Fill Out Your Us Estimated Tax Form

The U.S. Estimated Tax form, known as Form 1040-ES, plays a critical role for individual taxpayers who receive income not normally subject to withholding. This includes self-employment income, interest, dividends, rents, and more. Taxpayers utilize this form to calculate their expected tax liability for the year and to ensure they make timely payments to avoid underpayment penalties. Key aspects of Form 1040-ES include determining who is required to make estimated tax payments based on income levels and overall tax liability, as well as outlining special rules for specific categories of taxpayers, such as farmers, fishermen, and those with household employment tax obligations. Crucially, the form’s guidelines specify that taxpayers should expect to make these payments if they believe they will owe at least $1,000 in tax after subtracting any withholding and refundable credits. Notably, 2022 saw some updates, such as increases in standard deduction amounts and shifts in income limits that affected taxpayers’ obligations. Understanding these nuances is essential for anyone navigating the complexities of tax year regulations and ensuring compliance with federal tax laws.

Us Estimated Tax Example

2022

Form

Department of the Treasury

Internal Revenue Service

Estimated Tax for Individuals

Purpose of This Package |

Note. These percentages may be different if you are a |

|||||||||

Use Form |

farmer, fisherman, or higher income taxpayer. See |

|||||||||

Special Rules, later. |

||||||||||

for 2022. |

Exception. You don’t have to pay estimated tax for 2022 |

|||||||||

|

Estimated tax is the method used to pay tax on income |

|||||||||

|

if you were a U.S. citizen or resident alien for all of 2021 |

|||||||||

that isn’t subject to withholding (for example, earnings |

and you had no tax liability for the full |

|||||||||

from |

year. You had no tax liability for 2021 if your total tax was |

|||||||||

etc.). In addition, if you don’t elect voluntary withholding, |

zero or you didn’t have to file an income tax return. |

|||||||||

you should make estimated tax payments on other |

Special Rules |

|||||||||

taxable income, such as unemployment compensation |

||||||||||

and the taxable part of your social security benefits. |

There are special rules for farmers, fishermen, certain |

|||||||||

Change of address. If your address has changed, file |

household employers, and certain higher income |

|||||||||

Form 8822, to update your record. |

taxpayers. |

|||||||||

Future developments. For the latest information about |

Farmers and fishermen. If at least |

|||||||||

developments related to Form |

gross income for 2021 or 2022 is from farming or fishing, |

|||||||||

instructions, such as legislation enacted after they were |

substitute 662/3% for 90% in (2a) under General Rule. |

|||||||||

published, go to |

IRS.gov/Form1040ES |

. |

|

Household employers. When estimating the tax on your |

||||||

|

|

|||||||||

Who Must Make Estimated Tax |

taxes if either of the following applies. |

|||||||||

Payments |

2022 tax return, include your household employment |

|||||||||

• You will have federal income tax withheld from wages, |

||||||||||

The estimated tax rules apply to: |

pensions, annuities, gambling winnings, or other income. |

|||||||||

• |

U.S. citizens and resident aliens; |

• You would be required to make estimated tax payments |

||||||||

• |

Residents of Puerto Rico, the U.S. Virgin Islands, |

to avoid a penalty even if you didn’t include household |

||||||||

Guam, the Commonwealth of the Northern Mariana |

employment taxes when figuring your estimated tax. |

|||||||||

Islands, and American Samoa; and |

Higher income taxpayers. If your adjusted gross |

|||||||||

• |

Nonresident aliens (use Form |

income (AGI) for 2021 was more than $150,000 ($75,000 |

||||||||

|

! |

If you filed a Schedule H or Schedule SE with your |

if your filing status for 2022 is married filing separately), |

|||||||

|

Form 1040 or |

substitute 110% for 100% in (2b) under General Rule, |

||||||||

CAUTION some of the household employment and/or |

earlier. This rule doesn’t apply to farmers or fishermen. |

|||||||||

Increase Your Withholding |

||||||||||

use Form |

||||||||||

this payment separate from other payments and apply the |

If you also receive salaries and wages, you may be able to |

|||||||||

payment to the 2020 tax year where the payment was |

avoid having to make estimated tax payments on your |

|||||||||

deferred. You can use Direct Pay, available only on |

other income by asking your employer to take more tax |

|||||||||

IRS.gov, to make the payment. Select the "balance due" |

out of your earnings. To do this, file a new Form |

|||||||||

reason for payment or, if paying with a debit or credit card, |

Employee's Withholding Certificate, with your employer. |

|||||||||

select “installment agreement.” Go to IRS.gov/Payments |

Generally, if you receive a pension or annuity you can |

|||||||||

to see all your payment options. |

|

|

||||||||

use Form |

||||||||||

General Rule |

Pension or Annuity Payments, to start or change your |

|||||||||

withholding from these payments. |

||||||||||

In most cases, you must pay estimated tax for 2022 if both |

You can also choose to have federal income tax |

|||||||||

of the following apply. |

||||||||||

withheld from certain government payments (see Form |

||||||||||

|

1. You expect to owe at least $1,000 in tax for 2022, |

|||||||||

|

||||||||||

after subtracting your withholding and refundable credits. |

nonperiodic payments and eligible rollover distributions |

|||||||||

|

2. You expect your withholding and refundable credits |

(see Form |

||||||||

to be less than the smaller of: |

Payments and Eligible Rollover Distributions). |

|||||||||

or |

a. |

90% of the tax to be shown on your 2022 tax return, |

|

You can use the Tax Withholding Estimator at |

||||||

b. 100% of the tax shown on your 2021 tax return. |

TIP |

IRS.gov/W4App to determine whether you need |

||||||||

|

|

|

|

|||||||

|

|

to have your withholding increased or decreased. |

||||||||

Your 2021 tax return must cover all 12 months. |

|

|

|

|||||||

Jan 24, 2022 |

Cat. No. 11340T |

Additional Information You May Need

You can find most of the information you will need in Pub. 505, Tax Withholding and Estimated Tax, and in the instructions for the 2021 Form 1040 and

For details on how to get forms and publications, see the 2021 Instructions for Form 1040.

What's New

In figuring your 2022 estimated tax, be sure to consider the following.

