Fill Out Your Fs 6T Form

The FS-6T form plays a vital role in the process of obtaining a certificate of title for vehicles in New York State. This receipt is issued when an individual applies for a title at any Motor Vehicle office, and it is essential before one can file for apportioned registration under the International Registration Program. To successfully obtain this receipt, applicants must provide several documents. These include a completed MV-82 or MV-82TON form, proof of ownership, sales tax clearance, identification, and a title processing fee. Different scenarios surround proof of ownership and sales tax clearance, depending on whether the vehicle was purchased from a private seller, a New York dealer, or an out-of-state dealer. After submitting the necessary paperwork and fees, the representative will process the application and provide the FS-6T receipt. This receipt confirms the application for a title, ensuring applicants can proceed with their vehicle registration needs.

Fs 6T Example

INSTRUCTIONS FOR OBTAINING A RECEIPT (FORM

FOR A CERTIFICATE OF TITLE OR SALES TAX CLEARANCE

International Registration Bureau

PO Box 2850 - ESP

Albany NY

Phone: (518)

Form

You must bring all of the following documents to a Motor Vehicles office when you apply for your certificate of title:

1.A completed form

The form must be completed and signed by the owner of the vehicle, or by a corporate officer or someone with Power of Attorney.

2.Proof of Ownership for the Vehicle

A)If purchased from an individual, you need:

n a bill of sale from the seller to the new owner

n for 1973 & newer vehicles, the previous owner's certificate of title properly transferred on the back to the new owner, with the odometer information completed.

B)If purchased from a registered NYS dealer:

na Certificate of Sale (form

nfor new vehicles, a Manufacturer's Certificate of Origin properly transferred to the new owner

OR

nfor used vehicles, the previous owner's certificate of title properly transferred to the dealer.

C)If purchased from an

nan original bill of sale from the dealer to the new owner.

nfor new vehicles, a Manufacturer’s Certificate of Origin properly transferred to the new owner.

nan odometer statement for vehicles less than 10 years old.

nfor used vehicles, the previous owner's certificate of title, or the appropriate proof of ownership, properly transferred to the dealer.

3.Sales Tax Clearance (Required for an

Proof of Sales Tax Clearance:

1.If the vehicle is bought from a New York dealer, provide a Retail Certificate of Sale

2.The original bill of sale and the front of form

3.If you claim an exemption from sales tax, complete form

4.If partial sales tax was paid to another state, complete form

5.If the vehicle is leased, a copy of the lease agreement is required. Additional tax may be due when the vehicle is registered.

*You can get DTF sales tax forms from any Motor Vehicles office, from the New York State Department of Taxation and Finance or from DMV's web site.

dmv.ny.gov |

PAGE 1 OF 2 |

4.Proof of Identity or Corporation

Please refer to “Proofs of Identity for Registration and Title” (form

5.A $50 Title Processing Fee

When you apply for a certificate of title, tell the Motor Vehicles Representative who assists you that you want to “apply only for a title because you will have an IRP apportioned registration”.

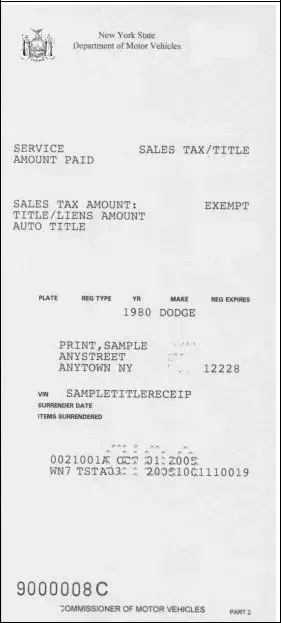

Upon receipt of the necessary documents and forms, the Motor Vehicles Representative will process the title transaction and give you form

$50.00

$50.00

If the receipt does not specify “Title - $50.00” as shown above, it is incorrect and should be returned to the Motor Vehicles Representative who assisted you, for correction.

