Fill Out Your Uia 1718 Form

The UIA 1718 form, officially known as the Claimant’s Statement of Wages, plays a crucial role in Michigan's unemployment benefits process. It becomes essential when a claimant feels that the wages reported by their employers are incorrect or when an employer has completely failed to report wages. Through this form, individuals can clarify discrepancies that may affect their monetary determination for unemployment benefits. By providing detailed information about their employment history, including names of employers, wages, and employment periods, claimants can help ensure they receive the appropriate benefits. It is important to follow the instructions carefully to complete the form accurately, as this can impact the outcome of the unemployment claim. Along with the form, claimants are required to submit supporting documentation, such as pay stubs or W-2s, to verify the wages they are reporting. The process of completing the UIA 1718 form necessitates attention to detail, as errors or omissions may lead to delays or denials of benefits. Overall, understanding the significance of this form and how to fill it out correctly is vital for anyone navigating the unemployment claims process in Michigan.

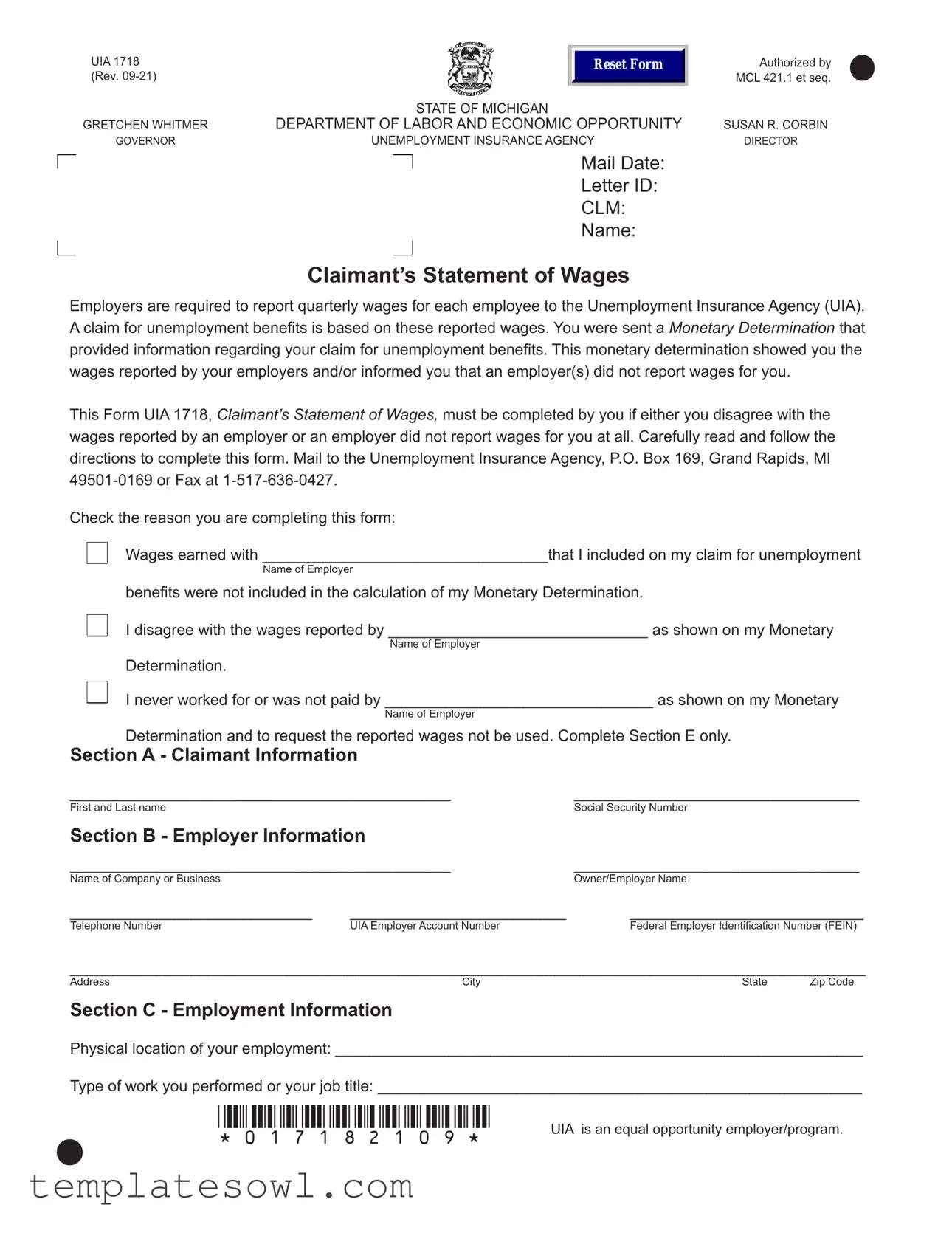

Uia 1718 Example

UIA 1718 |

|

|

|

Reset Form |

(Rev. |

|

|

|

|

|

|

|

STATE OF MICHIGAN |

|

GRETCHEN WHITMER |

DEPARTMENT OF LABOR AND ECONOMIC OPPORTUNITY |

|||

GOVERNOR |

UNEMPLOYMENT INSURANCE AGENCY |

|||

|

|

|

|

Mail Date: |

|

|

|

||

|

|

|

||

|

|

|

|

Letter ID: |

|

|

|

|

CLM: |

|

|

|

|

Name: |

Authorized by |

• |

MCL 421.1 et seq. |

|

SUSAN R. CORBIN |

|

DIRECTOR |

|

Claimant’s Statement of Wages

Employers are required to report quarterly wages for each employee to the Unemployment Insurance Agency (UIA). A claim for unemployment benefits is based on these reported wages. You were sent a Monetary Determination that provided information regarding your claim for unemployment benefits. This monetary determination showed you the wages reported by your employers and/or informed you that an employer(s) did not report wages for you.

This Form UIA 1718, Claimant’s Statement of Wages, must be completed by you if either you disagree with the wages reported by an employer or an employer did not report wages for you at all. Carefully read and follow the directions to complete this form. Mail to the Unemployment Insurance Agency, P.O. Box 169, Grand Rapids, MI

Check the reason you are completing this form:

Wages earned with _________________________________that I included on my claim for unemployment

Name of Employer

benefits were not included in the calculation of my Monetary Determination.

I disagree with the wages reported by ______________________________ as shown on my Monetary

Name of Employer

Determination.

I never worked for or was not paid by _______________________________ as shown on my Monetary

