Fill Out Your Wh 58 Form

The WH-58 form is an essential document issued by the U.S. Wage and Hour Division of the Department of Labor, designed to facilitate the payment of wages, employment benefits, or other compensation to employees following the conclusion of an investigation. It serves as a formal acknowledgment of receipt for back wages and outlines the specifics of payments made to employees, allowing them to understand the parameters of their compensation. The form includes crucial information such as the employee's name, the employer's details, the specific period during which the wages were earned, and the corresponding payment amounts. Essential legal considerations are also highlighted, particularly a notice concerning the employee's rights under the Fair Labor Standards Act (FLSA). Signing this form signifies that the employee has received the stated amount, thereby relinquishing their right to pursue further claims for unpaid wages during the specified timeframe, which is critical to ensuring compliance with wage agreements. Additionally, the form demands the employer's certification, reinforcing their obligation to pay the full owed amount and warning against falsification, which can lead to severe penalties. Understanding the implications of the WH-58 form is vital for both employees and employers navigating the landscape of wage enforcement and legal compliance.

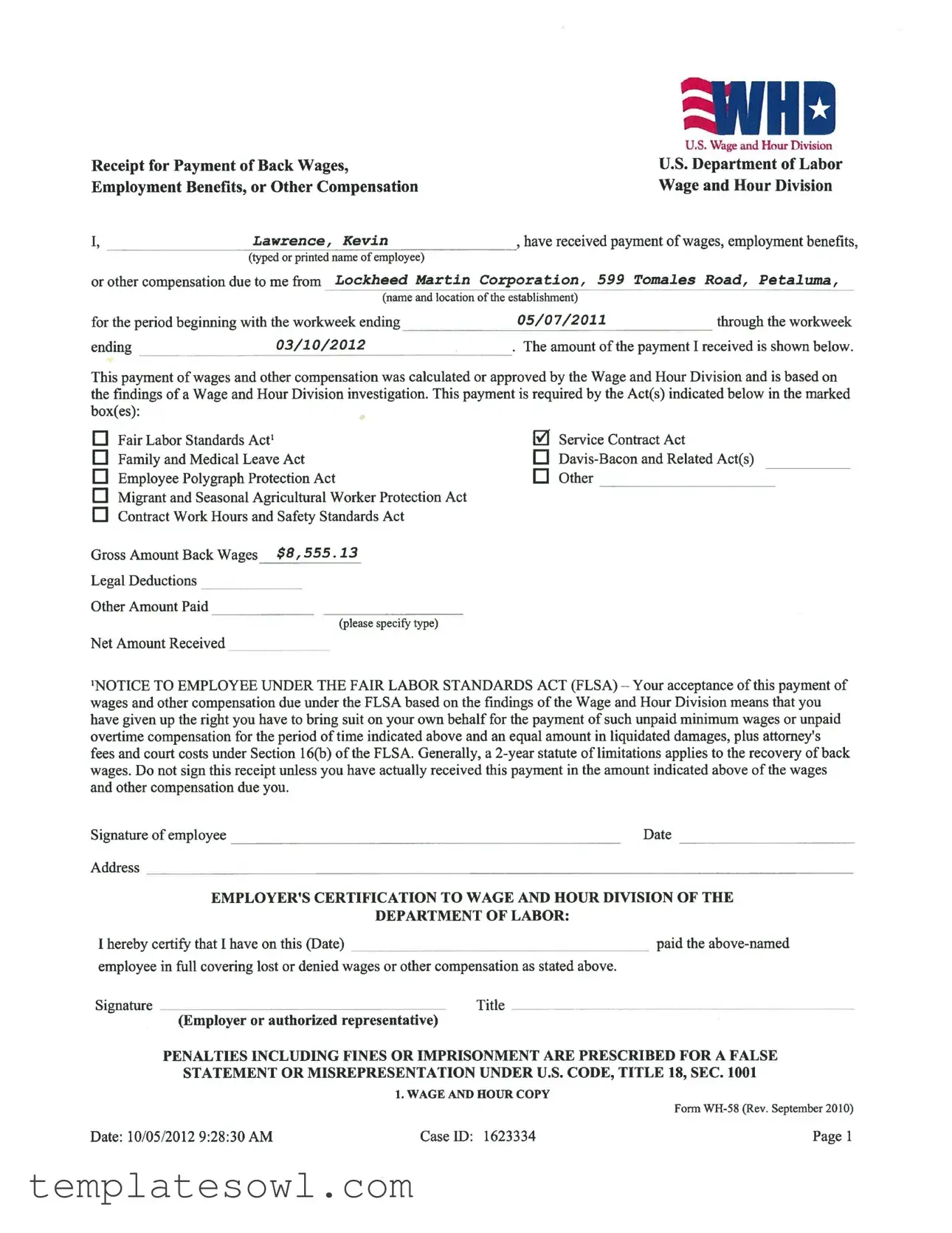

Wh 58 Example

|

3NHD |

|

U.S. Wage and Hour Division |

Receipt for Payment of Back Wages, |

U.S. Department of Labor |

Employment Benefits, or Other Compensation |

Wage and Hour Division |

I, _________________Lawrence,_ Kevin |

have received payment of wages, employment benefits, |

(typed or printed name ofemployee) |

|

or other compensation due to me from Lockheed Martin Corporation, 599 Tomales Road, Petaluma,

|

(name and location ofthe establishment) |

|

for the period beginning with the workweek ending |

05/07/2011______________ through the workweek |

|

ending |

03/10/2012 |

, The amount of the payment I received is shown below. |

This payment of wages and other compensation was calculated or approved by the Wage and Hour Division and is based on the findings of a Wage and Hour Division investigation. This payment is required by the Act(s) indicated below in the marked box(es):

П Fair Labor Standards Act1 |

0 Service Contract Act |

Family and Medical Leave Act |

О |

Employee Polygraph Protection Act |

Other |

