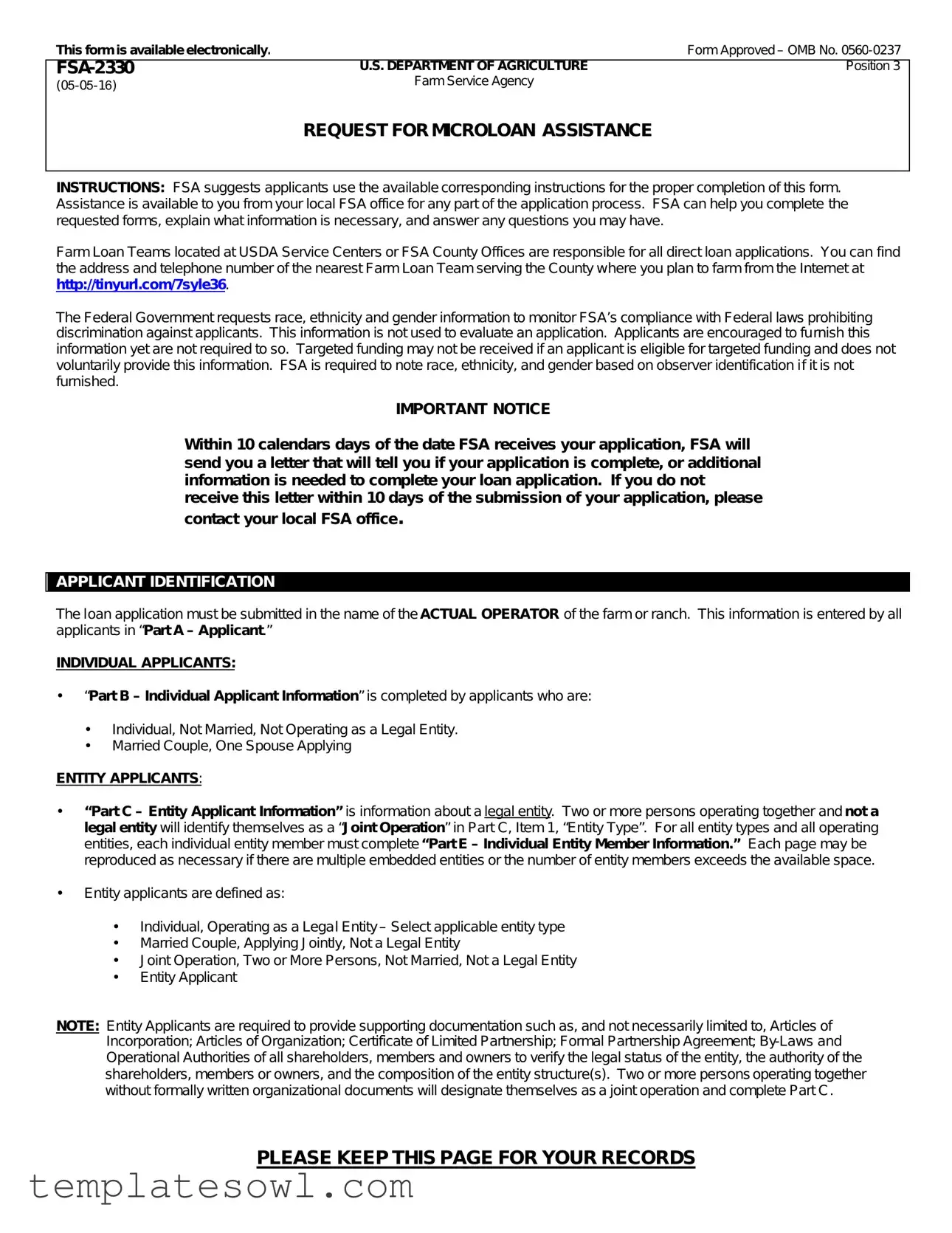

Fill Out Your Fsa 2330 Form

The FSA 2330 form, officially titled "Request for Microloan Assistance," serves as a crucial tool for individuals and entities seeking funding to support agricultural ventures through the Farm Service Agency (FSA). This form can be conveniently accessed electronically, streamlining the application process. It requires detailed information from applicants, including identification data, financial statements, and entity details when applicable. Individual applicants must complete various parts, such as providing personal information in Part B, while entities must fill out specific sections that outline their legal structure and ownership. Notably, the form also requests race, ethnicity, and gender data, not for evaluative purposes, but to ensure compliance with federal anti-discrimination laws. It is important to recognize that applicants are encouraged to share this information, as failing to supply it could affect eligibility for targeted funding. Each application initiates a timeline during which the FSA commits to communicating the status of the application within 10 days. From identifying the actual operator of the farm to detailing income and expenses through financial statements, the FSA 2330 form facilitates a structured approach to securing vital microloan assistance for agricultural endeavors, ensuring that both individual and joint applications are comprehensively reviewed and considered.

