Fill Out Your Fs 118A Form

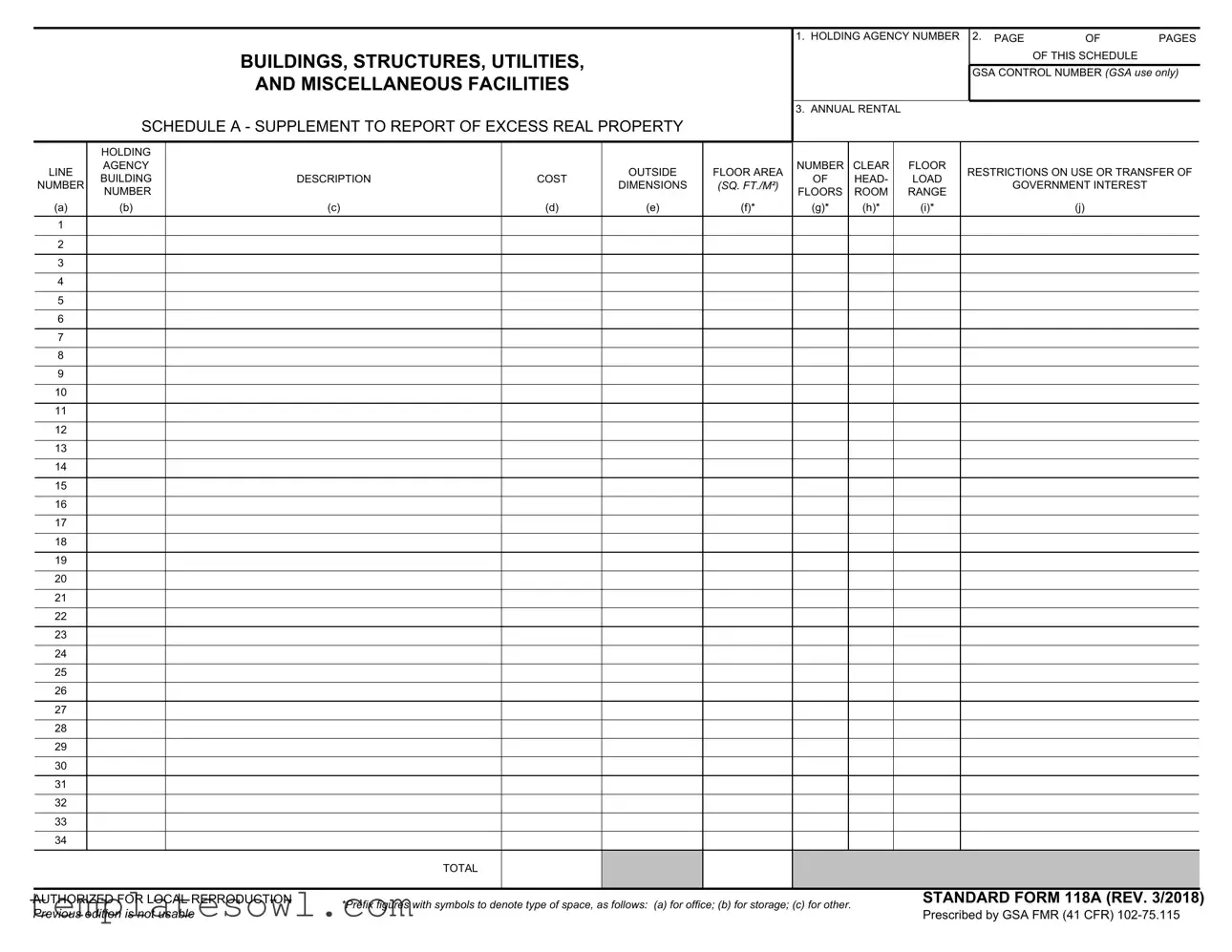

The FS 118A form serves a critical function in the management and reporting of excess real property by federal agencies. Specifically designed as a supplement to the Report of Excess Real Property, this form captures essential details about buildings, structures, utilities, and miscellaneous facilities. Users begin by entering information related to the holding agency number, control number, and page count, ensuring each submission is properly categorized and traceable. The form requires comprehensive data on the properties, including annual rental costs, dimensions, and the number of floors. Additionally, it addresses restrictions on the use or transfer of these buildings, making clear the limitations that may apply. Each property is categorized with specific codes indicating its use—such as office, storage, or other types. Importantly, the FS 118A facilitates standardized reporting practices, thereby enhancing transparency and accountability in the management of federal properties. This structure benefits not only the agencies involved but also the public by ensuring that all surplus properties are documented and managed appropriately.

Fs 118A Example

BUILDINGS, STRUCTURES, UTILITIES,

AND MISCELLANEOUS FACILITIES

SCHEDULE A - SUPPLEMENT TO REPORT OF EXCESS REAL PROPERTY

1. HOLDING AGENCY NUMBER 2. PAGE |

OF |

PAGES |

OF THIS SCHEDULE

GSA CONTROL NUMBER (GSA use only)

3. ANNUAL RENTAL

|

|

HOLDING |

|

|

|

|

|

|

|

|

|

|

|

|

|

LINE |

AGENCY |

|

|

|

|

OUTSIDE |

FLOOR AREA |

NUMBER |

|

CLEAR |

FLOOR |

RESTRICTIONS ON USE OR TRANSFER OF |

|

|

BUILDING |

|

DESCRIPTION |

|

COST |

OF |

|

HEAD- |

LOAD |

|||||

|

NUMBER |

|

|

DIMENSIONS |

(SQ. FT./M²) |

|

GOVERNMENT INTEREST |

|||||||

|

NUMBER |

|

|

|

|

FLOORS |

|

ROOM |

RANGE |

|||||

|

|

|

|

|

|

|

|

|

|

|

||||

|

(a) |

(b) |

|

(c) |

|

(d) |

(e) |

(f)* |

(g)* |

|

(h)* |

(i)* |

(j) |

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AUTHORIZED FOR LOCAL REPRODUCTION |

