Fill Out Your Chapter 128 Form

The Chapter 128 form is a crucial document for individuals seeking debt relief through voluntary amortization in Milwaukee County. This process allows debtors overwhelmed by financial obligations to create a structured plan to pay off their debts in a manageable way. It begins with the filing of a petition that includes personal information about the debtor, such as their name, address, and employer. Alongside the petition, individuals must submit an affidavit of debts detailing all creditors and account balances. It’s essential to notarize this affidavit to ensure its validity. Additionally, the proposed order appointing a trustee and outlining payment methods must be included. Debtors face a choice: either have funds deducted directly from their paychecks or make payments directly to the trustee. After meticulously preparing the required documentation, including stamped envelopes for the court, debtors must file these forms with the Clerk of Circuit Court, paying a filing fee in the process. The timeline for this procedure is tight, as confirmation of court orders must be diligently followed up on within 25 days. A successful filing not only halts collection efforts but also paves the way for financial stability.

Chapter 128 Example

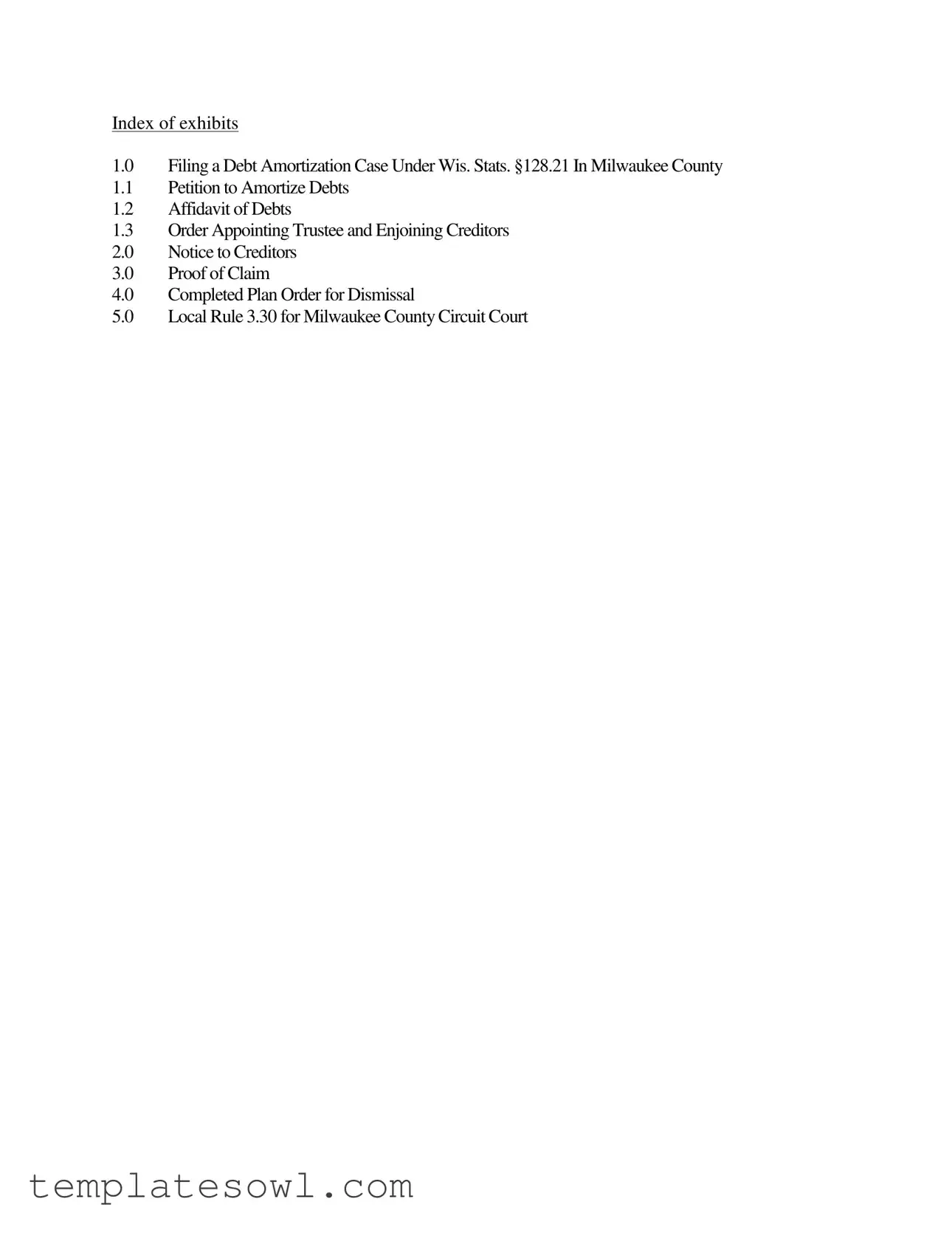

Index of exhibits

1.0Filing a Debt Amortization Case Under Wis. Stats. §128.21 In Milwaukee County

1.1Petition to Amortize Debts

1.2Affidavit of Debts

1.3Order Appointing Trustee and Enjoining Creditors

2.0Notice to Creditors

3.0Proof of Claim

4.0Completed Plan Order for Dismissal

5.0Local Rule 3.30 for Milwaukee County Circuit Court

Filing a Debt Amortization Debt Case Under Wis. Stats. §128.21 – IN MILWAUKEE COUNTY

1.Petition to Amortize Debts

A.Include debtor’s name and address

B.In paragraph 2 state the debtors’ employer

C.In paragraph 6, choose between payroll deduction or making direct payments to the

trustee.

2.Affidavit of Debts

A.List all of the creditors to be included in the plan.

B.State the balance due each creditor and the account number.

C.State the total of all the debts.

D.It must be notarized.

3.Proposed Order Appointing Trustee and Enjoining Creditors