Standard deduction amount increased. For 2022, the standard deduction amount has been increased for all filers. If you don't itemize your deductions, you can take the 2022 standard deduction listed in the following chart for your filing status.

IF your 2022 filing status is... |

THEN your standard |

|

deduction is... |

||

|

||

Married filing jointly or |

$25,900 |

|

Qualifying widow(er) |

||

|

||

Head of household |

$19,400 |

|

Single or Married filing separately |

$12,950 |

|

|

|

|

However, if you can be claimed as a dependent on |

|

another person's 2022 return, your standard deduction is |

||

the greater of: |

|

|

• |

$1,150, or |

|

• |

Your earned income plus $400 (up to the standard |

|

deduction amount). |

|

|

|

Your standard deduction is increased by the following |

|

amount if, at the end of 2022, you are: |

|

|

• |

An unmarried individual (single or head of household) |

|

and are: |

|

|

65 or older or blind |

$1,750 |

|

65 or older and blind |

$3,500 |

|

•A married individual (filing jointly or separately) or a qualifying widow(er) and are:

65 or older or blind |

$1,400 |

|

65 or older and blind |

$2,800 |

|

Both spouses 65 or older |

$2,800* |

|

Both spouses 65 or older and blind |

$5,600* |

|

*Only if married filing jointly. If married filing separately, these |

|

|

amounts do not apply. |

|

|

! |

Your standard deduction is zero if (a) your spouse |

|

itemizes on a separate return, or (b) you were a |

||

CAUTION |

||

as a resident alien for 2022. |

|

|

Social security tax. For 2022, the maximum amount of earned income (wages and net earnings from

Adoption credit or exclusion. For 2022, the maximum adoption credit or exclusion for

adoption benefits has increased to $14,890. In order to claim either the credit or exclusion, your modified adjusted gross income must be less than $263,410.

Reminders

Individual taxpayer identification number (ITIN) re- newal. If you were assigned an ITIN before January 1, 2013, or if you have an ITIN that you haven’t included on a tax return in the last 3 consecutive years, you may need to renew it. For more information, see the Instructions for Form

Advance payments of the premium tax credit. If you buy health care insurance through the Health Insurance Marketplace, you may be eligible for advance payments of the premium tax credit to help pay for your insurance coverage. Receiving too little or too much in advance will affect your refund or balance due. Promptly report changes in your income or family size to your Marketplace. See Form 8962 and its instructions for more information.

Access Your Online Account (Individual Taxpayers Only)

Go to IRS.gov/Account to securely access information about your federal tax account.

• View the amount you owe and a breakdown by tax year.

• See payment plan details or apply for a new payment plan.

• Make a payment, view 5 years of payment history and any pending or scheduled payments.

• Access your tax records, including key data from your most recent tax return, your economic impact payment amounts, and transcripts.

• View digital copies of select notices from the IRS.

• Approve or reject authorization requests from tax professionals.

• Update your address or manage your communication preferences.

How To Figure Your Estimated Tax

You will need:

• The 2022 Estimated Tax Worksheet,

• The Instructions for the 2022 Estimated Tax Worksheet,

• The 2022 Tax Rate Schedules, and

• Your 2021 tax return and instructions to use as a guide to figuring your income, deductions, and credits (but be sure to consider the items listed under What's New, earlier).

Matching estimated tax payments to income. If you receive your income unevenly throughout the year (for example, because you operate your business on a seasonal basis or you have a large capital gain late in the year), you may be able to lower or eliminate the amount of your required estimated tax payment for one or more periods by using the annualized income installment method. See chapter 2 of Pub. 505 for details.

Changing your estimated tax. To amend or correct your estimated tax, see How To Amend Estimated Tax Payments, later.

Form |

You can’t make joint estimated tax payments if ! you or your spouse is a nonresident alien, you are

CAUTION separated under a decree of divorce or separate maintenance, or you and your spouse have different tax years.

Additionally, individuals who are in registered domestic partnerships, civil unions, or other similar formal relationships that aren’t marriages under state law cannot make joint estimated tax payments. These individuals can take credit only for the estimated tax payments that they made.

Payment Due Dates

You can pay all of your estimated tax by April 18, 2022, or in four equal amounts by the dates shown below.

1st payment |

April 18, 2022 |

2nd payment |

June 15, 2022 |

3rd payment |

Sept. 15, 2022 |

4th payment |

Jan. 17, 2023* |

*You don’t have to make the payment due January 17, 2023, if you file your 2022 tax return by January 31, 2023, and pay the entire balance due with your return.

If you mail your payment and it is postmarked by the due date, the date of the U.S. postmark is considered the date of payment. If your payments are late or you didn’t pay enough, you may be charged a penalty for underpaying your tax. See When a Penalty Is Applied, later.

You can make more than four estimated tax TIP payments. To do so, make a copy of one of your

unused estimated tax payment vouchers, fill it in, and mail it with your payment. If you make more than four payments, to avoid a penalty, make sure the total of the amounts you pay during a payment period is at least as much as the amount required to be paid by the due date for that period. For other payment methods, see How To Pay Estimated Tax, later.

No income subject to estimated tax during first pay- ment period. If, after March 31, 2022, you have a large change in income, deductions, additional taxes, or credits that requires you to start making estimated tax payments, you should figure the amount of your estimated tax payments by using the annualized income installment method, explained in chapter 2 of Pub. 505. If you use the annualized income installment method, file Form 2210, including Schedule AI, with your 2022 tax return even if no penalty is owed.

Farmers and fishermen. If at least

• Pay all of your estimated tax by January 17, 2023.

• File your 2022 Form 1040 or

the 1st month of the following fiscal year. If any payment date falls on a Saturday, Sunday, or legal holiday, use the next business day. See Pub. 509, Tax Calendars, for a list of all legal holidays.

Name Change

If you changed your name because of marriage, divorce, etc., and you made estimated tax payments using your former name, attach a statement to the front of your 2022 paper tax return. On the statement, show all of the estimated tax payments you (and your spouse, if filing jointly) made for 2022 and the name(s) and SSN(s) under which you made the payments.

