Fill Out Your Wd 10 Form

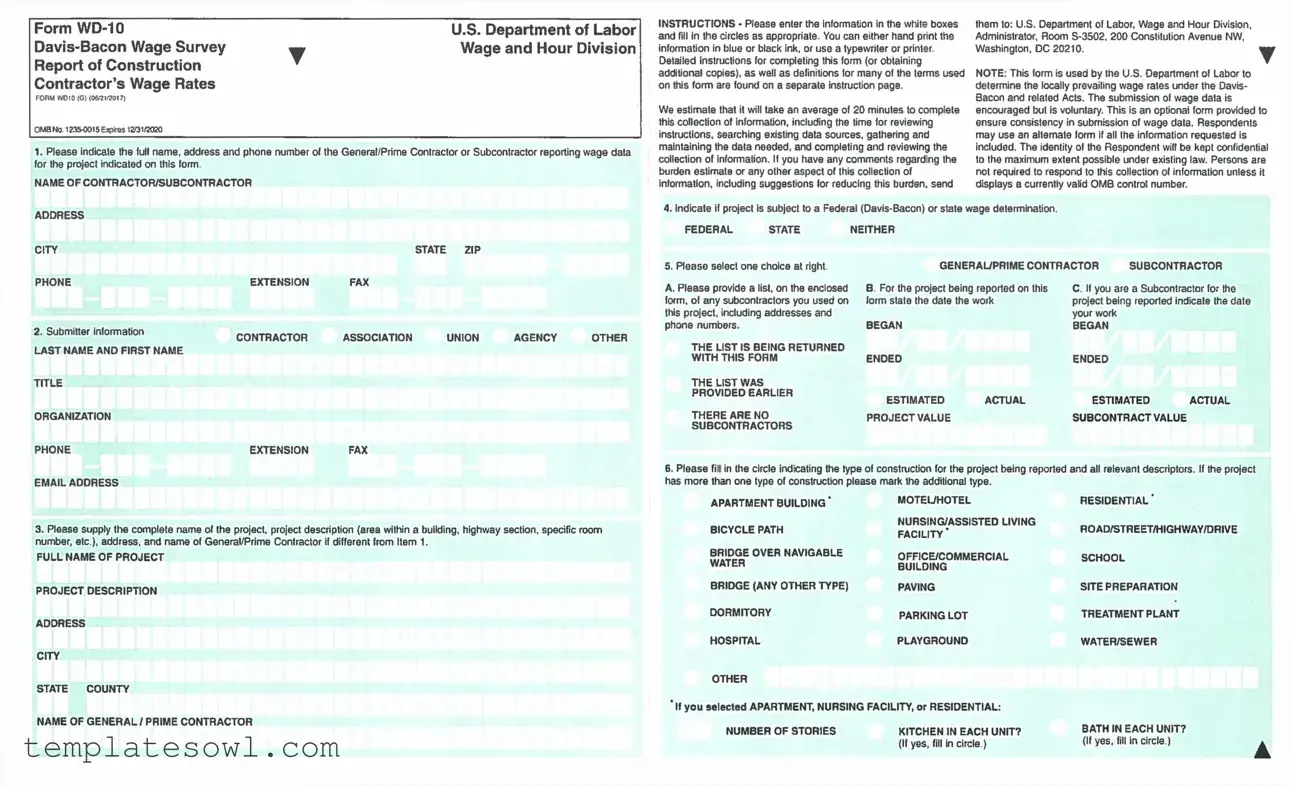

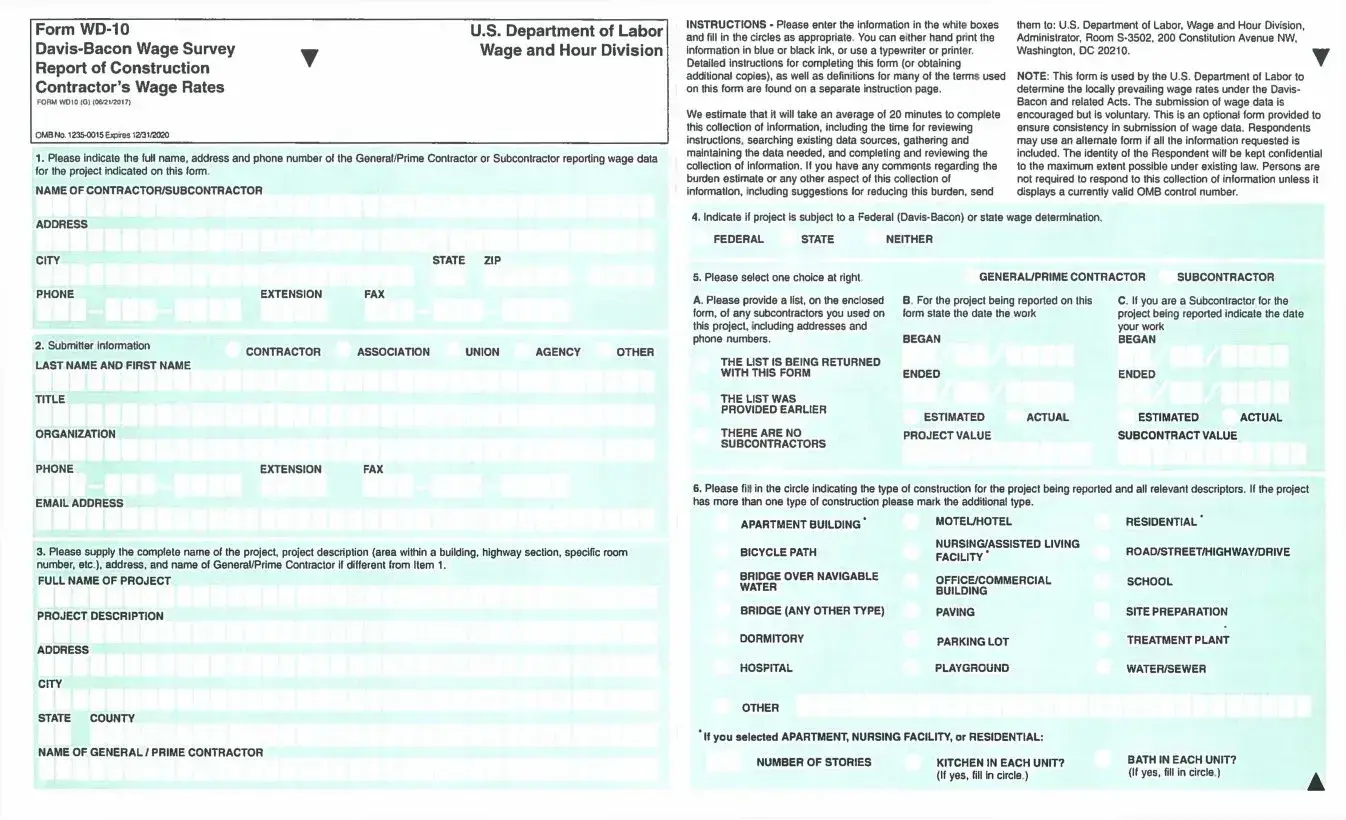

The WD-10 form serves a crucial role in the landscape of construction contracting by aiding the U.S. Department of Labor in establishing prevailing wage rates as mandated by the Davis-Bacon and Related Acts. This form captures vital details about the contractor, the project, and the workforce engaged, allowing for transparency and accountability in wage reporting. While submission of wage data is encouraged, it remains voluntary, offering flexibility to contractors who may wish to utilize alternative reporting formats that encompass all requisite information. Key components include the contractor's name and contact information, project specifics such as location and type of construction, and financial figures like project value and estimated starting and completion dates. Additionally, the form requires a classification of employees, adherence to wage determinations—either federal or state—and details about any collective bargaining agreements that may be in effect. This comprehensive approach ensures that wage rates reflect local standards while maintaining confidentiality for the reporting parties. Importantly, the form emphasizes the ramifications of submitting false information, highlighting the legal responsibilities underlying wage reporting in the construction industry.

Wd 10 Example

Form |

|

U.S. Department of Labor |

▼ |

Wage and Hour Division |

|

Report of Construction |

|

|

Contractor’s Wage Rates |

|

|

FORM WD10 (Q) (06/21/2017J

OMB No.

