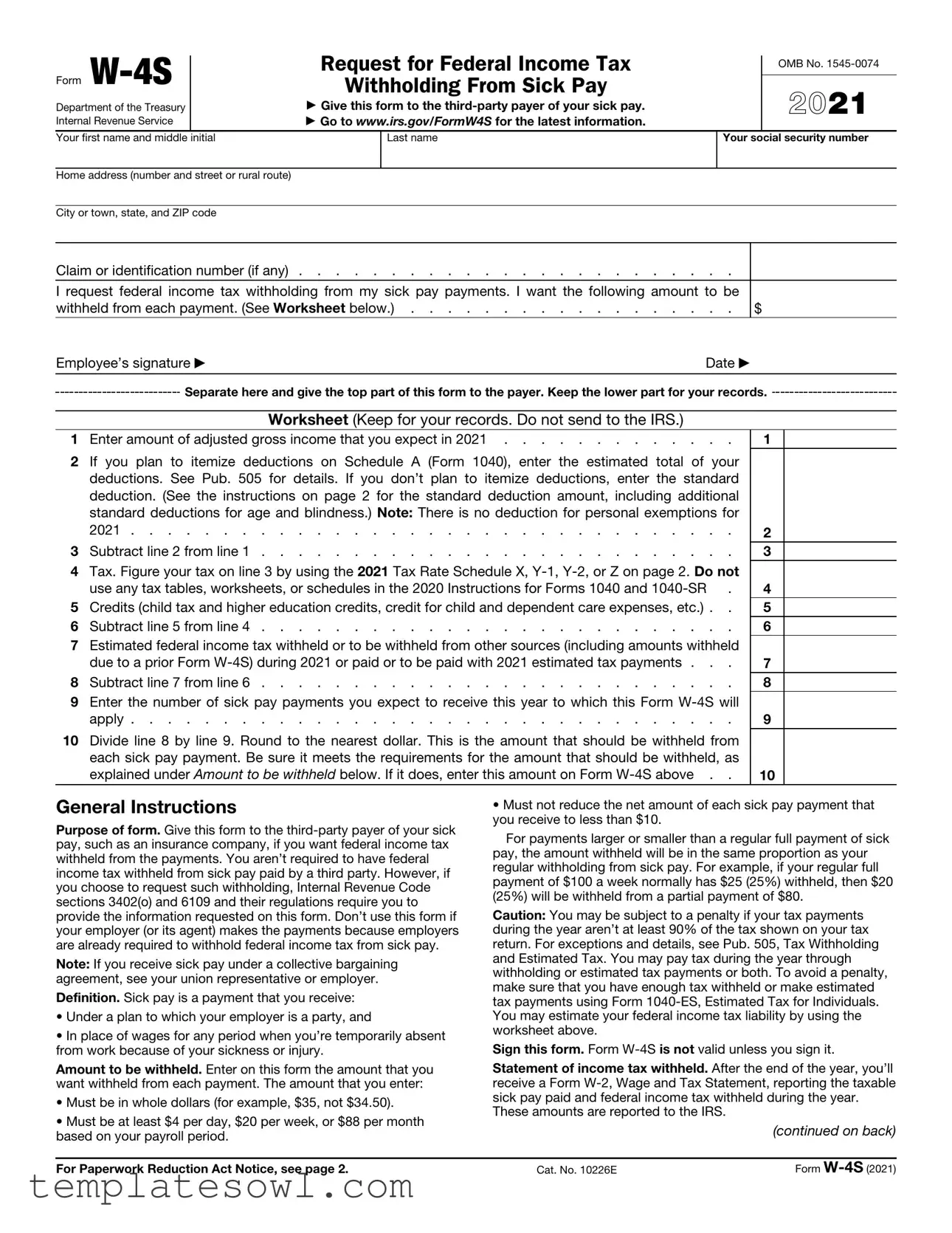

Fill Out Your W 4S Form

When managing your finances during a time of illness or injury, understanding the W-4S form can be particularly beneficial. This form is utilized to request federal income tax withholding specifically from sick pay issued by third-party payers, such as insurance companies. While it is not a strict requirement to have taxes withheld from sick pay, many individuals opt to do so to avoid a larger tax bill later. The W-4S prompts you to share some personal details, including your name, Social Security number, and address, ensuring that your tax obligations are accurately reported. Calculating the appropriate withholding amount involves considering your expected adjusted gross income and any potential deductions you plan to take. It requires you to provide an estimated amount that specifies how much you want withheld from each sick pay payment. The guidelines on the form ensure that the withholding is both effective and compliant, establishing minimum amounts that can be withheld while avoiding significantly reducing the net payment you receive. Keep in mind, the is essential for proper tax reporting, and you will need to provide this form to the payer, retaining a copy for your own records. This introductory guide will detail how to navigate the W-4S, ensuring you are prepared when faced with unexpected health challenges.