*Prefix figures with symbols to denote type of space, as follows: (a) for office; (b) for storage; (c) for other. |

|

STANDARD FORM 118A (REV. 3/2018) |

|

||||||||||

Previous edition is not usable |

|

|

|

|

|

|

|

|

Prescribed by GSA FMR (41 CFR) |

|||||

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | Fs 118A is titled "Buildings, Structures, Utilities, and Miscellaneous Facilities Schedule A - Supplement to Report of Excess Real Property." |

| Governing Authority | This form is prescribed by the General Services Administration (GSA) under Federal Management Regulation (41 CFR) 102-75.115. |

| Usage Purpose | The primary purpose of the Fs 118A form is to report excess real property assets for federal agencies. |

| Sections Included | The form includes important sections such as Holding Agency Number, Page of Pages, and GSA Control Number. |

| Cost Information | Cost details are required for each building or facility, contributing to accountability and financial management. |

| Space Types | Various types of spaces are denoted using specific prefixes, including office (a), storage (b), and other (c). |

| Dimensions Provided | Applicants must provide dimensions in square feet or square meters, ensuring clarity in the space being reported. |

| Clear Floor Restrictions | Restrictions on the use or transfer of buildings must be clearly reported on the form to ensure compliance. |

| Room Count | A detailed room range section is included, requiring a comprehensive count of rooms within the reported facilities. |

| Local Reproduction | The form is authorized for local reproduction, allowing agencies to maintain necessary copies for their records. |

Guidelines on Utilizing Fs 118A

Completing the FS 118A form involves several key steps to ensure that all necessary information is accurately provided. After filling out the form, it will need to be revised and submitted according to your agency's procedures.

- Obtain the form: Make sure you have the latest version of the FS 118A form. You can download it from the appropriate government website.

