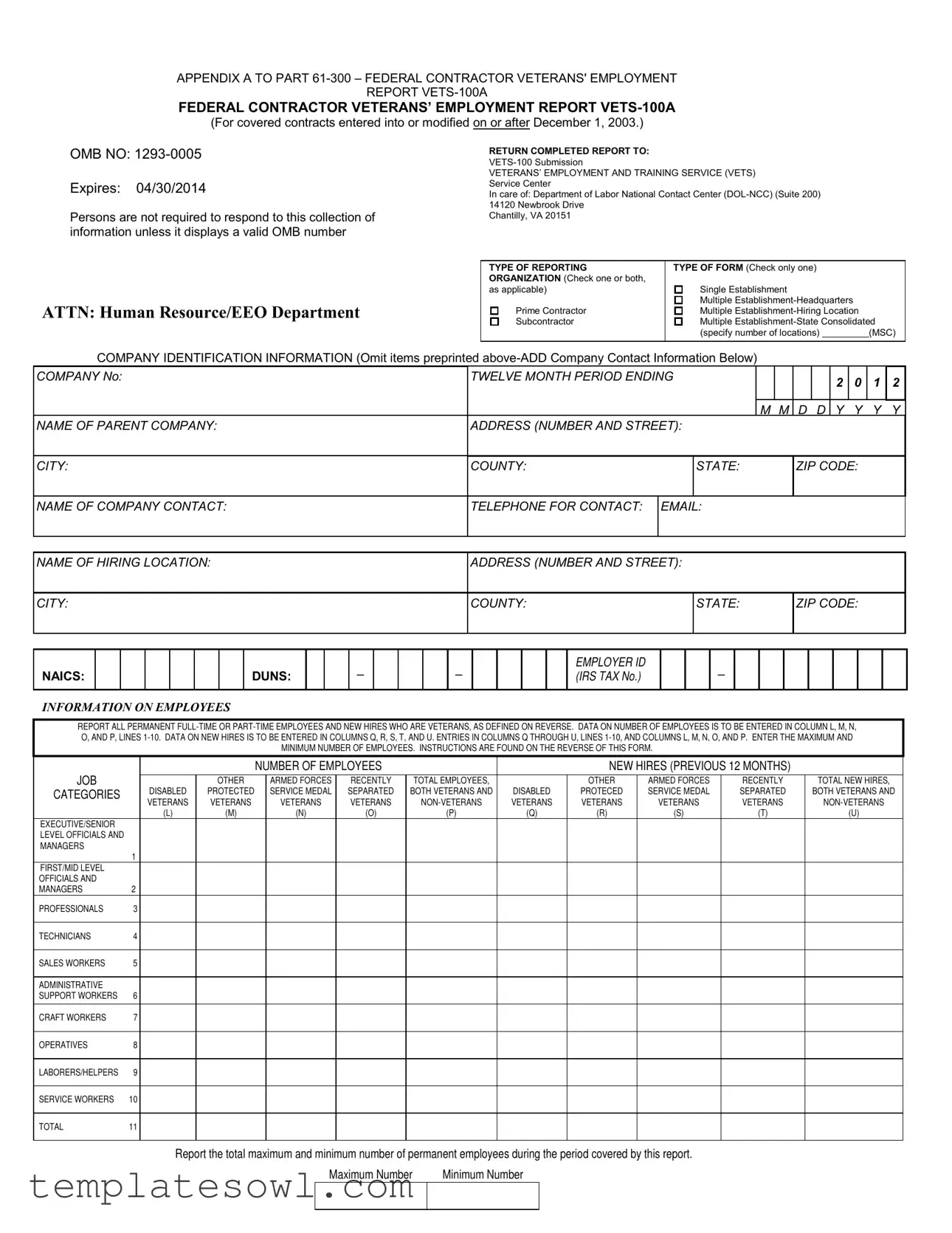

Fill Out Your Vets 100A Form

The VETS-100A form serves as a crucial tool for federal contractors and subcontractors needing to report employment data related to veterans. Particularly aimed at those contracts established or modified after December 1, 2003, this report collects valuable workforce information, including the total number of employees categorized by job types and the specific number of new hires for veterans. Organizations must categorize their employees into various classifications, such as executive officials, professionals, and service workers, to provide a clear overview of their hiring practices regarding veterans. The form also entails identifying company and location details, thereby ensuring that the Department of Labor can accurately track compliance with employment obligations. Furthermore, due by September 30 each year, the VETS-100A form emphasizes the legal requirements set forth by Title 38 of the United States Code, mandating that contractors actively contribute to improving veteran employment rates. Not only does this form gather essential data, but it also reinforces the commitment to supporting those who have served in the armed forces, ensuring their skilled contributions are recognized and utilized in the civilian workforce.