Fsa 2330 Example

This form is available electronically. |

|

Form Approved – OMB No. |

U.S. DEPARTMENT OF AGRICULTURE |

Position 3 |

Farm Service Agency |

|

|

|

|

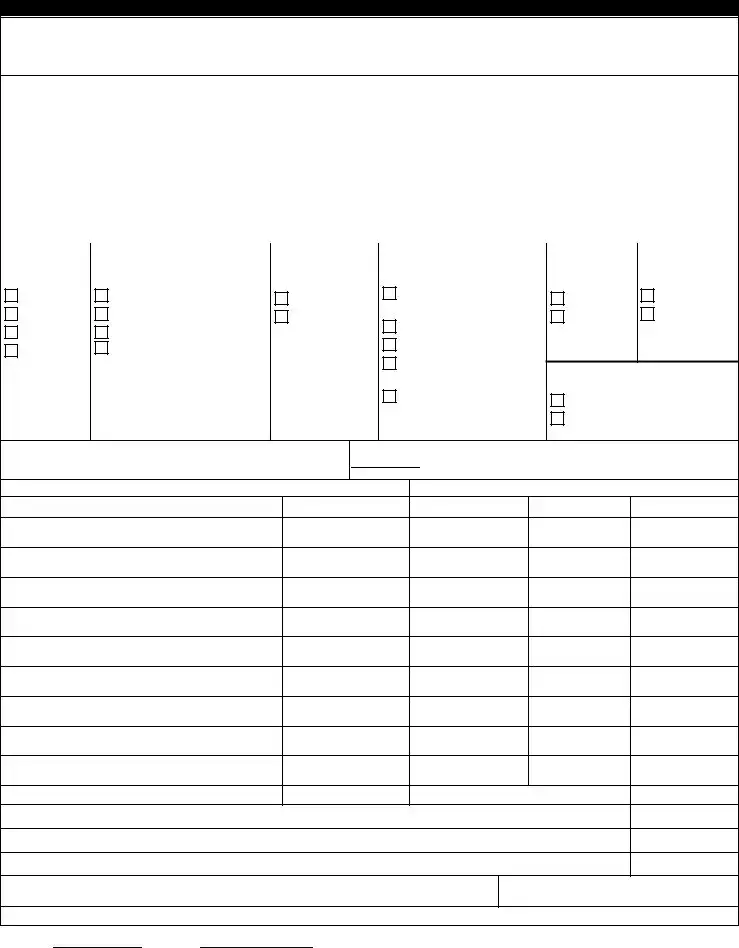

REQUEST FOR MICROLOAN ASSISTANCE |

INSTRUCTIONS: FSA suggests applicants use the available corresponding instructions for the proper completion of this form. Assistance is available to you from your local FSA office for any part of the application process. FSA can help you complete the requested forms, explain what information is necessary, and answer any questions you may have.

Farm Loan Teams located at USDA Service Centers or FSA County Offices are responsible for all direct loan applications. You can find the address and telephone number of the nearest Farm Loan Team serving the County where you plan to farm from the Internet at http://tinyurl.com/7syle36.

The Federal Government requests race, ethnicity and gender information to monitor FSA’s compliance with Federal laws prohibiting discrimination against applicants. This information is not used to evaluate an application. Applicants are encouraged to furnish this information yet are not required to so. Targeted funding may not be received if an applicant is eligible for targeted funding and does not voluntarily provide this information. FSA is required to note race, ethnicity, and gender based on observer identification if it is not furnished.

IMPORTANT NOTICE

Within 10 calendars days of the date FSA receives your application, FSA will send you a letter that will tell you if your application is complete, or additional information is needed to complete your loan application. If you do not receive this letter within 10 days of the submission of your application, please contact your local FSA office.

APPLICANT IDENTIFICATION

The loan application must be submitted in the name of the ACTUAL OPERATOR of the farm or ranch. This information is entered by all applicants in “Part A – Applicant.”

INDIVIDUAL APPLICANTS:

·“Part B – Individual Applicant Information” is completed by applicants who are:

·Individual, Not Married, Not Operating as a Legal Entity.

·Married Couple, One Spouse Applying

ENTITY APPLICANTS:

·“Part C – Entity Applicant Information” is information about a legal entity. Two or more persons operating together and not a legal entity will identify themselves as a “Joint Operation” in Part C, Item 1, “Entity Type”. For all entity types and all operating entities, each individual entity member must complete “Part E – Individual Entity Member Information.” Each page may be reproduced as necessary if there are multiple embedded entities or the number of entity members exceeds the available space.

·Entity applicants are defined as:

·Individual, Operating as a Legal Entity – Select applicable entity type

·Married Couple, Applying Jointly, Not a Legal Entity

·Joint Operation, Two or More Persons, Not Married, Not a Legal Entity

·Entity Applicant

NOTE: Entity Applicants are required to provide supporting documentation such as, and not necessarily limited to, Articles of Incorporation; Articles of Organization; Certificate of Limited Partnership; Formal Partnership Agreement;

PLEASE KEEP THIS PAGE FOR YOUR RECORDS

This form is available ele ctronically.

Form Approved – OMB No.

U.S. DEPARTMENT OF AGRICULTURE |

Position 3 |

|

Farm Service Agency |

|

|

|

|

|

|

REQUEST FOR MICROLOAN ASSISTANCE |

|

|

|

|

Instructions: |

All applicants must complete Part A. Individual applicants complete Parts B, D, F and G. Two or more persons applying jointly, including married |

|

|

persons, are considered an entity. Entities must complete Parts C, D, F and G. Entity members must use the sheets provided on Part E. Non- |

|

|

citizen nationals and qualified aliens must provide appropriate documentation under Federal immigration law. *Race, ethnicity, and gender |

|

information is requested by the Federal Government to monitor FSA's compliance with Federal laws prohibiting discrimination against applicants. Applicants are not required to furnish this information, but are encouraged to do so. Failure to provide this information ma y result in not receiving targeted funds for which the applicant may be eligible. One or more boxes may be selected for race. This information will not be used to evaluate the application. FSA is required to note race, ethnicity and gender on the basis of observer identification if you do not furnish it.