- Fill in the holding agency number: In the designated box at the top of the form, enter the holding agency number that corresponds to your agency.

- Indicate the page number: Write down the page number in the format "1 of X" where "X" refers to the total number of pages in this schedule.

- Provide the GSA control number: Leave this section blank unless specified otherwise by your agency, as it is intended for GSA use only.

- Complete the annual rental information: List the annual rental costs associated with the property.

- Fill in the holding agency outside floor area: Indicate the total square footage or square meters of the property being reported.

- Identify the clearing restrictions: If there are any restrictions on the use or transfer of the building, note them in the designated area.

- Provide a description of the building: Enter a clear and concise description of the building or structure.

- Input the cost details: Write down the necessary cost information in its respective columns, following the provided labels.

- Document room dimensions: For each room, fill in the dimensions in the appropriate columns, indicating whether the figures represent square feet or square meters.

- Indicate government interest: Enter the relevant government interest details, if applicable.

- List the number of floors: Provide the total number of floors in the building.

- Complete the room range: Fill in the room range as indicated, numbering them accordingly.

- Verify all entries: Review the entire form for accuracy and completeness before finalizing.

- Submit the form: Follow your agency’s procedures to ensure the form is submitted correctly to the respective authority.

What You Should Know About This Form

What is the purpose of the Fs 118A form?

The Fs 118A form, officially known as the Supplement to Report of Excess Real Property, is used to provide detailed information about buildings, structures, utilities, and miscellaneous facilities that the federal government considers excess. By filling out this form, the holding agency can report on various aspects of the property, which assists in managing and ultimately disposing of properties no longer needed.

Who is required to fill out the Fs 118A form?

This form must be completed by federal agencies that hold excess real property. When an agency determines that a property is no longer required for its operations, it is their responsibility to accurately fill out this form. This helps ensure that all pertinent details are recorded and that the property can be managed appropriately.

What kind of information is collected on the Fs 118A form?

The form collects essential information such as the holding agency number, the dimensions of the space in both square feet and square meters, and the description of the property. Additionally, there are fields to indicate the annual rental cost, floor area, government interest number, and any restrictions on use or transfer. Each type of space—office, storage, or other—must also be clearly marked.

How is the information from the Fs 118A form used?

The data collected from the Fs 118A form is utilized by the General Services Administration (GSA) to assess the status of federal properties. This information plays a crucial role in determining how these properties can be disposed of, transferred, or rehabilitated. It ensures that the federal government complies with regulations regarding excess properties, facilitating efficient asset management.

What does it mean if a property has restrictions on use or transfer?

If a property listed on the Fs 118A form has restrictions noted, it indicates limitations on how that property can be utilized or transferred to another agency or entity. This could be due to various reasons, including legal or environmental concerns. Understanding these restrictions is vital for any future planning or actions related to that property.

Can the Fs 118A form be reproduced for local use?

The Fs 118A form has a note that it is authorized for local reproduction, meaning that agencies can print and use the form as needed, as long as they adhere to the prescribed format. This flexibility allows agencies to efficiently manage their reporting processes without waiting for official supplies.

Common mistakes

Filling out the FS 118A form can seem straightforward, but many individuals encounter pitfalls that can complicate the process. One common mistake is failing to provide complete information for all requested fields. Each entry matters, and omitting even small details can lead to delays or rejections. It’s important to ensure that every section of the form is thoroughly filled out to avoid issues down the line.

Another frequent error involves misinterpreting the definitions of terms used in the form. For example, the requirements for documenting the dimensions of each facility can lead to confusion. Some may inadvertently enter incorrect square footage, which can misrepresent the property in question. Always double-check how the dimensions should be recorded according to the guidelines provided in the form.

Not using the proper symbols to denote the type of space being reported is an additional mistake. The FS 118A form requires specific prefixes for different space types—office, storage, and other. Failure to include these symbols can lead to misclassification and a loss of clarity in understanding the type of facility being reported.