Name of Employer

Determination and to request the reported wages not be used. Complete Section E only.

Section A - Claimant Information

____________________________________________ |

_________________________________ |

|

First and Last name |

|

Social Security Number |

Section B - Employer Information |

|

|

____________________________________________ |

_________________________________ |

|

Name of Company or Business |

|

Owner/Employer Name |

____________________________ |

_________________________ |

___________________________ |

Telephone Number |

UIA Employer Account Number |

Federal Employer Identification Number (FEIN) |

____________________________________________________________________________________________

Address |

City |

State |

Zip Code |

Section C - Employment Information |

|

|

|

Physical location of your employment: _____________________________________________________________

Type of work you performed or your job title: ________________________________________________________ |

||

• |

*017182109* |

UIA is an equal opportunity employer/program. |

|

||

UIA 1718 (Rev.

How were you paid?

Cash Check

Direct deposit

Letter ID:

Other - explain: ____________________

Was there other remuneration (e.g. bonuses, commissions, 401K, room and board, etc.) in your wages?

No

Yes - explain:

Were deductions made from your pay (e.g. FICA, income taxes, etc.) in your wages? |

No |

||

Total gross wages during current calendar year: $____________________ |

actual |

||

Total gross wages during preceding calendar year: $__________________ |

actual |

||

Were there other employees? |

No |

Yes - how many? ______________ |

|

Is the employer still operating? |

No |

Yes |

|

Additional comments: |

|

|

|

Yes

estimated

estimated

Section D - Quarterly Wage Information

You must report the quarterly gross wages (before taxes) on the chart on the next page. There are four calendar quarters per year. The quarters are numbered and are the same from year to year. Each quarter contains three calendar months as follows:

1st Quarter |

January 1 |

through |

March 31 |

2nd Quarter |

April 1 |

through |

June 30 |

3rd Quarter |

July 1 |

through |

September 30 |

4th Quarter |

October 1 |

through |

December 31 |

The involved quarters are the same quarters that are shown on your Monetary Determination under the heading “Monetary Determination Calculations”. Label the chart on the next page with the same quarter dates.

•If you are completing this form because wages earned with an employer that you included on your claim were not used in the calculation of your Monetary Determination, complete all quarters that contained wages from that employer.

•If you are completing this form because you disagree with the wages reported by your employer, complete only the quarters that you disagree with.

