Fill Out Your Withdrawal Slip Td Bank Form

The Withdrawal Slip form from TD Bank serves as a vital tool for customers managing their savings accounts. This form is designed to facilitate the withdrawal process, ensuring clients can access their funds efficiently. It contains specific sections where users must provide their account number, the date of the transaction, and the amount they wish to withdraw. Customers are required to write the amount in full, both in numerical and written form, to ensure clarity and reduce the potential for errors. Additionally, the form provides space for signatures to confirm the transaction and authenticate the account holder's identity. To enhance accuracy, there are also provisions for listing various items involved in the transaction, making it easier to keep track of deposits and withdrawals. Importantly, users should note that deposits made may not be available for immediate withdrawal, emphasizing the need for careful planning. Overall, the Withdrawal Slip is a straightforward yet essential document that underlines the importance of proper record-keeping in banking transactions.

Withdrawal Slip Td Bank Example

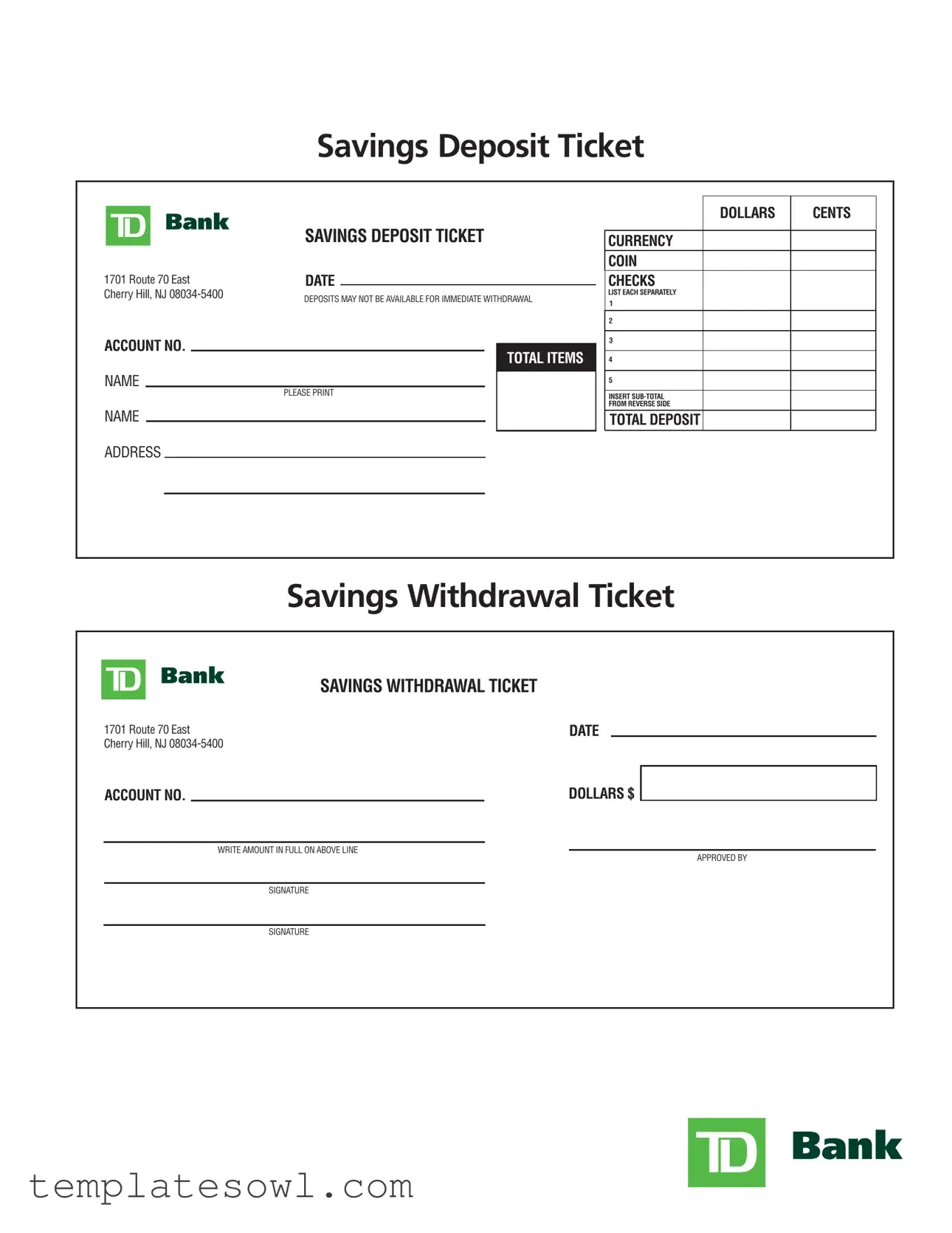

Savings Deposit Ticket

|

|

|

|

|

|

|

SAVINGS DEPOSIT TICKET |

|||

1701 Route 70 East |

DATE |

|

|

|

||||||

|

|

|||||||||

Cherry Hill, NJ |

DEPOSITS MAY NOT BE AVAILABLE FOR IMMEDIATE WITHDRAWAL |

|||||||||

|

|

|

|

|

|

|

||||

ACCOUNT NO. |

|

|

|

|

|

|||||

|

|

|

TOTAL ITEMS |

|||||||

|

|

|

|

|

|

|

|

|

|

|

NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

PLEASE PRINT |

|

||

NAME |

|

|

|

|

|

|

|

|||

ADDRESS |

|

|

|

|

|

|

||||

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

DOLLARS |

CENTS |

|

|

|

CURRENCY |

|

|

|

|

|

COIN |

|

|

CHECKS |

|

|

LIST EACH SEPARATELY |

|

|

1 |

|

|

|

|

|

2 |

|

|

|

|

|

3 |

|

|

|

|

|

4 |

|

|

|

|

|

5 |

|

|

|

|

|

INSERT |

|

|

FROM REVERSE SIDE |

|

|

|

|

|

TOTAL DEPOSIT |

|

|

|

|

|

Savings Withdrawal Ticket

SAVINGS WITHDRAWAL TICKET |

|

1701 Route 70 East |

DATE |

Cherry Hill, NJ |

|

ACCOUNT NO. |

DOLLARS $ |

WRITE AMOUNT IN FULL ON ABOVE LINE |

APPROVED BY |

|

|

SIGNATURE |

|

SIGNATURE |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Savings Deposit Ticket | This is the form used for making deposits at TD Bank. |

| Withdrawal Restrictions | Deposits may not be available for immediate withdrawal, ensuring funds are processed securely. |

| Location Details | The form is associated with the Cherry Hill, NJ branch at 1701 Route 70 East. |

