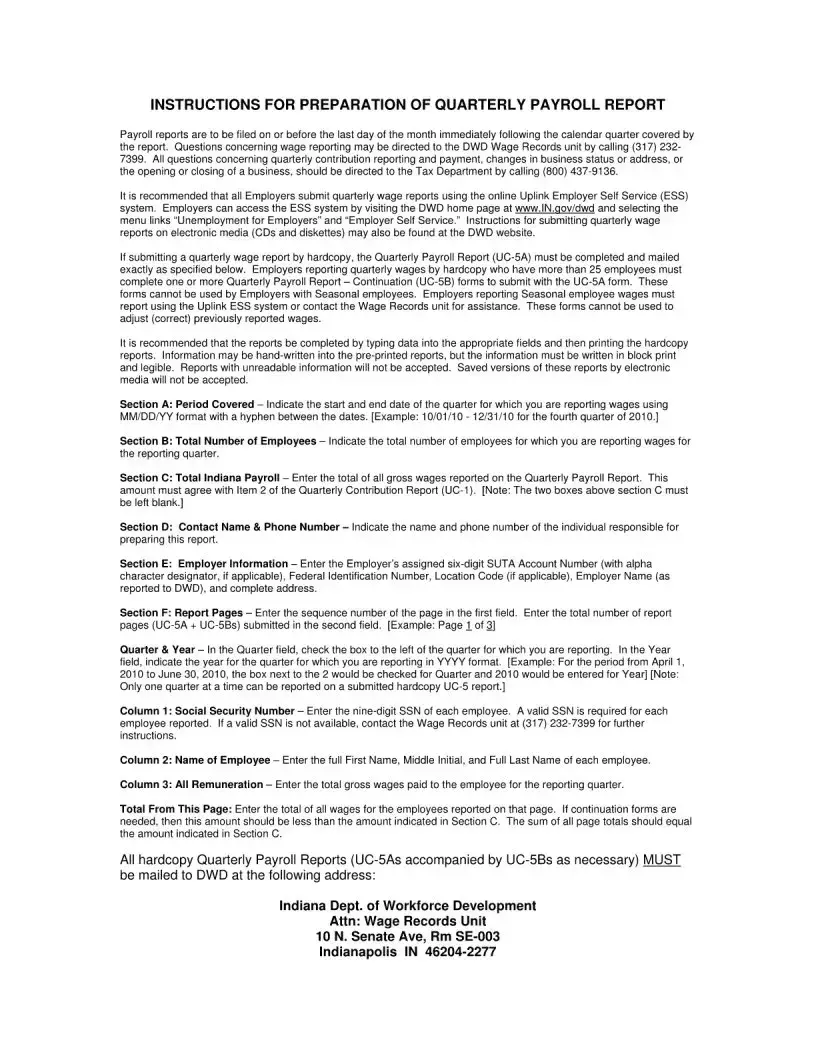

The UC-5A form, officially titled the Quarterly Payroll Report, serves as a crucial document for employers in Indiana to report employee wages over a specific calendar quarter. The form must be submitted to the Indiana Department of Workforce Development by the last day of the month following the quarter being reported. It captures essential information, including the period covered by the report, total number of employees, and the total Indiana payroll—summing up the gross wages for all employees. Employers are required to include their SUTA account number, federal identification number, and contact details for the individual preparing the report. The form also necessitates detailed payroll data for each employee, including social security numbers, names, and total remuneration. For those with more than 25 employees, continuation forms (UC-5B) are mandated to accompany the UC-5A. It is recommended that employers utilize the online Uplink Employer Self Service (ESS) system for submitting these reports, although hardcopy submissions are accepted under certain guidelines. Accuracy and legibility are vital; unreadable forms will be rejected. Additionally, the instructions clarify that this form cannot be used to amend previously reported wages, directing employers to consult specific units for assistance with such inquiries. Understanding the nuances of this form is essential for compliance and effective payroll management for businesses operating in the state.