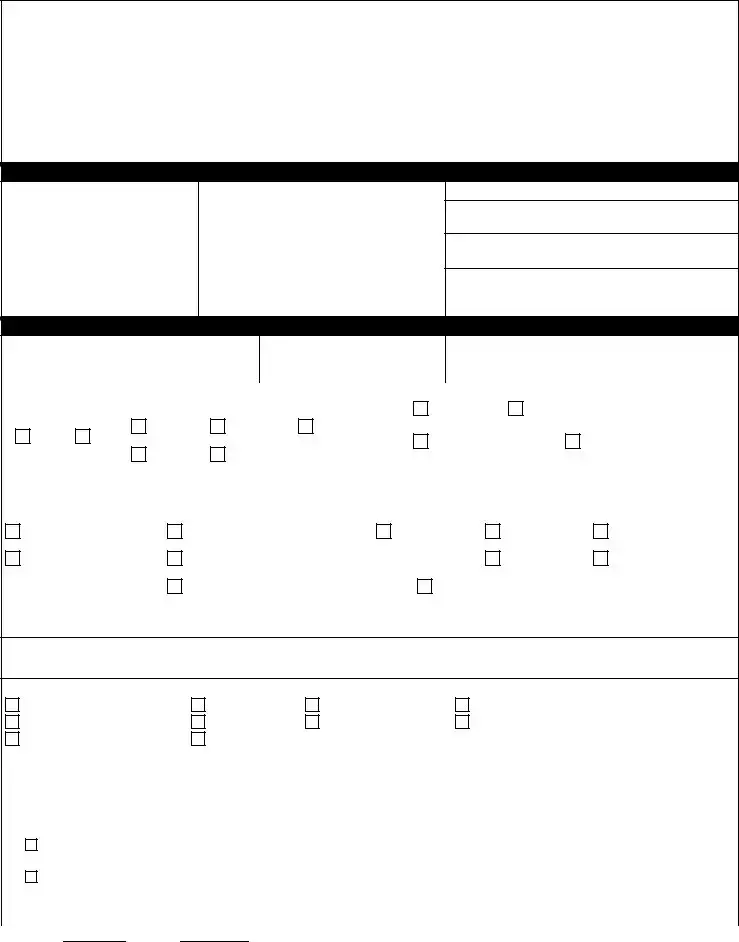

PART A – APPLICANT

1. Exact Full Legal Name

2. Address

3. Contact Information:

A.Home Telephone No. (Include Area Code)

B. Cell Telephone No. (Include Area Code)

C.

PART B – INDIVIDUAL APPLICANT INFORMATION

1. Social Security Number (9 digit No.)

2. Birth Date

3. County of Operation Headquarters

|

4. Veteran Status |

5. |

Marital Status: |

|

|

|

|

6. Applicant Is: |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

U.S. Citizen |

|

|||

|

YES |

NO |

|

|

Married |

Separated |

Unmarried |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Resident Alien |

*Refugee or Other |

|

||||

|

|

|

|

|

Divorced |

Married, Applying as Individual |

|

|

|

||||||

|

|

|

|

|

|

|

*NOTE: Applicant will be asked to provide |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

found under PRWORA (8 U.S.C. 1641). |

||||

|

*7. Ethnicity |

|

|

|

|

*8. Race |

|

|

|

|

|

*9. Gender |

10. FSA Use Only |

||

|

Hispanic or Latino |

|

|

American Indian/Alaskan Native |

Asian |

|

Male |

Provided |

|||||||

|

Not Hispanic or Latino |

|

Black/African American |

|

|

|

|

|

Female |

Observed |

|||||

|

|

|

|

|

|

Native Hawaiian/Other Pacific Islander |

|

|

White |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

PROCEED TO PART D |

||||||

|

|

|

|

|

|

NOTE: More than one box may be selected. |

|

||||||||

|

|

|

|

|

|

|

|

|

|

||||||

|

PART C – ENTITY APPLICANT |

INFORMATION |

|

|

|

|

|

|

|

|

|||||

NOTE: Individual liability will be required regardless of the entity type. Informal entities may leave Items 2 through 4 blank, if not applicable. By signing in Part E you certify that you have read and understand the statements and certifications on Pages 4 through 6. Balance Sheet provided in Part E for entity member use.

1. |

Entity Type |

|

|

|

|

|

|

|

Cooperative |

S Corp |

Formal Partnership |

Joint Operation (Including married filing together) |

|||

|

Limited Liability Company |

C Corp |

Life Estate |

|

Revocable Trust |

||

|

Irrevocable Trust |

Other (specify): |

|

|

|

|

|

|

|

|

|

|

|

||

2. |

State of Registration |

|

|

3. |

Registration Number |

||

|

|

|

|

|

|||

4. |

Tax Identification Number (9 Digit No.) |

|

|

5. Exact Full Legal Name of Primary Entity Contact |

|||

|

|

|

|

|

|||

6. |

Does Entity Contain Embedded Entity? |

|

7. |

List all Embedded Entities |

|||

|

YES, (Complete Items 7, 8, and 9 for each entity) (Proceed to |

|

|

|

|||

|

Part D) |

|

|

|

|

|

|

|

NO, (Proceed to Part D) |

|

|

|

|

|

|

8. |

Percentage of Interest |

|

|

9. |

Number of Entity Members |

||

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Initials:Date:

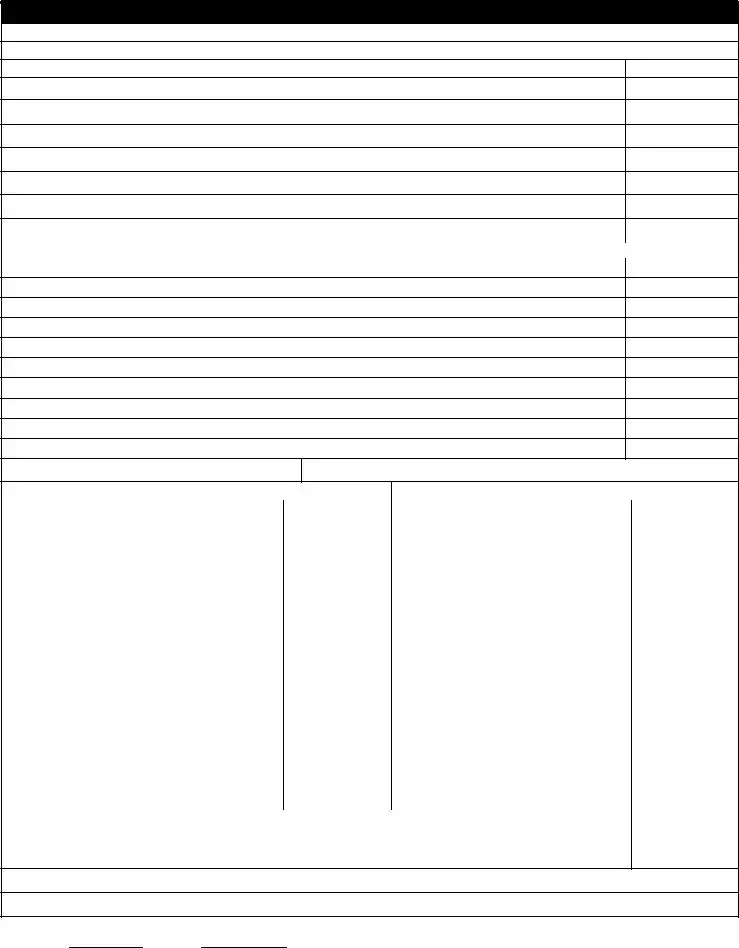

PART D – FINANCIAL STATEMENTS FOR INDIVIDUAL OR ENTITY APPLICANT

PROJECTED ANNUAL INCOME AND EXPENSES

1.INCOME:

