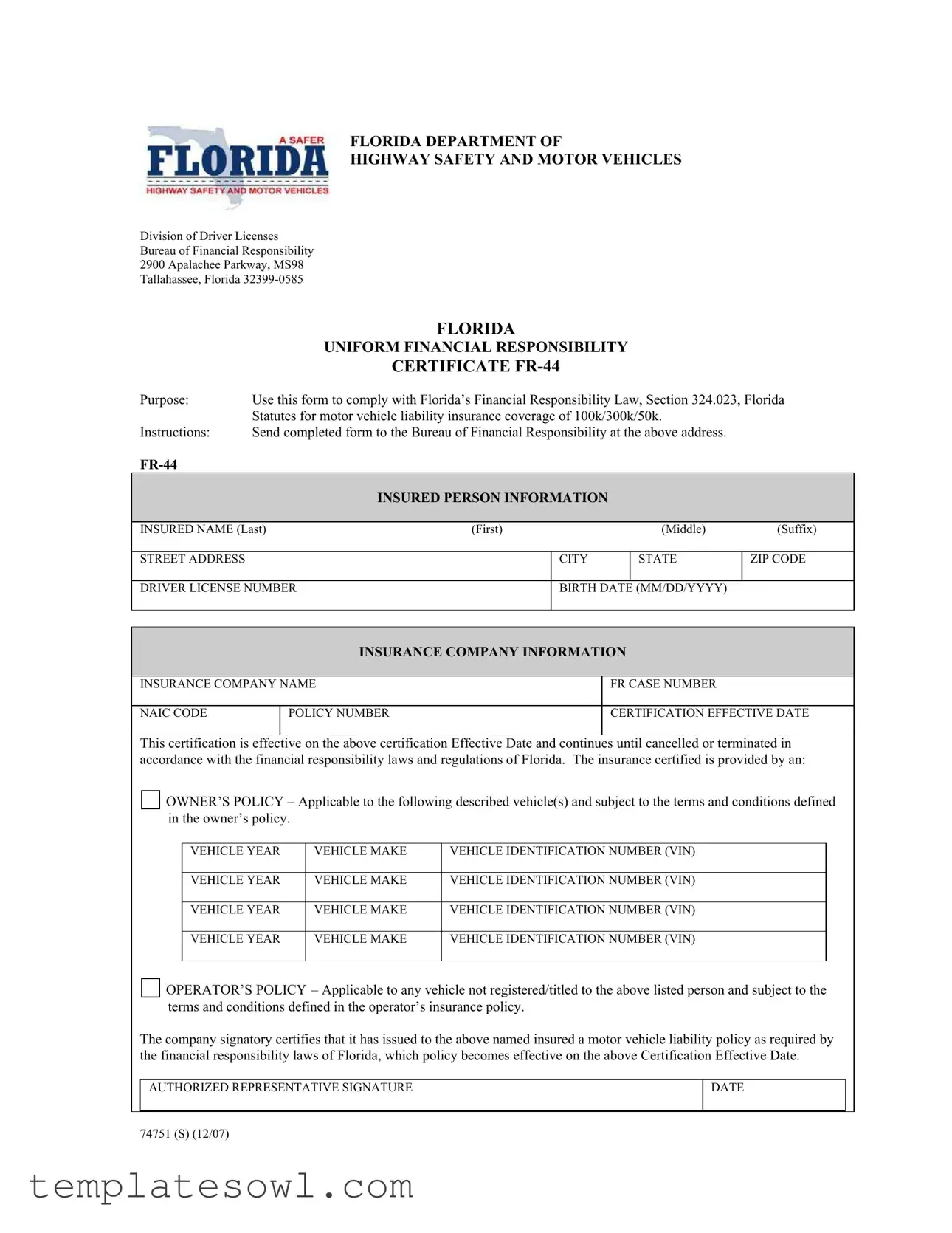

Fill Out Your Fr44 Florida Form

Navigating the world of auto insurance can often feel overwhelming, particularly in Florida, where specific requirements govern financial responsibility for vehicle owners and operators. The FR44 form plays a crucial role in this ecosystem, serving as a certificate designed to demonstrate compliance with Florida's Financial Responsibility Law. This law mandates minimum insurance coverage levels of $100,000 for bodily injury per person, $300,000 for bodily injury per accident, and $50,000 for property damage. By completing this form, individuals and insurance companies confirm that adequate coverage is in place, either through an owner's policy directly tied to the vehicle in question or through an operator's policy that extends to vehicles not registered in the name of the insured. The form requires detailed information, including the insured person's name, their driver's license number, and specifics about the insurance coverage and associated vehicle(s). Additionally, the certified insurance remains effective until it is officially cancelled or terminated, ensuring continuous protection under Florida law. Completing and submitting the FR44 is not merely a bureaucratic step; it is an essential process that provides peace of mind and legal assurance to drivers in the state.