1.Please indicate the full name, address and phone number of the General/Prime Contractor or Subcontractor reporting wage data for the project indicated on this form.

NAME OF CONTRACTOR/SUBCONTRACTOR

ADDRESS

INSTRUCTIONS • Please enter the information in the white boxes |

them to: U.S. Department of Labor, Wage and Hour Division, |

and fill in the circles as appropriate You can either hand print the |

Administrator, Room |

information in blue or black Ink, or use a typewriter or printer. |

Washington, DC 20210. |

Detailed instructions for completing this form (or obtaining |

|

additional copies), as well as definitions for many of the terms used |

NOTE: This form is used by the U.S. Department of Labor to |

on this form are found on a separate instruction page. |

determine the locally prevailing wage rates under the Davis- |

We estimate that it will take an average of 20 minutes to complete |

Bacon and related Acts. The submission of wage data is |

encouraged but is voluntary. This is an optional form provided to |

|

this collection of information, including the time for reviewing |

ensure consistency in submission of wage data. Respondents |

instructions, searching existing data sources, gathering and |

may use an alternate form if all the information requested is |

maintaining the data needed, and completing and reviewing the |

included. The identity of the Respondent will be kept confidential |

collection of information. If you have any comments regarding the |

to the maximum extent possible under existing law. Persons are |

burden estimate or any other aspect of this collection of |

not required to respond to this collection of information unless it |

Information, Including suggestions for reducing this burden, send |

displays a currently valid OMB control number. |

4.Indicate if project is subject to a Federal

FEDERAL STATE NEITHER

CITY |

|

STATE ZIP |

PHONE |

EXTENSION |

FAX |

2. Submitter information

CONTRACTOR ASSOCIATION UNION AGENCY OTHER

LAST NAME AND FIRST NAME

TITLE

ORGANIZATION

PHONE |

EXTENSION |

FAX |

5.Please select one choice at right

A. Please provide a list, on the enclosed form, of any subcontractors you used on this project, including addresses and phone numbers.

THE LIST IS BEING RETURNED WITH THIS FORM

THE LIST WAS

PROVIDED EARLIER

THERE ARE NO

SUBCONTRACTORS

GENERAL/PRIME CONTRACTOR |

SUBCONTRACTOR |

|||

В For the project being reported on this |

C. If you are a Subcontractor for the |

|||

form stale the date the work |

project being reported indicate the date |

|||

BEGAN |

|

your work |

|

|

|

BEGAN |

|

|

|

ENDED |

|

ENDED |

|

|

ESTIMATED |

ACTUAL |

ESTIMATED |

ACTUAL |

|

PROJECT VALUE |

|

SUBCONTRACTVALUE |

|

|

EMAIL ADDRESS

3.Please supply the complete name of the project, project description (area within a building, highway section, specific room number, etc ), address, and name of General/Prime Contractor If different from Item 1.

FULL NAME OF PROJECT

PROJECT DESCRIPTION

ADDRESS

CITY

STATE COUNTY

NAME OF GENERAL/PRIME CONTRACTOR

6, Please fill in the circle indicating the type of construction for the project being reported and all relevant descriptors. If the project has more than one type of construction please mark the additional type.

APARTMENT BUILDING* |

MOTEL/HOTEL |

RESIDENTIAL * |

|

BICYCLE PATH |

NURSING/ASSISTED LIVING |

ROAD/STREET/HIGHWAY/DRIVE |

|

FACILITY* |

|

||

BRIDGE OVER NAVIGABLE |

OFFICE/COMMERCIAL |

SCHOOL |

|

WATER |

|

||

BUILDING |

|

|

|

|

|

|

|

BRIDGE (ANY OTHER TYPE) |

PAVING |

SITE PREPARATION |

|

DORMITORY |

PARKING LOT |

TREATMENT PLANT |

|

HOSPITAL |

PLAYGROUND |

WATER/SEWER |

|

OTHER |

|

|

|

‘if you selected APARTMENT, NURSING FACILITY,or RESIDENTIAL: |

|

|

|

NUMBER OF STORIES |

KITCHEN IN EACH UNIT? |

BATH IN EACH UNIT? |

▲ |

|

(If yes, fill in circle.) |

(If yes, fill in circle.) |

|

|

|

|

|

Form

▼ |

Page 2 (see reverse for instructions)