A.Choose between payroll deduction or making direct payments to the trustee.

B State the amount to be deducted from each paycheck OR a monthly amount to be paid directly to the trustee. Total debt x 1.07 (payroll deduct) or 1.10

4.Make two copies of the Petition to Amortize Debts, the Affidavit of Debts and the Proposed Order Appointing Trustee and Enjoining Creditors.

5.Prepare three (3) stamped envelopes

A.Two should be addressed to you, so you can receive a signed order from the court

B.Another is blank for the Clerk to stamp the Trustee’s information.

6.File your papers with the Clerk of Circuit Court and pay the $35 filing

A.The original and two copies of your Petition to Amortize Debts

B.The original and two copies of your Affidavit of Debts

C.The original and three copies of Proposed Order Appointing Trustee and Enjoining Creditors

D.Your three stamped envelopes, two addressed to you and a blank one for the Trustee.

7.Cover letter to Clerk of Court with instructions

8.Calendar file for 25 days from filing to confirm that Order is signed.

9.Once the court issues the Order, the Court will return copies to you and the trustee.

10.Send Order to employer/debtor with cover letter instructing payments

Exhibit 1.0

STATE OF WISCONSIN |

CIRCUIT COURT |

MILWAUKEE COUNTY |

|

CIVIL DIVISION |

|

_____________________________________________________________________________

In the Matter of the Voluntary Amortization of Debts of:

_____________________________________ Case No. _________________

Debtor(s) – Name and Address

_____________________________________________________________________________

Petition to Amortize Debts under Wis. Stat. §128.21

1.Debtor is an adult resident of Milwaukee County, Wisconsin, residing at

________________________________

_______________________________________________________________________

(state address).

2.Debtor is employed by

_______________________________________________________________________

______________________________________________________________________

(state full name and address of each employer).

3.Debtor is indebted beyond debtor’s ability to pay debts as they mature, and the assistance of the court is needed in the amortization of such indebtedness pursuant to Wis. Stat. § 128.21.