A.DESCRIPTION (Include income from crops and livestock ): Crop(s):

Livestock:

Page 2 of 7

B. $ Amount

|

2. Total Annual Farm Income: |

|

|

3. EXPENSES: |

|

A. DESCRIPTION: |

B. $ Amount |

4. Total Annual Farm Expenses:

5.Net Farm Income (Subtract Item 4 from Item 2):

6.Total Annual

7.Total Annual Family Living Expenses:

8.Net

9.Net Total Annual Income (Add Item 5 to Item 8):

ASSETS AND DEBTS (Farm and

10. ASSETS: |

12. DEBTS: |

|

|

A. DESCRIPTION |

B. $ VALUE A. CREDITOR |

B. $ PAYMENT |

C. $ BALANCE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. TOTAL ASSETS: |

13. TOTAL DEBTS: |

|

14. Total Assets from Item 11: |

|

|

|

15. Total Debts from Item 13: |

|

16. Net Worth (Subtract Item 15 from Item 14): |

INDIVIDUAL APPLICANTS – PROCEED TO PART F

ENTITY APPLICANTS – PROCEED TO PART E

Initials:Date:

Page 3 of 7 |

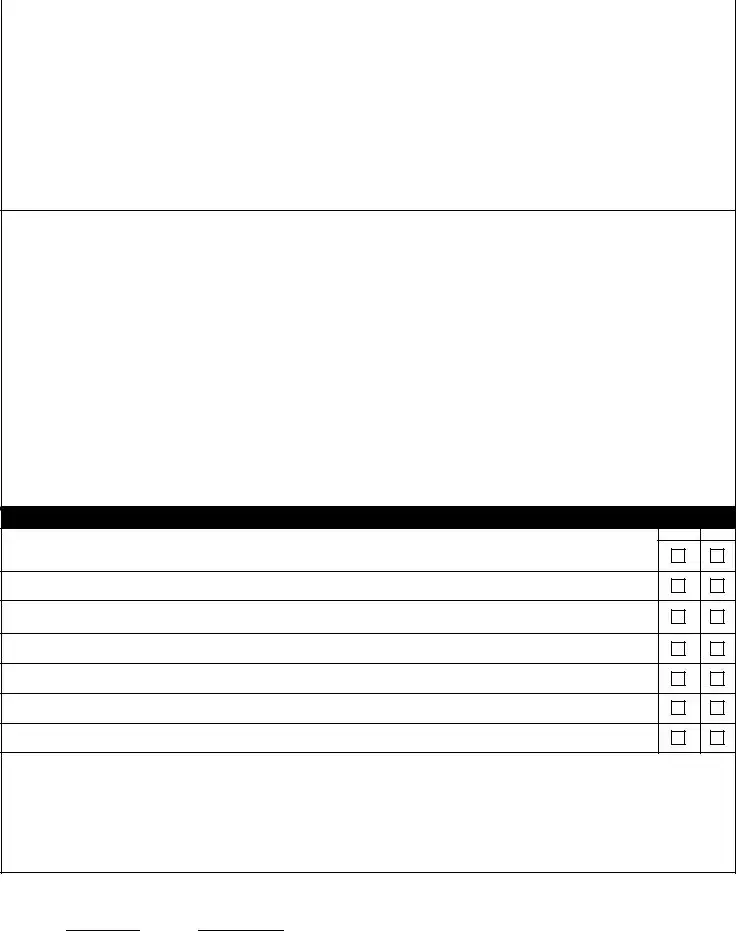

PART E – INDIVIDUAL ENTITY MEMBER INFORMATION

Instructions: Two or more persons, including married persons, who are applying jointly and do not have an entity name or Tax ID Number, will be considered a joint operation. In Part C, married persons applying jointly check the “Joint Operation” box. Complete Items 1A through 1I for each entity member. *Items 1K through 1M are voluntary. Provide balance sheet information for each entity member. Signature and Date blocks below must be completed for all entity members. Use separate Part E pages for each entity member.

NOTE: Individual liability will be required regardless of the entity type. By signing below in Item 9 you certify that you have read and understand the statements and certifications on Pages 4 through 6

1A. Exact Full Legal Name of Entity Member |

1B. Social Security No. (9 Digit No.) |

1C. |

Birth Date |

|

|

|

|

1D. Address |

1E. Contact Numbers |

1F. Percent of Ownership |

|

|

|

|

% |

|

|

|

|

|

1G. Email Address |

1H. |

Annual |

|

|

|

$ |

|

|

|

|

1I. Marital Status

Married

Separated

Unmarried

Divorced

1J. Applicant Is:

U.S. Citizen

*Resident Alien

*NOTE: Applicant will be asked to provide

(8 U.S.C. 1641).

*1K. Ethnicity

Hispanic/Latino

Not Hispanic/

Latino

*1L. Race

American Indian/Alaskan

Native

Asian

Black/African American

Native Hawaiian/Other

Pacific Islander

White

NOTE: More than one box may be selected.