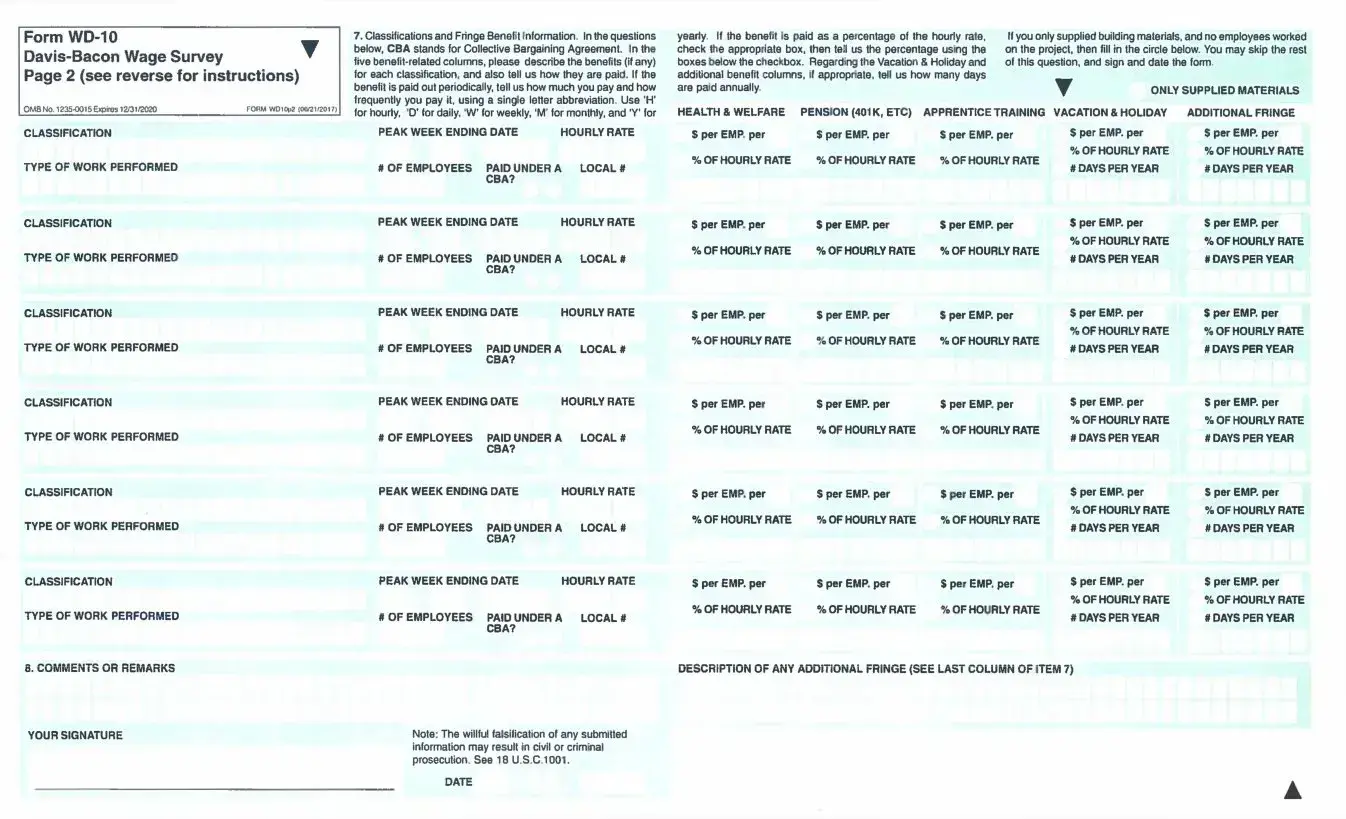

7. Classifications and Fringe Benefit Information. In the questions |

below, CBA stands for Collective Bargaining Agreement. In the |

five |

for each classification, and also tell us how they are paid. If the |

benefit is paid out periodically, tell us how much you pay and how |

frequently you pay it, using a single letter abbreviation. Use *H’ |

yearly If the benefit is paid as a percentage of the hourly rate, |

If you only supplied building materials, and no employees worked |

|

check the appropriate box, then tel us the percentage using the |

on the project, then fill in the circle below. You may skip the rest |

|

boxes below the checkbox. Regarding the Vacation & Holiday and |

of this question, and sign and date the form |

|

additional benefit columns, if appropriate, tell us how many days |

▼ |

ONLY SUPPLIED MATERIALS |

are paid annually. |

||

QMS No. 12354)015Expires 12/31/2020_____________________ FORM WDiop2 (06/21/2017)

CLASSIFICATION

TYPE OF WORK PERFORMED

CLASSIFICATION

TYPE OF WORK PERFORMED

CLASSIFICATION

TYPE OF WORK PERFORMED

CLASSIFICATION

TYPE OF WORK PERFORMED

CLASSIFICATION

TYPE OF WORK PERFORMED

CLASSIFICATION

TYPE OF WORK PERFORMED

for hourly, 'D* for daily, W’ for weekly, ‘M‘ for monthly, and V for |

PEAK WEEK ENDING DATE |

HOURLY RATE |

# OF EMPLOYEES PAID UNDER A LOCAL #

CBA?

PEAK WEEK ENDING DATE |

HOURLY RATE |

# OF EMPLOYEES PAID UNDER A LOCAL #

CBA?

PEAK WEEK ENDING DATE |

HOURLY RATE |

# OF EMPLOYEES PAID UNDER A LOCAL #

CBA?

PEAK WEEK ENDING DATE |

HOURLY RATE |

# OF EMPLOYEES PAID UNDER A LOCAL #

CBA?

PEAK WEEK ENDING DATE |

HOURLY RATE |