W 4S Example

Form |

|

Request for Federal Income Tax |

|

OMB No. |

|

|

|

||||

|

|

|

|

||

|

Withholding From Sick Pay |

|

|

||

|

|

2021 |

|||

Department of the Treasury |

|

▶ Give this form to the |

|

||

Internal Revenue Service |

|

▶ Go to www.irs.gov/FormW4S for the latest information. |

|

|

|

Your first name and middle |

initial |

|

Last name |

Your social security number |

|

|

|

|

|

|

|

Home address (number and street or rural route) |

|

|

|

|

|

|

|

|

|

|

|

City or town, state, and ZIP code |

|

|

|

|

|

Claim or identification number (if any) |

|

|

I request federal income tax withholding from my sick pay payments. I want the following amount to be |

|

|

withheld from each payment. (See Worksheet below.) |

. . . . . . . . . . . . . . . . . . |

$ |

Employee’s signature ▶ |

Date ▶ |

|

|

|

|

Separate here and give the top part of this form to the payer. Keep the lower part for your records.

Worksheet (Keep for your records. Do not send to the IRS.)

1 Enter amount of adjusted gross income that you expect in 2021 . . . . . . . . . . . . .

2If you plan to itemize deductions on Schedule A (Form 1040), enter the estimated total of your deductions. See Pub. 505 for details. If you don’t plan to itemize deductions, enter the standard deduction. (See the instructions on page 2 for the standard deduction amount, including additional

standard deductions for age and blindness.) Note: There is no deduction for personal exemptions for 2021 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . .

4Tax. Figure your tax on line 3 by using the 2021 Tax Rate Schedule X,

use any tax tables, worksheets, or schedules in the 2020 Instructions for Forms 1040 and

5Credits (child tax and higher education credits, credit for child and dependent care expenses, etc.) . .

6 Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . .

7Estimated federal income tax withheld or to be withheld from other sources (including amounts withheld due to a prior Form

8 Subtract line 7 from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . .

9Enter the number of sick pay payments you expect to receive this year to which this Form

apply . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10Divide line 8 by line 9. Round to the nearest dollar. This is the amount that should be withheld from each sick pay payment. Be sure it meets the requirements for the amount that should be withheld, as

explained under Amount to be withheld below. If it does, enter this amount on Form

1

2

3

4

5

6

7

8

9

10

General Instructions

Purpose of form. Give this form to the

Note: If you receive sick pay under a collective bargaining agreement, see your union representative or employer.

Definition. Sick pay is a payment that you receive:

•Under a plan to which your employer is a party, and

•In place of wages for any period when you’re temporarily absent from work because of your sickness or injury.

Amount to be withheld. Enter on this form the amount that you want withheld from each payment. The amount that you enter:

•Must be in whole dollars (for example, $35, not $34.50).

•Must be at least $4 per day, $20 per week, or $88 per month based on your payroll period.

•Must not reduce the net amount of each sick pay payment that you receive to less than $10.

For payments larger or smaller than a regular full payment of sick pay, the amount withheld will be in the same proportion as your regular withholding from sick pay. For example, if your regular full payment of $100 a week normally has $25 (25%) withheld, then $20 (25%) will be withheld from a partial payment of $80.

Caution: You may be subject to a penalty if your tax payments during the year aren’t at least 90% of the tax shown on your tax return. For exceptions and details, see Pub. 505, Tax Withholding and Estimated Tax. You may pay tax during the year through withholding or estimated tax payments or both. To avoid a penalty, make sure that you have enough tax withheld or make estimated tax payments using Form

Sign this form. Form

Statement of income tax withheld. After the end of the year, you’ll receive a Form

These amounts are reported to the IRS.

(continued on back)

For Paperwork Reduction Act Notice, see page 2. |

Cat. No. 10226E |

Form |

Form |

Page 2 |

Changing your withholding. Form

Specific Instructions for Worksheet

You may use the worksheet on page 1 to estimate the amount of federal income tax that you want withheld from each sick pay payment. Use your tax return for last year and the worksheet as a basis for estimating your tax, tax credits, and withholding for this year.