Be sure to report the change to your local Social Security Administration office before filing your 2022 tax return. This prevents delays in processing your return and issuing refunds. It also safeguards your future social security benefits. For more details, call the Social Security Administration at

How To Amend Estimated Tax Payments

To change or amend your estimated tax payments, refigure your total estimated tax payments due (see the 2022 Estimated Tax Worksheet). Then, to figure the payment due for each remaining payment period, see Amended estimated tax in chapter 2 of Pub. 505. If an estimated tax payment for a previous period is less than

When a Penalty Is Applied

In some cases, you may owe a penalty when you file your return. The penalty is imposed on each underpayment for the number of days it remains unpaid. A penalty may be applied if you didn’t pay enough estimated tax for the year or you didn’t make the payments on time or in the required amount. A penalty may apply even if you have an overpayment on your tax return.

The penalty may be waived under certain conditions. See the Instructions for Form 2210 for details.

How To Pay Estimated Tax

Pay Online

Paying online is convenient and secure and helps make sure we get your payments on time. To pay your taxes online or for more information, go to IRS.gov/Payments.

Once you are issued a social security number (SSN), use it when paying your estimated taxes online. Use your SSN even if your SSN does not authorize employment or if you have been issued an SSN that authorizes employment and you lose your employment authorization. An ITIN will not be issued to you once you have been issued an SSN. If you received your SSN after previously using an ITIN, stop using your ITIN. Use your SSN instead.

You can pay using any of the following methods.

• Your Online Account. You can now make tax payments through your online account, including balance

Form |

payments, estimated tax payments, or other types. You can also see your payment history and other tax records there. Go to IRS.gov/Account.

• IRS Direct Pay. For online transfers directly from your checking or savings account at no cost to you, go to IRS.gov/Payments.

• Pay by Card. To pay by debit or credit card, go to IRS.gov/Payments. A convenience fee is charged by these service providers.

• Electronic Fund Withdrawal (EFW) is an integrated

• Online Payment Agreement. If you can’t pay in full by the due date of your tax return, you can apply for an online monthly installment agreement at IRS.gov/Payments.

Once you complete the online process, you will receive immediate notification of whether your agreement has been approved. A user fee is charged.

Pay by Phone

Paying by phone is another safe and secure method of paying electronically. Use one of the following methods:

(1) call one of the debit or credit card service providers, or

(2) the Electronic Federal Tax Payment System (EFTPS). Debit or credit card. Call one of our service providers. Each charges a fee that varies by provider, card type, and payment amount.

Link2Gov Corporation

WorldPay US, Inc.

ACI Payments, Inc.

EFTPS. To use EFTPS, you must be enrolled either online or have an enrollment form mailed to you. To make a payment using EFTPS, call

Mobile Device

To pay through your mobile device, download the IRS2Go app.

Pay by Cash

Cash is an

Pay by Check or Money Order Using the Estimated Tax Payment Voucher

Before submitting a payment through the mail using the estimated tax payment voucher, please consider alternative methods. One of our safe, quick, and easy online payment options might be right for you.

If you choose to mail in your payment, there is a separate estimated tax payment voucher for each due date. The due date is shown in the upper right corner. Complete and send in the voucher only if you are making a payment by check or money order. If you and your spouse plan to file separate returns, file separate vouchers instead of a joint voucher.

To complete the voucher, do the following.

• Print or type your name, address, and SSN in the space provided on the estimated tax payment voucher. Enter your SSN even if your SSN does not authorize employment or if you have been issued an SSN that authorizes employment and you lose your employment authorization. If you have an ITIN, enter it wherever your SSN is requested. An ITIN will not be issued to you once you have been issued an SSN. If you received your SSN after previously using an ITIN, stop using your ITIN. Use your SSN instead. If filing a joint voucher, also enter your spouse's name and SSN. List the names and SSNs in the same order on the joint voucher as you will list them on your joint return.

• Enter in the box provided on the estimated tax payment voucher only the amount you are sending in by check or money order. When making payments of estimated tax, be sure to take into account any 2021 overpayment that you choose to credit against your 2022 tax, but don’t include the overpayment amount in this box.

• Make your check or money order payable to “United States Treasury.” Don’t send cash. To help process your payment accurately, enter the amount on the right side of the check like this: $ XXX.XX. Don’t use dashes or lines (for example, don’t enter “$

• Enter “2022 Form

• Enclose, but don’t staple or attach, your payment with the estimated tax payment voucher.

Notice to taxpayers presenting checks. When you provide a check as payment, you authorize us either to use information from your check to make a

No checks of $100 million or more accepted. The IRS can’t accept a single check (including a cashier’s check) for amounts of $100,000,000 ($100 million) or more. If you are sending $100 million or more by check, you will need to spread the payment over 2 or more checks with each check made out for an amount less than $100 million. This limit doesn’t apply to other methods of payment (such as electronic payments). Please consider

Form |

a method of payment other than check if the amount of the payment is over $100 million.

Where To File Your Estimated Tax Payment Voucher if Paying by Check or Money Order

Mail your estimated tax payment voucher and check or money order to the address |

A foreign country, American Samoa, |

Internal Revenue Service |

|

shown below for the place where you live. Do not mail your tax return to this address or |

or Puerto Rico (or are excluding |

P.O. Box 1303 |

|

send an estimated tax payment without a payment voucher. Also, do not mail your |

income under Internal Revenue Code |

Charlotte, NC |

|

estimated tax payments to the address shown in the Form 1040 instructions. If you |

933), or use an APO or FPO address, |

|

|

need more payment vouchers, you can make a copy of one of your unused vouchers. |

or file Form 2555 or 4563, or are a |

|

|

|

|

|

|

|

|

resident of Guam or the U.S. Virgin |

|

|

|

Islands |

|

Caution: For proper delivery of your estimated tax payment to a P.O. box, you must |

Guam: |

Department of |

|

include the box number in the address. Also, note that only the U.S. Postal Service can |