Vets 100A Example

APPENDIX A TO PART

REPORT

FEDERAL CONTRACTOR VETERANS’ EMPLOYMENT REPORT

(For covered contracts entered into or modified on or after December 1, 2003.)

OMB NO:

Expires: 04/30/2014

Persons are not required to respond to this collection of information unless it displays a valid OMB number

ATTN: Human Resource/EEO Department

RETURN COMPLETED REPORT TO:

VETERANS’ EMPLOYMENT AND TRAINING SERVICE (VETS) Service Center

In care of: Department of Labor National Contact Center

Chantilly, VA 20151

TYPE OF REPORTING |

TYPE OF FORM (Check only one) |

|

|

ORGANIZATION (Check one or both, |

|

|

|

as applicable) |

Single Establishment |

|

|

|

Multiple |

|

|

Prime Contractor |

Multiple |

|

|

Subcontractor |

Multiple |

||

|

(specify number of locations) |

(MSC) |

|

|

|

|

|

COMPANY IDENTIFICATION INFORMATION (Omit items preprinted

COMPANY NO:

NAME OF PARENT COMPANY:

CITY:

NAME OF COMPANY CONTACT:

TWELVE MONTH PERIOD ENDING |

|

|

|

|

2 |

0 |

1 |

2 |

||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M M |

D D |

Y |

Y |

Y |

Y |

||

ADDRESS (NUMBER AND STREET): |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

COUNTY: |

|

STATE: |

|

|

ZIP CODE: |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

TELEPHONE FOR CONTACT: |

EMAIL: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME OF HIRING LOCATION:

CITY:

ADDRESS (NUMBER AND STREET):

COUNTY: |

STATE: |

ZIP CODE: |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAICS:

DUNS:

_

_

EMPLOYER ID (IRS TAX NO.)

_

INFORMATION ON EMPLOYEES

REPORT ALL PERMANENT

|

|

|

|

NUMBER OF EMPLOYEES |

|

|

NEW HIRES (PREVIOUS 12 MONTHS) |

|

||||

JOB |

|

|

OTHER |

|

ARMED FORCES |

RECENTLY |

TOTAL EMPLOYEES, |

|

OTHER |

ARMED FORCES |

RECENTLY |

TOTAL NEW HIRES, |

CATEGORIES |

|

DISABLED |

PROTECTED |

|

SERVICE MEDAL |

SEPARATED |

BOTH VETERANS AND |

DISABLED |

PROTECED |

SERVICE MEDAL |

SEPARATED |

BOTH VETERANS AND |

|

VETERANS |

VETERANS |

|

VETERANS |

VETERANS |

VETERANS |

VETERANS |

VETERANS |

VETERANS |

|||

|

|

|

||||||||||

|

|

(L) |

(M) |

|

(N) |

(O) |

(P) |

(Q) |

(R) |

(S) |

(T) |

(U) |

EXECUTIVE/SENIOR |

|

|

|

|

|

|

|

|

|

|

|

|

LEVEL OFFICIALS AND |

|

|

|

|

|

|

|

|

|

|

|

|

MANAGERS |

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

FIRST/MID LEVEL |

|

|

|

|

|

|

|

|

|

|

|

|

OFFICIALS AND |

|

|

|

|

|

|

|

|

|

|

|

|

MANAGERS |

2 |

|

|

|

|

|

|

|

|

|

|

|

PROFESSIONALS |

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TECHNICIANS |

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SALES WORKERS |

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADMINISTRATIVE |

|

|

|

|

|

|

|

|

|

|

|

|

SUPPORT WORKERS |

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CRAFT WORKERS |

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATIVES |

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LABORERS/HELPERS |

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SERVICE WORKERS |

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Report the total maximum and minimum number of permanent employees during the period covered by this report.