If you or a staff member in the Motor Vehicles office have any questions regarding this matter, please contact IRB at (518)

PAGE 2 OF 2 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | Form FS-6T is a receipt issued after applying for a New York State certificate of title. |

| Application Requirement | Before filing for apportioned registration in the International Registration Program, you must obtain FS-6T at a Motor Vehicles office. |

| Necessary Documents | You need to present a completed form MV-82 or MV-82TON, proof of vehicle ownership, sales tax clearance, proof of identity, and a $50 title processing fee. |

| Sales Tax Clearance | Proof of sales tax payment is required for both New York State and out-of-state titles, including specific forms and receipts. |

| Processing Fee | A $50 title processing fee must be paid at the time of application for the title. |

| Contact Information | For questions regarding this form, you can call the International Registration Bureau at (518) 473-5834. |

Guidelines on Utilizing Fs 6T

Before you fill out the FS-6T form, gather all important documents. This includes proof of ownership and identity, as well as any necessary sales tax clearance forms. The correct completion of the FS-6T form is essential for receiving your title receipt, which is needed for further vehicle registration processes.

- Collect the required documents:

- Completed form MV-82 or MV-82TON signed by the vehicle owner or authorized person.

- Proof of Ownership, depending on where the vehicle was purchased (from an individual, NYS dealer, or out-of-state dealer).

- Sales Tax Clearance documentation.

- Proof of Identity or corporate proof based on form ID-82 and MV-82.1.

- Visit a Motor Vehicles office. Take all collected documents with you.

- Inform the Motor Vehicles Representative that you are applying for a title in order to obtain an IRP apportioned registration.

- Submit your documents to the Motor Vehicles Representative for processing.

- Receive form FS-6T, ensuring it includes “Title - $50.00” on the receipt.

- If the receipt is incorrect, return it immediately for correction.

After you have obtained the FS-6T form, you can proceed with your application for apportioned registration in the International Registration Program.

What You Should Know About This Form

What is Form FS-6T?

Form FS-6T is a receipt issued by the New York State Motor Vehicles Office. It provides confirmation that you have applied for a certificate of title for a vehicle. Before you can file an application for apportioned registration under the International Registration Program, you need to obtain this receipt.

What documents do I need to bring to obtain Form FS-6T?

When applying for Form FS-6T, you must bring several key documents. First, you need a completed MV-82 (Vehicle Registration/Title Application) or MV-82TON (Application for Title). Second, proof of ownership of the vehicle is essential; this may include a bill of sale, a properly transferred title, or a Certificate of Sale, depending on where you purchased the vehicle. Additionally, you need proof of sales tax clearance, proof of identity, and the $50 title processing fee.

How do I prove ownership when purchasing from an individual?

If you bought the vehicle from an individual, you need a bill of sale as well as the previous owner’s certificate of title, which should be properly transferred to your name. For vehicles from 1973 or newer, it’s also important to provide the odometer information on the title.

What if I purchased the vehicle from a New York dealer?

When purchasing from a registered New York State dealer, you’ll need to provide a Certificate of Sale (form MV-50) that shows the transfer from the dealer to you. If it’s a new vehicle, the Manufacturer’s Certificate of Origin must also be transferred, while for used vehicles, ensure the previous owner’s certificate of title is properly transferred to the dealer first.

Is a sales tax clearance required for all vehicles?

Yes, sales tax clearance is required regardless of whether the vehicle has a New York State title or an out-of-state title. If the vehicle was bought from a New York dealer, you’ll need the Retail Certificate of Sale (MV-50). If it was purchased from an out-of-state dealer, the original bill of sale showing that sales tax was collected is mandatory.

What should I do if my receipt for Form FS-6T is incorrect?

If your receipt does not specify “Title - $50.00,” it is considered incorrect. You should immediately return it to the Motor Vehicles Representative who assisted you for correction to ensure you have the proper documentation for your title application.

What type of proof of identity is required to apply for Form FS-6T?

To obtain Form FS-6T, you will need to provide acceptable proof of identity. This can range from a driver's license to various forms of identification laid out in the “Proofs of Identity for Registration and Title” document (form ID-82). If you are applying on behalf of a corporation, proofs of incorporation will also be necessary.

How much is the processing fee for the certificate of title?

The processing fee to apply for a certificate of title is $50. It's critical to inform the Motor Vehicles Representative that you are applying solely for a title, particularly if you plan to register the vehicle for IRP apportioned registration later.