# OF EMPLOYEES PAID UNDER A LOCAL #

CBA?

PEAK WEEK ENDING DATE |

HOURLY RATE |

# OF EMPLOYEES PAID UNDER A LOCAL #

CBA?

HEALTH & WELFARE PENSION (401K, ETC) APPRENTICE TRAINING

S per EMR per |

$ per EMP. per |

$ per EMP. per |

% OF HOURLY RATE |

% OF HOURLY RATE |

% OF HOURLY RATE |

$ per EMP. per |

$ per EMP. per |

S per EMP. per |

% OF HOURLY RATE |

% OF HOURLY RATE |

% OF HOURLY RATE |

$ per EMP, per |

$ per EMP. per |

S per EMP. per |

% OF HOURLY RATE % OF HOURLY RATE %OF HOURLY RATE

$ per EMP. per |

$ per EMP. per |

$ per EMP. per |

%OF HOURLY RATE % OF HOURLY RATE % OF HOURLY RATE

$ per EMP. per |

S per EMP. per |

$ per EMP. per |

%OF HOURLY RATE %OF HOURLY RATE % OF HOURLY RATE

$ per EMP. per |

$ per EMP. per |

$ per EMP. per |

% OF HOURLY RATE |

% OF HOURLY RATE |

% OF HOURLY RATE |

VACATION & HOLIDAY |

ADDITIONAL FRINGE |

S per EMP. per |

S per EMP. per |

% OF HOURLY RATE |

%OF HOURLY RATE |

# DAYS PER YEAR |

#DAYS PER YEAR |

$ per EMP. per |

$ per EMP. per |

%OF HOURLY RATE |

% OF HOURLY RATE |

#DAYS PER YEAR |

#DAYS PER YEAR |

$ per EMP. per |

$ per EMP. per |

% OF HOURLY RATE |

% OF HOURLY RATE |

# DAYS PER YEAR |

#DAYS PER YEAR |

$ per EMP. per |

$ per EMP. per |

% OF HOURLY RATE |

%OF HOURLY RATE |

#DAYS PER YEAR |

#DAYS PER YEAR |

$ per EMP. per |

S per EMP. per |

% OF HOURLY RATE |

%OF HOURLY RATE |

# DAYS PER YEAR |

#DAYS PER YEAR |

$ per EMP. per |

S per EMP. per |

% OF HOURLY RATE |

% OF HOURLY RATE |

#DAYS PER YEAR |

# DAYS PER YEAR |

8.COMMENTS OR REMARKS

YOUR SIGNATURE

Note: The willful falsification of any submitted information may result in civil or criminal prosecution. See 18 U.S.C 1001.