| Account Identification | Each form requires the account number for accurate processing of deposits or withdrawals. |

| Currency Breakdown | Users must list the dollar and cent amounts separately, including currency and coins. |

| Signature Requirement | Withdrawals require the signature of the account holder for verification. |

| Governing Law | In New Jersey, banking transactions are governed by state laws, including the New Jersey Banking Act. |

Guidelines on Utilizing Withdrawal Slip Td Bank

When preparing to withdraw funds from your TD Bank account, you'll need to fill out the Withdrawal Slip accurately. Following the steps below will help ensure that the transaction is completed smoothly and without any issues.

- Begin by locating the Withdrawal Slip at your TD Bank branch or online.

- At the top of the slip, write the current date.

- Enter your account number in the designated field.

- In the section labeled DOLLARS, write the amount of money you wish to withdraw. Make sure to spell it out fully on the line above.

- Sign the slip in the SIGNATURE area to authorize the withdrawal.

- If applicable, ask a bank representative for help reviewing the form to confirm everything is filled out correctly.

After you've completed the form, present it to a bank representative at the counter. They will process your withdrawal request and provide you with the cash or any further instructions if needed. If you experience any delays or issues, don't hesitate to ask for assistance.

What You Should Know About This Form

What is the TD Bank Withdrawal Slip?

The TD Bank Withdrawal Slip is a form used by customers to withdraw funds from their savings accounts. It is important to fill out this form correctly to ensure a smooth transaction at the bank.

How do I fill out the Withdrawal Slip?

To complete the Withdrawal Slip, provide your account number, the date of the transaction, and the withdrawal amount in both numbers and words. You will also need to print your name and address. Ensure the information is clear and legible to prevent any issues with your request.

Can I withdraw all my funds using this slip?

You can request to withdraw all your funds, but be aware that some accounts may have minimum balance requirements. Additionally, recent deposits might not be available for immediate withdrawal. Always check your account terms before trying to withdraw all funds.

What if I make a mistake on the form?

If you make a mistake, it's best to start over with a fresh slip. Crossed-out information can create confusion and might delay your transaction. Take a moment to review the slip before submitting it to ensure everything is correct.