*1M. Gender |

1N. Veteran |

|

Status |

Male |

YES |

Female |

NO |

1O. FSA Use Only

Provided

Observed

Complete balance sheet below for entity member listed above in Item 1A. ASSETS AND DEBTS (Farm and

2. ASSETS:

A. DESCRIPTION

|

4. DEBTS: |

|

B. $ VALUE |

A. CREDITOR |

B. $ PAYMENT C. $ BALANCE |

3.TOTAL ASSETS:

9.Signature

5.TOTAL DEBTS:

6.Total Assets from Item 3:

7.Total Debts from Item 5:

8.Net Worth (Subtract Item 7 from Item 6): 10. Date

PROCEED TO PART F

Initials:Date:

|

|

Page 4 of 7 |

|

|

PART F – GENERAL INFORMATION |

|

|

|

|

|

|

|

1. Counties Being Farmed |

2. Acres Owned |

3. Acres Rented |

|

|

|

|

|

4A. Purpose of Loan |

4B. Amount Requested |

|

|

|

$ |

|

|

|

|

|

5.Describe your existing or planned operation, including a description of your existing or planned production:

6.If not provided previously, describe fully all your farm training (include any applicable education such as animal husbandry,

PART G – NOTIFICATIONS, CERTIFICATIONS AND ACKNOWLEDGMENT

YES NO

1.Are you currently or have you ever, and in the case of an entity any member of the entity, conducted business under any other name? If "YES," list names in Item 8.

2.Have you ever, or in the case of an entity any member of the entity, obtained a direct or guaranteed farm loan from FSA or Farmers Home Administration?

3.If Item 2 is "YES," did you receive any debt forgiveness through

4.Are you, or in the case of an entity any member of the entity, delinquent on any Federal debt or have any outstanding Federal judgments? If " YES," provide details in Item 8.

5.Are you, or in the case of an entity any member of the entity, involved in any pending litigation? If "YES," provide details in Item 8.

6.Have you, or in the case of an entity any member of the entity, ever been in receivership, discharged in bankruptcy, or filed a petition for reorganization in bankruptcy? If "YES," provide details in Item 8.

7.Are you, or in the case of an entity any member of the entity, an FSA employee or related to or closely associated with an FSA employee? If "YES," provide details in Item 8.

8.Additional answers. Write the Item number to which each answer applies. If you need additional space, use sheets of paper the same size as this page and write the applicant's name on each additional sheet.

Initials:Date:

Page 5 of 7 |

|

9. SPECIAL PROGRAM INFORMATION: |

|

Certain FSA programs are, by law, designed to reach targeted applicants. If you are interested in any of the programs described here, or have questions about these programs and whether you may qualify for a specific program, the FSA office processing your application will help you.

A.SOCIALLY DISADVANTAGED APPLICANTS : A portion of FSA farm ownership, operating, and conservation loan funds are, by law, targeted to applicants who have been subjected to racial, ethnic or gender prejudice because of their identity as a member of a group, without regard to individual qualities. Under the applicable law, groups meeting this condition are: American Indians/Alaskan Natives, Asians, Blacks or African Americans, Native Hawaiians/Other Pacific Islanders, Hispanics and women. In addition, FSA has a down payment program, which receives special funding.

B.BEGINNING FARMER ASSISTANCE: FSA has the authority to assist beginning farmers through the farm ownership, operating, and conservation loan programs. A portion of FSA farm ownership, operating, and conservation loan funds are, by law, targeted to beginning farmers. In addition, FSA has a down payment program, which receives special funding. In some States, FSA has agreements with State beginning farmer programs to help meet the credit needs of beginning farmers.

C.LIMITED RESOURCE LOANS : Limited resource farm ownership and operating loans are available to qualified applicants. This program provides loans at reduced interest rates to

10.RIGHTS AND POLICIES :

A.RIGHT TO FINANCIAL PRIVACY ACT OF 1978 (Public Law

B.THE FEDERAL EQUAL CREDIT OPPORTUNITY ACT: Prohibits creditors from discriminating against applicants on the basis of race, color, religion, sex, national origin, marital status, age (provided the applicant has the capacity to enter into a binding contract), because all or a part of the applicant's income derives from any public assistance program, or because the applicant has in good faith exercised any right under the Consumer Credit Protection Act.

C.FEDERAL COLLECTION POLICIES: Delinquencies, defaults, foreclosures and abuses of mortgage loans involving programs of the Federal Government can be costly and detrimental to your credit, now and in the future. The mortgage lender in this transaction, its agents and assigns as well as the Federal Government, its agencies, agents and assigns, are authorized to take any and all of the following actions in the event loan payments become delinquent on the mortgaged loan described in the attached application: (1) Report your name and account information to a credit bureau; (2) Assess additional interest and penalty charges for the period of time that payment is not made; (3) Assess charges to cover additional administrative costs incurred by the Government to service your account; (4) Offset amounts owed to you under other Federal programs; (5) Refer your account to a private attorney, collection agency or mortgage servicing agency to collect the amount due, foreclose the mortgage, sell the property and seek judgment against you for any deficiency; (6) Refer your account to the Department of Justice for litigation; (7) If you are a current or retired Federal employee, take action to offset your salary, or civil service retirement benefits; (8) Refer your debt to the Department of the Treasury for

11.RESTRICTIONS AND DISCLOSURE OF LOBBYING ACTIVITIES:

A.The applicant:

(1)Certifies that if any funds, by or on behalf of the applicant, have been or will be paid to any person for influencing or attempting to influence an officer or employee of any agency, a Member, an officer or employee of Congress, or an employee of a Member of Congress in connection with the awarding of any Federal contract, the making of any Federal grant or Federal loan, and the extension, continuation, renewal, amendment, or modification of any Federal contract, grant, or loan, the applicant shall complete and submit Standard Form - LLL, "Disclosure of Lobbying Activities," in accordance with its instructions.

(2)Shall require that the language of this certification be included in the award documents for all

Initials:Date:

Page 6 of 7 |

RESTRICTIONS AND DISCLOSURE OF LOBBYING ACTIVITIES: (CONTINUED)

B.This certification is a material representation of fact upon which reliance was placed when this transaction was made or entered into. Submission of this statement is a prerequisite for making or entering into this transaction. Any person who fails to file the required statement shall be subject to a civil penalty imposed by 31 U.S.C. 1352.