DATE

DESCRIPTION OF ANY ADDITIONAL FRINGE (SEE LAST COLUMN OF ITEM 7)

▲

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The WD-10 form is utilized by the U.S. Department of Labor to determine prevailing wage rates in construction projects under the Davis-Bacon Act and Related Acts. |

| Voluntary Submission | While wage data submission on the form is encouraged, it remains voluntary for contractors. |

| Confidentiality | The identity of the respondent is kept confidential as much as possible under existing laws. |

| Governing Law | The form operates under the Davis-Bacon Act (40 U.S.C. §§ 3141-3148) applicable to federally funded construction projects. |

| Submission Flexibility | Contractors may use an alternate form as long as it contains all the required information outlined in the WD-10. |

| Burden Statement | It's estimated that completing the WD-10 will take approximately 20 minutes on average, including data gathering and reviewing instructions. |

Guidelines on Utilizing Wd 10

Next, you are required to gather specific information to complete the WD-10 form properly. Ensuring all details are accurate will help streamline the submission process. Follow these steps carefully to fill out the form correctly.

- Contractor Information: Fill in the contractor’s name, address, and telephone number at the top of the form.

- Project Details: Provide the project name and a brief description, including the location (street address, city, county, and state).

- Contract Type: Indicate whether the contract is a General/Prime contract or a Subcontract.

- Project Value: State the approximate total project value for general contractors, or approximate subcontract value for subcontractors.

- Starting Date: For general contractors, enter the date the project started; subcontractors should indicate when their specific work began.

- Completion Date: Provide the estimated or actual completion date of the project.

- Type of Construction: Specify if the project is Residential, Building, Heavy, or Highway and note the number of stories and units.

- Wage Determination: Check whether the project is subject to Federal (Davis-Bacon), State wage determination, or neither. Mark both if applicable.

- Employee Classification: List all employee classifications on the project, including the particulars for apprentices and helpers.

- Collective Bargaining Agreement: Indicate with a check mark whether the contractor is party to a collective bargaining agreement.

- Workweek Ending Date: Fill in the ending date of the workweek when wages were paid for each classification.

- Peak Number of Employees: Enter the peak number of employees for each classification employed.

- Basic Hourly Rate: Provide the basic hourly rate of pay for each classification without grouping workers.

- Fringe Benefits: Detail any fringe benefits provided for each classification, noting hourly rates or percentages where applicable.

- Remarks: Use this section for any additional information regarding wage rates or other relevant details.

- Submitted By: List the name, title, and contact information of the person submitting the form.

- Date Report Submitted: Fill in the submission date.

What You Should Know About This Form

What is the purpose of the WD 10 form?

The WD 10 form is utilized by the U.S. Department of Labor to establish the locally prevailing wage rates under the Davis-Bacon and Related Acts. It ensures that wage data is submitted consistently for construction projects, promoting fair wage practices across the industry.

Who needs to submit the WD 10 form?

This form must be filled out by construction contractors who are engaged in federally funded projects that fall under the jurisdiction of the Davis-Bacon Act. While submission is encouraged, it is voluntary. Contractors may also use an alternative form as long as it contains all the necessary information.

What information is required on the WD 10 form?

The form asks for various details about the project and contractor, including the contractor's name and contact information, project name and location, contract type, approximate value, starting and completion dates, and classifications of employees. Additionally, it requires details on wage rates and benefits paid to employees involved in the project.

How does the confidentiality of submitted information work?

The identity of the respondent submitting the WD 10 form is kept confidential to the greatest extent possible by law. This means that the information provided will not be disclosed publicly, protecting the contractor's identity and sensitive business information.

What happens if inaccurate information is submitted?

Submitting false information on the WD 10 form can lead to serious legal consequences, including civil or criminal prosecution. It is important for respondents to ensure that all information is accurate and truthful to avoid these potential repercussions.

Is there a deadline for submitting the WD 10 form?