Do I need to sign the Withdrawal Slip?

Yes, your signature is required on the Withdrawal Slip. This verifies that you are the account holder and are authorizing the withdrawal. Make sure your signature matches the one the bank has on file for you.

Where can I obtain a Withdrawal Slip?

Withdrawal Slips are typically available at any TD Bank branch. You can also ask a bank representative for assistance if you don't see the forms readily available. Some forms may even be accessible online or through your banking app.

Is there a fee for using the Withdrawal Slip?

Generally, there are no fees associated with using the Withdrawal Slip for withdrawals. However, fees may apply if you overdraw your account or perform certain types of transactions. It's always good to check with the bank for any specific details.

What should I do if my Withdrawal Slip is not processed?

If your Withdrawal Slip is not processed after submission, contact TD Bank as soon as possible. They can help track the status of your transaction and resolve any issues that may arise. Keeping a record of your transaction can greatly assist in this process.

Common mistakes

Filling out the Withdrawal Slip for TD Bank can seem straightforward, yet many individuals make simple mistakes that can complicate their transactions. One common error involves the date. This information is crucial as it indicates when the withdrawal is being made. Omitting the date or entering an incorrect one can cause unnecessary delays, as the bank may not process the request properly without this vital detail.

Another frequent mistake is related to the account number. It is essential to enter the correct account number to ensure your funds are withdrawn from the intended account. A typo here can lead to confusion and may even result in the wrong account being debited. Double-checking the account number before submitting can help avoid these issues.

People often forget to fill in the amount they wish to withdraw clearly. While the form does prompt you to write the amount in full on the designated line, some individuals might only write it in numbers but neglect to spell it out. This oversight can lead to misinterpretation, which could delay the process. Both the written amount and the numeric amount should match to prevent any ambiguity.

Another mistake is neglecting to provide a proper signature. The form requires a signature to authorize the withdrawal, and skipping this step can result in the form being rejected. It is vital to ensure that your signature matches the one the bank has on file for you. If you forget to sign or use a different signature, the transaction will not proceed.

In addition, some users overlook the importance of listing checks separately if they are part of the transaction. The form specifically asks for items to be listed distinctly. Failure to do so may cause confusion when processing the withdrawal and could potentially lead to an incomplete transaction.

A further error is not reviewing the completed form for any mistakes before submitting it. Taking a moment to double-check each section can save you time and frustration. Whether it's correcting a minor detail or ensuring everything is filled in accurately, a quick review can bring clarity and prevent issues down the road.

Lastly, forgetting to confirm the process of your transaction can lead to uncertainty. Once you have submitted the slip, it can be beneficial to follow up or request a receipt confirming your withdrawal. Staying informed on the status of your transaction helps to ensure that your banking needs are met promptly and that your funds are available when needed.

Documents used along the form

When managing your financial transactions, several forms may accompany the Withdrawal Slip at TD Bank. Each of these documents plays an essential role in ensuring proper record-keeping and compliance. Below is a list of common forms that you may encounter.

- Savings Deposit Ticket: This document is used when you deposit money into your savings account. It outlines the total amount being deposited, including any checks or currency, and helps confirm the transaction.

- Account Statement: Account statements provide a summary of all transactions within a specified period. These monthly or quarterly documents help you track your savings and withdrawals.

- Direct Deposit Form: If you wish to have funds automatically deposited into your account, this form must be completed. It allows for regular deposits from an employer or government agency.

- Change of Address Form: If you move, this form updates your account information. Keeping your address current is vital for receiving important banking documents.

- Overdraft Protection Form: This allows customers to opt-in for overdraft protection on their checking account. It ensures that transactions can still be completed even if there are insufficient funds.

- Transfer Request Form: Use this form to transfer funds between accounts. It is vital for individuals managing multiple accounts within the bank.

- Stop Payment Request: If you need to prevent a check from being cashed or deposited, this form allows you to officially request a stop payment on that check.

- Authorization for Automated Payments: This document facilitates automatic payments from your account for recurring expenses like utilities or subscriptions, providing a convenient way to manage monthly expenses.

Understanding these forms and their purposes can streamline your banking experience. Be sure to keep any necessary documents readily accessible to maintain smooth transactions.

Similar forms

The Withdrawal Slip used at TD Bank bears similarities to several other financial documents. Each of these documents serves a specific purpose within banking transactions, particularly those involving deposits and withdrawals. Below is a list detailing five documents that resemble the Withdrawal Slip.