12.CONTROLLED SUBSTANCES:

The applicant certifies that as an individual, or any member of an entity applicant, has not been convicted under Federal or State law of planting, cultivating, growing, producing, harvesting, or storing a controlled substance within the previous 5 crop years. See the Food Security Act of 1985 (Public Law

13.DISQUALIFICATION DUE TO FEDERAL CROP INSURANCE FRAUD:

The applicant certifies that as an individual or any member of the entity, has not been disqualified for Federal benefits as provided in Section 515(h) of the Federal Crop Insurance Act (FCIA). Applicants who willfully and intentionally provide false or inaccurate information to the Federal Crop Insurance Corporation (FCIC) or to an approved insurance provider with respect to a policy or plan of FCIC insurance, after notice and an opportunity for a hearing on the record, will be subject to one or more of the sanctions described in Section 515(h)(3) of FCIA.

14.TEST FOR CREDIT:

The applicant certifies that the needed credit, with or without a loan guarantee, cannot be obtained by (1) the individual applicant;

(2) in the case of an entity, considering all assets owned by the entity and all of the individual members.

15.PERMISSION TO FILE FINANCING STATEMENT, ORDER A CREDIT REPORT, AND VERIFY CREDIT INFORMATION:

Under the Uniform Commercial Code, you do not have to sign the financing statement which allows FSA to obtain a security interest in your property. If the loan is approved and funded, FSA will file a financing statement at the earliest possible date, before you enter into a SECURITY AGREEMENT. BY SIGNING BELOW OR PART E, I GIVE FSA PERMISSION TO FILE A

FINANCING STATEMENT PRIOR TO THE EXECUTION OF THE SECURITY AGREEMENT AS WELL AS TO FILE AMENDMENTS AND CONTINUATIONS OF THE FINANCING STATEMENT THEREAFTER. I FURTHER AUTHORIZE FSA TO ORDER A CREDIT REPORT AND VERIFY ANY OTHER CREDIT INFORMATION.

16.CERTIFICATION:

Icertify that the information provided is true, complete, and correct to the best of my knowledge and is provided in good faith to obtain a loan. (WARNING: Section 1001 of Title 18, United States Code, provides for criminal penalties to those who provide false statements to the Government. If any information is found to be false or incomplete, such finding may be grounds for denial of the requested action).

17A. Signature of Individual Applicant, Spouse or Entity Member |

17B. Capacity |

17C. |

Date Signed |

|

Self |

|

|

|

Entity Representative |

|

|

18A. Signature of Individual Applicant, Spouse or Entity Member |

18B. Capacity |

18C. |

Date Signed |

|

Self |

|

|

|

Entity Representative |

|

|

19A. Signature of Individual Applicant, Spouse or Entity Member |

19B. Capacity |

19C. |

Date Signed |

|

Self |

|

|

|

Entity Representative |

|

|

20A. Signature of Individual Applicant, Spouse or Entity Member |

20B. Capacity |

20C. |

Date Signed |

|

Self |

|

|

|

Entity Representative |

|

|

21A. Signature of Individual Applicant, Spouse or Entity Member |

21B. Capacity |

21C. |

Date Signed |

|

Self |

|

|

|

Entity Representative |

|

|

|

|

Page 7 of 7 |

||||

|

|

PART H– FSA USE ONLY |

|

|

|

|

|

1. |

Date Form |

|

2. |

Date Application Complete |

|

|

|

|

|

|

|

|

|

3. |

Credit Report Fee |

4. Date Received |

5. |

Name of Agency Official |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

NOTE: The following is made in accordance with the Privacy Act of 1974 (5 USC 552a – as amended). The authority for requesting the information identified on this form is 7 CFR Part 761, 7 CFR Part 764, and the Consolidated Farm and Rural Development Act (Pub. L.

According to the Paperwork Reduction Act of 1995, an agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a valid OMB control number. The valid OMB control number for this information collection is

In accordance with Federal civil rights law and U.S. Department of Agriculture (USDA) civil rights regulations and policies, the USDA, its Agencies, offices, and employees, and institutions participating in or administering USDA programs are prohibited from discriminating based on race, color, national origin, religion, sex, gender identity (including gender expression), sexual orientation, disability, age, marital status, family/parental status, income derived from a public assistance program, political beliefs, or reprisal or retaliation for prior civil rights activity, in any program or activity conducted or funded by USDA (not all bases apply to all programs). Remedies and complaint filing deadlines vary by program or incident.

Persons with disabilities who require alternative means of communication for program information (e.g., Braille, large print, audiotape, American Sign Language, etc.) should contact the responsible Agency or USDA’s TARGET Center at (202)

To file a program discrimination complaint, complete the USDA Program Discrimination Complaint Form,

Form Characteristics

| Fact Name | Description |

|---|---|

| Availability | The FSA 2330 form is available electronically, making it accessible for applicants at any time. |

| Regulatory Approval | This form is approved by the Office of Management and Budget (OMB), with the approval number OMB No. 0560-0237. |

| Application Feedback | Within 10 calendar days of receiving your application, FSA will notify you about whether your application is complete or if more information is needed. |

| Race and Ethnicity Data | Applicants are asked to provide race, ethnicity, and gender information to help monitor compliance with federal discrimination laws, but it is voluntary and won’t be used to assess eligibility. |

| Entity Applications | For group applications, the form allows two or more individuals to apply together as entities and requires individual entity members to provide specific information. |

| State-Specific Laws | Governing laws can vary by state, but applicants typically follow federal laws set forth by the USDA and FSA when applying for microloan assistance. |

Guidelines on Utilizing Fsa 2330

Before you start filling out the FSA 2330 form, it’s important to gather all the necessary information. This includes personal details, financial information, and any required documentation. Completing this form correctly is essential to ensure the smooth processing of your microloan assistance application. Follow the instructions closely for each section to avoid delays.

- Part A – Applicant: Fill out your exact full legal name, address, and contact information, which includes home and cell phone numbers as well as an email address.