Fr44 Florida Example

FLORIDA DEPARTMENT OF

HIGHWAY SAFETY AND MOTOR VEHICLES

Division of Driver Licenses

Bureau of Financial Responsibility

2900 Apalachee Parkway, MS98

Tallahassee, Florida

|

|

|

FLORIDA |

|

|

|

|

||

|

|

UNIFORM FINANCIAL RESPONSIBILITY |

|

|

|||||

|

|

|

CERTIFICATE |

|

|

|

|

||

Purpose: |

Use this form to comply with Florida’s Financial Responsibility Law, Section 324.023, Florida |

|

|||||||

|

Statutes for motor vehicle liability insurance coverage of 100k/300k/50k. |

|

|

||||||

Instructions: |

Send completed form to the Bureau of Financial Responsibility at the above address. |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INSURED PERSON INFORMATION |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

INSURED NAME (Last) |

(First) |

|

(Middle) |

(Suffix) |

|

||||

|

|

|

|

|

|

|

|

|

|

STREET ADDRESS |

|

|

|

CITY |

|

STATE |

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

||

DRIVER LICENSE NUMBER |

|

BIRTH DATE (MM/DD/YYYY) |

|

|

|||||

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

||||

|

|

INSURANCE COMPANY INFORMATION |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

INSURANCE COMPANY NAME |

|

|

|

FR CASE NUMBER |

|

|

|||

|

|

|

|

|

|

|

|

||

NAIC CODE |

|

POLICY NUMBER |

|

|

|

CERTIFICATION EFFECTIVE DATE |

|

||

|

|

|

|

|

|

|

|

|

|

This certification is effective on the above certification Effective Date and continues until cancelled or terminated in accordance with the financial responsibility laws and regulations of Florida. The insurance certified is provided by an:

OWNER’S POLICY – Applicable to the following described vehicle(s) and subject to the terms and conditions defined in the owner’s policy.

VEHICLE YEAR |

VEHICLE MAKE |

VEHICLE IDENTIFICATION NUMBER (VIN) |

|

|

|

VEHICLE YEAR |

VEHICLE MAKE |

VEHICLE IDENTIFICATION NUMBER (VIN) |

|

|

|

VEHICLE YEAR |

VEHICLE MAKE |

VEHICLE IDENTIFICATION NUMBER (VIN) |

|

|

|

VEHICLE YEAR |

VEHICLE MAKE |

VEHICLE IDENTIFICATION NUMBER (VIN) |

|

|

|

OPERATOR’S POLICY – Applicable to any vehicle not registered/titled to the above listed person and subject to the terms and conditions defined in the operator’s insurance policy.

The company signatory certifies that it has issued to the above named insured a motor vehicle liability policy as required by the financial responsibility laws of Florida, which policy becomes effective on the above Certification Effective Date.

|

AUTHORIZED REPRESENTATIVE SIGNATURE |

DATE |

|

|

|

|

|

74751 (S) (12/07)

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The FR44 form is required to comply with Florida’s Financial Responsibility Law, specifically Section 324.023 of the Florida Statutes, which mandates certain minimum liability insurance coverage for motor vehicles. |

| Coverage Limits | This form certifies motor vehicle liability insurance coverage of at least $100,000 for bodily injury per person, $300,000 per accident, and $50,000 for property damage. |

| Who Must File | Typically, individuals required to submit the FR44 include those involved in severe traffic offenses or certain accidents, where proof of higher liability coverage is necessary. |

| Submission Guidelines | Completed forms must be sent to the Bureau of Financial Responsibility at the address provided by the Florida Department of Highway Safety and Motor Vehicles. |

| Policy Type | The FR44 can certify either an owner’s policy, which applies to specific vehicles, or an operator’s policy, which covers any vehicle not registered in the name of the insured individual. |

Guidelines on Utilizing Fr44 Florida

After you gather the necessary information and documents, you can begin filling out the FR44 form. This form is crucial for demonstrating financial responsibility regarding motor vehicle liability insurance in Florida. Follow these steps for accurate completion.

- Enter the insured person's full name in the appropriate fields: Last name, First name, Middle name, and Suffix.

- Provide the insured person's street address, city, state, and ZIP code.

- Input the insured person's driver license number.

- Fill in the birth date in the format MM/DD/YYYY.

Next, you will supply information about the insurance company.

- Write down the insurance company’s name.

- Fill in the FR case number.

- Include the NAIC code.

- Input the policy number assigned by the insurance company.

- State the certification effective date.

Now, you need to specify the type of policy being certified.

