Fill Out Your Vtr 264 Form

The VTR 264 form, designed specifically for the repossession of motor vehicles in Texas, plays a crucial role in the documentation and transfer process that follows such an event. This form must be thoroughly completed whenever a vehicle is repossessed, and all required fields must be filled in accurately. It necessitates the selection of an appropriate “Method of Repossession,” which includes options such as a lien agreement, sequestration, or a floor plan lien. Each method has its own set of documentation requirements, ensuring that the repossession is legally recognized and properly executed. Vehicle information, including details such as the Vehicle Identification Number, make, model, and year, must also be recorded. Additionally, lienholder information, including the name of the lienholder and their contact details, is essential. Submitting the VTR 264 form to the county tax assessor-collector's office, along with other required documents, is mandatory for obtaining a new title. This thorough process helps prevent fraudulent claims and ensures the rightful transfer of vehicle ownership following repossession.

Vtr 264 Example

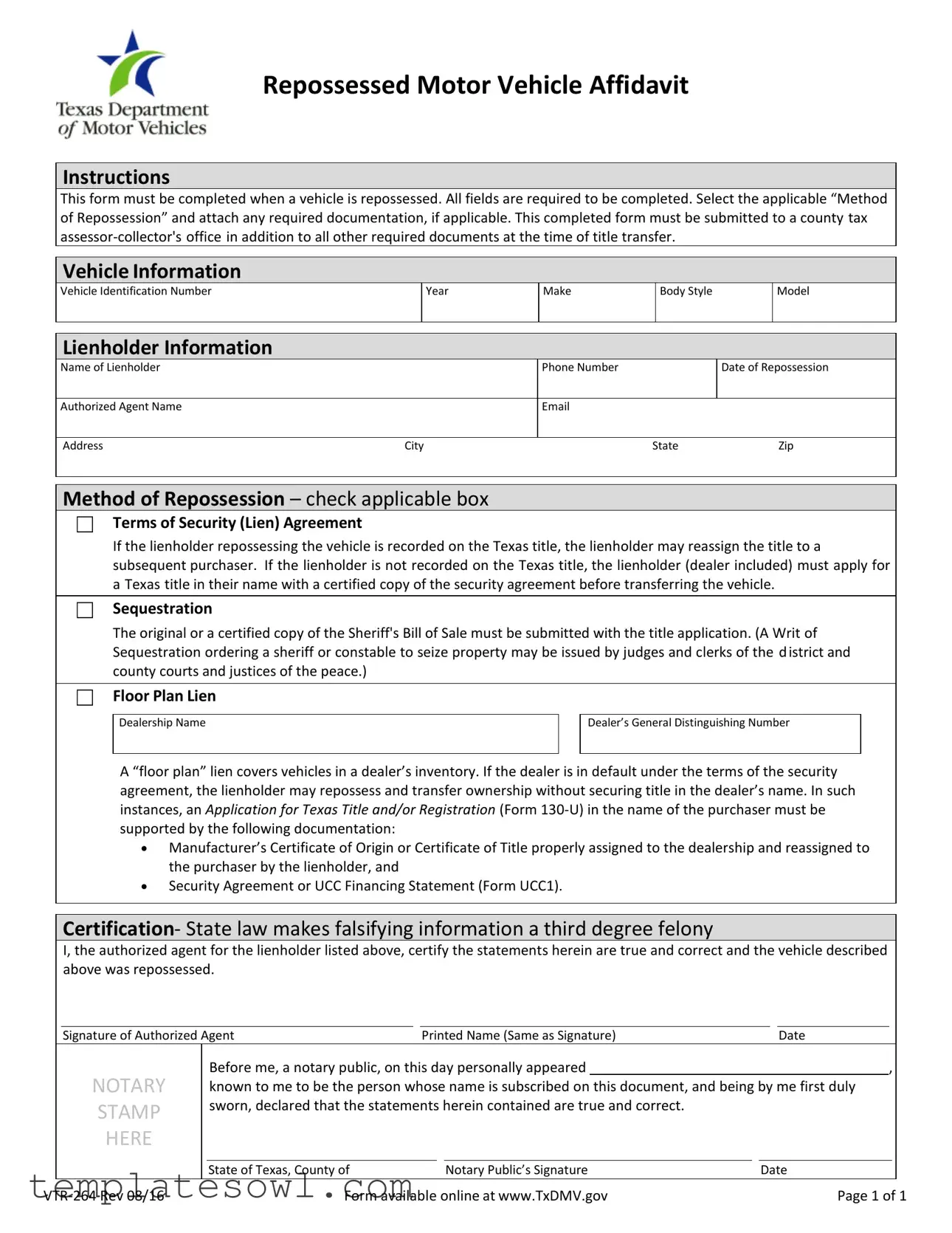

Repossessed Motor Vehicle Affidavit

Instructions

This form must be completed when a vehicle is repossessed. All fields are required to be completed. Select the applicable “Method of Repossession” and attach any required documentation, if applicable. This completed form must be submitted to a county tax

Vehicle Information

Vehicle Identification Number

Year

Make

Body Style

Model

Lienholder Information

Name of Lienholder

Phone Number

Date of Repossession

Authorized Agent Name

Address |

City |

State |

Zip |

Method of Repossession – check applicable box

☐Terms of Security (Lien) Agreement

If the lienholder repossessing the vehicle is recorded on the Texas title, the lienholder may reassign the title to a subsequent purchaser. If the lienholder is not recorded on the Texas title, the lienholder (dealer included) must apply for a Texas title in their name with a certified copy of the security agreement before transferring the vehicle.

☐Sequestration

The original or a certified copy of the Sheriff's Bill of Sale must be submitted with the title application. (A Writ of Sequestration ordering a sheriff or constable to seize property may be issued by judges and clerks of the district and county courts and justices of the peace.)

☐Floor Plan Lien

Dealership Name

Dealer’s General Distinguishing Number