- Part B – Individual Applicant Information: Provide your Social Security number, birth date, county of operation headquarters, veteran status, and marital status. Indicate whether you are a U.S. citizen or a qualified alien, and provide race, ethnicity, and gender information. Note that providing this information is encouraged but not mandatory.

- Part C – Entity Applicant Information: If applying as an entity, select the entity type you fall under, such as a cooperative, limited liability company, or joint operation. Fill in the state of registration, registration number, tax identification number, and the exact full legal name of the primary entity contact. Specify whether your entity contains embedded entities and provide percentages of interest.

- Part D – Financial Statements: For both individual and entity applicants, outline projected annual income and expenses. This involves describing income sources and listing dollar amounts. Document total annual income, expenses, net farm income, and net non-farm income. Also, assess assets and debts.

- Part E – Individual Entity Member Information: If applying as a group or entity, list information for each individual entity member, including full legal name, social security number, contact information, ownership percentage, and financial details. Ensure each member signs and dates their section.

- Part F and Part G: Complete any remaining sections as instructed, including additional documentation if applicable.

After completing the form, double-check all information for accuracy and completeness. Make copies for your records, and then submit the application to your local FSA office. Prompt follow-ups may be needed based on the FSA’s response timeframe.

What You Should Know About This Form

What is the FSA 2330 form used for?

The FSA 2330 form is primarily a Request for Microloan Assistance. It is designed for farmers and ranchers who are seeking financial support through microloans provided by the Farm Service Agency (FSA). This form helps applicants demonstrate their eligibility and provides the necessary information for processing their loan applications.

How can I obtain the FSA 2330 form?

The FSA 2330 form is available electronically, allowing easy access for applicants. You can download the form from the official FSA website or from local FSA office resources. If needed, assistance is also available from personnel at your local FSA office to help with the application process.

What information do I need to provide on the form?

Applicants must complete several parts of the form depending on their status. Individual applicants need to submit their personal information, including full legal name, address, Social Security number, and marital status. If you are applying as an entity (like a partnership or corporation), you will need to fill out the sections pertaining to entity-specific details, including the legal name of the entity and its type, along with information about its members.

Is providing race, ethnicity, and gender information mandatory?

Providing information regarding race, ethnicity, and gender is not required for submitting the FSA 2330 form. However, applicants are encouraged to provide this information to ensure compliance with federal laws that prohibit discrimination. If you choose not to provide this information, FSA is required to note it through observer identification.

What should I do if I do not receive a confirmation letter after submitting my application?

If you do not receive a confirmation letter within 10 calendar days of submitting your application, you should reach out to your local FSA office. They can provide clarification on the status of your application, whether it is complete, or if additional information is required to move forward.

What are the consequences of not providing requested documentation as an entity applicant?

Entity applicants must submit supporting documentation to confirm their legal status and operational authority within the entity structure. If the required documentation, such as Articles of Incorporation or formal partnership agreements, is not provided, the application may be delayed or denied. It is essential to ensure that all necessary documents are submitted for your application to be processed effectively.

Can I apply for a microloan if I am not a U.S. citizen?

Non-citizen nationals and qualified aliens may apply for the microloan, provided they have appropriate documentation under federal immigration law. Such applicants should be prepared to present valid identification, such as I-551 documentation, to establish their eligibility in accordance with federal regulations.

Common mistakes

Completing the FSA 2330 form can be a straightforward process when approached carefully. However, many applicants inadvertently make mistakes that can delay their application or even result in rejection. One common error is failing to provide accurate personal information. For example, listing an incorrect Social Security number or misspelling one’s name can lead to complications. It's essential to double-check all information for accuracy before submission.

Another frequent mistake involves misunderstanding the requirements for entity applicants. Some individuals mistakenly believe that if they are applying as a marital entity, they don't need to provide additional documentation. However, all entity applicants must submit supporting documents verifying their legal status. This includes articles of incorporation or partnership agreements. Therefore, it is critical to gather these documents ahead of time and understand what is needed.

Additionally, many applicants overlook the importance of completing all relevant parts of the form. Certain sections, such as Parts D and E, might be skipped entirely. Not completing these parts can result in missing financial information, which is crucial for the assessment of the loan application. Each section must be filled out completely and accurately, reflecting the applicant's financial situation.

Another mistake often made is related to the race, ethnicity, and gender information section. Some applicants hesitate to provide this information, thinking it is optional and unimportant. However, omitting this data can adversely affect eligibility for targeted funding. It is beneficial to complete this section or at least understand how it affects the overall application process.

Furthermore, applicants sometimes misinterpret the financial statement requirements. Individuals often provide incomplete or outdated financial information, leading to confusion and complications in evaluating their application. Keeping financial records current and detailed is crucial to accurately represent one’s financial health. This includes not only income but also a comprehensive list of assets and debts.

Lastly, lack of follow-up constitutes a major pitfall. Once the application is submitted, some applicants wait passively, assuming everything will be processed smoothly. However, the process involves receiving a confirmation letter within ten days. If this letter is not received, promptly contacting the local FSA office is essential for resolving potential issues. Proactive communication encourages a timely resolution and keeps the application process on track.

Documents used along the form

The FSA 2330 form, also known as the Request for Microloan Assistance, is essential for individuals and entities seeking financial aid in agricultural endeavors. Applicants often need to submit additional forms and documents concurrently to ensure a seamless application process. Below is a list of documents frequently required alongside the FSA 2330 form, providing a brief description of each.

- FSA-850 - This is the "Farm Loan Program Borrower Information" form. Borrowers use it to provide details about their agricultural experience and financial background necessary for loan assessments.

- FSA-2450 - Known as the "Application for Direct Loan," this form goes into detail about the applicant's requested loan amount and the purpose of the funds.

- FSA-202 - This is the "Farm Operating Plan" form, which outlines the operational aspects of the farm. It includes information about the types of crops or livestock the applicant intends to manage.

- FSA-222 - The "Asset and Liability Worksheet" helps applicants list their financial assets and liabilities, giving lenders insight into the applicant's financial health.

- FSA-1199A - This is the "Direct Deposit Sign-Up Form." It allows applicants to choose direct deposit for future loan disbursements, streamlining the funding process.

