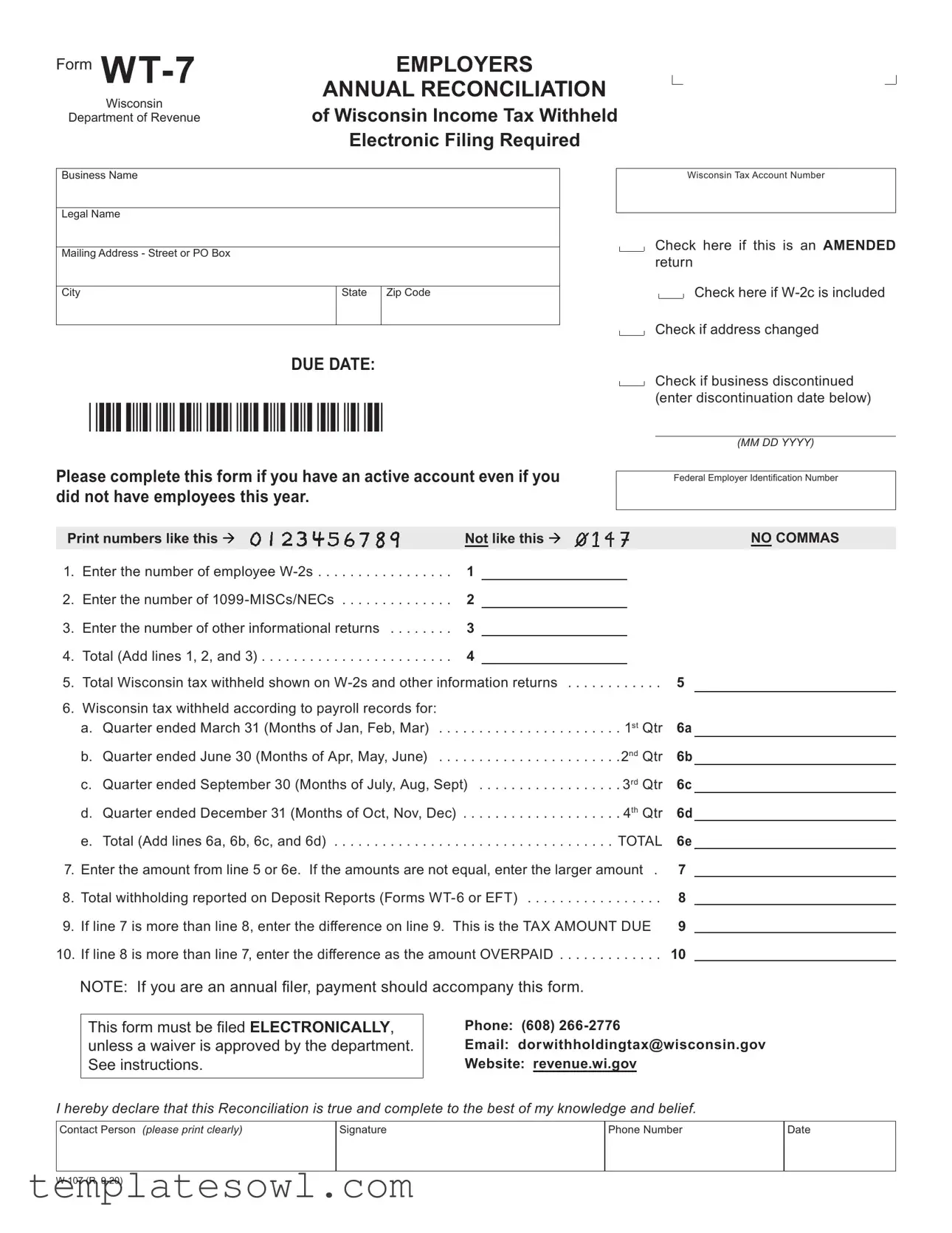

Fill Out Your Wt 7 Form

The WT-7 form is vital for employers in Wisconsin, as it serves as the annual reconciliation of income tax withheld from employee wages. Each year, businesses need to accurately report the total amount of Wisconsin income tax they have withheld, along with details regarding their employees and the nature of any payments made. The form collects essential information such as business names, addresses, and federal identification numbers. Employers must indicate the number of W-2s and 1099 forms issued, ensuring that all data reflects actual payroll and withholding records. They need to account for quarterly withholding totals and identify any discrepancies between the amounts reported and the actual withholdings. Because electronic filing is mandatory for this form, employers must ensure compliance to avoid penalties. Whether it's a standard submission or an amended return, understanding the WT-7 is crucial for managing state income tax obligations effectively.