4.Debtor believes that unless the assistance of the court is obtained for the amortization of indebtedness pursuant to Wis. Stat. §128.21, creditors will continue to harass debtor by the issuance of garnishment, attachment or execution.

5.Debtor is of the opinion and belief that debtor will be able to make future payments at regular intervals according to a plan of amortization so at to amortize debtor’s indebtedness over a period of not more than three (3) years.

6.Debtor requests that (choose one):

the court enter an order that a portion of debtor’s payroll checks be assigned directly to the trustee in this proceeding in an amount set forth in the proposed order submitted with this petition.

Exhibit 1.1

debtor pay to the trustee directly an amount set forth in the proposed order submitted with this petition.

7.Attached is my affidavit of debts to be included in the plan.

8.Debtor requests to be permitted to amortize debts pursuant to Wis. Stat. § 128.21, and that a plan of amortization as may be proposed by the Trustee and submitted to the creditor(s) be approved by the court.

9.Debtor has submitted a proposed Order appointing the Trustee and enjoining the creditors listed in this petition from further collection procedures.

Dated: _______________________, 20___.

_____________________________________________

Debtor Name

_____________________________________________

Debtor Name Subscribed and sworn to before me

this _______ day of _______________, 20___.

_____________________________________

Notary Public, State of Wisconsin

My commission expires ____________, 20___

or is permanent

If debtor is represented by an attorney the attorney must complete the following:

Dated:_________________________, 20__.

________________________________________________________

Signature

Print: Name, Bar number, address, phone and email address:

Note: Include two (2) stamped envelopes – one to be sent to Trustee (name and address will be filled in by the court) and one

STATE OF WISCONSIN |

CIRCUIT COURT |

MILWAUKEE COUNTY |

|

CIVIL DIVISION |

|

____________________________________________________________________________________________

In the Matter of the Voluntary Amortization of Debts of:

_______________________

_______________________

_______________________,

Debtor(s)

Case No. ______________

____________________________________________________________________________________________

Affidavit of Debts - §128.21, Wis. Stats.

State of Wisconsin )

)SS

Milwaukee, County )

___________________ (Debtor[s] names), being first duly sworn upon oath, deposes and states:

That he/she/they is/are the debtor(s) in the above entitled proceeding and that the following is a

true list of the debts debtor(s) desire(s) to be included in the amortization plan to be formulated by the

Trustee.

CREDITOR:

List each creditor by name and address and identify any account number you have for that creditor

unless there would be an identity theft issue, i.e. social security number is the account number.

List the amount due each creditor.

State the total of all debts to be included in the plan.

Dated:_________________20__.

|

____________________ |

|

Debtor Name |

|

____________________ |

|

Debtor Name |

Subscribed and sworn to before me |

|

This _______ day of __________, 20__. |

|

______________________________ |

|

Notary Public, State of Wisconsin |

|

My commission expires _________, 20__ or is permanent |

Exhibit 1.2 |

STATE OF WISCONSINCIRCUIT COURTMILWAUKEE COUNTY

CIVIL DIVISION

____________________________________________________________________________

In the Matter of the Voluntary Amortization of Debts of: |

|

_____________________________________, |

Case No._______________ |

Debtor(s) Name and address |

|

_____________________________________________________________________________

Order Appointing Trustee and Enjoining Creditors

This matter is before the court on petition of the debtor(s) listed above for the amortization of indebtedness pursuant to Wis. Stat. § 128.21.

NOW THEREFORE, IT IS ORDERED, that:

1.The petitioner(s) are allowed to proceed with the amortization of debts pursuant to the provisions

of Wis. Stat. § 128.21.

2.

is appointed Trustee in this proceeding. The Trustee is directed to comply with Wis. Stat. §§ 128.21(3) and (3g). (Clerk will stamp original and copies)

3.No distributions to creditors shall be made before a plan is approved.