You may not want to use Form

If you expect to file a joint return, be sure to include the income, deductions, credits, and payments of both yourself and your spouse in figuring the amount you want withheld.

Caution: If any of the amounts on the worksheet change after you give Form

Line

Itemized deductions. Itemized deductions include qualifying home mortgage interest, charitable contributions, state and local taxes (up to $10,000), and medical expenses in excess of 7.5% of your adjusted gross income. See Pub. 505 for details.

Standard deduction. For 2021, the standard deduction amounts are:

|

|

|

Standard |

Filing Status |

|

Deduction |

|

Married filing jointly or qualifying widow(er) . . |

. . . $25,100* |

||

Head of household |

. . |

. |

$18,800* |

Single or Married filing separately |

. . |

. |

$12,550* |

*If you’re age 65 or older or blind, add to the standard deduction amount the additional amount that applies to you as shown in the next paragraph. If you can be claimed as a dependent on another person’s return, see Limited standard deduction for dependents, later.

Additional standard deduction for the elderly or blind. An additional standard deduction of $1,350 is allowed for a married individual (filing jointly or separately) or a qualifying widow(er) who is 65 or older or blind, $2,700 if 65 or older and blind. If both spouses are 65 or older or blind, an additional $2,700 is allowed on a joint return. If both spouses are 65 or older and blind, an additional $5,400 is allowed on a joint return. Additional standard deductions are also allowed on your separate return for your spouse who is 65 or older and/or blind if your spouse has no gross income and can’t be claimed as a dependent by another taxpayer. An additional $1,700 is allowed for an unmarried individual (single or head of household) who is 65 or older or blind, $3,400 if 65 or older and blind. See the 2021 Estimated Tax

Limited standard deduction for dependents. If you are a dependent of another person, your standard deduction is the greater of (a) $1,100 or (b) your earned income plus $350 (up to the regular standard deduction for your filing status). If you’re 65 or older or blind, see Pub. 505 for additional amounts that you may claim.

Certain individuals not eligible for standard deduction. For the following individuals, the standard deduction is zero.

•A married individual filing a separate return if either spouse itemizes deductions.

•A nonresident alien individual. For exceptions, see Pub. 519, U.S. Tax Guide for Aliens.

•An individual filing a return for a period of less than 12 months because of a change in his or her annual accounting period.

Line

Include on this line any tax credits that you’re entitled to claim, such as the child tax credit and credit for other dependents, higher education credits, credit for child and dependent care expenses, earned income credit, or credit for the elderly or the disabled. See the Tax Credits table in Pub. 505 for more information.

Line

Enter the federal income tax that you expect will be withheld this year on income other than sick pay and any payments made or to be made with 2021 estimated tax payments. Include any federal income tax already withheld or to be withheld from wages and pensions.