A “floor plan” lien covers vehicles in a dealer’s inventory. If the dealer is in default under the terms of the security agreement, the lienholder may repossess and transfer ownership without securing title in the dealer’s name. In such instances, an Application for Texas Title and/or Registration (Form

•Manufacturer’s Certificate of Origin or Certificate of Title properly assigned to the dealership and reassigned to the purchaser by the lienholder, and

•Security Agreement or UCC Financing Statement (Form UCC1).

Certification- State law makes falsifying information a third degree felony

I, the authorized agent for the lienholder listed above, certify the statements herein are true and correct and the vehicle described above was repossessed.

Signature of Authorized Agent |

|

Printed Name (Same as Signature) |

|

Date |

NOTARY STAMP HERE

Before me, a notary public, on this day personally appeared |

|

|

, |

||||

known to me to be the person whose name is subscribed on this document, and being by me first duly |

|||||||

sworn, declared that the statements herein contained are true and correct. |

|

|

|

|

|||

|

|

|

|

|

|

||

State of Texas, County of |

|

Notary Public’s Signature |

|

Date |

|

||

Form available online at www.TxDMV.gov |

Page 1 of 1 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of Form | The VTR 264 form is used when a vehicle is repossessed to provide legal documentation of the repossession process. |

| Mandatory Fields | All fields on the form must be completed. Missing information may delay the repossession process. |

| Submission Location | This form must be submitted to the county tax assessor-collector's office at the time of title transfer, along with all required documentation. |

| Methods of Repossession | The form includes options for various methods of repossession, such as Terms of Security Agreement, Sequestration, and Floor Plan Lien. |

| Certification Requirement | The authorized agent must certify the accuracy of the information provided on the form, emphasizing the legal implications of false statements. |

| Legal Accountability | Falsifying information on the VTR 264 form is classified as a third-degree felony under Texas law. |

| Notary Requirement | A notary public must acknowledge the signature of the authorized agent, validating the form's authenticity. |

Guidelines on Utilizing Vtr 264

Once you have the Vtr 264 form in hand, be sure to read through the instructions carefully. Completing it correctly is essential for a smooth title transfer. Here are the steps to fill out the form accurately:

- Fill in the Vehicle Information section. Include the Vehicle Identification Number, Year, Make, Body Style, and Model.