4.Upon the filing of this Order and while the case is proceeding, no execution, attachment, activation of wage assignment or garnishment may be initiated or enforced by creditors of the

5.Choose one:

As requested by the debtor in the petition filed with the court, debtor’s employer,

____________________________________________________________________ (list employer) or

debtor’s current employer, shall, until otherwise directed by the Trustee or further order of the court, deduct $ __________ from each of debtor’s payroll checks and mail that sum directly to the Trustee named above

Exhibit 1.3

The debtor shall, until otherwise directed by the Trustee or further order of the court, pay directly to the Trustee, named above, the sum of $ __________monthly, on or before 15 days after the date of this order.

Dated: _______________. 20___.

BY THE COURT:

______________________________

Circuit Court Judge

STATE OF WISCONSINCIRCUIT COURT MILWAUKEE COUNTY

____________________________________________________________________________________

IN THE MATTER OF THE PROCEEDINGS FOR |

|

THE AMORTIZATION OF DEBT OF: |

Case No. |

________________________ |

NOTICE TO CREDITORS |

________________________

________________________

____________________________________________________________________________________

TO ALL CREDITORS OF _______________:

Upon a Petition to Amortize Debts filed by the debtor(s), the Circuit Court has ordered relief under §128.21 Wis. Stats. A copy of the Order, entered ______________ is enclosed. The Order

appoints the undersigned as Trustee to administer the Plan.

PLEASE TAKE NOTICE that a creditor's meeting will be held at the office of the undersigned trustee at the address given below on___________, 2011, at __________ a.m., for the

purpose of considering an amortization plan and determining the claims to be covered by said plan. Creditors are not required to attend the meeting. The plan shall have the debtor pay sums sufficient to pay all creditors and administrative fees and costs within a three year period. Disbursements will begin after the Plan is approved by the Circuit Court following the meeting. Funds will be disbursed every 90 days on a

You are currently scheduled to be paid the amount set forth in the attached Affidavit of Debts. The amount due is the balance as of ___________(date of petition). If the amount of debt as of

the date of filing or address shown is incorrect, file a claim by the date of the meeting of creditors set forth above. Simply mail or fax your most recent statement, invoice, ledger or other proof of the debt. The fax number is

If you object to these proceedings, submit your objection in writing to the trustee no later than the date of the creditor's meeting given above. Objections filed after the conclusion of the meeting will not be considered. You must state the grounds for your objection in detail, and if you want the court to conduct a hearing, you must request one in your written objection.

PLEASE TAKE FURTHER NOTICE that, pursuant to the Order, no execution, attachment, wage assignment or garnishment or other collection actions may be taken against the debtor(s).

Further, this is not a bankruptcy and should not be reported as one.

Dated at Milwaukee, Wisconsin, this _____ day of _________, 2011.

Mont L. Martin, Trustee

P.O. ADDRESS:

933 North Mayfair Road, Suite 107 Milwaukee, WI 53226

Exhibit 2.0

STATE OF WISCONSIN : CIRCUIT COURT : ______________ COUNTY

______________________________________________________________________________

IN THE MATTER OF THE VOLUNTARY |

Case No. ________________ |

AMORTIZATION OF THE DEBTS OF: |

|

_________________________{debtors name} |

PROOF OF CLAIM |

_________________________{address} |

|

_________________________{city,state.zip} |

|

______________________________________________________________________________

Please insert correct account number here: _________________________

I/We _________________________ whose address is:__________________________________

______________________________________________________________________________

states as follows:

(1)At the time the debtor's petition was filed, the above debtor was indebted to you in the amount of $_________________________.

(2)Proof of your claim/how you arrived at the amount of your claim must be included with this completed Proof of Claim.

(3)No judgment has been rendered relating to this debt except as follows: (attached copy of judgment). _________________________

(4)if nothing is owed, and/or this account has been paid, indicate here: ___________

(5)Do NOT submit claims or expect payment on debts not listed in the Affidavit of Debts.

(6)Return (or fax) this claim to the address below.