Common mistakes

Filling out the FS-6T form can seem straightforward, yet many make avoidable mistakes. One common error is failing to provide all required documents. To obtain a receipt, you must submit several key items like form MV-82 or MV-82TON, proof of ownership, and proof of identity. Missing even one document can stall the process.

Another mistake is not completing the form MV-82 accurately. The owner of the vehicle, or someone with authority, must sign the form. If this signature is missing or incorrect, the application for the FS-6T will not be processed, resulting in delays.

People often overlook the need for a clear proof of sales tax clearance. If you purchased the vehicle from a New York dealer, a Retail Certificate of Sale (MV-50) is necessary. Forgetting this document can lead to complications, especially for out-of-state purchases where a detailed bill of sale is required to prove that sales tax was collected.

Additionally, some applicants do not pay the title processing fee. The FS-6T cannot be issued without the necessary $50 fee. Ensure that this amount is correct when paying, as discrepancies will require further action.

To complicate matters further, mistakes can occur with ownership details. Missing or incorrectly filled details on the previous owner's certificate of title can create issues when trying to establish proof of ownership. Double-checking that all names and details are accurately reflected is essential.

Another common error involves the understanding of exemptions. If claiming exemption from sales tax, users must complete form DTF-803. Many fail to do this, which can result in extra taxes or fees being assessed.

Sometimes, individuals apply for an FS-6T without understanding that they need to indicate that they will seek IRP apportioned registration. If this intent is not communicated, the Motor Vehicles representative may not process the request correctly, leading to delays or rejections.

Lastly, forgetting to check the final receipt is a frequent oversight. If the receipt does not specify “Title - $50.00,” it is incorrect. Returning it for correction is essential, otherwise, the application process could face unnecessary complications.

Documents used along the form

The FS-6T form is an essential document for individuals seeking a certificate of title in New York State. There are several other forms and documents that are required or recommended to accompany the FS-6T form during the title application process. Each of these documents serves a specific purpose, ensuring that all necessary information is provided for a smooth transaction.

- MV-82 (Vehicle Registration/Title Application) - This form is completed and signed by the vehicle owner or their authorized representative. It is the primary application for registering or titling a vehicle in New York.

- MV-82TON (Application for Title) - Similar to MV-82, this form is specifically for individuals looking to obtain a title without registering the vehicle at the same time.

- Proof of Ownership - This includes documents such as a bill of sale or a previous owner's title, verifying the applicant's ownership of the vehicle. Different requirements apply based on whether the vehicle was purchased from an individual or a dealer.

- Sales Tax Clearance - Proof that sales tax has been paid on the vehicle. It is required for both out-of-state and New York titles. Proper documentation such as a Certificate of Sale or original bill of sale is necessary.

- DTF-802 (Sales Tax Exemption Certificate) - To claim exemptions related to sales tax, this form must be completed. It is vital for instances of casual sales or gifts, and has specific signing requirements depending on the sale type.

- DTF-803 (Claim for Exemption from Sales Tax) - If seeking exemption from sales tax, this form provides the necessary details to justify the claim. Submission of this form is essential to avoid unexpected tax obligations.

- Proof of Identity or Corporation (Form ID-82) - This document verifies the identity of the individual or the corporate status of a business. Acceptable proofs of identity must be provided as outlined by the New York State Department of Motor Vehicles.

Gathering these documents ensures that the process of obtaining a certificate of title runs efficiently. It is recommended to review the specific requirements for each form and collect all pertinent documentation before visiting a Motor Vehicles office.

Similar forms

- Form MV-82: This is the Vehicle Registration/Title Application, which must be completed and signed to apply for a title. Like the FS-6T, it serves as a necessary step in the registration process.

- Form MV-50: The Certificate of Sale required when purchasing from a dealer. This document is essential for establishing ownership and is similar to FS-6T because both documents confirm transactions related to vehicle registration.

- Form DTF-802: This form is used for sales tax clearance during private transactions. The FS-6T also requires proof of sales tax clearance, underscoring the importance of tax documentation in the title process.

- Form DTF-803: This form is completed to claim exemptions from sales tax. Similar to the FS-6T, it addresses the financial obligations related to ownership transfer.

- Form DTF-804: Used when partial sales tax has been paid in another state. Just like FS-6T, it seeks confirmation that all financial dues are addressed prior to registration.