- Enter the Lienholder Information. Provide the name of the lienholder, their phone number, and the date of repossession.

- Complete the Authorized Agent section. Include their name, email address, city, state, and zip code.

- Choose the Method of Repossession. Check the box that applies to your situation (terms of security agreement, sequestration, or floor plan lien).

- If applicable, attach any required documentation for the method of repossession you selected.

- Sign and date the certification section as the authorized agent for the lienholder. Print the agent's name below their signature.

- Complete the notary section. Ensure a notary public witnesses your signature and provides their stamp.

Once filled out, submit the completed Vtr 264 form along with all other required documents to the county tax assessor-collector's office for the title transfer process. Make sure to keep copies of all documents for your records.

What You Should Know About This Form

What is the VTR-264 form used for?

The VTR-264 form is a specific document required when a motor vehicle has been repossessed. It helps to officially record the details of the repossession and is submitted to the county tax assessor-collector's office. This is necessary for facilitating the transfer of the vehicle's title to a new owner.

Who needs to fill out the VTR-264 form?

The lienholder or their authorized agent must complete the VTR-264 form. This person is typically someone representing the financial institution that financed the vehicle or a dealer who has a security agreement in place with the owner of the vehicle.

Are there any specific requirements for filling out the form?

Yes, all fields on the VTR-264 form are mandatory. This includes information about the vehicle itself, such as its make, model, and Vehicle Identification Number, as well as details about the lienholder, like their name and contact information. Accurate completion of this form is crucial for ensuring the repossession is properly documented.

What documentation do I need to attach to the VTR-264 form?

This depends on the method of repossession selected. For instance, if the lienholder is listed on the original title, they may need to attach a certified copy of the security agreement. If the vehicle was repossessed under a writ of sequestration, the original or a certified copy of the Sheriff's Bill of Sale must be included. Each method has specific requirements that need to be followed.

What information is included in the vehicle section of the form?

The vehicle section requires the Vehicle Identification Number (VIN), year, make, body style, and model. This information is essential for properly identifying the vehicle in question and ensuring that the correct title is transferred.

Can the lienholder directly transfer the title of the repossessed vehicle to a new purchaser?

Yes, if the lienholder is recorded on the Texas title, they can reassign the title directly to a new owner. However, if they are not listed, they must first apply for a new Texas title in their name using the certified copy of the security agreement before transferring ownership.

What are the consequences of falsifying information on the VTR-264 form?

Falsifying information on the VTR-264 form is considered a serious offense under state law. Specifically, it is classified as a third-degree felony. This emphasizes the importance of accuracy and honesty when completing the document.

Do I need to have the form notarized?

Yes, the VTR-264 form requires notarization. The authorized agent must sign the form in the presence of a notary public, who will then verify the identity of the signer and confirm that the statements made in the form are true and correct. This adds an extra layer of legitimacy to the document.

Where should the completed VTR-264 form be submitted?

The completed VTR-264 form must be submitted to the county tax assessor-collector's office. It needs to accompany any other required documents at the time of title transfer. This ensures that all necessary paperwork is in order, allowing for a smooth transfer process.

Common mistakes

When completing the VTR-264 form, one common mistake people make is failing to complete all required fields. Each section on the form must be filled out entirely. Incomplete forms can lead to delays in processing and potential rejection by the county tax assessor-collector's office.

Another frequent error involves not selecting the correct method of repossession. There are specific methods outlined on the form, and each comes with its own set of requirements for documentation. Selecting the wrong method can complicate the title transfer process and might cause issues down the line.