Maximum Number |

Minimum Number |

|

|

Federal Contractor Veterans’ Employment Report

WHO MUST FILE

This

WHEN/WHERE TO FILE

This annual report must be filed no later than September 30. Mail to the address

LEGAL BASIS FOR REPORTING REQUIREMENTS

Title 38, United States Code, Section 4212(d) requires that federal contractors report at least annually the numbers of employees in the workforce by job category and hiring location, and the number of such employees, by job category and hiring location, who are qualified covered veterans. Federal contractors must report the total number of new hires during the period covered by the report and the number of such employees who are qualified covered veterans. Additionally, federal contractors must report on the maximum and minimum number of employees during the period covered by the report.

HOW TO SUBMIT THE

RECORD KEEPING

Employers must keep copies of the completed annual

HOW TO PREPARE THE FORMS

Answers to questions in all areas of the form are mandatory.

Type of Reporting Organization Indicate the type of contractual relationship (prime contractor or subcontractor) that the organization has with the Federal Government. If the organization serves as both a prime contractor and a subcontractor on various federal contracts, check both boxes.

Type of Form If a reporting organization only has a covered contract that was entered into or modified on or after December 1, 2003, it then must use a

If a reporting organization submits only one

COMPANY IDENTIFICATION INFORMATION:

Company Number Leave Blank. If there are any questions regarding a Company Number, please call the

Twelve Month Period Ending Enter the end date for the twelve month reporting period used as the basis for filing the

Name and Address for Single Establishment Employers COMPLETE the identifying information under the Parent Company name and address section. LEAVE BLANK all of the identifying information for the Hiring Location.

Name and Address for Multi Establishment Employers For parent company headquarters location, COMPLETE the name and address for the parent company headquarters, LEAVE BLANK the name and address of the Hiring Location. For hiring locations of a parent company, COMPLETE the name and address for the Parent Company location, COMPLETE the name and address for the Hiring Location.

NAICS Code, DUNS Number, and Employer ID Number Single Establishment and Multi Establishment Employers must COMPLETE the Employer ID Number, NAICS Code, DUNS Number, as described below.

NAICS Code Enter the six (6) digit NAICS Code applicable to the hiring location for which the report is filed. If there is not a separate NAICS Code for the hiring location, enter the NAICS Code for the parent company.

Dun and Bradstreet I.D. Number (DUNS) If the company or any of its establishments has a Dun and Bradstreet Identification Number, please enter the nine (9) digit number in the space provided. If there is a specific DUNS Number applicable to the hiring location for which the report is filed, enter that DUNS Number. Otherwise, enter the DUNS number for the parent company.

Employer I.D. Number (EIN) Enter the nine (9) digit number assigned by the I.R.S. to the contractor. If there is a specific EIN applicable to the hiring location for which the report is filed, enter that EIN. Otherwise, enter the EIN for the parent company.

INFORMATION ON EMPLOYEES

Counting Veterans. Some veterans will fall into more than one of the qualified covered veteran categories. For example, a veteran may be both a disabled veteran and an other protected veteran. In such cases the veteran must be counted in each category.

Number of Employees. Provide all data for regular

New Hires. Report the number of regular

Maximum/Minimum Employees. Report the maximum and minimum number of regular employees on board during the

DEFINITIONS:

'Hiring location' means an establishment as defined at 41 CFR

‘Job Categories’ means any of the following: Officials and Managers (Executive/Senior Level Officials and Managers and First/Mid Level Officials and Managers), Professionals, Technicians, Sales Workers, Administrative Support Workers, Craft Workers, Operatives, Laborers and Helpers, and Service Workers and are defined in 41 CFR

'Disabled Veteran' means (i) a veteran of the U.S. military, ground, naval or air service who is entitled to compensation (or who but for the receipt of military retired pay would be entitled to compensation) under laws administered by the Secretary of Veterans Affairs, or (ii) a person who was discharged or released from active duty because of a

'Other Protected Veteran' means a veteran who served on active duty in the U.S. military, ground, naval, or air service during a war or in a campaign or expedition for which a campaign badge has been authorized. For those with Internet access, the information required to make this determination is available at http://www.opm.gov/staffingportal/vgmedal2.asp . A replica of that list is enclosed with the annual

‘Armed Forces Service Medal Veteran’ means a veteran who, while serving on active duty in the U.S. military, ground, naval or air service, participated in a United States military operation for which an Armed Forces service medal was awarded pursuant to Executive Order 12985 (61 Fed. Reg. 1209) at http://www.opm.gov/staffingportal/vgmedal2.asp

‘Recently Separated Veteran’ means a veteran during the

‘Covered Veteran’ means a veteran as defined in the four veteran categories above.