Uc 5A Example

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The UC-5A form is used to report quarterly payroll information for employees in Indiana. |

| Filing Deadline | Employers must submit the UC-5A form by the last day of the month following the end of the reporting quarter. |

| Governing Laws | This form is governed by Indiana Code IC 22-4-19-6 and IC 4-1-6. |

| Employer Requirements | Employers with more than 25 employees need to include the UC-5B continuation forms with their UC-5A submission. |

| Submission Method | Employers can file reports online via the Uplink Employer Self Service (ESS) system or by mailing hard copies. |

| Required Information | Essential details such as social security numbers, employee names, and total wages must be included on the form. |

Guidelines on Utilizing Uc 5A

The UC-5A form, used for reporting quarterly payroll, requires accurate and thorough information. Ensure you have all the necessary details on hand before beginning the process of completing the form. Follow these specific steps to ensure proper submission.

- Begin with Section A: Period Covered. Enter the start and end dates of the reporting quarter in MM/DD/YY format, separated by a hyphen (e.g., 10/01/10 - 12/31/10).

- In Section B: Total Number of Employees, input the total count of employees for which wages are being reported during the quarter.

- Move to Section C: Total Indiana Payroll. Enter the total gross wages from the report; confirm that this amount matches item 2 on Form UC-1.

- Complete Section D: Contact Name and Phone Number. Indicate the name and contact number of the individual responsible for filing the report.

- For Section E: Employer Information, fill in the Employer's SUTA Account Number, Federal Identification Number (FEIN), Location Code (if applicable), and the full employer address.

- In Section F: Report Pages, specify the page number in the first field and the total number of submitted report pages in the second field (e.g., Page 1 of 3).

- Select the applicable quarter and year. Check the box corresponding to the specific quarter and input the year in YYYY format.

- For each employee, complete Column 1: Social Security Number by entering the nine-digit SSN.

- In Column 2: Name of Employee, provide the full name (First Name, Middle Initial, and Last Name) for each employee.

- In Column 3: All Remuneration, input the gross wages for each employee during the reporting quarter.

- Calculate the total wages from that page and enter it in the 'Total From This Page' field. Ensure this total is less than the amount indicated in Section C if continuation forms are used.

- Finally, once the form is completed, mail the UC-5A along with any required continuation forms (UC-5Bs) to the specified address for the Indiana Department of Workforce Development.

What You Should Know About This Form

What is the UC-5A form used for?

The UC-5A form is a Quarterly Payroll Report required by the Indiana Department of Workforce Development. This form is used to report the total number of employees and the total Indiana payroll for each quarter. Accurate reporting on this form is essential for employers to fulfill their unemployment insurance obligations. It ensures compliance with state regulations, maintains proper records, and affects the calculation of unemployment taxes for employers.

What information must be included on the UC-5A form?

The UC-5A form requires several key pieces of information. Employers must provide the period covered, the total number of employees, and the total Indiana payroll amount. Additionally, the employer’s contact name and phone number, as well as detailed employer information (such as the SUTA Account Number, FEIN Number, and address), are necessary. Each employee’s Social Security Number, name, and total remuneration for the quarter must also be listed. All total amounts from individual report pages need to agree with the totals specified in Section C.

When is the UC-5A form due?

Employers must file the UC-5A form on or before the last day of the month immediately following the calendar quarter covered by the report. For example, the report for the first quarter would be due by April 30. Timely submission is vital to avoid penalties and ensure that unemployment insurance accounts are accurately maintained.

How should the UC-5A form be submitted?

The UC-5A form can be submitted either electronically or via hardcopy. For those using hardcopy, the completed form should be mailed to the Indiana Department of Workforce Development’s Wage Records Unit. Employers with more than 25 employees must also complete additional continuation pages (UC-5B) and include them with the UC-5A. If submitting electronically, it is recommended that employers use the Uplink Employer Self Service (ESS) system to facilitate the process.