People often neglect to attach the necessary documentation when submitting the form. Depending on the method of repossession indicated, additional documents may be required. For instance, if the method is sequestration, a certified copy of the Sheriff’s Bill of Sale is essential. Lack of proper documentation can stop the title transfer process.

Another mistake frequently made is failing to provide accurate lienholder information. The name, phone number, and other details related to the lienholder must be correct. Any inaccuracies can result in complications regarding ownership and the processing of the affidavit.

Lastly, individuals sometimes overlook the importance of notarization. The completed VTR-264 form must be signed and notarized, affirming the truthfulness of the information provided. Without a notary's signature, the submission may be deemed invalid, leading to further delays in title processing.

Documents used along the form

When dealing with the repossession of a vehicle, several forms and documents are often required in conjunction with the VTR-264 form. Each document serves a specific purpose in the overall process, and understanding their roles can facilitate a smoother transaction. Here’s a list of commonly used forms that complement the VTR-264.

- Application for Texas Title and/or Registration (Form 130-U) - This application must be completed to obtain a new title and registration for the vehicle being transferred. It is critical for any vehicle sale or transfer.

- Manufacturer’s Certificate of Origin (MCO) - Issued by the manufacturer, this document proves ownership and provides important details about the vehicle. It is often needed for first-time registrations.

- Certificate of Title - This document indicates who officially owns the vehicle. It must be properly assigned when the vehicle is sold or transferred to another party.

- UCC Financing Statement (Form UCC-1) - This form is used to announce a security interest in personal property, including vehicles. It provides public notice regarding the lender’s interest in the vehicle, securing their position in case of default.

- Sheriff’s Bill of Sale - This document is necessary if the vehicle was repossessed through a legal action, such as sequestration. It serves as proof of the transaction and ownership transfer.

- Security Agreement - This is a contract between a borrower and a lender outlining the terms under which the vehicle was financed. It details the rights and responsibilities of each party.

- Notarized Affidavit of Repossession - This document, often required, certifies that the vehicle has been repossessed and is usually signed by the authorized agent. Notarization adds authenticity.

- Notice of Default - This is sent to the borrower to inform them that they have failed to make payments as agreed. It is a crucial step before repossession takes place.

- Vehicle Inventory Sheet - Dealers often keep this document to track vehicles in their possession, including those under a floor plan lien. It details the vehicles and their current status.

- Affidavit of Identity - This may be needed to confirm the identity of the individual signing documents related to the repossession, ensuring proper verification and legitimacy.

Understanding these forms can streamline the process of vehicle repossession and title transfer, helping all parties involved to fulfill legal obligations efficiently. It's essential to gather and correctly complete all relevant documents to ensure compliance with state laws and regulations.

Similar forms

- VTR-130: This form is used for transferring the title of a motor vehicle within Texas. Like the VTR-264, it requires specific vehicle and owner information to ensure a smooth transfer process.

- Application for Texas Title (Form 130-U): This document is essential for anyone applying for a new title, much like the VTR-264. Both forms necessitate details about the vehicle and any pertinent financial agreements associated with it.

- UCC Financing Statement (Form UCC1): Similar to the VTR-264, this form serves to establish a security interest in collateral. Both forms address lienholder information, underscoring the importance of clear ownership rights in vehicle transactions.

- Bill of Sale: Just as the VTR-264 is crucial for repossessions, a Bill of Sale is key when transferring ownership. Each document serves as proof of ownership and outlines obligations between parties involved.

- Power of Attorney: This form allows the lienholder or an authorized agent to act on behalf of the vehicle owner. Both the Power of Attorney and VTR-264 require signatures and verification to complete transactions securely.

- Insurance Certificate: An insurance certificate may be required when transferring or repossessing a vehicle. Similar to the VTR-264, it protects both parties involved by ensuring that the vehicle is insured during transitions of ownership.