Precision is key, and many people miscalculate the annual rental values. These figures must accurately represent the costs associated with the properties reported. Inaccuracies here can lead to significant financial discrepancies. Before submitting, it is vital to ensure that calculations are correct and well-documented.

Forgetting to check for any restrictions on the use or transfer of buildings is another mistake that can have lasting implications. Understanding these restrictions is crucial, as they can affect future plans for the property. Always review any pertinent regulations or guidelines that might influence the usability of the buildings.

Many individuals also overlook the importance of maintaining consistency throughout the form. For instance, if one section states a specific cost or measurement, it should align with other related sections. Inconsistent information can raise flags during processing and lead to further scrutiny.

Not providing adequate descriptions of buildings and structures can hinder an accurate assessment of the properties listed. Detailed descriptions help officials understand the characteristics of each facility, facilitating accurate evaluations. Descriptions should be thorough yet concise, giving necessary information without overwhelming details.

Lastly, failing to follow up after submission is a common error. Once the FS 118A form is submitted, it’s important to confirm its receipt and check on any potential issues. Keeping lines of communication open with the relevant agency can help ensure the process runs as smoothly as possible.

Documents used along the form

When managing public properties or government-held real estate, filing the Fs 118A form is just one step in the process. Several other forms and documents accompany it, helping to provide a full picture of the property’s status, restrictions, and intended usage. Below is a list of essential documents that often work in conjunction with the Fs 118A form.

- Standard Form 118: This foundational document outlines the necessary details about the excess real property being reported, serving as the primary form for communicating key characteristics and status to the General Services Administration (GSA).

- Form GSA 3606: Primarily used for reporting the reassignment of property, this form lays out specifications regarding the transfer or reutilization of a building or structure once it is determined as excess.

- Form GSA 1334: This document provides vital information on property inventory and allows agencies to keep track of their holdings effectively. The GSA 1334 complements the Fs 118A by ensuring details about each property are properly recorded and accounted for.

- Form GSA 122: Focused on real property disposal, this form indicates the intent to dispose of the property. It outlines the necessary steps and declares the conditions under which the property can be sold or transferred.

- Form 29-CFR 963.7: This form concerns the environmental review process. It ensures compliance with federal environmental regulations by assessing potential impacts before the property’s transfer or disposal.

- Standard Form 254: Required for potential contractors, this form collects information about the qualifications and experience for any contractor looking to engage with the GSA on real estate projects, including renovations of the properties on the Fs 118A list.

- Form GSA 1333: Documenting how property evaluations are conducted, this form acts as a record of assessments determining the value and usability of the buildings or structures in question.

- Form SF 26: Also known as the Award/Contract form, this document can be necessary when property contracts related to the maintenance, use, or transfer of government buildings are sought. It establishes the foundational agreement between parties involved.

Understanding these forms and documents is pivotal for anyone involved in managing real properties under government oversight. Clarity around these requirements can streamline the process of reporting, transferring, or disposing of excess properties, ensuring adherence to regulations while fostering effective management of public assets.

Similar forms

- Form 118 - This is the basic version used for reporting excess real properties. It includes many of the same data fields such as agency number and property description but is less detailed than the 118A.

- Form 149 - This form focuses on the transfer of excess property. It shares similarities in that both require property descriptions, agency details, and transfer conditions, although Form 149 is specifically for property disposition.

- Form 120 - This form is used for property management and includes annual rental information. It has overlapping items related to holding agency details and property dimensions, providing essential metrics for property management.

- Standard Form 277 - Primarily used for reporting real estate transactions, this form includes similarities in financial reporting of properties, including costs and dimensions, which are pivotal for accounting purposes.

- Standard Form 118C - This is a derivative of the 118 series, focusing on capital improvements to properties. It overlaps with the 118A in reporting agency details and property specifications but centers more on improvements rather than capability.

- Standard Form 2510 - Often required for environmental assessments of properties, this form includes property usage limitations, similar to the restrictions in the 118A. Both documents address how properties may be utilized or transferred.