Bona fide residents* |

Revenue and Taxation |

|

deliver to P.O. boxes. Therefore, you cannot use a private delivery service to make |

|

Government of Guam |

|

estimated tax payments required to be sent to a P.O. box. |

|

|

P.O. Box 23607 |

|

|

|

GMF, GU 96921 |

IF you live in . . . |

THEN send it to . . . |

U.S. Virgin Islands: |

Virgin Islands Bureau |

|

|

Bona fide residents* |

of Internal Revenue |

|

|

|

6115 Estate Smith Bay |

|

|

|

Suite 225 |

|

|

|

St. Thomas, VI 00802 |

Alabama, Arizona, Florida, Georgia, |

Internal Revenue Service |

|

|

Louisiana, Mississippi, New Mexico, |

P.O. Box 1300 |

|

|

North Carolina, South Carolina, |

Charlotte, NC |

|

|

Tennessee, Texas |

|

|

|

Arkansas, Connecticut, Delaware, |

Internal Revenue Service |

|

|

District of Columbia, Illinois, Indiana, |

P.O. Box 931100 |

|

|

Iowa, Kentucky, Maine, Maryland, |

Louisville, KY |

|

|

Massachusetts, Minnesota, Missouri, |

|

|

|

New Hampshire, New Jersey, New |

|

|

|

York, Oklahoma, Rhode Island, |

|

|

|

Vermont, Virginia, West Virginia, |

|

|

|

Wisconsin |

|

|

|

Alaska, California, Colorado, Hawaii, |

Internal Revenue Service |

|

|

Idaho, Kansas, Michigan, Montana, |

P.O. Box 802502 |

|

|

Nebraska, Nevada, Ohio, Oregon, |

Cincinnati, OH |

|

|

North Dakota, Pennsylvania, South |

|

|

|

Dakota, Utah, Washington, Wyoming |

|

|

|

*Bona fide residents must prepare separate vouchers for estimated income tax and

Instructions for the 2022 Estimated Tax Worksheet

Line 1. Adjusted gross income. When figuring the adjusted gross income you expect in 2022, be sure to consider the items listed under What’s New, earlier. For more details on figuring your AGI, see Expected

If you are

Line 7. Credits. See the 2021 Form 1040 or

Line 9.

for each of you separately. Enter the total on line 9. When estimating your 2022 net earnings from

Line 10. Other taxes. Use the 2021 Instructions for Form 1040 to determine if you expect to owe, for 2022, any of the taxes that would have been entered on your 2021 Schedule 2 (Form 1040), line 8 through 12 and 14 through 17z (see Exception 2, later). On line 10, enter the total of those taxes, subject to the following two exceptions.

Exception 1. Include household employment taxes from Schedule 2 (Form 1040), line 9, on this line only if:

• You will have federal income tax withheld from wages, pensions, annuities, gambling winnings, or other income; or

• You would be required to make estimated tax payments (to avoid a penalty) even if you didn’t include household employment taxes when figuring your estimated tax.

If you meet either of the above, include the total of your household employment taxes on line 10.

Form |

2022 |

Keep for Your Records |

Lines 1 and 9 of the Estimated Tax Worksheet |

1a. Enter your expected income and profits subject to |

1a. |

b.If you will have farm income and also receive social security retirement or disability benefits, enter your expected Conservation Reserve Program payments that will be

|

included on Schedule F (Form 1040) or listed on Schedule |

b. |

|

2. |

. . . . . . . . . .Subtract line 1b from line 1a |

2. |

|

3. |

. . . . . . . . . .Multiply line 2 by 92.35% (0.9235) |

3. |

|

4. |

. . . . . . . . . . . . .Multiply line 3 by 2.9% (0.029) |

. . . . . . . . . . . . . . . . . |

|

5. |

Social security tax maximum income |

5. |

$147,000 |

6.Enter your expected wages (if subject to social security tax or the 6.2% portion of

|

tier 1 railroad retirement tax) |

6. |

7. |

Subtract line 6 from line 5 |

7. |

|

Note. If line 7 is zero or less, enter |

|

8. |

Enter the smaller of line 3 or line 7 |

8. |

9. |

Multiply line 8 by 12.4% (0.124) |

. . . . . . . . . . . . . . . . . . |

10. |

Add lines 4 and 9. Enter the result here and on line 9 of your 2022 Estimated Tax Worksheet |

. . . . . . . . . . . . . . . . . |

11. |

Multiply line 10 by 50% (0.50). This is your expected deduction for |

|

|

Schedule 1 (Form 1040), line 15. Subtract this amount when figuring your expected AGI on |

11. |

|

line 1 of your 2022 Estimated Tax Worksheet |

4.

9.

10.

*Your net profit from

Exception 2. Because the following taxes are not required to be paid until the due date of your income tax (not including extensions), do not include them on line 10.

• Uncollected social security and Medicare or RRTA tax on tips or

• Recapture of federal mortgage subsidy (Schedule 2, line 17b),

• Excise tax on excess golden parachute payments (Schedule 2, line 17k),

• Excise tax on insider stock compensation from an expatriated corporation (Schedule 2, line 17m), and

•

Additional Medicare Tax. For information about the Additional Medicare Tax, see the Instructions for Form 8959.

Net Investment Income Tax (NIIT). For information about the Net Investment Income Tax, see the Instructions for Form 8960.

Repayment of

For details about repaying the

Line 12b. Prior year's tax. Enter the 2021 tax you figure according to the instructions in Figuring your 2021 tax unless you meet one of the following exceptions.

• If the AGI shown on your 2021 return is more than $150,000 ($75,000 if married filing separately for 2022), enter 110% of your 2021 tax as figured next.

Note. This doesn’t apply to farmers or fishermen.

• If you will file a joint return for 2022 but you didn’t file a joint return for 2021, add the tax shown on your 2021

return to the tax shown on your spouse's 2021 return and enter the total on line 12b.

• If you filed a joint return for 2021 but you will not file a joint return for 2022, first figure the tax both you and your spouse would have paid had you filed separate returns for 2021 using the same filing status as for 2022. Then multiply the tax on the joint return by a fraction, the numerator being the tax you would have paid had you filed a separate return, over the total tax you and your spouse would have paid had you filed separate returns. Enter this amount on line 12b.

• If you didn’t file a return for 2021 or your 2021 tax year was less than 12 full months, don’t complete line 12b. Instead, enter the amount from line 12a on line 12c.

Figuring your 2021 tax. Use the following instructions to figure your 2021 tax.