2021 Tax Rate Schedules

Schedule |

|

|

|

Schedule |

|

||||

If line 3 is: |

But not |

The tax is: |

of the |

If line 3 is: |

But not |

The tax is: |

of the |

||

|

|

|

amount |

Over— |

|

|

amount |

||

Over— |

over— |

|

|

over— |

over— |

|

|

over— |

|

$0 |

$9,950 |

$0 + 10% |

$0 |

$0 |

$14,200 |

$0 + 10% |

$0 |

||

9,950 |

40,525 |

995 |

+ 12% |

9,950 |

14,200 |

54,200 |

1,420 |

+ 12% |

14,200 |

40,525 |

86,375 |

4,664 |

+ 22% |

40,525 |

54,200 |

86,350 |

6,220 |

+ 22% |

54,200 |

86,375 |

164,925 |

14,751 |

+ 24% |

86,375 |

86,350 |

164,900 |

13,293 |

+ 24% |

86,350 |

164,925 |

209,425 |

33,603 |

+ 32% |

164,925 |

164,900 |

209,400 |

32,145 |

+ 32% |

164,900 |

209,425 |

523,600 |

47,843 |

+ 35% |

209,425 |

209,400 |

523,600 |

46,385 |

+ 35% |

209,400 |

523,600 |

and greater |

157,804.25 |

+ 37% |

523,600 |

523,600 |

and greater |

156,355 |

+ 37% |

523,600 |

Schedule |

Schedule |

||||||||

If line 3 is: |

But not |

The tax is: |

of the |

If line 3 is: |

But not |

The tax is: |

of the |

||

|

|

|

amount |

|

|

|

amount |

||

Over— |

over— |

|

|

over— |

Over— |

over— |

|

|

over— |

$0 |

$19,900 |

$0 + 10% |

$0 |

$0 |

$9,950 |

$0 + 10% |

$0 |

||

19,900 |

81,050 |

1,990 |

+ 12% |

19,900 |

9,950 |

40,525 |

995 |

+ 12% |

9,950 |

81,050 |

172,750 |

9,328 |

+ 22% |

81,050 |

40,525 |

86,375 |

4,664 |

+ 22% |

40,525 |

172,750 |

329,850 |

29,502 |

+ 24% |

172,750 |

86,375 |

164,925 |

14,751 |

+ 24% |

86,375 |

329,850 |

418,850 |

67,206 |

+ 32% |

329,850 |

164,925 |

209,425 |

33,603 |

+ 32% |

164,925 |

418,850 |

628,300 |

95,686 |

+ 35% |

418,850 |

209,425 |

314,150 |

47,843 |

+ 35% |

209,425 |

628,300 |

and greater |

168,993.50 |

+ 37% |

628,300 |

314,150 |

and greater |

84,496.75 |

+ 37% |

314,150 |

Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue

law. Generally, tax returns and return information are confidential, as required by Code section 6103.

The average time and expenses required to complete and file this form will vary depending on individual circumstances. For estimated averages, see the instructions for your income tax return.

If you have suggestions for making this form simpler, we would be happy to hear from you. See the instructions for your income tax return.

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Form Name | The W-4S form stands for "Request for Federal Income Tax Withholding From Sick Pay." |

| Who Uses It? | This form is used by employees who want to have federal income tax withheld from their sick pay. |

| Third-Party Payer | Give the completed W-4S form to a third-party payer, like an insurance company, not your employer. |

| Withholding Requirement | You are not required to have taxes withheld from your sick pay; it's your choice. |

| Minimum Amount | The minimum amount withheld must be at least $4 per day, $20 per week, or $88 per month. |

| Eligibility | Sick pay is defined as payments received in place of wages due to illness or injury under an employer's plan. |

| Worksheet Usage | A worksheet is included to help estimate your desired withholding amount, using last year’s tax return data. |

| Taxation Reference | Form W-4S is governed by Internal Revenue Code sections 3402(o) and 6109. |

| Validity Criteria | This form is only valid if signed and delivered to the appropriate payer. |

| Year-Specific Guidance | The W-4S form can be updated and the latest version should be checked at www.irs.gov/FormW4S. |

Guidelines on Utilizing W 4S

After completing the W-4S form, you'll give the top part to the payer of your sick pay. Keep the lower part for your personal records. Follow these steps to fill out the form correctly.

- Write your first name, middle initial, and last name in the designated spaces.

- Enter your social security number.

- Provide your home address, including number and street, city or town, state, and ZIP code.

- If applicable, include your claim or identification number.

- Indicate that you request federal income tax withholding from your sick pay payments.

- Determine the amount you want withheld from each sick pay payment. Make sure it meets the minimum requirements.

- Sign and date the form at the bottom.

- Separate the form where indicated and give the top part to the payer. Keep the bottom part for your records.

What You Should Know About This Form

What is Form W-4S?

Form W-4S is a request for federal income tax withholding from sick pay payments. It is specifically intended for individuals who receive sick pay from a third-party payer, such as an insurance company. By submitting this form, you can indicate how much tax you wish to have withheld from your sick pay.

Who should use Form W-4S?

This form is for individuals who receive sick pay that is not subject to automatic federal income tax withholding. If your employer is paying your sick pay, you should not use this form, as they are already required to withhold taxes from your wages.

How do I complete Form W-4S?

To complete Form W-4S, you will need to provide your personal information, including your name, Social Security number, and address. You will also need to specify the amount you want withheld from each sick pay payment. Calculating this amount may require using the worksheet included with the form to estimate your tax liability for the year.

What amount can I choose to withhold from my sick pay?

The amount you choose to withhold must be in whole dollars and can vary based on your payroll period. The minimum withholding is $4 per day, $20 per week, or $88 per month. Importantly, the net amount of each sick pay payment must not fall below $10 after withholding.

Do I need to recalculate my withholding amount?

Yes, if any of the amounts on the worksheet change after you submit Form W-4S, you should fill out a new form to adjust your withholding. This is important to ensure that your withholding aligns with your current financial situation.

What happens after I submit Form W-4S?

After you submit the form to your sick pay payer, the payer is responsible for withholding the specified tax amount from your sick pay. At the end of the year, you will receive a Form W-2 reporting the total sick pay received and the tax withheld, which you will need for your tax return.