- Form GSA 1004 - This form involves real property transactions and contains aspects like annual rental costs and property boundaries, similar to the financial and structural details found in Form 118A.

Dos and Don'ts

When completing the Fs 118A form, it's important to follow specific guidelines to ensure your submission is accurate and complete. Below is a list of things you should and shouldn't do:

- Do double-check the details filled in for the Holding Agency Number to ensure accuracy.

- Do use clear measurements when documenting the dimensions of buildings or areas. This involves specifying square footage correctly.

- Do make sure all applicable fields in the form are filled out completely. Leaving sections blank may delay processing.

- Do provide clear descriptions of the buildings and structures, noting any restrictions on their use or transfer.

- Don't forget to prefix figures with the correct symbols; failing to do so can cause confusion about the type of space being reported.

- Don't submit the form without reviewing it for typos or errors — a quick review can save time in the long run.

- Don't ignore the guidelines for local reproduction — ensure you follow them to avoid potential compliance issues.

Misconceptions

Misconceptions surrounding the Fs 118A form can lead to confusion about its purpose and requirements. Here are six common misconceptions, along with clarifications for each one.

- The Fs 118A form is only for federal agencies. Many believe that only federal entities need to complete this form. However, state and local agencies involved in real property transactions may also be required to use it, depending on their interactions with federal properties.

- This form is optional. Some assume that completing the Fs 118A is optional. In reality, it is a necessary component for reporting excess real property, and failure to complete it could hinder real property transactions and compliance.

- The form only covers buildings. Another misconception is that the Fs 118A exclusively pertains to buildings. In truth, it also includes structures, utilities, and miscellaneous facilities, giving a broader scope to the reporting process.

- It requires extensive technical knowledge. Many people think that filling out the Fs 118A demands advanced technical skills or knowledge. While some familiarity with real property terms can be helpful, the form is designed to be user-friendly and accessible to individuals without technical expertise.

- Information on the form is not confidential. There is a belief that the information submitted on the Fs 118A is public and easily accessible. However, certain details may be classified as sensitive and subject to restrictions on disclosure to protect privacy and sensitive data.

- The form is the same for every reporting period. Some assume that the Fs 118A does not change from year to year. In fact, the form may be revised periodically to reflect updated regulatory requirements or changes in the reporting process, thus requiring users to confirm they are using the latest version.

Key takeaways

Using the FS 118A form is an important process for managing excess real property. Here are some key takeaways to consider while filling it out and utilizing it effectively:

- Understand the Purpose: This form is designed specifically for reporting excess real property, including buildings, structures, and utilities.

- Identify Your Agency: You must enter your holding agency number clearly. This helps the General Services Administration (GSA) track submissions accurately.

- Report All Relevant Details: Provide comprehensive information, such as the floor area, dimensions, and the number of floors. Accurate details contribute to effective reporting.

- Use Clear Formatting: Follow the prescribed format for reporting various types of spaces by using the correct symbols (e.g., (a) for office space, (b) for storage).

- Document Restrictions: Be sure to note any restrictions on the use or transfer of the property, as this information is crucial for compliance.

- Review for completeness: Double-check that all sections of the form are filled out completely before submission. Incomplete forms may cause delays.

- Keep a Copy: After submitting the FS 118A form, retain a copy for your records. This ensures you have access to the information for future reference.

- Be Mindful of Deadlines: Timeliness is important. Familiarize yourself with any deadlines related to submitting the FS 118A form to avoid penalties or missed opportunities.

By following these key points, you can navigate the FS 118A form with greater confidence and efficiency.

Browse Other Templates

Virginia State Application - Future educational programs and expected completion dates can be noted in this section.

Florida Divorce Financial Affidavit - Complete the form in black ink to maintain clarity and officialness in your submission.

Massmutual Retirement Login - The option to cancel specific riders is available, contingent upon the owner’s requests documented within the form.