The tax shown on your 2021 Form 1040 or

1.Unreported social security and Medicare tax or RRTA tax from Schedule 2 (Form 1040), lines 5 and 6;

2.Any tax included on Schedule 2 (Form 1040), line 8, on excess contributions to an IRA, Archer MSA, Coverdell education savings account, health savings account, ABLE account, or on excess accumulations in qualified retirement plans;

3.Amounts on Schedule 2 (Form 1040) as listed under Exception 2, earlier; and

4.Any refundable credit amounts on Form 1040 or

Form |

2022 Tax Rate Schedules

Caution. Don’t use these Tax Rate Schedules to figure your 2021 taxes. Use only to figure your 2022 estimated taxes.

Schedule |

|

Schedule |

|

|

|||||||

Single |

|

|

|

|

|

Head of household |

|

|

|

|

|

If line 3 |

|

The tax is: |

|

|

|

If line 3 |

|

The tax is: |

|

|

|

is: |

|

|

|

of the |

is: |

|

|

|

of the |

||

|

But not |

|

|

|

|

But not |

|

|

|

||

Over— |

|

|

|

amount |

Over— |

|

|

|

amount |

||

over— |

|

|

|

over— |

over— |

|

|

|

over— |

||

$0 |

$10,275 |

+ |

10% |

$0 |

$0 |

$14,650 |

+ |

10% |

$0 |

||

10,275 |

41,775 |

+ |

12% |

10,275 |

14,650 |

55,900 |

+ |

12% |

14,650 |

||

41,775 |

89,075 |

4,807.50 |

+ |

22% |

41,775 |

55,900 |

89,050 |

6,415.00 |

+ |

22% |

55,900 |

89,075 |

170,050 |

15,213.50 |

+ |

24% |

89,075 |

89,050 |

170,050 |

13,708.00 |

+ |

24% |

89,050 |

170,050 |

215,950 |

34,647.50 |

+ |

32% |

170,050 |

170,050 |

215,950 |

33,148.00 |

+ |

32% |

170,050 |

215,950 |

539,900 |

49,335.50 |

+ |

35% |

215,950 |

215,950 |

539,900 |

47,836.00 |

+ |

35% |

215,950 |

539,900 |

162,718.00 |

+ |

37% |

539,900 |

539,900 |

161,218.50 |

+ |

37% |

539,900 |

||

Schedule |

|

Schedule |

|

||||||||

Married filing jointly or Qualifying widow(er) |

|

Married filing separately |

|

|

|

|

|||||

If line 3 |

|

The tax is: |

|

|

|

If line 3 |

|

The tax is: |

|

|

|

is: |

|

|

|

|

of the |

is: |

|

|

|

|

of the |

|

But not |

|

|

|

|

But not |

|

|

|

||

Over— |

|

|

|

amount |

Over— |

|

|

|

amount |

||

over— |

|

|

|

over— |

over— |

|

|

|

over— |

||

$0 |

$20,550 |

+ |

10% |

$0 |

$0 |

$10,275 |

+ |

10% |

$0 |

||

20,550 |

83,550 |

+ |

12% |

20,550 |

10,275 |

41,775 |

+ |

12% |

10,275 |

||

83,550 |

178,150 |

9,615.00 |

+ |

22% |

83,550 |

41,775 |

89,075 |

4,807.50 |

+ |

22% |

41,775 |

178,150 |

340,100 |

30,427.00 |

+ |

24% |

178,150 |

89,075 |

170,050 |

15,213.50 |

+ |

24% |

89,075 |

340,100 |

431,900 |

69,295.00 |

+ |

32% |

340,100 |

170,050 |

215,950 |

34,647.50 |

+ |

32% |

170,050 |

431,900 |

647,850 |

98,671.00 |

+ |

35% |

431,900 |

215,950 |

323,925 |

49,335.50 |

+ |

35% |

215,950 |

647,850 |

174,253.50 |

+ |

37% |

647,850 |

323,925 |

87,126.75 |

+ |

37% |

323,925 |

||

Form |

2022 Estimated Tax Worksheet |

Keep for Your Records |

|||

1 |

Adjusted gross income you expect in 2022 (see instructions) |

. . . . |

1 |

|

2a |

Deductions |

. . . . |

2a |

|

|

• If you plan to itemize deductions, enter the estimated total of your itemized deductions. |

} |

|

|

|

|

|

||

|

• If you don’t plan to itemize deductions, enter your standard deduction. |

|

|

|

b If you can take the qualified business income deduction, enter the estimated amount of the deduction |

2b |

|||

c |

Add lines 2a and 2b |

. . . ▶ |

2c |

|

3 |

Subtract line 2c from line 1 |

. . . . |

3 |

|

4 |

Tax. Figure your tax on the amount on line 3 by using the 2022 Tax Rate Schedules. |

|

|

|

|

Caution: If you will have qualified dividends or a net capital gain, or expect to exclude or deduct foreign |

|

|

|

|

earned income or housing, see Worksheets |

. . . . |

4 |

|

5 |

Alternative minimum tax from Form 6251 |

. . . . |

5 |

|

6Add lines 4 and 5. Add to this amount any other taxes you expect to include in the total on Form 1040

|

or |

6 |

7 |

Credits (see instructions). Do not include any income tax withholding on this line |

7 |

8 |

Subtract line 7 from line 6. If zero or less, enter |

8 |

9 |

9 |

|

10 |

Other taxes (see instructions) |

10 |

11a |

Add lines 8 through 10 |

11a |

bEarned income credit, refundable child tax credit* or additional child tax credit, fuel tax credit, net premium tax credit, refundable American opportunity credit, section 1341 credit, and refundable

|

credit from Form 8885* |

11b |

||||||

c |

Total 2022 estimated tax. Subtract line 11b from line 11a. If zero or less, enter |

. |

. ▶ |

11c |

||||

12a |

Multiply line 11c by 90% (662/3% for farmers and fishermen) |

|

12a |

|

|

|

|

|

|

|

|

|

|

|

|||

b |

Required annual payment based on prior year’s tax (see instructions) . . . |

|

12b |

|

|

|

|

|

c |

Required annual payment to avoid a penalty. Enter the smaller of line 12a or 12b . . . |

. |

. ▶ |

12c |

||||

Caution: Generally, if you do not prepay (through income tax withholding and estimated tax payments) at least the amount on line 12c, you may owe a penalty for not paying enough estimated tax. To avoid a penalty, make sure your estimate on line 11c is as accurate as possible. Even if you pay the required annual payment, you may still owe tax when you file your return. If you prefer, you can pay the amount shown on line 11c. For details, see chapter 2 of Pub. 505.