- Select either "Owner's Policy" or "Operator's Policy" based on your situation.

- If selecting "Owner's Policy," list the vehicles involved by entering the year, make, and VIN for each vehicle.

- If selecting "Operator's Policy," ensure that this applies to vehicles not registered to the insured person.

Finally, complete the form by certifying the information.

- The authorized representative of the insurance company should sign the form.

- Enter the date of the signature.

Once the form is completed, send it to the Bureau of Financial Responsibility at the address provided on the form.

What You Should Know About This Form

What is the FR44 form in Florida?

The FR44 form is a financial responsibility certificate required by Florida law. It demonstrates that a driver has the necessary motor vehicle liability insurance coverage. Specifically, this coverage must meet the state's minimum limits of $100,000 for bodily injury per person, $300,000 for total bodily injury, and $50,000 for property damage. The form is typically needed after certain driving violations, such as DUI offenses, to reinstate driving privileges.

Who needs to file an FR44 form?

How do I complete the FR44 form?

How do I submit the FR44 form?

How long is the FR44 form valid?

What happens if I fail to file an FR44 form?

Can I obtain an FR44 form online?

Where can I get help if I have questions about the FR44 form?

Common mistakes

When completing the FR44 Florida form, it’s essential to be meticulous to avoid common errors that can lead to complications. One frequent mistake is leaving out required personal information. Every section needs to be filled out correctly, including the insured’s name, address, and driver license number. Omitting any of this information can result in delays or rejection of the form.

Another error is providing incorrect vehicle information. Ensure that the vehicle identification number (VIN), make, and year match those on the vehicle's title and registration. Inaccuracies here can not only slow down the processing but also cause issues in proving insurance compliance mandated by Florida law.

A third common mistake involves mishandling the insurance policy details. Failing to include the correct policy number or the effective date can create significant problems. It’s also important to ensure that the insurance company’s name and information are precisely entered, as any discrepancies can lead to complications in your financial responsibility certificate.

Lastly, neglecting to sign the form is a mistake that can be easily avoided. The authorized representative signature is crucial. Without this signature, the form will not be considered valid, forcing you to resubmit everything, further delaying compliance. Double-checking each part of the form before submission can save time and frustration.

Documents used along the form

When you are navigating the requirements surrounding the FR44 form in Florida, it helps to understand a few related documents. Each of these forms plays a crucial role in ensuring compliance with state regulations regarding vehicle insurance. Here’s a brief overview of some commonly used documents:

- FR-19 Form: This form is a certification of proof of insurance for drivers seeking reinstatement of their licenses after a suspension due to noncompliance with insurance laws. It confirms that the driver now has the necessary insurance coverage.

- FR-57 Form: Known as the “Notice of Suspension,” the FR-57 informs a driver that their license has been suspended and outlines the reasons for the suspension, often relating to financial responsibility issues such as lacking adequate insurance.

- SR-22 Form: This is a certificate of financial responsibility that proves that a driver has purchased a specific amount of liability insurance. It is often required after certain violations, and it must be filed with the state for a designated period.

- Application for a Driver’s License: When you need to obtain or renew a driver's license, this application is necessary. Completing this form accurately helps you make sure all information is in order according to state requirements.

- License Reinstatement Application: If your license has been suspended or revoked, this document is essential for initiating the reinstatement process. It usually includes proof of insurance, payment of fees, and acknowledgment of any terms set forth by the state.

- Vehicle Registration Application: To legally drive a vehicle, you must register it with the state. This application captures key details about the vehicle and its owner, which is critical for ensuring that all insurance and liability requirements are met.

- Proof of Insurance Card: This card serves as immediate proof of insurance coverage when requested by law enforcement. It includes important information about your insurance policy and the coverage limits.

- Financial Responsibility Law Education Materials: Often distributed by the Florida Department of Highway Safety, these materials provide valuable insights and guidelines on the financial responsibility laws to help drivers stay informed and compliant.

- Insurance Policy Declaration Page: This document summarizes your auto insurance policy, detailing the coverage amounts, policy effective dates, and the vehicles covered. It is often used in conjunction with other forms to demonstrate compliance.

Having these documents readily available can simplify the compliance process and provide peace of mind. Each one of these forms serves a distinct purpose and is integral to ensuring that you meet Florida's financial responsibility requirements. Understanding them is a step towards responsible driving.

Similar forms

-

SR-22 Certificate: Similar to the FR-44, the SR-22 is a form that proves a driver has the minimum required insurance coverage. It is commonly mandated after violations such as DUI offenses, emphasizing financial responsibility in driving.

-

Proof of Insurance Card: This document serves as evidence of active insurance coverage. Just like the FR-44, it is necessary to show that a driver meets the state’s insurance requirements, often needed during traffic stops.