Migrant and Seasonal Agricultural Worker Protection Act |

|

Contract Work Hours and Safety Standards Act |

|

Gross Amount Back Wages $0,555.13

Legal Deductions

Other Amount Paid

(please specify type)

Net Amount Received

‘NOTICE TO EMPLOYEE UNDER THE FAIR LABOR STANDARDS ACT (FLSA) - Your acceptance of this payment of wages and other compensation due under the FLSA based on the findings of the Wage and Hour Division means that you have given up the right you have to bring suit on your own behalf for the payment of such unpaid minimum wages or unpaid overtime compensation for the period of time indicated above and an equal amount in liquidated damages, plus attorney's fees and court costs under Section 16(b) of the FLSA. Generally, a

Signature of employee |

Date |

Address

EMPLOYER’S CERTIFICATION TO WAGE AND HOUR DIVISION OF THE

DEPARTMENT OF LABOR:

I hereby certify that I have on this (Date) |

paid the |

employee in full covering lost or denied wages or other compensation as stated above.

SignatureTitle

(Employer or authorized representative)

PENALTIES INCLUDING FINES OR IMPRISONMENT ARE PRESCRIBED FOR A FALSE

STATEMENT OR MISREPRESENTATION UNDER U.S. CODE, TITLE 18, SEC. 1001

1. WAGE AND HOUR COPY

Form

Date: 10/05/2012 9:28:30 AM |

Case ID: 1623334 |

Page 1 |

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Form Purpose | The WH-58 form acknowledges the receipt of back wages, employment benefits, or other compensation by an employee. |

| Governing Laws | This form is governed by several laws, including the Fair Labor Standards Act and the Family and Medical Leave Act. |

| Employee Rights | By signing the form, the employee waives the right to bring a independent suit for unpaid wages or overtime compensation for the specified period. |

| Calculation of Payment | The amount paid on the WH-58 is determined or approved by the Wage and Hour Division following an investigation. |

| Statute of Limitations | A two-year statute of limitations generally applies for recovering back wages under the Fair Labor Standards Act. |

| Certification Requirement | The employer must certify the payment to the Wage and Hour Division, confirming that the employee has been paid in full. |

| Consequences of False Statements | False statements or misrepresentation on this form can result in penalties, including fines or imprisonment under U.S. Code, Title 18, Section 1001. |

| Version | The current version of the WH-58 form was revised in September 2010. |