13Income tax withheld and estimated to be withheld during 2022 (including income tax withholding on

|

pensions, annuities, certain deferred income, etc.) |

. . . . . . . . |

13 |

|||

|

|

|

|

|

|

|

14a |

Subtract line 13 from line 12c |

|

14a |

|

|

|

|

Is the result zero or less? |

|

|

|

|

|

|

Yes. Stop here. You are not required to make estimated tax payments. |

|

|

|

|

|

|

No. Go to line 14b. |

|

|

|

|

|

b |

Subtract line 13 from line 11c |

|

14b |

|

|

|

|

Is the result less than $1,000? |

|

|

|

|

|

|

Yes. Stop here. You are not required to make estimated tax payments. |

|

|

|

|

|

|

No. Go to line 15 to figure your required payment. |

|

|

|

|

|

15If the first payment you are required to make is due April 18, 2022, enter ¼ of line 14a (minus any 2021 overpayment that you are applying to this installment) here, and on your estimated tax payment

voucher(s) if you are paying by check or money order |

15 |

* If applicable.

Form |

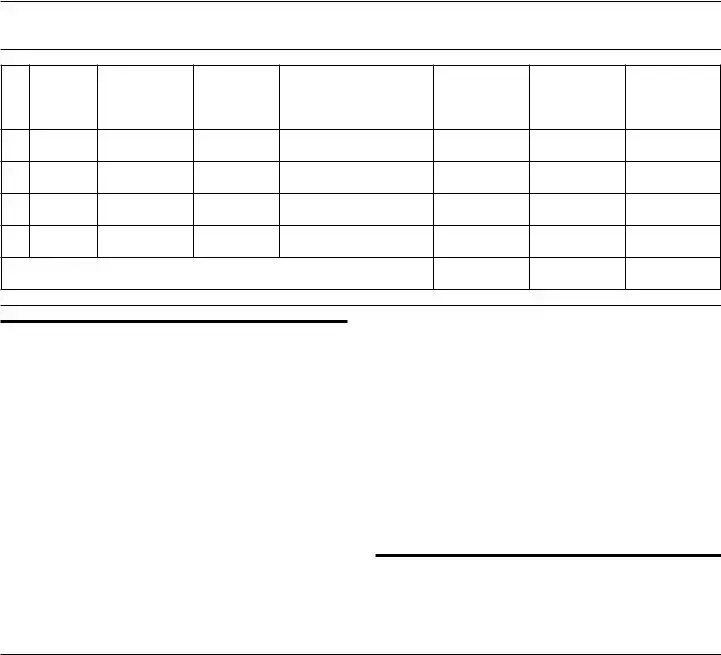

Record of Estimated Tax Payments (Farmers, fishermen, and fiscal year taxpayers, see Payment Due Dates.)

Keep for Your Records

Payment number |

date |

|

|

(c) Check or |

any convenience fee) |

credit applied |

(add (d) and (e)) |

|

|

confirmation number |

|||||

|

Payment |

(a) Amount |

(b) Date |

money order number, or |

(d) Amount paid |

(e) 2021 |

(f) Total amount |

|

due |

due |

paid |

credit or debit card |

(do not include |

overpayment |

paid and credited |

|

|

|

|

|

14/18/2022

26/15/2022

39/15/2022

41/17/2023*

Total |

. . . . . . . . . . . . . . . . . . . . . . . ▶ |

* You do not have to make this payment if you file your 2022 tax return by January 31, 2023, and pay the entire balance due with your return.

Privacy Act and Paperwork Reduction Act Notice. We ask for this information to carry out the tax laws of the United States. We need it to figure and collect the right amount of tax. Our legal right to ask for this information is Internal Revenue Code section 6654, which requires that you pay your taxes in a specified manner to avoid being penalized. Additionally, sections 6001, 6011, and 6012(a) and their regulations require you to file a return or statement for any tax for which you are liable; section 6109 requires you to provide your identifying number. Failure to provide this information, or providing false or fraudulent information, may subject you to penalties.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as stated in Code section 6103.

We may disclose the information to the Department of Justice for civil and criminal litigation and to other federal agencies, as provided by law.

We may disclose it to cities, states, the District of Columbia, and U.S. commonwealths or possessions to carry out their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

If you do not file a return, do not give the information asked for, or give fraudulent information, you may be charged penalties and be subject to criminal prosecution.

Please keep this notice with your records. It may help you if we ask you for other information. If you have any questions about the rules for filing and giving information, please call or visit any Internal Revenue Service office.

The average time and expenses required to complete and file this form will vary depending on individual circumstances. For the estimated averages, see the instructions for your income tax return.

If you have suggestions for making this package simpler, we would be happy to hear from you. See the instructions for your income tax return.

Tear off here

Pay online at www.irs.gov/ etpay

Simple.

Fast.

Secure.

Form |

|

|

2022 Estimated Tax |

Payment |

4 |

OMB No. |

|||||

|

|||||||||||

Internal Revenue Service |

|

|

Voucher |

|

|||||||

|

Department of the Treasury |

|

|

|

|

|

|

|

|

|

|

File only if you are making a payment of estimated tax by check or money order. Mail this |

Calendar |

||||||||||

|

|

|

|

|

|

||||||

voucher with your check or money order payable to “United States Treasury.” Write your |

Amount of estimated tax you are paying |

||||||||||

social security number and “2022 Form |

by check or |

|

|

|

|

||||||

cash. Enclose, but do not staple or attach, your payment with this voucher. |

money order. |

|

|

|

|||||||

|

|

|

|

|

|

|

|

||||

|

Your first name and middle initial |

Your last name |

|

|

Your social security number |

||||||

|

|

|

|

|

|

|

|

|

|||

|

If joint payment, complete for spouse |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||||

or type |

Spouse’s first name and middle initial |

Spouse’s last name |

|

|

Spouse’s social security number |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Address (number, street, and apt. no.) |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

City, town, or post office. If you have a foreign address, also complete spaces below. |