Wt 7 Example

Form |

EMPLOYERS |

|

|

ANNUAL RECONCILIATION |

|

|

Wisconsin |

|

|

of Wisconsin Income Tax Withheld |

|

Department of Revenue |

||

Electronic Filing Required

Business Name

Legal Name

Mailing Address - Street or PO Box

City |

State |

Zip Code |

|

|

|

DUE DATE:

Wisconsin Tax Account Number

Check here if this is an AMENDED return

Check here if

Check if address changed

Check if business discontinued (enter discontinuation date below)

Please complete this form if you have an active account even if you did not have employees this year.

(MM DD YYYY)

Federal Employer Identification Number

Print numbers like this |

Not like this |

|

|

|

NO COMMAS |

||

1. |

Enter the number of employee |

1 |

|

|

|

|

|

2. |

Enter the number of |

2 |

|

|

|

|

|

3. |

Enter the number of other informational returns |

3 |

|

|

|

|

|

4. |

Total (Add lines 1, 2, and 3) |

4 |

|

|

|

|

|

5. |

Total Wisconsin tax withheld shown on |

. . . . . . |

5 |

|

|||

6. |

Wisconsin tax withheld according to payroll records for: |

|

|

|

|

|

|

|

a. Quarter ended March 31 (Months of Jan, Feb, Mar) . . . |

. . . . . . . . . . . . . . . . . . . |

. 1st Qtr |

6a |

|

||

|

b. Quarter ended June 30 (Months of Apr, May, June) . . . |

. . . . . . . . . . . . . . . . . . . |

.2nd Qtr |

6b |

|

||

|

c. Quarter ended September 30 (Months of July, Aug, Sept) |

6c |

|

||||

|

d. Quarter ended December 31 (Months of Oct, Nov, Dec) |

. . . . . . . . . . . . . . . . . . . |

. 4th Qtr |

6d |

|

||

|

e. Total (Add lines 6a, 6b, 6c, and 6d) |

. . . . . . . . . . . . . . . . . . . |

TOTAL |

6e |

|||

7. |

Enter the amount from line 5 or 6e. If the amounts are not equal, enter the larger amount . |

7 |

|

||||

8. |

. . . . . . . . . . .Total withholding reported on Deposit Reports (Forms |

. . . . . . |

8 |

|

|||

9. |

If line 7 is more than line 8, enter the difference on line 9. This is the TAX AMOUNT DUE |

9 |

|

||||

. . . . . . .10. If line 8 is more than line 7, enter the difference as the amount OVERPAID |

. . . . . . |

10 |

|

||||

NOTE: If you are an annual filer, payment should accompany this form.

This form must be filed ELECTRONICALLY, unless a waiver is approved by the department. See instructions.

Phone: (608)

Email: dorwithholdingtax@wisconsin.gov

Website: revenue.wi.gov

I hereby declare that this Reconciliation is true and complete to the best of my knowledge and belief.

Contact Person (please print clearly)

Signature

Phone Number

Date

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The WT-7 form is used for the annual reconciliation of Wisconsin income tax withheld by employers. |

| Filing Requirement | This form must be filed electronically unless a waiver is approved by the Wisconsin Department of Revenue. |

| Due Date | The due date for submitting the WT-7 form aligns with the end of the calendar year, reflecting all withholding for that year. |

| Governing Law | The WT-7 form is governed by the Wisconsin Administrative Code and state tax regulations. |

Guidelines on Utilizing Wt 7

Once you have gathered all necessary information, filling out the Wt 7 form is a straightforward process. It is important to complete the form accurately and submit it electronically. Follow these steps closely to ensure proper submission.