A copy of 41 CFR part

__________________________________________________________________________________________________________

Public reporting burden for this collection is estimated to average 45 minutes per response, including the time for reviewing instructions, searching existing data source, gathering and maintaining the data needed, and completing and reviewing the collection of information. Send comments regarding this burden estimate or any other aspect of this collection of information, including suggestions for reducing the burden to the Department of Labor, Office of Information Management, Room

Form Characteristics

| Fact Name | Details |

|---|---|

| Who Must File | All nonexempt federal contractors and subcontractors with contracts or subcontracts of $100,000 or more entered into or modified on or after December 1, 2003, must file the VETS-100A form. |

| Filing Deadline | The annual VETS-100A Report must be submitted by September 30 each year. |

| Legal Basis | Reporting is required under Title 38, United States Code, Section 4212(d), which mandates federal contractors to report employee numbers and veteran statistics annually. |

| Submission Method | Reports can be mailed to the Department of Labor or submitted electronically at the DOL’s official website. |

Guidelines on Utilizing Vets 100A

Completing the VETS-100A form is an essential process for federal contractors and subcontractors as it aids in reporting veteran employment data. The following steps guide users through the process to ensure that necessary information is accurately submitted.

- Gather Required Information: Collect all necessary data such as company identification, employee counts, and hiring information for the appropriate reporting period.

- Identify Your Organization: Determine if your organization is a single or multiple establishment and whether you are a prime contractor or subcontractor. Check the appropriate boxes at the top of the form.

- Company Information: Fill in the required company identification details including the name of the parent company, address, telephone number, and contact person's email.

- Report Period: Specify the twelve-month period ending date. Choose a date between August 1 and September 30 of the current year, corresponding to the end of a payroll period.

- Employment Data: In the respective columns, report the number of employees by job categories, accounting for both veterans and new hires during the specified period.

- Maximum and Minimum Numbers: Identify the highest and lowest number of employees present during the reporting year and record these figures in the specified areas.

- Veteran Categories: Accurately categorize veterans according to their status as disabled veterans, other protected veterans, Armed Forces service medal veterans, or recently separated veterans.

- Submission Method: Once the form is completed, submit it either by mailing it to the address provided on the front of the form or electronically through the Department of Labor’s website.

After these steps, verify all the entered information for accuracy. It is critical to maintain a copy of the completed report for one year for your records. Failing to submit accurately or timely could have significant implications for compliance with federal reporting requirements.

What You Should Know About This Form

What is the purpose of the VETS-100A form?

The VETS-100A form is designed for federal contractors and subcontractors to report annually on the employment of veterans. Specifically, it collects data on the number of employees by job category and hiring location. It helps ensure that these organizations fulfill their obligations under federal law to promote veteran employment. This report is essential for tracking progress related to veteran employment and for ensuring compliance with legal requirements.

Who is required to file the VETS-100A form?

All nonexempt federal contractors and subcontractors must file this report if they have a contract or subcontract worth $100,000 or more, and the contract was entered into or modified on or after December 1, 2003. Whether providing personal property or non-personal services, such as construction or research, these companies must complete the VETS-100A form annually if they meet the criteria.

When is the VETS-100A form due, and where should it be sent?

Contractors must submit the VETS-100A form by September 30 each year. Completed reports should be mailed to the address provided on the front of the form. It’s vital to comply with this deadline to avoid potential penalties and to ensure veteran employment data is collected in a timely manner.

How do multi-establishment employers file the VETS-100A report?

Multi-establishment employers must file a report for their headquarters and a separate report for each hiring location that employs 50 or more persons. Additionally, they can either submit a report for each hiring location with fewer than 50 employees or provide a consolidated report that includes all such locations in a state. This method facilitates organization and ensures accurate reporting across different locations.