While the form itself does not specify a particular deadline, it is essential for contractors to submit the WD 10 form in a timely manner as part of compliance with federal labor regulations. Contractors should refer to any project-specific requirements or guidance from the contracting agency for submission timelines.

Common mistakes

When filling out the WD-10 form, many make common mistakes that can lead to delays or complications. Awareness of these mistakes can facilitate a smoother submission process.

One frequent error involves incomplete information. Respondents occasionally skip sections or fail to provide the necessary details, especially in parts like the Contractor Name, Address, Telephone and Project Name, Description, and Location. Omitting these can create confusion and stall the assessment process.

Another issue arises from failing to accurately classify employees. It's crucial to list all classifications employed on the project, including any helpers. In some cases, individuals might group different classifications under one title, which can lead to inaccuracies in wage determination.

Providing incorrect wage data is also a common mistake. For item 13, respondents should specify the basic hourly rate for each classification. Submitting a range or an average instead of a specific amount can result in complications. Similarly, for fringe benefits, it’s essential to list the exact hourly rate or percentages without ambiguity.

Missing signatures can derail the process as well. The form must be signed by the individual submitting it, along with their printed name and title. Inaccessible or omitted contact information creates a lack of accountability and can prolong communication efforts.

Some respondents misunderstand the requirements for subcontractor listings. Only subcontractors involved directly in the project should be included. Listing material suppliers or unrelated entities leads to unnecessary complications and extended processing time.

Another common pitfall is neglecting to indicate whether the contractor is party to a collective bargaining agreement. Selecting the appropriate option for item 10 is vital for proper classification of wages. A mistaken "No" could lead to inaccurate assessments of wage compliance.

Lastly, overlooked deadlines can negatively affect submission. Contractors must ensure they submit their reports timely, particularly as the form collects data from a specific working period. Keeping track of workweek ending dates is essential to avoid confusion.

By avoiding these mistakes, contractors can streamline their experience when filling out the WD-10 form, facilitating a smoother review process and ensuring compliance with wage requirements.

Documents used along the form

The following documents are commonly associated with the Wd 10 form, facilitating compliance with labor regulations and ensuring accurate wage reporting. Each document plays a significant role in the overall process of wage determination and reporting within the framework of the Davis-Bacon and related acts.

- Davis-Bacon Wage Determination: This document outlines the prevailing wage rates for various classifications of laborers and mechanics on federally funded contracts. It serves as a reference to ensure that contractors pay at least the specified rates in compliance with federal law.

- Subcontractor List: This list details all subcontractors who will be engaged on the project. Contractors must provide the names, addresses, and contact information for each subcontractor involved. This document ensures transparency in labor practices and compliance with wage reporting.

- Payroll Records: These records include detailed payroll information for all workers on the project, including hourly rates and hours worked. Accurate payroll records are critical to verify compliance with wage rates paid to workers and to provide evidence in case of audits.

- Collective Bargaining Agreement (CBA): If applicable, this document outlines the terms and conditions of employment agreed upon between the contractor and labor unions. A CBA may specify wage rates, working conditions, and benefits, which must be adhered to alongside federal regulations.

Together, these documents help ensure compliance with labor laws and protect the rights of workers. Proper completion and submission of these forms is critical for maintaining transparent and fair wage practices on projects subject to federal regulation.

Similar forms

The WD-10 form is an important document used to report wage rates by construction contractors. Here are seven documents that share similarities with the WD-10 form, each serving a distinct purpose in wage reporting and compliance within the construction industry:

- Form WH-347: This form is used to report the wages paid to workers on federally funded construction projects. Similar to the WD-10, it collects wage data to ensure compliance with the Davis-Bacon Act, focusing specifically on reported wages for each classification of workers.

- Form WH-2: The WH-2 is a wage report used by employers to disclose wage rates paid to employees. Like the WD-10, it serves to document employee compensation, but it is broader in scope, applicable to multiple industries beyond construction.

- Certified Payroll Report: Required for contractors working on projects that fall under the Davis-Bacon Act, this document provides a detailed account of wages and benefits paid to each worker. It mirrors the WD-10 in its purpose to maintain compliance with wage laws on federal projects.