-

Vehicle Registration Document: This document includes important details about the vehicle and its owner. While the FR-44 focuses on insurance, both ensure that a vehicle is legally operable and compliant with state laws.

-

Financial Responsibility Certificate (Form FR-19): Required for certain circumstances, this certificate demonstrates compliance with the financial responsibility law similar to the FR-44. It indicates that a driver can cover liability claims.

-

Bodily Injury Liability Insurance Policy: This insurance protects against claims for injuries caused to others in accidents. The financial coverage amounts specified in an FR-44 are akin to the limits set within such policies.

-

Uninsured Motorist Coverage Policy: Just as the FR-44 requires proof of insurance, this coverage protects against damages caused by uninsured drivers, enhancing the principle of financial responsibility.

-

Insurance Declaration Page: This document outlines the specifics of an insurance policy, including coverage limits. Like the FR-44, it unequivocally states the financial commitments made by the insurer.

-

Insurance Renewal Notice: This notice reminds policyholders of upcoming expirations and reestablishes proof of continuing coverage, ensuring that they remain compliant—similar to maintaining a valid FR-44.

-

Accident Report Form: In the event of a crash, this form documents the accident details and insurance information. This is interconnected with the FR-44, as it often needs to be filed to ensure financial responsibility after an incident.

-

Liability Waiver Form: While primarily a release from liability for accidents or damages, this form functions similarly by asserting that individuals understand their financial responsibilities in certain situations.

Dos and Don'ts

Filling out the FR44 form for Florida can seem overwhelming, but following a few guidelines can ease the process. Here’s a list of things to do and avoid while completing the form.

- Ensure accuracy: Double-check all names, addresses, and dates for correctness.

- Include complete insurance information: Fill in the insurance company name, policy number, and effective date clearly.

- Use legible handwriting: If filling out the form by hand, write clearly to avoid confusion.

- Keep a copy: Save a copy of the completed form for your records before sending it off.

- Submit on time: Send the form to the Bureau of Financial Responsibility as soon as it is complete.

- Don’t leave blanks: Fill out every section to prevent delays in processing.

- Avoid using abbreviations: Use full names of places or insurance companies, as abbreviations may cause confusion.

- Don’t submit without a signature: Ensure the authorized representative’s signature is included, along with the date.

- Steer clear of conflicting information: Make sure that all information provided matches the details on your insurance policy.

Misconceptions

Understanding the FR-44 form in Florida can be challenging. Here are seven common misconceptions surrounding this important document:

- The FR-44 is the same as the FR-19. The FR-44 and FR-19 are distinct forms. While both relate to financial responsibility, the FR-44 is specifically for DUI convictions and requires higher insurance coverage limits.

- Every driver in Florida needs an FR-44 form. Not true. The FR-44 is only required for drivers who have been convicted of certain offenses, such as DUI. Most drivers do not need this form.

- The FR-44 guarantees insurance approval. Receiving a form does not mean automatic approval of coverage. Drivers still need to secure an insurance policy that meets state requirements.

- Filing an FR-44 is optional for DUI offenses. This is a misconception. If convicted of DUI, Florida law mandates that the FR-44 be filed, making it a necessary step to regain driving privileges.

- The FR-44 form is a one-time requirement. The form must be maintained for a minimum period. Typically, it remains valid for three years, during which insurance must not lapse.

- Any insurance company can issue an FR-44. Only companies authorized to operate in Florida can provide an FR-44. Ensure your insurer is approved to avoid issues.

- You can submit the FR-44 form online. Currently, submissions must be made via mail to the Bureau of Financial Responsibility. It's important to send it to the correct address to ensure compliance.

Being informed about these misconceptions can help ensure that individuals follow the proper procedures and comply with Florida’s financial responsibility laws effectively.

Key takeaways

Here are key takeaways regarding the FR44 form in Florida:

- The FR44 form is essential for complying with Florida’s Financial Responsibility Law, which mandates specific motor vehicle liability insurance coverage.

- It requires **liability coverage** of $100,000 for bodily injury per person, $300,000 for total bodily injury per accident, and $50,000 for property damage.

- Complete the form accurately with personal information, including your name, address, and driver's license number, as well as details about your insurance company.

- The completed form should be sent to the Florida Bureau of Financial Responsibility at the provided address to ensure proper processing.

- This certification remains effective until cancelled, so it's important to monitor your insurance status and update the form as needed.

Browse Other Templates

8-5 Practice Law of Sines Answer Key - Exercise 16 asks for substitutes in the Law of Cosines for given triangle dimensions.

Who Should Get Tdap Vaccine - It is important for patients to provide accurate information about their employment status for billing purposes on the form.