Guidelines on Utilizing Wh 58

After completing the WH-58 form, ensure that all information is accurate and thoroughly reviewed. This form plays a crucial role in acknowledging the payments for wages, benefits, or other compensation that you have received due to an investigation by the Wage and Hour Division. Below are step-by-step instructions to fill out the form correctly.

- Fill in Your Name: Type or print your full name in the designated space at the top of the form.

- Enter Employer's Name: Provide the name of your employer, in this case, "Lockheed Martin Corporation."

- Insert Employer's Address: Fill in the complete address, which will include the street name, city, and state.

- Identify Employment Period: Specify the beginning and ending date of the workweek for which the payment was made.

- State the Gross Amount: Write the total gross amount of back wages received. Ensure the format is correct: for example, $0,555.13.

- Document Legal Deductions: Include any deductions that apply to your wages.

- Specify Other Amounts Paid: If any additional amounts were paid, give details on the type of payment.

- Calculate Net Amount Received: Sum up all amounts to determine the total net amount you've received.

- Read the Notice: Carefully review the notice regarding the Fair Labor Standards Act. Understand the implications of accepting the payment.

- Sign the Form: Sign your name to confirm that you have received the specified payment.

- Provide Your Address: Include your current address underneath your signature.

- Date the Signature: Write the date on which you are signing the receipt.

- Employer’s Certification: The employer or authorized representative must fill in their name and title.

- Certify Payment Date: The employer's representative must certify the date on which the payment was made.

What You Should Know About This Form

What is the WH-58 form?

The WH-58 form is a receipt used by employees to acknowledge the payment of back wages or other compensation as calculated by the U.S. Wage and Hour Division of the Department of Labor. This form signifies that an employee has received wages, benefits, or compensation due after an investigation by the Wage and Hour Division.

Who issues the WH-58 form?

The WH-58 form is issued by the U.S. Wage and Hour Division, which falls under the Department of Labor. The Division conducts investigations to determine the wage entitlements of employees and issues this form when payments are made based on those findings.

What information is included on the WH-58 form?

The WH-58 form contains essential details, such as the name of the employee, the employer's name and address, the period for which compensation is owed, the gross amount of back wages paid, any legal deductions, and the net amount received. Additionally, it outlines the employee's rights regarding further legal actions and the penalties for false statements under U.S. Code.

What does signing the WH-58 form mean for the employee?

By signing the WH-58 form, an employee acknowledges receipt of the payment and waives the right to file a lawsuit for similar claims regarding unpaid minimum wages or overtime compensation for the specified period. This acceptance also relates to potential liquidated damages and attorney's fees.

What are the legal protections in place for employees who have unpaid wages?

The Fair Labor Standards Act (FLSA) provides legal protections for employees regarding unpaid wages. This act allows employees to recover unpaid minimum wages, overtime compensation, and related damages. A statute of limitations, typically two years, applies to the recovery of these back wages.

Can employees contest the information presented on the WH-58 form?

If employees believe there is an error or dispute regarding the amount presented on the WH-58 form, they should contact the Wage and Hour Division to discuss their concerns. It's essential to document any discrepancies and communicate promptly to resolve any issues.

What should an employee do if they have not received their payment as noted on the WH-58 form?