- Begin by entering your business name and legal name in the appropriate fields.

- Fill in your mailing address, including the street or PO Box, city, state, and zip code.

- Input your Wisconsin Tax Account Number, and check any relevant boxes for amendments or changes.

- Provide your Federal Employer Identification Number (EIN), ensuring to format the numbers correctly without commas.

- Complete line 1 by entering the number of employee W-2s.

- On line 2, enter the number of 1099-MISCs/NECs.

- For line 3, record the number of other informational returns you are submitting.

- Add the numbers from lines 1, 2, and 3 to get the total on line 4.

- On line 5, enter the total Wisconsin tax withheld shown on the W-2s and other informational returns.

- Complete line 6 by providing the Wisconsin tax withheld according to your payroll records for each of the four quarters.

- Then, add the quarterly totals together and place the sum in line 6e.

- On line 7, enter the larger amount between line 5 and line 6e.

- Fill in line 8 with the total withholding reported on your Deposit Reports (Forms WT-6 or EFT).

- If line 7 exceeds line 8, calculate the difference and enter it on line 9. This is the tax amount due.

- If line 8 is more than line 7, enter the difference on line 10 as the amount overpaid.

- Finally, sign the form, print your contact person's name clearly, and provide a phone number and date.

What You Should Know About This Form

What is the Wt 7 form?

The Wt 7 form, also known as the Employers Annual Reconciliation for Wisconsin Income Tax Withheld, is used to report the total income tax withheld from employees and other payments throughout the year. This form consolidates information from W-2s, 1099-MISCs/NECs, and other informational returns. It ensures compliance with Wisconsin tax regulations and must be filed electronically unless a specific waiver has been granted.

Who needs to file the Wt 7 form?

If you have an active tax account in Wisconsin, you must complete the Wt 7 form—even if you did not have any employees during the year. This includes businesses that may have had employees in the past but experienced no activity this year.

What is the due date for the Wt 7 form?

The Wt 7 form does not have a fixed due date mentioned in the provided information. Generally, it needs to be filed after the end of the calendar year and in conjunction with your W-2s and other related forms. Check the Wisconsin Department of Revenue website for the most accurate due dates.

What does the form include regarding employee information?

The form requires you to report the total number of W-2s, 1099-MISCs/NECs, and any other informational returns. It's essential to provide accurate counts to reflect your total employee-related tax withholding accurately.

How do I calculate the amount to report on the Wt 7?

You will need to add together the amounts shown on your W-2s and other informational returns to determine your total Wisconsin tax withheld. The form also instructs you to compare this total with your payroll records for each quarter of the year.

What should I do if I find a discrepancy between reported amounts?

If you find that your total tax withheld differs from what you reported on your deposit reports, you'll need to adjust accordingly. The Wt 7 form allows you to indicate whether there’s an amount due or if you have overpaid. Always use the larger amount if there is a difference between the two.

Do I need to make a payment when filing the Wt 7?

If you’re an annual filer, you should include any payment due along with your Wt 7 form. This ensures that your filing is complete and meets Wisconsin’s requirements. The instructions on the form will guide you through this process.

What if I need to make changes to my Wt 7 form?

If you need to amend your Wt 7, there is an option to check that you are filing an amended return. Make sure to complete the form accurately and provide any necessary explanations for changes made to your original filing.

How can I contact the Wisconsin Department of Revenue if I have questions?

You can reach out to the Wisconsin Department of Revenue for any questions regarding the Wt 7 form. They can be contacted by phone at (608) 266-2776 or via email at dorwithholdingtax@wisconsin.gov. Their website, revenue.wi.gov, also has resources and additional information.

Common mistakes

Filling out the WT-7 form correctly is crucial for ensuring compliance with Wisconsin tax regulations. However, many people make common mistakes that can lead to delays or penalties. Awareness of these pitfalls can help streamline the process and ensure accuracy.