What happens if a contractor has multiple categories of veterans in their workforce?

In cases where a veteran qualifies under more than one category—such as being both a disabled veteran and an other protected veteran—they must be counted in every applicable category. This approach ensures that the data reflects the full scope of veterans employed by the organization, contributing to a more accurate assessment of veteran employment within federal contracting.

What are the record-keeping requirements for the VETS-100A form?

Employers must maintain copies of the completed VETS-100A reports for one year. This requirement is crucial for accountability, making it essential for organizations to keep accurate records not only for compliance but also for future reference should the need arise to verify the information provided.

Common mistakes

Filling out the VETS-100A form can be a straightforward process, but many make common errors that can lead to complications. One common mistake involves incorrectly identifying the type of organization. Organizations often fail to specify whether they are a prime contractor, subcontractor, or both. Accurate identification is crucial for maintaining compliance with federal reporting requirements.

Another frequent error is related to the completion of company identification information. Many filers neglect to provide complete information for the parent company or inadvertently leave out important details such as the Employer ID Number or NAICS code. This can cause delays in processing and may lead to additional inquiries from the Department of Labor.

Many people also mistakenly omit or miscount veterans in their employee tallies. Some veterans qualify under multiple categories; therefore, they must be reported in each pertinent category. Failing to count these individuals correctly can skew data and affect compliance outcomes.

In the section concerning new hires, a common oversight occurs when employers report incomplete data. All new hires from the previous twelve months must be captured in the appropriate columns. This includes both veterans and non-veterans. Missing even one hire can impact the accuracy of this report.

Another mistake involves choosing the wrong reporting period. The selected payroll period must fall between August 1 and September 30; however, some organizations confuse these dates and select inappropriate ones. This confusion can lead to inaccurate reporting and potential violations.

Many organizations fail to report maximum and minimum employee counts. The data on these figures is essential for a comprehensive report. Employers need to accurately capture the number of employees throughout the covered period to remain compliant.

Poor attention to detail in data entry is another serious issue. Errors in figuring totals or transcribing numbers can be detrimental. It is essential that employers double-check all data entries to ensure accuracy throughout the report.

Some filers neglect to retain copies of the completed reports. Companies are required to keep a record of their submissions for at least one year. Failure to do so can result in complications or lack of compliance during audits.

Finally, not adhering to submission deadlines remains a common pitfall. The VETS-100A report must be filed by September 30 each year, but many forget this crucial deadline. Late submissions can incur penalties and affect future contract eligibility.

Documents used along the form

The VETS-100A form is an important document for federal contractors to report employment statistics about veterans. However, it is often submitted alongside several other forms and documents that may be required for compliance. Each of these documents serves a specific purpose that helps ensure transparency and support for veteran employment.

- VETS-100 Form: This form is used for federal contractors who have contracts entered into before December 1, 2003. It tracks similar data as the VETS-100A, focusing on veteran employment statistics.

- EEO-1 Report: This report is required by the Equal Employment Opportunity Commission. It collects demographic information about employees, including race, gender, and job category, providing insights into workplace diversity and inclusion.

- Affirmative Action Program (AAP): Federal contractors often create an AAP to outline their strategies for promoting equal employment opportunities and increasing the hiring of underrepresented groups, including veterans.

- Department of Labor Compliance Statement: This statement certifies compliance with labor laws and regulations relevant to the hiring and employment of veterans, confirming that the organization is actively supporting veteran employment initiatives.

These documents complement the VETS-100A form and contribute to a more comprehensive understanding of an organization’s commitment to hiring veterans. Proper completion and reporting using these forms not only ensure compliance but also reflect a dedication to supporting those who have served our country.

Similar forms

- VETS-100 Form: Similar to VETS-100A, this form is also required for federal contractors, but applies to those with contracts entered before December 1, 2003. It collects similar employee data regarding veterans.

- EEO-1 Report: This report focuses on the demographic breakdown of a company's workforce based on race, gender, and job category. Like VETS-100A, it is mandated for federal contractors and aims to address employment diversity.

- OFCCP Compliance Report: This report is submitted to the Office of Federal Contract Compliance Programs (OFCCP) and evaluates a contractor's compliance with equal opportunity and affirmative action regulations, paralleling the data collection focus of the VETS-100A.