What should employers do if they need to correct previously reported wages?

The UC-5A form is not used for adjusting or correcting wages that have already been reported. Employers needing to make corrections should contact the Wage Records unit for further guidance. It is important for employers to maintain accurate records and promptly address any discrepancies to avoid future issues.

Common mistakes

When filling out the UC-5A form, many people make mistakes that can lead to delays or issues in processing. One common error is forgetting to indicate the period covered by the report accurately. The start and end dates must be in the MM/DD/YY format, separated by a hyphen. If these dates are incorrect, it can result in complications when matching the payroll period to submitted data. Ensure that the dates reflect the correct quarter to avoid discrepancies.

Another typical mistake involves misreporting the total number of employees. It is crucial to count all employees for whom wages are being reported during the specified quarter. Providing an incorrect total can misrepresent a business's payroll and may lead to further inquiries from the Department of Workforce Development. Always double-check this figure before submission.

Many also overlook the necessity for the total Indiana payroll amount to align with Item 2 on Form UC-1. This is a specific requirement, and any mismatch can cause the report to be flagged for review. You must ensure that the total gross wages reported matches the amount indicated in Section C on the UC-5A form. Failure to do this can complicate the review process.

Additionally, some employers fail to provide complete contact information in Section D. This section should include the name and phone number of the individual responsible for preparing the report. If the contact details are missing or unclear, it may slow down any necessary follow-up communication from the state's tax department.

Lastly, people often misinterpret the report pages section. It is essential to fill in the sequence number and total number of pages correctly. For example, if there are multiple pages of reports, indicate correctly how many pages are being submitted. Forgetting to follow this guideline can lead to confusion about the submission, causing processing delays. Keep your records organized and ensure all pages are accounted for.

Documents used along the form

The UC 5A form is essential for reporting quarterly payroll information in Indiana, but it often accompanies several other important documents. Each of these documents serves a specific purpose in the payroll reporting process, ensuring that employers meet state requirements accurately. Below is a list of forms and documents commonly used alongside the UC 5A form.

- UC-1 Form: This form is the Quarterly Contribution Report. Employers use it to report contributions owed for unemployment insurance. It summarizes the taxable wages for each employee and the corresponding contribution amounts.

- UC-5B Form: This is the Quarterly Payroll Report - Continuation form. Employers need it when reporting more than 25 employees. It acts as an extension of the UC-5A form, allowing for additional employee wage reporting.

- Wage Records Unit Contact Information: This document provides necessary contact details for the Wage Records unit. Employers can use it to get assistance regarding wage reporting questions or issues.

- Employer Self-Service (ESS) System Instructions: Instructional documentation for accessing the online Uplink ESS system. It guides employers through filing their quarterly wage reports electronically, which is recommended for ease and efficiency.

- Employee Information Sheets: These sheets contain necessary details about each employee, including Social Security numbers and remuneration amounts. These sheets help ensure accurate reporting on the UC 5A and related forms.

- State Wage and Employment Records: A document that tracks the employment history of individuals within the state. Employers may need it to verify employee wage information and ensure compliance with reporting requirements.

Understanding these additional forms can help employers streamline their payroll reporting and maintain compliance with state regulations. Having all necessary documents ready can simplify the process and reduce the chance of errors or delays.

Similar forms

The UC-5A form, which serves as a Quarterly Payroll Report for Indiana, shares similarities with several other employment-related forms submitted by employers. Below are four documents that bear resemblance to the UC-5A form:

- Form 941: This federal form is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employees' paychecks. Like the UC-5A, it requires the total number of employees and total wages to be reported for a specific period, ensuring compliance with tax obligations.

- W-2 Form: Employers use this form to report annual wages and the taxes withheld for each employee. The W-2 includes detailed information about remuneration, similar to the remuneration column found in the UC-5A, and both forms must be completed and filed accurately to ensure proper tax reporting.