If your address changes, it is important to update it with the Unemployment Insurance Agency.

If you have questions, you may contact us through your MiWAM account or by calling

UIA 1718 |

Letter ID: |

• |

|

||

(Rev. |

|

These quarterly charts allow you to enter wage information per week to help you determine your quarterly total wages. If you know your gross wages for each quarter, complete only the Total Quarterly Wage box for each involved quarter. Wages are reported in the quarter they are paid to you.

Example: You may have worked during the last week of March (1st quarter), but you were not paid until April (2nd quarter). These wages must be reported in the 2nd quarter (the quarter containing the date you were PAID).

You are required to send in clear, legible proof of wages to support the information you provide on this form. This can include check stubs,

Quarter ___ |

Year ______ |

Quarter ___ |

Year ______ |

Quarter ___ |

Year ______ |

Quarter ___ |

Year ______ |

Quarter ___ |

Year ______ |

|

WEEK PAID |

GROSS WAGES |

WEEK PAID |

GROSS WAGES |

WEEK PAID |

GROSS WAGES |

WEEK PAID |

GROSS WAGES |

WEEK PAID |

GROSS WAGES |

|

PAID |

PAID |

PAID |

PAID |

PAID |

||||||

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

TOTAL |

|

TOTAL |

|

TOTAL |

|

TOTAL |

|

|

Quarterly |

|

Quarterly |

|

Quarterly |

|

Quarterly |

|

Quarterly |

|

|

Wages |

|

Wages |

|

Wages |

|

Wages |

|

Wages |

|

|

|

|

|

|

|

|

|

|

|

|

Section E - Certification Statement

Certification: I certify that the information I have reported is true and correct. I understand that if I intentionally make a false statement, misrepresent facts or conceal material information, I may be required to pay damages and could be subject to criminal prosecution.

_____________________________________________________ |

_______________________ |

Signature |

Date |

• |

*017182109* UIA is an equal opportunity employer/program. |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The UIA 1718 form is used by claimants to report discrepancies in wages that affect their unemployment benefits. |

| Governing Law | This form is governed by the Michigan Employment Security Act, MCL 421.1 et seq. |

| Submission Methods | Claimants can submit the completed form by mail or fax to the Unemployment Insurance Agency. |

| Required Information | Claimants must provide their personal information, employer details, and specific wage details for accurate processing. |

Guidelines on Utilizing Uia 1718

Once you have gathered your information, you can proceed to fill out the UIA 1718 form accurately. This form is essential if you believe there are discrepancies in your reported wages. Follow these steps to ensure you complete the form correctly.

- Begin by checking the reason for completing the form. Indicate if wages were not included, if you disagree with reported wages, or if you never worked for the listed employer.

- In Section A, fill in your personal information: your first and last name and Social Security Number.

- Move to Section B. Enter the employer’s company name, business owner’s name, telephone number, and relevant identification numbers such as the UIA Employer Account Number and Federal Employer Identification Number (FEIN).

- Provide the complete address of your employer, including city, state, and zip code.

- In Section C, list where you worked and your job title.

- Specify how you were paid: by cash, check, direct deposit, or other means. If "other," provide details.

- Indicate if you had any additional remuneration (like bonuses), and whether deductions were made from your pay.

- Report your total gross wages for the current and the preceding calendar year.

- Answer if there were other employees at the company and whether the employer is still operating.

- If applicable, include any additional comments in the space provided.

- In Section D, fill out the quarterly wage information. Label each quarter with the corresponding dates, and provide your gross wages for each week paid during the quarters involved.

- Calculate and enter the total quarterly wages for each of the quarters listed.

- In Section E, sign and date the certification statement to verify the accuracy of the information you’ve reported.

After completing the UIA 1718 form, ensure you have included necessary wage proof documents such as check stubs or W-2s. Send the completed form and documentation to the Unemployment Insurance Agency by mail or fax.

What You Should Know About This Form

What is the purpose of the UIA 1718 form?

The UIA 1718 form, also known as the Claimant’s Statement of Wages, is designed for individuals who are applying for unemployment benefits in Michigan. It allows claimants to report discrepancies in wages as presented in their Monetary Determination or to inform the Unemployment Insurance Agency (UIA) if an employer failed to report wages. This information is crucial for ensuring the correct calculation of unemployment benefits.

Who needs to complete the UIA 1718 form?

How do I submit the completed UIA 1718 form?