Dos and Don'ts

The VTR 264 form is essential for repossessing a motor vehicle in Texas. To ensure that your application is processed smoothly, here's a handy list of things to do and not to do when filling it out.

- Do fill out all required fields completely.

- Do select the correct “Method of Repossession” that accurately reflects your situation.

- Do attach any necessary documentation, like a Sheriff’s Bill of Sale if required.

- Do review your information carefully for accuracy before submission.

- Don't forget to have the form signed by the authorized agent and notarized.

- Don't provide misleading or false information, as this can lead to serious legal consequences.

By following these guidelines, you can make the process as straightforward as possible.

Misconceptions

There are numerous misunderstandings regarding the VTR 264 form, which is essential for the process of vehicle repossession in Texas. Here is a list of common misconceptions and clarifications:

- Only lienholders can use the VTR 264 form. Many believe that only lienholders have the authority to complete this form. However, the form can also be filled out by authorized agents acting on behalf of the lienholder.

- The form is optional for all repossessions. A prevalent myth is that the VTR 264 is optional. In reality, completing and submitting this form is mandatory whenever a vehicle has been repossessed.

- Filing the VTR 264 form guarantees immediate title transfer. Some individuals think that submitting this form automatically leads to a swift title transfer. Yet, it is essential to accompany it with other required documents for the title transfer to occur.

- Documentation is not necessary with the VTR 264 form. Many assume that the VTR 264 can be submitted without additional documents. In fact, depending on the method of repossession, specific documentation, such as a Sheriff's Bill of Sale or a security agreement, must be attached.

- Sequestration is the only method of repossession recognized. Another misconception is that sequestration is the sole valid method of repossession. The form actually provides several methods of repossession, including security agreement repossession and floor plan lien repossession.

- All information on the form is optional. It's often thought that the fields within the VTR 264 can be left blank. However, all fields are required to be completed to ensure the form's validity.

- The VTR 264 form does not need notarization. Many people mistakenly believe notarization is unnecessary. However, the signature of the authorized agent must indeed be notarized for the form to be considered valid.

- Only the repossessing agent needs to provide personal information. Some think that providing personal information is only necessary for the repossessing agent. In truth, the form requires specific details about both the lienholder and the authorized agent.

- Once filed, the form cannot be amended. A common misconception is that once the VTR 264 is submitted, it cannot be modified. However, if errors are found, it is possible to correct them by submitting a revised form.

- Failure to use the VTR 264 form results in penalties only for lienholders. Some believe that only lienholders face consequences for not using this form. In reality, both lienholders and authorized agents may incur penalties for failing to adhere to the correct filing procedures.

Key takeaways

When dealing with the VTR 264 form, it is essential to understand its requirements and implications during the process of repossessing a vehicle. The following key takeaways provide a concise overview of the form and its usage:

- Complete All Fields: Every section of the VTR 264 form must be filled out. Incomplete forms may result in delays or rejection during the title transfer process.

- Attach Necessary Documentation: Depending on the method of repossession selected, you may need to provide additional documentation, such as a Sheriff's Bill of Sale or a certified copy of the security agreement.

- Submit to the Right Office: This form must be submitted to a county tax assessor-collector's office. Ensure that you include this form along with all required documents when transferring the vehicle's title.

- Understand Methods of Repossession: There are specific categories for how a vehicle can be repossessed, such as through a security agreement or sequestration. Selecting the correct method is crucial for legal compliance.

- Certification is Mandatory: The authorized agent must certify that the information provided is accurate. Falsifying details can lead to severe legal consequences, as it is classified as a third degree felony under Texas law.

By adhering to these key points, the process of filling out and utilizing the VTR 264 form can be conducted more smoothly, ensuring compliance with legal requirements.

Browse Other Templates

Ozempic Insurance Approval - Submitting additional documentation can strengthen the request and clarify the medical necessity.

Da Form 4137 Example - Participants must provide their name, rank, sex, and identification numbers on the form.

Social Security Tax Form - This form should be kept for personal records and tax purposes.