One frequent error involves providing incorrect identification numbers. This includes the Business Name, Federal Employer Identification Number (FEIN), and Wisconsin Tax Account Number. Ensure all numbers are printed clearly and follow the specified format: no commas and accurate digits. Mistakes here can cause processing issues and delays.

Another common mistake is failing to check all relevant boxes. For instance, you must indicate if the form is amended, if a W-2c is included, or if there has been a change in address or business status. Omitting these checks can create confusion and lead to questions from the Wisconsin Department of Revenue.

Entering incorrect figures in lines 1 through 10 is also a frequent problem. Double-check the number of W-2s, 1099s, and other informational returns. Line 4 should accurately reflect the total of these entries. Additionally, ensure that the amounts on lines 5 and 6e align. If they do not, a larger amount must be reported, but selecting the lesser number could result in penalties.

Pay attention to the calculation of quarters. Each quarter, from March 31 to December 31, must be filled out accurately. Common issues arise when totals for the quarterly amounts are either miscalculated or misreported. Failing to total these correctly on line 6e may lead to discrepancies that trigger further scrutiny.

Not accompanying the form with payment, if applicable, is another oversight. If you are an annual filer and owe tax, make sure to include your payment. This ensures that the form will be processed without unnecessary delays.

Lastly, people often neglect to sign and date their WT-7 forms. A signature is important as it verifies that all information contained in the form is true and complete. Without this final step, the form may be deemed incomplete, leading to possible rejection or follow-up inquiries from the tax department.

By keeping these common mistakes in mind and taking the time to carefully review your WT-7 form before submission, you can help ensure a smoother and more efficient filing experience.

Documents used along the form

The WT-7 form, used for the Employers Annual Reconciliation of Wisconsin Income Tax Withheld, is not the only document necessary for compliance with tax reporting obligations. Several other forms and documents complement the information submitted through the WT-7, ensuring a complete and accurate tax filing process. Below is a list of these additional forms.

- W-2 Form: This form is used to report wages paid to employees and the taxes withheld from those wages. Employers must provide a copy of the W-2 to each employee and submit copies to the Social Security Administration and state tax authorities.

- W-3 Form: This is a summary form that accompanies the W-2 forms. It reconciles the total wages, tips, and other compensation reported on all W-2s submitted for the year. The W-3 is also sent to the Social Security Administration.

- 1099-MISC Form: This form is used to report various types of payments made to non-employees, including independent contractors and freelancers. It is necessary for any payments that meet the reporting threshold.

- 1099-NEC Form: Introduced to specifically report non-employee compensation, this form is now used instead of the 1099-MISC for payments made to independent contractors. It simplifies reporting for businesses that regularly utilize freelance services.

- Form WT-6: This form is used for periodic withholding tax deposits. Employers must report their withholding tax payments on the WT-6 throughout the year to ensure compliance with their withholding obligations.

- Employer's Quarterly Federal Tax Return (Form 941): This form reports income taxes, Social Security tax, and Medicare tax withheld from employee wages. It is filed quarterly and is crucial for maintaining accurate payroll tax information with the IRS.

- FFR (Federal Filing Requirement): This is a document that outlines the timeline and requirements for federal tax filing. It summarizes due dates and various forms required for federal income tax reporting.

These forms, when completed accurately and submitted timely, help facilitate the proper administration of tax responsibilities. Compliance is essential not only for avoiding penalties but also for supporting the effective operation of public services funded by tax revenue.

Similar forms

- W-2 Form: This form reports an employee's annual wages and the taxes withheld. The WT-7 agrees in sharing the reconciliation of the withheld tax amounts for employees.

- 1099-MISC/NEC Form: Used for reporting other income paid to non-employees. It parallels the WT-7 in reconciling and reporting tax withheld on various non-employee compensations.

- W-3 Form: This is a summary of W-2 forms submitted. The WT-7 is similar in that it serves as a summary for total taxes withheld for the year.

- Form 941: Quarterly Federal Tax Return, it reports income taxes, Social Security tax, and Medicare tax withheld from employees' paychecks. Like the WT-7, it is used to reconcile withheld taxes.