State |

|

|

|

ZIP code |

||||||

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

||||

|

Foreign country name |

|

Foreign province/county |

|

|

Foreign postal code |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

For Privacy Act and Paperwork Reduction Act Notice, see instructions. |

Form |

THIS PAGE INTENTIONALLY LEFT BLANK

Form Characteristics

| Fact Name | Description |

|---|---|

| Who Must File | U.S. citizens, resident aliens, and certain nonresidents must file estimated tax using Form 1040-ES if they expect to owe at least $1,000 in taxes after subtracting withholding and credits. |

| Payment Schedule | Estimated tax payments are due in four installments: April 18, June 15, September 15, and January 17 of the following year. |

| Special Rules | Farmers and fishermen can avoid making estimated tax payments if at least two-thirds of their income comes from these sources. They can pay all estimated taxes by January 17 of the next year or file by March 1 without penalty. |

| Adjusted Gross Income | Higher income taxpayers (AGI over $150,000) have different payment requirements and may need to pay 110% of last year’s taxes under certain conditions. |

| Standard Deduction | The standard deduction increased for 2022: $25,900 for married couples, $19,400 for heads of household, and $12,950 for single filers. |

| State-Specific Forms | State-specific estimated tax payments vary widely, governed by each state's tax laws. Always check local tax regulations for compliance. |

Guidelines on Utilizing Us Estimated Tax

Filling out the U.S. Estimated Tax Form, also known as Form 1040-ES, doesn’t have to be complicated. You'll need specific financial information, such as your expected income and deductions. Following the steps below will guide you through the process, ensuring you provide the necessary details accurately.

- Gather your financial documents, including your previous year's tax return, to use as a reference.

- Open the 2022 Form 1040-ES, available on the IRS website or via tax software.

- Complete the “Estimated Tax Worksheet” on page 1 of the form. Start with your expected adjusted gross income (Line 1).

- Calculate adjustments, including any self-employment deductions, if applicable.

- Fill out any tax credits you anticipate claiming (Line 7).

- Estimate any other taxes that you may owe (Line 10), including household employment taxes.

- Compute your total tax liability for the year.

- Divide the total tax by four to get your estimated quarterly payments.

- Use the payment vouchers included with the form to send in your estimated tax payments by mail, if not paying electronically.

- Keep a copy of your completed Form 1040-ES for your records.

Once you’ve filled out the Estimated Tax Form, remember to submit your payments on time according to the specified due dates. Staying organized will help avoid any penalties for late payments.

What You Should Know About This Form

What is Form 1040-ES and why do I need it?

Form 1040-ES is used by individuals to calculate and pay their estimated taxes for the year. You’ll need this form if you receive income that doesn’t have taxes withheld, such as self-employment earnings, interest, dividends, rents, or unemployment benefits. If you expect to owe at least $1,000 in taxes after subtracting withholdings and refundable credits, it's necessary to use this form to avoid underpayment penalties.

Who needs to make estimated tax payments?

U.S. citizens, resident aliens, and certain residents of U.S. territories must make estimated tax payments if they expect to owe at least $1,000 in tax after subtracting withholding and refundable credits. This includes those who earn income from sources that don’t have federal taxes withheld. Higher-income taxpayers with an adjusted gross income over $150,000 may also need to make these payments.

When are estimated tax payments due?

Estimated tax payments can be made in four equal installments. The due dates for these payments are typically April 15, June 15, September 15, and January 15 of the following year. However, if you file your tax return early and pay your balance due by January 31 of the next year, the January payment may not be required.

What happens if I don’t make the required estimated tax payments?

If you don’t pay enough estimated tax throughout the year or miss deadlines, you may face penalties for underpayment when you file your return. The penalty is calculated based on the amount not paid by the due date and the number of days the payment is late. Making payments promptly can help you avoid these penalties.

Can I change my estimated tax payments if my income changes?

Yes, if you experience a significant change in income, you can adjust your estimated tax payments accordingly. You would do this by recalculating your expected tax liability using the 2022 Estimated Tax Worksheet. If necessary, you can make additional payments or amend your estimated payment amounts to reflect changes in your financial situation.

Common mistakes

Filling out the US Estimated Tax form correctly is essential to ensure that you meet your tax obligations without incurring penalties. Unfortunately, many people make common mistakes in the process. Understanding these pitfalls can help you avoid costly errors.

One frequent mistake is failing to consider all sources of income. Your estimated tax liability isn't limited to salaries and wages. If you receive income from side gigs, self-employment, interest, dividends, or rental properties, you must include all that income when calculating your estimated taxes. Ignoring these can lead to underpayment penalties.

Another common error involves incorrect calculation of taxable income. Many forms of income, like social security benefits or unemployment compensation, can be taxable. Ensure you know which of your earnings are taxable and appropriately report them on your 1040-ES form to avoid nasty surprises when filing your return.

People often underestimate their tax liability for the coming year. It's essential to project your income and deductions accurately. Many individuals will guess their numbers, but inaccuracies can lead to underestimating the amount owed. Always base estimates on realistic expectations using data from previous years as a guide.

Additionally, failing to update personal information can cause issues. If you've changed your address, marital status, or significant financial situation, you should update your tax records using Form 8822. Not doing so may result in miscommunication from the IRS, potentially complicating your case.

Another mistake is not adhering to payment deadlines. The due dates for estimated tax payments can be tricky, and missing one could lead to penalties. Remember to mark your calendar or set reminders for the payment due dates to stay compliant.

Many people overlook credits available to them that could lower their tax bill. Eligible tax credits vary from educational to energy-related credits. Failing to account for these can lead to paying more than necessary.

Sometimes, taxpayers will fill out the form without checking that all sections are complete. Be diligent. Each line matters, and missing information can lead to processing delays or incorrect calculations.

Another issue arises when individuals attempt to make joint estimated tax payments without ensuring compatibility with their spouse's tax situation. If either partner is a nonresident alien or has been granted different tax years, joint payments cannot be made. Understanding these rules helps avoid confusion later on.

Buying into the misconception that estimated payments are optional can also lead to trouble. If you expect to owe $1,000 or more at tax time, you need to make estimated payments. Ignoring this obligation can result in penalties and interest on the unpaid amount.