- Employee Earnings Record: This internal document tracks the pay history of individual employees. It resembles the WD-10 by requiring detailed wage information, although it is used primarily for internal record-keeping rather than external reporting.

- Form 990: While primarily a tax document used by nonprofits, it requires full disclosure of compensation paid to employees. Its focus on reporting wage specifics aligns it with the WD-10 in terms of transparency and compliance reporting, albeit for a different sector.

- Prevailing Wage Schedule: This publication outlines wage rates determined by the Department of Labor for various trades and locations. It is similar to the WD-10 in context, as both relate to the enforcement of prevailing wage laws, although the schedule itself is a reference document rather than a report form.

- Labor Condition Application (LCA): Required for employers looking to hire foreign labor, the LCA necessitates that employers pay a wage that meets or exceeds the prevailing wage for the job being filled. Like the WD-10, it aims to protect worker wages and enhance compliance with labor regulations.

Dos and Don'ts

When filling out the Wd 10 form, it is important to be diligent and thorough. Here are six recommendations to consider:

- Ensure Accuracy: Fill in all required fields with accurate and up-to-date information.

- Review Instructions: Read the instructions carefully before beginning to complete the form.

- Provide Clear Descriptions: Write clear and concise descriptions in the project name and classification sections.

- List Subcontractors: If applicable, attach a separate list of all subcontractors engaged in the project.

- Check for Valid OMB Number: Ensure that the form displays a valid OMB control number to validate the collection of information.

- Do Not Rush: Take your time to avoid mistakes that could lead to complications later.

Additionally, avoid these common pitfalls:

- Do Not Omit Information: Leaving out required information may lead to processing delays.

- Do Not Use Outdated Forms: Ensure that you are using the correct and up-to-date version of the form.

- Do Not Provide Incorrect Wage Rates: List accurate wage rates under specified classifications.

- Do Not Submit Without Review: Always review the completed form for accuracy before submission.

- Do Not Ignore Confidentiality: Remember that information provided should be treated confidentially.

- Do Not Forget Signature: Ensure that the form is signed and dated by the appropriate party.

Misconceptions

Understanding the Wd 10 form is crucial for contractors. However, several misconceptions can lead to confusion. Here are five common misconceptions about the Wd 10 form:

- It's mandatory to submit the Wd 10 form. Many assume that the submission of this form is compulsory. In fact, providing wage data through this form is encouraged but strictly voluntary.

- All contractors must use the Wd 10 form exclusively. There’s a belief that only the Wd 10 form can be used. Contractors may use alternate forms, as long as they include all the requested information.

- The information submitted is public. Some contractors worry about their confidentiality. The identity of respondents is kept as confidential as possible, per existing laws.

- The form only applies to federal contracts. Many assume that only federal contracts require the Wd 10 form. Both federal and state wage determinations can apply, depending on the nature of the project.

- Wage rates are automatically accepted. Contractors often think that once wage rates are submitted, they will be considered valid. Wage rates cannot be recognized under Davis-Bacon unless the information is provided as requested in the form.

Being informed can significantly impact compliance and operational efficiency. Understanding these misconceptions helps ensure smooth project execution and adherence to regulations.

Key takeaways

Filling out the Wd 10 form accurately is essential for compliance with the U.S. Department of Labor standards. Here are key takeaways to consider:

- Voluntary Submission: While reporting wage data is encouraged, it is voluntary. You may utilize an alternate form as long as it captures all required information.

- Confidentiality Assurance: The identity of the respondent will be kept confidential to the maximum extent allowed by law. This protects the contractor's information during the submission process.

- Details on Employment Classes: Thoroughly list every classification of employees involved in the project, specifying the peak number employed. This includes journeymen, helpers, and apprentices.

- Fringe Benefits Breakdown: Clearly provide data on any bona fide fringe benefits associated with each classification, detailing the hourly rate or percentage applicable.

Browse Other Templates

How to Write a Landscaping Contract - Payment for services is due by the 10th of the following month.

Va Form 10-10ezr - The form assists in enrolling for urgent care services through the VA.

American Speciality Health - Complete the Ash Mnr form to help assess your acupuncture needs.