- Form SF-1444: This is the "Request for Employment Information" form that federal contractors use to verify employee qualifications. It shares similar goals of ensuring the correct employment practices for veterans.

- Form VETS-4212: Required by federal contractors, this form gathers data on the hiring of veterans and is used to monitor compliance with federal regulations regarding veteran employment, much like the VETS-100A.

- Form I-9: While primarily focused on verifying employee eligibility to work in the U.S., this form also requires basic employee information similar to what is collected in VETS-100A.

- Department of Labor AAP Report: Through this Affirmative Action Plan (AAP), contractors report their affirmative action efforts and outcomes. The aim of monitoring veteran employment aligns closely with what VETS-100A seeks to achieve.

- State Veterans Employment Reports: Various states may require reports from employers regarding veteran employment similar to the data collected through VETS-100A, ensuring compliance with local regulations regarding veteran hiring practices.

Dos and Don'ts

When filling out the VETS-100A form, ensuring accuracy and compliance is crucial. Here are essential dos and don'ts to consider:

- Do carefully read all instructions before filling out the form to understand requirements.

- Do include all full-time and part-time employees in your counts, correctly categorizing veterans as specified.

- Do double-check your company identification details for accuracy, as errors can lead to compliance issues.

- Do submit the form by the September 30 deadline to avoid penalties and ensure timely processing.

- Don’t leave any sections blank; if a number is zero, enter '0' to provide complete data.

- Don’t file if your contracts are only with private companies; this report is for federal contractors only.

- Don’t forget to keep a copy of the submitted report for at least one year for your records.

Misconceptions

When it comes to understanding the VETS 100A form, it’s easy to run into some misconceptions. Here are five common myths and the realities behind them.

- Only large companies need to file the VETS 100A form. Contrary to this belief, any federal contractor or subcontractor with a contract of $100,000 or more must file the form, regardless of their size. This includes both small businesses and larger entities.

- The VETS 100A form is optional. This is not true. The VETS 100A form is a mandatory requirement for nonexempt federal contractors with current qualifying contracts. Failing to file can result in penalties or loss of contract opportunities.

- The form is only for reporting disabled veterans. Some might think this is the case, but the VETS 100A form is designed to gather data on various categories of veterans, including recently separated veterans, other protected veterans, and armed forces service medal veterans. Each category is important for comprehensive reporting.

- There is no deadline to submit the form. Many believe they can submit this form at their convenience, but it must be filed by September 30 of each year. Missing this deadline can have serious implications for compliance with federal regulations.

- You can count veterans multiple times in different categories. It’s a common misunderstanding that veterans can only be counted once. In fact, veterans who meet more than one category should be counted in each applicable category on the form, accurately reflecting your workforce demographics.

Clearing up these misconceptions helps ensure compliance and supports veterans in the workplace. Proper understanding of the VETS 100A form can greatly enhance how businesses manage their reporting responsibilities.

Key takeaways

Understanding the VETS-100A Form is crucial for employers who engage in federal contracts. Here are five key takeaways regarding filling out and utilizing this form:

- The VETS-100A form must be submitted annually by federal contractors and subcontractors with contracts valued at $100,000 or more, as long as those contracts were entered into or modified after December 1, 2003.

- Completing the report requires collecting information on both current employees and new hires who are veterans, as well as their job categories, ensuring accurate data entries in the designated columns.

- Employers must file the VETS-100A report by September 30 each year. Reports can be mailed or submitted online, but consolidated reports are only allowed under certain circumstances for employers with multiple locations.

- It is essential to accurately categorize veteran employees by their respective statuses, such as disabled veteran, other protected veteran, or recently separated veteran, to ensure comprehensive reporting.

- Retaining a copy of the filed VETS-100A report for at least one year is a legal requirement for all employers, which aids in compliance and any future audits or inquiries by the Department of Labor.

Browse Other Templates

Milburn Printing - It helps manage expectations regarding shipment timelines and costs.

Where Does Bail Money Go - Each bondsman must submit a general affidavit of qualifications detailing their experience and capabilities.

Academy of Art University Transcript - The form helps in ensuring accurate record keeping by the registrar's office.