If an employee does not receive the payment acknowledged on the WH-58 form, they should first verify with their employer's payroll department. If the issue persists, contacting the Wage and Hour Division may be necessary to seek further assistance and ensure compliance with wage laws.

Common mistakes

Filling out the WH-58 form can seem straightforward, but many individuals encounter common pitfalls. Understanding these mistakes can help ensure that the process goes smoothly. One prevalent error is failing to provide complete and accurate information. Many people may rush through the form and miss crucial details, such as the full name of the employer or the specific period during which wages were earned. Missing information can lead to delays in processing and confusion for both the employee and the employer.

Another frequent oversight involves the calculation of amounts. Employees sometimes miscalculate the gross amount of back wages due. This mistake can arise from not properly assembling all earnings for the indicated period or failing to account for legal deductions. Submitting an incorrect amount might lead to complications in receiving the rightful compensation.

In addition, individuals often overlook the importance of the signature section. It is essential that the employee signs the form, confirming receipt of the payment. Some people neglect to sign at all or do not date the form correctly. A missing signature or date renders the document incomplete and may necessitate a resubmission.

Another mistake relates to the **choice of applicable acts** in the designated boxes. Because various laws govern wage and hour regulations, selecting the wrong acts can create issues. Individuals should carefully assess which acts apply to their situation to avoid erroneous claims that could impede their case.

Moreover, the lack of clarity in entering the address can pose challenges. It is vital that the address provided is legible and accurate. Illegible handwriting can lead to miscommunication and may result in difficulties while processing the claim.

People often assume that they can skip the **instructions** outlined on the form. Ignoring specific guidance can lead to confusion about how to properly fill out various sections. Taking the time to understand the form’s requirements can prevent misunderstanding and ensure compliance with the outlined procedures.

Moreover, some may not realize the significance of the “WARNING” section at the bottom of the form. Failing to recognize that penalties exist for false statements can lead to serious legal consequences. It is crucial for individuals to understand that submitting inaccurate information can have lasting repercussions.

Lastly, individuals frequently forget to consult any **legal representation** before signing the form. Seeking legal counsel can be especially beneficial, particularly when the implications of signing the WH-58 affect one's rights to future compensation. Engaging with a knowledgeable advisor can provide vital insight and help navigate the complexities of labor laws.

Documents used along the form

The WH-58 form is commonly used by employees who have received payment for wages, employment benefits, or other compensation. Along with this form, several other documents may also be relevant in wage-related cases. Below is a list of these documents and their brief descriptions.

- WH-1 Form: This is a complaint form filed with the Wage and Hour Division. It allows employees to report violations regarding wage and hour laws, including unpaid wages or overtime.

- WH-2 Form: This form is submitted to request an investigation of wage claims. It provides details regarding the employee's work hours, pay rates, and specific grievances.

- FLSA Notification: Employers must provide employees with information about their rights under the Fair Labor Standards Act. This notification includes details about minimum wage, overtime pay, and other employee rights.

- Back Wage Agreement: This document outlines the terms and conditions of any agreed-upon payments for back wages owed to employees, specifying amounts and payment schedules.

- Employer Certification: An employer must certify payment of back wages to the Wage and Hour Division. This includes information on the employee, payment amounts, and compliance with labor laws.

- Release of Claims: This document is signed by employees to release their right to pursue legal action for unpaid wages in exchange for receiving their back wages.

These documents support the processing of wage claims and ensure protections for both employees and employers under labor laws. Understanding each document helps clarify the rights and responsibilities involved in wage disputes.

Similar forms

- Form WH-1: Used for reporting wage and hour violations. Like WH-58, it documents wage payments but focuses on complaints rather than receipts.

- Form WH-2: This form records wage disputes. Similar to WH-58, it aims to resolve issues surrounding unpaid wages.

- Form WH-3: Utilized for wage calculations. WH-58 presents the final payment, while WH-3 outlines how those wages were determined.