- IRS Form 4506-T - This form is a request for a transcript of a tax return. Lenders often require it to verify the applicant's income as part of their assessment.

- Management Plan - A narrative document that describes how the applicant plans to manage their farming operation. It typically includes strategies for crop selection, marketing, and financial management.

- Credit Report - Lenders may request a copy of the personal or business credit report to evaluate the borrowing history and creditworthiness of the applicant.

- Proof of Identity - Acceptable documents include a state-issued ID or passport. This is required to confirm the identity of the applicant and comply with federal regulations.

- Business Plan - If applicable, a comprehensive business plan detailing the goals, financial projections, and strategies for success in the farming endeavor could be needed.

Having these additional documents in order can significantly enhance the chances of a successful application process for microloans through the FSA. It's crucial for applicants to consult with their local FSA office to ensure they are preparing the correct forms and documents according to their specific situations.

Similar forms

- FSA-2331 Form: This form is also used by the Farm Service Agency for different types of loan assistance requests. Like FSA-2330, it requires individual and entity applicant information, and financial statements to assess eligibility for loans.

- FSA-2001 Form: This form is utilized for requesting farm ownership loans. Similar to the FSA-2330, it collects demographic information and requires financial disclosure from both individual and entity applicants.

- FSA-1001 Form: This form pertains to agricultural conservation programs. It is like the FSA-2330 in that it mandates details on applicants and their farms while also requiring income and expense projections.

- FSA-2020 Form: This form is for disaster assistance and includes information on applicant demographics and financial conditions, akin to the requirements found in the FSA-2330.

- USDA Loan Application Form: This document applies to a broader range of loans provided by the USDA. It also requires applicant identification and financial details similar to those in the FSA-2330.

- Farm Credit System Application: This application is necessary for borrowers wishing to secure loans through the Farm Credit System. It requests personal and financial information like the FSA-2330.

- Small Business Administration (SBA) Form 1919: This form is used for SBA loan applications. It gathers essential business and personal applicant data, paralleling the FSA-2330 in format and purpose.

- IRS Form 1040: While primarily a tax form, it collects income and expense information that can also be found on the FSA-2330. This data aids in financial assessment for loan eligibility.

- Commercial Loan Application: This document captures the financial history and needs of the applicant. Like the FSA-2330, it requires a comprehensive financial disclosure.

- Nonprofit Organization Application: This application is for nonprofits seeking funding. It requests demographic and financial information almost identical to that required on the FSA-2330.

Dos and Don'ts

When completing the FSA 2330 form, there are several important guidelines to follow to ensure a smooth application process. Below is a list of dos and don'ts to keep in mind:

- Do use the available electronic version of the form to simplify the process.

- Don’t forget to use the corresponding instructions for each section of the form; they are there to help you.

- Do reach out to your local FSA office if you have questions or need assistance while filling out the application.

- Don’t skip providing your race, ethnicity, and gender information, as doing so may affect your eligibility for targeted funding.

- Do ensure accurate information, especially in Part A, where you must list the actual operator of the farm or ranch.

- Don’t overlook the need for supporting documentation if you are applying as an entity; this verification is essential for processing your application.

Misconceptions

There are several misconceptions surrounding the FSA 2330 form. Understanding these can help applicants navigate the application process more effectively.

- Misconception 1: The form is only available in paper format.

- Misconception 2: All applicants must provide race, ethnicity, and gender information.

- Misconception 3: The Federal Government uses demographic information to assess loan applications.

- Misconception 4: You must receive confirmation from FSA within 10 days after submission.

- Misconception 5: Only individuals can apply; entities cannot.

- Misconception 6: All entity applicants must have formal documentation.

- Misconception 7: Everyone must provide their Social Security number to apply.

- Misconception 8: The application process is entirely self-service.

The FSA 2330 form is actually available electronically, making it easier for applicants to access and submit.

While this information is requested, applicants are not required to submit it. It's encouraged as it helps with targeted funding, but it's entirely voluntary.

This information is only used for compliance monitoring and does not play a role in evaluating the application itself.

If an applicant does not receive a letter within this timeframe, it is crucial to contact the local FSA office to ensure the application was received and is being processed.

Both individual applicants and entities can apply. The form contains specific sections for both types of applicants, ensuring all relevant information is captured.

If an applicant is a group without formal documentation, they can still register as a joint operation, which simplifies the process.

While individuals typically do provide this information, non-citizen nationals or qualified aliens must show appropriate documentation instead.

Assistance is readily available from your local FSA office, which can help you with forms, necessary information, and any questions during the application process.

Key takeaways

Filling out the FSA 2330 form requires careful attention to detail. Here are some key takeaways to guide applicants through the process:

- Eligibility: The application must be submitted by the actual operator of the farm or ranch. Ensure that the name on the application reflects this.

- Form Accessibility: The FSA 2330 form is available electronically. Take advantage of this for convenience.

- Consultation: Local FSA offices provide assistance throughout the application process. Seek help if you have questions or need guidance.

- Applicant Information: Complete Parts A and B for individual applicants. If multiple individuals are applying, Parts C, D, E, F, and G must be filled out instead.

- Documentation: Entity applicants must provide additional documentation, such as Articles of Incorporation or Partnership Agreements. This is essential for verifying legal status.

- Financial Information: Enter comprehensive projected income and expenses in Part D. Accurate financial statements are crucial for the review process.

- Non-Mandatory Demographics: While you are encouraged to provide race, ethnicity, and gender information, this is not compulsory. Opting not to disclose this may affect eligibility for targeted funding.

- Timely Communication: Within 10 days of application submission, the FSA will notify you regarding the completeness of your application. If you do not receive this communication, it is crucial to follow up with your local office.

- Individual Liability: Regardless of the entity type, individual liability will be required. This means each member or individual involved must be prepared to assume responsibility.

Browse Other Templates

Sc Restraining Order Requirements - These advocates can guide you in gathering the right information for the restraining order application.

What Is an Itil Certification - Text in green provides helpful hints to the author.