What information is required on the UIA 1718 form?

What if my employer is no longer operating?

What supporting documentation do I need to provide?

What are the potential consequences of providing false information?

Common mistakes

Completing the UIA 1718 form accurately is essential for ensuring that unemployment benefits are processed correctly. However, there are common mistakes that individuals make when filling out this form. First, failing to include all relevant employment information often leads to complications. Many claimants neglect to provide complete details about their employers, such as the business address or federal employer identification number. This oversight can delay the processing of their claims and lead to misunderstanding between the claimant and the Unemployment Insurance Agency (UIA).

Another frequent error involves inaccurately reporting wage information. Claimants may inadvertently provide incorrect figures for their gross wages or forget to include wages for specific quarters. Such inaccuracies can result in a lower benefit amount than deserved. It is crucial to check the monetary determination statement and ensure that all wages, including bonuses or other forms of remuneration, are reported accurately.

A third mistake stems from misunderstanding the certification statement at the end of the form. Some individuals mistakenly believe that signing the document is merely a formality. In reality, this signature affirms that all reported information is true and complete. Misrepresenting facts, even unintentionally, can lead to severe consequences, including fines or legal repercussions.

Lastly, failing to submit clear and legible proof of wages often hinders claims. Claimants must attach supporting documents such as pay stubs or W-2 forms when submitting the UIA 1718 form. Submitting unclear or incomplete documentation may result in requests for further information, delaying the processing time and potentially affecting the benefits granted. For a smooth claims process, it is critical to pay attention to details and carefully follow the submission guidelines.

Documents used along the form

When navigating unemployment claims, several forms and documents enhance the process surrounding the UIA 1718 form. Each serves a distinct purpose and is vital for ensuring accurate processing and support for claimants. Here’s a concise overview of the most commonly used documents:

- Monetary Determination Notice: This document explains the wages reported by employers and the basis for the benefits you may receive. It’s essential for understanding the calculations behind your unemployment claim.

- W-2 Form: This IRS tax form shows an employee's annual wages and the amount of taxes withheld. It helps verify income when filing for unemployment benefits.

- Pay Stubs: Regular pay stubs detail gross and net wages earned throughout employment. They provide proof of income for the specific periods claimed on the UIA 1718.

- Employer Verification Letter: A written confirmation from your employer outlining employment details and earnings. This can clarify any discrepancies in reported wages.

- UIA Account Summary: This summary gives a broader view of the unemployment account history, showing any prior claims and processing information relevant to your current case.

- Claimant’s Statement Form: Often required, this form collects your detailed statements related to your employment history and reasons for filing the claim.

- Section 2 of the Claimant Handbook: This section outlines your rights and responsibilities while receiving benefits. It provides essential tips and instructions for maintaining compliance during the unemployment process.

- Appeal Form: If you disagree with the outcome of your claim, this form allows you to formally request a review of your case, providing a path for resolution.

Understanding these documents and how they interact with the UIA 1718 form can streamline the claims process. Having the right paperwork ready helps ensure that you receive the benefits for which you are eligible. Always keep copies of your submissions and any supporting documentation for your records.

Similar forms

The UIA 1718 form serves a specific purpose related to unemployment benefits by allowing individuals to report discrepancies in their wage records. Several other documents share similar functions or processes. Here are five such documents:

- W-2 Form: This form is provided by an employer to an employee at the end of the year. It summarizes the individual's total earnings and the amount of taxes withheld. Like the UIA 1718, the W-2 is essential for verifying income when applying for unemployment benefits.

- Monetary Determination: This is a notice sent by the Unemployment Insurance Agency that outlines the benefits a claimant may be eligible for based on reported wages. Claimants can challenge the accuracy of this document, similar to how they can dispute the information in the UIA 1718 form.

- UIA 1719 (Request for Reconsideration): If a claimant disagrees with the monetary determination, they may use this form to request a review. This document allows individuals to provide additional evidence, echoing the purpose of the UIA 1718 in addressing wage disputes.

- SS-5 Form: This application for a Social Security card is crucial for verifying identity and income when filing for unemployment. While it does not directly handle wage disputes, it aids in establishing a claimant's identity in relation to reported earnings.

- Pay Stubs: These documents provide a record of the wages earned over a specific pay period and can be used as evidence when disputing reported wages. Just as the UIA 1718 form requires proof of wages, pay stubs serve to support claims made about income discrepancies.