PLEASE PRINT LEGIBLY

______________________________________________________________________________

Your Name (person completing form) |

Telephone Number |

Title: _________________________ |

______________________________ |

|

Fax Number |

Address: ______________________ |

______________________________ |

|

Today's Date |

TO CREDITORS: MAIL OR FAX THIS COMPLETED FORM PRIOR TO CREDITORS' MEETING TO:

Mont L. Martin, Trustee

933 N. Mayfair Road. Ste 107

Milwaukee, WI 53226

Phone:

Fax No.

Exhibit 3.0

STATE OF WISCONSIN : CIRCUIT COURT : MILWAUKEE COUNTY

____________________________________________________________________________________

IN THE MATTER OF THE PROCEEDINGS |

|

FOR THE AMORTIZATION OF THE DEBTS |

Case No. ______________ |

OF: |

|

|

COMPLETED PLAN |

|

ORDER FOR DISMISSAL |

________________________ |

|

________________________ |

|

________________________ |

|

____________________________________________________________________________________

Upon the petition of Mont L. Martin, Trustee, and upon the records and files herein,

IT IS ORDERED as follows:

1.The Trustee’s Final Report is approved; and the paid claims are deemed paid in full.

No further action to collect said debts may be taken.

2.This case is dismissed;

3.All interested parties shall be notified of the dismissal herein; and

4.Upon providing notice of dismissal to all interested parties, Mont L. Martin shall be discharged as trustee.

Dated this ____ day of _______________, 2011.

BY THE COURT:

_______________________________

Circuit Court Judge

Exhibit 4.0

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The Chapter 128 form is governed by Wis. Stat. §128.21, which outlines the process for debt amortization in Wisconsin. |

| Purpose | This form is used by individuals residing in Milwaukee County who are seeking to organize and manage their debts through court assistance. |

| Filing Fee | A filing fee of $35 must be paid when submitting the petition to the Clerk of Circuit Court. |

| Components of the Form | The filing includes several documents: a Petition to Amortize Debts, an Affidavit of Debts, and a Proposed Order Appointing Trustee. |

| Notarization Requirement | Both the Petition and the Affidavit must be signed and notarized to ensure authenticity and compliance. |

| Notice to Creditors | A Notice is sent to all creditors informing them about the debtor's intention to create an amortization plan. |

| Payment Method | Debtors must indicate their preferred payment method: either payroll deduction or direct payments to the trustee. |

| Timeline for Court Order | The process requires a confirmation period of 25 days from filing before the court issues an Order. |

| Post-Order Action | Once the court issues the Order, the debtor must send copies to their employer and the trustee, along with a cover letter detailing payment instructions. |

Guidelines on Utilizing Chapter 128

After gathering the necessary documents and information related to your debts, proceed with filling out the Chapter 128 form. This process requires careful attention to detail, as incorrect or incomplete information could lead to delays. Ensure that each section is completed thoroughly. Below are the steps required to complete the form accurately.

-

Petition to Amortize Debts:

- Enter the debtor’s name and address.

- In paragraph 2, state the debtor’s employer.

- In paragraph 6, indicate whether you prefer payroll deduction or direct payments to the trustee.

-

Affidavit of Debts:

- List all creditors to be included in the plan.

- For each creditor, state the balance due and the corresponding account number.

- Calculate and provide the total of all debts.

- Make sure this section is notarized.

-

Proposed Order Appointing Trustee and Enjoining Creditors:

- Again, indicate whether you prefer payroll deduction or direct payments to the trustee.

- State the amount to be deducted from each paycheck or the monthly amount to be paid to the trustee. Use the following formula: Total debt x 1.07 (if payroll deduct) or 1.10 (for debtor-direct) ÷ 36 (monthly), 72 (semi-monthly), 78 (bi-weekly), or 156 (weekly).

- Make two copies of the following documents: the Petition to Amortize Debts, the Affidavit of Debts, and the Proposed Order Appointing Trustee and Enjoining Creditors.

- Prepare three stamped envelopes: two addressed to yourself and one blank for the Clerk's stamping of the Trustee’s information.