Can I change my withholding amount later?

You can change or revoke your withholding request at any time by submitting a new Form W-4S. To revoke your previous request, fill out the new form and write “Revoked” in the amount box.

Is there a penalty for incorrect withholding?

If the total tax withheld from your income does not meet the required percentage of your tax liability for the year, you may be subject to penalties. Ensuring that adequate tax is withheld or making estimated tax payments can help avoid this situation.

Where can I find more information about Form W-4S?

For the most current information regarding Form W-4S and related tax regulations, visit the IRS website at www.irs.gov/FormW4S. This site offers guidance on completing the form and understanding tax withholding.

Common mistakes

Completing Form W-4S can be a straightforward process, but several common errors might lead to complications. One mistake people often make is providing inaccurate personal information. The form requires your full name, Social Security number, and address. Any discrepancies in this information can cause delays or issues with tax withholding.

Another frequent error occurs when individuals calculate the amount of withholding incorrectly. The form includes a worksheet to help estimate the appropriate amount based on projected income and deductions. Failing to use this worksheet accurately can result in either under-withholding or over-withholding of taxes, which can affect your financial situation during tax filing season.

Many also neglect to sign the form, making it invalid. A signature is required for the Form W-4S to be processed. Without it, the third-party payer will not withhold the indicated taxes, which could lead to unexpected tax bills at the end of the year.

People sometimes misunderstand the requirements for the amount to be withheld. The form specifies that the amount must be a whole dollar figure and should not reduce the net payment to less than $10. Ignoring these guidelines not only affects the immediate payments but may also lead to tax penalties down the line.

Lastly, failing to update the W-4S when financial circumstances change is a common oversight. If your income, deductions, or the number of expected sick pay payments change, a new Form W-4S should be submitted. This will ensure the correct amount of federal income tax is withheld throughout the year, aiding in proper tax management.

Documents used along the form

The W-4S form is an important document used to request federal income tax withholding from sick pay payments. While the W-4S itself is key to managing tax withholding, several other forms and documents commonly support this process. Below are descriptions of these forms and documents.

- Form W-2: This Wage and Tax Statement is provided by employers at the end of the year. It reports the total wages paid and taxes withheld during the year, including federal income tax from sick pay, making it essential for filing your tax return.

- Form W-4: While focused on employee withholdings from regular wages, this form is sometimes relevant for those on sick leave. Employees may use it to adjust their tax withholding allowances while they are receiving sick pay.

- Form 1040: This Individual Income Tax Return form is used to report all taxable income for the year. Sick pay received, along with other income sources, must be reported here.

- Form 1040-ES: This form is used for making estimated tax payments. Individuals expecting to owe additional taxes not covered by withholding should consider using this to avoid penalties.

- Publication 505: This IRS publication provides guidance on tax withholding and estimated tax. It includes detailed instructions for using the W-4S worksheet to calculate the appropriate amounts to withhold from sick pay.

- Form 1099: This form is used for reporting various types of income other than wages. If sick pay is received from a source that issues a 1099, it will be important to report this income on your tax return.

- Form 4868: If individuals need more time to file their tax return, this form allows for an automatic extension. It’s vital to remember that it doesn’t extend the time to pay taxes owed.

- Social Security Administration Forms: If sick pay relates to disability benefits, forms from the SSA may be involved. These documents help report income related to disability claims.

Each of these forms plays a critical role in ensuring proper reporting and withholding of taxes related to sick pay. Understanding and using these documents effectively can help avoid unexpected tax liabilities and ensure compliance with federal tax laws.

Similar forms

Form W-4: This form allows employees to specify the amount of federal income tax withheld from their paychecks. Similar to the W-4S, it is a request for withholding, but it applies generally to all types of wages, not just sick pay.

Form W-2: Employers use this document to report annual wages and taxes withheld from paychecks. Like the W-4S, it is crucial for accurate income reporting and tax liability calculation.

Form 1040: This is the individual income tax return used to report income and calculate taxes owed. While the W-4S involves withholding requests, the 1040 is for reporting actual income and tax obligations.

Form 1040-ES: This form is used for estimated tax payments. Similar to the W-4S's estimation section, it helps taxpayers determine and pay their estimated taxes in advance.

Schedule A: This schedule allows taxpayers to itemize deductions. It parallels the W-4S in the sense that both forms ask for information that affects tax liability calculations.

Form 1099: This form reports various income types received outside of wages. It shares the purpose of informing the IRS about income and potential tax liabilities, much like the W-4S.