Dos and Don'ts

When filling out the UIA 1718 form, it's important to do certain things correctly to ensure your claim is processed smoothly. Here’s a list of what you should and shouldn’t do:

- Do read all instructions carefully before starting the form.

- Do provide your complete and accurate information in all sections.

- Do check the reason for completing the form and mark the correct box.

- Do report your gross wages clearly for each quarter you worked.

- Do include any supporting documents like pay stubs or W-2 forms.

- Don't leave any section blank unless instructed otherwise.

- Don't submit the form without reviewing for any errors or omissions.

- Don't misrepresent any information; this could lead to serious consequences.

- Don't forget to sign and date the certification statement section.

- Don't delay mailing the form or sending it via fax to ensure timely processing.

Misconceptions

There are several misconceptions surrounding the UIA 1718 form that can lead to confusion for individuals applying for unemployment benefits. Here are some of the most common misunderstandings:

- Assumption that the form is optional: Many believe that filling out the UIA 1718 form is optional. In reality, if you disagree with the wages reported by your employer, or if your employer did not report any wages, it is essential to complete this form to ensure your claim is processed correctly.

- Misunderstanding who should fill it out: Some think that only employers can complete this form. However, it is up to the claimant, the individual seeking unemployment benefits, to fill out the UIA 1718 when discrepancies in wage reporting occur.

- Confusion about supporting documents: It is a common misconception that you can submit the form without any proof of wages. In fact, clear and legible proof, such as pay stubs or W-2s, must accompany the form for the information to be considered.

- Belief that incomplete forms will still be processed: Many assume that even if the form is not filled out completely, it will still be reviewed. This is not the case; submitting an incomplete UIA 1718 form can delay the processing of your claim.

- Thinking wages must be reported by calendar year: Some claimants mistakenly believe that wages must be reported based on the calendar year alone. Instead, you should report wages by the specific quarter they were paid, regardless of when you worked.

- Ignoring the importance of accurate information: There is a misconception that inaccuracies will not be noticed. However, filing false information on the UIA 1718 can lead to severe consequences, including potential criminal prosecution.

- Underestimating the deadline: Individuals often overlook the urgency of submitting the UIA 1718 form in a timely manner. Failing to submit it promptly can adversely affect your eligibility for benefits.

- Believing the form only covers wages: Some people think the UIA 1718 is solely for reporting wages. However, it also includes other forms of remuneration like bonuses or commissions, which must be accurately reported.

- Assuming that all communications can be done online: While many aspects of the unemployment process can be handled through your MiWAM account, there are situations where mailing or faxing the UIA 1718 is required. Always check the necessary submission method.

Understanding these clarifications can help you navigate the unemployment benefits process more effectively. It is always best to approach your unemployment claim with attention to detail and accuracy.

Key takeaways

The UIA 1718 form, known as the Claimant’s Statement of Wages, serves a unique purpose in Michigan’s unemployment insurance process.

- Eligibility to Use the Form: Use this form if you disagree with the wages reported by an employer or if an employer failed to report your wages altogether.

- Claimant Information: Fill in your first and last name, along with your Social Security number, in Section A.

- Employer Details: Provide accurate information about your employer in Section B, including their name, telephone number, and tax identification numbers.

- Employment Information: Section C requires you to describe your job and how you were compensated. You need to provide past wage information as well.

- Quarterly Wage Reporting: In Section D, report gross wages for each calendar quarter, ensuring accuracy according to when wages were paid.

- Proof of Wages: It's crucial to include clear and legible documentation, such as check stubs or W-2s, as evidence of the wages you report.

- Certification Statement: Your signature in Section E confirms the truthfulness of the information provided and acknowledges potential consequences for false statements.

- Mailing Instructions: Submit the completed form to the Unemployment Insurance Agency at the provided address or via fax.

- Deadline Awareness: Be aware of any deadlines associated with your claim that may require timely submission of this form.

- Contact for Questions: For assistance, utilize your MiWAM account or call the UIA at 1-866-500-0017.

Understanding these points can facilitate a smoother process in resolving wage discrepancies during your unemployment benefits claim.

Browse Other Templates

Pds Form 2023 Editable - APFT score breakdown of push-ups, sit-ups, and running.

Vision Test at Dmv - Applicants must bring completed forms and any corrective lenses for review at the DMV.

Closing Disclosure Timing - Prompt medical attention is crucial, and this form helps facilitate that in critical moments.