- Form UC-1: This form is a Quarterly Contribution Report in Indiana, summarizing the total contributions owed for unemployment insurance based on employee wages. Like the UC-5A, it requires employer information and details about total wages paid during the quarter, providing a comprehensive view of the employer's responsibilities.

- Form 1099-MISC: This form reports payments made to independent contractors or non-employees. Although it serves a different purpose, it shares the requirement of detailing remuneration paid during a specific period, akin to the wage reporting requirements of the UC-5A.

Dos and Don'ts

- Do fill out the form completely, ensuring all required fields are filled in.

- Do double-check your figures to confirm they are accurate and match the totals needed.

- Do ensure you enter the quarter and year correctly based on the reporting period.

- Do submit the report by the deadline, which is the last day of the month following the quarter.

- Do use block print if filling out the form by hand; legibility is essential.

- Don't leave any boxes blank that require a response.

- Don't use previously reported wage information to correct errors on this form.

- Don't submit saved versions of electronic reports; hardcopy is mandatory if not submitted electronically.

- Don't forget to include your SUTA Account Number and FEIN in the Employer Information section.

Misconceptions

Here are nine misconceptions about the UC-5A form and the realities behind them:

- Myth: The UC-5A form is optional for employers. Reality: Filing the UC-5A form is mandatory for all employers in Indiana who have employees and must report wages quarterly.

- Myth: Employers can submit the UC-5A form at any time. Reality: The form must be filed on or before the last day of the month immediately following the calendar quarter covered.

- Myth: There is no requirement to include employee Social Security Numbers. Reality: A valid Social Security Number is required for each employee reported on the form.

- Myth: Hardcopy submissions do not require consistency with electronic records. Reality: The total wages reported on the UC-5A must match the total on the Quarterly Contribution Report (UC-1).

- Myth: Employers can report wages for multiple quarters on one form. Reality: Only one quarter of wages can be reported at a time on the UC-5A form.

- Myth: Handwritten submissions are acceptable without restrictions. Reality: While information may be handwritten, it must be in block print and completely legible; unreadable information will be rejected.

- Myth: The UC-5A form can be used to correct previously reported wages. Reality: The UC-5A cannot be used to adjust previously reported wages; different procedures must be followed for corrections.

- Myth: Information submitted via electronic media is acceptable as a submission. Reality: Only hardcopy submissions are allowed, and saved versions from electronic media will not be accepted.

- Myth: Seasonal employees can report their wages using the UC-5A form. Reality: Employers with seasonal employees must use the Uplink Employer Self Service system or contact DWD for assistance.

Correctly completing and submitting the UC-5A form is crucial for compliance with state regulations. Ensure all requirements are met to avoid unnecessary delays or issues.

Key takeaways

Understanding the Uc 5A form is crucial for employers in Indiana. Here are some key takeaways that will help navigate this important quarterly report:

- Timeliness is Essential: Employers must file the Uc 5A form by the last day of the month following the end of the reporting quarter. Keeping this deadline in mind can prevent penalties.

- Be Ready with Accurate Information: Gather the necessary data before filling out the form. This includes the total number of employees, total payroll, and appropriate contact details.

- Electronic Submission Recommended: It’s suggested that employers submit the quarterly reports through the online Uplink Employer Self Service (ESS) system. This method is more efficient than mailing hard copies.

- Legibility Matters: If submitting a hardcopy, information must be typed or printed clearly. Reports with illegible handwriting will not be accepted, which could lead to delays and complications.

- Only Report One Quarter: Keep in mind that only one quarter can be reported on a submitted hardcopy UC-5 form. Ensure that all totals and employee details are complete and accurate to avoid the need for adjustments later.

By following these guidelines, employers can effectively meet their reporting requirements and streamline their payroll process.

Browse Other Templates

Background Check in Nj - It also requests the address of the applicant's employer.

How to Obtain a Background Check on Myself - Completing this form is a crucial step toward your employment with Cracker Barrel.