- File all papers with the Clerk of the Circuit Court, along with a $35 filing fee. Include the following:

- The original and two copies of the Petition to Amortize Debts.

- The original and two copies of the Affidavit of Debts.

- The original and three copies of the Proposed Order Appointing Trustee and Enjoining Creditors.

- Your three stamped envelopes.

- Prepare a cover letter to the Clerk of Court, providing clear instructions on the filing.

- Record a calendar reminder for 25 days from filing to confirm that the Order is signed.

- Once the court issues the Order, expect to receive copies that will be sent to both you and the trustee.

- Finally, send the Order to your employer along with a cover letter instructing on payment procedures.

What You Should Know About This Form

What is the Chapter 128 form used for?

The Chapter 128 form is used to file a debt amortization case in Milwaukee County under Wisconsin law. It helps individuals manage their debts by creating a plan to pay them off over time. This process involves the court and a trustee, allowing for relief from aggressive creditors.

What documents do I need to submit with the Chapter 128 form?

You will need to submit several documents when filing a Chapter 128 case. These include: 1. Petition to Amortize Debts 2. Affidavit of Debts 3. Proposed Order Appointing Trustee and Enjoining Creditors. Additionally, make two copies of each document, prepare three stamped envelopes, and include a cover letter with instructions for the Clerk of Court.

How do I complete the Petition to Amortize Debts?

When completing the Petition, include your name and address. Specify your employer in paragraph 2. In paragraph 6, decide if you want payroll deductions or direct payments to the trustee. It's essential to answer all sections accurately, as this information is crucial for your case.

What is the Affidavit of Debts and how do I complete it?

The Affidavit of Debts lists all your creditors and the amounts you owe them. You need to provide the balance due for each creditor and include your account numbers. This document must be notarized to confirm its authenticity. Make sure it accurately reflects all debts to be included in your amortization plan.

What happens after I file my documents with the Clerk of Court?

After filing your documents, you will need to wait for about 25 days. This time is used to confirm that an order is signed by the court. Once the order is issued, the court will send copies back to you and the trustee, at which point you must share the order with your employer or debtors with clear instructions for payments.

What are the costs associated with filing a Chapter 128 case?

The filing fee for a Chapter 128 case is $35. Additionally, you might incur other expenses for notarizing documents or sending out copies. Planning these costs in advance can help you manage your finances effectively during the process.

Can I represent myself in a Chapter 128 case?

Yes, individuals can represent themselves in a Chapter 128 case. However, because of the complexities involved, seeking assistance or guidance from legal professionals or a document preparer might make the process smoother and help ensure that all necessary details are accurately completed.

Common mistakes

Completing the Chapter 128 form can be challenging, and many individuals often encounter pitfalls that hinder their submission. One common mistake is failing to include complete information in the Petition to Amortize Debts. For instance, when noting the debtor's name and address, ensure that all required details are accurate and up-to-date. Inaccuracies or omissions can lead to delays in processing or even rejection of the petition.

Another frequent error occurs in the Affidavit of Debts. It’s crucial to list all creditors. Missing a creditor can complicate the debt management process, leaving a creditor out of the plan could lead to unexpected collection actions. Additionally, when mentioning the account balance for each creditor, include precise amounts. Vague figures can create confusion and might raise questions during court review.

Understanding the payment options is essential, yet many people overlook this in the Proposed Order Appointing Trustee and Enjoining Creditors. Choosing between payroll deduction or direct payments should be thoughtfully decided based on financial capabilities. Moreover, stating the correct amount that will be deducted from paychecks or paid directly to the trustee is vital. Errors in calculations can lead to insufficient payments and potential complications with creditors.

Submitting necessary documents can also prove problematic. Individuals sometimes forget to make two copies of all essential documents. This includes the petition and affidavits, which can drastically slow down the process if not addressed. Keeping well-organized records will aid in efficient submissions and streamline any follow-up communications.