- Form ID-82: This document verifies identity or corporate status. Much like the FS-6T, it ensures that the individual or entity applying for title possesses the required legitimacy in the registration process.

Dos and Don'ts

When filling out the FS-6T form, being attentive to details can make a significant difference in the process. Here’s a concise guide on what to do and what to avoid:

- Do ensure all documentation is complete. Make sure you have form MV-82 or MV-82TON and proof of ownership properly signed and transferred.

- Do provide accurate sales tax documentation. Depending on where you purchased the vehicle, you will need the appropriate sales tax clearance forms. Double-check that you have the correct bills of sale.

- Do clearly communicate your intentions at the Motor Vehicles office. Inform the representative that you are applying solely for a title for IRP apportioned registration.

- Do keep a copy of all submitted documents. Having duplicates can be crucial if questions arise in the future.

- Don't overlook details. Errors or missing information on your FS-6T form can cause delays. Review all entries carefully.

- Don't provide incorrect fees. Make sure you include the correct $50 title processing fee. An incorrect fee can lead to complications.

- Don't forget to check for proper signatures. Ensure that all required signatures are present on forms like DTF-802, as missing signatures can invalidate your application.

- Don't hesitate to seek help. If you have any questions about your application or the required documents, reach out to the Motor Vehicles office or call the IRB.

Misconceptions

Understanding the FS-6T form is crucial for those navigating vehicle title applications in New York State. However, several misconceptions may lead to confusion.

- The FS-6T form is unnecessary for all vehicle registrations. This form is specifically required for those applying for a New York State certificate of title before seeking apportioned registration.

- You can get the FS-6T without providing necessary documents. To receive the FS-6T, you must bring specific documents to the Motor Vehicles office, including proof of ownership and sales tax clearance.

- Only the original title is sufficient for proof of ownership. Depending on how you purchased the vehicle, you may also need a bill of sale, a Manufacturer's Certificate of Origin, or other documents to prove ownership.

- Sales tax clearance only applies to out-of-state purchases. You must show proof of sales tax clearance whether you bought the vehicle from a New York dealer or an out-of-state dealer.

- The FS-6T receipt itself is a title. The FS-6T is a receipt for your application for a title, not the title itself. The actual title will be issued after your application is processed.

- You can submit the FS-6T form online. The process requires you to visit a Motor Vehicles office in person to obtain the FS-6T form.

- Any Motor Vehicles representative can assist with obtaining an FS-6T. It's essential to inform the representative that you're applying specifically for a title to ensure proper processing.

- The FS-6T form is valid indefinitely. The FS-6T serves as a temporary receipt and is only valid for a short period, as you will need to follow up with the title application.

- Corporate owners do not need a Power of Attorney. If the vehicle is owned by a corporation, a corporate officer or someone with Power of Attorney must sign the application.

Clearing up these misconceptions can streamline the process of obtaining the FS-6T and ultimately your vehicle title. It’s critical to gather all necessary documents and information before visiting the Motor Vehicles office.

Key takeaways

Completing and using the FS-6T form is an essential step in obtaining a certificate of title or sales tax clearance in New York State. Here are some key takeaways to help guide you through the process:

- Understand the Purpose: The FS-6T form serves as a receipt that confirms your application for a New York State certificate of title. This is crucial before applying for apportioned registration in the International Registration Program.

- Gather Required Documents: Ensure you bring all necessary documents to the Motor Vehicles office. This includes a completed MV-82 form, proof of ownership, sales tax clearance, and proof of identity.

- Pay Attention to the Fee: A processing fee of $50 is required when applying for the title. It's important to inform the Motor Vehicles Representative that you are applying solely for a title, as this specifies your need for the FS-6T receipt.

- Verify Receipt Details: After receiving the FS-6T form, double-check that it states “Title - $50.00”. If there's any discrepancy, return it immediately for correction to avoid delays in your registration process.

Browse Other Templates

Who Is Exempt From Ifta - Inclusion of detailed contact information helps streamline communication with tax authorities when needed.

Alabama Farmers Bulletin - Environmental stewardship is highlighted in future farming plans.

Affidavit Template California - It includes a section for the legal description of the decedent's real property.