Form 4868: This application provides an automatic extension to file the tax return. While it does not pertain specifically to withholding, it reflects aspects of tax planning found in the W-4S.

Form 8812: Used to claim the Child Tax Credit. This connects to the deductions and credits calculated in the W-4S, both of which aim to mitigate overall tax burdens.

Form 8880: This form is for claiming the Credit for Qualified Retirement Savings Contributions. As with the W-4S, it addresses factors that reduce tax liability and must be accurately reported.

Form 8508: This application allows for a waiver from filing forms electronically. While it serves a different purpose, it involves compliance with IRS processes similarly to the submission of the W-4S.

Dos and Don'ts

When completing the W-4S form, it is important to follow guidelines to ensure accuracy and compliance. The following list outlines important do's and don'ts.

- Do provide your accurate first name, middle initial, last name, and social security number.

- Do specify the amount you wish to have withheld, ensuring it is in whole dollars.

- Do sign and date the form before submitting it to the payer of your sick pay.

- Do keep a copy of the completed form for your personal records.

- Don't submit the form without reviewing it for errors or omissions.

- Don't use this form if your sick pay is being paid directly by your employer.

Misconceptions

Misconceptions about Form W-4S can lead to confusion and potentially impact tax withholding decisions. Understanding these misconceptions is crucial for anyone dealing with sick pay. Here are nine common misconceptions along with clarifications:

- Misconception 1: Form W-4S is mandatory for all sick pay recipients.

- Misconception 2: You can use Form W-4S for sick pay from your employer.

- Misconception 3: You can enter any amount to be withheld on Form W-4S.

- Misconception 4: If you request withholding, you cannot change the amount later.

- Misconception 5: You don’t need to worry about your tax liability if you have federal taxes withheld from sick pay.

- Misconception 6: All paid sick leave is considered sick pay.

- Misconception 7: Form W-4S cannot be revoked.

- Misconception 8: There is no connection between the W-4S and your annual tax return.

- Misconception 9: You only need to fill out one W-4S for the entire year.

This is incorrect. You are not required to use Form W-4S to have federal income tax withheld from your sick pay. Using this form is optional.

That’s not true. Form W-4S is specifically intended for sick pay from third-party payers, such as insurance companies, not for payments made by your employer.

No, there are minimum amounts that must be withheld, such as at least $4 per day or $20 per week, based on your payroll period.

This is misleading. You can change the withholding amount by submitting a new Form W-4S with the updated amount.

This is dangerous thinking. If the total amount withheld throughout the year isn’t at least 90% of the tax owed, you may face penalties.

Not necessarily. Sick pay specifically refers to payments made in place of wages due to temporary absence from work because of illness or injury.

This is false. You can revoke a submitted Form W-4S by submitting a new form indicating "Revoked" or submitting a written notice.

In fact, the amounts withheld as noted on Form W-4S will directly affect your tax return and could influence your refund or balance due.

This is misleading. If your financial situation changes during the year, it is advisable to complete a new Form W-4S to reflect changes in income or deductions.

Key takeaways

Understanding the W-4S form is essential for ensuring accurate tax withholding from sick pay. Here are some key takeaways to keep in mind:

- Purpose of the Form: The W-4S form is designed for individuals who wish to request federal income tax withholding from sick pay paid by a third party, such as an insurance company.

- Submission: After filling out the form, submit it to the third-party payer of your sick pay. Keep the lower portion for your records, as it serves as a confirmation of your withholding request.

- Withholding Amount: Specify the exact amount you want withheld from each sick pay payment. This figure must be in whole dollars and should not reduce your payment to below $10.

- Regular Income Tax Reporting: The sick pay is subject to income tax just like regular wages. You'll receive a Form W-2 at the end of the year detailing the taxable sick pay and the federal income tax withheld.

- Worksheet for Estimation: Use the included worksheet to estimate your tax withholding based on your expected income and deductions. This can help you plan better and avoid surprises during tax season.

- Changes to Withholding: If your financial situation changes during the year, you can fill out a new W-4S to adjust your withholding. This ensures that the amounts withheld align with your current income tax liability.

- Record Keeping: It's crucial to keep the records of your W-4S, as they may be needed for future reference or if discrepancies arise regarding your tax withholding.

Browse Other Templates

Cancel Centurylink - Each submission of the form corresponds to a single payment for completed work.

Chapter 7 Bankruptcy Forms Packet - File the Statement of Social Security Numbers for individual debtors.