When preparing envelopes, a common misstep is forgetting to include all the required stamped envelopes. Individuals should prepare two addressed to themselves and one to remain blank for the clerk. Neglecting this step could result in frustrating delays in communication from the court.

Filing requirements must not be ignored. Some may attempt to file without the correct fee. The $35 filing fee must accompany the forms to ensure processing. Skipping this can lead to paperwork being set aside, causing significant delays in addressing debts.

Writing a cover letter may feel unnecessary to some, but it can serve as a helpful guide for the court clerk. Individuals often underestimate the importance of clear instructions and relevant information about the submission. Failing to submit a cover letter can lead to confusion regarding the intent of the filing.

Another mistake is not tracking important deadlines. After filing, it’s recommended to check back with the court within 25 days to confirm that the order has been signed. Many people forget to do this, missing out on valuable updates or necessary next steps.

Lastly, once the court issues the Order, some individuals overlook sending it to their employer or the debtor with the required instructions. This step is crucial in ensuring that the payment process begins smoothly. Failing to couple the Order with proper communication can disrupt payment arrangements unnecessarily.

Documents used along the form

When filing a case for debt amortization under Chapter 128 in Milwaukee County, certain additional documents are often required alongside the primary Chapter 128 form. These forms help streamline the process and provide essential information to the court and involved parties. Here’s a closer look at some of these necessary documents:

- Affidavit of Debts: This document lists all creditors to be included in the plan, detailing the amount owed to each. It also states the total debt amount and must be notarized, verifying its authenticity.

- Order Appointing Trustee and Enjoining Creditors: This order designates a trustee who will oversee the debt repayment plan. It also prevents creditors from initiating collection actions, allowing time for the debtor to settle their debts under the agreed plan.

- Notice to Creditors: A formal notification that is sent to all listed creditors informing them of the filing. This ensures that creditors are aware of the proceedings and can respond accordingly.

- Proof of Claim: Creditors submit this document to verify their claim against the debtor. It outlines the details of the debt owed, allowing the trustee to assess and approve the claim for inclusion in the repayment plan.

- Plan of Amortization: This document presents the proposed repayment schedule, detailing how the debtor intends to pay back the debts over time. It specifies payment amounts, frequency, and duration of payments, offering a clear roadmap for both the debtor and creditors.

- Cover Letter to Clerk of Court: Accompanying the filed documents, this letter provides instructions on processing. It may include information on the filings made and requests for handling the documents by court staff.

Each of these documents plays a critical role in the debt amortization process. Properly completing and submitting them can significantly impact the proceedings and the debtor’s journey toward financial recovery.

Similar forms

- Bankruptcy Petition: Similar to the Chapter 128 form, a bankruptcy petition initiates a process for debt relief. Both documents require personal information about the debtor, a list of creditors, and a statement of debts.

- Affidavit of Support: This document provides a sworn statement of an individual’s financial status, much like the Affidavit of Debts in the Chapter 128 form. It serves to confirm the legitimacy of the financial information provided to courts or agencies.

- Debt Settlement Agreement: Both documents detail negotiations between debtors and creditors. A Debt Settlement Agreement outlines the terms to resolve debts while the Chapter 128 form establishes a repayment plan overseen by a trustee.

- Income Verification Form: This often requires the debtor to show proof of income, just as the Chapter 128 form includes employment details. Both documents help establish the debtor's financial capability to repay debts.

- Proof of Claim: This document allows creditors to assert a claim against a debtor's estate. Similarly, the Proof of Claim is involved in transparency about debts, which both forms emphasize.

- Repayment Agreement: Like the payment structure outlined in the Chapter 128 form, a Repayment Agreement specifies how a debtor will repay their obligations, detailing payment amounts and schedules.

- Trustee's Report: This report summarizes the trustee's findings and recommendations, akin to the Proposed Order Appointing Trustee. Both documents go through court for ratification and guidance on debt management.