- Form WH-4: Acknowledges receipt of wages. Both WH-58 and WH-4 serve to confirm that an employee received compensation.

- Form WH-5: This form is for filing claims related to wage discrepancies. WH-58 is part of the resolution process for those claims.

- Form WH-6: Used for recording working hours. WH-58 references the time period for wage payments, making these forms interconnected.

- Form WH-7: Applied for reports of underpayment. Whereas WH-58 indicates payment receipt, WH-7 addresses issues of non-payment.

- Form WH-8: Similar to WH-58, this form is designed for calculating unpaid wages but differs in reporting mechanisms.

- Form WH-9: Assists in documenting complaints about wage violations. WH-59 helps ensure that workers receive the wages owed to them.

Dos and Don'ts

When filling out the WH-58 form, it's important to be careful and informed. Follow these guidelines to ensure you complete the document correctly.

- Do read the entire form carefully before you start filling it out.

- Do include accurate and up-to-date information about your employment.

- Do ensure that all amounts are filled out clearly, especially the payment received.

- Do double-check your calculations to avoid any errors.

- Do sign and date the form only after confirming you have received the amount stated.

- Don't leave any required fields blank.

- Don't use whiteout or other correction tools on the form.

- Don't provide misleading information or estimates.

- Don't forget to keep a copy of the completed form for your records.

- Don't ignore the instructions regarding legal rights and consequences.

Misconceptions

The WH-58 form, also known as the "Receipt for Payment of Back Wages, Employment Benefits, or Other Compensation," is often misunderstood. Here are five common misconceptions about this form:

- Misconception 1: The WH-58 form is only for back wages.

- Misconception 2: Signing the WH-58 form means giving up all rights against the employer.

- Misconception 3: The payment reported on the WH-58 is final and cannot be challenged.

- Misconception 4: The employer has unrestricted authority to decide the payment amount.

- Misconception 5: Employees must sign the WH-58 form immediately.

This form covers not only back wages but also employment benefits and other compensation due to an employee. It is essential to understand that the form encapsulates all types of payments that may be owed.

Signing the form only waives the right to sue for the specific wages and benefits included. Employees retain the right to pursue other claims that may not be related to the payment they received.

While acceptance of the payment is an acknowledgment of the amount stated, it does not prevent the employee from disputing the calculations or seeking additional compensation, especially if unpaid minimum wage or overtime was involved.

Payments listed on the WH-58 form are calculated or approved by the Wage and Hour Division based on the results of their investigation. Employers cannot arbitrarily set the amounts without compliance with applicable labor laws.

Employees should only sign the WH-58 form after verifying that they have received the payment amount indicated. Rushing the signing process may lead to complications or misunderstandings regarding the compensation owed.

Key takeaways

When dealing with the WH-58 form, here are some important points to keep in mind:

- Understand the Purpose: The WH-58 form serves as a receipt for employees who have received payment for back wages, employment benefits, or other forms of compensation approved by the Wage and Hour Division.

- Details Matter: Be sure to fill in accurate details such as your name, the employer's name, and the specific period during which you believe you were owed compensation. Mistakes in these areas can cause delays or complications.

- Read the Notice: The form includes a notice regarding the Fair Labor Standards Act (FLSA). Accepting the payment may mean giving up the right to sue for additional unpaid wages for the indicated period. Understanding the implications is crucial.

- Double-Check Amounts: Before signing the form, verify that the amounts listed for gross payment, deductions, and net amount are correct. Only sign if you have received the specified payment.

- Employer's Responsibilities: The form also requires the employer's certification, confirming they have paid the employee in full. This certification is an important step in the process, ensuring that both parties are on the same page.

Browse Other Templates

Wade College Dallas - Check the mailing times to ensure your request is sent in a timely manner.

Jeans Warehouse Application - Keep in mind that your application is confidential.

Tfn Declaration Form - Any changes to your personal or financial circumstances should be communicated to your payer via this form.