- Deposit Slip: This document is used to deposit funds into a bank account. Similar to the Withdrawal Slip, it requires information such as account number, date, and the total amount being deposited. Both forms facilitate transactions at the bank and require proper completion for processing.

- Direct Deposit Form: This allows funds to be automatically deposited into a bank account, often used by employers for payroll. Like the Withdrawal Slip, it requires account details but does not involve physical cash or checks being deposited. Both forms streamline the transfer of funds into or out of an account.

- Transfer Form: When you wish to move funds from one account to another within the same bank, a transfer form is utilized. Much like the Withdrawal Slip, it details the amounts and accounts involved, providing clarity in the transaction process to both the customer and the bank.

- Check Withdrawal Slip: This document is specifically used to request cash from a bank account via check. It resembles the Withdrawal Slip in that it provides necessary account information and specifies the amount being withdrawn. Both documents serve the purpose of accessing funds from an account.

- Withdrawal Order: A formal request that authorizes a bank to withdraw funds from an account, this order requires specific details like the account number and the amount, akin to the Withdrawal Slip. Both documents ensure that withdrawals are documented and authorized, maintaining clear records for both the bank and the customer.

Dos and Don'ts

When completing the Withdrawal Slip at TD Bank, there are important steps to follow. Here is a list of dos and don'ts to ensure a smooth transaction:

- Do write the date clearly at the top of the form.

- Do print your name and account number legibly.

- Do double-check the amount you are withdrawing to avoid errors.

- Don't leave any blank spaces on the form; fill in all required sections.

- Don't forget to sign the form at the bottom to authorize the transaction.

- Don't use abbreviations when writing the amount; always write it in full.

Following these guidelines can help prevent delays in processing your withdrawal and ensure that your banking experience is efficient and hassle-free. Time is of the essence, so be thorough and accurate!

Misconceptions

Understanding the Withdrawal Slip at TD Bank can be straightforward, yet several misconceptions often cloud its practical use. Here are ten common misunderstandings:

- It's only for savings accounts. Many assume that the withdrawal slip is limited to savings accounts, but it can also be used for various other account types.

- Withdrawal slips are not necessary. Some people think they can simply request a withdrawal verbally or through an app. However, for in-person transactions, the slip is typically required.

- Funds are immediately available upon withdrawal. Another misconception is that money withdrawn is instantly available. In fact, deposits made may not be available for immediate withdrawal.

- You can only withdraw cash. Many believe withdrawal slips are for cash only, but you can also request withdrawals in checks, depending on your account type.

- Only customers can use the withdrawal slips. While typically customers use these slips, others can assist in the process if they have the required information.

- All withdrawals require signature approval. Some might think that every transaction needs two signatures. However, solo requests can be valid for certain account holders.

- Withdrawal slips are not required for electronic banking. While electronic transactions do not need a paper slip, in-branch transactions usually do.

- You can write any amount on the slip. There might be a belief that you can write any amount. However, you should only withdraw what is available in your account.

- Any bank employee can approve the withdrawal. Many feel that any staff member can approve these slips, but generally, there are designated personnel for this task.

- All transactions are the same regardless of the slip used. People often assume that all withdrawal slips function identically. Different types of slips may have unique rules and processes.

It is beneficial to clarify these misconceptions to ensure a smooth banking experience at TD Bank.

Key takeaways

When filling out and using the Withdrawal Slip for TD Bank, there are several important considerations to keep in mind:

- Accurate Information: Ensure that you complete all fields accurately, including the account number, date, and the amount you wish to withdraw.

- Full Amount: Write the withdrawal amount in full on the designated line to prevent any processing issues.

- Signatures Required: Remember that the form must be signed in the appropriate places for it to be accepted.

- Available Funds: Be aware that deposits may not be available for immediate withdrawal, so plan your transactions accordingly.

- Use of Funds: Clearly list any checks that you plan to include with your withdrawal, as this will help in processing your request quickly.

Browse Other Templates

California Elder Abuse Report,Dependent Adult Abuse Notification,Report of Suspected Abuse,Elder and Dependent Adult Abuse Report,Abuse Reporting Form,Adult Protective Services Report,Elder Abuse Incident Report,Reporting Form for Elder Abuse,Suspect - Specific incidents and types of abuse must be recorded.

Va Form 26-1880 - Laws under Title 38 outline the eligibility criteria for loan benefits and the application process.