- Notice of Default: A Notice of Default informs a borrower of overdue payments. It’s related to the Chapter 128 form, as both documents operate in the sphere of identifying and managing debts and payment plans.

Dos and Don'ts

When filling out the Chapter 128 form, consider the following guidelines to ensure a smooth process.

- Do: Include the full name and address of the debtor to avoid any confusion.

- Do: Ensure all creditors are listed accurately in the Affidavit of Debts.

- Do: Provide the correct balance due and account numbers for each creditor.

- Do: Have the affidavit notarized before submission.

- Do: Make two copies of each document: Petition to Amortize Debts, Affidavit of Debts, and the Proposed Order.

- Do: Include stamped envelopes addressed to yourself and a blank one for the trustee.

- Do: Pay the correct filing fee of $35 when submitting your paperwork.

It is equally important to avoid certain mistakes while completing this form.

- Don't: Forget to choose between payroll deduction or direct payment when proposing the order to the trustee.

- Don't: Leave any sections blank, especially those requesting specific amounts for payments.

- Don't: Use shorthand or abbreviations that may lead to misunderstandings.

- Don't: Submit the documents without confirming that all required signatures are in place.

- Don't: Overlook the importance of double-checking calculations for debt amounts.

- Don't: Neglect to include a cover letter with clear instructions for the Clerk of Court.

- Don't: Delay the filing; ensure that your papers are filed promptly within the designated time frame.

Misconceptions

Understanding the Chapter 128 form can be challenging due to several common misconceptions. Below are four of the most prevalent misunderstandings that people often have regarding this form:

- It is a bankruptcy filing. Many believe that a Chapter 128 form is equivalent to filing for bankruptcy. However, this form is specifically designed for debt amortization under Wisconsin law, allowing debtors to create a manageable payment plan for their debts without going through the bankruptcy process.

- Once the form is filed, creditors cannot collect debts. It’s important to clarify that while the Chapter 128 process does provide some protection from creditor actions, it does not completely eliminate the ability of creditors to collect. Creditors will be enjoined from further collection efforts in accordance with the plan approved by the court, but they retain the right to pursue collections on debts outside the plan.

- You can include any debt in the plan. Another misconception is that all types of debt are eligible for inclusion in a Chapter 128 plan. In reality, certain debts, such as student loans or specific tax obligations, may not be included in the amortization plan. Debtors should carefully review the eligibility of their debts.

- The process is straightforward and quick. While filling out a Chapter 128 form is relatively simple, the actual process can take time. After filing, debtors must wait for the court to review the case and issue an order. This can take several weeks and requires careful attention to details throughout the entire procedure.

Clarifying these misconceptions can significantly affect how individuals approaching their debts perceive the Chapter 128 process. Awareness and understanding pave the way for informed decisions and better outcomes.

Key takeaways

Filling out and using the Chapter 128 form is a critical process for anyone seeking to manage debt in Milwaukee County. Here are the key takeaways to keep in mind:

- Provide Complete Information: Ensure that the debtor's name, address, and employer are accurately included in the form. This information is crucial for the court's records.

- Accurately List Debts: The affidavit must detail all creditors, account numbers, and the total debt amount. Omitting details could delay the process.

- Select Payment Method: The form requires a decision between payroll deduction and direct payment to the trustee. This choice will impact how creditors are paid and should reflect the debtor's financial circumstances.

- Prepare Necessary Copies: Always make two copies of the Petition, Affidavit, and Proposed Order. This ensures that the court has the required documents and that the debtor retains a record.

- Follow Filing Procedures: After preparing the documents, file them with the Clerk of Circuit Court and pay the $35 fee. Include stamped envelopes, and allow time for processing to ensure that the order reaches the trustee efficiently.

These considerations will help streamline the process and improve the likelihood of successfully amortizing debt.

Browse Other Templates

Daily Tracker Template - Allocate time for breaks and leisure activities.

Chp 362 Form - The decision serves as a reference for future cases involving similar legal principles.

Designing Training Programs - Establish a specific date for the actual execution of training.