- Form 940: Used for reporting annual Federal Unemployment Tax (FUTA). While focused on unemployment, it shares with the WT-7 the purpose of summarizing tax obligations at year's end.

- Schedule H: Household Employment Taxes, which allows taxpayers to report employment taxes for household employees. It too addresses withheld taxes, similar to the WT-7.

- W-2c Form: The corrected version of the W-2. When discrepancies arise in previously reported wages or taxes, the WT-7 addresses these same corrections during reconciliation.

- Form 1096: This form summarizes and transmits information returns to the IRS. Like the WT-7, it acts as a connective document for the reconciliation of reported income and withheld amounts.

Dos and Don'ts

- Do verify your business and legal name to ensure accurate reporting.

- Do enter the total number of employee W-2s and other informational returns correctly.

- Do check the boxes for any amendments or changes to your business status.

- Do ensure that all tax amounts match the records from your payroll documentation.

- Do complete the form electronically unless you have received a waiver from the department.

- Don't use commas when entering numerical amounts; format numbers clearly.

- Don't forget to provide accurate contact information in case of inquiries.

Misconceptions

Misunderstandings about the WT-7 form can lead to costly mistakes for businesses. Here are some common misconceptions:

- It's only for businesses with employees. Many believe the WT-7 form is necessary only if a business had employees. In reality, if you have an active tax account, you still need to submit this form, even if you had no employees during the year.

- You don't need to file if you didn't withhold any taxes. Some think that if no tax was withheld, they can skip filing the WT-7. This is not accurate. All active accounts must file, regardless of withholding.

- The form can be mailed in. It's a common belief that the WT-7 can simply be mailed. However, the form must be filed electronically unless you have received a waiver from the Department of Revenue.

- Once filed, you can’t make changes. Some people think that after submitting the WT-7, it's final. If corrections are needed, you can amend the return, but be sure to check specific instructions on how to do this properly.

- Filing the WT-7 means you've paid your taxes. Filing the form does not equal the payment of taxes due. It’s critical to ensure that payments are made alongside or prior to filing to avoid penalties.

- Information on the form is not important. A misconception exists that the information you provide isn't critical. Each piece of information you enter helps ensure accuracy and compliance with state tax laws.

- Your business name and legal name can be different. Some might think it’s acceptable to list different names on the form. You should use your legal business name for accurate record-keeping and to avoid issues with the Department of Revenue.

- The due date is flexible. Some believe that deadlines for filing can be adjusted. It’s important to recognize that there are strict deadlines for filing the WT-7, and missing these can lead to penalties.

- All tax records must be submitted with the form. There is a misconception that you need to submit all original documents, like W-2s. You should summarize the data on the WT-7 but keep the supporting documents for your records in case of an audit.

Understanding these points can help ensure that you comply with Wisconsin state tax laws and avoid unnecessary complications. Always consult the latest guidance or reach out to the Department of Revenue if you have specific questions.

Key takeaways

Filling out the WT-7 form may seem daunting at first, but it is essential for business owners in Wisconsin to understand its requirements and implications. Here are some key takeaways to keep in mind:

- Completing the WT-7 form is mandatory for all employers with an active Wisconsin tax account, regardless of whether they had employees during the tax year.

- Be sure to report accurate figures. Even small mistakes, like using commas or misrepresenting the number of W-2s, can lead to complications.

- It's crucial to check all relevant boxes, such as if the return is amended or if there has been a change of address. Missing these could delay processing.

- Payment should accompany the WT-7 form if you are an annual filer and owe taxes. Submitting the form electronically is required unless a waiver is granted.

- If the amount of tax withheld reported on the form does not match your deposit reports, the difference must be noted. Identify whether it results in an amount due or an overpayment.

- Finally, maintain documentation of the information provided. This ensures you have records that support the figures reported should any questions arise in the future.

By following these guidelines and understanding the intricacies of the WT-7 form, you'll help ensure a smoother tax filing experience.

Browse Other Templates

Teacher Search - The Arizona GED® program is designed to assist you in obtaining your educational credentials.

What Is Form 8453 Used for - Form MO-8453 assists in verifying the completion of tax information submitted electronically.