In summary, being aware of these ten common mistakes can be a crucial step toward ensuring accurate and timely completion of your estimated tax form. Understanding how to navigate the form correctly will not only help you avoid penalties but also give you peace of mind about your tax obligations.

Documents used along the form

The Form 1040-ES is a crucial document for individuals who need to pay estimated taxes. However, several other forms and documents often accompany it, helping to ensure accurate reporting and compliance with tax obligations. Below are some commonly utilized forms that may be pertinent when dealing with estimated taxes.

- Form W-4: This is the Employee’s Withholding Certificate. Employees submit it to their employers to specify how much federal income tax should be withheld from their paychecks. Adjustments made on this form can help reduce the need for estimated tax payments.

- Form W-4P: Known as the Withholding Certificate for Periodic Pension or Annuity Payments, this form is completed by individuals receiving pensions or annuities. It allows recipients to request specific tax withholding amounts from their periodic payments to avoid underpayment of taxes.

- Form 2210: This form is used to figure out if an individual owes a penalty for underpaying estimated tax. It provides options to compute the penalty, depending on specific underpayment circumstances, allowing taxpayers to avoid unnecessary charges.

- Form 1040: This is the standard individual income tax return form. It summarizes all income, deductions, and credits for the year. Taxpayers will reconcile their actual tax liability with their estimated payments using this form when filing their annual tax return.

Using these accompanying forms and documents can facilitate a smoother process when filing estimated taxes and help in making adjustments throughout the year to better align tax liabilities with payments. By staying organized and informed, individuals can navigate their tax responsibilities with greater confidence.

Similar forms

-

Form 1040: This is the main income tax return form for individuals. Like Form 1040-ES, it is used to report income, deductions, and tax due. However, Form 1040 is submitted after the end of the tax year, while Form 1040-ES is used for estimating tax throughout the year.

-

Form W-4: This form is used to inform your employer about your tax withholding preferences. Both Form W-4 and Form 1040-ES help ensure you are paying the correct amount of tax, but W-4 deals with withholding from paychecks, while 1040-ES focuses on estimated tax payments.

-

Form 2210: This form is used to determine penalties for underpayment of estimated tax. Similar to Form 1040-ES, it addresses estimated tax, but it specifically focuses on assessing whether you have paid enough tax throughout the year to avoid penalties.

-

Form 1099: This form reports various types of income received other than wages. Like Form 1040-ES, it provides crucial information for tax reporting. Form 1099 helps taxpayers understand what income may require estimated tax payments, just as 1040-ES aids in planning those payments.

Dos and Don'ts

When filling out the US Estimated Tax form (Form 1040-ES), keeping certain guidelines in mind can help ensure a smooth process. Below is a list of recommended practices as well as things to avoid:

- Do read the instructions carefully. Understanding the requirements can save you time and potential issues down the line.

- Do ensure your personal information, like your Social Security Number, is entered correctly to avoid delays.

- Do use your previous tax return as a reference to estimate your income and deductions accurately.

- Do make sure to check the due dates for estimated tax payments and pay on time to avoid penalties.

- Do consider adjusting your withholding with your employer if you think paying estimated taxes will be too burdensome.

- Don't guess your estimated taxes. Use the provided worksheets to calculate based on your earnings and expenses.

- Don't forget to include all sources of income, even those that typically do not have tax withheld, such as freelance work.

- Don't submit your tax payments without the appropriate vouchers, as this can lead to processing delays.

- Don't ignore any changes in your income or financial situation; update your estimates if necessary.

Misconceptions

It's important to have accurate information when dealing with estimated taxes. Below are some common misconceptions about the US Estimated Tax Form that you might encounter.

- Misconception 1: You must pay estimated taxes if you are self-employed.

- Misconception 2: You cannot adjust your estimated tax payments once they are set.

- Misconception 3: You only need to make estimated payments if you file a tax return.

- Misconception 4: You don’t need to file if you owe less than $1,000 in estimated taxes.

- Misconception 5: You must make four equal payments each year.

This is not entirely true. While self-employed individuals often need to make estimated tax payments, others may also be required to pay them. If you expect to owe at least $1,000 in tax after subtracting withholding and refundable credits, you should consider making estimated payments.

Many people believe that once they calculate their estimated payments, they are locked in until the end of the tax year. However, you can change your estimated tax payments if your income decreases or if you have significant changes in deductions or credits.

This is misleading. Even if you don’t file a return, you may still need to make estimated payments. If you have income that is not subject to withholding, such as dividends or rental income, you are responsible for paying taxes on that income throughout the year.

It's a common belief that owing less than $1,000 means you are exempt from filing. In truth, while you may not owe a penalty, you still need to file your tax return if you meet other filing thresholds.

While four equal payments are the norm, there are situations where this may not be necessary. If your income fluctuates throughout the year, you might be able to use the annualized income installment method to determine your required payments.

Understanding these misconceptions can help you navigate the complexities of estimated taxes more effectively. Always consult with a tax professional if you’re uncertain about your obligations.

Key takeaways

Filling out and using the U.S. Estimated Tax form can seem daunting, but understanding key points can simplify the process. Here are some essential takeaways:

- Who Must Pay: Estimated tax payments are generally required for anyone who expects to owe at least $1,000 in taxes for the year. This could include self-employed individuals, certain investors, or those with significant income not subject to withholding.

- Payment Due Dates: You can choose to pay all your estimated tax at once or in four separate installments. Keeping track of these due dates is essential to avoid possible penalties.

- Adjusting Payments: If your income varies throughout the year, you can use methods such as the annualized income installment method to adjust your estimated payments accordingly. This way, you can pay less in periods of lower income.

- Payment Methods: The IRS offers multiple convenient payment options. You can pay online, by phone, or via check. Each option has its own benefits, so choose one that works best for your situation.

Familiarity with these points can lead to a smoother experience when handling estimated tax payments. Always stay on top of your tax obligations to avoid unnecessary complications and penalties.

Browse Other Templates

Ig a - Applicants are reminded that providing false information can lead to dismissal, emphasizing honesty.

Medicaid North Carolina - Income details for each household member must be reported on Attachment B, if applicable.

Ngb 36-11 - Accuracy in reporting training and awards is critical, as these elements are heavily weighted in promotions.